Conditions for refinancing a mortgage at Uralsib Bank

The most general conditions for refinancing a mortgage at Uralsib Bank are as follows.

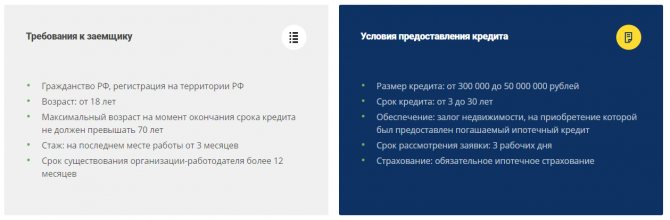

- The total loan amount is from RUB 300,000. up to 50 million rubles and is determined individually based on the information provided by the client about himself and the nature of the previously taken loan.

- The loan term ranges from 3 to 30 years, depending on the size of the loan and the financial capabilities of the borrower.

- Securing refinancing is mandatory: this is real estate that acted as collateral when registering a primary mortgage (a mortgage must be issued for its purchase).

- Obtaining mortgage insurance (in accordance with Federal Law No. 102 “On Mortgages”) is mandatory.

- The decision taken by the bank to approve refinancing is valid for 90 days. During this time, the borrower repays the mortgage at the primary bank and provides the necessary documents to Uralsib.

The listed conditions do not contain any pitfalls: they are transparent.

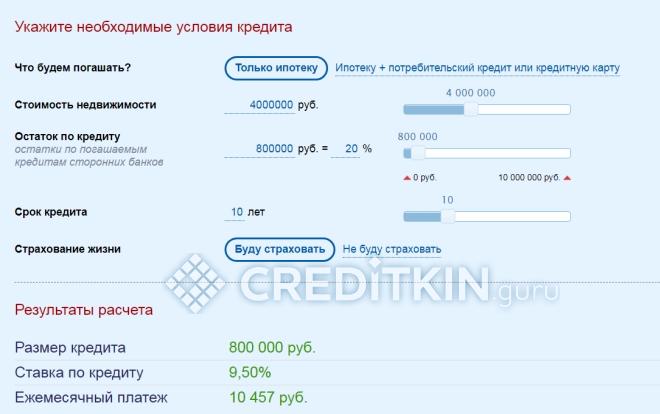

You can calculate the loan repayment period and the monthly payment amount based on the declared total refinancing amount using the calculator on the bank’s website. The result will be preliminary and indicative: the loan amount will be adjusted based on the borrower’s income level and the scoring score he received (when checking the content of the application).

Requirements of URALSIB Bank when refinancing a mortgage

In order not to delay the refinancing procedure, read the bank’s requirements for individuals and real estate, the conditions for the old bank’s loan and the required list of documents.

Requirements for individuals

In order to participate in the mortgage refinancing program of URALSIB Bank today, you need to familiarize yourself with its requirements. Basically, they are no different from the requirements of competing banks. But there are still nuances, since URALSIB is customer-oriented:

- At the time of contacting the bank, the borrower’s age is 18 years or older.

- He must have citizenship of the Russian Federation and permanent registration at his place of residence.

- The borrower's age at the time of full repayment of the mortgage loan should not be more than 70 years.

- At the last place of work, an experience that exceeds three months is required.

- It is also important how many years the borrower’s employer has been on the market. It must fully carry out its activities for at least one year.

Important! Age restrictions are extended as much as possible. This fact is convenient for the client, because on average, a mortgage is issued for a period of 10–15 years. You can buy a home at 50 years old.

Requirements for a refinanced loan

A refinanced loan at URALSIB can combine a mortgage and other loans. You need to know what requirements the bank imposes on the consideration of applications under this program for existing loans:

- The bank does not impose restrictions on the number of loans.

- If there was at least one delay in repaying the loan, URALSIB will refuse to refinance the loan.

- A loan taken from a microfinance organization (MFO) that does not have the status of a bank will not be considered.

- It is not possible to refinance a loan taken in the currency of another state.

- Business loans are not subject to renegotiation.

- Only the borrower's loans are considered - the co-borrower does not participate in this program.

- The cost of real estate can vary from 300 thousand to 50 million rubles.

- The term provided for by the refinancing program is from 3 to 30 years.

- The bank takes the property and the mortgage on it as collateral from the previous bank.

- The application is reviewed within three days.

Important! When considering loans, URALSIB pays attention to some nuances, but in general the conditions are quite realistic. The ability to combine several loans into one is very convenient.

Real estate requirements

The collateral that URALSIB accepts when considering mortgage lending can be an apartment or townhouse. In the case of the latter, the rate automatically increases by one percent. The remaining requirements are as follows:

- Housing that is recognized as unsafe will not be considered by the bank. There are special criteria for assessing wear that are acceptable. They can be clarified with the staff.

- The property in question must be owned. In confirmation, you will need to provide the necessary documents: an extract from Rosreestr, a cadastral or technical passport.

- Real estate should not be under encumbrance, except for those objects that are directly related to the refinancing program.

- It is necessary to carry out an assessment procedure with independent appraisers. Usually the list of such organizations is provided by the bank itself, since they must be accredited.

The requirements for real estate objects mortgaged from other banks are the same at URALSIB. When refinancing a mortgage, the old bank will do almost all the work of collecting real estate documents for you.

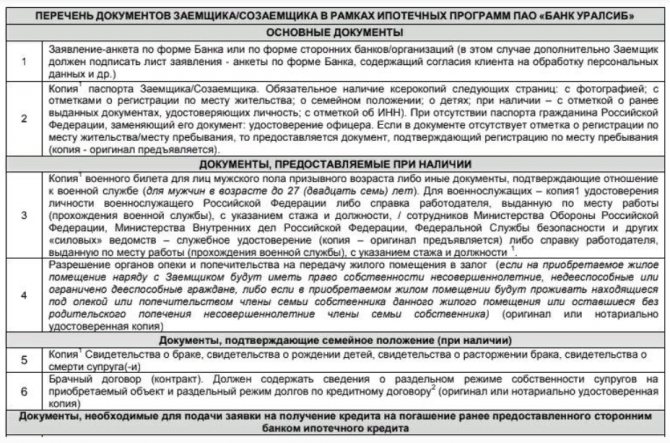

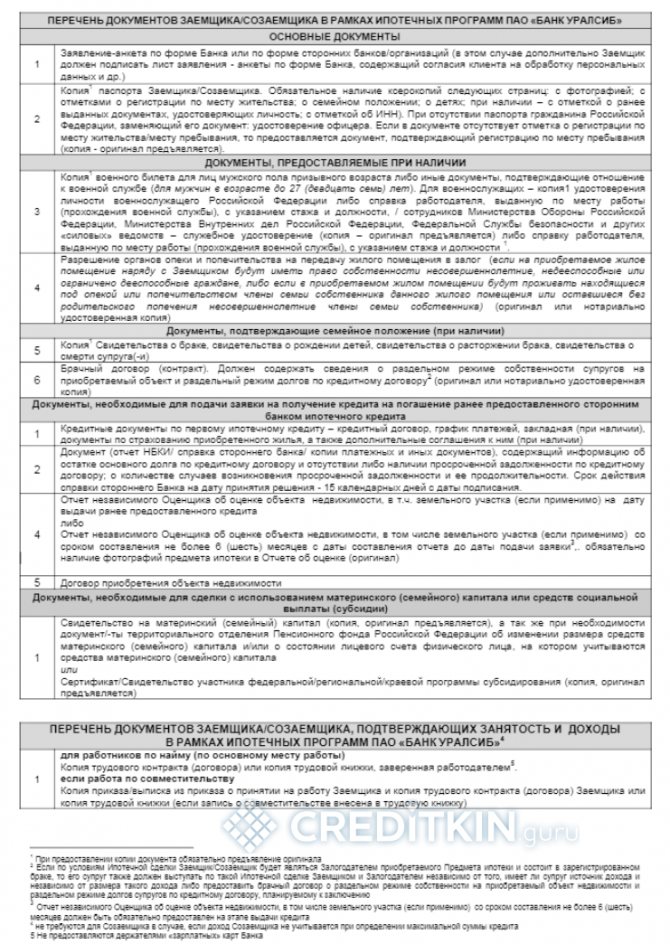

List of documents

All documents that URALSIB Bank requests from an applicant are divided into two types: mandatory and optional.

Required:

- Application form. Filled out according to the form of URALSIB or another bank. There must be a mark indicating consent to the processing of personal data and requesting a credit history.

- A copy of the passport of a citizen of the Russian Federation. The following pages are required: with a photograph, with a note about registration at the place of residence, about marital status, about children, if any - with a note about previously issued passports and TIN.

If there are no marks in the passport, you must provide the following documents:

- certificate of marriage or divorce;

- children's birth certificate; if children are over 18 years old, it is not necessary to provide it.

Important! If a military officer does not have a passport, it is possible to provide a military personnel identification card.

One of the following documents may also be required:

- driver's license;

- international passport;

- TIN;

- SNILS;

- document confirming registration in the individual accounting system.

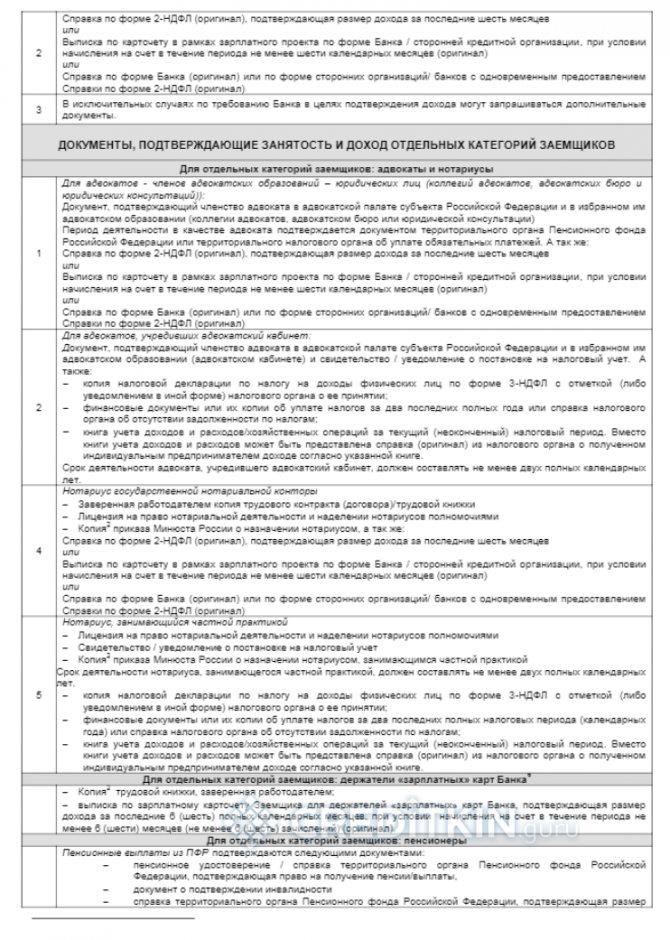

When refinancing a mortgage, it is mandatory to provide a certificate of income in the form of a bank or 2NDFL, an extract from the salary account (if the salary is received on the card) for the last six months.

This is the main list of documents that must be submitted to the bank. There are features for various types of citizen activities.

Refinancing of mortgages to our clients

For payroll clients, Uralsib provides a simplified procedure for obtaining on-lending. Since the bank knows the size of the client’s monthly income, the latter does not need to provide a certificate of income (although if he has several jobs, and not all of them receive a salary through Uralsib Bank, a certificate will be needed).

The applicant only needs to provide:

- Passport;

- A copy of the work book certified by the HR department at the last place of work;

- An extract from your salary account for the last six months.

Relatively recently, Uralsib clients could count on a 0.5% discount from the standard rate. Salaried and reliable clients, public sector employees, and employees of the Rosneft State Corporation were entitled to it. However, as of the current year, the discount is inactive.

List of documents

To draw up an agreement, you will need the same papers as for obtaining a regular loan. Only you will have to add to them certificates about the current mortgage from a third-party organization. Thus, the package of papers includes:

- application form;

- passport of a citizen of the Russian Federation;

- a copy of the employment contract or work record book;

- marriage and birth certificates;

- military ID (up to 27 years);

- income certificates.

From the loan documents you will need:

- loan agreement;

- payment schedule;

- account statement;

- additional agreements (insurance, mortgage, home assessment report and others);

- certificate of ownership.

The bank has the right to request additional papers at any time until the refinancing agreement is signed. A complete list of documents that may be required from the borrower can be found here.

Mortgage refinancing rate at Uralsib Bank

As of 2020, the mortgage refinance rate is 10.9%. For individual entrepreneurs and business owners it is 11.9%.

Uralsib provides additions to the standard interest rate:

- For refusal of life insurance – by 1%;

- For a certificate of income in the bank form (instead of 2-NDFL) - by 0.5%;

- For combining a mortgage with another loan(s) in a single refinancing – 0.65%.

When refinancing a mortgage at Uralsib, clients are unpleasantly surprised that the rate turns out to be 2% higher than stated. In fact, this is a temporary measure: the increased rate is valid until the client removes the encumbrances from the collateral object in the primary bank and registers it in favor of Uralsib Bank.

The same temporary measure, an increase in the rate by 3%, applies if the borrower has not properly registered collateral housing within two months from the date of registration of the loan.

Mortgage refinancing from Uralsib over 3 million rubles

Uralsib Bank offers mortgage refinancing opportunities for individuals on favorable terms. Mortgage loans or loans from third-party banks issued for the purchase of housing, including apartments, townhouses and apartments, are subject to refinancing.

Refinancing is provided by Uralsib banks in the form of a one-time loan for a period of up to 3 to 30 years. In this case, the refinancing period may be increased compared to the original mortgage term.

The minimum amount for refinancing a mortgage from other banks is 3,000,000 rubles, the maximum is 50,000,000 rubles. The value of the loan/collateral ratio should be in the range from 0.2 to 0.8.

The minimum mortgage refinancing rate of other banks for this range of loan amounts is 8.79% per annum.

The interest rate for using a loan increases by:

- 2 percentage points for the period from the date of granting the loan to the last day of the month in which the state registration of the mortgage/pledge of property rights of the Borrower/Pledger's claims to the Developer for a shared construction project in favor of the Bank was carried out, the Borrower provided documents confirming the full repayment of credits/loans that are additional refinancing purposes, and the Bank has confirmed the intended use of the loan through a request to the Credit History Bureau;

- by 3 percentage points additionally from the first day of the month following the month in which the period of 60 (sixty) calendar days expired from the date of granting the loan for state registration of the mortgage/pledge of property rights of the Borrower/Pledger's claims to the Developer for the shared construction project in favor of the Bank and provision The borrower of documents confirming full repayment of loans/loans from JSC DOM. RF" until the last day of the month in which the state registration of the mortgage/pledge of property rights of the Borrower/Pledgor's claims to the Developer for a shared construction project in favor of the Bank was carried out, the Borrower provided documents confirming the full repayment of loans/loans of JSC "DOM. RF”, and the Bank confirmed the intended use of the loan through a request to the Credit History Bureau;

- by 1 percentage point in the case of: providing a loan without concluding a life insurance contract and the risk of disability of the Borrower/Borrowers;

- collateral Apartments in a townhouse;

- for Borrowers – Individual Entrepreneurs/Business Owners.

In case of simultaneous implementation of several specified conditions, the applied price parameters are summed up.

There is no fee for issuing a loan. Applications are reviewed by Uralsib specialists within up to 3 working days. The application itself can be filled out either at any office of Uralsib Bank or on the website.

The loan can be repaid in equal monthly payments. You can calculate the approximate amount of monthly payments using the online calculator on this page.

This offer is not an offer. Lending conditions for a specific borrower are determined by Uralsib Bank individually and may differ from the specified conditions. The bank has the right to refuse to issue a loan without giving reasons.

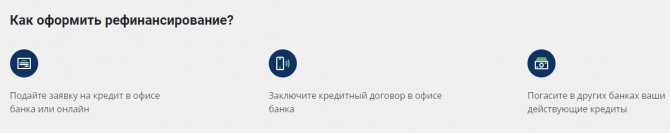

How to apply for refinancing in Uralsib

Mortgage refinancing in Uralsib goes through stages standard for any bank.

- Submitting an application for refinancing. It is done online on the bank's website. A preliminary decision on the application is made within three working days.

- If the application is approved, the borrower personally comes to the Uralsib Bank branch with a package of documents.

- The bank examines complete information on the mortgage and makes a decision on the possibility of refinancing it.

- After the loan is issued, the borrower closes the mortgage with the primary bank, removes the encumbrance from the collateral real estate and registers it with a new bank - Uralsib.

- After completing all the formalities, the increased rate is reduced to the standard rate if the borrower has completed all the necessary procedures on time.

Uralsib works quickly: from the moment the applicant submits a package of documents until the bank makes a final decision on refinancing, no more than 1 week passes.

How to apply

Before refinancing a mortgage with Uralsib Bank, you need to clarify the conditions for early repayment of a loan for the purchase of a home with the bank in which it was opened.

There are conditions under which early repayment of a loan is possible only after a certain period has passed after its execution.

If early repayment is possible, the potential borrower needs:

- apply for a loan at a bank office or online on the financial institution’s website;

- upon approval of the application, sign a loan agreement at the branch;

- wait until the bank pays off the debts;

- use the balance for personal purposes;

- repay a new loan from Uralsib Bank monthly.

The application is reviewed within 3 days. After repaying the mortgage, the borrower needs to visit the office of the old bank and take a document confirming the removal of the encumbrance on the property.

After this, Uralsib should come again and sign a mortgage agreement.

Required documents

The documents provided by the applicant to Uralsib Bank are divided into mandatory and optional.

Look at the same topic: Full and partial early repayment of a mortgage in [y] year: when is the best time to do it + how is the mortgage recalculated?

Mandatory ones include:

- Application for requested refinancing;

- Russian Federation passport;

- Documents confirming income (certificate of income, extract from salary account, etc.).

If there are other documents that may be useful, the applicant provides:

- Documents confirming information about the borrower’s marital status;

- A copy of the work book or employment contract;

- Military ID (required if the applicant is 27 years old or younger);

- Insurance certificate.

Depending on the circumstances, the bank may also require the provision of additional documents: a pension certificate, documents indicating that the borrower has assets - real estate or a car, the presence of deposits, etc.

An important component of the refinancing process is providing Uralsib Bank with documents for the collateral property:

- Mortgage and loan agreement (this can be 1 or 2 documents);

- Contract of sale;

- Report on the assessment of collateral real estate;

- Documents from the primary bank regarding the payment schedule, the amount paid on the mortgage and the presence/absence of late payments on the mortgage loan.

Required documents and procedure for obtaining

Before submitting an application to Uralsib, employees familiarize all clients with the list of basic documents in advance. There are two types of them: mandatory and optional.

The first includes:

- application form;

- passport.

If available, please bring:

- documents confirming marriage, divorce, death of one of the spouses, prenuptial agreement;

- documents of minor children;

- work book or a certified copy of all pages;

- employment contract;

- if the borrower is no more than 27 years old, then a military ID must be provided;

- certificates confirming solvency;

- insurance certificate.

The bank, in addition to the list of required documents, may request a number of papers, these include:

- certificate confirming ownership of assets;

- other documents confirming income;

- pensioner's certificate.

For a refinanced loan you must provide:

- loan agreement, mortgage agreement;

- payment schedule;

- certificates about the balance of the debt and the presence/absence of arrears at the moment and in the past;

- contract of sale;

- assessment report.

There are also a number of specific requirements for different categories of borrowers and real estate; you can download a detailed list from the link.

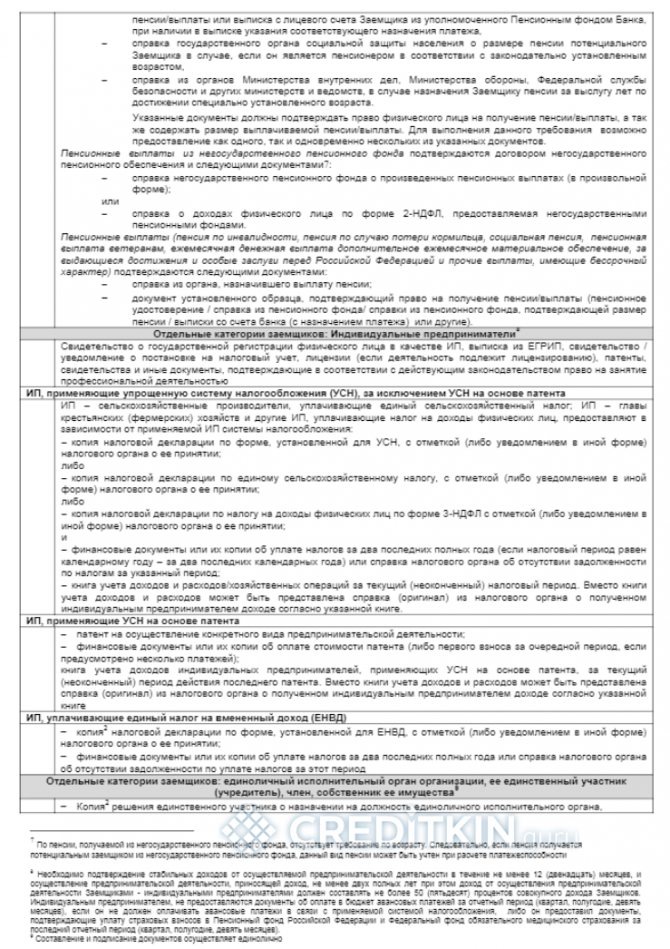

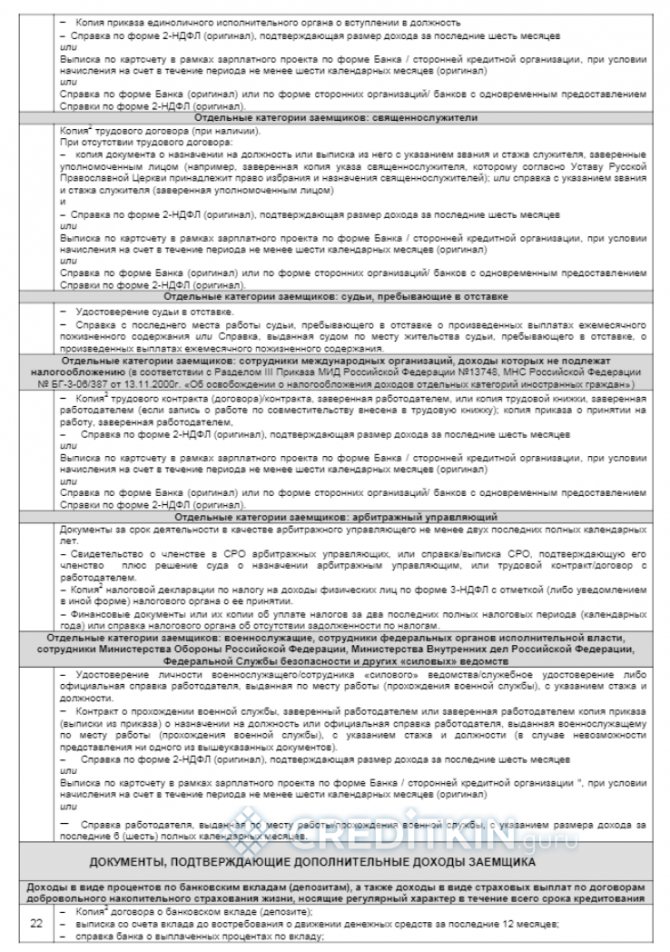

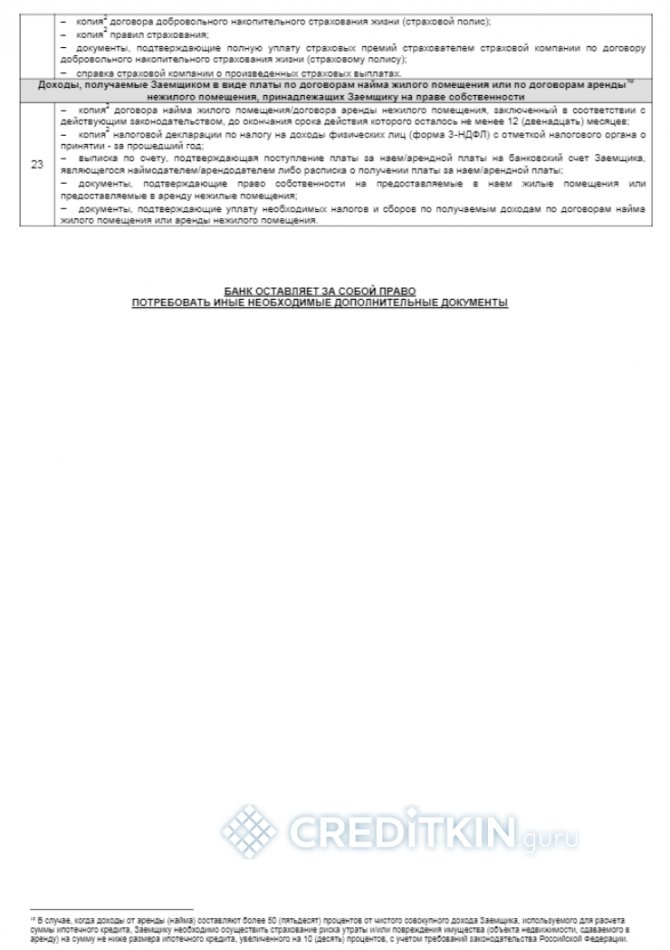

p.1

p.2

p.3

p.4

p.5

After collecting all the necessary documents, you can proceed directly to the receipt procedure itself. Before you begin the mortgage refinancing procedure, you can roughly calculate the monthly payment amount using a special calculator.

Next, you should fill out an application form and submit it for consideration to the nearest branch of Uralsib Bank or to the official website. Within 3 business days, the credit institution will process the application and provide a response, on the basis of which further actions will be taken.

If a positive decision is made, then after providing the requested documents and concluding an agreement, during the same day or the next, the bank will transfer the funds to the institution where there are obligations on the mortgage loan. Next, you need to go to this institution and get a certificate, according to which it removes the encumbrance from this property, after which the property is pledged to Uralsib Bank.

Requirements for the borrower, existing loan and real estate

An application for mortgage refinancing in Uralsib will not be approved if the borrower, the collateral property and the previously taken out mortgage loan do not meet a number of conditions.

Requirements for the borrower:

- Availability of Russian citizenship;

- Permanent registration in the Russian Federation;

- Compliance with age limits: 18-70 years. The borrower must be no more than 70 years old at the end of the loan term;

- Work experience of at least 3 months at the current place of work;

- The organization providing the borrower with work must exist for more than 1 year.

Requirements and terms of provision

Requirements for the borrower:

- Borrowers who apply for refinancing must be at least 18 years of age.

- Russian citizenship and registration in the Russian Federation is desirable.

- At the time of loan repayment, the client’s age should not be older than seventy years.

- Work experience at the last place of work is required for more than 3 months. In this case, the employing organization must exist on the market for more than a year.

Requirements in case of a mortgage taken out from the same bank:

- the borrower must have made at least 6 monthly payments;

- a positive credit history, including loans for which the rights were assigned to a new mortgagee, repaid within the previous 24 months;

- For salary card holders, the period of use of the card must be at least three months.

Requirements in case of a mortgage taken out from another bank:

- the loan to be closed must be issued more than 6 months ago;

- positive credit history;

- liquid collateral;

- high level of solvency.

The bank accepts only liquid real estate as collateral (apartments in multi-apartment buildings, townhouses, houses with plots). Housing should not be located in an emergency fund . Typically, the collateral property has already been verified by another bank, so its verification by Uralsib occurs quite quickly.

The main thing is that the housing is in demand and can be sold at any time if the borrower cannot pay the loan.

Requirements for an existing loan

Since Uralsib allows the combination of mortgage and other loans when processing refinancing, it is necessary to highlight the general requirements of this bank for loans.

- Uralsib does not impose restrictions on the number of refinanced loans.

- Loans for which one or more late payments were made are not eligible for refinancing.

- Uralsib does not refinance microloans taken from microfinance organizations and other microfinance organizations that do not have bank status.

- A loan taken in foreign currency is not subject to refinancing.

- The bank does not undertake refinancing of loans taken for business development or lines of credit.

- When refinancing, only the borrower's loans are taken into account: loans taken by co-borrowers are not added to them.

Requirements for collateral real estate

As of 2020, Uralsib only recognizes apartments in multi-storey buildings and townhouses as collateral. But a townhouse as collateral for refinancing increases the rate by 1%.

Otherwise, the collateral requirements set by Uralsib are standard for any other bank in the Russian Federation.

- The collateral housing should not be intended for demolition; the degree of wear and tear must correspond to the criteria voiced by bank employees.

- The property must have legal title.

- No encumbrances should be placed on the collateral object (except for encumbrances in connection with the refinancing of the mortgage, which is issued).

- The borrower must be ready to provide the bank with the necessary documents for housing, against which the refinancing will be issued.

- The collateral must be assessed by an independent expert (an appraiser who is not interested in refinancing).

Look at the same topic: Everything about refinancing mortgages from other banks in Rosselkhozbank

Advantages and disadvantages of refinancing a mortgage at Uralsib

Like any banking product, the one being analyzed has certain pros and cons. There is no ideal mortgage refinancing loan that will satisfy the needs of any client. But every applicant can find a banking organization whose services, in the opinion of a potential borrower, are more comfortable and profitable.

Advantages:

- The borrower's ability to lower the rate in comparison with the primary mortgage rate and thereby ease his own financial situation.

- There are no restrictions on the number of loans combined into one when refinancing.

- Acceptable interest rate subject to all refinancing conditions.

- Availability of Uralsib Bank offices in 100 cities of Russia.

Flaws:

- Restrictions on the collateral property: houses or apartments are not considered at all.

- The presence of increases to the rate, but the absence of discounts on it as of the current moment.

Advantages and disadvantages

Any banking product can have both advantages and disadvantages. As for refinancing, it can definitely lead to savings in the family budget if everything is calculated in advance and accurately. The advantages of this product at Uralsib Bank include:

- Reduced interest rates and long loan terms, which allows the client to reduce their financial burden.

- Possibility to apply all available loans into one – mortgage.

- No additional fees.

- Offices in 100 cities of Russia.

It is also worth noting the disadvantages:

- Restrictions on the property; the bank does not consider houses or apartments as collateral.

- The presence of increases to the basic interest rate, but no discounts on it.

- Additional costs for re-issuing a loan agreement and mortgage for a notary and insurance.

Remember that you should only renew your loan when you are confident that the deal is profitable. A difference of less than 1.5% per annum, as a rule, does not radically solve the situation.

Only by carefully weighing the pros and cons can you understand how much you can actually save.

Also, not all banks are ready to let the borrower go so easily, and without their consent it is impossible to reissue the loan. And do not forget that you will probably have to pay a penalty for early repayment of the loan, if this is provided for in the agreement.

Personal customer experience

Customer reviews show a positive attitude towards the analyzed banking product, although there are complaints (standard for any bank) about the lack of competence of individual employees of a financial organization.

Andrey Ts., Stary Oskol. I thought about refinancing my mortgage, since the rates on it have seriously decreased in the few years that have passed since it was issued. I liked Uralsib’s offers: a quite normal rate, information on the programs is publicly available on the website. Everything would be fine, but we got an incompetent employee. While she was drawing up the contract, she chatted on the phone at the same time, despite the fact that I made comments to her several times. As a result, an error crept into the text of the contract, which had to be corrected through the branch administrator. They apologized to me for the inconvenience caused, but it left an unpleasant aftertaste. I hope that refinancing payments and the issuance of a certificate of no debt by the bank will take place without unpleasant surprises. In general, managers should be more responsible.

Olga M., Kazan. In addition to the mortgage, I had one unclosed consumer loan. I contacted Uralsib because I discovered that the refinancing program allows you to combine different loans into one. The refinancing process was completed quickly. Now I live in peace: I lowered the rate, and I also pay both loans in the same place. I was satisfied.

Anna L., Omsk. Recently I was faced with the need to refinance my mortgage and another loan to it. I considered various proposals. Uralsib's offer was attractive due to its acceptable rate and the opportunity to combine a mortgage and a loan into one loan at interest when refinancing. But the reality was disappointing. In my application, I refused to take out personal insurance. The application was pre-approved. On the appointed day, I came to the bank already with documents. And then it turned out that in the application there was a tick in the place where I... agree to take out insurance. They did it over my head! I demanded that the checkbox be unchecked again, after which the manager stated that then I would not be given refinancing. Never set foot in this bank again!