- Anna Antonova

- 4 661

One of the priority areas in lending to Russians is reducing the interest rate on mortgage loans. In past years, the state has developed several programs with proposals aimed at providing support to citizens in need of their own housing, including programs for young families. Mortgage lending in Russia in 2020 has the following distinctive features:

- Quite a high interest rate compared to world indicators (at least nine percent);

- Long lending period (you can get a mortgage for a maximum period of up to thirty years);

- As a rule, loans for the purchase of housing are issued in rubles (taking into account the sharp rise in euro and dollar exchange rates in previous years, which caused a crisis among foreign currency mortgage borrowers);

- You can become a full-fledged owner of real estate with the right to sell, rent, redevelop and other actions only after full repayment of the entire mortgage amount. The object of purchase is still collateral;

- The collateral property must be insured (at the expense of the borrower, not the bank).

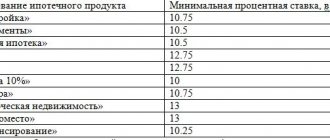

If you decide to get a mortgage in 2020, you will be offered many banking products under the programs. Let's look at the main basic mortgage programs:

General conditions of mortgage lending

You can become a homeowner using bank money by choosing an offer that is convenient for you:

Mortgage

Under the program, you will need to contribute 10-20 percent of the market value of the property and obtain a mortgage for a period of 15-20 years. The annual interest rate will be no more than 13 percent, but not less than 10 percent.

Mortgage loan without down payment

In this case, be prepared to pay a higher interest rate under the program. In addition, the bank may require you to issue an insurance policy not only for the home you are purchasing, but also for you personally (health and life). To have your application approved, you will need to provide guarantors (up to three people) with good financial standing.

Mortgage loan for maternity capital

You can resort to using money under the program from a maternal certificate. But keep in mind that not all banks offer this opportunity. You can pay for the property in whole or in part by making a down payment. In the home you buy, you will need to allocate an equal share for each child in your family. The list of documents required for presentation to the bank must include the written consent of the Pension Fund of the Russian Federation.

Mortgage for the military

The program is offered only to those citizens who serve in the Russian Armed Forces. The loan amount is limited. A serviceman can only spend borrowed funds on the purchase of real estate.

Mortgage with State support

The program offer is only relevant for beneficiaries who officially need improved living conditions. It is also available to young professionals, families with many children and young families. The state undertakes to pay a certain part of the cost of the property. In addition, money can be handed out to citizens - but this option is extremely rare.

Preferential mortgage loan partially repaid by large concerns

Only specialist organizations can obtain such a mortgage under the program. The group's partner bank acts as a lender. The firm pays interest on the loan from its personal financial fund. As a rule, employees of organizations need to confirm the absence of a place to live. At the moment, the list of Russian enterprises that are ready to help their specialists purchase housing space is very modest. Let's highlight Gazprom and Russian Railways. The above loan terms are approximate. If you want to take out a loan to purchase real estate, you should find out the exact conditions of banking programs.

Unstable economic situation

In essence, a mortgage is a long-term loan, measured not in years or months, but in decades. Credit organizations that provide mortgage loans to citizens invest their money for an average period of 10 to 20 years. To be able to offer such long-term projects, banks need some guarantee of economic stability. And borrowers want to be sure that they will be able to repay the loan over a long period of time.

The economy of our country largely depends on global prices for resources and on the economic situation in the world as a whole. Today, the income of our state and each individual citizen either falls or rises, subject to drastic changes in the context of the global crisis and the introduction or lifting of sanctions. Therefore, today no one can give guarantees about financial stability in Russia.

As a result, providing long-term mortgage loans is associated with great risks for banks, and in order to protect themselves and neutralize all kinds of risks, credit institutions are forced to compensate for possible losses with high interest rates. And paying high interest on a loan, again, can only be afforded by a small percentage of citizens, who, moreover, are protected only by the state and the law “On Mortgage.” The way to solve this problem of the development of mortgage lending lies in the stability of the economic and political situation in the country.

High cost of mortgages

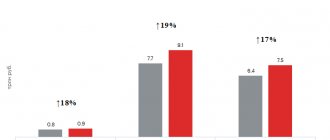

From the two previous reasons for the insufficient development of mortgages in Russia, another, no less important, problem of housing lending in our country follows - high interest rates on mortgages. In 2013, the average mortgage interest rate was 13%, in 2014 – 15%, and in 2020, the cost of mortgage lending soared to 20%. The overpayment on a mortgage at such rates will be very large and can reach up to 200% if the borrower takes out a loan for 25–30 years.

What hinders the development of mortgages in the Russian Federation?

The high cost of attracting resources does not allow financial institutions to reduce the cost of mortgages, that is, reduce interest rates - interest on deposits must be no less than the inflation rate so that it is profitable for depositors to keep money in the bank. That is, the same situation in a circle that we talked about when covering the problem of inflation. Accordingly, as interest on the deposit increases, rates on housing loans also increase.

At the beginning of 2020, the Russian government proposed temporary solutions to the problem: reducing the mortgage rate to 13% through state subsidies for mortgage loans, and the possibility of reducing the rate to 12% is being considered. However, this is only a temporary solution; only a significant reduction in inflation rates in Russia will help to completely eradicate the problem.

Monopolization of the lending market

Unfortunately, the primary housing market is still opaque. There are very few construction companies in Russia engaged in the construction of multi-apartment residential buildings. The lack of healthy competition between developers leads to an artificial increase and retention of high prices for residential real estate. Managers of construction companies, wanting to make big profits, deprive ordinary citizens of the opportunity to purchase housing on the primary market.

In turn, credit organizations that provide housing loans also directly depend in the development of mortgage programs on prices dictated by monopoly construction companies. This problem can only be solved by reducing real estate prices in new buildings. And housing prices on the primary market will automatically decrease when the shared construction market ceases to be monopolized and developers have competition.

In order to support the founding of new organizations that will specialize in the construction of residential multi-apartment buildings, it is necessary to create preferential conditions for the development of this promising line of business. Only then will mortgages on the primary market become cheaper and more attractive for the average population of our country.

Insufficient number of social mortgage programs

Mortgage loans, in addition to solving the housing problem, are a tool for solving various social problems. The Government of the Russian Federation has developed a number of preferential mortgage programs for military personnel, young families, police and Ministry of Internal Affairs workers, young professionals, scientists and teachers. However, as practice shows, all these programs require significant improvements. The state should soon develop similar programs for young doctors and large families. So far, these socially vulnerable categories of citizens are forced to take out a mortgage on general terms.

For the population, preferential mortgage lending programs are certainly a significant help. But banks are not at all interested in the emergence of social programs, since such loans are not profitable for them. Credit organizations offer preferential mortgage loans only on the condition that the state compensates for financial losses from the benefits provided to the borrower. Therefore, these categories of citizens can only hope for government support.

What is the mortgage interest rate?

Before you go to the bank, think, maybe you can become a participant in some preferential mortgage program operating this year? Possible options:

Preferential mortgage for families with children

At 6% per annum you can get a loan to purchase a home. The loan term and required down payment will be determined for you individually. The part of the interest rate that exceeds 6% will be subsidized for you. Please note that the offer is only valid for refinancing a previously issued mortgage loan or for the purchase of real estate in a new building.

Mortgage interest on maternity capital

The interest rate, loan term and required down payment will be set for you individually. You will need to provide papers from the Russian Pension Fund and allocate each child in the family an equal share in the purchased housing.

Mortgage for young scientists and teachers

The down payment is 10%, the loan period will be set for you individually. As for the interest rate, it is fixed - 8.5% per annum. In addition, you will receive additional compensation equal to one fifth of the price of the purchased home.

Social mortgage lending

The interest rate and loan term will be set for you individually. Please note that you will need to make a down payment of more than 10% of the cost of the selected property. The offer applies only to Russians who are solvent and in need of improved living conditions. You can receive: a reduced interest rate, money for making a down payment, or the opportunity to purchase an apartment at a cost several times lower than the market price;

Mortgage loan for military personnel

For a period of up to two decades, having contributed at least 15% of the cost of the chosen housing, at a fixed 9.5%, you can get a mortgage for those Russians who are registered in the Russian military forces. This is a government program that allows you to receive targeted loans of up to 2,300,000 rubles for the purchase of “square meters”;

Mortgage for a young family

If you need housing, are officially married, and are under 35 years old, you can apply for a mortgage under the conditions provided for young families.

The state will reimburse you 30-40% of the market price of the property. The interest rate, loan term and required down payment will be set for you individually. Once again, we point out the need to clarify all the conditions for mortgage lending: at a bank branch or on its official website.

Mortgage term

The mortgage lending service is a long-term banking product, under the terms of which, over a set period, the client undertakes to pay the bank the cost of the purchased home along with the agreed interest rate.

The average loan repayment period today is 10–15 years, but the maximum loan repayment period can vary and even reach 30 years.

It is conventional to distinguish several types of mortgage debt obligations:

- short-term (payment period up to 10 years);

- medium-term (issued for 10–20 years);

- long-term (exceed 20 years, but must be repaid in no more than 30 years).

Many banks and credit organizations set a strictly fixed deadline for repaying a mortgage loan, but depending on the situation, the deadlines can be changed.

A long-term mortgage allows you to reduce the amount of the monthly payment, making it easier to make partial early repayments whenever possible.

Short-term debt obligations oblige the client to repay the loan in 5–10 years. The main advantage of this type is that for a shorter period you will have to pay less interest, as a result, buying a home will be more profitable.

The disadvantages of a short-term mortgage are a high monthly payment and the likelihood of being refused a loan if the bank has reason to doubt the client’s solvency.

Each type of lending has both positive and negative sides, so you should carefully choose the appropriate period during which you can repay the mortgage loan in full and without delays.

Mortgage for a young family with two or three children

This year, the decision to subsidize mortgages for young families has legal force. As we know, the President signed a decree that families with more than two children can count on the following loan conditions under the program:

- Get a mortgage at a fixed 6% (part of the interest rate above 6% is repaid by the state);

- Apply for a loan in the amount of 3-8 million rubles, taking into account the place of residence (the larger the city, the greater the amount);

- It is possible to refinance an already issued mortgage;

- Conclude a mortgage agreement by making a down payment of less than 20% of the cost of the chosen home.

Several important conditions of the new program for families with children:

- The age of mortgage borrowers does not matter (there is no limit to 35 years);

- Families with more than two children born after January 1, 2020 can participate in the program;

- The duration of the state program is until 2022 inclusive;

- It is necessary to issue insurance policies: for real estate, health and life of borrowers;

- Families with a first-born child or a fourth or subsequent child do not participate in the program;

- The borrower must pay monthly fees on time, otherwise he will be disqualified from participating in the program.

State support for young families

In the coming year, young families can participate in the state program “Affordable Housing 2018”. The terms of the offer are as follows:

The loan is targeted and is provided only for improving housing conditions;- The marriage union must be officially registered in the Civil Registry Office of Russia;

- The age limit for program participants is maximum 35 years, minimum 21 years;

- The fact of the need to purchase housing must be officially confirmed;

- Participation in the program can include, among other things, young people without children living in an area of no more than 42 square meters;

- You need to make a down payment on your mortgage.

In what form is government assistance provided? As a percentage of the property price:

- Families with 2 or more children will receive up to 40%;

- A family with one or more children and a husband/wife who has citizenship of another state will receive up to 35%;

- A parent raising a child independently will receive up to 35%;

- Families without children will receive up to 30%.

Not all Russian banks participate in the state program. Let's consider several proposals from those organizations that offer to obtain a mortgage under the state program “Affordable Housing 2018”.

Requirements for the borrower

A bank's decision to provide a mortgage to a potential borrower is influenced by whether the client meets a number of requirements.

There are two types of requirements for the borrower when obtaining a mortgage - mandatory, failure to comply with which entails refusal to issue a loan, and additional, which are advisory in nature, but improve the conditions of the approved loan.

Mandatory requirements that are the same for all banks include:

- citizenship of the Russian Federation (you must present a passport of a Russian citizen);

- age (most often from 21 to 55 years for women and 60 years for men);

- good credit history (checking whether the client has any debts or other outstanding obligations is carried out through the Credit History Bureau);

- the presence of a bank in the same area where the property is located;

- consent to the execution of the transaction by all owners of the purchased property;

- the borrower has continuous work experience (long work experience guarantees the client’s stable position).

Mandatory requirements include confirmation of social status and membership in a special program, if any.

Additional requirements for the borrower should reduce the risk of non-repayment of funds to the bank:

- marital status, since the banking organization considers the total income of the family;

- availability of life and health insurance for the client in addition to mandatory insurance of collateral real estate;

- absence of criminal record, confirmed by a special document.

All information received about the client is carefully studied by the bank, and based on this analysis, a decision is made to issue a mortgage loan.

How to lower your mortgage rate

You can try to reduce the rate on your mortgage this year by choosing the following options:

- Apply for a salary card from the lender from whom you will take out a mortgage under the state program;

- Offer other real estate (one that is your property and already belongs entirely to you or your spouse) as collateral for the mortgage;

- Find financially secure guarantors who can document their good welfare;

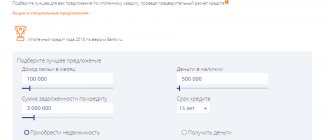

- If you want to get a mortgage from Sberbank, use the online service for concluding a mortgage transaction;

- Do not refuse to purchase an additional insurance policy (it allows you to reduce the interest rate by several percent).

Also remember that a reduced interest rate is usually available for minimum mortgage terms.