Why do you need a bank certificate?

Employers may pay wages unofficially.

Employers trying to reduce tax costs pay their employees unofficially.

Such citizens do not have the opportunity to obtain a 2-NDFL certificate, which is required by banks when applying for a loan. This document confirms the income of the potential borrower.

RSHB, meeting its clients halfway, agrees to accept a certificate developed by the bank itself as a document confirming the solvency of the loaned person.

Mortgage under two documents

When applying for a mortgage at Rosselkhozbank using two documents, you will receive an increased interest rate, but you will not need to collect a large package of documents.

All you need is a passport with a registration mark and a second document confirming your identity.

You will also need to fill out an application form and provide additional documents for the property described above.

It is worth noting that this program is not valid in all regions. The possibility of using this program can be clarified on the official website or by calling the hotline.

In what cases is it necessary to provide a certificate in the bank form?

Loans are issued based on a document in a bank form:

- mortgage;

- consumer;

- non-targeted secured by existing residential or commercial real estate;

- car loans;

- for the development of private household plots, "Gardener".

A financial document, the form of which was developed by the Russian Agricultural Bank, is necessary for clients wishing to refinance loans received from third-party banks, as well as when applying for credit cards.

Why confirm solvency?

Rosselkhozbank, when issuing a loan, tries to avoid the risk of non-repayment of its own funds. A client who has a regular income and is able to document this looks more reliable. Such borrowers pay their debt obligations on time.

It is necessary to confirm solvency to avoid the risk of non-repayment of funds.

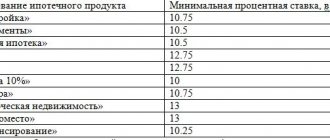

The Russian Agricultural Bank has more attractive conditions for providing loans to citizens with high incomes.

Loans with a reduced interest rate or for a large amount are issued to those who can confirm regular cash receipts sufficient to fulfill loan obligations.

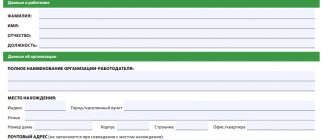

Contents of the certificate according to the RSHB form

The certificate developed by Rosselkhozbank contains the same information as 2-NDFL. The employer enters the following information into it:

- last name, first name, patronymic and date of birth of the employee applying for a loan;

- date of employment at the enterprise, position held;

- name of the enterprise, its address, form of ownership and bank details;

- the employee's salary;

- the amount of deductions for the previous 6 months;

- signature and transcript of the signature of the head of the enterprise;

- signature and transcript of the signature of the chief accountant;

- telephone numbers of personnel services and accounting departments;

- stamp and seal of the enterprise.

The document contains the date of issue. Its validity period is 30 calendar days. If the borrower does not have time to receive a loan during this time, he will have to issue a certificate again.

Documents required for obtaining a mortgage from Rosselkhozbank

Rosselkhozbank is a state institution that was created specifically for the agricultural complex, as well as for conducting other types of agricultural business. Today there are more than 100 foreign partners, which guarantee reliable and proper operation of the company.

If you are interested in where and how to download a certificate on the bank form for a loan from Rosselkhozbank in 2020, then this article is for you. We will also find out why this certificate is needed, and what data needs to be entered into it, and consider a detailed algorithm for filling it out.

If the employee is employed unofficially, or works under a contract (without a work book), then fill in the date from which he actually began his work duties.

The list of documents for obtaining a mortgage from Rosselkhozbank also includes certificates of the property being purchased. Let's find out about them.

Write a statement and let the court sort it out. But you can talk to the tenant and try to solve everything yourself.

How to obtain a certificate of income from Rosselkhozbank

To obtain a certificate, you need to take a form from the bank or download it from the RSHB website. Then you should send it to the accounting department at your place of work to fill it out.

The accountant may invite the employee to fill out the certificate independently. In this case, you should carefully enter the information in all fields of the document, and then have it certified by the chief accountant and the head of the company.

Information about the requested amount

The field containing the question about the employee’s income includes the average monthly salary for the last 6 months. If you have problems calculating the amount, you should contact an accountant.

Information about the average monthly salary can be obtained from an accountant.

Candidate's personal data

Last name, first name, patronymic are entered in the dative case. An example is Pyotr Sidorovich Ivanov. The date of birth is entered in the format DD/MM/YYYY.

The information must match the passport data.

Employment information

In the section containing information about work activity, the date of the employee’s hiring and position at the time of issuing the certificate are entered.

Rosselkhozbank mortgage application form - filling out procedure

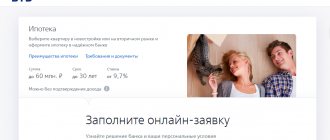

To notify the bank of your intentions to take out a mortgage, you must submit an application. This can be done either in paper form or online by sending a completed document from the credit institution’s website. Rosselkhozbank posts a current sample application form for a mortgage on the official website. The document consists of several important sections that must be completed.

The presented example of filling out a mortgage application form at Rosselkhozbank contains several sections:

- Loan recipient status. In this section, you must enter information about those who submit the application - the borrower or the guarantor. The bank has the same requirements for all participants in the transaction who are ready to assume financial responsibility, so each of them fills out a questionnaire.

- Information about the requested loan. This section records the client’s intentions: the purpose of receiving money, the mortgage program he has chosen, the planned loan amount, and the repayment period.

- Security information. The bank is interested in whether the applicant will provide an apartment as collateral or use the support of a legal entity or individual. When borrowing a large amount, several types of encumbrance are possible.

- Convenient loan repayment dates. The numbers are indicated when it is convenient to make contributions, as well as the appropriate type of payments: annuity or differentiated.

- Experience in farming. The bank is interested in whether you own a plot of land, a private farm, how many years you have been running it, and whether you have registered it in the household register. This item must be completed when a loan is granted.

- Borrower's personal data. The recipient's full name, basic documents, marital status, work activity, salary level, savings, property owned are indicated.

- Consent to data processing. Without the approval of the borrower, the bank has no right to request a credit history, send advertising materials by email, or provide property insurance or collateral assessment services.

Recommended article: How to get a mortgage holiday: essence, pros and cons

The task of filling out the application form for a Rosselkhozbank mortgage is to identify the person and convince the bank of the borrower’s solvency. Let's look at the section with personal data in detail.

- Identity verification. The bank is interested in your full name, date and place of birth, level of education, diplomas, TIN and SNILS numbers, place of registration and residence. You will need to indicate your marital status and the number of dependent children.

- Labor activity. Representatives of the credit institution will pay great attention to data on work: position held, length of service in the profession, last place of employment, salary. Based on the reliability of the company and income level, the institution will calculate the financial viability of the applicant.

- Facts confirming solvency. The lender is interested in your apartments, cars, dachas, bank accounts and securities. High solvency is confirmed by trips abroad throughout the year, as well as host countries with a high standard of living.

- Contacts for communication. When filling out the form, it is important to indicate several telephone numbers, one of which is a landline, and an e-mail for correspondence and sending documents.

Important! If your relatives work at Rosselkhozbank, this information must be indicated in the application form. The bank punishes harshly for concealing important information, refusing to lend without explanation.

Rules for filling out a certificate using the Rosselkhozbank form

When filling out the document, you must adhere to the following rules:

- a certificate for the Russian Agricultural Bank is provided by the company where the loan applicant works, or by the body paying the potential borrower a pension;

- financial official documents cannot be issued to employees who are planned to be fired in the near future, or to those whose salary deductions exceed half of their monthly accruals;

- the signatures of the chief accountant and manager are subject to mandatory decoding;

- Marks and corrections are unacceptable.

If there is no chief accountant in the company's staffing table, a corresponding note is made and the signature is signed by the manager.

Signature and seal

The certificate is not considered fully completed without the seal and signature of the manager. There are special fields on the form for these details.

Significant Features

This certificate is not a document confirming unofficial income. It can be issued to an employee who works for a company or individual entrepreneur, but receives more than what appears in tax reports.

A potential borrower should be prepared for the bank's security service to check what his salary is by calling the company. This is especially true for collecting documents for mortgages or other large loans. Therefore, you should not bring fake papers to the bank.

The bank can check your salary by calling the company.

What documents need to be attached?

application form;- passport;

- documents on marital status: wedding certificate, birth certificate of children (if they are minors), marriage contract (if any);

- military ID (for men under 27 years old);

- documents on employment and income: work book or employment contract, 2NDFL certificate or certificate in the form of a bank;

- certificate of participation in NIS (for the “Mortgage for the Military” program).

For those who cannot confirm the amount of income, there is a simplified application procedure using two documents. The borrower needs to provide a passport and any other identification document, an example could be:

- driver license;

- government employee ID;

- international passport.

Typical mistakes when filling out a certificate on a bank form

The most common mistakes made when filling out certificates are:

- Grammar corrections, typos. The bank may return the document with similar errors for re-issuance or completely refuse the loan.

- The employer details are entered incorrectly. Before issuing a loan, the bank checks all information relating to the borrower, including the company where he works. This can only be done if the certificate contains the correct information.

- Abbreviated name of the organization. Be sure to write it in full, for example, “Individual entrepreneur Ivan Petrovich Sidorov,” and not “IP Sidorov Ivan Petrovich.”

- Incorrect phone numbers, addresses and other contact information. If the RSHB employee is unable to contact the accountant or head of the company that issued the certificate, the borrower will be denied a loan.

- Issue date is more than 1 month.

Requirements for borrowers

When applying to the Russian Agricultural Bank for a loan, you need to know that the bank imposes a number of requirements on borrowers. The main ones are:

- minimum age - 23 years;

- the maximum age at the end of payments is 65 years;

- presence of registration in the region where the RSHB branch to which the borrower is applying is located.

Depending on the type of loan, requirements vary.

How to fill out an application at a bank branch?

The purpose of the BANKCLIC website is to provide users of banking products with informational information only. All images on the site belong to their respective owners.

After entering your personal data and information about the required loan program, you must provide contact information. The bank can issue loans to clients with an average income level if the borrower is willing to make a down payment of more than 20%.

The conclusion of a loan agreement is preceded by the submission of an application by the potential borrower to the bank. The candidate has the right to bring the document to any Rosselkhozbank office convenient for him. It is also possible to submit an application online on the official Internet resource of the institution. Based on the information contained in the document, the bank will decide to issue a loan.

You can familiarize yourself with all the basic requirements and conditions for the Target Mortgage of Rosselkhozbank Bank, as well as apply for a mortgage online on our website, and bank representatives will contact you as soon as possible.

You can familiarize yourself with all the basic requirements and conditions for the Target Mortgage of Rosselkhozbank Bank, as well as apply for a mortgage online on our website, and bank representatives will contact you as soon as possible.

To apply for a mortgage loan, you need to contact any bank branch, the only condition is that it must be located in the borrower’s region of residence. At the time of application, the borrower must be at least 21 years old, and not older than 65 at the end of the loan agreement.

You can familiarize yourself with all the basic requirements and conditions for the Target Mortgage of Rosselkhozbank Bank, as well as apply for a mortgage online on our website, and bank representatives will contact you as soon as possible.

To apply for a mortgage loan, you need to contact any bank branch, the only condition is that it must be located in the borrower’s region of residence. At the time of application, the borrower must be at least 21 years old, and not older than 65 at the end of the loan agreement.

The list of specified documents is not exhaustive. In some cases of lending, additional documents are submitted (for a loan for the construction of real estate for industrial purposes/for reconstruction and overhaul of real estate for industrial purposes, etc.).

- Large portfolio of diverse mortgage products. Loans for a period of up to 30 years and in an amount of up to 20 million rubles. At the same time, the interest rate is quite competitive, taking into account the highest reliability rating.

- A loan with just two documents at a normal rate.

- Availability of a wide network of reliable, trusted, certified partners. Among them are developers, realtors, appraisers, and insurers. High degree of convenience.

- A range of special programs for various target customer groups. Special lending conditions for military personnel and young families. Special loan program when using maternal (family) capital.

- Reliable and stable state bank.

- Lending to citizens running personal subsidiary plots.

- Presence in remote rural areas.

- Possibility to obtain a mortgage for a minimum amount of 100 thousand rubles.

- Business owners are considered as individuals according to a standard package of documents.

- One of the lowest comprehensive mortgage insurance rates.

Data reliability

It happens that a citizen who wants to take out a loan asks the employer to indicate a higher salary or longer work experience. Sometimes clients of financial institutions try to buy a certificate from scammers. Don't mislead the bank. The security service verifies the accuracy of the information provided by the borrower in various ways. Among them:

- a telephone call to the organization that issued the official document;

- analysis of credit history (if zero or negative, the application may be rejected);

- checking the company using available databases (does such an organization exist, what is its financial condition, etc.).

Bank security department employees can contact the Pension Fund and the tax authority to verify the accuracy of the information.

If a forgery is detected, the client is blacklisted. It happens that a bank turns to law enforcement agencies with a corresponding statement against a deceiving client.

How to get a loan without a bank certificate

The bank issues loans to some citizens without certificates confirming income. These include RSHB clients who are participants in the salary project, pensioners, and government employees.

Rosselkhozbank offers loans secured by existing property. You can take out a loan under the guarantee of a person who can confirm your own income.

Information about all available products is published on the RSHB website. Among them there are also those that are issued without providing a certificate of income. Having selected the most suitable loan, you need to submit an application (it is better to do this online, without wasting time visiting the bank). The solution will be ready within a few minutes.

How long does it take to process an application?

The period for consideration and approval of the application depends on the method of contacting the bank. If the borrower submitted the application in person at the office, he can receive a decision within 5 working days . When applying online, the review period is also 5 days. But when choosing this method of submitting the application, the bank will additionally need time to check the documents that the borrower must provide after preliminary approval.

The approval period may be extended at the discretion of the bank.

The applicant's review time is affected by: The selected program.

If a client applies for a preferential mortgage, the bank needs more time to verify data on receiving government support. Availability of documents.

The fewer documents the client provides, the longer the data verification will take. Under the “Mortgage on two documents” program, the review period may take up to 10 days. The verification process can also be extended if the borrower confirms income with a certificate on a bank form or provides additional documents evidencing income. Availability of co-borrowers and guarantors.

In this case, the bank's security service will have to check not only the recipient of the mortgage, but additional participants in the transaction.