Will they give me a mortgage if I have a loan?

Formally, the bank is only interested in the final financial burden. In reality, analyzing the borrower's reliability is somewhat more complicated.

There are two main situations:

- the borrower has an outstanding loan and plans to take out a mortgage loan

- the borrower plans to take out a consumer loan (this amount will be the down payment), and then apply for a mortgage

SITUATION No. 1

It really depends on your debt load + credit history and current financial situation.

If there are no arrears on the debt, the payments are relatively small, and new ones will not create a critical overload for the client’s income, the application will be approved with a fairly high probability.

SITUATION No. 2

Most likely will lead to refusal.

We specifically interviewed more than 50 realtors and it turned out that this is a typical story .

I want to move, but there is no opportunity (or desire) to wait and save up a down payment. The buyer takes out a consumer loan and expects to contribute it to obtain a mortgage. But the second application is rejected almost immediately.

The most offensive thing is when this happens after choosing an apartment and agreeing on all the nuances.

Why is this happening

- The bank, in principle, considers the lack of a down payment as a high risk factor - the client either does not have a large enough income, or is not disciplined enough to collect even 10% of the cost of housing, does not know how to control spending, etc. It is not safe to approve a mortgage for such a client.

- Often the total amount of payments turns out to be too large and no longer fits into traditional limits.

How to reduce overpayment on a mortgage loan at Sberbank? Advice for borrowers

Mortgage lending programs at Sberbank of Russia are focused on various amounts, client groups and real estate objects. For example, a financial institution offers loans for the purchase of an apartment in a building under construction, the purchase of countryside housing, and there are mortgages for young families and the elderly. The final cost of a home loan can be reduced in several ways.

- Registration of a Sberbank debit (salary) card. Clients who already use any of Sberbank’s services are more likely to receive mortgage loan approval. Before submitting an application, a potential borrower can apply for a salary card, open a deposit or a consumer loan at Sberbank.

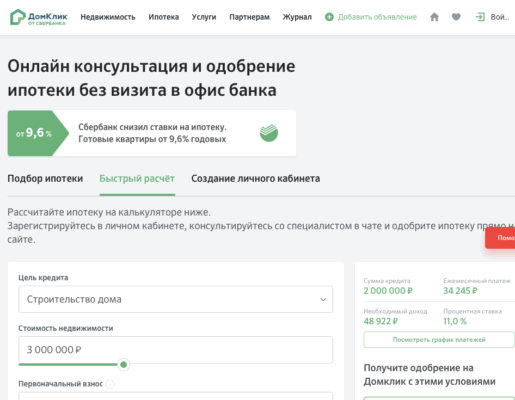

- Buying real estate through the DomClick platform. The DomClick portal is integrated with the Sberbank platform for accepting electronic mortgage applications. Buyers of apartments on the portal receive a 0.3% discount on the final mortgage loan rate, as well as additional protection from fraudsters when registering property.

- Registration of a life insurance program. Borrowers who pay for insurance from a Sberbank subsidiary or other accredited insurance companies receive an additional 1% discount on the established mortgage interest rate. A life insurance program is not a requirement to obtain a mortgage, but it increases the likelihood of loan approval.

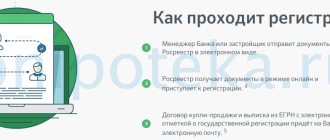

- Electronic registration of the transaction on the Sberbank portal. Users of the DomClick portal can register a transaction for the purchase of real estate remotely, without visiting the MFC or Rosreestr. The borrower is provided with a personal manager, transaction support services, as well as execution and registration of a residential real estate purchase and sale agreement. Electronic registration is provided for a fee (from 7 to 11 thousand rubles) and entitles the client to a 0.1% discount on the mortgage interest rate.

- Discounts for young families. If one of the borrower spouses or a single parent is under 35 years of age at the time of issuing the mortgage, Sberbank provides an additional discount of 0.5% of the final loan rate. According to banking regulations, to obtain a mortgage, clients must be at least 21 years old (at the time the loan is issued) and no more than 75 years old on the date of expected repayment of the debt.

In general, when applying for a mortgage, clients are advised to request the minimum amount to reduce the amount of overpayment. According to Sberbank regulations, the maximum mortgage amount is 85% of the estimated or contractual value of the residential premises. The down payment on the loan is 15% of the final price of the apartment or house, but clients should pay at least 30% from their own funds in order to receive favorable mortgage loan terms.

Sberbank provides mortgage loans to citizens who do not have an official place of work and have not provided a certificate of income (form 2-NDFL). However, such borrowers pay 0.6% more than other clients due to the increased risk of loan default. According to Russian law, a bank cannot oblige a client to take out life insurance, but if they refuse this product, the mortgage rate increases by 1%.

How to get out of this situation

You should save up the down payment yourself without resorting to a consumer loan. You can look for developers who will let you buy an apartment with a mortgage without a down payment, but such programs are vanishingly few in number. Therefore, there is a risk of not finding suitable housing + running into an increased rate.

Before applying for a mortgage loan, you must pay off all debts (even utility bills - this also plays a role).

Life hacks to increase your chances

- Refinance your existing debt obligations - this will reduce the burden and indirectly confirm that you are a person who knows how to count their money

- Do not hide information about existing loans

- Contact the bank with which you already cooperate (you have a salary, personal or legal account, debit or credit card, deposit) - lenders are usually more loyal to their own clients.

Timeframes for consideration of the application and making a decision by the bank

The assessment of the borrower's data is carried out by Sber within 5 to 10 days from the date of submission of the questionnaire. If the application was filled out through online resources, the processing time is usually from 3 to 5 days.

Important! This refers to working days, not calendar days.

After initial approval, the client brings the documents to the bank (or sends them electronically) to the apartment. You can immediately send an assessment report along with them. But many people do not order it right away, but only when they are convinced that the property they provided meets the bank’s basic requirements.

The main shortcomings (inconsistency of the technical condition of the apartment with Sber's conditions) can be found out immediately from the lending manager. But the bank will conduct a full review of the provided property only after presenting all documents, including an assessment. This takes up to 10 days.

Important! Initial loan approval is valid for 90 days. During this period, the client must find an apartment that suits the bank and conclude a deal on it. How many times you can apply for a mortgage from Sberbank for a new apartment within one approval does not matter. The main thing is to keep within the allotted 90 days.

Will they give me a mortgage with a salary of 20,000 - 30,000 rubles?

The decision depends not so much on the size of the salary, but on the accompanying circumstances.

What factors influence:

- credit history

- additional sources of income

- cost of desired housing

- potential monthly payments

- no utility bills/fines

- family/children (this is a potential financial burden)

You won't be able to get by on a salary of 20,000. But the chances of getting approval when choosing inexpensive housing and a positive CI are quite real.

All of the above points seem obvious, except for the last one. It's worth explaining