Features of obtaining a loan

The main condition for obtaining a loan to purchase real estate without official documents about the borrower’s financial situation is a relatively large down payment (50% of the cost of the purchased apartment or house). The following certificates and statements can confirm that a potential borrower has a down payment:

- A statement of the balance of funds on the deposit or account that the client opened with the bank;

- Receipts certifying the fact of payment of part of the cost of the apartment or house;

- A paper indicating a citizen’s rights to receive budget funds allocated to pay part of the cost of residential real estate.

The minimum loan size is 300 thousand rubles. The maximum loan amount depends on the region of residence of the potential client. Residents of Moscow and St. Petersburg have the opportunity to receive up to 15 million rubles. Citizens living in other regions of the Russian Federation can apply for a loan of up to 8 million rubles.

A mortgage without a certificate of financial status is provided to those citizens of the Russian Federation who have reached 21 years of age. Loan repayment must occur before the client turns 65 years old. Co-borrowers (up to three people) can be involved in paying for the mortgage loan. The interest rate on a loan for the purchase of real estate without providing information about the financial situation may be reduced in the following cases:

- Life and health insurance;

- Participation in the Sberbank salary project;

- Attracting co-borrowers;

- The age of one of the spouses is less than 35 years;

- Digital registration of property rights (no visit to Rosreestr or MFC required);

- Purchasing real estate from a developer accredited by Sberbank.

A discount on a mortgage loan in the amount of 0.5% per annum is provided to single parents raising minor children (the age of the father or mother should not exceed 35 years). A mortgage loan agreement without transferring documents about the borrower’s financial position to bank employees can be concluded for a period of 1 to 30 years. The interest rate under the agreement ranges from 9.6 to 10.5% per annum. A preliminary calculation of the cost of the loan can be made using a special application, which is posted on the official website of the financial company.

Terms of service

A simplified mortgage is characterized, as a rule, by the following lending conditions:

- providing a large amount of down payment (from 40%);

- increased interest rate (by about 1 percent);

- reduced debt repayment period (15-25 years).

It is also possible to reduce the maximum loan amount, but such a limitation is typical only for some banks.

Specific terms and requirements depend on the selected bank and loan product.

Documents on the provided collateral

Before applying for a mortgage loan without providing information about the financial situation, the client must prepare a complete package of documents relating to the collateral property. The bank accepts as collateral:

- Rights to claim property. The financial institution is provided with papers that indicate the borrower's relevant powers. If the client is married, then he must provide a notarized consent of the spouse to transfer the rights of claim. Single borrowers must write a statement indicating the absence of family relationships at the time of transfer of the collateral (this paper must be certified by a notary);

- Vehicles. A car passport, CASCO policy, property value assessment report and car registration certificate are provided;

- Securities. The bank employee is presented with an account statement in the register or a certificate from the depository (in the case of securities of Sberbank PJSC provided as collateral). If shares and bonds of third-party companies are transferred as collateral, the bank may request additional certificates from the borrower;

- Measured ingots made of precious metals. Products made of gold and silver are recognized as collateral if there are certificates from the manufacturer. Bullions and certificates are placed in bank vaults. Jewelry is kept in safe deposit boxes until debt obligations are fully repaid;

- Real estate (apartment, cottage, garden house, land plot). This object is registered as collateral in the presence of a state registration certificate, a value assessment report, a cadastral passport and a floor plan. An extract from the Unified State Register confirming the absence of encumbrances (seizure, lease, unpaid loan) is also provided. If one of the owners of the premises is a minor, then the co-owner of the property must obtain permission from the guardianship and trusteeship authorities. The owners of the premises who have entered into a marriage contract must provide the bank with a copy of this agreement. In addition to the listed papers, the borrower must bring a certificate from the housing office confirming the absence of registered citizens in the premises. You will also need a document for the land plot on which the building is built (if there are formalized land relations).

If the pledgor is a legal entity, then the bank requests an extract from the Unified State Register of Legal Entities (the validity period of this paper is 30 days) and the current charter of the company. The transaction can be completed by a person who has the appropriate authority and has the following official documents:

- Minutes of the General Meeting of Shareholders (General Meeting of Shareholders) or the Board of Directors (for LLC) on the election of an executive body and the transfer of management powers to it;

- A power of attorney giving the right to enter into a pledge agreement (presented by a person who acts on behalf of the organization);

- The decision of the collegial management bodies to approve the transaction (relevant for cases where confirmation of such a transaction is provided for by the constituent documents of a commercial organization).

Certificates that have a limited validity period are provided immediately before the loan is issued.

Mortgage conditions secured by property in VTB 24

The borrower is not always able to make a down payment. Moreover, a mortgage without certificates from VTB 24 involves paying 40% of the price, which is several hundred thousand rubles. In such a situation, the bank can issue borrowed money, but only if the client provides collateral.

The terms of such a mortgage remain standard. The loan amount can vary up to 30 million rubles, and the annual interest is 13.6% per annum. The loan term for each client is determined individually, but the maximum is 20 years.

List of required documents

The standard package of documents for obtaining a mortgage without proof of income includes a passport of a citizen of the Russian Federation, as well as a second document confirming identity. If the application for a VTB mortgage has been approved, then within a few days the client must provide the bank with documents for the collateral. These include:

- cadastral passport;

- certificate of ownership;

- extract from the unified state register.

The client must also attach a completed banking application form.

Insurance of collateral property

Selling an insurance policy allows the bank to reduce its own financial risks. In this case, the insured event is the loss of ability to work or death of the borrower. If the above events occur, the financial obligations of the policyholder will be repaid at the expense of the credit institution. Insurance compensation is paid within 25 days after receipt of all necessary documents.

Before purchasing an insurance policy, the client must fill out a special questionnaire. It contains questions related to the following topics:

- Chronic diseases (AIDS, diabetes, cancer, pancreatitis, etc.);

- Having a disability;

- Intent to visit countries where hostilities are ongoing;

- Registration in a narcological and psychoneurological dispensary;

- Availability of current insurance contracts.

The questions asked must be answered honestly and completely. Inaccurate information may result in a potential borrower being placed on the so-called stop list. The application for insurance and credit agreements will be rejected.

A mandatory condition for approving a mortgage application without proof of income is insurance of the collateral. Insurance is issued for the balance of funds that the borrower must return to the bank. The policy allows you to insure real estate and its structural elements (load-bearing walls, ceilings, partitions, etc.) against the following events:

- Fire, lightning strike, gas explosion;

- The fall of aircraft and the cargo they carry;

- Vehicle collisions and ship pile-ups;

- Breakthrough of sewer, water pressure and heating systems;

- Criminal assaults;

- Natural disasters;

- Hidden structural defects of the building;

- Falling trees, power line supports and elements of advertising structures.

If the collateral is a private house, then the roof and foundation of the building are insured. After signing the insurance contract, the policy will be sent to the client by registered mail.

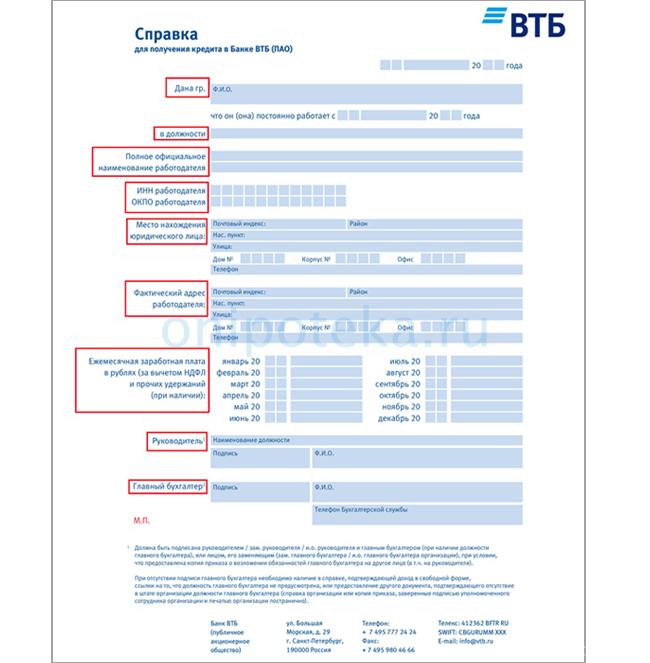

What information is included in the certificate?

Let's start with the fact that the legal force of the certificate in the form of banks is questionable. It is more of a questionnaire form that includes information that is relevant to the lender. However, each institution has a different template.

On a note. The information requirements in the certificate depend on the parameters of the scoring program used by the bank when lending. The financial institution requests only the information that is necessary to make a decision on the application.

For example, at Sberbank the employer will be asked:

- personal information of the employee;

- the name and category of his position;

- duration of work at the enterprise;

- details of the employer himself;

- phone numbers of the manager, accountant;

- the borrower's monthly income;

- withholdings on taxes and fees.

For Alfa-Bank, the passport data of the organization’s employee, as well as information on income for each month for the last six months, are important. The lender is not interested in the tax deductions of the applicant. If you need to apply for a loan in the near future, you can download a certificate on the bank’s mortgage form from the official resource.

Having received the document in hand, the citizen needs to apply for a loan as quickly as possible. Applying for a housing loan is a lengthy process, since several parties are involved in the transaction, it takes time to search for housing, examination, insurance, property registration, and a certificate in the form of a bank for a mortgage is only valid for a month.

Recommended article: Mortgage terms Bank communication

Electronic registration of property rights

The Digital Registration service allows you to register the right to living space without visiting the MFC and Rosreestr. The registration process consists of three stages:

- The bank manager sends a package of documents to Rosreestr;

- The government agency receives the papers online and begins the registration process (a prerequisite for registration is payment of the state fee). The registration procedure lasts from 3 to 7 days;

- An extract from the Unified State Register and a purchase and sale agreement will be sent to the email inbox of the new owner of the premises. The extract is supplied with an enhanced qualified electronic signature, which certifies the fact of transfer of ownership rights. The agreement is endorsed by the electronic signature of Rosreestr.

available to buyers who are planning to purchase housing in a building under construction or on the secondary market. The electronic service can be used by citizens purchasing land plots on credit (we are talking about real estate, the ownership of which was registered after 1998).

The borrower should not forget that starting from 2020, an extract from the Unified State Register of Real Estate is the only evidence confirming ownership. Rosreestr no longer issues paper documents (so-called “green cards”). An electronic statement can be ordered at the MFC.

Real estate requirements

To get a mortgage using two documents at VTB24, you need to find a suitable property. Remember that the loan will be approved only if the selected apartment, house or plot completely satisfies the credit managers.

for new buildings : the developer must be a partner of VTB; the building in which the apartment is located must be put into operation.

Help: You can find out whether the developer you have chosen is a VTB partner at the VTB branch or on their official website. The list is extensive, so you can easily find something profitable and convenient.

for secondary real estate are more stringent:

- Floors must be reinforced concrete;

- Year of construction no later than 1955;

- The building is not on the list for demolition, on the list of houses in disrepair and on the list of buildings requiring major repairs;

- The wear and tear of the building, according to reports from the BTI, is no more than 60%.

Security of the transaction

Real estate transactions involve the movement of large amounts of cash. Counterparties to the transaction need to be especially vigilant in order not to become victims of fraudsters. A person who decides to apply for a loan from Sberbank to purchase real estate without a certificate of financial status should adhere to the following simple rules:

- Under no circumstances do not disclose passwords and CVV codes of your bank cards to unauthorized persons;

- Do not follow links to dubious sites that “masquerade” as the portal of a legal commercial structure;

- Use antivirus programs;

- Install only official Sberbank applications;

- It is not recommended to use computers and Wi-Fi networks that have public access for data transfer;

- Change the card's secret code periodically (it is recommended to do this once every three months);

- Do not give your plastic card to strangers, friends, relatives and acquaintances;

- Do not write down your PIN or enter it on dubious sites. You just need to remember the combination of numbers;

- If you have changed your phone number, be sure to notify the credit institution employee about this;

- All electronic transactions are accompanied by entering a password, which the client receives via SMS. Make sure that unauthorized persons do not have access to the code.

In some cases, scammers pose as technical support employees and try to find out your plastic card details under any pretext. Criminals exert psychological pressure and intimidate the client of a credit institution with non-existent technical problems (a failure in the corporate database, checking new equipment, etc.).

They try to persuade the subscriber to take certain actions that will lead to leakage of personal data. You should not give in to provocations. Real bank employees never ask clients to give their card details. If a dialogue with an unknown caller seems suspicious to you, then you need to stop the conversation and write down the caller’s number. If you have questions or complaints, you should call 900 and explain the situation to a contact center employee.

A great danger for clients who decide to take out a mortgage from a bank without providing information about their financial situation is posed by illegal actions of staff. Every month, the Internal Bank Security Department of Sberbank uncovers dozens of different criminal schemes. We are talking about fraud, corruption and the use of insider information. The borrower can report illegal actions to the police and the Central Bank of the Russian Federation.

How to take out a mortgage using two documents: step-by-step instructions

The design stages are as follows:

- Selecting a property and comparing it with banking requirements.

- Study of mortgage programs from different banks of the Russian Federation, their comparison.

- Submitting an application to the selected bank.

- Review of the application by employees of the credit department.

- Signing a loan agreement and a mortgage agreement.

- Making a down payment in favor of the seller.

- Registration of the transaction in the Registration Chamber, transfer of real estate to the bank as collateral.

- Transfer of the remaining amount by the bank to the seller’s account.

A mortgage based on 2 documents does not mean that the borrower will not have to collect other documents.

As mentioned earlier, the bank needs to provide documents for real estate, so it is advisable to take care of collecting them in advance. Their authenticity and correctness will be carefully checked by the bank's security service.