Every day the interest of citizens in such a credit product as... This is due to the fact that not everyone can provide salary certificates, since they work unofficially. Let's see together whether it is realistic to take out such a mortgage, how it differs from standard home lending, and what features it has.

Who is interested in this option?

A mortgage loan without official proof of income is mainly attractive to two categories of citizens:

- The employee has a minimum official salary (in most cases, due to receiving a gray salary). If you indicate such a salary in the application, the mortgage will most likely not be approved due to the client’s insolvency.

- A person works for himself without reporting to the tax authorities. This includes online freelancers, making money on social networks, providing various types of services (nail services, hairdressing services, construction crews, loaders, taxis, etc.).

Does Sberbank give a mortgage without proof of income and employment?

Obtaining a mortgage without collecting additional information about employment and earnings is possible in the following cases:

- For salary clients. This category includes persons who receive income from work on a Sberbank card (from an employer accredited by the bank as part of a salary project), or pension payments are transferred to the card. Documents on financial status are not requested, since the bank can independently track the income of such a borrower.

- For all other borrowers, but on more stringent conditions.

We are more interested in lending to the second category of borrowers, so we will dwell on them in more detail.

No need to touch: contactless cards from Sberbank

Recently, paying for goods and services with a card was something unusual, but now making contactless payments with a Sberbank card is commonplace. Advances in technology are making it easier for people around the world to pay for their purchases.

Sberbank cards with contactless payment technology have been around for ten years, but such a service has become popular among Russians relatively recently. You can also make contactless payments with a Sberbank card using a smartphone (iPhone). The process takes a few seconds, and there is no need to transfer payment card details.

Sberbank contactless card - what does it mean?

Externally, cards with contactless payment technology from Sberbank are no different from regular plastic ones, except for one thing – a special wave-shaped icon. Otherwise, the functionality of contactless cards is the same as that of classic cards: you can store money on them, pay for purchases in stores and on the Internet, withdraw funds, etc.

Touchless payment is carried out using a special built-in chip with a radio antenna (RFID), which transmits payment data to the terminal, so there is no need to enter a PIN code.

IMPORTANT!

Contactless payment is not available at all terminals. Only POS terminals can receive payment data via radio signal.

Sberbank - one-touch payment: instructions

How to use a Sberbank contactless card? First, you need to make sure that there is an icon in the form of waves on the payment terminal.

Terminals that accept contactless payments are equipped with the MasterCard PayPass and Visa PayWave logos. Accordingly, cards are issued in MasterCard and Visa payment systems.

Recently, it has become possible to make contactless payments using a Mir card from Sberbank.

How it works → Step-by-step instructions for paying at the checkout:

- First you need to check the amount of purchases. The possibility of contactless payment is only relevant for checks worth less than 1 thousand rubles. If this value is exceeded, you can pay by card, but in the classic way with entering a PIN code.

- Bring the card to the terminal. Moreover, you do not need to touch the reader - a distance of 3-5 centimeters is enough.

- After a couple of seconds, the terminal will make a characteristic sound (in case of successful payment), and the money will be debited from the card instantly.

Thanks to Sberbank’s innovations, in your personal account on the official website you can find out how the payment was made - by entering a PIN code, or whether the payment was contactless.

Just like with a card, you can pay using your smartphone. To do this, you need to download the Android Pay application on Google Play and link your Sberbank card to it. You can also connect to Android Pay in the Sberbank Online application.

REFERENCE!

The phone must have a built-in NFC module (external field communicator) and an operating system higher than Androin 4.4.

Advantages and disadvantages of contactless payment

There are both pros and cons to this banking product. It's worth taking a closer look at each of these, as it may influence your future choice of card type.

Benefits include:

- Fast payment without entering a PIN code, which helps to increase the speed of customer service, reducing the time spent in queue.

- The ability to pay for travel on the metro and other public transport by tapping the card to the reader.

- Cameras cannot record the process of entering a PIN code, which provides additional protection against intruders.

- A contactless card will last longer since you do not need to insert it into the terminal every time.

- You can pay with such a card without taking it out of your case or wallet (with this approach there is no danger of compromising personal data).

The disadvantages are as follows:

- Reading equipment is expensive, so it is not available in all stores.

- If the card falls into the hands of criminals, they can make purchases in small amounts up to 1000 rubles, since they do not need to know the PIN code.

- Fraudsters use RFID readers, with close contact of the card with which the funds will be instantly debited. To protect yourself, it is better to use a security wallet that does not transmit radio waves.

Over time, contactless payment cards are becoming more and more popular, especially among young people. Despite some shortcomings, this banking product is a convenient and safe tool for paying for purchases.

Over time, one-touch payment technology will become more widespread. The limit on amounts for contactless payment without entering a PIN code will also increase, so purchasing such a card is definitely profitable.

You might also be interested in:

Source: https://creditvsbervbanke.ru/karta-sberbanka/ne-nado-kasatsya-beskontaktnyie-kartyi-ot-sberbanka

Available loan offers

For those borrowers who are unable to document their income, the following mortgage programs are available:

- Mortgage for finished housing.

- Lending for new buildings. However, we note that it will not be possible to obtain a preferential mortgage at 5% upon the birth of children (a special state program valid from 01/01/2018) without confirmation of earnings, since one of the conditions for federal co-financing is the officially confirmed solvency of the borrower.

At the same time, if government programs are closed to such a borrower, then bank promotional offers are available to him without restrictions.

Salary clients have access to all mortgage offers, including the purchase of country real estate.

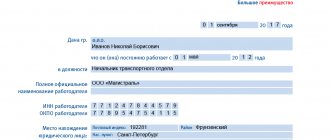

What replaces the 2-NDFL certificate

The 2-NDFL certificate can be replaced by an official certificate in the bank’s form. It is also filled out by the accountant of your company. Therefore, it cannot be obtained without the consent of the employer.

Sample certificate in bank form

Important! According to the resolution of the fiscal tax service (01/17/2018) No. “ММВ-7-11/ [email protected] ”, a new income certificate template has been installed. The resolution comes into force on 04/01/2018. But it has been allowed since 2020. That is, you can submit an extract either in the new or old format for 2020.

When you receive the form, pay attention to how it is filled out. Design rules:

- The document is filled out in a prescribed form.

- All information about the organization is entered, including details.

- Personal information of the employee - full name, place of registration, series and number of the identity card, where he is employed and what position he holds, personal and work telephone.

- For each month, salary and tax deductions are included.

- Other deductions, if any.

- Total profit, tax deduction.

- Company stamp, personal signatures of the boss, chief accountant.

- The date when the document was issued.

If one of the attributes is missing or filled in incorrectly, then the document is not valid.

Sberbank can obtain accurate information about the authenticity of the statement because it checks the data in the document and tax reporting. Therefore, it is enough to submit an extract on a standard template. But if you need a larger loan, then the document must be drawn up on a bank letterhead. The 2-NDFL certificate in the form of Sberbank is the same, but the official period of work in the company is also indicated. The document is drawn up in the accounting department, and the signature of the responsible persons is also required.

Poll: are you satisfied with the quality of services provided by Sberbank in general?

Not really

Conditions for issuing a loan without confirmed income

The essential conditions of such a mortgage are:

- Providing funds in the amount of 300 thousand to 8 million rubles, and for Moscow and St. Petersburg the amount is increased to 15 million rubles.

- Duration up to 30 years.

- Initially, you must pay at least 50% of the cost of the housing being financed. By increasing the fee, the bank reinsures itself in the event of client insolvency. Since only half of the cost of housing is credited, the lender will in any case return the funds not received from the borrower through the forced sale of the property.

- Transfer to the bank as collateral of real estate and rights of claim under a share agreement. Before re-registration of property as collateral, it is necessary to provide other security - a pledge of other real estate or a guarantee from third parties.

- Insurance of collateral assets.

For salary clients who have the right not to provide any certificates when receiving a loan, more loyal offers apply:

- There are no restrictions on the loan amount; it all depends on the borrower’s paying ability.

- The down payment for housing is 15%, and due to this, the amount of the approved amount increases (up to 85%), which allows you to cover the full cost of housing.

It might be interesting!

Mortgage 6 percent 2020: conditions, requirements and how to apply

Daily limit Sberbank Online

The bank sets certain restrictions on banking transactions using a card. Let's consider what the daily limit is set for Sberbank Online and other services when transferring in each individual case, and whether it is possible to increase it or remove it altogether.

Today, transferring from a Sberbank card is offered in several options, each of which has its own tariffs: commissions and limits.

Daily limit Sberbank Online

Internet bank

The most popular service among clients for making transfers is Internet banking. A remote bank allows you to conduct various banking operations, control accounts, check debts and interact with the bank remotely.

So, it is possible to transfer money online:

- between your accounts and cards;

- Sber client;

- to another institution.

The transaction can be made using account details or a specific card. Within the bank, transfers are possible using the recipient's phone number if it is connected to his card.

Useful: Commission for transfers between your Sberbank accounts

Transfer between your Sberbank cards via SMS

For transactions with confirmation

All transfers to Sberbank Online are confirmed by SMS. This acts as an additional measure of protection against the possible influence of intruders.

In addition to SMS confirmation, other things are sometimes necessary, for example, a call to the Contact Center.

Check out the daily limits on money transfers through Sberbank Online, exceeding which will require confirmation

Notes and explanations of amounts and definitions can be found in the downloadable file.

Download

Limits on transactions in Sberbank Online.pdf

It is impossible to set the settings so that funds are transferred through Sberbank Online without confirming the sender’s consent. And it doesn’t matter whether you try to do it yourself or through the Contact Center.

Without confirmation, you can only make transfers between your own accounts.

Note!

It is worth understanding that the wording “without confirmation” means that you do not have to call the Contact Center and undergo an express check.

Typically, a call center employee asks for the code word that was assigned by the card owner himself when he received it from the bank.

During initial registration in Internet banking, a message appears that informs the user about the daily limits for transactions in Sberbank Online without confirmation

Sberbank does not make transfers between its accounts difficult by entering a password code from SMS to confirm the debiting of money from one card to another, if the holder of both is the same person.

Limit for transferring funds from a Sberbank card

The daily limit for online transfer transactions within an institution depends on the type of card product:

- Social, Momentum: 100 thousand rubles.

- Classic Visa, MasterCard, MIR: 200 thousand.

- Gold, premium: 300 thousand.

We recommend: How much money can you withdraw from a Sberbank card?

Inside the bank

The daily limit for transferring money through Sberbank Online to other clients of this bank is limited to 1 million rubles .

If you need to send a larger amount of money, it is recommended to contact the department in person with your passport. Deductions through the cashier are not limited.

Please note that daily limits for transferring money without confirmation in the mobile version of Sberbank Online, others

The commission when using online banking is:

- 0% — between your products;

- 0% - on accounts serviced in the same Sber division;

- 1% - for others.

If you send money using a cashier, the tariff is higher - 1.5% of the amount.

To other banks

If you make transfers between card products, MCM or VMT technology is used. For such situations, special restrictions are provided.

The daily transfer limit from a Sberbank card to plastic issued by a third-party issuer depends on the type of product:

- simplest, instant, social: 50 thousand rubles ;

- Visa, MasterCard, MIR: 150 thousand rubles .

At the same time, one operation is limited to 30 thousand rubles, and the monthly limit is 1.5 million.

Daily limit Sberbank Online

Internet bank

Tariffs in Internet banking are:

- by account number: 1%;

- cards: 1.5%.

Personal appeal requires a payment of 2%.

If the money transfer is made from plastic, but using third-party resources, for example, the Internet bank of another issuer, the bank does not charge a commission.

Payment will be required according to the tariff schedule of the relevant institution.

Between your Sberbank accounts

The operation “transfer between your accounts” in Sberbank Online should be understood as any movement of funds from card to card or from card to account. This also includes replenishing deposits.

There are no daily limits on transfers between your online accounts.

Service providers (10 thousand rubles)

The daily limit is provided for any person, including service providers.

Among them there are recipients who are considered to be at high risk: payment for communications, replenishment of electronic wallets . The daily limit for this category is only 10 thousand rubles.

How to change the daily limit in Sberbank Online

If a person systematically makes transfers of considerable amounts, and the generally accepted conditions are not favorable to him, he can remove or increase the daily limit in Sberbank Online.

Increase amount

You can do this yourself.

Go to the service in the “Settings” – “Security and Access” – “Expenditure Limits” section.

This section allows you to set limits on payment transactions for a day that do not require confirmation

If you do not have your own settings, the “Not installed” line is active. By clicking on it, the user is taken to the settings window, where he can set transaction limits.

As a registered user of Sberbank Online, you can remove or set daily limits on card transactions without confirmation

To increase the limit, you must confirm the procedure via SMS.

Here you can also enable or disable confirmations: for all transfers and payments, except for your accounts and except for templates created in Sberbank Online.

Remove restrictions

Daily limits can be configured for any type of payment. To do this, select the appropriate item.

An SMS with a code will be sent to the phone number linked to the Sberbank card. Enter it in the empty field on the screen to set restrictions on spending money on the card.

If the established limits are no longer required, they can be removed in the same section of the online resource.

Important: How to buy a lake as your property

The daily transfer limit through Sberbank Online depends on the type of transaction (to an account, card), as well as on the recipient (to SB, to a third-party institution). The cardholder has the right to set his own parameters or remove restrictions.

Source: https://fin.zone/dopuslugi/ibank/sutochnyj-limit-sberbank-onlajn/

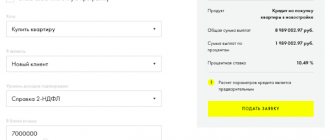

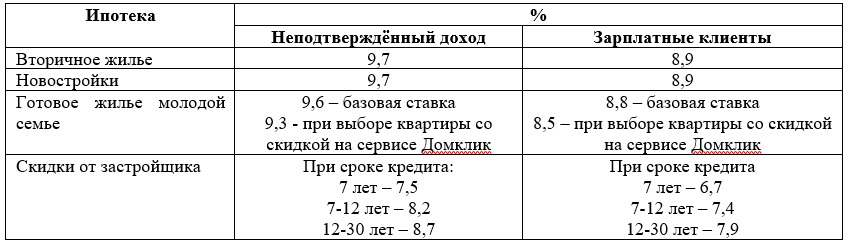

Interest rate

Without confirmation of financial status and employment, mortgage loan rates increase by 0.8% and have the following values:

- The base rate for apartments is 9.7%. For secondary housing there is a reservation that this rate is valid provided that it is selected using the Domklik service with a discount of 0.3%. If this is a third-party apartment, then the average rate will be 10%.

- Promotion for the purchase of finished housing for a young family (up to 35 years old). The rate is 9.6%, when choosing discount housing from Domklik - 9.3%.

- Promotions from accredited developers for new buildings are valid for the following loan terms:

- up to 7 years – 7.5%;

- from 7 to 12 years – 8.2%;

- from 12 years and more – 8.7%.

The offer does not apply to all projects under construction. Exact information about the participants of the promotion should be clarified with the bank.

The indicated rates take into account the life and health insurance of the borrower. If you refuse insurance, the rate is 1% higher.

For salary clients, mortgage conditions are much more favorable. We can see this from the comparison table.

SMS with Securecode from Sberbank does not arrive

When conducting a payment transaction on sites that support this technology, the service redirects the request to the website of the bank that issued the card. The bank sends a special code, after which the user enters it to confirm the payment. But what to do if the Sberbank SecureCode does not arrive? Let's consider what to do in this situation.

The secret code is sent automatically to the phone number linked to the bank card

When paying for purchases in online stores or conducting various transactions on the Internet, there is a risk of becoming a victim of fraudulent activities. Payment systems have developed special protection technology for such transactions. MasterCard SecureCode is a service of the MasterCard payment system.

How to connect Securecode in Sberbank

Before figuring out why SecureCode does not arrive, Sberbank recommends that you familiarize yourself with the main functions and tasks of the service, and also check whether this function is enabled.

To connect MasterCard SecureCode, you do not have to contact a Sberbank branch. This procedure can be carried out independently, following these rules:

- Log in to online banking using your personal password.

- Select the “Internet Protection” button in the “Cards” section.

- Determine the card to which you want to connect the service and click “Activation”.

- Enter the data in the window that opens: a personal message (will appear when confirming the purchase), enter a secret question and answer, create, enter and repeat a password.

- Click "Continue".

- Confirm the procedure with a one-time key.

- Click “Send to Bank”.

The connection process will take some time. To find out the status of the application, you need to go to the “Application Archive - Cards”. When o appears on the application, you can use the service.

If SecureCode from Sberbank does not arrive on Mastercard for a long time, it is better to contact a specialist on the hotline and clarify the reason for the delay in connecting the service.

The reason why SMS messages with a password from the bank do not arrive is most likely due to a technical malfunction.

You can contact the Contact Center by phone to find out what the problem is and when it will be resolved.

To confirm the transaction, you must enter a message with a one-time password

SMS with Securecode from Sberbank does not arrive - how to pay?

To use technology when paying for purchases, you must follow a number of rules and security measures:

- pay for purchases only on large well-known portals;

- The SecureCode logo must be located on the online store website.

- When filling out an application or purchase form, do not enter secret data (card PIN code);

- enter the secret code in the appropriate box when confirming payment.

But if the service is not connected to a specific site, you will not be able to pay for purchases with a guarantee of security. For example, users wonder why they don’t receive SMS with a one-time password when working with Aliexpress or other large trading platforms. The reason may be that the payment is made with a regular card, without this method of protection.

When conducting a payment transaction, the user is usually asked to confirm it in some way: enter the code from the receipt, receive it via SMS. But sometimes some problems may arise.

For example, when you enter a digital combination in the “enter your securecode” column, you do not receive an SMS confirmation of the operation. In this case, it is worth first finding out whether the procedure was completed before repeating it, so as not to duplicate the payment.

Helpful advice!

The check can be done by viewing the card balance through Internet banking or using the Sberbank Contact Center.

There may be several reasons why the one-time password does not arrive

The second reason for the absence of an SMS from the bank confirming the withdrawal of money from the account is related to the Mobile Banking package. If an economy package is connected to the card, then SMS messages are not received for every transaction, but only at the user’s request (USSD Sberbank commands). If the user does not tick the appropriate box on the online store website, he will not receive confirmation.

If the package is complete, but there is no confirmation password during payment, the problem is most likely related to the store's website.

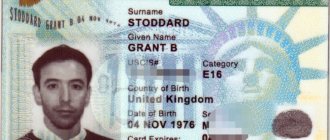

Mandatory documents

So, before going to the bank, you need to prepare the following papers:

- Personal:

- passport with a registration stamp (or with a certificate of temporary registration).

- second personal document (usually SNILS). You can also present a driver’s license, international passport, and service IDs of government officials/military personnel.

- if you have official employment - a copy of the work book, or a confirming certificate from the employer, or a copy of the contract.

- certificate of marriage, presence of children, relationship with guarantors/co-borrowers.

- Property:

- documents for the apartment (title documents, preliminary agreement with the seller, share agreement, registration certificate).

- expert report on the price of real estate.

- a document evidencing the presence of a down payment (account statement, certificate for family capital, documents for the sale of your own real estate (if an alternative transaction is planned)).

Parameters of a potential borrower

The recipient of a mortgage loan “according to two documents” must meet certain banking requirements:

- Age restrictions. The borrower must be at least 21 years old, and if it is not possible to confirm income, the loan term is reduced to 65 years (at the time of repayment of the entire amount). Salary clients can get a mortgage for up to 75 years.

- Total work experience of at least 1 year (for the previous 5 years), and if there is employment as of the current date - at least 6 months with the current employer.

- Citizenship of the Russian Federation.

- Availability of registration at the place of residence in the country.

- Possibility of making a down payment.

- Unblemished credit history.

It might be interesting!

Mortgage for salary clients of Sberbank in 2020

How to increase your chances of getting a mortgage loan without certificates

As an additional safety net for approving a mortgage “on two documents”, you can use the following techniques:

- Increase the amount of the down payment (if possible). After all, the larger the initial investment from the client, the more reliable he is for the bank, and, as a result, the approval rate will be higher.

- Take out life and health insurance. For the bank, this will be an additional guarantee of money back. In addition, due to insurance, the mortgage rate is reduced.

- Attracting solvent co-borrowers or guarantors to credit relationships, because the income of these persons will be taken into account when issuing a loan (the spouse must be the second borrower). Thus, not only the likelihood of receiving a loan will increase, but also the approved amount.

- The bank takes into account not only official income from employment, but also passive income in the form of rental payments from leasing residential or commercial real estate. However, such an agreement must be registered with Rosreestr and declared to the tax authority.

Reviews from borrowers about obtaining a mortgage using two documents

After the wedding, the son and his wife lived in a rented apartment and paid 18 thousand rubles monthly. My wife and I had small savings, but they weren’t enough to buy an apartment, so we decided to take out a mortgage. All my life I received a salary from Sberbank, so I chose a mortgage based on 2 documents. To be honest, I thought they wouldn’t approve of me, after all, I’m 50 years old. But no, the decision on the application came immediately, the amount was greater and the term was 15 years. We arranged everything in 3.5 weeks because we couldn’t choose an apartment. Valery, Rostov-on-Don

We literally picked up the keys to our brand new apartment 4 days ago. We submitted the application ourselves, online, and approval came very quickly. We had already looked at the apartment in advance, so we went for a tour that same day. In 8 days, we prepared all the documents and sent them to the bank. Sber agreed and immediately invited us to complete the transaction. They studied the contract, signed the insurance, made a down payment, registered it and immediately took the keys. We expected a six-month hassle, but everything was done in just 2 weeks. Svetlana, Krasnodar

I have a good credit history, but my husband had some serious delinquency in his youth, and since he is considered a co-borrower, they checked me for almost 7 days. Otherwise, everything went quickly, just a passport, SNILS and a mortgage was issued. Marina, Kazan

How to get a mortgage

The common procedure for applying for a mortgage looks like this:

- Application for a mortgage.

- Submission of documents.

- Pre-approval of the application.

- Selection of real estate and preparation of documents for it.

- Grade.

- Receiving a final response from the bank (based on the results of the submitted documents).

- Signing a mortgage agreement.

- Registration of ownership and pledge.

- Final settlements with the seller.

- Home insurance.

conclusions

Having studied all the nuances of the mortgage according to two documents, it becomes clear that this offer is most beneficial for salary clients, since they have always been and will be a priority for the bank (permanent promotions, benefits, reduced interest).

But this loan offer is also quoted among those clients who work officially, but receive gray salaries, and at the same time have a substantial amount for the down payment.

It is also important to understand that, although the bank provides the potential opportunity to obtain a mortgage without proof of employment and income, in real conditions it is unlikely to be possible to obtain a loan without a single official source of financing. In any case, the final decision always remains with the bank.

Is it possible to take one without official employment?

Banks are reluctant to issue mortgages to those who work informally and cannot confirm their salary. If it is impossible to confirm income on Form 2 of the personal income tax, they ask to submit other documents, for example, on the form of a bank or employer. Sometimes credit institutions are also ready to make a request to the client’s employing company or accept an extract from the Pension Fund’s personal account as confirmation. But it is still quite possible to get a mortgage loan without 2 personal income taxes. The main thing is to prepare in advance and choose the right bank.

Vasyukovich Artem

Mortgage expert. In lending since 2005. Editor-in-Chief IPOTEKAVED.RU

Ask a Question

In practice, it is worth considering first of all VTB and mortgages from Promsvyazbank. At the same time, in such a difficult situation as a mortgage without a certificate and real employment, it is better to contact a specialist (mortgage broker) for help.