What is a real estate appraisal and why is it needed?

A real estate appraisal when applying for a mortgage at Sberbank is a detailed report with detailed characteristics of the potential collateral, including:

- photographs of the premises with comments from the appraiser;

- copies of provided documents + layout in graphic format;

- detailed description of the property;

- collateral and market value calculated by the method chosen by the appraisal company.

The report usually ends with a final conclusion about the general condition of the property being assessed and its fair value.

The assessment of collateral for a mortgage is ordered by the borrower at his own expense at the request of Sberbank. It is for the bank that it serves as a kind of insurance and a guarantee that the purchased object is worth the money for which it is sold, and subsequently, if such a need arises, it will be sold at this price at auction.

Real estate appraisals for mortgages should only be carried out by a company that is properly licensed and meets fairly stringent requirements. Another important requirement for an appraisal company is to have Sberbank accreditation.

Why is an assessment needed?

A real estate appraisal for a mortgage at Sberbank is needed so that company employees can determine the amount of the loan for its purchase.

Knowing the market value of property, banks thereby insure themselves in case of force majeure circumstances. If the borrower for some reason cannot pay the debt, the bank will sell the apartment at the stated price and thereby be able to minimize losses or even win (depending on the situation on the real estate market).

The borrower pays for the price determination procedure. Organizations that have the appropriate licenses can engage in it. Features of real estate valuation using a mortgage and a list of organizations are available on the Sberbank website.

Why do banks cooperate with appraisal companies?

Appraising an apartment for Sberbank, a mortgage from which you are interested, involves the participation of three parties in the process - the appraiser, the borrower and the bank. Everyone remains in the black. The borrower receives the necessary amount to purchase a home, the bank is confident that the appraiser correctly took into account all the nuances when determining the price for it. Any omission identified in the report may result in a refusal to issue funds. Therefore, only an experienced appraiser who knows the requirements of a particular credit institution will be able to correctly prepare reporting documents and save time. An independent assessment of real estate for Sberbank has its own nuances. The bank will not accept a report from every company for consideration. LLC Expert Bureau of Izhevsk is an expert organization accredited by Sberbank, has successful experience of cooperation, takes into account all the features and requirements when conducting an assessment and drawing up a report.

By working with non-accredited companies, you risk wasting time and money. Despite the fact that the bank is obliged to accept the report, in practice you may encounter the fact that it will be sent for revision several times.

List of accredited appraisal companies of Sberbank

The law obliges banks to accept property valuation reports for mortgages from any appraisal companies. However, in practice, Sberbank offers those companies that it trusts.

The borrower can find a complete list of appraisal companies at this link or get a list of organizations in their city when visiting a mortgage center.

Currently, Sberbank has accredited over 2,700 companies that have proven their reliability and legitimacy. The bank has no right to insist on choosing a specific bank, but it is logical to choose the most convenient company in terms of cost and location from the list provided. This will significantly speed up the processing time for your mortgage application, as the lender will not need to further vet the appraiser.

Where to find a list of Sberbank appraisal companies

The manager will provide it to you when you apply to the bank for any housing loan. But information can also be obtained remotely; Sberbank publishes a list of appraisers on its website. This is an EXCEL file that you can download to your device.

Please note that Sberbank appraisal companies are different in each individual bank division. The bank is large, so it is divided into 11 territorial or regional networks. Therefore, first you need to indicate which territory you belong to, and only then look for Sberbank appraisal companies that relate to your region and specific city.

In fact, the list of appraisers whose services Sber clients can use is very large. Therefore, we will consider only a few companies for some territorial divisions of the bank:

1. List of appraisal companies for mortgages in Moscow (note that the Moscow region is a separate territorial unit of the bank, but most Moscow appraisers also work in its region):

- Terra Dox Invest;

- City Center for Assessment and Consulting;

- Mortgage appraisal;

- Prime consulting;

- Standard Assessment;

- Rover GROUP;

- Business Consulting;

- others. Accredited appraisers of Sberbank in Moscow are more than a hundred organizations.

2. Moscow region. There are also a lot of appraisers here, more than a hundred. here are some of them:

- Expert Bureau Stimul;

- Adero;

- Credit Center Assessment;

- MEN;

- Invest Project;

- Alliance assessment, etc.

3. Far Eastern Bank. These are Khabarovsk, Kamchatka and Primorsky territories, Sakhalin, Magadan regions, etc. The list of Sberbank accredited appraisers here is also large, including about a hundred companies.

For example, you can refer to the following:

- ORSI;

- Far Eastern Center for Property Assessment;

- Industry;

- Assessment-Service;

- Dalcom audit;

- Appraisal, etc.

4. Ural Bank, a large territorial division of Sberbank. These are Bashkortostan, Sverdlovsk, Kurgan, Chelyabinsk, Tyumen regions, Khanty-Mansi Autonomous Okrug, Yamalo-Nenets Autonomous Okrug. Sberbank accredited appraisal companies are also actively working here; the list of such companies is huge. Here are some of them:

- FEC "Business Visit";

- Expert Bureau of Yamal;

- Alfa Consulting;

- Prima;

- Valuation case;

- Consulting. Go to the terms and conditions section, scroll down the page. At the very bottom you will see the item “Documents and useful links”. It contains links to various useful information for mortgage borrowers, including Sberbank's pointers to a list of appraisal companies. Click on “List of appraisal companies” and download the file. Then open it and study the information.

How to study the list of accredited appraisal companies:

- Select your region. In a couple of seconds, the system will display a list of companies that operate in your region and are accredited by Sber.

- Pay attention to the last column - “Insurance policy expiration date”. It is better not to initially opt for companies where the deadline is about to expire. It is not yet known how long it will take to obtain a mortgage.

- do not consider, only with the status “Confirmed”.

All appraisal companies accredited by Sberbank are accompanied by full contact information: address, telephone, email. You can call immediately and clarify the necessary information.

What to do if you need to do an assessment with a company that is not accredited

A client applying for a mortgage from Sberbank has the legal right to have the property appraised not by an accredited appraiser, but by one he chooses independently. However, you need to be prepared for the fact that the bank initiates the accreditation procedure for this appraiser.

To do this, you will need to provide Sberbank with a package of papers, which includes:

- A copy of the state registration certificate of the legal entity (notarized).

- Copies of constituent documents.

- A copy of a bank card with sample signatures of responsible persons.

- A copy of the insurance policies of the appraisal company.

- Copies of passports and documents of appraisers (including a document confirming receipt of the relevant professional education).

- Extract from the Unified State Register of Legal Entities.

- A copy of the document on registration with the Federal Tax Service.

The company itself, engaged in determining the value of collateral for a mortgage, must meet the following key requirements:

- period of work in the market of appraisal services from 3 years;

- Availability of a license and documents confirming that employees have received specialized education;

- availability of a civil liability insurance policy;

- membership in a self-regulatory organization of appraisers;

- absence of orders from the Federal Tax Service, open enforcement proceedings, criminal cases and other sanctions and penalties.

IMPORTANT! If at least one point does not correspond to those indicated above, then Sberbank reserves the right to refuse approval from such a company and not accept a real estate report from it for a mortgage.

Practice also shows that a real estate report for a mortgage ordered from an appraiser not approved by Sber has a high chance of being sent for revision and correction of errors. All this will only increase the term of obtaining a mortgage loan.

Real estate valuation: what is it and why is it needed?

The valuation of real estate is a complex undertaking, the implementation of which must be carried out with the most responsible approach.

Assessing real estate to obtain a mortgage is required so that the manager of a credit institution can determine the amount of borrowed capital for its purchase. An apartment or a country house is collateral, so the lending institution must have confidence in its liquidity.

The collateral guarantees the bank that it will return its own funds if force majeure occurs and the client stops paying contributions. The credit institution will put up for sale the property it has as collateral, and the amount received from its sale will be able to minimize or completely compensate the bank for losses.

What documents are required

The appraisal of an apartment under a Sberbank mortgage is carried out by concluding an agreement with the appraiser and providing a set of documents, which consists of the following papers:

- Title documents for the purchased property.

- Cadastral passport + technical plan of the premises.

- Borrower's passport (copy).

- The purchase and sale agreement and any other document proving the basis of ownership of the apartment.

IMPORTANT! If possible, you should provide all available documents about the existence of an encumbrance, information about the owner in case of inheritance of housing, etc. This will reduce the time it takes to compile a report.

Assessment procedure

The procedure for assessing housing for a mortgage at Sberbank includes the following main steps:

- Selecting a company from those proposed by the bank, taking into account reputation, customer reviews and price levels (when studying available offers, you should choose the minimum price while maintaining the quality of the services provided and meeting the agreed deadlines).

- Obtaining advice from an appraiser, agreeing on terms and concluding a contract for the provision of services (at the same time the client pays the cost of the service).

- Collecting the necessary documentation package and providing it to the appraiser.

- Departure to the site by a specialist who will inspect the property in detail for assessment using a Sberbank mortgage and take photographs of the necessary locations, defects and features (a specific day should be agreed upon in advance, which will be convenient for both parties).

- Preparation of an assessment report (the preparation time depends on the complexity of the object being assessed and takes on average from 1 to 5 working days).

- Transfer of the report to the customer (the original is given directly to the borrower, and the appraisal company retains a copy in duplicate).

The report is a rather voluminous document that has an official status - usually it is a bound folder on 30-35 sheets with color photographs, graphs and logical conclusions.

NOTE! Any real estate appraisal report for a mortgage in Sberbank is valid for 6 months from the date of its preparation. If this period has expired, the borrower will need to order a similar document again.

Since 2020, Sberbank has the opportunity to evaluate real estate for a mortgage directly in the bank itself. This service is provided through the Eva Domklik service. The cost of the service is from 3000 rubles. To make an assessment through this service, you must contact your mortgage manager. In this case, the assessment will be made without the right to choose an assessment company. The evaluator will be selected automatically in order.

If you need to make an assessment in a specific company, then you need to contact realtors connected to the Eva.Domklik system. They have a function for selecting an appraiser, or you can contact the company itself directly. If she is connected to this service, she can make an assessment and transmit information to the bank remotely. In this case, you will not have to print out the report and take it to the bank.

Documents for appraising an apartment

The future borrower submits the following list of standard documents to the appraisal company:

- passport of a citizen of the Russian Federation;

- cadastral passport of the property;

- technical passport of the property, floor plan and explanations to these documents;

- documents confirming the ownership of housing;

- for new buildings - an act of acceptance and transfer of housing, for the secondary market - a document - a document - the basis for the acquisition of ownership (agreement of exchange, purchase, gift, etc.);

- documents confirming the absence of encumbrance (arrest, pledge of property).

Important! Documents must be submitted in original with copies attached for each sheet.

Each examination case is individual. To find out the exact list of documents, contact the organization where you plan to do the work.

After examining the documents, a contract for the provision of services is drawn up in two copies and the report is issued to the customer in person or by proxy.

How is the assessed value of real estate calculated?

Initially, there are 3 main approaches used in assessing collateral: comparative, income and cost. Most firms use a comprehensive method that takes into account factors such as:

- location of the object (region of the settlement, taking into account the development of infrastructure);

- the condition of the building in which the purchased apartment is located (number of floors, degree of wear, presence of common areas and areas, materials used in construction, etc.);

- the condition of the apartment itself (layout, presence of alterations, floor, common and living space, presence of a balcony/loggia, ceiling height, quality of repairs with a list of visible defects, condition of communications).

Additionally, the appraiser analyzes similar offers on the real estate market in the same city/region and takes into account the average price level.

The specialist determines the market and liquidation value of the property. The latter implies the price for which an apartment can be sold under force majeure circumstances and without a long wait. The market price is the price of an object if it is sold without haste and waiting for a better offer.

What is real estate valuation

This is an independent examination of the liquidity of a property purchased with a mortgage loan. An appraisal is needed to determine the exact amount of a home loan.

The expert's report must include the following information:

- basic information about the purchased object;

- photographs of appraised housing;

- copies of documents in accordance with the list;

- liquid value of housing.

Important! A standard expert assessment report contains from 27 to 30 pages of printed text, certified by a signature and a blue seal.

Criteria for evaluation

The organization evaluates real estate for Sberbank according to the following criteria:

- object area: ratio of residential and non-residential area;

- location of the apartment: middle or corner, presence of walls adjacent to neighbors;

- number of storeys of the building and the floor on which the apartment is located. The first and last floors are priced cheaper, apartments on the middle floors are in great demand;

- repair of communications: old pipes, lack of water and heat meters significantly reduce the cost;

- presence of a balcony (loggia);

- presence or absence of a pantry;

- repair or lack thereof;

- infrastructure: preschool institutions, general education institutions, public transport stops, proximity to the metro, shops and supermarkets, highways, etc.;

- year of construction and commissioning of housing: the older the house, the lower the cost;

- remoteness of the property from the city center or populated area.

Is it possible to overestimate or underestimate the cost?

If the borrower requires a real estate appraisal for a certain value, it is important to inform the appraiser about this in advance. It is quite possible to underestimate or overestimate the cost.

Since the existing price dispersion in the housing market sometimes reaches significant proportions, you can ask to adjust the price in the right direction. This is especially true for objects with unique characteristics and a potentially high price.

There is also a way to overestimate or underestimate the cost through an illegal agreement with an appraiser who, for an additional fee, will indicate the amount required by the customer. However, this is highly discouraged, since Sberbank may reject the assessment at the first suspicion that the assessment is unfair. In addition, there is a possibility of losing trust in the appraisal company itself.

Sberbank usually allows a deviation from the market price, but no more than 20-30% of the cost.

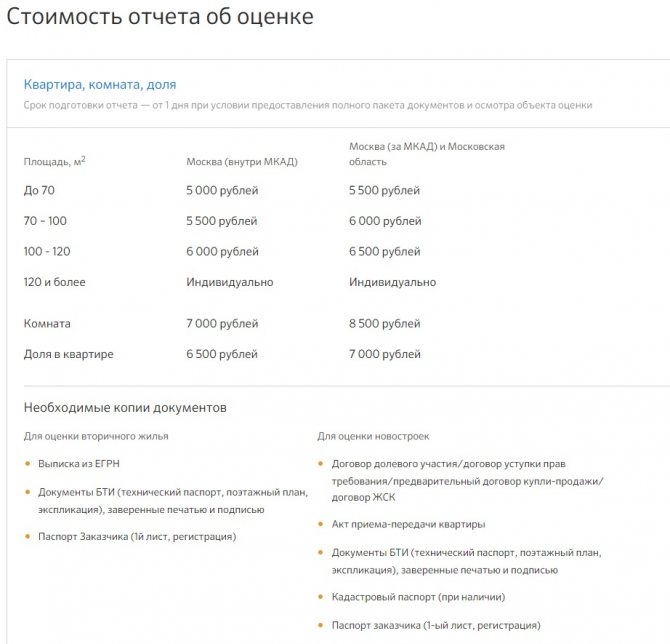

The cost of appraising an apartment in Sberbank

The premium paid by the borrower for appraising an apartment with a Sberbank mortgage depends on factors such as:

- the region in which the collateral is located;

- the pricing policy of the appraiser (price levels for a large company and a private appraiser can be very different);

- area and type of housing;

- the day on which the specialist is scheduled to visit (weekends are usually more expensive than weekdays).

It is logical that the cost of the assessment is 1-k. apartments for a mortgage and houses with a plot in an elite village outside the city will have a significant gap.

As for territorial differences, in Moscow and St. Petersburg prices will be maximum - from 5 thousand rubles. Prices vary in the region, the starting price is from 2 thousand rubles. Registration of real estate valuation by a Sberbank employee - from 3,000 rubles.

The cost of an assessment report for a Sberbank mortgage in Moscow and Moscow Region:

Why do you need an apartment appraisal for a mortgage at Sberbank?

Many Sberbank clients do not fully understand why they need to evaluate real estate to obtain a mortgage loan. The very fact that this procedure will have to be paid, and a considerable amount, alarms borrowers. By taking out a mortgage, they already acquire debts, and these are additional unplanned cash costs. The thing is that it is the real estate appraisal report that can become the decisive factor in the issue of mortgage lending to a particular borrower.

The bank, issuing such a huge amount of funds on credit for a long period, faces the risk of non-repayment. The security is a mortgage on a residential property. Since each residential property has its own actual value, the lender is interested in the cash equivalent of the collateral.

The main purpose of the expert assessment is to establish, taking into account all factors, the real market value of the property pledged as collateral for the loan. The appraiser's report allows you to determine with the highest accuracy the liquidity of the collateral object. After all, it is through this real estate that the bank will cover its expenses and losses if the client is unable to pay the debt.

Important! A home appraisal when applying for a mortgage is carried out in the interests of the client, not the bank. Therefore, all costs associated with this procedure are borne by the borrower.