What is assignment of rights under a mortgage?

Events may occur in the life of any borrower that make it impossible to fulfill their mortgage obligations as before. The causes of financial difficulties are often associated with divorce of spouses, unexpected loss of ability to work, dismissal, or salary reduction.

In such a situation, the mortgage borrower has the right to transfer his rights and obligations to repay the debt to the lender to a third party. This is an assignment of rights under a mortgage. Naturally, you will need to obtain official consent from the bank. To do this, you need to contact the bank’s authorized mortgage center and submit an application with a pre-prepared package of papers. If the credit institution, in the process of analysis, reveals that the assignment of rights is advisable and will not lead to an increase in risks, then the parties will enter into an assignment agreement (the new borrower will buy an apartment from the existing one).

After sealing the assignment contract (assignment of claims under the mortgage) with signatures, the buyer will become the new owner/owner of the living space and the borrower, and the bank will remain the existing lender, taking into account the unchanged key terms of the agreement.

IMPORTANT! A new borrower is subject to standard bank requirements in accordance with the current credit policy regarding age, solvency, quality of credit history and other factors.

Assignment of rights (cession) in Sberbank - registration procedure

To carry out such a procedure, the borrower will have to prove the fact of inability to continue to meet loan obligations. Otherwise, Sberbank will be reluctant to assign the mortgage, if it agrees at all.

- It is necessary to find a buyer for square meters who is ready to purchase them in this format.

- Then you will need permission from the lender - both parties to the transaction apply for it. To do this, you need to submit documents and wait for a decision.

- Afterwards, an agreement is concluded with the new buyer, it is registered and settlement is made between the parties (for example, using).

It will not be possible to sell an apartment through assignment of a mortgage if the package of documents is incomplete. Settlements are carried out through two deposit accounts or safe deposit boxes. In each, the buyer enters his own amount:

- In the first - the balance of the debt on the loan of the first shareholder.

- The second is the money due to the seller.

However, this option applies when housing is transferred after full payment. It is also possible to assign rights of claim with a mortgage through the purchase of square meters on credit. A new borrower is subject to standard requirements: stable and sufficient income, good credit history, age compliance, etc.

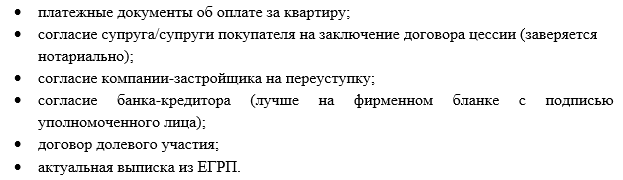

In order for the assignment of a mortgage on an apartment in Sberbank to be successful, you will have to collect the following documentation:

- permission from the construction company to conduct the transaction (if required based on the situation);

- the second spouse’s consent to the assignment and permissions from the lender from whom the first borrower’s loan was taken;

- an extract from the unified register, preschool education and permission from the guardianship authorities, if there are young children.

However, do not forget that Sberbank is extremely reluctant to assign rights to a mortgage if there are no sufficient grounds for concluding such a transaction. Therefore, you will have to carefully prepare for the procedure, or try your luck in other banks.

The procedure for assigning rights during divorce

The assignment of rights may become necessary in the event of a divorce of spouses, when one wants to withdraw from the agreement and transfer part of the property due to him to the second.

After a divorce, the spouses enter into an agreement on the division of jointly acquired property and the rights to it, which spells out in as much detail as possible all the parameters, actions, as well as rights and obligations in relation to the real estate pledged under the mortgage.

The important nuances of such a transaction are:

- It does not matter who the title borrower is under the agreement.

- An apartment purchased with the help of a mortgage during marriage is jointly acquired property and is divided equally between spouses (unless there is a prenuptial agreement providing for other conditions).

- Assignment of rights under a mortgage is possible only with the consent of both parties.

- The spouse who remains the primary borrower after assignment must have sufficient income to repay the remaining debt.

NOTE! If the solvency of the new title borrower is insufficient, the bank has the right to refuse to conclude such a transaction. We discussed mortgages during divorce in more detail earlier.

Who needs it?

It is generally accepted that the assignment of rights under a mortgage is only available upon concluding a shared construction agreement.

In this way, it is not the housing itself that is transferred, but the right to demand its transfer from the developer after the construction of the house is completed and it is put into operation.

This situation is indeed the most common, but not the only one.

Assignment is possible in cases where the mortgage was taken out by a married couple:

- after a divorce, one of the spouses can renounce his part of the common property in favor of the other;

- but at the same time assign all mortgage payments.

Another option could be an urgent sale of housing, for example, when moving for permanent residence abroad.

Not wanting to waste time on selling a home, paying off the mortgage early and removing the encumbrance on the home, the seller can simply shift all this to the buyer, who is in no hurry.

Such apartments are usually sold at the lowest price.

The reason for transferring the loan and rights to the apartment may also be inheritance.

The borrower does not need the consent of the creditor bank to bequeath his home (clause

3 Article 37 of the Mortgage Law).

After his death, the heir (or heirs) automatically receive the full range of rights and obligations of his relative.

Borrower rights

The borrower, who has signed a loan agreement with the bank, pledges the purchased apartment (house, townhouse, garage, cottage, etc.) to the bank. This creates certain restrictions on his rights as the owner.

For example, he can own and use his property only for the purposes for which it is intended (Article 29 of the Mortgage Law).

Even more restrictions affect the right to dispose of one's property. That is, sell, donate, exchange, contribute as a contribution to the management company of a legal entity, etc.

The borrower can do all this only with the consent of the mortgage bank (Article 37). This is the essence of the encumbrance imposed by the pledge.

The only way to dispose of your property without the bank’s knowledge is to bequeath it.

Transfer of rights to a third party with or without a mortgage

In accordance with 102-FZ, Russian banks have the right to transfer rights to mortgages under existing mortgage loans to other persons. Obtaining consent from the borrower is not required. In the best case, the client will receive notification of the fact of the sale of the mortgage and, accordingly, details for payment.

In general, banks transferring ownership rights to housing or an apartment with a mortgage to third parties is an effective way to attract capital for further lending. It is essentially an asset that its holder (the bank) can sell to a third party. Using the funds received, the lender will continue to issue new mortgage loans to the public.

Small banks often assign mortgage rights to larger market participants. In addition, such transactions are the direct responsibility of DOM.RF partner banks, to which mortgages begin to be transferred several months after the conclusion of the loan agreement.

If the mortgage has not been formalized, then the mortgage debt is assigned to a third party under a standard assignment agreement, under which the new lender will have the right to satisfy its claims at the expense of the collateral value of the real estate. The mortgagee, to whom the rights under the mortgage are transferred, is required by law to comply with all principles of maintaining the borrower’s personal data and trade secrets.

Documents for registration of the transaction

While we are waiting for approval, we can begin collecting the necessary documents for the transaction. Because the list stated above is only the documents you need to get a mortgage from a bank. In the second package of documents, the bank will check what it is allocating money for. That is, he will study all the documents on the transaction that he is lending.

This is an additional argument in favor of the security of transactions for the purchase/sale of apartments by assignment. These transactions are financed by banks, and they do not get involved in risky and untested schemes.

The list of documents required by the bank does not differ much from the documents that must be submitted to Rosreestr for the transaction. We published this list in our article on assignments (link).

So, you need to take to the bank:

- seller's passport;

- copy of DDU;

- a copy of the Reconciliation Report with the developer;

- permission to make an assignment if required by your contract;

- original documents confirming payment to the developer. For example, a payment order or opening a letter of credit;

- drawn up assignment agreement.

If you are unsure that you can correctly draw up an assignment agreement, then it is better to contact a notary, a specialized agency or, ultimately, a developer. Sometimes drawing up the right contract is very difficult.

In some cases, banks insist on their own form of agreement “according to the bank’s form”. There's nothing wrong with that. As a rule, this is a well-drafted and legally competent agreement.

But if you draw up an agreement yourself, be prepared for countless changes and lengthy coordination of these same changes with the bank’s legal services. Therefore, we recommend starting the procedure for agreeing on an agreement with the bank as early as possible. It is worth noting here that some banks, for example, Bank St. Petersburg, issue loans only in the case of a tripartite agreement. And if you wanted to avoid additional costs from the developer, then this will not work. You will have to go to the developer and pay him the amount he asks for the concession.

This is important to know: How 13 percent is paid on the purchase of an apartment: return rules

In transactions on the assignment of rights of claim, it is important to take into account that the seller sells his apartment at a higher price than he bought it for. Therefore, in order to avoid paying tax, the difference between the original and sales value of the property is not specified in the assignment agreement. When applying for a mortgage, this point is very important, because the bank will take into account the cost of the apartment that is listed in the contract. That is, the buyer must have cash to cover this difference and make a down payment.

Assignment of a mortgage to a new borrower

Replacing one borrower with another under a mortgage agreement is an extremely undesirable option for a bank. The creditor agrees to it, as a rule, only as a last resort, when there is a risk of long delays or a complete refusal of its obligations by the current debtor. First of all, the bank will offer the client to refinance or restructure the loan, give a deferment on the payment of the principal debt, but once convinced of the distress, there is a chance to replace the payer.

The new debtor must have a stable source of income, sufficient creditworthiness, meet the requirements for age, citizenship, credit reputation and other criteria.

The procedure for assigning a mortgage to a new borrower is carried out by concluding a new loan agreement with the new borrower (under a purchase and sale agreement between the old and new debtor). The bank will have to again accept a package of documents for the new borrower, analyze its financial situation and enter into a transaction with registration in Rosreestr. All this is fraught with additional money and time costs. Therefore, most Russian banks do not want to deal with replacing mortgage payers.

Requirements for a new borrower

Before issuing a loan, any bank client undergoes mandatory verification. The credit institution needs to gain confidence that it is possible to cooperate with the citizen and that his financial situation will allow him to repay the debt in full.

Renewal of the contract is possible only if the applicant meets the following requirements:

- stability of financial situation;

- having a permanent place of work;

- good quality credit history;

- lack of criminal history;

- low debt ratio;

- meeting age criteria.

Most banks today work with clients aged 21 to 65 years. The lower limit is due to the fact that young people often do not have a permanent source of income and many of them study in educational institutions. They have no experience in planning expenses and distributing funds. Elderly people have good financial discipline, but often have health problems and their main source of income is pensions.

Banks are not always willing to assign rights under a mortgage, and such a procedure is carried out only if the existing borrower has sufficient arguments. This situation is due to the fact that re-issuance of documents is always associated with certain difficulties, the need to waste time and use human resources. It is more profitable for credit institutions to deal with trusted clients who make payments regularly, and replacing the main debtor always carries certain risks.

It might be interesting!

What is a non-target mortgage, what is it, what are the requirements and conditions

Assignment of rights of claim under a mortgage with DDU

The process of purchasing an apartment in a new building is confirmed by signing an equity participation agreement (DPA). This document also involves the assignment of rights of claim to another person subject to mandatory registration with the MFC or the Registration Chamber.

ATTENTION! The assignment agreement under the DDU can be signed only before the delivery of the object and before the signing of the transfer deed of the premises. After this, it is no longer possible to assign rights.

The assignment of rights of claim under a mortgage with a DDU is a fairly common option and is most often associated with delays in the construction and delivery of the project. However, this is the riskiest way to purchase an apartment in a building under construction.

Possible risks include:

- the likelihood of bankruptcy of the development company (if after the conclusion of the assignment agreement the company goes bankrupt, then the new owner of the property will face long and grueling court hearings with the developer);

- invalidity of the assignment agreement (for example, if official consent is not received from the developer or the cost of the apartment is not paid in full, the assignment of rights may be considered illegal);

- challenging the contract (if the housing was purchased less than a year before the developer was declared bankrupt or was purchased at a reduced price, then there is a high chance of challenging the concluded contract);

- multiple assignment of rights under the DDU (when using so-called “investment memorandums” that are not subject to registration in Rosreestr, an unscrupulous shareholder can repeatedly assign his rights of claim).

Peculiarities of registration of a family mortgage by assignment of rights

To receive a housing loan at a preferential interest rate, you must meet the requirements specified in the law regarding the borrower (). Separate requirements apply to real estate . Thus, apartments in houses under construction or finished housing fall under the targeted state support program. In the first case, a family mortgage is available by assignment or through the conclusion of a DDU.

But not all types of assignment of rights will be approved. Permission is given only for signing an agreement with a legal entity - the developer or his representative.

It will not be possible to receive a loan under the support program by registering an assignment of rights from an individual. There are two exceptions to this though. Preferential mortgage on assignment from individuals. person is available if:

- Funds are issued for the purchase of housing in rural areas of the Far Eastern Federal District;

- Or refinancing is issued on the same conditions for residents of the Far Eastern Federal District.

As a result, the borrower will have access to a housing loan at 6% per annum. The difference between this rate and the bank's standard interest rate is covered by the state.

Conditions for the transaction for the assignment of the DDU

The seller or assignor is required by law to notify the developer of the assignment of its rights in writing. To do this, an application or notification is drawn up in a free format, containing information about the seller and buyer of the residential property, and a copy of the assignment agreement and a set of required papers are attached. Among them:

A new buyer is strongly advised to carefully study the developer's business reputation and history of activities. Only if you are completely confident should you enter into a deal.

The procedure for purchasing an apartment through assignment of the right of claim includes the following steps:

- Informing the construction company and obtaining permission for the assignment.

- Preparation of the required package of documents.

- Concluding an assignment (assignment) agreement and registering it with Rosreestr.

- Concluding a mortgage agreement with a bank.

notifications can be found here. You can download the agreement on the assignment of rights under the DDU using this link.

Registration process

The assignment of an apartment in a new building is a multi-stage process for both the buyer and the seller.

- Notify the construction company of your intention.

- Obtain official consent from the developer (companies charge a lot of money for issuing permission).

- Obtain a certificate from the developer about the absence of debts.

- Receive an extract from the Unified State Register.

- Obtain notarized consent from your spouse for the sale of real estate.

- Receive official confirmation from the bank that the debt has been repaid.

The buyer is only required to obtain consent from the spouse to purchase housing, and then sign an agreement for the assignment of the apartment. The developer usually has a sample, and it can also be downloaded freely on the Internet. The conclusion of the contract takes place in the office of a construction company or in a law office. Registration can be carried out at any MFC or at a branch of Rosreestr. At the time of concluding the contract, the presence of a representative of the registration authority and both parties to the transaction is mandatory. The seller also pays the state fee for registering the document. The agreement is registered within 10 working days.

The procedure for conducting an assignment transaction in Sberbank

Sberbank is usually very reluctant to agree to the assignment of rights under a mortgage. He can enter into such a deal only as a last resort, when the current borrower proves the objective facts of his financial insolvency and the advisability of transferring obligations.

The process of conducting a transaction for the assignment of rights under a mortgage agreement looks like this:

- The existing debtor is looking for a new buyer/mortgage borrower.

- The parties contact the financial institution to obtain permission to assign rights.

- The bank accepts documents from a potential borrower and makes a decision on it.

- The buyer and the bank enter into a loan and mortgage agreement, then register it.

- Payment is made between the buyer and seller.

- The new debtor begins to repay the loan in accordance with the signed agreement.

In general, there is a high probability that the client will be denied a mortgage assignment from Sberbank.

Advantages and disadvantages

Like any other procedure, selling an apartment by assignment has its pitfalls in the form of pros and cons for each party. The advantages lie in obtaining financial benefits for the seller and the buyer from the difference in the price of finished housing and at the construction stage.

At the initial stage, investments in a new building are much less in size than the sale price of the assignment before putting the facility into operation. But a finished apartment, which is purchased under a standard purchase and sale transaction, is an order of magnitude more expensive than its analogue that is still under construction.

This is important to know: Tax deduction when purchasing a share in an apartment

Among the disadvantages, we highlight the following nuances that can be dangerous for the buyer:

- difficulties associated with thoroughly checking the purity of the transaction;

- waiting for construction work to be completed in order to use your apartment in a new building;

- the need to control the transaction independently or to involve a lawyer;

- approval of the transaction with the developer (if there is no consent clause, then it is necessary to notify the new shareholder);

- the possibility of the developer refusing to assign or providing consent for a certain price (the amount can range from 1 to 15% of the cost of the apartment);

Buying an apartment on assignment in a new building is beneficial for citizens who have sufficient capital to invest in construction and strong nerves to monitor all the nuances associated with the purchase. After the transaction for the transfer of rights of claim, the buyer will need to independently monitor the schedule for the delivery of the new building. You also need to clearly know what to do when the property is ready - what documents to get from the developer and how to complete it correctly.

The main argument in favor of the seller’s reliability should be the transaction under the Shared Participation Agreement and the reputation of the developer in the real estate market of the selected region.

The procedure for conducting a transaction for the assignment of a mortgage at VTB

VTB Bank has a reputation as a lender that does not seek to approve the assignment of a mortgage. As an exception, it may be allowed to formalize a transaction of assignment of rights of claim under a mortgage in the event of a divorce of spouses, as well as in a number of tragic cases when the immediate relatives want to assume the obligation to repay the debt.

In all other situations, the bank will offer restructuring or sale of the apartment to further repay the loan debt.

If the transfer of an apartment is approved, then you need to be prepared for the fact that the new borrower will be subjected to a thorough check. It's unlikely that you can cheat here. The transaction scheme will be similar to that of Sberbank.

A significant feature of VTB is the organization of work on the assignment of military mortgages and loans through the official website of Rosvoenipoteka, where current advertisements for the sale of such apartments are posted.

The concept of assignment of the right to claim an apartment in a building under construction

The assignment can be made by an individual or legal entity in favor of another citizen or company. The right to it is guaranteed by law - a person who has entered into an agreement with a developer to purchase housing at the construction stage has the right to sell housing that has not yet been built through the assignment of the right of claim. Simply put, there is a change of buyer: after the completion of the new building, registration will take place in the name of the new owner, and not the one who initially financed the construction.

Another document that the parties should be aware of, since on its basis the ownership right is transferred, is called an assignment agreement. The parties participating in the transaction are called:

- assignor - seller,

- assignee – buyer.

In addition to the above-mentioned persons, the developer and the bank (in case of purchase with a mortgage) take part in the process.

There are two types of assignment of rights to property:

- Through a DDU agreement, the party to the agreement transfers its rights under it to the buyer. Until the house is put into operation, such deals can be concluded an infinite number of times.

- Through a preliminary purchase and sale agreement - according to this document, the parties undertake an obligation in the future (after putting the house into operation) to conclude a purchase and sale agreement on pre-agreed conditions. But banks do not lend to this form of transactions, considering them too risky.

Risks and benefits for the new owner

For a new participant in legal relations, the procedure has both positive and negative aspects.

The advantages of the situation include:

- It’s easier to collect documentation from the list for a loan. There is no need to provide papers related to real estate valuation. Since the services of appraisers are not cheap, this will save you a lot.

- A decision on assignment can be obtained much earlier, since, again, the bank no longer checks the documentation for assessing the cost of square meters.

- Almost always you get legally clean living space (without third party rights or debts).

- You may be pleased with the price of the apartment. In any case, it will be less than the value on the real estate market.

Along with all the advantages, there are also significant disadvantages to choosing to purchase an apartment this way.

Every advantage has its own “but”, which can completely cross it out and devalue it in the eyes of a potential borrower:

- a full solvency check cannot be avoided;

- you must provide all documents required for loan approval;

- accrued sanctions can significantly increase the final cost of purchased housing. It is necessary to clarify and negotiate the transfer of such obligations on an individual basis;

- An additional agreement to an existing contract is not drawn up, but a new one is concluded. This is also fraught with changed lending conditions - an increase in the interest rate, a reduction in the liquidation period, and the addition of various commission fees. All these measures accordingly increase the size of the monthly payment;

- the organization's requirement to enter into new insurance agreements;

- in case of debt formation, the bank has the right to sell the property through an auction or transfer the prerogative again to another person;

- there is a risk of refusal to evict the original borrower. Then you will have to resort to the help of the Department of Internal Affairs;

- the former owner also has the right to challenge the validity of the transaction. The court will take his side if the latter proves the existence of obviously unfavorable conditions for him in the transaction.