How should ex-spouses deal with an apartment with a mortgage during a divorce?

An apartment taken on a mortgage is a serious test for a family. It is very difficult to predict what will happen in the coming years, much less 10-15 years. It is very possible that the dollar exchange rate will rise, and if the mortgage was issued in foreign currency, then such a burden becomes unbearable for the family. Unemployment may make further adjustments to plans.

In connection with the current process of deindustrialization in the country, it is difficult to predict the future fate of the enterprise, and therefore future income. The same can be said about doing business. How long will it stay afloat - 10 years or one year? In a word, there are a lot of risks.

But there may be another sensitive case: when spouses get divorced. There can be many reasons why this can happen, but the result is the same. And something needs to be decided with housing, because an apartment with a mortgage during a divorce requires special attention, since it affects the interests of not only spouses and family members, but also the interests of the banking institution that issued the mortgage for this apartment. As a result, a lot of questions, life situations and controversial issues arise. In any case, there are ways out of them; you can always either reach an amicable agreement or go to court to resolve controversial issues.

Division of a mortgaged apartment during a divorce: what does the law say?

Before moving on to considering specific cases and possible actions of each party, including the banking institution, let’s consider what Russian legislation states regarding this? In Russian legislation, this issue is regulated by the Family Code. Article 33 of this legal act determines that all property acquired during marriage is considered joint. Unambiguously and categorically. That is, whether you buy an apartment on credit or immediately pay the entire amount for it - it represents jointly acquired property and joint ownership.

Another legislative act, namely the federal law “On Mortgage”, which was adopted in 1998, does not contain any restrictions regarding the division of a mortgaged apartment. However, Article 7 of this law establishes that property that was acquired during marriage and is jointly owned is established by mortgage only when there is written consent of all owners of this property. Particular attention must be paid to the fact that such consent must be in writing only.

Based on the above regulations, it turns out that if the apartment belongs to jointly acquired property, then the division of the apartment upon divorce of spouses is made into equal parts. This conclusion is confirmed by the Family Code of the Russian Federation in paragraph 1 of Article 39, which states that during the division of jointly acquired property and the establishment of the share of each of them in it, these shares are recognized as equal. As an exception, it is provided that there may be a concluded agreement between the spouses. Then you need to proceed from the terms of this agreement, if they do not contradict current legislation.

But if everything is clear with the apartment, it is divided into equal shares between the spouses after a divorce, then what to do with the existing loan? There is also no uncertainty with the loan and it must be dealt with in accordance with paragraph 3 of the article, which determines that if the spouses have a loan during a divorce. then it is distributed between them in accordance with the proportions of the distributed shares of jointly acquired property.

Everything is very clear. We divide the apartment in half, which means we pay the loan in half during the divorce. And it makes no difference at all who registered it for themselves, their husband or wife. Debts in this case are considered common. And if everything is so extremely clear and spelled out in Russian legislation, then why do a lot of controversial issues arise, and why does the division of a mortgage in a divorce itself cause many difficulties?

The whole point is that, in addition to the two separating spouses, a third participant enters the stage - the bank.

Resolving the issue through court

If the husband and wife cannot agree, in accordance with paragraph 3 of Article 38 of the RF IC, a judicial procedure is provided for dividing the jointly acquired property of the spouses and determining its shares. Filing a claim for division of marital property is possible:

- during marriage;

- simultaneously with its termination;

- after termination for 3 years (clause 7, article 38 of the RF IC).

Documents and evidence

List of required documents to submit to court for the division of a mortgaged apartment:

- copies of the statement of claim for the defendant and third parties;

- marriage certificate or certificate of marriage registration;

- certificate of divorce or a copy of the court decision on divorce (if the marriage has already been dissolved);

- title and status document for the apartment - information about the location of the apartment as collateral with the bank;

- certificate of state registration of rights or extract from the Unified State Register of Real Estate;

- loan agreement;

- payment schedule for loan repayment;

- a certificate from the bank about the amount paid and the balance of the debt;

- a document confirming payment of the state duty;

- power of attorney if the application is submitted by a representative.

This is important to know: Tax deduction when purchasing a share in an apartment

If the division of the apartment does not in any way affect the debt obligations of the spouses to the bank, consent to the division of the apartment from the creditor is not required. The rights of the bank as a pledge holder are not violated - the apartment remains pledged, the creditor continues to exercise its pledge right.

Drawing up a statement of claim

Elements of the claim:

- name of the court to which the claim is filed;

- information about the plaintiff and defendant: full name, place of residence, contact phone number and email address (optional);

- information of representatives, if the claim is filed by an authorized person: full name, place of residence, details of the power of attorney on the basis of which he acts, as well as contact telephone number and email address (optional);

- a claim for divorce if the claim is filed for simultaneous dissolution and division of property;

- a requirement for division of property indicating which parts of the jointly acquired property should be awarded to the plaintiff and which parts to the defendant;

- the circumstances on which the plaintiff’s claims are based and the evidence supporting them.

Deadlines and costs

It will take at least 2 months from the filing of the claim until the court decision is made. Typically, the process of considering a case is delayed for 2-6 weeks - court hearings are often postponed. The court decision is formalized and issued to the parties a week after its adoption. Within one month, the parties can challenge it by filing an appeal. If this does not happen, the court decision comes into force.

Costs for the procedure:

- The amount of the state fee depends on the price of the claim: for 2020 it ranges from 0.5 to 4%. The cost of the claim is calculated based on the share of ownership of the apartment claimed by the plaintiff.

What to do if the court refuses?

The court may refuse to satisfy a claim for division of a mortgaged apartment and mortgage payments for the following reasons:

- the statute of limitations has expired;

- at least one mandatory clause is missing in the statement of claim;

- there is no consent of the creditor when it is required;

- the plaintiff’s demands contradict the legislation of the Russian Federation;

- the plaintiff’s demands contradict the interests of common minor children (child), if the spouses have them.

If your claim is denied, you can file an appeal. In this case, it is advisable to take into account the reasons for the refusal and correct all shortcomings, if possible.

The complexity and neglect of the situation, the ambiguity and insufficiency of judicial practice - this is how the considered category of cases is often characterized. In this regard, it is better to seek qualified legal assistance from professionals rather than try to handle the case yourself. This way there will be more chances of success.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

What actions can a banking institution take?

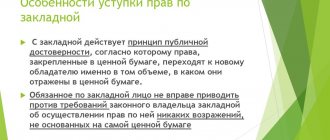

Difficulties arise due to the fact that housing purchased with a mortgage loan is secured by a banking institution with all the ensuing consequences. This means that after a divorce, in order to carry out any transaction with a mortgaged apartment, the bank's permission will be required. Without this permission, it will not be possible to sell the apartment, change it, or transfer the remaining debt to either spouse. Even in order to divide the loan amount and monthly payments between former spouses, you will need to obtain permission from the bank.

By the way, about selling an apartment with a mortgage during a divorce. The bank agrees to this, that is, gives permission for this, only in the most extreme cases, especially when spouses divorce. But obliging one of the spouses to bear previously assumed loan obligations is also problematic. Moreover, this is regulated at the legislative level by the Civil Code of the Russian Federation, namely paragraph 1 of Article 391, in which the transfer of debt from one person to another is possible only with the permission of the creditor.

As for the question of how to reissue a mortgage into two parts, allowing each of the former spouses to bear sole responsibility for their part of the debt, there is an option for such a division only if we are talking about a multi-room apartment. If the apartment is one-room and it is impossible to physically divide it into two equal shares, then the mortgage loan cannot be divided into its independent parts. This is stated by the legislator in Article 5 of the federal law “On Mortgage”, which states that it is impossible to allocate part of the property as an independent subject of mortgage if this part cannot be allocated without changing its purpose.

An important point is that the bank itself is not interested in the number of debtors increasing for one loan. This means that he will strive to prevent one monthly payment from being divided in two. Moreover, the law gives him the right to veto. In other words, it is better for a bank to have several debtors on one loan than to have one debtor on each loan.

In the first case, the risks of non-repayment of the debt are less, which means that the bank will strive to maintain the current position on the loan, despite the change in the marital status of the borrowers. One involuntarily recalls the words of the hero of the movie “Primorsky Boulevard” that with the new insurance system, the spouse will think three times before getting a divorce. The role of such insurance of marital relations is performed by a mortgage, being the material guardian of the family hearth.

What to do with loan payments if spouses divorce?

Article 256 of the Civil Code of the Russian Federation states that property acquired during marriage belongs equally to both spouses.

During a marriage, spouses choose how to distribute property during a divorce:

- In accordance with the legislation of the Russian Federation. The method of distribution of property is specified in Article 39 of the RF IC: it is divided in half, unless the spouses choose a different option.

- In accordance with the marriage contract. In the contract, the couple can establish any option for the development of events that is convenient for them.

After the divorce, the division of property occurs either through an agreement or in court. As property is divided, so are mortgage payments.

Mortgage payment distribution options:

- Separation between two spouses. Thus, a separate agreement is drawn up for each spouse.

The bank may not comply with this request, because It is more profitable for him to have several debtors on one loan. This increases the chances that the funds will be paid. Before the division, each borrower will be checked for solvency. In accordance with the distribution of mortgage payments, the apartment is also divided. However, if the apartment is one-room, such a division is impossible, because shares must be allocated in kind. - You can transfer the entire debt to one of the spouses. Thus, the apartment will subsequently belong to him.

Features of the situation depending on the presence of a marriage contract

The marriage contract is regulated by the Family Code of the Russian Federation. Such a document has not yet taken root in Russia and many spouses do not sign it, believing that the marriage will not fall apart. A prenuptial agreement may be entered into before or during marriage.

After the divorce, such a document cannot be concluded. If this is necessary during a divorce, the document is concluded before filing an application for divorce.

The document is in writing and requires certification by a notary. Thanks to such an agreement, a person establishes his own method of dividing property during a divorce, and not the one established by law.

The marriage contract is terminated by agreement of the parties or if one of the parties does not fulfill its obligations. But the borrower must notify the lender of the termination of the agreement.

Upon termination of the marriage contract, the bank may require changes to the loan agreement or early repayment of the loan.

Initial factors influence the outcome of the situation:

- Is the marriage official? Civil marriage does not fall under the scope of the Family Code; the relationship of the couple is considered on the basis of the Civil Code of the Russian Federation.

- Whether the property was purchased during or before marriage. Real estate purchased before marriage belongs to the person who acquired it (you can find out how an apartment is divided after a divorce if the mortgage was taken out before marriage).

- Has a marriage contract been drawn up?

- Do the spouses have children (we wrote in detail about the most effective options for dividing property and mortgage debt and filing the procedure for divorcing spouses with children with a mortgage here).

What are the options for resolving the issue?

Despite the seemingly hopeless situation that may arise during a divorce and the possible behavior of the bank, there are some recommendations on how to divide a mortgage during a divorce for a successful resolution of the issue. Since the Family Code of the Russian Federation, Article 38, establishes that the jointly acquired property of spouses, by their consent, can be divided between them, this means that it is enough to draw up such a written agreement before applying for a mortgage. In this case, the agreement can be drawn up not only before marriage, but also during its existence.

The presence of such an agreement, provided for in Articles 40-44 of the Family Code of the Russian Federation, greatly simplifies the situation. The court simply follows the terms of this agreement and will not take part at all in the division of both the mortgaged apartment and the loan itself. But in this case, the bank, as an interested party, can challenge this agreement between the spouses. He can do this if the spouses, when registering a mortgage, hid the very fact of the existence of such an agreement between them.

If the spouses have not foreseen such an agreement in advance, then all that remains is to rely on the will of the banking institution and accept the following lines of behavior. The best option is that the spouses, who are initially co-borrowers, receive equal shares in the mortgaged apartment and, after the annulment of the marriage, jointly repay the debt to the creditor.

The next option differs from the first in that the borrower is one of the spouses. Shares in the apartment and the debt for it are distributed equally. If there are two rooms in the apartment, then the bank can split the mortgage loan. It is worse if in this situation the apartment is one-room and one of the spouses refuses to pay his share of the debt, while not claiming a share in the apartment. The bank may go so far as to transfer the entire debt to one of the spouses and after it is repaid, he will remain its sole owner. In order to re-register a mortgage in this way, it is necessary to provide a written refusal from the second spouse, which must be notarized.

And finally, the last option, in which the bank does not cooperate when dividing the total mortgage loan of borrowers into individual loans. The primary borrower is unable to make further regular mortgage payments. The solution in this situation is to sell the apartment, which is pledged to the bank, return the entire amount of the loan received, and divide the remaining money equally between the spouses. All of the above options are quite conditional and serve as a guide for further actions of the ex-spouses.

What is the difference between a co-borrower and a guarantor?

The first has the right to register collateral real estate acquired under a housing loan agreement in his name in shared or joint ownership, and the second acts only as a guarantor of solvency. Another difference is that in the first case, at the request of the bank, insurance protection can be issued.

If you are married, then your spouse automatically becomes a co-borrower when purchasing a car or real estate on credit. It does not take into account whether the second spouse is employed or not.

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

This requirement can only be circumvented if you have previously concluded a prenuptial agreement, which clearly outlines your rights and obligations in relation to the purchase of a home. In this case, if you have enough income to pay the loan alone, you can draw up an agreement only for yourself.

4 banks that are happy to issue mortgage loans

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

When signing a loan agreement, you should immediately indicate the registration of property - to whom it applies. After all, the situation may change, the spouses may file for divorce, and it is the agreement that will determine whether you have rights to the property or only the obligation to repay the debt.

Exceptions to the general case when an apartment cannot be shared by two people

There are a number of special cases, there are only two of them, in which both the division of an apartment under a mortgage and the division of the loan received for it are not provided. The first case refers to such a phenomenon as a personal mortgage, in which an apartment was purchased with the personal money of one of the spouses before or during marriage. In accordance with Article 36 of the Family Code of the Russian Federation, such property is not included in the list of jointly acquired property and is not subject to division upon divorce.

Such property and such personal money include those funds that were received by one of the spouses before he entered into marriage, or funds that were received during the marriage, but from the sale of property of the spouse acquired by him before the marriage. This includes money and property that was inherited by the husband or wife, as well as property or funds received during privatization or other gratuitous transactions.

The following exception applies to military mortgages. In this matter, everything is not as clear as with personal funds. For example, a number of lawyers insist on the application in such cases of the provisions of Article 34 of the Family Code of the Russian Federation, which states that jointly acquired property includes all the labor income of each spouse, the results of intellectual work, etc. including any cash payments that do not have a special purpose.

Some lawyers believe that the money that is transferred to the military under the savings-mortgage program is targeted and is not jointly acquired property. In this case, a wife or husband who is not a military personnel cannot claim part of this apartment.

As you can see, everything is logical and in accordance with the law, if not for one thing. If additional funds covered by the definition of joint property were used to purchase such an apartment, then the specified restriction does not apply to these funds. This means that the spouse of a military personnel has the right to claim half of these additional funds. There may also be cases where additional funds were taken from other property that was not subject to the joint property regime.

For example, a military husband takes out a military mortgage, and his wife allocates money that was inherited from her parents to pay for it. In this case, she claims the entire amount that she invested. If the husband himself invested this inherited money from his parents, then the wife cannot claim either the apartment or these additional funds.

The apartment was not purchased during marriage

In accordance with Art. 36 of the RF IC, an apartment that belonged to each of the spouses before marriage, as well as one received by one of the spouses during marriage as a gift, by inheritance or through other gratuitous transactions, for example, under a privatization agreement, is his property.

In case of divorce and division of property, the apartment acquired before marriage will remain the property of the spouse to whom it belonged.

There are cases when one of the spouses purchased housing with a mortgage before marriage, and after the wedding both spouses paid the mortgage jointly. In the event of a divorce, the apartment remains with the owner, but the second spouse has the right to demand reimbursement of the funds invested by him in repaying the loan.

This is important to know: Tax refund on the purchase of an apartment in 2020 under the new law

How does this happen

In practice, as a rule, evidence is provided in court that the payment was made at the expense of the matrimonial property. The court, taking into account the arguments of the parties and the materials available in the case, makes a decision on compensation (payment) to the other spouse of part of the cost of the property or on the allocation of a share in the apartment.

Community property

The income of each spouse from work, entrepreneurial activity and the results of intellectual activity, pensions, benefits received by them, as well as other monetary payments.

The common property of the spouses also includes movable and immovable things acquired at the expense of the spouses' common income, securities, shares, deposits, shares in capital contributed to credit institutions or other commercial organizations, and any other property acquired by the spouses during the marriage, regardless of whether in the name of which of the spouses it was purchased or in the name of which or which of the spouses contributed funds.

The right to the common property of the spouses also belongs to the spouse who, during the marriage, managed the household, cared for children, or for other valid reasons did not have independent income.

Is it possible not to pay the mortgage after divorce?

There is a misconception that, in the case where the mortgage debt is borne by both spouses, one of them can safely evade loan payments, or more precisely, their share of monthly payments. This is not true and here's why. Late payment leads (even in part) to an increase in debt, that is, when the monthly payment has been made, but not in full, the bank automatically charges a penalty according to the terms of the agreement.

This penalty is distributed to both borrowers. By continuing to fail to pay interest and interest on the loan, as well as accrued penalties, borrowers increase the amount of debt. In this case, the debt increases for both borrowers, regardless of which of them pays and which does not. The end result of this behavior of debtors will be the taken away apartment and debts that they will have to pay to the bank.

Still have questions?

Call number 8 (ext. 147) and our lawyer will answer all your questions for FREE

How to buy an apartment while married and avoid problems in the future

The acquisition of a shared apartment by spouses is a responsible procedure. Before signing a contract, you need to think through all the details and possible consequences in advance.

First of all, the couple needs to decide on the form of ownership. There is an option when the living space is the common property of both spouses, and the share of each of them is officially determined - this is shared ownership. However, there is also so-called joint ownership, when the apartment belongs to both spouses, but the ownership shares of each of them are not specified in the title deed. This form is only possible for married couples, while a shared form can be issued even for people who are not related to each other. In addition, one of the spouses can become the sole owner.

So which form is better? For those who fear an unfair division of property, it is better to register a shared form of ownership - this is what experts say. It can be issued in unequal shares - this remains at the discretion of the potential owners of the purchased home. The joint form does not determine shares, and therefore, during a divorce, the division of all property acquired during marriage is carried out by court decision. Initially, the court proceeds from the principle of equal rights of spouses to jointly acquired property, but if one of the parties is able to prove its right to a larger share, a decision may be made on division in a ratio other than 50/50.

The same rules as for joint ownership will apply if the owner of an apartment purchased during marriage is one of the spouses - the property is still considered jointly acquired.

If you purchase an apartment during marriage, the income tax refund (NDFL) has its own specific features. Despite the fact that the property of the spouses is common, the tax deduction can be provided in different ways. This again depends on the form of ownership that was chosen by the spouses when purchasing the apartment.

To receive a tax deduction. The following must be taken into account. If the apartment is registered in the name of one spouse, and the payment documents are in the name of the other, then there is a high probability of refusal to provide a deduction. To receive an income tax refund, it is necessary to provide documents certifying payment of funds for the apartment, as well as ownership of it. You can split the deduction between two spouses, but in this case both must have a regular official income in order to be able to take advantage of the tax refund. There is an option to refund the income tax for one of the spouses in full - in this case, the other reserves the opportunity to take advantage of the deduction in the future.

A prenuptial agreement is necessary to discuss in advance the responsibilities and rights of the spouses, as well as all the nuances of dividing property in the event of a divorce. Such a document is usually drawn up by a lawyer.

The marriage contract stipulates who will become the owner of the property after a divorce (regardless of who pays for the purchase of real estate), whether it will be possible to transfer the apartment to a minor child with the right of one of the parents to live in it until the child reaches the age of majority, whether this will be done in the event of a divorce deregistration of one of the spouses. Other requirements may also be specified.

tThe marriage contract defines a regime different from the standard division of property, and when carrying out divorce proceedings in the presence of a contract, disputes should not arise. However, in some cases, a marriage contract may be declared invalid. To avoid this, when drawing it up, you need to take into account the established rules. A prenuptial agreement cannot be drawn up if the conditions that one of the parties wishes to include in it puts the other party in a disadvantaged position. If such conditions are nevertheless prescribed, the contract can be challenged in court.

To avoid additional problems during the divorce process, you should remember: divorce does not always entail an automatic division of property, and spouses can always voluntarily agree among themselves who will get what.

Purchasing real estate using mortgage funds for a married couple can be done in two main ways. First of all, this is an option when both spouses are co-borrowers (that is, they register a joint form of ownership). And the second option is when the mortgage is issued to only one of the spouses.

If mortgage funds are raised by one of the spouses, the other must provide his official consent. Such consent is not required only if it is specified in the marriage contract.

It is possible to obtain a mortgage for both spouses when registering ownership of one of them, as well as issuing a mortgage for one of them and registering ownership for both. In either case, during a divorce, obligations and debts will be distributed equally between the parties.

To simplify the situation, experts suggest drawing up a marriage contract and specifying the obligations of each party in it, including who exactly will have to make the down payment on the mortgage, monthly payments during the marriage and monthly payments in the event of a divorce.

In addition, the contract may stipulate which of the spouses and in what shares will become the owner of the property purchased with a mortgage, whether it will be necessary to make compensation for funds, and whether it is possible to change the terms of the contract in the event of the birth of a child (children).

To purchase an apartment, a couple will need to collect and provide a certain package of documents, without which the purchase and sale of property in accordance with the legislation of the Russian Federation is impossible. The main documents that will need to be provided are:

- ID cards of both spouses, as well as birth certificates of children (if any), military ID (for those undergoing military service);

- if the transaction is carried out not directly, but through a proxy, a power of attorney with a current validity period;

- contract of sale.

in case of purchasing an apartment with the right of ownership to one of the spouses - notarized consent of the spouse to purchase the property;

In addition, when purchasing an apartment with a mortgage, it will be necessary to certify the financial solvency of the person who is involved in raising mortgage funds (if both spouses are borrowers, then it will be necessary to confirm the financial solvency of both) - a complete list of documents required for this is compiled by the specific bank from which the loan is taken. mortgage.

All real estate news and interesting information on our social media channel. Subscribe and stay updated!

The apartment was purchased during marriage

According to the general rule (Article 34 of the RF IC), property acquired by spouses during marriage is their joint property.

An apartment purchased from common income is the common property of the spouses, regardless of whose name it is registered in.

At the same time, in accordance with clause 5. Article 244 of the Civil Code of the Russian Federation, by agreement of the participants in joint ownership, shared ownership of these persons can be established.

Thus, spouses can purchase real estate in common joint ownership without allocating shares or in common shared ownership - with the definition of shares. As a rule, the size of shares is assigned to spouses equally - ½ each.

If initially the size of the spouses’ shares was not determined in the apartment purchase and sale agreement, and subsequently the spouses decide to establish shared ownership for each, then they can enter into an agreement on determining the shares, having it certified by a notary.

When purchasing an apartment with a mortgage, as a rule, spouses act as co-borrowers at the bank. In some cases - as a borrower and guarantor.

Marriage contract

Spouses have the right to divide common property and determine shares by concluding an agreement on determining shares. Or conclude a prenuptial agreement, specifying in it any provisions relating to property relations. The prenuptial agreement will specify what property will be transferred to each spouse in the event of divorce.

What is a marriage contract?

According to Art. 40 of the RF IC, a marriage contract is an agreement between persons entering into marriage or spouses that defines property rights and obligations in marriage and (or) in the event of its dissolution. It can be concluded both before marriage and during marriage.

A marriage contract concluded before marriage will come into force only from the date of state registration of the marriage.

If there is a marriage contract, the property will be divided as specified in it. Therefore, when concluding a prenuptial agreement, it is important to provide for how the spouses’ debts will be distributed in the event of a divorce.

What to do if there is no prenuptial agreement

In the absence of a marriage contract, the legal regime of marital property applies, i.e. regime of their joint ownership. Thus, if the shares of the spouses are not established, then they are assumed to be equal.

In this case, when dissolving a marriage and dividing the property of the spouses, the court proceeds from the equality of the marital shares.

The court has the right to deviate from the principle of equality of shares of spouses in their common property in the interests of minor children and/or in the interests of one of the spouses. For example, if the second spouse did not receive income for unjustified reasons or spent common property to the detriment of the interests of the family.

The spouses have minor children

If there are minor children in the family, the court, when dividing property, may deviate from equality of shares in the interests of the children. In this case, the share of the spouse with whom the children remain will be increased. In each specific case, the interests of children are determined by the court (clause 2 of Article 39 of the RF IC).

If the owner is a minor

Conducting transactions with real estate owned by a minor requires permission from the guardianship and trusteeship authority.

I'll get a divorce!

How the mortgaged apartment is divided during a divorce greatly depends on the timing of the loan. The conclusion of a loan agreement before or after the official registration of marriage will affect the legality of the division of acquired real estate upon dissolution of family ties.

Mortgage before marriage

Divorce from a mortgage taken out before registering the relationship with the registry office is one of the easiest options. If one of the spouses purchased housing with a mortgage before marriage, then he remains the sole owner of the apartment and will pay the balance of the debt independently. The second spouse can claim a share in real estate or a compensation payment if he can prove that during his family life he participated in the payment of monthly loan payments or repairs to the apartment were made at his expense.

According to the law, all debts and property are divided equally between spouses, so it is quite possible for a spouse who has no property left to file an application to court for compensation.

Division of mortgage in a civil marriage

According to Russian legislation, people living in a civil marriage do not have obligations to divide property after the termination of the relationship, as in the case of a divorce in a registered family.

Housing purchased during the period of cohabitation will remain with the person who owns it according to the certificate of ownership.

A mortgage before an official marriage can be divided between former lovers only if the apartment was registered for two, and the common-law wife and husband were co-borrowers.

Mortgage during marriage

Housing acquired during marriage automatically becomes the joint property of both spouses, even if only one owner is listed on the title deed. If an apartment was purchased on credit taken by one of the spouses, then the second in the vast majority of cases is a co-borrower. Thus, both become jointly and severally liable for repaying the debt to the creditor. When family ties are dissolved, all property is usually divided equally. The question of how to divide an apartment with a mortgage can lead to a dead end , especially if the divorcees still have a significant debt to the bank.

- If the spouses maintained good relations during the divorce, then the already divorced spouses can continue to pay the mortgage together. But you will still have to notify the bank about the divorce, especially if this clause is specified in the mortgage agreement.

- Former spouses in most cases prefer to divide the property and monthly payments into equal shares. However, today banks very rarely decide to reissue a mortgage, because they risk getting two overdue loans instead of one. Moreover, in the event of a divorce, the bank may demand early repayment of the entire amount of the debt.

- You can pay off the debt to the bank, sell the apartment and divide the proceeds in half. If the balance of the mortgage debt to the bank is small, then this will be the best option to solve the problem.

- One of the spouses can give up their share in the apartment. In this case, banks agree to remove him from the mortgage agreement, provided that the latter is financially able to make monthly payments on time.

If an apartment was purchased during marriage, but personal funds in bank accounts or inherited were used as a down payment, then if there is sufficient evidence, the spouse who actually bought the home with his own funds can expect to remain its sole owner. In the event of a divorce, the mortgage will be left to him, and the second spouse will be entitled to compensation in the amount of half of the monthly payments paid during the period of cohabitation.

A special situation arises if housing was purchased under the Military Mortgage program. According to its terms, only a military serviceman can be the owner of the apartment, as well as the borrower of the loan. Members of his family after a divorce will not be able to claim square meters in such a residential space, which contradicts the provisions of the Family Code. Banks solve this problem by introducing a clause into the mortgage agreement requiring the conclusion of a marriage contract between spouses.

The impact of a prenuptial agreement on a mortgage in a divorce

Divorce in the presence of a mortgage can be significantly delayed. Spouses who are co-borrowers can speed up this process by specifying how to divide the credit housing and who will pay the mortgage after the divorce in the prenuptial agreement.

A prenuptial agreement certified by a notary can be drawn up both before marriage and during family life, including after purchasing an apartment with a mortgage. In the latter case, you must notify the bank about its signing. A credit institution can only challenge how the mortgage is divided after the spouses divorce under a marriage contract in court.

In most cases, banks require you to sign a prenuptial agreement before applying for a mortgage. Most often this is due to the fact that one of the spouses interferes with a positive decision on the mortgage. The main reasons may be:

- Bad credit history;

- Debt load;

- Lack of official income of the spouse and, as a consequence, general insolvency of the family.

This marriage contract specifies everything that can happen that is important for the bank, namely:

- The second spouse refuses to claim. The division of the apartment into a mortgage during a divorce will occur in favor of the main borrower.

- Disclaims obligations and is not responsible for paying the deposit.

Division of an apartment on a mortgage through the court

If the parties could not reach a consensus or the bank refused to accept the agreed conditions, the court comes into action. Rules:

- The mortgage can be divided at the same time as filing for divorce or after the end of the marriage;

- the statute of limitations for such disputes is 3 years (starts from the moment when one of the participants became aware that the second partner was violating the property interests of the first);

- In court, the presence of the creditor whose property interests are affected is mandatory.

Jurisdiction

Federal courts of general jurisdiction hear such cases. The magistrate's court does not consider claims, since there is a high probability of conflict between husband, wife, and bank. The interested party sends a statement of claim to the authority located at the address where the disputed real estate is located.

Documents and sample application

The petition must contain the following blocks of information:

- the name of the federal court to which the claim is being brought;

- personal data of the plaintiff;

- personal information of the defendant;

- details of the legal entity - the creditor (official name, address - can be found in the loan agreement);

- Title of the document;

- description of the circumstances of the termination of the marriage (divorce certificate details);

- specifying the conditions for purchasing property with a mortgage;

- a request to divide property and debt between the participants;

- a list of additional documents;

- signature and date of registration.

Table “List of required documents”

| Who directs | Scroll |

| Plaintiff |

|

| Defendant |

|

| Bank |

|

This list is not complete. Additionally, other documents related to the specifics of the property dispute may be required.

Judicial practice and court decision

60% of cases end with the court dividing the loan and the apartment in half. Another 25% is a refusal to distribute debt obligations, which is due to the opinion of the bank. The remaining 15% is the division of property in different shares.

An example of the division of an apartment in a mortgage from practice:

- after full repayment of the debt, the apartment must be registered in the name of citizen Ivanova and citizen Ivanov in equal shares - 50% each.

Algorithm for dividing a mortgage during divorce

To figure out what to do with a mortgage during a divorce and how to divide it between a divorcing couple without litigation, we will create a step-by-step algorithm of actions:

- If the mortgage was issued during marriage and the spouses decided to divorce, then they need to enter into an amicable agreement on the division of the apartment and the remaining part of the debt;

- With this agreement, borrowers are sent to the bank's mortgage manager. This should be done after the divorce is officially registered. The bank will need to provide a mortgage agreement and income statements for each co-borrower for the last six months;

- If the lender makes a positive decision on dividing the mortgage, two new mortgage agreements are drawn up for each borrower and adjusted payment schedules are issued. To re-register documents, you will most likely have to pay a fee of 1-2% of the debt amount. Or one of the co-borrowers is removed from the list of debtors and is deprived of the right to real estate.

It should be remembered that banks do not like to take risks. The situation when co-borrowers on a mortgage get divorced does not in itself constitute a reason for them to divide payments and the loan balance into two parts or to remove the spouse from the list of borrowers. It is extremely difficult to obtain approval for such a transaction. Therefore, it is advisable to discuss in advance what to do if the bank refuses to change the terms of the agreement.

What happens to the mortgage if spouses with minor children divorce?

In the event of a divorce between spouses and children , like jointly acquired property, can only be divided by a court. The mortgaged apartment is divided taking into account the interests of minor children.

An apartment with a mortgage in the event of a divorce in a family where there is a child can be divided between spouses only if it consists of several rooms. A one-room apartment with a mortgage cannot be divided during a divorce, since it is impossible to allocate shares in kind. If a husband leaves his wife with a small child in a one-room apartment, he may be paid part of the cost of housing in the form of compensation.

What are the division options if the apartment is mortgaged during a divorce and there is a child:

- If he renounces his share in the apartment, banks will issue the remaining debt on the loan to the ex-wife only if she has enough funds to pay the payments. If the ex-wife cannot pay the loan, then even in the absence of claims for housing, the husband will remain among the co-borrowers and will be forced to pay mortgage payments.

- The one who remains to live with the minor child most often gets a larger share of the living space. The court may divide the mortgage equally or in proportion to the shares in the property. If there are certain circumstances (the mother is on maternity leave, disability or temporary incapacity for work), with the consent of the creditor, the share of the spouse remaining with the child in the monthly payment may be reduced. Child support and mortgage will become the responsibility of the second parent for a time established by the court.

- Mortgage and minor children can be connected using maternity capital. After the birth of their second child, many families use the subsidy they receive to partially repay their mortgage debt or make a down payment. In this case, the parents become obligated to include their children among the owners of the apartment. In the event of a divorce, the share in the apartment of the parent remaining with the children will be increased at the expense of the children's shares. The loan debt will most likely be divided equally between both parents, since they are both responsible for supporting their joint children.

- After the spouses divorce and divide the mortgage, the mother can pay off her part of the debt with maternity capital. But she will not be able to dispose of her part of the apartment until her ex-spouse fully repays the remaining part of the loan.

The role of the bank when dividing a mortgaged apartment during a divorce

The creditor is an obligatory participant. In court, a decision cannot be made without taking into account the opinion of the borrower, which is approved by the articles of the Civil Code of Russia. Opportunities and powers of the creditor when dividing the collateral property and the mortgage:

This is important to know: Buying an apartment by assigning rights in a rented or under construction house: risks

- drawing up a new loan agreement;

- maintaining current debt repayment terms;

- participation in court and expression of personal opinion;

- the right to prohibit the division of a mortgaged apartment until the debt is fully repaid.

The bank makes decisions taking into account personal financial interests. And the law always takes the side of the creditor. It will be possible to get a divorce, but it will not be possible to divide the property. The division will take place only after the loan has been paid in full.

Refusal to pay debt by one of the former spouses

If a separating husband and wife do not agree on how to pay the mortgage during a divorce, then if one of them refuses to pay the monthly payments, the arrears will build up. If there is a delay of more than three to four months, the lender has the right to take away the mortgaged housing in order to sell it and pay off the debt.

A situation often arises when co-borrowers on a mortgage divorce, and one of them remains with the apartment. The former spouse who left the apartment may refuse to pay his part of the payment to the bank, citing the fact that he does not use the housing. If at the same time he renounces his share in the apartment, then the mortgage after the divorce, with the consent of the bank, can be re-registered to the remaining borrower.

If the ex-husband or wife refuses only the obligation to pay the debt, then the second spouse will have to independently repay both parts of the payment or wait for sanctions from the bank for late repayment of the loan. Banks usually wait several months, charging penalties on the overdue amount, and then take the apartment and put it up for auction.

The selected apartment can be sold at a cost significantly lower than its market price. The proceeds from the sale will pay off the balance of the mortgage debt, including penalties and late fees. The remaining amount will be returned to the co-borrowers. As a result, a conscientious payer may be left without housing and money.

What to do with mortgage housing upon divorce?

- If the apartment is multi-room, you can allocate shares in kind, and the spouses can live on their own square meters. The problem here is that after the divorce, the ex-spouses are unlikely to want to live in the same living space.

- The mortgage, like the right of ownership, can be transferred to one of the spouses.

- Sale of an apartment with subsequent repayment of debt.

- Early loan repayment. In some cases, such an obligation is specified in the loan agreement. The difficulty is that you need to find a large sum of money, which may require the sale of other property or another loan.

If a marriage contract is concluded between the spouses, then the division of property will occur in accordance with it.

Read more about how to divide an apartment with a mortgage during a divorce and who should pay the loan here.