Difficulties

In mortgage relationships, especially if they involve minors, there are a lot of difficulties:

- Often, parents forget about the rights of minor children and do not provide them with a mandatory share. If funds under MS are involved in the purchase, then the Pension Fund and guardianship authorities will, of course, remind you of the need to allocate the child’s share, but when buying an apartment without using MS, this does not always happen.

- The sale of a real estate property, if the co-owner is a child, is possible only with the consent of the PLO and the approval of the credit institution.

- Often, the minor’s share in the new mortgaged apartment turns out to be less than in the previous residential premises, and this is unacceptable.

- A parent's failure to make future mortgage payments could result in the entire family being evicted, even if the child has an ownership interest in the home.

Therefore, everything will depend on the bank’s decision. Of course, there are some ways potential borrowers can use to make a small impact on being more likely to be approved for a mortgage:

- Find a more loyal lender . But there are some pitfalls here: a bank that is more loyal to borrowers takes a greater risk, therefore, loans from such credit institutions are often given at a higher interest rate than usual.

- Check your credit history in advance . If the borrower accidentally forgot that he already had difficulties repaying a loan from this or other banks, then he may face a refusal to issue a mortgage loan.

- Transfer another property to the bank as collateral . In this case, parents will be able to freely allocate their children's share.

- Allocate the share of minors in another residential area . To do this, you can use the apartments of close relatives, for example, a grandmother will allocate a share in her apartment for her grandson, to whom she was already going to inherit the living space.

In this case, the likelihood of mortgage approval increases significantly. Of course, if the borrower has a permanent official job and has a good credit history.

Example

The Zinoviev couple lived for about ten years in an old two-room apartment, which the wife inherited from her grandmother. But a year after the birth of the child, they decided to improve their living conditions and turned to the bank to apply for a mortgage loan. They offered the bank an old apartment as collateral. The bank agreed with the collateral and approved a loan for Zinoviev to purchase a new residential property. The spouses transferred the children's share in the old apartment to a new one, purchased on credit, and the old one remained as collateral in case of any difficulties with repaying the mortgage.

Subsequently, after repaying the loan, when the lien on the old apartment was removed, the couple sold both residential premises and were able to buy a spacious three-room residential premises with an improved layout.

And the banks are against it

The second option is problematic due to the position of banks, most of which refuse to accept an apartment as collateral if the owners include children.

Alexander Zhestkov, head of the mortgage center of the St. Petersburg branch of Promsvyazbank:

We do not allocate shares to minor children. This is due solely to the fact that it is wrong to take responsibility for allocating a share to a minor child in the event that his parents, bank borrowers, suddenly for some reason refuse or are unable to service their mortgage loan, and the apartment will have to be sold.

The caution of credit institutions is explained by the fact that, in accordance with current Russian legislation, it is very difficult in the event of a borrower’s default to sell an apartment in which a minor has a share. The problem can be solved by excluding from the scheme the pledge of real estate owned by a minor. For example, offer other real estate as collateral, if the family has one. Or take out a consumer loan for additional payment when exchanging housing. But, firstly, it is less than a mortgage loan, and secondly, it is noticeably more expensive - approximately 18-22% per annum versus 12-14% for a housing loan. Another option: if the size and cost of the apartment allow it, then you can sell it and buy a smaller home in the child’s name, and use the difference as a down payment on the mortgage. But the child’s share should not become less. To ensure that the purchased property does not remain empty, it is advisable to rent it out, covering part of the costs of servicing the mortgage loan through rental payments.

Finally, you can give your child ownership of other real estate, such as an apartment or grandparent's house. The guardianship authorities give consent to the sale of the apartment if the relatives undertake to give the minor a share in their home. In this case, it becomes possible to get a mortgage loan secured by a new apartment in which the child will no longer have a share of the property.

How to allocate a share in a mortgaged apartment to a child

There are two ways to allocate a share in a mortgaged apartment:

- by agreement between the spouses;

- under a gift agreement.

Voluntary method of allocating a share: procedure, instructions

To allocate a child's share in a mortgaged apartment, parents must do the following:

- Submit an application to a lending institution for a mortgage loan.

- To get approval.

- Find residential premises to buy.

- Obtain permission from the bank to allocate the children's share in the purchased apartment.

- Write a request to OOP.

- Draw up a purchase and sale agreement.

- Highlight the proportion of minors.

- Sign an agreement with a credit institution to issue a loan.

- Start paying off your debt.

Required documents

Obtaining a mortgage loan while allocating a child's share involves preparing a large package of documents and applying to several authorities.

To apply for a mortgage loan you will need:

- Estimation of the cost of housing that the spouses want to purchase with a mortgage.

- A receipt from the seller stating that he agrees to sell the apartment.

- Consent of the second spouse to purchase a home with a mortgage.

- Extract from the Unified State Register for the purchased apartment.

- A photocopy of the passport of the spouse for whom the loan agreement will be drawn up.

- An extract from the work record book, or another document confirming that the mortgage applicant has an official job.

- Certificate in form 2-NDFL confirming the client’s solvency.

- A copy of the marriage certificate.

This is important to know: Allocation of shares to children after repayment of the mortgage with maternal capital

To register a child’s share, you will have to contact Rosreestr , where you will need to submit:

- Passports or birth certificates of everyone to whom part of the real estate is supposed to be allocated.

- A copy of the marriage certificate.

- Copies of birth (or adoption) certificates of all minor children.

- Contract of purchase and sale of real estate.

- An agreement between parents on the allocation of a child’s share, or a deed of gift for a part of an apartment for a child.

- Receipt for payment of state duty.

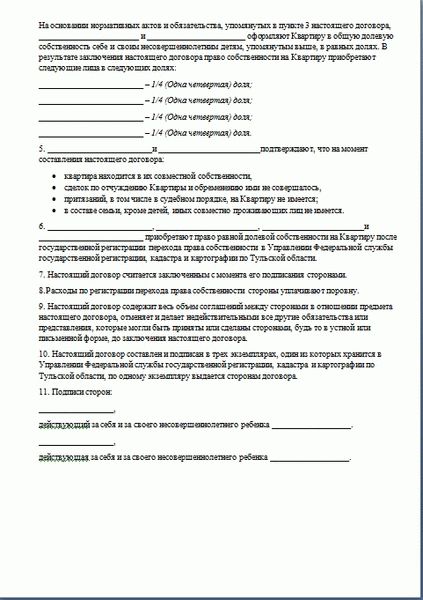

Agreement on the allocation of children's shares

In cases where the parents intend to use MS to purchase an apartment , the Pension Fund will control this agreement, but if the mortgage is issued without using the MS, control is assigned to the PFR.

The document must be certified by a notary; without notarization it has no legal force and will not be accepted by Rosreestr employees.

The spouses will have 6 months from the date on which they make the last payment on the mortgage loan to fulfill the agreement.

Deadlines

When purchasing an apartment with a mortgage, it is impossible to negotiate any real time period for allocating the children's portion; in each situation it will be purely individual. For example:

- waiting for the bank's decision can last from 10 to 30 working days;

- obtaining permission from the PLO will take up to 14 days;

- fulfillment of the obligation to allocate a child’s share is possible within six months after the conditions for their fulfillment have occurred;

- The process of registering property rights will take from two weeks to a month.

Cost, expenses

What documents are needed to allocate shares to children?

To fulfill the obligation to allocate shares to children in an apartment purchased with a mortgage using funds from maternal capital, you must provide the following package of documents:

- applications for registration of ownership rights to a share in an apartment on behalf of each participant in the transaction (to be completed by the state registrar);

- an agreement on the allocation of shares in an apartment or a donation agreement in a number of copies equal to the number of participants in the transaction (signed by the parties in the presence of the registrar);

- originals and copies of parents’ identity documents;

- original and copy of marriage certificate;

- originals and copies of birth certificates of all minor children participating in the transaction;

- original and copy of an extract from the Unified State Register confirming ownership of residential premises;

- original document confirming the transfer of ownership of the property (DDU agreement, purchase and sale agreement, etc.);

- original receipt of payment of the state duty (the amount is divided equally among all parties to the agreement).

The period for consideration of the application and package of documents in Rosreestr or the MFC is 10-12 working days. Based on the results of the review, each applicant receives a state registration certificate indicating a certain share in the residential property.

Allocation of a share to a minor in a mortgaged apartment

Hello, in this article we will try to answer the question “Allocating a share to a minor in a mortgaged apartment.” You can also consult with lawyers online for free directly on the website.

Instead of a minor, such a document is sent to his parents or guardians, since a child under eighteen years of age cannot make independent decisions.

How are shares allocated to children after the mortgage is paid off with maternal capital? How to give shares to children after paying off the mortgage?

Each family member has the right to own and dispose of their own apartment at their discretion, without violating the rights of other owners. They often resort to establishing special operating modes so that their stay does not cease to be comfortable. A convenient option for families of three is to allocate a separate room for each person.

How to allocate shares to children before and after paying off the mortgage

In practice, the allocation of shares to minors in most cases occurs after full repayment of loan obligations, otherwise permission for such actions must be obtained in advance from the bank. According to established practice, the borrower, after making the last payment amount, receives a certificate from the bank to confirm the fact that there is no debt and the account is closed.

The procedure for allocating a share involves collecting the necessary documents for submission to Rosreestr.

These include:

- Notarized written agreement of parents on the allocation of shares;

- Identity cards of the parties to the transaction, including for children

- Marriage certificate;

- Extract from the Unified State Register regarding the object of the transaction;

- A document with a decision on the size of the allocated parts of the property.

Applicants will need to pay a state fee of 2,000 rubles. To simplify the procedure, citizens are given the opportunity to submit documents through the MFC, and, if necessary, obtain the necessary registration regarding the allocation of shares. If desired, citizens can use other methods of submitting documents, including by mail or using the services of a proxy. The average time for registering shared ownership rights can vary from 5 to 12 days.

Allocation of shares to children in a mortgaged apartment

Help, please! The apartment has a mortgage, divided equally between me, my husband and my minor daughter (3.5 years old). My husband doesn’t live with us, he only pays his share for the mortgage, and I pay my share and the child’s share. I applied for alimony, the husband completely stopped paying his share.

And the third option - in case there are no accommodating relatives: sell the existing home, buy something small, without taking out a mortgage loan, in order to provide the child with the necessary space in the property. Use the remaining difference from the sale as a down payment to obtain a mortgage. Is it possible to allocate a share in an apartment to a child? This procedure is carried out, you just need to carry it out on the basis of the law. A share is a part of real estate.

Is it possible to get a mortgage for an apartment for a minor?

Registration of a share is carried out through the execution of a deed of gift or the signing of an agreement to transfer part of the property to the child. Both methods represent a procedure for the gratuitous transfer of a share in residential real estate.

This issue arises especially acutely in a situation where a decision has been made to exchange an object in which a minor already has a share. The guardianship and trusteeship authorities do not allow the sale of an object without making sure that the share will be retained in the object of purchase.

Now you have information on how, in accordance with the law, to allocate shares to children in mortgaged housing.

The obligation to allocate shares, which is a condition for the allocation of MSC (maternal or family capital) to improve housing conditions, states that their size is determined by agreement. Since minor children do not have the right to decide such issues, in fact it is the parents who do this.

We have highlighted. We bought an apartment and a mortgage. The notary immediately allocated shares for everyone. And after receiving the documents, they invested mat capital.

They will advise you free of charge, based on the norms of current legislation, on what to do in your specific situation.

But, as a rule, the procedure does not imply the collection of certificates; if necessary, registrars carry out their request independently using their own local database.

Without using maternity capital. In this case, the guardianship authorities oblige the parents to allocate square meters to their children in advance, before the loan is repaid and the property is registered as property. Banks rarely give permission for such a procedure.

Refinancing a mortgage with children's shares

If you already have a mortgage, and children have shares in the collateral, you have the right to refinance it. But here the same problems will arise as when obtaining a housing loan. What to do for borrowers who want to reduce their loan burden and transfer debt to another bank:

- Obtain the consent of the creditor and guardianship to pledge real estate partially owned by children. If this condition is met, we can hope that the refinancing will be successful.

- If the bank categorically refuses such collateral, consider the option of removing the encumbrance from the apartment. This can be done by offering the lender another property or by issuing a guarantee.

It will not be difficult to obtain permission from the guardianship authorities to refinance your mortgage, because they have already issued you a similar document once. For them, only a change of mortgagee will occur, so there is no need to worry about consent. What documents should be provided to the guardianship for mortgage refinancing:

- parents' passports;

- certificate for the child or his passport;

- the bank’s consent to refinance the existing mortgage;

- application from the borrower;

- documents for the apartment (cadastral passport, extract from the register of rights, foundation agreement, etc.).

Recommended article: Mortgage without a credit history - chances of getting approval

The most difficult thing is to refinance a mortgage for which maternity capital funds have already been allocated. The fact is that the notarial obligation to allocate shares to children must be fulfilled within six months after closing the loan (ground -).

However, the borrower will not be able to do this, because the apartment will again be pledged, only to another bank. Accordingly, the mortgage payer and the financial organization will face serious claims from the Pension Fund and inspection authorities. Such real estate cannot be considered a full-fledged collateral, because important legal obligations have not been fulfilled in relation to it.

If the client, before refinancing the mortgage, registers part of the apartment for the children, and the bank places an encumbrance on it, the risks will arise for the lender. If the client stops paying the debt, it will be difficult to sell the property. Although there are such cases in judicial practice, therefore it is impossible to take mortgage repayment lightly.

How to Allocate a Share in an Apartment to a Minor Child with a Mortgage

Many mortgage recipients are young parents, and at first glance it seems that they should be given priority mortgages.

Those banks that actively work with shares have an advantage in the flow of clients. Many mortgage recipients are young parents, and at first glance it seems that they should be given priority mortgages. This promise can be fulfilled if the family uses funds from maternity capital to pay off the mortgage.

This is important to know: Re-registration of a house after the death of the owner

We will try to correct this by providing in this article as much useful information as possible about the features of such lending. Let us consider in detail whether it is possible to obtain a mortgage for a minor, how to assign shares to a child before or after paying for the mortgage apartment, and other nuances.

Those banks that actively work with shares have an advantage in the flow of clients. Many mortgage recipients are young parents, and at first glance it seems that they should be given priority mortgages. This promise can be fulfilled if the family uses funds from maternity capital to pay off the mortgage.

We will try to correct this by providing in this article as much useful information as possible about the features of such lending. Let us consider in detail whether it is possible to obtain a mortgage for a minor, how to assign shares to a child before or after paying for the mortgage apartment, and other nuances.

On January 1, a new procedure for receiving money came into force, according to which money due for the birth of a second and subsequent children can be immediately spent on paying off the mortgage.

And under Sberbank’s Young Family program, upon the birth of a child, a borrower can receive a deferment in repayment of the principal debt or increase the loan term until the child reaches three years of age.

You probably have MK separately from the mortgage and your child is over three years old. But I have less than three years and it goes inside the mortgage as a down payment, so the bank determines only one owner, me, and family members will receive their shares after the mortgage is paid off. And this way it’s easier for the bank to take away the apartment if I don’t pay.

Guardianship and trusteeship authorities ensure that the child does not permanently lose his property. It is from these authorities that it is necessary to obtain permission for transactions with real estate owned by a minor child.

If maternity capital was used when purchasing an apartment, then allocating a share for the child becomes a mandatory requirement for completing the transaction.

Possible solutions to the problem.

This condition applies if the family decides to buy an apartment or invest money in building a house without taking out a loan. If you buy an apartment or house with a mortgage, you can bypass this requirement.

It is possible to partially or fully repay the mortgage loan from maternity capital funds, if the amount of the remaining debt allows.

You also need to know whether this will require permission from the banking institution. Let's take a closer look at all the nuances associated with these issues.

Before contacting the guardianship authorities, the borrower must obtain a preliminary decision from the bank on the possibility of obtaining a mortgage, find a buyer for the apartment being sold and find housing to be purchased. Parents must provide the guardianship authorities with an impressive package of documents for both apartments, as well as the bank’s consent that the owner will be a minor child.

Over the past 10 years, mortgages in our country have been developing rapidly and are becoming increasingly popular every year. Now this is almost the only way for the average person to acquire their own home.

If divorcing owners of a mortgaged apartment have minor children, the court has the right to deviate from the standard rules for dividing loan payments.

Definitely yes, but the contract may indicate an additional condition when discharging children if the bank’s conditions are not met or the borrower is a debtor.

These rules differ for a co-borrower-spouse. When applying for a mortgage, husband and wife have equal rights and responsibilities to the bank. In the event of the death of one of the co-borrowers, they will pass to the surviving spouse. Therefore, if the wife did not enter into an inheritance after the death of her husband, she will still have to pay the loan and pay for property insurance for the mortgaged apartment.

The list of rights that the borrower is entitled to in relation to the property is determined by each bank independently. Most often, the lender's permission is not required to register in the apartment yourself and register your family members there.

Either banks provide for a similar development of the situation in the contract - they prescribe mandatory early repayment of payments in the event of a divorce or require a marriage contract to be drawn up, in which all the nuances will be spelled out. It is worth noting that a prenuptial agreement helps not only in controversial situations with mortgage housing, but also in other, no less difficult situations.

This is important to know: Legal assistance to orphans

The list of rights that the borrower is entitled to in relation to the property is determined by each bank independently. Most often, the lender's permission is not required to register in the apartment yourself and register your family members there.

For the bank and spouses, the best option is to repay the mortgage payment early (the payment is divided into equal shares or through a court order).

Possible problems There is a certain risk when parents use a form of mortgage lending to purchase a home.

If there is no such rule in your mortgage agreement, then you still have a chance to convince the bank representatives that donating this apartment is primarily beneficial for them. For example, the current owner of the property is elderly or seriously ill, and therefore wants to transfer all the rights and obligations associated with the apartment to his employed son or daughter.

We also note that if you are going to give an apartment with a mortgage debt to a minor child or an elderly person, you will not receive the bank’s consent to this transaction since it is almost impossible to obtain timely debt payments from disabled persons.

Families who have not had time to take advantage of family capital find themselves in the most advantageous position.

You should not abuse your own position, because the bank, in the absence of mortgage payments, has the right to demand that the child be discharged from the mortgaged apartment. This usually happens before they decide to sell it.

It is possible to register the shares of the owner’s children in the ownership of an apartment that was purchased with a mortgage loan. Since the ownership right is encumbered with a mortgage, registration will require coordination with the guardianship and trusteeship authorities, as well as the consent of the bank that issued the loan.

How to allocate shares after paying off a mortgage

Before paying off the mortgage, the allocation of a share may become necessary if the apartment is purchased using family capital. When using family capital, the parents agree to allocate a share in the property to their children after repaying the loan, which is certified by a notary. When buying or selling an apartment in which the owner is a minor child, you may encounter certain difficulties. This is due, first of all, to the fact that there are certain legal norms that protect the rights of minor children when making transactions.

It must be borne in mind that, in accordance with current legislation, for the sale of an apartment in which the owners are minor children, permission from the guardianship and trusteeship authorities is required.

The allocation of children's shares in an apartment purchased with a mortgage must be made by spouses in agreement. The document is drawn up in writing and certified by a notary. The agreement must be fulfilled within 6 months after the mortgage is repaid. The child is assigned the share specified in the text of the agreement. Its size must be no less than that established by law in each specific region.

Allocating a share to children after paying off the mortgage

Allocating shares to children after paying off the mortgage is much easier, because this procedure does not require additional approvals from the bank. Let's take a closer look at this process.

Peculiarities

This procedure also has a number of nuances:

- If during the term of the loan agreement another child appears in the family, he must be given a share on an equal basis with the older children.

- 6 months are allotted for collecting all documents and carrying out the transfer procedure after settlement of the loan. If the family does not have time to complete the process during this period, the supervisory authorities have the right to legally recover the nominal value of the capital back.

- To transfer ownership rights, you can draw up a gift agreement or an agreement on the transfer of part of the apartment. Both of these documents are notarized. They imply the transfer of ownership without making additional payments.

- If both spouses are owners, but the share of each of them is not determined, first it is necessary to allocate their parts, then the children's parts. It will not be possible to allocate everyone’s shares at the same time due to different reasons for receiving. Parts of the spouses are allocated on the basis of an agreement on the division of marital property, while the children are transferred by gift or agreement on the allocation of shares.

Documentation

The following kit will be required. To remove the encumbrance after paying off the mortgage:

- Mortgage from a bank.

- An application for withdrawal will be drawn up by an MFC employee. There is no need to prepare anything in advance; there is also no state duty.

Next, to divide shares in the MFC, you need to prepare:

Share of minor children in a mortgaged apartment

Additional costs may arise if paid certificates and statements are required. On average, you will have to pay from 300 to 1500 thousand rubles for them. But, as a rule, the procedure does not imply the collection of certificates; if necessary, registrars carry out their request independently using their own local database.

Total characters: #LENGTH#.', f_author : ' writes:n', f_cdm : 'The message will be deleted permanently.

Our experts will help you quickly find the correct answer to the question – how to allocate a share in an apartment to your child without violating anyone’s interests.

When the construction of a house is completed, the child must be given not only part of the structure, but also the land on which it is located. The rule was approved by Art. 35 of the Land Code. You can transfer a house only with the land on which it is located. Therefore, you will have to divide not only the house itself, but also the land plot.

How to allocate before and after loan repayment?

After the birth of our children, my husband and I improved our living conditions through swearing. capital, accordingly, according to the law, shares in the new apartment were allocated to the children.

To obtain permission from the guardianship authorities, the borrower will need to collect even more documents than to draw up a loan agreement.

In June 2020, the Supreme Court summarized its practice in such cases, and its recommendations are binding. The Family Code establishes that parents do not have the right to the property of their children, and they, in turn, do not have the right to the property of their parents (Article 60). Therefore, it is recognized as the correct decision when the share of children is determined in proportion to the amount of maternal capital divided among all family members.

Without the permission of the municipalities, it will not be possible to make the apartment the subject of collateral. From the point of view of the board of trustees, encumbering real estate with collateral is a significant deterioration in living conditions. Even if the mortgage involves a significant increase in the child’s share, the guardianship authorities consider the risk that is in any case present when lending.

Is it possible to allocate shares to children in a mortgaged apartment?

Before taking out a mortgage loan, you need to assess all the risks. Registration of documents and their notarization will cost a tidy sum. You can receive preferential conditions if housing is purchased in whole or in part using maternity capital. For example, Sberbank and VTB 24 set a reduced rate.

The child has a share in my apartment, obtained through privatization, my ex-wife takes out a mortgage on the apartment, with the participation of maternal capital, will she have to allocate him a share in the mortgaged apartment.

Within six months after the mortgage is repaid, the legal representatives of minors are required to allocate a share in housing for the children (if necessary). If this condition is not met, the authorized bodies may go to court against the parents, and the maternity capital will need to be returned.

Buying real estate with children's shares on a mortgage

Buying an apartment with a mortgage with children's shares is similar to a simple loan transaction. However, there are a number of significant nuances and documents that must be taken into account. In particular, such purchase and sale takes much longer. You need to be prepared for this if you plan to purchase an apartment with shares of minors. The need to involve guardianship authorities in this situation is spelled out in.

It is advisable to involve a lawyer in the transaction so that he can minimize the risks of cancellation of the transaction in the future.

What is the procedure for obtaining a housing loan when the sellers include minors:

- Decide on the property you are purchasing.

- The owner must collect a package of documents for the property in accordance with legal requirements. In order for the buyer to send a standard list of papers for consideration by the bank, the seller must obtain permission from the guardianship authorities to purchase an apartment and sell the existing living space. It turns out that he must already have a specific purchase option that allows him to obtain the consent of the guardianship.

- Obtain the bank's permission to conduct the transaction.

- Sign an agreement with the seller and give him the down payment. Complete the loan documents at the bank branch and submit all papers for registration of ownership.

Buying an apartment with a mortgage with guardianship , i.e. with shares of children, is done only through a notary. Be prepared to incur additional costs to pay for his services. The parties decide independently how they will be distributed.

When you buy an apartment with guardianship on a mortgage, you need to attach special importance to the permission of government agencies for the transaction. It must be completed, otherwise Rosreestr will return the documents for revision. Do not sign any paperwork until you personally verify that you have consent to sell.

What documents will be required for the guardianship authorities regarding the mortgage of the apartment being sold:

- parents' passports;

- child’s certificate or passport;

- extract from Rosreestr for the housing space being sold;

- certificate from the house register;

- statement.

Information. In accordance with the law, for minors under fourteen years of age (minors), property transactions can be carried out on their behalf only by their parents, adoptive parents or guardians.

It is imperative to attach documents confirming that there is no violation of the child’s property rights. If you gave him a share in another apartment, attach an extract from the register of rights. When purchasing a new property with the proceeds, a preliminary purchase agreement must be drawn up.

Recommended article: Which apartment can you get a mortgage

Does Sberbank allocate shares to children on a mortgage?

If Sberbank allocates shares to children, then why is there a lot of information on the Internet that it is impossible to formalize this? The problem arises for those people who want to provide their child with guaranteed housing before repaying their housing loan. Few people understand how possible this is. And even fewer parents have enough legal knowledge to carry out the procedure correctly. Therefore, let's talk about everything in order in simple words.

Is it possible to allocate shares to children in a mortgaged apartment?

According to statistics, about a third of families use mortgage loans when purchasing housing. Two- and three-room apartments in new buildings are popular among the population. In such houses, the rooms have sufficient area so that each family member has the required number of square meters for a comfortable stay.

This is important to know: Voluntary abandonment of a land plot in shared ownership

A mortgage in Sberbank involves providing a share to a child if the parents have used maternity capital, which is 453,026.00 rubles. We remind you that money is paid to families upon the birth of their second baby. The procedure involves formalizing an obligation to allocate a share. The document is long-term, and people become actual owners after repaying the debt to Sberbank.

You can allocate a share to a child if the guardianship authorities require it. In this case, there is no need to use maternal capital as a down payment. Guardianship authorities require parents to register a share in advance. The bottom line is that if the debt to Sberbank is not repaid and the apartment is repossessed, then at the time of its sale the interests of the baby will be protected. But such deals come with a number of difficulties.

Possible difficulties

Allocating shares to children adds to the problems. Mortgage lending is a complex procedure, given the mass of documents and aspects that Sberbank takes into account when determining the terms of the loan. The controversial points are:

- The use of maternity capital does not necessarily imply a share of real estate for the child.

- The decision to sell real estate obliges parents to obtain Sberbank approval for the transaction.

- The share does not have to be the same as in the previous apartment. When applying for a mortgage, it may decrease.

- The presence of a share does not deprive Sberbank of the right to evict the father and mother in the event of debt on the loan.

When registering a share, they receive the approval of Sberbank. To increase your chances, do the following:

- carefully choose a lender (Sberbank is considered the best option);

- improve (if necessary) credit history, eliminate all debts to banks;

- provide Sberbank with collateral in the form of other property owned by the applicant;

- distribute children's shares in other apartments and houses of second-degree relatives (grandparents, aunts, uncles).

In this case, you can count on a favorable distribution of shares and guaranteed approval of Sberbank. So, if parents live in a house or apartment with their grandmother and receive living space as an inheritance, it can be mortgaged. Then the share can be redistributed so that in the new apartment taken on a mortgage, the child is entitled to a ¼ share.

Until the debt to Sberbank is repaid, the collateral property is pledged as a guarantee. After repayment, both objects become the property of the family. Another option is to sell granny squares so that the money received can be used as a down payment along with maternal capital. In this case, permission from the guardianship authorities is issued, since we are talking about depriving children of a share of the inheritance.

How to allocate a share in a mortgaged apartment to a child?

Instant transfer of a share is most often impossible. This fact is due to the fact that the square meters belong to the bank until the mortgage is repaid. An alternative is to formalize a deferred execution, issued if maternity capital was used. After the debt is repaid, the share is transferred on the basis of a gift or by mutual consent of the parents. Another possibility is to register a share through the court.

Procedure, instructions

Proper implementation of the procedure for allocating shares is a guarantee of providing the offspring with housing. The step-by-step instructions suggest:

- Submitting an application for mortgage lending from Sberbank.

- Obtaining approval from Sberbank with consent to allocate a share.

- Discussion of loan terms (term, amount, interest rate).

- Providing Sberbank's consent to the guardianship authorities.

- Signing a real estate purchase and sale agreement.

- Registration of the allocation of the children's share in the total volume of the quadrature.

- Sign a loan agreement for the purchase of housing with Sberbank.

- Pay off your mortgage in full without delays.

The difficulty is that each step is associated with a number of difficulties that you have to go through. A large number of authorities and documents, approvals, justification, etc. But any problem can be solved if you follow the above instructions.

Required documents

To approach the procedure prepared, you must do the following:

- Get an opinion on the value of the property.

- Obtain a receipt from the owner of the property that the apartment is ready for re-registration.

- Provide written consent from the spouses.

- Receive an extract from the Unified State Register of Real Estate (USRN).

- Prepare a certificate of employment (copy of the work book, license to operate an individual entrepreneur, copy of the employment contract, certificate 2-NDFL, etc.).

- Marriage certificate.

Cadastral papers are not provided. Rosreestr requests data independently. And to get a statement for Sberbank, you will have to prepare:

- identification documents of all participants in the allocation of shares;

- marriage certificate (original and copy);

- receipt for payment of state duty;

- child's birth certificate;

- papers proving the right to own housing;

- written consent of the baby's father and mother.

All papers must be valid. The list is long, but as a rule, every borrower has documentation.

Agreement on allocating a share to children

At its core, this document is an obligation assumed by parents. Controls the transfer of the share to the Pension Fund of the Russian Federation if maternity capital is used. A special feature of the design is mandatory notarization. Obligations come into force from the moment the mortgage agreement is signed at Sberbank.

The child is allocated a share no less than that specified in the legislative acts of Russia. For regions, the number of square meters varies. The average required area is 12 sq.m. the document does not have a unified form, but this is rather a minus. You must provide all required information. A sample parental agreement for the allocation of a share can be downloaded on the Internet or obtained from a notary.

Deadlines

The situation here has a number of features. Each case with regard to the timing of determining the share is individual. It all depends on the following factors:

- Sberbank approval is issued within a period of ten to one month.

- It takes up to two weeks to obtain permission from the guardianship authorities.

- The period allotted for the execution of the agreement is up to six months.

- Registration with Rosreestr will take from 14 to 30 days.

The trial is carried out within 2-6 months, if there are no complications. At the same time, the procedure involves expenses, and this is in addition to the obligation to repay the debt to Sberbank.

Cost, expenses

Allocation of shares to children when using maternity capital for a mortgage

The legislation obliges the owner of the certificate, after removing the encumbrance from the mortgaged housing, to undergo the procedure for allocating shares within 6 months. Such an obligation is confirmed by a notarized document, which is transferred to the Pension Fund upon receipt of permission to use maternal capital funds. A copy of the paper remains with the authorized body, serving as confirmation of the promises made by the parents.

The size of the allocated share is determined by citizens independently. In some regions, a specific area size is established, less than which part of the property cannot be. A certain share is allocated to each child and both spouses. To avoid misunderstandings, notaries and real estate market specialists recommend allocation so that its value is approximately equal to the volume of raised maternity capital.

Failure to comply with the current rules may result in negative consequences for the borrower. Removing the encumbrance from an apartment does not mean that the owner has the right to immediately sell the apartment or conduct other types of property transactions with it. Such actions may lead to the termination of the contract in the future. Claims may come from authorized bodies or from relatives.

The initiators of legal proceedings may be:

- guardianship service;

- Pension Fund;

- prosecutor's office;

- adult children;

- legal representative of the child;

- interested people.

Selling a mortgaged apartment with allocated children's shares is also fraught with certain difficulties. If the child is the owner, then, according to the current rules, after the transaction is completed, his rights should not be violated. This means that the minor must take possession of a similar part of residential real estate, the quality of which is not inferior to the previous one. Violation of such a requirement may lead to objections from the guardianship authorities, which can lead to the cancellation of the contract. This development of events is fraught with problems for the buyer and seller of the apartment.