Legislative nuances of the return of mortgage interest in 2020

The main legal act of the Russian Federation regulating relations between the state and taxpayers is the Tax Code. Chapter 23 contains several articles that describe in detail the conditions under which a citizen has the right to compensation for expenses incurred by him from funds paid to the budget in the form of taxes.

According to the Tax Code of the Russian Federation, six types of deductions are legally established, each of which has its own characteristics:

- standard;

- social;

- investment;

- property;

- professional;

- when carrying forward losses from transactions with securities to future periods.

Citizens who have entered into a mortgage lending agreement with a bank receive the right to return taxes transferred to budget revenue on the basis of Article 220 of the Tax Code of the Russian Federation, which talks about property deductions. An important nuance is that there are two calculation options depending on the date of purchase of real estate:

- until 2014;

- after 2014.

Paragraph 3 of Article 220 of the Tax Code provides for the return of personal income tax on expenses for the purchase of a house, apartment, plot, etc., and paragraph 4 – on expenses for paying interest to the bank. In the first case, the maximum amount of spending on which the deduction is calculated is 2 million rubles, and in the second - 3 million rubles. This means that the citizen will receive 260 and 390 thousand rubles, respectively (13% of the specified maximum amounts).

Thus, the law provides for the possibility of obtaining a deduction if the borrower spent funds for the purpose of:

- repayment of interest on a mortgage or target loan, at the expense of which a residential house, apartment, room, land plot was built or purchased;

- repayment of interest on loans aimed at refinancing previous loans, also used for the purchase of residential real estate or a plot of land for construction.

How much can you get back?

You can get back 13% of the purchase price of the home, but the maximum amount on which this percentage is charged is limited to 2 million. That is, if you bought a home for 5 or 10 million, you can still only count on 13% of 2 million (260 thousand). If the housing cost less, 13% is calculated based on its actual cost.

When registering living space worth, for example, 5 million as shared ownership with your spouse, each of you will receive 13 percent of two million (520 thousand in total).

The amount of the deduction is determined depending on the cost of the housing purchased with borrowed funds and the amount of interest paid to the bank . That is, the maximum amount for deduction from the price of housing is 2 million rubles, and additionally from interest – 3 million rubles.

Who is entitled to a mortgage interest refund?

To get back part of the taxes paid to the state, the mortgagee must meet several requirements: be a resident of the Russian Federation, have official employment and “white” income, 13% of which goes to the treasury. As a rule, these are hired employees of state, municipal and commercial organizations and enterprises, as well as individual entrepreneurs who submit a declaration to the fiscal authority in form 3-NDFL, that is, who do not apply special tax regimes. Pensioners who stopped working and, accordingly, paying taxes, no more than three years ago are also entitled to a deduction.

For real estate purchased by spouses in a registered marriage, the procedure for calculating the amount of the deduction differs depending on whether the housing was purchased before January 1, 2014 or after. It was from this date that changes to the legislation came into force, according to which the tax deduction was no longer tied to the share of property. In order to receive a refund of personal income tax paid in the maximum possible amount, it is important to take into account the specific circumstances of each family.

[offerIp]

How to receive the money?

Go to the tax office at your place of registration, having made an appointment in advance through the official website of the institution. Then tell the inspector about your intention to return the money for the mortgage and present the documents you brought.

Based on them, you need to receive a declaration in form 3-NDFL. As a rule, this document is not prepared by the tax office itself, but by a third-party organization that provides services to the public. Most often, they are either in the same building or nearby. Production time – 1 day.

Advantageous mortgage offers from Sberbank of Russia ⇒

After this, you need to contact the Federal Tax Service again with a 3-NDFL certificate. Next, you will need to write an application for a tax deduction, which must indicate the bank account number for transferring funds. A copy of the passport and TIN is attached.

You might also be interested in these articles:

The appeal will be considered within three months, after which you will have to provide a bank account number to transfer funds.

How many times can you use your mortgage interest refund?

Since 2014, another change to the Tax Code of the Russian Federation came into force: deductions for expenses on purchasing housing and expenses for paying interest on a mortgage were divided. You can get your taxes back when purchasing one or more real estate properties, but not more than 2 million rubles. What is the situation with the deduction for interest? Does the law provide for the right of the mortgagee to return part of the funds paid to the bank for the second apartment?

Clause 8 of Article 220 of the Tax Code of the Russian Federation states: “The property tax deduction provided for by subclause 4 of clause 1 of this article can be provided only in relation to one piece of real estate.”

In addition, paragraph 11 of Art. 220 states that repeated provision of tax deductions provided for in subparagraph 4 of paragraph 1 of Article 220 is not allowed.

This means that it is possible to return part of the interest paid to the credit institution on a mortgage loan only in relation to one property. Even if you contributed less than the 3 million rubles established by the Tax Code as interest, you will not be able to “get” the required 13% when purchasing another apartment, room or plot.

It is important to understand that the fiscal authorities cannot return more than what was received from you in the form of personal income tax for the past year. That is, if the amount paid to the bank exceeds the amount of taxes withheld from wages, the balance is carried over to the next year. In this case, pensioners receive a refund from funds transferred to the budget in the previous year. In addition, simultaneous deductions for other reasons are taken into account, for example, for the return of part of the funds spent on treatment. Thus, you can receive mortgage interest reimbursement for several years until you reach the limit of 390 thousand rubles.

If before 2014 an apartment was already purchased with a mortgage, and 13 percent of the interest paid to the bank for using the loan was returned, can the borrower count on a deduction when purchasing another property?

2014 was the year of important changes to the Tax Code of the Russian Federation concerning the procedure for calculating and paying property deductions. To better understand the essence of innovation, let’s look at specific examples.

Let's say an apartment was purchased in 2012, and the owners exercised their right to a property deduction, including mortgage interest. If after January 1, 2014, another home is purchased, then filing a second declaration in the hope of again returning part of the funds paid to the bank in the form of interest is pointless. This is directly stated in the letter of the Ministry of Finance of the Russian Federation dated April 2, 2020 No. 03-04-05/18240.

Calculation example

How to get 13 back from a mortgage? The tax deduction and income tax refund for mortgage interest is structured similarly to the cost deduction.

Let your salary be one million rubles a year. And so - for 10 years. Let's say at the end of December of this year, you purchased a home at a price of 2,200,000 rubles. For this purchase, you took out a mortgage loan for one and a half million rubles. The 2020 mortgage was issued for a period of five years, the rate is 12% per annum. What are you entitled to in terms of personal income tax refund on interest? And how to return the interest on the loan?

Your property tax deduction will be 260,000 rubles. This is 13% of the cost of the apartment, but not more than 2 million.

In the reporting year, you paid income tax of 130,000 rubles - 13 percent of your earnings of one million. All personal income tax compensation when purchasing an apartment with or without a mortgage will be within the limits of these 130,000.

What can you claim in the year following the year of purchase? If your income has not changed, then you will receive another 130,000. For 2 years, you have received a full property tax deduction for the apartment and it’s time to apply for a personal income tax refund on the interest paid.

In the third year, you can repay the mortgage interest. Over these three years, you paid the bank approximately 417,000 rubles in interest. Of these, you have the right to return 13 percent from the mortgage, for mortgage interest - 54,210.

Thus, although you paid taxes in the third year of the same 130,000 rubles, you will receive a deduction of only 54,210. Next year the amount will be even less because You submit data only for the interest paid for the 4th year. This is approximately 63,700 of which the tax refund for mortgage interest will be only 8,281 rubles.

Over the years, you will receive less and less tax refund because... Mortgage payments (interest) will decrease. If repaid early, this amount will be further reduced.

The maximum return on mortgage interest in our example will be 2,200,000 * 13% = 286,000. You will not be able to receive them because... According to the schedule, only 501,807 rubles in interest will be paid over 5 years. Of this, you can return 13 percent through the tax office, up to a maximum of 65,234 rubles. and this is subject to repayment of the mortgage strictly on schedule.

Mortgage interest repayment period

There are often cases when taxpayers find out that they are entitled to a tax deduction on interest, not immediately after purchasing housing with borrowed funds, but after some time. In this regard, they have a question about how long the right to issue a personal income tax refund remains. This topic is also relevant for those apartment owners who currently do not have legal grounds for a property deduction, since they do not pay taxes to the budget at a rate of 13%. Among them are pensioners, the unemployed, and women on maternity leave.

The Tax Code in Article 220 does not establish a time limit after which the taxpayer is deprived of the opportunity to issue a refund of interest on the mortgage. This means that there are no time restrictions for this property deduction. The buyer of real estate can immediately exercise his right to a refund, or he can do this several years later, when he begins to transfer personal income tax to the budget.

Paragraph 7 of Article 78 of the Tax Code of the Russian Federation states that an application for offset or refund of the amount of overpaid tax can be submitted within three years from the date of payment of the specified amount. It follows from this that the time limit for applying for a tax refund on mortgage interest is also three years, and you cannot include a year in which the right to deduction has not yet arisen. An exception to this rule applies only to pensioners: they can return taxes withheld from them for the years preceding the registration of the mortgage.

Let's look at this situation using an example:

The apartment was purchased using borrowed funds in 2014, but the owner only learned in 2020 that the state was returning part of the interest on the mortgage to taxpayers. The law does not establish a statute of limitations for tax refunds, so he has every right to submit a 3-NDFL declaration for 2020 to the tax service at his place of residence. Earlier periods (2014 and 2015) cannot be used due to the three-year limitation on the return of mortgage interest.

How to calculate the return for this year?

Everything is very simple - for calculations you will need data from your income certificate. You need to take your official salary and multiply it by the number of months worked this year and multiply again by 0.13.

Remember that you will have to submit documents for a refund annually until you return 13% of the cost of housing. You need to fill out a tax return at the end of the tax period, i.e. early next year.

What salary is needed to get a mortgage at Sberbank ⇒

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

It is noteworthy that in one tax period you cannot receive a payment greater than in the past. In other words, if last year they paid 60,000 rubles, then this year the amount will be the same, this must be taken into account.

If you don't use the full amount, it may carry over to your future property purchases.

https://youtu.be/AjiJ1ow03iA

You may be denied a tax refund in the following cases:

- if the apartment was purchased at the expense of the employer or a budget of any level;

- in the case where the transaction was made between close relatives;

- in a situation where there is a fictitious purchase and sale transaction.

Do not forget that you can return the money for a mortgaged apartment through the tax service only once in your life.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

List of banks with the lowest mortgage rates today ⇒

Question-answer section:

2020-01-16 16:23

Yana

Good afternoon, I quit my job 3 months ago, now I’m temporarily unemployed, is it possible to apply for a refund in this situation or only through an officially arranged job? Thank you.

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Yana, a refund can only be issued by officially employed citizens who receive wages, and part of the money is withheld from it in the form of tax

2019-03-03 18:46

Hope

What if my husband and I took out a mortgage in 2020? The mortgage amount was 1 million 600, and the down payment was 1 million 200, and they got an official job in 2020. We have the right to a refund, if so, please tell us how much. My husband and I are two owners. We are waiting for your reply. Thank you.

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Hope, starting from 2020 you will only receive the right to a tax deduction. You cannot apply for it without employment and official income on which taxes are paid

2019-02-17 16:29

Natalia

Good afternoon. Please tell me if I can return the income tax for the mortgage that was taken out in 2009 in full if I have never applied for a refund over these years. The mortgage ends in 2020. Thank you

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Natalya, unfortunately, no. You can return the amounts paid for no more than 3 years preceding the submission of the application. That is, now you can apply for a deduction for 2015-2017

2016-09-15 12:14

Anna

Good day. My husband and I decided to buy a home and heard that we could get some of the money back for the apartment mortgage through the tax office. In this article you described how this can be done and what documents to prepare. However, it is not entirely clear to us who has the right to this benefit.

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Anna, this is not a benefit, but a property tax refund. Anyone who has taken out a housing loan and is officially employed can use it. Contact the Federal Tax Service in your area, they will explain everything to you.

View all questions and answers ⇒

06/04/2017 Information about the authors | Category: Mortgage

Examples of mortgage interest repayments

1. Typical case of filing a deduction . You bought an apartment in 2020, using financial assistance from the bank, and immediately registered ownership. The loan amount was 1 million rubles, the term was 10 years, the interest rate was 11%. The monthly annuity payment is 13,755 rubles, of which 9,166 is interest. This amount becomes smaller with each installment, while payments to repay the principal debt increase. The total amount of interest on the loan is 653,000.14 rubles. We multiply it by 13%, we get 84,890.01 rubles, this is exactly the amount of the deduction due to you.

The borrower's salary allows him to make monthly payments, so it does not matter much. We will assume that the property deduction for the purchase of residential real estate has already been applied previously; this right cannot be used again.

| Year | % in a year | 13,00% | Fact. return |

| 2019 | 107124 | 13926 | 13926 |

| 2020 | 100393 | 13051 | 13051 |

| 2021 | 92882 | 12074 | 12074 |

| 2022 | 84501 | 10985 | 10985 |

| 2023 | 75152 | 9769 | 9769 |

| 2024 | 64720 | 8413 | 8413 |

| 2025 | 53081 | 6900 | 6900 |

| 2026 | 40095 | 5212 | 5212 |

| 2027 | 25606 | 3328 | 3328 |

| 2028 | 9441 | 1227 | 1227 |

| Total | 653000 | 84890 | 84890 |

It is not possible to refund personal income tax on mortgage interest in advance, before the borrower’s funds arrive in the bank account. This is contrary to common sense, because there is no complete certainty that the loan will be fully repaid, just as there is no certainty that the mortgage will not be repaid ahead of schedule, saving %.

2. Tax deduction for mortgage interest for several years . In 2020, you entered into an equity participation agreement with the developer; mortgage loan funds were used for payment (2 million rubles for 10 years at 11%). The property was registered in 2020. Annuity payments, 27,550 rubles. At first, about 18,000 of them are interest, gradually their share in the payment decreases, and payments to repay the principal debt increase. According to the loan agreement, the amount of interest for the entire period of its validity is 1,036,000.27 rubles. The taxpayer is entitled to a personal income tax refund in the amount of 169,780.03 rubles (1,306,000.27 * 13%).

If the borrower’s salary is about 50,000 rubles per month, then the annual deduction is expected to be 78,000 rubles. If the amount of income has not changed during the previous three years and is expected to remain the same for the term of the mortgage agreement, then the taxpayer is entitled to a lump sum refund of mortgage interest for the three previous years. During this period, despite the fact that ownership of the apartment had not yet been registered, payments under the loan agreement were regularly made. To return the overpaid tax, 3-NDFL declarations for 2020, 2020, 2020 are submitted. In the following years, documents for deduction are submitted annually or after three years.

This example also does not take into account a property deduction in the amount of 260 thousand rubles for the purchase of housing.

| Year | % in a year | 13% | Fact. return |

| 2016 | 214249 | 27852 | — |

| 2017 | 200786 | 26102 | — |

| 2018 | 185764 | 24149 | — |

| 2019 | 169003 | 21970 | 78000 |

| 2020 | 150304 | 19539 | 19639 |

| 2021 | 129440 | 16827 | 16827 |

| 2022 | 106162 | 13801 | 13801 |

| 2023 | 80191 | 10424 | 10424 |

| 2024 | 51213 | 6657 | 6657 |

| 2025 | 18883 | 2454 | 2454 |

| Total | 1306000 | 169780 | 169780 |

The taxpayer can return the overpaid tax only after signing the transfer and acceptance certificate and registering the ownership of the property with the authorized government bodies.

Yulia Dymova, director of the Est-a-Tet secondary real estate sales office, answers:

The tax deduction and declaration in form 3-NDFL must be submitted from the moment the acceptance certificate is signed. In May 2020, you can submit a declaration for the three previous years - that is, from 2020. To do this, you need to provide the following package of documents: a share participation agreement, a transfer and acceptance certificate, a 2-NDFL certificate on income for the entire period, a copy of the loan agreement and a certificate from the bank on the interest paid during this time.

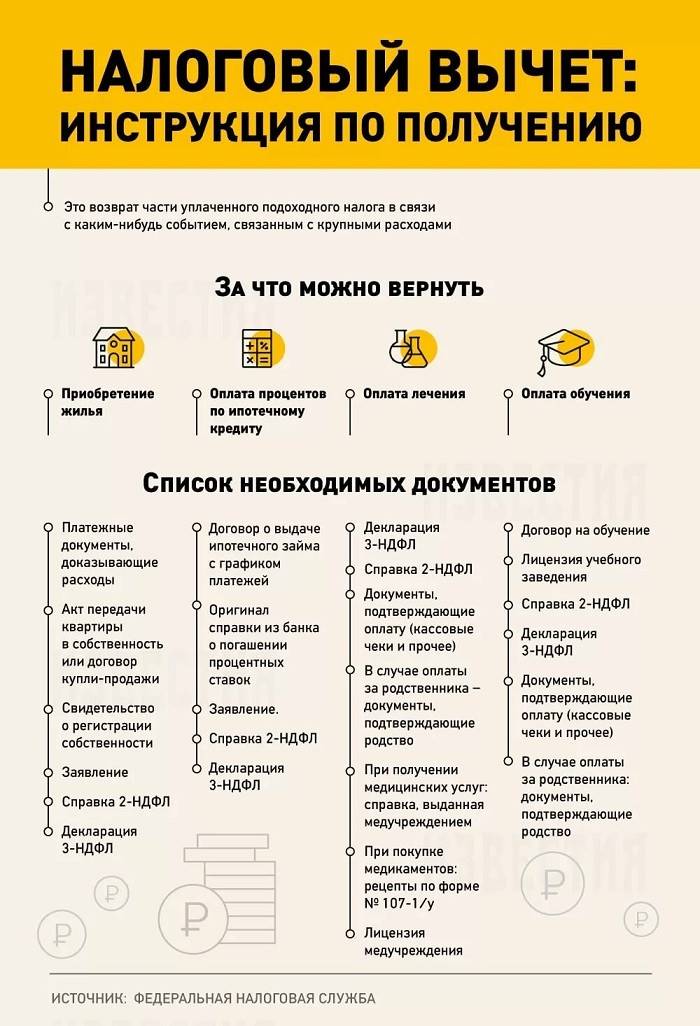

What documents are needed to return mortgage interest?

An application for a refund of mortgage interest at the tax office will be processed quickly and without comments if you pay attention to the collection and preparation of documents. Required package includes:

- personal documents of the taxpayer (passport and TIN);

- property purchase and sale agreement;

- document confirming ownership of real estate;

- declaration (form 3-NDFL);

- mortgage payment receipts and certificate of current debt;

- certificate in form 2-NDFL (original);

- application for refund;

- loan payment schedule (as an appendix to the agreement);

- a certificate from the bank with the current account number for crediting.

From the above list it is clear that partial reimbursement of funds spent on the purchase of residential real estate is available to adult citizens of the Russian Federation who are officially employed and pay personal income tax.

However, the applicant for the deduction does not have to be an employee. Individual entrepreneurs who are subject to basic taxation and pay 13% of their income to the state budget have the same right to return these funds in the form of a mortgage interest deduction.

When housing is shared ownership of spouses, a marriage certificate (original and copy) is added to the list of documents.

If a tax deduction is expected to be received for past years, but the citizen does not have documents confirming regular payments, then the tax office will accept a bank account statement for consideration.

The amount of personal income tax refund on mortgage interest is calculated by employees of the fiscal authority based on the submitted documents and information on the payment of personal income tax. If there are no claims against the applicant, the deduction due to him is transferred to his account.

The above list of documents is not exhaustive; if it is necessary to clarify the circumstances of the case, additional information may be required. Most often this happens if a credit institution is declared bankrupt and restructured during the term of the agreement. This means that another legal entity becomes the creditor, therefore, documents on the assignment of claims are required.

Property deduction funds can be credited to the recipient’s card or issued at the cash desk.

Mortgage interest repayment procedure: main stages

The actions of the taxpayer, claiming compensation for part of the interest paid to the bank, coincide with those that he carried out when filing a deduction for the principal amount of the purchase of a home.

To receive back overpaid personal income tax, the borrower must:

- collect a package of documents, thanks to which the tax service will verify his right to a refund from the budget;

- submit an application to the tax office, which provides detailed information about the transaction for the acquisition of residential real estate and the mortgage agreement with the bank;

- wait for the results of the review of the submitted documents by the Federal Tax Service employees responsible for working with individuals;

- receive funds into your current account.

This procedure is general for applying for a deduction when buying an apartment, and if you want to return personal income tax for interest on the mortgage. The only difference is the need to indicate that the purpose of the appeal is to return part of the remuneration paid to the bank for the loan provided. You cannot do without evidence of depositing funds to pay off interest on a housing loan.

When refinancing a loan, there are some features of applying for a refund:

- when the borrower reimburses interest on the principal amount of the debt, repeating the procedure with refinancing is impossible: according to the law, only one request is approved;

- refinancing should be targeted exclusively for the purchase of residential real estate. Having an amount for personal needs may be a reason for refusal;

- The limitation of the tax base to 3 million rubles also applies in the event of concluding an on-lending agreement.

It is very difficult to independently understand all the nuances of return and deduction of mortgage interest. Federal Tax Service employees provide assistance to citizens free of charge, as part of their direct official duties, so if you have any questions, you should contact the nearest department.

Tax deduction for the purchase of housing

That's the rule. But there is an exception to it. This exception is called a tax deduction. Being interested in people buying housing, the state partially allows its citizens to write off income taxes if citizens spent their salaries on purchasing housing. There is a personal income tax refund when purchasing a home.

If you buy an apartment or house with a mortgage loan, then the mortgage payments used to pay off bank interest are also considered spent on housing. A citizen who buys this property receives a tax deduction. On this basis, the mortgage interest paid is returned.

Let's start with a tax deduction on the principal amount from the purchase of an apartment or other housing, since before claiming a refund on mortgage interest, the principal amount must be compensated. You may return the interest to the bank ahead of schedule, but the principal amount will not go anywhere.

Let's say in 2020 you earned one million rubles. Every month they regularly automatically paid (through their employing organization) 13 rubles. from every hundred. Over the course of the year, you paid 130,000 rubles to the treasury, which is exactly 13% of the tax base, that is, your annual earnings. And suddenly, at the end of the year, you bought a room in a communal apartment for 500,000 rubles. This is where the state provides you with a tax deduction. It reduces your tax base by these 500 thousand and tells you that you must pay income tax of 13 percent not on the full amount of your earnings, but on its amount minus the cost of the purchased home, i.e. You should get back 65,000 rubles previously paid by your employer for your taxes. This allows you to return a 13 percent tax deduction.

This is how the tax deduction works. Basically.

How to get deductions for an apartment and for mortgage interest at the same time

Let us say right away that this is an atypical situation. This need arises if the taxpayer missed the deadline for filing a return. Another option is to purchase an object under an equity participation agreement, as a result of which ownership rights arise later than the borrower’s relationship with the bank began. In addition, citizens whose income is much higher than the average can apply for a simultaneous return of personal income tax on the apartment itself and on the %. In the three years preceding registration of property, they must pay enough taxes so that the amount exceeds the standard deduction for the purchase of housing (260 thousand rubles) and there is still a balance for mortgage interest.

As a rule, the personal income tax refund is processed first under clause 3 of Art. 220 of the Tax Code of the Russian Federation, and when it is exhausted, an interest deduction is issued.

Let's look at an example.

Let's assume you bought an apartment for 2 million rubles. in 2020 and immediately registered ownership. You borrowed the missing funds from the bank - 1 million for 10 years at an interest rate of 11%. The monthly annuity payment amounted to 13,775 rubles, of which interest was 9,166. Every month the amount of interest decreases, the contribution to repay the principal debt increases.