Refund of interest on a mortgage loan at Sberbank

Every citizen of the Russian Federation and some foreign citizens are given the right to receive a tax deduction on mortgage interest. This possibility is enshrined in paragraph 4 of paragraph 1 of Art. 220 of the Tax Code of the Russian Federation. Borrowers who have obtained a mortgage from the country's main bank are no exception. Repayment of interest on mortgage interest at Sberbank occurs on a general basis; there are no special or restrictive conditions.

Thanks to the registration of a tax deduction, the state provides the borrower with a benefit through the return of money on the mortgage,

which are returned in cashless form.

The tax deduction for a mortgage at Sberbank can be basic - 13% of the total value of the property, but not more than 2,000,000. Accordingly, the borrower will be able to return a maximum of 260,000.

The second option for receiving benefits is the return of interest on interest on a mortgage loan with Sberbank.

Such interest compensation is carried out according to the following parameters:

- the subject can return 13% of the amount of all annual interest paid to the bank for the entire period of the agreement;

- the maximum deduction amount is 390,000 rubles;

- the amount of funds expected to be returned from the budget will be equal to the amount of tax withheld from wages in the reporting year. If during the year you paid 70,000 from your personal income tax salary to the state treasury, then the tax deduction for a mortgage loan from Sberbank cannot exceed this limit.

As a rule, repayment of money on a loan occurs in stages, over several years, until the deduction is fully transferred and is equal to 13% of the amount of interest on the mortgage.

How to return mortgage interest to a married couple?

Applying for a loan for spouses is much easier and faster. This is due to the fact that the total income of each participant in the transaction is taken into account. Responsibility is also divided in half.

According to the law, every citizen of the Russian Federation who purchases housing with a mortgage is entitled to benefits. Therefore, here the benefit from the use of this legislation is also doubled. Each spouse has the right to apply for a refund of 13% of 2 million.

In total, a maximum of one transaction can return up to 520 thousand rubles, provided that both the wife and the husband have a permanent official income. To do this, you will need to comply with some procedural rules:

- Registration of ownership in shared participation. Each participant must own part of the real estate.

- The application is submitted individually by the spouse.

- If one of the family members received a deduction, then the share of the second participant cannot exceed half.

It is worth noting that there is no time limit for submitting an application. Thus, if one of the spouses currently does not have official earnings (maternity leave, temporary disability), then you can claim your rights to tax relief after reinstatement.

Transferring the funds received as debt repayment will significantly simplify mortgage payments. For example, the cost of an apartment is 5 million rubles, the down payment is made in the amount of 1 million, the loan is 4 million, respectively. Of these 4 million, the state returns 520 thousand to citizens, i.e. 26%.

Grounds for obtaining a mortgage interest deduction

The main basis for the return of interest on a mortgage agreement in Sberbank of Russia is the mortgage agreement. In other words, only for those legal relations that involve the acquisition of real estate, be it an apartment, a room, a private house, a plot of land or a share in the right to such property. The mortgage agreement must contain comprehensive information about the real estate that is the subject of the agreement and indicate the cost of such acquisition, on the basis of which all proposed calculations are made.

Subjects eligible to receive a deduction

At the legislative level, the state establishes a number of rules , according to which a borrower who has entered into a mortgage legal relationship with a financial institution, including Sberbank, can claim a refund of part of the funds from the amount of interest under this agreement:

- Subjects can be both citizens of the Russian Federation and subjects of a foreign state;

- Official employment in the Russian Federation;

- Payment to the state treasury of the corresponding income tax in the amount of 13%;

You will not be able to receive a tax deduction on mortgage interest if:

- the citizen became the owner of the mortgaged property due to its payment by a third party;

- a person is engaged in business activities on the basis of a patent or a simplified taxation system;

- the right to the benefit was exercised earlier (unlike the general property deduction, the deduction for interest on a mortgage agreement is provided once in a lifetime, regardless of whether the amount limits have been exhausted or not).

Tax deduction

In contrast to the state tax exemption for the amount transferred to a bank account to improve housing conditions, the maximum amount of money paid as remuneration for using a loan has been increased to 3 million rubles. The bank's remuneration is also considered funds spent on the purchase of housing.

Considering that the repayment period of a housing loan usually exceeds 10 years, contacting the tax service is possible immediately after paying income tax. Let’s say your annual earnings are 1 million rubles. A citizen has the right to apply annually and return up to 130 thousand.

If we consider the totality of two types of deductions, then we can return money in the amount of 650 thousand for each citizen. This also applies to married couples, doubling the amount of repayment, provided they have a regular income and a large mortgage loan. More than 1 million rubles is a significant help in purchasing your own home.

The tax deduction applies directly to the amount of interest the bank receives. This variable allows you to reduce the overpayment for using credit funds. The final indicator must be calculated based on the amount of the bet, and not on the main body of the loan.

Required package of documents

In order to receive a mortgage deduction from Sberbank, you must confirm the existence of factual grounds for such a right. Therefore, the borrower should collect a list of documents for the tax authority, which pays such funds.

The package of documents includes:

- Title documents for the property;

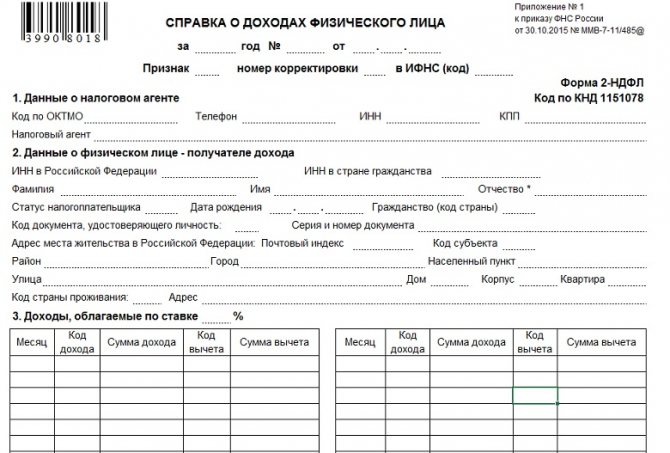

- Certificate from the employer (2 personal income taxes);

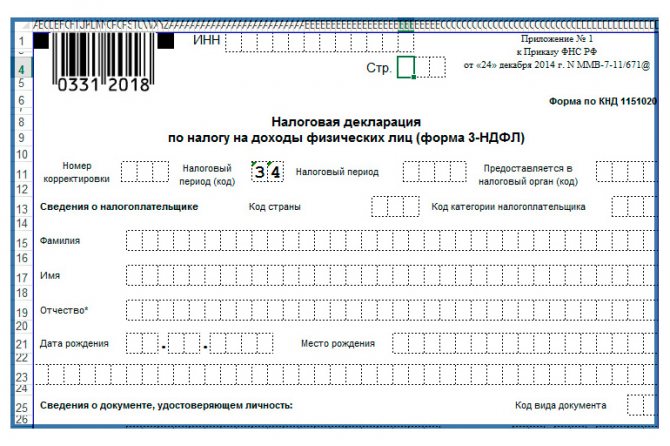

- Declaration 3 personal income tax;

- Purchase and sale agreement using borrowed funds (mortgage agreement);

- Documents, receipts confirming the fact of making payments, including interest repayments (Sberbank can also provide a certificate reflecting the procedure and amount of payments you make for the entire period from the beginning of the legal relationship);

- Photocopy of passport;

- Payment repayment schedule;

- Bank account details where the deduction amounts will be transferred;

- Application for transfer of funds in non-cash form (the form will be provided by the Federal Tax Service when submitting a list of documents or you can download it in advance on the official website);

- Register of documents (inventory of all documents submitted for delivery).

Most borrowers prefer to first receive a general deduction on the mortgage, thus, when exercising the right to receive interest on interest, some of the documents may not be needed, since information about them will already be in the corresponding database. For example: a copy of the mortgage agreement, bank account number, payment schedule.

Required documents

To receive a deduction, you need to prepare and submit a package of documents to the territorial inspectorate of the Federal Tax Service (IFTS) at your place of permanent registration. You have to prepare three groups of documents:

- Basic documents

- Home ownership documents

- Documents for your mortgage loan, for recalculating personal income tax on the mortgage.

The documents of the first group include:

- Passport. It's best to have a copy with you. Typically, a passport is sufficient to determine an individual taxpayer number (TIN). Just in case, submit an application through the tax office to issue you a Tax Registration Certificate. You don’t need to give your passport, just show it.

- Application for income tax refund. This application contains the details of your bank account.

- Certificate in form 2-NDFL. You can obtain this certificate from the accounting department at your place of work. This certificate reflects the amount of income tax (NDFL) accrued and withheld from you. It is this amount that is subject to refund.

- Tax return in form 3-NDFL. From us you can download an electronic sample and this form itself, and if you have one place of work and a stable salary, you can easily fill it out yourself. In difficult cases, it is better to use the help of professionals.

The second group is documents for housing. In the basic case there are only three such documents:

- Contract of purchase and sale of housing. It should mention the amount for which the object was purchased.

- The act of acceptance and transfer of the object, signed by both parties.

- Certificate of registration of ownership of the object with government agencies.

Be sure to have the originals with you and, just in case, copies to leave them with the inspection.

And finally, the third group is loan documents. Let us remind you that first, documents are drawn up to compensate for the costs of purchasing housing, and only then does a tax refund occur when purchasing real estate with a mortgage. The third group contains only two documents:

- A loan agreement between you and the bank providing your lending. In order to receive a tax refund for purchasing an apartment with a mortgage, it must mention the targeted nature of the loan - for the purchase of housing. Whether your mortgage provides for a return of 13 percent depends not on the bank, but on you and your employer. An integral part of the agreement is the schedule of payments that you undertake to pay, highlighting in the payments the amounts of repayment of the principal debt and payment of interest on the loan.

- A certificate from the bank about payments made during the year, with a mandatory breakdown of the repayment amounts and loan servicing. To return interest on a mortgage, a decryption is needed for interest on the mortgage. Contact your bank and they will issue you a certificate on a special form. The data from the certificate may differ from the schedule from the contract, for example, when repaying a loan early. Payment of money for early repayment of a mortgage occurs according to a specified schedule.

Have copies of documents with you, be prepared to attach them to your application for personal income tax refund for the purchase of housing and reimbursement of mortgage interest.

After submitting your application, the tax office will begin reviewing your case. Verifying the validity of an income tax refund takes from two to four months. After which, if the decision is positive, the money will be credited to your account.

How to return interest from interest in Sberbank: step-by-step algorithm of actions

So, if you have not previously realized the possibility of receiving a mortgage interest deduction, you must choose one of the following algorithms:

- Independent submission of documents to the Federal Tax Service during a personal visit or through the taxpayer’s office;

- Through your employer.

First option

The first option for obtaining a deduction from interest on a mortgage loan can only be carried out on behalf of the owner of the property or on behalf of an official representative who has a notarized power of attorney and occurs as follows:

- Preparation of necessary documents;

- Transferring them to the Federal Tax Service at the place of registration or through the online account of an individual (uploading scanned copies is required);

- If all data is consistent and complete, the employee accepts the documents and, if necessary, can give you a stamp with a date indicating the start of their processing.

- The beginning of a desk audit, the duration of which cannot exceed 3 months from the date of acceptance of the documents by the tax authority;

- If any document is missing or incorrect information is identified, you will be asked to replace or report it;

- Transfer of funds to the taxpayer’s personal account within one month from the end of the desk audit.

It should be understood that the total response time to a request for a refund from the budget is 4 months. However, a desk audit does not always last three calendar months (this is the maximum established period, beyond which it is prohibited); as a rule, it is much shorter, so the taxpayer receives the transfer much earlier.

In 2020, mortgage clients of Sberbank of Russia have the opportunity to take advantage of a special program from the bank - “Let's return taxes to the family.” As part of this promotion, the borrower is given the opportunity to receive a tax deduction on interest without unnecessary delay, which will be issued by the bank itself. After paying a small fee, you are assigned a personal consultant who will guide the process and notify you of the provision of all the necessary documents, which you can transfer without leaving your home - via a secure communication channel between you.

Based on the data received, he will fill out a declaration and submit all documents to the Federal Tax Service, from which you will receive your interest deduction.

Second option

The second option for returning interest on mortgage interest at Sberbank –

from the employer. This option does not require the borrower to provide 3 personal income tax returns.

Algorithm for refunding funds through the employer:

- Prepare the necessary package of documents;

- Submit all the papers to the Federal Tax Service and fill out an application for issuing a special notification there;

- The application is reviewed within 30 days;

- Receiving a notice and transmitting it to the employer’s accounting department.

It is important to understand that receiving a deduction through the employer occurs in a different form. To do this, you do not have to wait until the end of the tax period (year) in which the property was purchased. Having received a corresponding notification from you from the Federal Tax Service, the employer no longer withholds income tax in the amount of 13% from earnings until the entire amount of money due is paid.

After what time can a deduction be made?

You can submit an application to the Federal Tax Service for the return of part of the principal amount of the transaction at the end of the current year. The deduction has no statute of limitations. It can be obtained at any time. It is allowed to return the money, even if at the time of submitting the documents the apartment has already been sold or donated.

However, this preference is not used for mortgages. It is problematic to sell an apartment or other collateral housing before repaying the loan.

After receiving funds for the property, the owners claim compensation provided for the interest paid.

List of documents

The main documents for obtaining a deduction are:

- Copy of the passport.

- Refund application indicating bank account.

- Tax return 3-NDFL, completed independently or with the help of a consultant. The preparation of the document is carried out both by various Internet resources and by consulting firms.

- Certificate 2-NDFL about the total amount of income and taxes withheld for the past year.

- A certificate of ownership or an extract from the Unified State Register of Real Estate for the property for which the return is being issued.

- Agreement of assignment of rights, purchase and sale or equity participation.

- The act of acceptance and transfer of real estate.

- A receipt confirming the transfer of money to the buyer, or a bank statement - for non-cash payments.

- Marriage certificate (if available).

- Application for division of deductions between the parties to the transaction.

- Passport of the minor homeowner or birth certificate.

- Loan agreement.

- Interest repayment certificate.

- Bank statements or checks confirming payments.

- Repayment schedule.

You can submit documents on the Federal Tax Service website through your personal account or in person at the place of registration of an individual.

Registration through the employer

The law provides for compensation at the place of work. First, a refund is issued for the cost of housing. After exercising this right, you can take advantage of the interest deduction.

In this case, the employer stops withholding personal income tax from the salary. The employee receives the entire accrued amount until the due portion of the cost of the apartment and interest are repaid.

After contacting the accounting department, the participant in the mortgage agreement submits documents to the Federal Tax Service.

These include:

- passport;

- statement;

- certificate 2-NDFL;

- an extract from the Unified State Register or a certificate of ownership of the property;

- mortgage agreement with repayment schedule;

- purchase and sale agreement with APP;

- receipt confirming receipt of funds by the seller.

After a month, the inspectorate issues a notice for the principal amount or interest, which the mortgage participant delivers to the place of work. Additionally, he sends an application addressed to the employer to the accounting department.

Where else to apply

You can receive a deduction in 1 of 2 ways:

- annually, submitting documents to the tax office at the end of the period;

- monthly by sending a notification from the tax office to the employer.

There are no other options for exercising the right to return the deduction.

Some nuances associated with the return of mortgage interest at Sberbank

The process of exercising the right to receive a deduction from interest on the purchase of real estate is often associated with some nuances. All this is due to the fact that this kind of deduction is a fairly large amount, the transfer of which requires certain reserves in the state treasury, as well as a thorough check for the reliability of the legal basis from the provided list of documents.

At the legislative level, the order of receipt of a deduction is not established, be it a general deduction from the purchase of an apartment or a deduction on interest from such a loan agreement. However, practice in this area shows that it is more cost-effective to resort to the right to receive an interest deduction in the second place. This is explained by the fact that during the period until you receive the total deduction in full, the amount of annual interest paid to the bank will increase, and therefore the amount of the available interest deduction will increase.

If your property was purchased before the beginning of 2014, then the return of mortgage interest has no restrictions, since such an amendment to the Tax Code of the Russian Federation was made later than the specified date. Accordingly, the tax authority will be obliged to return to you an amount that is a multiple of 13% of the interest paid under the mortgage agreement with Sberbank, even if it exceeds 390,000 . However, if you took advantage of the right to the corresponding deduction before 2014, then splitting the amount by receiving a tax refund from the purchase of other real estate is not allowed.

Also, unlike other methods of returning funds from the budget, which have a time limit for exercising the right, you can return interest on a mortgage from Sberbank not only within three years after purchasing the property. This right remains valid as long as the limits are not exhausted, even if this process takes decades.

If the property under a mortgage agreement is registered as shared ownership, for example, in half between spouses, then the amount of the tax deduction for interest on such a legal relationship is divided into two parts, proportional to the shares of property. So, the husband and wife will receive a total deduction for each of a maximum of 130,000 (which will amount to a limit of 260,000) and a deduction of 195,000 for interest on the mortgage agreement (for a total of 390,000). However, if the spouses express a desire, then only one of them can receive the corresponding deduction in full.

Transferring the balance of the main deduction to a new home

We are asked: I bought an apartment before January 1, 2014 and used only part of the maximum deduction amount. Is it possible to receive the rest of the deduction when purchasing a new apartment after 01/01/2014?

The current version of the Tax Code (paragraph 2, paragraph 1, paragraph 3, Article 220 of the Tax Code of the Russian Federation) states that a property tax deduction can be obtained for several residential properties within the amount of 2 million rubles.

However, Federal Law No. 212-FZ dated July 23, 2013 (as amended on November 2, 2013) gives a clear answer: the new rules apply only to housing purchased after January 1, 2014.

If you received a tax deduction for an apartment purchased before January 1, 2014, it is understood that you have completely exhausted your right to a property deduction. The old rules apply to you, when the deduction was given only once in a lifetime and for one piece of real estate.

Even if the deduction you receive is less than the maximum allowable amount, the remainder of the deduction is not transferred to other housing and is burned out. It does not matter when the other housing was purchased - before or after January 1, 2014. Additional grounds: Letter of the Federal Tax Service of the Russian Federation dated September 18, 2013 No. BS-4-11/ [email protected] , Letters of the Ministry of Finance of Russia dated March 7, 2020 No. 03-04-05/12936, July 26, 2020 No. 03-04-05/43559.

Place your order and we will fill out the 3-NDFL declaration for you!

Order a declaration

Example:

In 2013, you purchased an apartment for 700 thousand rubles and received a property deduction. 91 thousand rubles were returned to your account. In 2019, you buy a house for 4 million rubles.

You heard that a deduction of up to 2 million rubles can be obtained for several housing properties, so you thought that after the first purchase you were left with a deduction that was not received. But you were denied a deduction for your house, since you completely exhausted your right to a tax deduction when purchasing an apartment in 2013.

If you only received a principal deduction for a home purchased before January 1, 2014, you can receive a mortgage interest deduction for a home purchased after January 1, 2014. Let's take a closer look at the situation.

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Conclusion

The owner of real estate registered under a mortgage agreement with Sberbank of Russia enjoys tax benefits on a general basis. He can claim a deduction from interest on a mortgage agreement, the subject of which is absolutely any real estate, within the limits of 390 thousand rubles once in a lifetime, which distinguishes this benefit from the general deduction for the purchase of real estate.

You can exercise your right: through personal efforts by contacting the Federal Tax Service, through an employer, or using a new service from Sberbank. The legislator establishes restrictions on the circle of persons applying for benefits - citizens of the Russian Federation or subjects of another state who officially work in the territory of our country and regularly pay income tax.

Who has the right to return funds?

The relaxation is available only to certain categories of citizens who meet the requirements. It includes:

- Those who have official income subject to tax.

- Citizens of the Russian Federation.

- Foreigners living and working in the Russian Federation for at least half of each year.

State benefits do not apply to the following group of persons:

- Pensioners and women on maternity leave.

- Persons who purchased real estate with the funds of other citizens.

- Entrepreneurs with a special form of taxation.

- Those who bought real estate from close relatives.

- Having no official income.

The payment is a one-time payment; it can only be received once for each citizen. However, if the maximum limit is not reached, then an application for the remaining funds is submitted when the second mortgage is paid off. The same applies to women who went on maternity leave, after which they can also return the rest.