Loan disputes

In case of delay or failure to repay the loan in full, a dispute arises between the bank and its client.

Judicial practice speaks about the most common reasons for disputes with borrowers:

| Client's financial inability | fulfill the obligation to repay the loan |

| Borrower's desire | change the terms of the loan agreement |

| Start of the recognition process | certain clauses in the text of the contract are invalid |

| Disagreement | with foreclosure of a residential property |

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

In the event of non-payment of the balance of a monetary debt, when, for example, the last payment of several thousand rubles is not made, it is necessary to understand that mortgage interest is charged on this balance.

This is stated in the payment schedule, as well as interest as a penalty for late payment.

Responsibility for delay is provided not only by the law on mortgages and the Civil Code of the Russian Federation, but also by the agreement itself.

It is this document that specifies the amount of the collected penalty, which may be higher than specified in the Civil Code of the Russian Federation.

According to the terms of the mortgage agreement, the bank has the right to demand that the client repay the full amount of the loan after the first delay.

In litigation, much attention is paid to contractual terms.

For the most part, legislation in the field of civil law, in particular on mortgage relations, is applied with reservations specified in the contract.

This is why it is so important to carefully study the loan agreement when applying for a mortgage. Everything written in the document becomes binding.

Going to court

You should go to court if the bank was unable to reach an agreement with the client. In practice, the bank will not, on its own initiative, carry out any conciliation procedures without the borrower contacting it.

Therefore, as soon as the client understands that he will not be able to pay the loan on time, he should contact the bank with a request for installments, deferment, interest reduction, loan refinancing, or other “help” from the organization.

The agreement itself may not indicate the possibility of receiving a measure of support from the bank, but this does not deprive the right to make such a request.

Typically, a loan agreement with government support (for example, under the Housing program, under the savings program for the military) provides for the possibility of deferred payment.

The bank notifies the borrower about going to court. Typically, litigation is viewed as a last resort and does not immediately follow the first delay.

Practice shows that litigation is initiated when there is a delay of 5% of the price of the mortgaged housing.

The appeal is prepared for court in the manner of litigation, if we are talking about the need to collect the pledged property (determining the starting price for bidding).

In other situations, if we are talking about writing off accounts, and not about the sale of collateral, it is permissible to apply for a court order in accordance with Chapter 11 of the Code of Civil Procedure of the Russian Federation.

Required documents

Once the borrower has received court notice of the commencement of the process, he must prepare for the proceedings.

For this purpose, the following documents are drawn up and collected:

| An objection is being written | to the bank's claim |

| Loan agreement | receipts for payment of monthly amounts |

| About income | and family financial situation |

| Other documents | confirming the borrower’s situation in which it has become difficult for him to pay the loan (for example, medical certificates about the need for expensive treatment) |

The bank itself, the initiator of the proceedings, prepares the following documents:

- statement of claim;

- loan agreement.

If during the trial there is a need to obtain certain documents, you can file a petition to obtain them from the court or provide them yourself.

Invalidation of the contract

A loan agreement can only be declared invalid in court.

For such recognition, sufficient grounds are required indicating that during the execution of the transaction there were violations of the law or the will of the counterparty.

Judicial practice allows the recognition of a mortgage agreement as invalid for the following reasons:

| There were violations of civil law | for example, the requirement to indicate the interest rate or other important terms of the agreement in the text is not met |

| Russian law and order was violated | for example, the purpose of the agreement is to support terrorist activities |

| The agreement was signed by a person who does not have the authority to do so. | the borrower or co-borrower is a child or incapacitated person |

| In order to sign the contract, the borrower was deceived and misled | was issued for appearances sake, it did not give rise to legal consequences |

| Violence was used against the borrower | threats, other forms of coercion to sign an agreement |

| Concluded to cover up another deal | for its conclusion, forged documents were used (we can talk about the initiation of a criminal case and the transfer of materials in court for pre-investigation verification) |

If a mortgage transaction is declared invalid, then all legal consequences that followed its conclusion are terminated, and everything received is returned back.

That is, there is a need to return the money to the bank. If this is not possible, then it is permissible to pay compensation.

The participants in the credit relationship can invalidate the transaction within three years after the agreement comes into force.

If the validity of the contract affects outside interests, then such interested parties may apply to the court with a request to declare the transaction void within ten years from the date of validity of the contract.

Video: what to do if you have nothing to pay off your loan. Arbitrage practice

Void means that even if the parties agree to the agreement, it cannot give rise to legal consequences and should not have been concluded by force of law at all (for example, a mortgage transaction that was executed only for show, imaginary, is void).

The validity of a mortgage agreement can be challenged within a year from the day the person learned about this possibility.

Contestability means that a transaction is recognized as such by the court and can be recognized as not giving rise to consequences for the future (for example, it was made by a person who did not have sufficient authority).

Consideration of the case.

After all formalities have been completed (you will be invited to court, given the opportunity to prepare counterarguments, etc.), the actual hearing will begin. Let's assume that you will not challenge the validity of the loan agreement and the fact of receiving funds. In this case, after reviewing the case materials by the mortgage court, it will be officially established that you violated the deadlines for making payments, which resulted in a total debt to the bank. Next, the court will confirm the legality of the creditor’s right to foreclose on the collateral, establish the final amount to be compensated, as well as the initial sale price at which it will be sold at public auction, the start date and the period during which you will have to vacate the home.

It is worth noting that the above example of a mortgage case is purely theoretical, since in reality, during the proceedings, many disagreements arise between the lender and the borrower. As an example, here are those that occur most frequently:

Requirements Law on the Law and the Constitution . Here the subject of dispute is the provision of Article 40, according to which each of us has the right to housing. Accordingly, borrowers believe that foreclosure on their property is contrary to this right, and, therefore, it can be challenged. Unfortunately, those who have chosen such a defense strategy should be upset, since the Constitutional Court has repeatedly considered similar complaints, but the decision has always been the same: the creditor’s claims are legitimate if the loan was issued for the purchase of real estate.

Disagreement with the selling price . It happens that you agree with the bank, but do not share its point of view regarding the price at which it will sell your former property. As court decisions on mortgages show, in such situations the court proceeds on the basis of documents that are at its disposal, for example, a report of an independent appraiser for examination purposes. For this reason, it is worth confirming your disagreement in advance with reports from another appraisal company, or other objective evidence - until they are among the case materials, the court will take the position of a creditor. Also, do not be surprised that the sale price will be 20% lower than what appears in the appraisal report - these are the requirements of the law.

The borrower's desire to receive a deferment . Existing legislation in the field of mortgage lending does not exclude the possibility of providing a deferment for up to 1 year, if available, but your arguments must be convincing. In addition, it must be recorded: the fact that you repaid the loan to the best of your ability, there are objective reasons to return it. For understanding, here are two examples:

Example 1: You were hiding from the bank, the case went to court, you got scared and promise the lender to repay the loan within one year. Even if you confirm this possibility, the court will most likely refuse you, citing the fact of your bad faith in the past.

Example 2: You repaid the loan, but in amounts much less than established in the agreement, while your employer officially confirmed its intention to provide you with financial assistance. In this situation, the court will probably be on your side.

Excessive penalty . Quite rarely, but it happens that the court uses the right to reduce the amount of the penalty calculated by the bank. If this did not happen, but you do not agree, then you can try to challenge it, but the likelihood of your success is minimal.

In conclusion, it is worth noting that, despite its apparent simplicity, judicial practice on mortgages is a complex process, which is often accompanied by appeals, cassations, and in some cases, appeals to the Constitutional Court. For this reason, the outcome of your case will depend solely on the skill of the attorney representing you.

Controversial issues that arise in the process of implementing mortgage legal relations can often be resolved only in court.

Judicial practice on mortgages in 2020 is multilateral and has its own nuances, especially in cases such as the division of an apartment under mortgage or during the procedure for granting a military mortgage.

A mortgage loan agreement creates an obligation for the debtor to promptly pay the debt to the creditor bank.

In 2020, as a result of the economically unstable situation, many borrowers are experiencing difficulties in paying loans, so the judicial practice in such cases is extensive.

Judicial practice on mortgages

When a conflict arises with a client, the bank is interested in returning the money invested.

Therefore, most disputes in court are resolved on issues of repayment of mortgage debt.

Judicial practice comes up with the following options for resolving the conflict:

| Termination of an agreement | or recognition of its invalidity |

| Foreclosure | on mortgaged property |

| Conclusion of a settlement agreement | it is permissible to formalize it at any stage of the trial, but before the court leaves for a meeting |

Judicial practice knows little about cases in which it is necessary to invalidate a mortgage. The bulk are associated with demanding events.

In favor of the borrower

The client can win a legal dispute under the mortgage agreement. To do this, you should carefully study your own loan agreement and receipts for payment of loan funds.

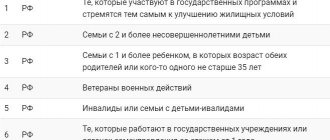

A court decision may be made in favor of the borrower for the following reasons:

| Bank fees charged | which are not provided for by contract, law |

| Requirement by the bank to issue life and health insurance for the borrower | or establishing fines for failure to comply with such a requirement (establishing discounts and benefits when calculating interest after taking out insurance are not penalties, but are considered means of stimulating the registration of insurance) |

| Interest charges are higher | than is provided for in the contract (the final percentage is established in the contract, and its change after registration of the mortgage, registration of insurance, birth of a child and other circumstances is stated in the text) |

In any case, a mortgage dispute is a type of complex financial dispute.

If it is resolved, it is advisable to seek the help of a professional lawyer.

The participation of a specialist greatly increases the chance of a positive outcome of the trial.

By currency

Before the 2020 crisis, borrowers with foreign currency mortgages benefited compared to those who entered into an agreement with a price in Russian rubles.

Interest rates on foreign currency mortgages have always been (and at the moment too) lower than on “domestic” mortgages.

When the rate was, for example, 35 rubles per dollar, then such clients significantly benefited in the final amount.

The outbreak of the crisis, the consequences of which mainly occurred in 2020, made many foreign currency borrowers feel their own financial insolvency.

A significant part of them receive salaries in Russian rubles. Even if it is indexed, it cannot keep up with the growth of the dollar exchange rate.

Banks cannot satisfy everyone’s requests for deferments and other support measures.

Therefore, the number of legal proceedings with defaulting foreign currency borrowers is growing.

The greatest danger in this case was represented by contracts with floating interest, when the final amount of the monthly payment depends on fluctuations in the exchange rate on the foreign exchange market.

The sharp rise in the dollar made a significant number of foreign exchange clients unable to repay their obligations.

Questions arise about how to get out of a mortgage, especially since legal disputes are mostly resolved not in favor of the borrowers.

Military

The savings and mortgage program for the military continues to operate in 2020.

After three years of service, every military man has the right to become a participant.

Enrollment in the participant program is carried out automatically, but the issuance of a participant certificate is based on a report from an employee.

Conflicts may arise not only with the bank regarding a specific loan, but also with Rosvoenipoteka.

For the deadline for removing mortgage encumbrances in Rosreestr, read the article: removing mortgage encumbrances. Mortgages secured by land and real estate, read here.

The most common disputes are:

- On the refusal to include the military in the program.

- Refusal to issue a certificate.

- Incorrect calculation of the amount of annual payments to the military’s personal account.

If a military man has drawn up a mortgage loan agreement, then going to court may occur due to:

- non-payment of debt under the contract;

- refusal to insure the pledged property.

The military man himself can challenge the bank’s actions in court:

| Under duress | take out additional insurance |

| If the percentage is calculated incorrectly | the amount itself, deduction of commissions from the amount in contradiction to the terms of the agreement |

If the accumulated funds are sufficient, then the military man may not resort to the services of a bank loan.

Moreover, the military does not have an obligation to buy residential premises only in the area or region in which he received a program participant certificate.

But if bank funds are required, the loan agreement is drawn up in the region where it is planned to purchase housing.

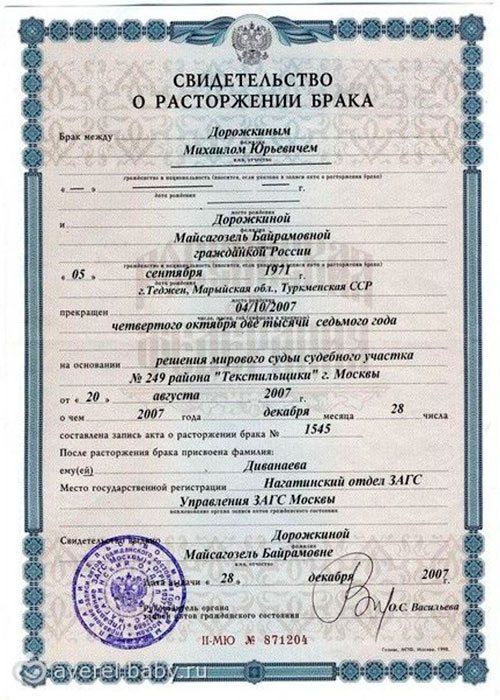

Judicial practice on military mortgages during divorce speaks about the peculiarities of litigation in this case, which arise due to:

| The apartment is “in double mortgage” | from the bank and from the Russian Ministry of Defense |

| The loan agreement is concluded by the military himself | who is the owner of the property |

| Mortgage agreement | not re-registered in case of divorce |

In the case of a military mortgage, banks and Rosvoenipoteka may require the execution of a marriage contract between a military man and his spouse.

Upon divorce

Many borrowers are concerned about what will happen to the loan agreement and the residential premises pledged under it in the event of a divorce.

Divorce is not grounds for termination of a loan agreement.

But the situation itself often develops in such a way that it becomes necessary to divide the property that is pledged, as well as determine the procedure for repayment.

If a mortgage is issued during marriage, then the property acquired on credit is considered joint property, and the debt is distributed among both spouses.

In case of divorce, the bank may require:

- Pay off your debt early.

- Dividing other property into shares to repay the loan.

Information about a divorce event is not automatically transmitted to the bank by the authorities, unless a dispute arises over the loan or property pledged.

But the presence of a conflict between spouses provokes the bank to take active action in the form of demands for early repayment.

Some credit organizations may require, at the stage of registering a mortgage, the conclusion of a prenuptial agreement, which states whose property after the divorce the mortgaged living space is considered to be, as well as the procedure for repaying the balance of the debt.

Family participation in the state program requires that the apartment be registered as the property of all members, including children.

It is important to remember that according to the current Code of Civil Procedure of the Russian Federation, a mortgaged apartment, even if it is the only real estate and a family with a child, may be subject to foreclosure (in case of delay).

What does the legislation say?

The legislation considers the possibility of concluding a mortgage agreement between two individuals as a special case. There are currently no restrictions on the signing of such an agreement between citizens. The main issues of the transaction are regulated by the following regulatory and legislative acts:

- Civil Code of the Russian Federation;

- Federal Law “On Mortgage”, including the latest amendments from 2014.

Read more: Which doctors should an accountant undergo a medical examination?

In order for a mortgage agreement between individuals to become valid, several mandatory conditions must be met:

- the agreement is drawn up in writing in compliance with all existing legal requirements for the document;

- there is a notarization of the transaction;

- The mortgage has passed the state registration procedure.

In practice, the process of concluding an agreement looks like reaching an agreement between two individuals that one of them provides a certain amount of money to the other with the formalization of the reached terms of the agreement as a loan agreement. Essentially there are two documents:

- agreement to borrow funds;

- pledge agreement, with mandatory state registration.

For the duration of the agreement, the borrower of the funds transfers the real estate to the lender. During this time, restrictions are imposed on residential real estate, which means for the owner the impossibility of selling, donating or alienating the collateral property in any way (the same as when transferring real estate as collateral to a bank). If the terms of the mortgage agreement are not met, the latter has the right to foreclose on the pledged property, which is ensured by selling it to return the amount of debt.

Consideration of claims

The claims are considered by the district court, since its price is more than 50 thousand rubles. If the cost of the claim is less, then the process is initiated by the magistrate.

According to the rules of procedural law, the trial is held in an open hearing, which anyone can attend.

After receiving the application with attachments, the judge checks them for compliance with the requirements of the Civil Procedure Code of the Russian Federation for the form and content of the claim.

Incorrect execution of documents will result in their refusal to be accepted for consideration and return to the applicant.

If the documents are completed correctly, the judge makes a decision to schedule the hearing itself.

All participants and interested parties are notified about this (for example, in the event of a conflict between the borrower and the bank, the spouse is notified as an interested person).

The parties to the conflict are invited to a preliminary meeting, where the judge, before the start of the process itself, proposes to resolve the conflict peacefully and explains how to waive the requirements in accordance with the Code of Civil Procedure of the Russian Federation.

At this meeting, the circumstances of the dispute are clarified, documents and other evidence are transferred.

Direct consideration of the claim takes place in court. The failure of a party to the conflict to appear at the trial may serve as grounds for its postponement.

The whole process consists of stages:

| Representation of participants in the proceedings | statement of circumstances |

| Hearing | parties (first the plaintiff, then the defendant), witnesses and examination of documents and other evidence |

| Are being heard | final speeches of the parties and the court makes a decision |

Based on the results of the consideration of the claim, a decision is being prepared.

If one of the parties to the dispute does not agree with it, then he can appeal to a higher court to appeal the judicial act (ten days are given for this).

Decisions made

The judge communicates the final part of his act, that is, the immediate decision, on the last day of consideration of the conflict.

The Code of Civil Procedure of the Russian Federation gives the court five days to draw up the act in its final form.

In a decision on a mortgage dispute, the court states:

| Introductory part | information about the participants in the process, the judge, the secretary, the date and time of the decision, the applicant’s requirements |

| Description | demands, objections to them, explanations of persons |

| Motivation | facts of the case, evidence supporting them, arguments and legal position of the court |

| Final part | immediate decision, result of the process |

Once a decision has been made, it cannot be changed.

But it is permissible to accept an addition to the decision in the case of:

- one of the claims in the lawsuit was ignored in the decision;

- the amount of the award was not specified;

- determining the procedure for compensating the costs of the process.

If the borrower or bank representative does not understand the decision, the judge has the right to explain it.

The decision acquires full legal force after ten days from its announcement. During this period, the interested person is given the opportunity to challenge it in a higher-level court.

Penalties imposed

If the borrower refuses to repay the mortgage debt, the court may impose the following types of penalties:

| For mortgaged property | more often - housing for the purchase of which a loan was issued |

| To other property | which can be recovered under the Federal Law “On Enforcement Proceedings” (for example, property for business) |

The collection procedure may be postponed if the decision is challenged in the court of the next instance. To do this, it is necessary to prepare a corresponding petition.

Things to remember when going to mortgage court

First of all, no one has the right to evict you from your apartment without a court decision. Moreover, the subpoena must be delivered to you by certified mail, meaning you must sign for it.

Even the mortgage court has already passed, you can still try to keep your home. Especially if during this time your financial affairs have improved and you can pay off the resulting arrears along with fines.

Litigation cannot be ignored. Moreover, you need to prepare for them, even if foreclosure is the only possible outcome. Banks often sin by wanting to take advantage of the helplessness and financial illiteracy of debtors, charging fabulous fines and interest on interest. All this can be challenged in the same court, but to do this you will have to spend either money on legal advice or time studying the laws and regulations.

Collecting from your ex-spouse mortgage payments made after divorce

Please check to see if the statement of claim is correct:

Statement of claim for debt collection

On September 7, 2002, a marriage was registered between the Plaintiff and the Defendant. From September 7, 2002 to February 3, 2013, they lived together and ran a common household.

From the marriage two children were born, child born. and b.b. Child support is paid by the Plaintiff in full.

On January 23, 2012, the marriage between the Plaintiff and the Defendant was dissolved by the decision of the magistrate of court district No. 3 of Chelyabinsk, Chelyabinsk region, which entered into legal force on February 3, 2012. No application for division of jointly acquired property was submitted.

On December 7, 2009, the right to this apartment was registered with the Plaintiff and the Defendant. Confirmed by a state certificate. registration of rights

In 2010, the mortgage on the apartment of JSCB Tver was transferred to OJSC South Ural Housing Construction and Mortgage Corporation. In 2011, the mortgage was transferred to OJSC Agency for Housing Mortgage Lending, to which current payments were made.

According to paragraph 1 of Art. 33 of the RF IC, the legal regime for the property of spouses is the regime for their joint ownership.

By virtue of paragraph 1 of Art. 39 of the RF IC, when dividing the common property of spouses and determining shares in this property, the shares of the spouses are recognized as equal.

By virtue of clause 3 of Art. 39 of the RF IC, the common debts of the spouses when dividing the common property of the spouses are distributed between the spouses in proportion to the shares awarded to them.

According to paragraph 1 of Art. 395 of the Code of Civil Procedure of the Russian Federation, For the use of someone else’s funds due to their unlawful retention, evasion of their return, other delay in their payment or unjustified receipt or savings at the expense of another person, interest on the amount of these funds is subject to payment.

Calculation of the amount for the use of money for the period from July 1, 2012 to September 13, 2012

Calculation of the amount for the use of money for the period from September 14, 2012 to April 15, 2013

Based on the above, guided by art. 38, 39 RF IC, art. 131, 132, Code of Civil Procedure of the Russian Federation, please:

2) To collect from the Defendant in favor of the Plaintiff a state fee of 6071.40

2. Copy of the apartment purchase and sale agreement

3. Copy of the loan agreement

4. Payment orders for transfers of mortgage loan payments

5. Account statement for the period from 02/03/2012 to 06/30/2012

This is important to know: Documents for the arbitration court for debt collection

What do you need to know?

Let's start with the fact that credit institutions prefer to resolve issues through the courts in extreme cases. Initially, the bank will definitely try to negotiate with the debtor and find a compromise.

Before filing a claim, the lender will send the borrower a notice of its intentions asking them to remember their financial obligations. If the debtor does not respond to the document, the bank will go to court. And, as mortgage lawyers note, in most cases the court takes the side of the credit institution, satisfying the claims.

Will it be possible to keep the apartment after the trial?

Let us immediately note that if the bank has already applied to the judicial authorities in order to “knock out” the mortgage debt from you, then you can say goodbye to the apartment, since it acts as collateral for the loan. As a result of the case, the living space is guaranteed to go to the bank.

Is it then even worth defending your rights in court, do you think? We answer: definitely worth it! Because during the case, not only the fate of the property will be considered, but also the amount of penalties, fines and total debt. And if you don’t fight for your rights, then as a result of the case you will not only lose your home, but you will also owe the bank.

Is it possible to cope without a mortgage lawyer?

You can cope if you are well versed in housing legislation. If you do not have sufficient knowledge in law, then a positive outcome is unlikely. A professional can achieve a favorable court decision for you or facilitate the conclusion of a settlement agreement with the bank.

It is impossible not to mention the fact that often the bank, when selecting an apartment as collateral, indicates the value current at the time of purchase. That is, if several years have passed since the transaction and the apartment has increased in price, you lose this difference, and it cannot be used to pay off the debt. In this case, the lawyer will help drag out the trial, and in the meantime you can find someone who will buy the apartment at market value.

If you still intend to get by in the courtroom without the help of a specialist, then at least consult a mortgage lawyer. He will study the case materials, and most importantly, the bank’s requirements set out in the claim, and tell you what can be done in your particular case.

What can be disputed?

The amounts that will be demanded from you during the course of the case will be disputed. This is the amount of the debt, late fees and even compensation for paying the fee for the claim.

The first step will be to recalculate the debt. It is not uncommon for the penalties in a claim to exceed the actual ones by several tens of thousands. It is impossible to say for sure whether this is a consequence of simple inattention or intentional foul play, however, you can demand a reduction in the amount of compensation.

Next, the lawyer will check whether the actual terms of the mortgage agreement coincide with those that the bank indicated in the claim: the amount of the loan issued, repayment terms, amounts of payments and even the days on which payments occurred. If inconsistencies are identified, this will also help you significantly reduce the size of your financial obligations to the bank.

Going to court.

So, going to court will follow the discovery of circumstances that allow the bank to take away the apartment or other real estate pledged by you. More precisely, he will be able to take such actions after he has submitted to you in writing a request to fully repay the debt, and you are unable to fulfill it. As soon as this fact is recorded, the bank’s lawyers will file a claim to terminate the contract, as well as to collect the debt from you.

This mortgage lawsuit will detail all the circumstances that led to this unpleasant situation. Thus, the bank will indicate that it has entered into a loan agreement with you, according to which it provided you with a certain amount of funds to purchase a home. The following will be a detailed description of its conditions in the form of the loan amount, its term, interest rate and the date of monthly payments. The lawsuit will also draw the court's attention to the fact that the real estate that became your property acted as collateral. Of course, lawyers will also tell you that the creditor fulfilled its obligations in full by transferring the above funds to you.

Then the bank will provide evidence indicating that you have not fulfilled your obligations under the agreement, for example, you have repeatedly violated the deadlines by which monthly payments or their amounts should have been made. As a result of your inaction, the total amount of debt will be indicated in the form of overdue principal, accrued interest and unpaid penalties. It is likely that in addition to these figures, the claim will also include compensation for the state duty for accepting it for consideration and other related expenses of the creditor bank.

Mortgage debts. What to do when you have nothing to pay and the bank sues?

Mortgages in Russia appeared relatively recently. And for many, this is the only way to get their own home. When people talk about mortgages, most people by mortgage (mortgage loan) mean a loan to buy a home. We will also use this definition, although in fact, mortgage is a broader concept.

A mortgage is a type of collateral secured by real estate. At the same time, a loan can be taken for other purposes: for business expansion, for urgent needs. And a mortgage, the collateral for real estate, can be not only an apartment, a house, but also a garage, commercial and other real estate.

Let's not get into the theoretical jungle, let's move closer to the topic.

Get a free consultation

Housing prices are high compared to the income of ordinary citizens, which is why mortgages are predominantly issued for 15-20 years. Mortgage rates in our country are high compared to foreign ones.

If for Russians 12% per annum on a mortgage is “divinely” against the backdrop of rates on consumer loans, which are above 20% per annum, then foreigners would consider us crazy, because In Europe and the USA, mortgage rates are several times lower.

The rate is 12% per annum, which is 1% per month, and with a loan of 2 million rubles (the approximate cost of a 1-2-room apartment in small and medium-sized regions of our country), the interest accrued in the first years of payments will be about 20 thousand rubles per month . Plus, in addition to interest, the principal is repaid monthly.