The essence of the preferential mortgage program in 2018

Considering the financial difficulties of a large number of citizens that arose due to the decline in Russia's economic power, the government took measures to stabilize the situation. Since 2020, married couples who decide to have more than one child can enjoy preferential terms for mortgage loans. The Government of the Russian Federation, represented by the following, had to abandon banal measures:

- increase the size of social media subsidies;

- index payments under the maternity capital certificate;

- introduce additional subsidies.

Mortgage subsidies in 2020 include provisions aimed at reducing overpayments for purchased apartments and minimizing the debt burden.

The reduced interest rate will allow this program to answer all the questions that users of real estate loans have after the next round of inflation. Shortcomings were identified in the subsidy program. The increase in social benefits did not bring relief to any family that received an apartment with a mortgage.

Now you can get a preferential rate of 6%. Among the planned new mortgage conditions, this is available from January 1, 2018. Other programs make it possible to obtain a mortgage on the same terms. It is planned that the introduction of mortgage loan subsidies for other categories of Russian citizens will happen in the coming months.

The essence is to give everyone the opportunity to improve their living conditions. Innovations in the provisions of the legislation of the Russian Federation will affect parents who have decided on a second or third child. This should happen in the coming year. The mechanism will operate for another 60 months from the date of entry into force.

Duration of preferential lending

The bill on preferential mortgages with a rate of 6% involves a temporary reduction in the financial burden for such families. The validity period depends on what kind of child was born in the family:

- upon the birth of a second child, the state reduces the interest rate for 3 years;

- the birth of a third child increases the period of preferential lending by 5 years.

If during the program period both a second and a third child were born, then the family is entitled to benefits for each of them. This means that the financing terms are cumulative, meaning the 6% interest rate will remain in effect for 8 years.

Conditions for compensation of mortgage loans

It is assumed that money will be allocated from the budget so that the debtor does not pay more than 6%. The loan refinancing mechanism is intended for parents of any age. The second child is not the only criterion for selecting applicants. The firstborn must be a dependent due to his minority.

Additional selection criteria for issuing a 6 percent mortgage in 2020 are the requirements listed in the following list:

- The control point is January 2020 (compensation to ease credit pressure is provided if the birth occurred before the New Year). The existing mortgage loan will be refinanced if applied before December 31, 2022.

- A 6 percent mortgage in 2020 (see conditions below) applies if the loan is already being paid off and the interest on it exceeds the 6% mark. It is assumed that those who currently pay the same or less do not need mortgage assistance, and are quite capable of coping with the situation on their own, without government intervention.

- The loan is secured by an apartment in a new building. In cases where the secondary was taken, the mechanism cannot be used.

- Mortgage conditions at 6 percent also apply to houses under construction. When the apartment was purchased unfinished before the New Year holidays, and after January 1, 2020 the family was replenished, then refinancing is available. Let us repeat that benefits are not yet available for secondary housing.

The terms of mortgage subsidies starting in 2020 raise many questions. We invite you to familiarize yourself with the most popular of them. Benefits to reduce interest payments can also be obtained upon the birth of a third child. The date when the birth took place is decisive.

Question: Good evening, please tell me what the total family income should be in order to take advantage of the state program for refinancing mortgages up to 6%, taking into account the latest news (latest changes in the legislation of the Russian Federation)?

Answer: A 6% mortgage (conditions provided by the President of Russia) is available to families who have a total income below three subsistence levels established for the region (1.5 for each).

What is a mortgage at 6 percent per annum?

This is a government program aimed at supporting families with children (and at the same time supporting the primary real estate sector). Its essence lies in the fact that a family in which a second, third (fourth, etc.) child was born can refinance their mortgage loan by reducing the interest rate on it to 6% per year (subject to a number of conditions).

The documents are submitted to the bank that issued the mortgage loan. In order for the bank not to refuse, a number of conditions must be met simultaneously:

- the mortgage loan must be issued no earlier than January 1, 2020 (for residents of the Far East - no earlier than January 1, 2020) and no later than December 31, 2022 (if the second and subsequent children were born between July 1, 2022 and December 31, 2022 g., then it is allowed to issue a mortgage until March 1, 2023 inclusive);

- using loan funds, housing (an apartment or a house with a plot) was purchased from a legal entity, that is, on the primary market;

- the basis for the purchase of housing is a purchase and sale or equity participation agreement;

- the amount of the down payment was at least 20%;

- the borrower has Russian citizenship;

- loan amount – up to 6 million rubles throughout Russia and up to 12 million rubles in Moscow, St. Petersburg and their regions;

- The borrower is obliged to enter into a personal insurance agreement and insure the property purchased on credit.

If the loan was issued for the purpose of refinancing a mortgage, then it can be refinanced at 6% regardless of the date when it was received by the borrower.

For the Far East, slightly different rules apply:

- you can buy housing not only from a legal entity, but also from an individual, if it belongs to the residential category and is located in a rural area;

- the second or subsequent child must have been born between January 1, 2019 and December 31, 2022;

- the rate is not 6%, but 5% per annum.

A mortgage at 6 percent in 2020 can be issued by both the mother and the father of the second or subsequent child.

If you are applying for refinancing of a previously refinanced mortgage loan, then the size of the loan should not exceed 80% of the original value of the property. That is, if you initially took 1 million rubles and did not pay the down payment, but after a few years you refinanced it, taking 800,000 thousand rubles from another bank (or less - but not more), then you fall under the terms of the Program.

Freeze of family capital

Many people are concerned about whether the changes in laws involve increasing cash grants. The resolution deals exclusively with making debt repayment easier if there are more descendants of the family. The conditions for subsidizing mortgages in 2020 will not affect social payments intended to provide financial support for children.

Previously, a resolution was adopted proposing to abandon their indexation, taking into account inflation. It remains in effect. Maternity capital will not be increased in 2020. The fall of the ruble leads to an annual loss of over 49 thousand rubles, which causes disapproval from parents.

Question: Hello, we have the next question. Being a mother of many children, I was faced with the problem of when is the best time to use up the mat. capital? Prices are rising, but the amount of payments remains the same. Thank you.

Answer: Hello, please consider using the allocated funds early. The conditions for subsidizing mortgages in 2020 do not imply an increase in the amount of social payments. It makes sense to use the money as early as possible.

Who can apply

The main difference between this initiative and many others is the absence of restrictions on the borrowers themselves. Any citizen of Russia can take out a mortgage loan at 6.5% . The main thing is that the requirements specified in the block above are met.

To receive a preferential rate, it is not necessary to have a specific number of children, a certain level of income, or receive maternity capital. In this case, adequate income will likely be a plus - this will increase the chance of approval from banks.

Standard portrait of a borrower who is most likely to be approved:

- over 20 years old

- work experience from 6 months

- opportunity to officially confirm income

- no problems with credit history

If you have unpaid debts, past arrears, unofficial salary, there is also a chance of approval. But you need to understand that even under regular programs, many banks often refuse in this case.

Reduced mortgage rates for borrowers when a child is born

A minimum overpayment limit has been established. Anything beyond that will be compensated by the state if the applicant meets the requirements. Subsidizing a mortgage in 2020 involves conditions where, after delivering documentary evidence of the legitimacy of the claims, bankers are required to recalculate the loan rate by the number of percentage points paid by the debtor. A further mechanism is to additionally pay the missing money from the state reserve.

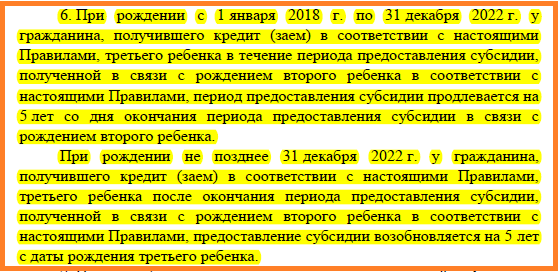

The reduction in mortgage interest rates still has a time frame. The mechanism operates until 2023. At this time, you can request a recalculation. Mortgage subsidy conditions are valid for 36 months if we are talking about the birth of a second child in 2020. The birth of a third extends this period to 60 months. There are two features here:

- Changes in the terms of the mortgage at 6 percent in 2020 involve an extension of preferential measures for a period of up to 60 months, if applicants are already using the program because they have two children. But if the number of heirs is replenished with one more (third) baby, then this is possible. The start date of the renewal period is the end of the initial period.

- Subsidizing a mortgage in 2020 (conditions for reducing the interest rate) involves recalculating the mortgage loan again. If the third child was born before December 31, 2022, and 3 years of benefits for the second have already passed, you can submit documents again.

A mortgage at 6% in terms of conditions provides relief not only for families of 3 and 4 people formed in such a composition during the specified period. The program also offers benefits to other categories of citizens with children.

Question: Hello! Will the program be extended if we decide to give birth to another baby after 2012?

Answer: Now we are waiting for the circuit to be tested. Practice shows that the state always supports such programs if they are effective and provide effective assistance to citizens. For now, there is every reason to believe that the refinancing program can be used later, and on different mortgage terms. Naturally, this will happen after the adoption of the relevant laws.

Nuances of the state program

Not everyone will be able to get the low 6 percent rate. There are certain conditions. Let's go over the important points.

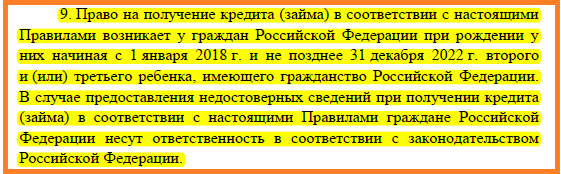

a) for 2 or 3 children born in a family from January 1, 2018 to December 31, 2022, the government is ready to subsidize your mortgage at 6%;

b) the mortgage loan must be issued at any bank in the country or at JSC AHML (Housing Mortgage Lending Agency) no earlier than January 1, 2020;

c) another 6% rate can be counted on for families who have previously taken out a mortgage loan, but whose 2nd or 3rd child was born in the family after January 1, 2020 and they decided to apply for refinancing of their mortgage loan. For them, the reduced rate will also be valid for 3 or 5 years;

d) there are no restrictions on the age of the children’s parents, which undoubtedly pleases;

e) another advantage of the state program is that borrowers will need to provide documents to obtain a mortgage at a preferential rate directly to the banking institution itself, directly bypassing government agencies;

f) the state is ready to subsidize only those mortgage loans for which the family that took it out does not fall behind on monthly payments;

g) as is clear from the screenshot below, if a 3rd child is born in a family from 01/01/2018 to 12/31/2022, but at that time there will still be a 6% rate for 2 children, then as soon as its 3-year term ends, the state will still will extend this 6% rate for 5 years (for the birth of 3 babies);

h) you can expect an extension of the subsidized rate for 5 years when the 3rd baby is born and at the end of the 3-year mortgage period at 6% for the birth of the 2nd child. The main thing is that the 3rd child in the family is born before December 31, 2022;

Of course, one can understand the indignation of those people who had a 2nd or 3rd child in their family before January 1, 2020. But, unfortunately, they do not fall under the requirements of the new program.

State support measures for families with children from 2020

In November 2020, a meeting was held in the Kremlin, thanks to which citizens had the opportunity to recalculate. President of the Russian Federation V.V. Putin demanded that the Coordination Council develop a program of state support and stimulation of the birth rate.

According to statistics, more than half a million families have two or three heirs. We talked earlier about those children who will be born on January 1, 2018. Support for families with children who are not included in this category is as follows:

- Possibility to receive money from maternity capital in cash.

- Calculation of monthly benefits.

- Extending the validity period of the maternity capital program.

- Legitimizing additional ways to spend maternity capital funds.

The last point assumes that the money can be spent on the child’s education and other life needs and requirements.

Mortgage requirements

Banking institutions providing mortgage lending under preferential programs put forward a number of requirements for concluding a contract:

- a new contract for the purchase of housing must be concluded no earlier than 01/01/2020, and it can only be issued in rubles;

- the amount that the buyer can count on varies depending on the region where it is issued: for Moscow and St. Petersburg, as well as the Moscow and Leningrad districts, the maximum threshold is set at 8 million rubles, and for other regions - 3 million rubles;

- the down payment on a housing loan must be at least 20% of the value of the purchased property;

- the annual payment rate is 6%, and after the end of the subsidy period it cannot increase by more than 2%;

- it is assumed that the mandatory conclusion of an agreement on life insurance of the borrower and the property being purchased;

- monthly payments are made in an annuity manner.

When issuing loans, banking organizations pay great attention to co-borrowers. This may be the spouse of the loan recipient, but the level of his or her solvency is not taken into account, nor is the age or number of existing children taken into account.

If people are not married, it is permissible to involve as a co-borrower the person with whom the second or third child was born between 2020 and 2022.

A spouse cannot be involved as a co-borrower only if there is a marriage contract that is valid and implies separate ownership of property.

Real estate purchased with concessional loan funds must be located on the territory of the Russian Federation. Sberbank does not issue loans for the purchase of housing on the territory of the Crimean peninsula and the city of Sevastopol. This is due to the fact that the banking institution does not have its representative offices in this region.

Mortgage loans are refinanced at 6% or new contracts are concluded not only for finished housing, but also for housing under construction. In this case, the building structures must meet a number of safety requirements, have a reinforced concrete or concrete base, and be located in developed areas where hospitals, schools and other infrastructure are available.

If the borrower wants to make a redevelopment, then it should be agreed upon with the relevant authorities and a document about this should be provided. You can find out more detailed requirements for mortgage housing directly from bank employees.

Advantages of preferential loans for the purchase of residential premises for families with children

The program for providing preferential conditions for mortgages has a lot of advantages, the thesis description of which is as follows:

- You can borrow up to 90% of the housing price.

- Early repayment of the mortgage is allowed (in whole or in part), as determined by the borrower.

- If the family has children, the minimum down payment is 10% of the cost of the apartment. Without children – 15%. Single people, as well as those whose children have reached adulthood, will have to contribute 20% or more.

- Under the terms of a preferential mortgage, the amount of compensation may be higher than 4 percent.

- If the mortgage was issued before the birth of the first child, then from the moment of his birth a credit holiday must be granted for a period of up to 3 years.

- Mortgage conditions under the preferential program make it possible to get a credit holiday if a second child is born. However, during this period you will have to pay off interest. Repayment of the loan body is delayed for 5 years.

- Family capital can be used to fulfill debt obligations under a mortgage agreement.

- Mortgage conditions under a preferential refinancing program are also available to those receiving alimony for adopted children.

In this way, the state strives to achieve an effect in several aspects that make the lives of citizens easier, namely:

- make housing more affordable;

- facilitate the payment of an existing mortgage by refinancing its terms;

- speed up the process of repaying debts for purchasing a home;

- to interest banks in the development of mortgage lending programs.

The leading bank was and remains Sberbank. It is through it that budget money will be transferred to pay off the difference in the interest rate to achieve 6% for the population. The only drawback is that the innovations did not affect the apartments; they were purchased on the secondary housing market.

Bank conditions

These preferential conditions, of course, are “imposed” on the conditions for providing a regular mortgage loan by banks. There are certainly differences here, but the main indicators are as follows:

- Grant period – from 3 to 30 years;

- The maximum amount is 3 million rubles, but for Moscow, St. Petersburg, the Moscow and Leningrad regions, this parameter often increases to 6-8 million;

- The minimum down payment is from 15% to 20%.

But the most important thing is the mortgage interest! It is 9% or less in many banks as of mid-January 2020, and this is also fundamentally important.

Prerequisites

To the concerns of citizens that preferential mortgage terms are more than an act of populism, it is necessary to respond that there are sufficient prerequisites for the provision of such benefits. D.A. mentioned them in passing. Medvedev at a meeting with the governor in Samara. The list of prerequisites is as follows:

- Over the previous year, inflation dropped to 3 percent, which provided grounds for the key rate. Simply put, banks now cost money less.

- The average mortgage rate over the same period dropped to 10.5% (a record low for the entire period). It became possible to make it even lower.

- The conditions for Russia's foreign economic activity have become easier. Oil on the world market in 2020 was traded at a price that was comfortable for the Russian Federation. Attacks from hostile countries have been neutralized.

- The rate cut last year led to mortgages becoming the main source of income for Russian banks. The overdue percentage dropped to 13. In such conditions, the income of banking structures providing housing loans exceeded 2 billion rubles.

- The construction boom has led to the housing market becoming oversupplied. People are more willing to take out a secondary mortgage. Buying a new building, in most cases, means living in an area where the infrastructure has not yet been fully formed, and special construction equipment will be noisy under the windows for several years. Taking into account requests from developers, the state has set a goal to encourage citizens to buy apartments in new buildings.

- The stability of the country's economy is directly related to the situation in the domestic market. Construction is a flagship not only for the real estate market. These are jobs, working metallurgy, coke industry, mining industry and energy production. We need to add here the salaries of all workers involved. Money flows into other segments, such as the food industry, service sector, etc.

Although the upcoming elections cannot be excluded from the list of prerequisites. It is necessary to appease the electorate, which means it is necessary to make their life easier. And changing the terms of the mortgage is what is needed.

Refinancing conditions

The implementation of the program began on January 1, 2018, and it is planned to be completed on December 31, 2022. At the same time, the total amount allocated by the state for issuing a loan on preferential terms is 600 billion rubles.

The preferential mortgage scheme at 6 percent in 2020 assumes the availability of government subsidies. First, commercial banks that will participate in the program are selected. These organizations must submit an application with a special set of documents attached to it within 30 days to the Ministry of Finance of the Russian Federation. If the bank’s participation in the implementation of the mortgage project is approved, then when issuing loans at 6%, it will be provided with compensation for lost profits from the state.

However, if the borrower’s mortgage was transferred to the Housing Mortgage Lending Agency (AHML) or the loan was obtained from a bank that was not included in the list of the Ministry of Finance of the Russian Federation, then the recipient of the loan can take advantage of rate subsidies.

Now the loan rate in market conditions is approximately 10%, i.e. the Ministry of Finance will pay financial institutions the missing 4%. After the subsidization is completed, the annual rate will be equal to the refinancing rate set by the Central Bank. This percentage will be increased by 2 more indicators. However, loan recipients will not notice any changes since the contract specifies a fixed rate.

Borrowers should pay attention to the fact that different loan terms are provided for families with different numbers of children:

- parents with 2 children will be able to take advantage of the reduced rate for 3 years;

- for families with 3 or more children, the subsidy period is extended to 5 years.

The conditions for obtaining a mortgage loan of up to 6 percent require the purchase of an apartment only in new buildings. If the family has an existing mortgage and has already purchased housing in a built house, then the loan can be refinanced.

You can only purchase an apartment from a legal entity. This type of loan does not apply to the purchase of living space from individuals.

Banks participants

The list of banking structures participating in the program to provide preferential conditions for mortgage payments is as follows:

- Sberbank

- VTB 24 and Bank of Moscow

- Raiffeisenbank

- Gazprombank

- Deltacredit

- Rosselkhozbank

- Absalut Bank

- Bank "Revival

- Bank "Saint-Petersburg

- Promsvyazbank

- Russian capital

- Uralsib

- AK Bars

- Transcapitalbank

- Bank Center-Invest

- FC Otkritie

- Svyaz-bank

- Zapsibcombank

- Zhilfinance

- Credit Bank of Moscow

- Globex bank

- Metallinvestbank

- Bank Zenit

- Rosevrobank

- Binbank

- SMP Bank

- AHML

- Eurasian Bank

- Ugra

- Alfa Bank

In the future, it is possible that other banks will provide preferential mortgage terms.

Design methods

If you plan to conclude a new agreement, then the potential bank client must provide a package of documents required by a commercial institution, accompanied by birth certificates of children who are citizens of the Russian Federation. After the application has been reviewed and approved, the loan issuance procedure is carried out. Then the bank, through the Ministry of Finance, receives the missing income from the state.

If at this moment the family already has a mortgage loan, it is given the right to refinance. Refinancing a mortgage at 6 percent involves the borrower contacting a banking institution with an application to enter into an additional agreement that will allow him to receive a loan on preferential terms.

The children's birth certificates must also be attached to the application. After this, bank employees develop an additional contract, which is signed by the recipient. Then the annual loan payment rate is reduced to 6%. The bank also receives the missing profit from the state.

Is it possible to reduce the rate on an existing mortgage?

However, even after signing the agreement, the borrower still has ways to change the parameters of the home loan. How to reduce the interest rate on an existing mortgage:

- Apply for mortgage refinancing. Refinancing refers to refinancing: closing an old mortgage with a new one on more favorable terms. Refinancing can be arranged in the same bank or in another financial institution.

- Carry out restructuring. This is a change in the terms of the mortgage agreement due to objective reasons. During the procedure, it is not possible to reduce the rate, but it is possible to shorten the payment period. This reduces the final cost of the loan. Restructuring is mainly used by a borrower who is unable to pay the debt due to illness, job loss, or serious family difficulties. Restructuring may negatively impact your credit history and may result in future loan applications being rejected.

- Attracting subsidies. Partial or full repayment of the mortgage through government assistance is an excellent option for those who want to save on buying a home.

- File a lawsuit. Litigation is a difficult way to lower interest rates. Appeal to the authority is possible only if there is a loophole in the loan agreement. However, financial institutions are scrupulous in drafting agreements, so this route is unlikely. A key feature of the method is the need to pay the mortgage even during the trial.

- Make early payments. If you regularly pay more than what is specified in the loan agreement, the final overpayment will be reduced. In fact, the rate will decrease. An application for early repayment is submitted at a bank branch or through your personal account.

When revising the terms of the agreement, the bank has the right to request additional documentation. You will need a mortgage agreement, payment schedule, a copy of insurance policies and other information on a real estate loan. To carry out restructuring, the client needs to prove the need for changes. Submit health certificates, death certificate of a family member, birth certificate of a child, dismissal order due to reduction.