Mortgage conditions for a garage and parking space in Sberbank

You can buy a parking space for a car using borrowed funds from Sberbank under the following conditions:

- loan term – no more than 30 years;

- share of the down payment – from 25% of the market price of the property;

- loan amount – no more than 75% of the value of the collateral (the amount is specified individually for each client).

Loan collateral can be:

- pledge of the purchased garage/parking space;

- pledge of any other real estate owned by the borrower, comparable to the loan amount;

- guarantee of third parties.

If the amount of borrowed funds under the loan agreement does not exceed 1.5 million rubles, then the bank may agree to one guarantee from an individual who meets the solvency requirements. No deposit is required here.

If the amount is more than 1.5 million rubles, then a deposit will be required.

Also an important condition for approval of a loan application is the mandatory purchase of a property insurance policy for the entire period of repayment of debt to the bank. In case of refusal of such a service, the bank has the right to refuse to issue a loan.

Transaction procedure

Where exactly a mortgage is issued for a parking lot or garage and under what conditions, we will tell you in the following sections. First you need to understand the procedure for completing a transaction. It is carried out in several stages:

- Choose a suitable bank and carefully read the loan program. Pay attention to the interest rate, requirements for the borrower and collateral, package of documents, additional costs, etc.

- Collect the paperwork required to complete your loan application and submit it to the bank for review.

- If the decision is positive, you should start looking for a garage or parking space. But, as a rule, borrowers apply to the bank for a mortgage for parking in a specific location that has already been selected. Moreover, there are not many offers on the real estate market, and while searching for a suitable option, the loan approval period may expire.

- Collect a package of documents for the property. A list of papers can be obtained from the bank’s website, but it is better to contact a mortgage manager. He will be able to clarify exactly what documents will be required in your case.

- Papers for the loaned and collateral real estate are submitted to the lender for consideration. If there are no comments, you can enter into a deal.

- The first installment is transferred, which is confirmed by a receipt, payment order or corresponding inscription in the agreement between the parties. Loan and collateral documentation and an agreement between the seller and the buyer are signed. All papers are sent for registration to Rosreestr.

- The completed documents for the new owner of the property (the borrower) are sent to the bank, after which loan funds are issued. The money is transferred to the seller's account. From this moment the mortgage transaction is considered completed, the client will have to repay the loan monthly.

Recommended article: How to repay a VTB mortgage early - procedure and conditions

Interest rate

For the product in question, the base interest rate applies to categories of clients receiving wages into an account with Sberbank - 9.7% per annum.

In addition, the following surcharges apply:

- +0.5 p.p. – if the borrower is not a participant in the bank’s salary project;

- + 1 p.p. – in case of refusal of the client’s personal insurance (his health and life);

- +1 p.p. – is established for the period until the registration of the transaction to encumber the pledged object.

The percentage shown is comparable to standard mortgage products. Taking out such a loan will be much more profitable than a regular consumer loan, for which the rates are significantly higher.

Requirements for the borrower

Requirements for potential borrowers are a standard list applicable to most Sberbank loan products. Among them:

- age limit – from 21 to 75 years;

- availability of stable employment with work experience in the last place of at least six months and one year in total;

- sufficient solvency for timely debt service;

- positive credit history;

- citizenship of the Russian Federation.

If a garage is purchased by a legally married borrower, the spouse automatically becomes a title co-borrower, subject to the same requirements as the main borrower.

How to apply for a mortgage for a garage and parking space at Sberbank

You can apply for a mortgage for a garage and parking space at a convenient bank branch authorized to accept such applications. It is acceptable to submit an application online through the lender’s official website.

You can learn how to apply for a mortgage online via the Internet from a special post.

To submit, you must prepare the necessary package of papers in advance and fill out and personally sign the application form at the bank office. Before this procedure, it is recommended to consult with a bank manager about the details and conditions of the loan, as well as obtaining preliminary calculations for future payments and overpayments.

You can check the documents for a mortgage at Sberbank here.

Package of documents

At the first stage of consideration of a loan application, the client must provide a standard package of documents. It includes a passport, a completed application form, a salary certificate () and a copy of the work record book. If necessary, the credit institution may request other papers (for example, SNILS, pension certificate, military ID, etc.). If a co-borrower or guarantor is involved in the credit transaction, similar documents will be required from them.

Is it possible to buy a garage with a mortgage

using two documents? Of course, if, according to the bank’s conditions, it is not necessary to confirm income and employment. But it is worth considering that with simplified lending the interest rate is higher than the base rate.

After approval of the loan application and calculation of the possible amount, you should collect a package of documents for the purchased property:

- an extract from the state register confirming ownership and absence of restrictions;

- technical documentation, including cadastral passport;

- evaluation report;

- seller's passport;

- document establishing the right to own property;

- draft purchase agreement.

Depending on the situation, other documents may be required. If you simultaneously purchase a plot of land or mortgage your own real estate, a similar package of documents is collected for them. With the exception of the appraisal report for land, its value is calculated in conjunction with the building standing on it.

Is it possible to get a mortgage for a garage that is just planned to be built? Yes, in this case you should provide an estimate for work and materials. Construction can be carried out on an existing land plot, owned or leased. It is also necessary to collect a package of papers for the land, because it will automatically go as collateral ().

The procedure for obtaining a mortgage at Sberbank

The procedure for applying for a loan to purchase a parking space or garage includes the following main steps:

- Search for the object to be purchased (it is worth deciding in advance what type of parking space for the car will be purchased).

- Concluding a preliminary purchase and sale agreement with the owner, in which it is necessary to specify the terms of payment using a loan and the timing of registration of the transaction (it is better to immediately warn the seller that it is planned to issue a targeted loan and a non-cash payment scheme).

- Collection and preparation of a set of papers (if a secondary object is purchased, an appraisal from an accredited appraisal company will be required).

- Submitting a loan application at the selected bank branch.

- Consideration of the application and submission to the Credit Committee for discussion (each application is considered on average 2-7 working days).

- Concluding a loan agreement and a security agreement (mortgage or guarantee).

- Payment of the down payment (at least 25% of the price of the parking space or garage is paid by the borrower by transfer to the seller’s bank account).

- Encumbrance of the collateral object in the Registration Chamber or MFC (in case of a bank requirement to transfer the purchased object as collateral).

- Final settlement between the bank and the seller (also non-cash).

IMPORTANT! If Sberbank has approved a client’s loan for the construction of his own garage, then he will need to provide a drawing (plan) of the future construction, an estimate as close as possible to reality and detailed information about the hired contractor. The information provided will be analyzed by the bank taking into account reliability and possible risks.

Alternative purchasing options

There are more and more bank offers on the lending market every year. A significant share is made up of mortgages and consumer loans. Car storage space can be purchased with both a mortgage and a regular loan.

Look at the same topic: Mortgage for a family with 2 children in [y] year: conditions, state support for mortgages

The cost of such banking products varies; experts insist on purchasing a garage with a mortgage. It is easier to get such a loan; to make sure of this, try submitting 2 applications for the same amount at once at the same bank. Solvency requirements for a consumer loan will be higher, a mortgage may be approved even with a lower income, and the terms of a housing loan will be more favorable.

You must understand that you can count on the minimum rate in any bank if a number of conditions are met - participation in the bank’s salary program, availability of an individual and mortgage insurance policy, payment of a one-time commission that allows you to reduce the rate.

Any real estate transaction is fraught with potential risks. Consult with a specialist not only about a garage mortgage - study the bank’s offers regarding consumer loans, as well as loans secured by property. Before taking out a mortgage, assess your financial capabilities so that regular payments do not create an unbearable burden on the family budget.

Mortgage insurance

According to Russian legislation, for any lending products that involve the transfer of purchased real estate as collateral to the bank, only property insurance is mandatory. Such an insurance policy protects the object from loss and damage, and, accordingly, minimizes the potential risks of the lender.

The bank may recommend purchasing personal insurance at the same time and protecting your life and health from possible negative factors. It is not mandatory. However, like any other lender, if Sberbank refuses to purchase it, it will automatically increase the base interest rate by 1 percentage point.

Any pressure in this matter and an indication that in case of refusal a negative decision will be made will be illegal.

The insurance product you are interested in can be purchased at Sberbank Insurance.

Which bank is better - recommendations for choosing

Choosing a lender is an important point in purchasing a garage with a mortgage, because even a 1% difference in tariff rates over many years of paying such a substantial amount provides significant savings in the form of hundreds of thousands of rubles. By exploring the local market for banking offers, you can create your own rating of lenders or use expert assessments.

See on the same topic: Rating of banks for mortgage lending for [y] year

When choosing a bank, most of us focus on loyal lending conditions. But the reliability and credibility of the financial company should still come first. If a bank has recently appeared on the market and promises mountains of gold to beat its competitors, this should raise suspicions.

Do you care who you pay? If a bank fails, its powers will necessarily be transferred to another lender with its own policies and methods of doing business. Therefore, the experience and financial capabilities of the institution are important information not only for investors.

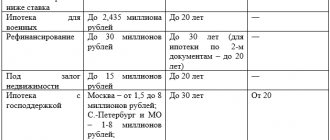

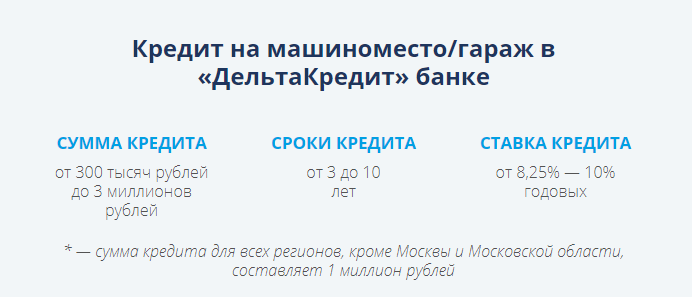

Among the most popular borrowers in this program on thematic forums are Sberbank, DeltaCredit and AbsolutBank. Sberbank, as can be seen from the table, has a maximum loan term (up to 30 years), and income is taken into account without confirmation, and there are discounts for holders of the bank’s salary cards.

The cost of a mortgage loan is affected not only by the rate, but also by the loan limit, payment terms, the size of the regular payment, and the amount of the down payment.