Read on the topic: Where can you apply for refinancing of consumer loans and under what conditions

To help a certain category of the population improve their living conditions, the state is developing special programs designed to make mortgage loans more accessible. Subsidizing the mortgage interest rate is compensation from the state for the lost benefit of the bank that provided a preferential loan for the purchase of housing. The subsidized rate makes it possible to significantly reduce the size of the payment, making it more affordable for many Russian families.

What is mortgage subsidy?

Attention

Mortgage subsidies are free financial assistance from the state provided to a citizen to close a mortgage loan.

Funds for subsidizing mortgages are issued under several government programs, the most popular are:

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

- military mortgage;

- family mortgage;

- mortgage under the “Young Family” program;

- rural mortgage;

- maternal capital;

- mortgages for teachers and scientists;

- mortgage for citizens of the Far North;

- housing for a Russian family.

Funds are provided from the budget. The federal state program is aimed at boosting the construction industry, normalizing the demographic situation, and providing assistance to families with children. Mortgage subsidies offset part of the cost of housing. Banks may provide additional programs to reduce rates if the purchase is made from certain developers. The terms of the subsidized mortgage cooperation vary depending on the selected offer.

What does a mortgage with government support mean?

So, what is it - a mortgage with state support from Sberbank of Russia? This is the name of a special loan program that is partially financed by the state. A mortgage loan issued under it has a reduced interest rate, which reduces the total cost of the loan.

Not all banking organizations in Russia are participating in this project, so obtaining a mortgage loan with state support is quite difficult, since it is necessary to meet the parameters and requirements of a particular banking institution. The government financially helps Russian families in purchasing their own homes, thereby contributing to the development of the construction market.

The state program from Sberbank for obtaining a mortgage applies to apartments located in newly built houses or in buildings under construction. Moreover, the property must be purchased from the developer and be accredited by a financial institution. Secondary market housing is not included in the state mortgage support program at Sberbank.

What does the law say about mortgage subsidies?

The procedure for providing assistance to the list of persons entitled to state support is enshrined in the Civil Code of the Russian Federation and budget legislation. It is recommended to pay attention to:

- Federal Law No. 117 of August 20, 2004 - regulates the rules for granting military mortgages;

- Federal Law No. 256 of December 29, 2006 - determines the rules for the provision of maternity capital;

- Government Decree No. 1050 of December 17, 2010 - determines the rules for providing preferential mortgages to young families;

- Decree of the Government of the Russian Federation No. 404 of May 5, 2014 - defines the rules for implementing the “housing for Russian families” program.

Mortgage subsidies are carried out in accordance with the standards set forth in Decree of the Government of the Russian Federation No. 220 of March 3, 2018. The conditions of the programs, the amount of allocated funds and the features of control are fixed in the form of rules.

Required documents

To apply for a mortgage, you need to submit an application and prepare a number of documents:

- Russian Federation passport.

- Spouse's passport.

- A certificate confirming the existence of temporary registration (if any).

- A marriage contract, if available, and a child’s birth certificate (when obtaining a mortgage for families with children).

- Papers certifying official employment and salary level (labor and 2-personal income tax).

- Certificate confirming participation in the mortgage savings system (when applying for a military mortgage).

- Certificate for receiving maternity capital (when using a program with maternity capital).

Types of mortgage loan subsidies

There are several mortgage subsidy programs in operation in the Russian Federation. The list includes:

- Military mortgage. Persons serving under contract can take part in the program. The state provides a subsidy to cover obligations to a financial organization. Cash payments occur every month. Payments are calculated so that the employee does not have to provide the money himself to pay off the mortgage. However, the funds will belong to the state until the person serves in the army for more than 20 years (the period is reduced to 10 years if there are valid reasons specified in Federal Law No. 117 of August 20, 2004). If a person leaves early, the amount of the subsidized mortgage will have to be returned. Payments are made over 10 years.

- Mortgage under the “Young Family” program. A specialized program of state support to provide housing for persons who have officially registered family legal relations and are unable to buy an apartment. The state undertakes to subsidize part of the costs of purchasing housing. As a result, the family will be able to purchase housing at reduced interest rates. If a child appears in the family, parents have the right to ask for a temporary deferment of payments.

- Maternal capital. When the first and subsequent children are born in a family, the state provides a subsidy to pay off the mortgage. The money can be used to improve living conditions. The state is ready to provide the amount as a down payment on a mortgage or use the money to pay off the principal debt.

- Mortgage for teachers and scientists. The state offers to pay up to 40% of the cost of the property independently. The amount can be used as a down payment, principal payment or monthly interest. Regions have their own specific features of providing material support for young professionals. Local legislation determines the size of the subsidized mortgage, the mechanism for its payment and the requirements for potential participants in the program.

- Mortgage for residents of the Far North. Residents of this area have the right to receive a certificate for improving their living conditions. The subsidy can be used to purchase an apartment or house, including a mortgage. The certificate allows you to pay up to 40% of the cost of real estate at the expense of the state. After this, the person will be able to pay the mortgage in accordance with the established procedure.

- Housing for a Russian family. The program is aimed at increasing the affordability of real estate for Russian citizens. As part of state support, citizens will be able to purchase real estate at a reduced price. The program allows you to reduce the cost of the premises by 20%. At the same time, the price of one square meter should not exceed 35,000 rubles. It is expected that the subsidy will provide an opportunity to save up to 50% on mortgage payments.

Housing requirements

Citizens wishing to take advantage of Sberbank's preferential mortgage with state support 2020 should note that this program does not apply to:

- objects of the secondary real estate market;

- purchase of apartments;

- refinancing of previously taken loans, taken, incl. and for the purchase of housing in new buildings.

All other housing requirements related to preferential lending coincide with the requirements for standard conditions for issuing housing loans.

Conditions for receiving a subsidy

If a citizen wants to take part in the program, he must read the conditions. They differ significantly. In 2020 the following conditions apply:

- Military mortgage. The end date of the program is unknown. Only military personnel who have served three years can take part. During this time, the state transfers a certain amount of money to the serviceman’s account every month. In 2020, you could save 280,009 rubles in a year. The amount is indexed annually. The funds received are used as a down payment on the mortgage. The maximum available amount is calculated so that all subsequent payments are covered by new contributions from the state. You cannot quit your job during the mortgage repayment period. If the rules are violated and the calculation has not yet been made, the citizen will have to make the calculation independently. The funds are owned by the state until the person has served 20 years or 10 years if there are preferential grounds for dismissal. Otherwise, the subsidy will have to be returned. The calculation is carried out within 10 years.

- Mortgage under the “Young Family” program. The program has been extended until 2020. Young families can take part in it if the age of both spouses does not exceed 35 years, and there is a need to improve living conditions. The subsidy amount is 35-40%. The money can be used to purchase residential premises, build real estate, make a down payment on a mortgage, or pay off the principal debt on a loan.

- Mortgage with maternity capital. An amount of 466,617 rubles is provided at the birth or adoption of the first child, after the birth of the second child another 150,000 is added and the total amount is already 616,617 rubles. The certificate is issued once. The applicant and children must have Russian citizenship.

- Mortgage for teachers and scientists. The program can be used by persons under the age of 35 who work as teachers, doctors, emergency paramedics or carry out scientific activities. At the time of application, the person must be working in their specialty. Additional conditions may be established by regional regulations.

- Mortgage for residents of the Far North. A subsidized mortgage can be used by working citizens living in northern areas, unemployed residents of the region if they are registered in employment centers and have the appropriate status for more than 1 year, pensioners who lived or worked in this area, disabled people of the first or second groups who have lost their ability to work due to for occupational injuries in specific industries, disabled children. Requirements for length of service are established if leaving the region. The indicator is at least 15 years. It also applies to disabled people who have lost their ability to work due to injuries received at a specific workplace in the Far North.

- Housing for a Russian family. Individuals who need to improve their living conditions, have two or more minor children, or are military veterans can take part in a subsidized mortgage. The family must have money for a down payment. It is acceptable to use your own savings, maternity capital, loan products from commercial banks, and other forms of government support. Persons must be legally married and between 25 and 40 years of age. Additionally, people whose housing is recognized as dilapidated or in disrepair take part in the program. The program was valid until 2020. It is now closed.

Which banks participate in the mortgage subsidy program?

The issuance of mortgages with subsidies is carried out by banks, the list of which is approved by the Ministry of Finance of the Russian Federation. The list included:

- Sberbank. The bank is ready to issue citizens from 300,000 rubles for a period of up to 30 years. The organization requires a down payment of 15%. The average overpayment for preferential offers is 8.5%.

- VTB 24. The organization is ready to provide up to 60 million rubles for a period of up to 30 years. A down payment of 10% is required. The average rate is 10.1% per annum.

- Gazprombank. The company can receive up to 60 million rubles for a period of up to 30 years. The down payment is 10%, and the average overpayment is 9.2% per annum.

- Bank opening. The company issues mortgage loans in the amount of up to 30 million rubles for a period of up to 30 years. The down payment amount is from 10%, the rate is 9.75%.

- Svyaz-bank. The company can receive up to 30 million rubles for a period of up to 30 years. The starting payment is from 15%. Money is issued at 9.9% per annum.

Typically, large financial institutions offer several products at once. Attention, the conditions are valid at the time of writing. You can find out more information about current offers by visiting the bank’s official website or contacting a consultant.

Existing government programs: their comparison, pros and cons

All government mortgage subsidy programs are aimed at easing the financial burden of citizens and increasing housing affordability. However, the specifics of subsidies can vary significantly. Thus, for some programs the state has established a preferential interest rate, making up the difference from the federal budget. Similar rules apply to the so-called family mortgage.

For your information

An alternative is to issue a certain amount of money to repay the principal debt on a loan or provide an amount to make a down payment. An example of such a program is a mortgage with maternity capital.

In rare cases, the state undertakes full settlements with banks. Recipients of military mortgages can count on similar preferences. However, the benefit is valid only during contract service. If the dismissal is carried out and the requirements of Federal Law No. 117 of August 20, 2004 are not met, the calculation will have to be made independently. Additionally, you will have to return the money received to the state.

The use of state mortgage subsidization programs is associated with a number of advantages and disadvantages. The main advantage is savings. Using funds from the federal or regional budget, you can repay a significant part of the loan. The disadvantages are also significant. Only certain categories of citizens can take part in government programs. Additionally, the choice of real estate may be significantly limited. Often certain requirements are established that the purchased apartment must meet.

Terms of social mortgage in Sberbank

Social mortgages at Sberbank are designed for the following categories of borrowers:

- State employees.

- Low-income citizens.

- Military personnel.

- Families with a disabled child or two or more children.

Each category has its own conditions for obtaining a mortgage loan from Sberbank. For example, mortgages for medical workers, teachers, state and municipal employees, police officers and military personnel are issued on the condition that they have worked (served) for at least 3 years. A mortgage program with state support for young families is issued at the birth of the second and subsequent children in the period from 2018 to 2022.

The down payment varies depending on which program you are receiving housing under:

- When using maternity capital - from 15% for any housing.

- Military mortgage - 0%.

- Program with state support for families with children - from 20%.

Regardless of the mortgage program, Sberbank issues funds without commission. The purchased real estate serves as collateral. Drawing up an insurance contract for residential premises is a mandatory condition of the mortgage. Personal insurance is at your discretion.

What is the mortgage subsidy program for developers?

The program is aimed at supporting developers in times of crisis, when the amount of loan overpayments has increased significantly. In this situation, the state is ready to compensate part of the interest rate. Subsidies are calculated according to the formula: rate of the Central Bank of the Russian Federation + 2.5%. The following conditions apply within the program:

- a citizen wants to buy housing from accredited companies;

- a package of documents must be submitted within 90 days from the date of approval of the application;

- the minimum loan amount is RUB 300,000;

- the calculation must be made within a period of 7 to 30 years;

- It is permissible to use maternity capital.

Please note:

The maximum amount for residents of the regions, the capital and St. Petersburg is different. Muscovites will be able to receive up to 8 million rubles. A similar indicator is established for residents of Moscow Region, St. Petersburg and Leningrad Region. If people from other regions want to take part in a subsidized mortgage, the amount is reduced to 3 million rubles. The subsidy is issued in 2 stages. The first part of the amount will be provided after registering the contract with the developer. The remaining funds are transferred 2 years before signing the transfer deed.

Mortgage restructuring

The state has developed a program to help existing mortgage borrowers who cannot pay the loan or want to reduce payments and the final overpayment. Only certain categories of borrowers who find themselves in a difficult situation are eligible for assistance. Restructuring involves making changes to the loan agreement in order to obtain repayment terms acceptable to the client (payment reduction, credit holidays, etc.). The state compensates for the bank's losses that arise during restructuring; the borrower, in turn, gets the opportunity to continue repaying the loan on acceptable terms, preserves the home and does not spoil the credit history.

Typically, this procedure is carried out with the help of AHML, a government agency. Strict conditions are imposed on the amount of total income (not higher than double the subsistence level for a family) and an increase in the size of the monthly payment by 30% or more from the moment of concluding an agreement with the bank.

Who is eligible for mortgage subsidies?

It all depends on the chosen program. Typically state support is provided:

- large families;

- military personnel;

- young families under 35 years of age;

- teachers, scientists.

Applicants for a subsidized mortgage must have the financial ability to pay the mortgage loan. The exception is programs for military personnel. Here the state is ready to completely take on the burden of repaying the housing loan at the expense of the federal budget.

Mortgage subsidy for the birth of a second child

A new program was launched in the Russian Federation. Thanks to it, young families with a child and other children born from January 1, 2020 to December 31, 2022, can get a mortgage on preferential terms. The main feature of the program is a reduced interest rate of up to 6% per annum. The subsidy applies to mortgage loans for the purchase of apartments or houses on the primary market. Also, families who already have an existing mortgage and in which a second or third child was born during the above period can count on refinancing at a rate of 6%.

You can also leave your feedback in the comments below or ask a question.

Calculate the benefits of refinancing a mortgage or loan Loan

refinancing calculator refinansirovanie.org

Documents for registration

To get a housing loan and take part in the state program, you will need to prepare a list of documents:

- identification;

- employment history;

- certificate from work about the amount of wages;

- SNILS;

- documents confirming your right to participate in the program;

- a preliminary purchase and sale agreement, if the property has already been selected and negotiations with the owner of the premises have been carried out;

- real estate valuation results;

- title papers for the premises.

How to get a mortgage under the state program at Sberbank?

The procedure for obtaining a mortgage loan consists of several stages:

- Filing an application. This can be done on the website or at a bank branch.

- Get pre-approval.

- Select property.

- Enter into a contract.

That's it in a nutshell. During the process, you will have to coordinate the selected property with the bank’s specialists: if it does not meet its requirements, the loan may be refused.

To apply for a housing loan, you only need a passport and a second document of your choice: driver’s license, SNILS, international passport, military ID, military personnel ID.

Important! If a person can confirm income, it is better to provide additional information. This will significantly increase the chances of your application being approved and receiving a larger amount.

Procedure for applying for subsidies

The list of necessary actions also changes depending on what program the citizen plans to take part in. Sometimes it is enough to contact the bank. In a number of situations, you will additionally need to prepare documents confirming your right to receive a subsidy. In general, when applying for a subsidized mortgage, you must proceed according to the following scheme:

- Make sure you are eligible to participate in the state program. To do this, you need to familiarize yourself in detail with all the conditions for providing a subsidy.

- Prepare a package of documents and contact the government agency responsible for monitoring the implementation of the program. Thus, military mortgages and maternity capital require additional registration. If there is no need to obtain a certificate or other supporting documentation, you can skip this step. The controlling authority will check the documentation package and ensure compliance with the established requirements. If all rules are followed, the application will be approved. The citizen will receive supporting documentation.

- Select a financial institution that participates in the appropriate mortgage subsidy program and submit an application.

- Wait for your request to be reviewed. The bank will check the citizen’s solvency and make sure that the borrower really has the right to participate in the program. If all the nuances are followed, the citizen will know how much he can count on.

- Select a suitable premises, negotiate with the seller to conclude a transaction, evaluate the apartment, and conclude a preliminary purchase and sale agreement.

- Contact the bank with real estate documents and provide a down payment. The financial institution will check the papers and then enter into a mortgage agreement with the client.

- Receive papers from the bank, register housing and the fact of transferring the apartment as collateral.

- Submit the documentation to the financial institution and wait until the funds are transferred to the seller’s account. From this moment the person becomes the owner of the property. However, the apartment will be encumbered until full settlement with the financial institution.

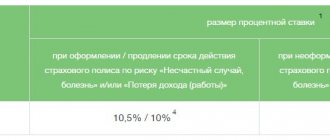

Subsidizing mortgage interest rates

To help young families, large families and other categories of the population buy housing, the Russian Federation operates a program to subsidize interest rates. Its essence lies in the fact that the borrower receives a rate lower than the standard one, which allows him to reduce his payment and save on overpayments. In turn, the bank does not lose anything, since the state compensates it for the lost benefit due to a reduction in the rate. On January 1, 2020, a new program was launched to support large families, which allows you to reduce the mortgage interest rate to 6% per annum. The duration of such subsidies for families with 2 children is set until the end of 2022, for families with 3 children or more - 5 years.