Most often, applying for a mortgage at a bank entails a lengthy procedure for collecting documents and various certificates, especially if the family has children.

This is understandable; the lender, wanting to protect himself from a reckless transaction, wants to receive the maximum possible amount of information.

Some banks, in an effort to attract customers, have launched a new program that provides a simplified package of documents.

“Victory over formalities” from VTB is just such a program. This offer works throughout the Russian Federation and allows the client to obtain the desired loan with a minimum of documents.

Features of the mortgage “Victory over formalities”

Mortgage is a loan issued by financial institutions for the purchase of real estate. Purchasing an apartment is not a cheap pleasure, which means that the amounts issued for such a loan are considerable.

Due to large amounts and long terms, banks receive considerable income in the form of interest, so they can afford to provide lower interest rates on mortgages compared to standard loans.

What is “Victory over formalities” at VTB? This is a relatively new proposal. Unlike other programs, it does not involve collecting a large package of documents.

Due to the lightweight package of documents, this program received a large number of positive reviews and made this offer quite attractive in the eyes of clients.

The main requirement is that the borrower must provide two documents . Both VTB salary clients and those who have never been a client of the bank can apply for such a mortgage.

“Victory over formalities” does not require the provision of income certificates . But if the client really wants to get a mortgage loan, then it is better to try to confirm his solvency with real documents.

What is a mortgage under the “Victory over formalities” campaign?

Purchasing real estate involves significant financial costs. It is not surprising that the lender carefully reviews applications for large long-term loans. Taking into account the noted initial conditions, the special attractiveness of the current VTB 24 mortgage program Victory over formalities is clear. The main difference compared to analogues is the simplicity of the procedure:

- In addition to the application, only 2 documents are provided (civil passport, SNILS);

- confirmation of official income is not required;

- the decision is made within a day.

The received loan can be used to purchase an apartment in a new building or on the secondary market.

Requirements for the borrower

To get a mortgage under the “Victory over formalities” program, you only need to provide two documents:

- passport;

- SNILS.

If the borrower is a man under the age of 27, he will be required to provide a military ID.

If you are determined to receive a loan under this particular program, it would be a good idea to provide maximum information about the employer.

So, be sure to write down complete information about your employer: TIN, legal address of the organization, landline telephone. A salary certificate will not be superfluous, especially since ordering it will not be difficult. The accounting department can easily provide such information.

Of course, you can provide information about your salary using the bank form by filling out a certificate on the spot. But even in this case, the amount of income will not be the least important.

It is important that the income is at least twice as much as the payment on the future mortgage. In case of low wages, it is allowed to attract co-borrowers from outside, but no more than five people.

After all documents are submitted, the bank checks each potential client for reliability. This is a mandatory procedure.

Absolutely any citizen can apply for a mortgage using two documents, the main thing is that he meets the basic requirements of the bank:

- Age limit - at the time of applying for a mortgage, the borrower must be at least 21 years old, at the time of making the last payment he must be no more than 70 years old;

- Work experience – at least 1 year.

These requirements are relevant not only for the main borrower, but also for co-borrowers and guarantors.

Program “Victory over formalities VTB 24”

The issuance of a loan under this scheme is carried out as follows:

- The bank client submits a loan application, which will be reviewed within 5 days.

- The user provides information on the selected real estate product.

- The applicant appears at the financial institution and presents all necessary documents.

- After the inspection is completed, a purchase and sale agreement is concluded with the seller and a mortgage agreement with a financial institution.

The conclusion of the contract will not be carried out without insurance. This service is mandatory, as it provides protection for the purchased property and property rights. What is it for? Primarily for the purpose of guarantees. The apartment is transferred according to documents to the financial institution issuing the loan. Only after the bank client repays the entire debt in full will the rights to own real estate be transferred to him. Bank employees must be sure that if any unforeseen situations develop, measures will be taken to compensate for expenses.

VTB 24 mortgage “Victory over formalities” is extremely popular in 2020. This is due to the fact that the financial organization meets its clients halfway, providing the most favorable conditions for cooperation in order to purchase real estate.

Before you go to the bank to apply for a mortgage, carefully read the loan terms and conditions. You should pay attention not only to the advantages, but also to the disadvantages, among which the level of penalties should be highlighted.

VTB Bank values every client, therefore it provides mortgage lending services on the most favorable terms for users. Despite this, the financial institution takes all possible measures to reduce the risks of possible expenses when collaborating with unscrupulous users.

Reasons for refusal of a mortgage

This turn of events is very undesirable for the borrower, but still quite real. So, for what reasons, most often, does a bank refuse to issue a mortgage:

- Insufficient salary level - just because the bank does not ask for a salary certificate does not mean that it will not pay attention to the low salary. Thus, it is much easier for an officially working citizen with a guaranteed income to get a loan than for an unemployed applicant.

- Lack of collateral - it is very advisable to provide documents for any other expensive property - a car, an apartment - as a guarantee.

- Unreliability of the client - banks can check this point on previously paid loans. If a client has irregularly made payments on loan obligations in other banks, this characterizes him as not very trustworthy. The chance of getting a mortgage drops significantly.

- Availability of other loans - if the borrower is making payments on other loan obligations at the time of application, then income minus these payments will be taken into account. The remaining amount may not be so large, and it may not be enough to apply for a loan.

- If the borrower does not meet the bank's basic requirements, a refusal is inevitable.

- Submitting false information - wanting to make a favorable impression on the bank, the borrower provided incorrect information about himself, for example, submitted incorrect information about employment.

The borrower must understand that the larger the amount he wishes to receive, the more guarantees the bank expects from him.

Mortgage terms

- The minimum loan amount cannot be less than 600 thousand rubles. The maximum limit varies depending on the region where the loan is received, so for residents of Moscow and St. Petersburg this amount reaches 30 million rubles. Borrowers from other regions can count on a limit of 15 million rubles.

- The maximum term for issuing a loan is 20 years; if financial capacity allows, the term may be shorter.

- The rate also varies; the key criterion here is the volume of acquired space. If the property is less than 65 sq. m, then the rate is higher. When purchasing an apartment above the established limit, the rate will decrease by almost a point.

- The down payment on a mortgage directly depends on the type of property purchased. If money is required to purchase an apartment in a new building, the down payment corresponds to 30% of the cost of the property. When purchasing a secondary property, the bank will require a more significant contribution - 40%.

- An important point is that in the “Victory over formalities” program there is no opportunity to use maternity capital to make a down payment. The borrower must provide this amount from his own savings. Maternity capital can be used to repay the principal amount of the debt after receiving approval from the bank for the loan.

These conditions are valid for 2020 . On the bank’s official website you can get all the necessary information on the terms of the “Victory over formalities” program.

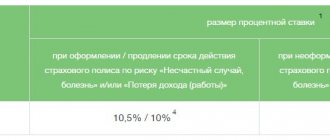

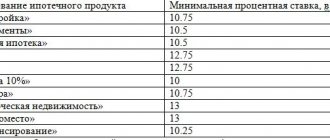

Interest rates and mortgage terms

When working with the “Victory over formalities VTB 24” tariff plan, the conditions differ from the classic version and require separate study.

These include the following parameters:

- the maximum loan term is up to 20 years and can be chosen independently;

- the limit of funds available is limited depending on the region of residence of the borrower. Residents of Moscow and the Moscow region can be guaranteed an amount from 600 thousand to 30 million rubles. Regional maximum threshold – 15 million;

- base interest rate, subject to all additional conditions, from 10.35% (from 65 sq.m.) to 10.85% (up to 65 sq.m.) in the absence of some additional parameters;

- When purchasing an apartment of 100 sq.m. or more, the interest rate starts from 9.95% under the “More meters - lower rate” program.

- the down payment is independent of the type of property purchased and has been increased to 30%, which is a kind of additional guarantee for a banking organization;

- payment is made monthly in the traditional way, early repayment is not subject to a penalty;

- payment with maternity capital is not provided.

The personal requirements for the client are as follows:

- age from 25 to 65 years;

- have permanent registration in the region;

- there is no need to confirm income;

- To increase the chance of a positive response, you can attract an additional guarantor.

How to get a mortgage at a lower interest rate

- Taking out insurance - this item is not mandatory for obtaining a loan, but is highly desirable, therefore, if you refuse it, the rate increases by a point, and this already deprives the offer of its former attractiveness.

- Being a salary client means having additional privileges. The bank sees the client’s income and understands the level of his solvency. Additional savings in bank accounts will also serve as a guarantee of reliability.

- Many banks enter into partnership agreements with construction companies or real estate firms. If you purchase real estate through such partners, you can also count on an additional discount.

Mortgage insurance

Taking out insurance is one of the most reluctant points of a loan agreement. However, as we have already indicated, you can refuse it, but you will have to pay for such a decision with your own ruble.

So what does insurance include, and is it really necessary?

What does insurance include:

- Personal policy - it is a guarantee that the insurance company through which the insurance was issued, in the event of the occurrence of certain conditions specified in the insurance contract, will make a payment for you. In the event of the death of the primary borrower, the insurance will fully cover all mortgage costs, and the relatives of the deceased will not be charged for the remainder of the mortgage.

- A collateral property policy is a mandatory condition provided by law - any housing purchased with a mortgage loan must be insured. This will allow compensation for damage in the event of a fire, earthquake or any other natural disaster. In this case, the insurance company will also compensate for all damage incurred.

- Title policy - this type of insurance allows you to protect the rights of a co-owner to this property, even if third parties try to claim any rights to this area, they will not succeed.

Many banks, including VTB, work with certain insurance companies, but the borrower can refuse to take out insurance with the bank and enter into an agreement with any other company.

The main thing is that the insurance policy covers all possible risks and gives the bank guarantees for payments in the event of an insured event.

When choosing an insurance company, it is better to turn to those companies that are accredited by the bank. Their list is available on the official VTB website.

However, you can insure yourself with another company. To do this, after issuing an insurance policy, you must submit it to the bank, the latter will check the selected company.

If it meets all the necessary characteristics, the bank accepts this insurance policy. But be prepared for the fact that this procedure may take time, and the company may not be accredited by the bank.

When purchasing insurance externally, you will have to purchase at least two policies . The first is insurance against damage and loss, the second policy is your choice, this can be a title policy or protection of property rights.

All this is necessary, since while the loan is being repaid, the property is pledged to the bank. Bank insurance is a reliable guarantee.

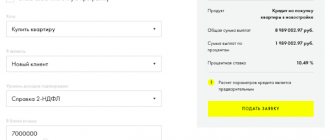

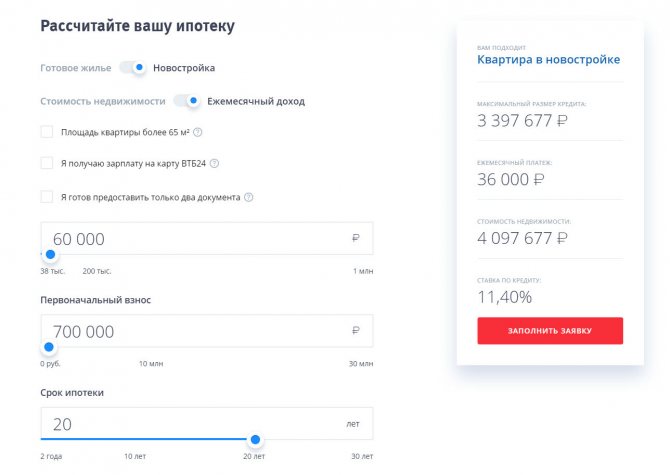

Mortgage calculator

Even without contacting the bank for advice, you can get preliminary information about the size of the down payment, the loan term and the amount of the monthly payment. All this can be calculated using a mortgage calculator. Here you can see how the interest rate and monthly payment will change with changes in the size of the down payment and the mortgage term.

To use the service, you need to go to the official page of the program, here are the fields that need to be filled out . After setting all the necessary parameters, you will see what monthly payment and interest rate will be provided by the bank under these conditions.

But you need to understand that these are only preliminary calculations. During a personal visit to the bank, a specialist will be able to make a more detailed calculation based on your personal capabilities.

Features and conditions of “Victory over formalities”

As part of the “ Victory over formalities ” program, the bank provides loans to:

- for the purchase of housing under construction or a finished apartment.

- for mortgage refinancing.

General terms

- loan amount - minimum 600 thousand, maximum 30 million rubles. (for metropolitan regions);

- the term of the loan agreement is up to 20 years, but the borrower has 65 years until execution;

- interest rate:

- purchase of an apartment less than 65 sq.m. - from 9.6% ,

- purchase of an apartment of 65 sq.m. or more – from 8.9% ,

- when refinancing a mortgage from a third-party bank - from 9.3%.

- The indicated rates apply subject to comprehensive insurance :

- property insurance of the collateral against risks of damage or loss (required),

- personal insurance of the borrower and guarantors,

- when purchasing a secondary home, title insurance (loss or limitation of rights to the property) for 3 years.

- Down payment (it is prohibited to use maternity capital):

- for a loan for secondary housing – from 40%,

- when purchasing a new building - from 30%.

Without obtaining personal and title insurance, the loan rate will be increased by 1 percentage point.

When purchasing an apartment at the construction stage, until the ownership of the completed object is registered and an insurance contract is concluded for it, the loan rate will be increased by 0.6 percentage points .

Important!

Until the end of 2020, interest rates for the VTB “Victory over formalities” product are the same as for programs with a full set of documents.

If we compare the conditions of “Victory over formalities” and standard mortgage products operating at VTB, the main feature and main obstacle to obtaining a mortgage with a simplified package of documents will be the increased amount of the down payment .

Comparative table of mortgage program conditions with proof of income and “according to two documents”.

| Condition | With proof of income | No proof of income |

| Maximum loan amount for metropolitan regions | 60 million rubles. | 30 million rub. |

| Maximum contract period | 30 years | 20 years |

| Minimum advance payment amount: | ||

| · when purchasing a new building | From 10% | 30% |

| · when purchasing secondary housing | From 10% | 40% |

| Possibility of using MSC to pay an advance payment | Yes | No |

For your information!

Despite the fact that when paying the down payment under this program, the use of maternity capital is not provided, it can be used to pay off regular payments.

Also, without submitting documents confirming income, you can receive a preferential loan under the state program to support large families.

What other documents may be needed to complete the application?

The terms of the program state that only two documents are enough to apply for a mortgage, but it is worth clarifying that this package is only enough to fill out an application for the bank to consider your candidacy as a borrower.

If you receive approval for a mortgage loan, be prepared to provide another package of papers . Without it, you will not be able to get credit:

- Cadastral and technical passport for the purchased housing;

- Extract from Rosreestr - in case of rent arrears, this information will be reflected here;

- Extract from Rosreestr about property - indicating the owners of this property;

- The document on the basis of which the transfer of ownership of the property takes place;

- Assessment of the market value of the apartment.

Also attached to the package of documents is an applicant’s application form, which contains information about the employer and the borrower’s income . The bank does not require you to provide official data, but do not let this mislead you. All information will be checked carefully.

The advantage of this program is that the client is spared the need to spend time preparing certificates and collecting official information about his employment. But this does not mean that the bank will not check the information provided.

Procedure for obtaining a mortgage

How to take out a mortgage using two documents? The algorithm of actions is as follows:

- Primary information can be obtained on the official VTB website, where you can also fill out an application to participate in the program. After receiving a positive response, you need to go to the bank with all the documents.

- You can, bypassing the first point, immediately contact the bank’s specialists and get maximum information from them. Don't forget to bring your documents (passport and SNILS).

- After filling out the questionnaire, you will have to wait a day, during which time bank employees will consider your candidacy as a potential client and make a preliminary decision.

- After receiving a positive decision, you can proceed to the most important step - searching for living space. This process may take a lot of time, but remember, the bank’s decision remains in force for 4 months. Then the application will have to be resubmitted.

- As soon as the object of purchase is found, the second stage of collecting papers begins.

- After discussing all the nuances, a mortgage agreement for this property is signed.

- The time has come to make a down payment.

- The loan funds are credited to the seller's account, and the property under the contract becomes collateral to the bank, where it will remain until the obligations under this loan to the bank are fulfilled in full.

Registration procedure

The standard algorithm is as follows:

- clarify the terms of the VTB mortgage Victory over formalities using reference information (calculation on a calculator);

- receive approval of the initial application;

- after successful verification of the legal purity of the property, the main loan agreement is concluded;

- register the transaction in Rosreestr;

- complete the calculation.

Documentation

At the first stage, it is enough to present a civil passport, SNILS and an application, and for men under 27 years old - a military ID. To conduct a thorough home inspection, bank specialists are provided with the following documents:

- a copy of the DCT (notarial certificate of receipt of inheritance, exchange agreement or privatization);

- an extended extract from the USRN database with a technical plan;

- certificate of registered residents;

- a copy of the passport pages (with records) of the home seller.

Additionally they provide:

- expert opinion on the value of the property;

- issued insurance policies.

If there is a minor owner of a (registered) child, the consent of the state guardianship authorities is required for the alienation of property. Additional confirmation of fulfilled obligations may be required. In particular, to obtain such permission, a scheme is used to open a conditional deposit in the name of the child.

When purchasing real estate from a company, no additional documents are required from the seller. The developer must be accredited by VTB in advance.

It should be remembered that the bank will not accept housing intended for demolition as collateral. To clarify, it may be necessary to organize an inspection of the property by an authorized employee of the territorial division of the lender.

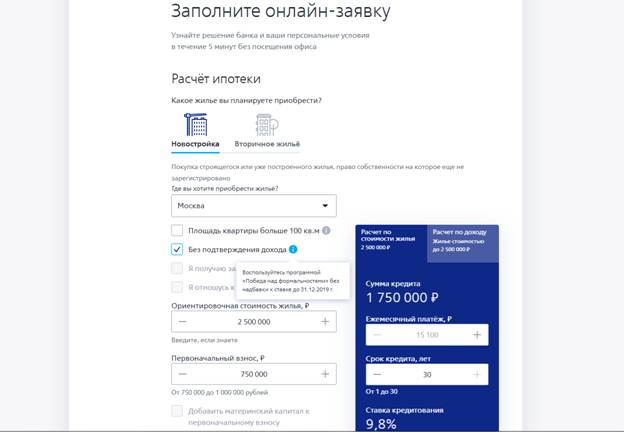

Where to apply

The application to the bank is filled out and submitted for verification using an electronic form on the bank’s official website. In a separate column, note the condition for obtaining a loan “Without proof of income.” Confirmation of this position meets the VTB mortgage criteria Victory over formalities.

Duration of consideration and validity of the decision

To activate an application for a VTB mortgage Victory over formalities, you must personally visit the mortgage center and provide a civil passport and SNILS for verification. You can reserve an appointment for a convenient time by phone. After the visit, a response to your request will be received no later than within 24 hours.

What to do after approval

The received positive decision is valid for four months. During this period you need:

- choose a suitable property;

- sign a preliminary agreement with the seller and transfer the deposit;

- make an expert assessment;

- submit documents to the bank to verify the property (legal purity of the transaction);

- enter into agreements with insurance companies.

If there are no obstacles to purchase, use the standard sequence of actions:

- sign the main mortgage agreement;

- register the new owner and the lien in Rosreestr;

- the bank pays for the property;

- the borrower fulfills its obligations for timely payments;

- After repayment of the loan, the ban on free disposal of property is removed from the Unified State Register of Real Estate.

For your information! For value assessment, VTB offers a list of authorized appraisers. You can order the service online using the bank client’s personal account.

Insurance

To clarify the costs of the policy, you can use a special calculator. Costs are offset by reduced risks. Real estate insurance is a mandatory item to obtain a mortgage loan. To get the most favorable conditions, you should take out insurance online. You can do this using the special calculator below.

Total costs of a mortgage transaction

To calculate costs, it is recommended to take into account the following mandatory items:

- an insurance policy for the purchased property, compensating for the risk of damage to valuable property;

- expert assessment of market value (when purchasing housing on the secondary market);

- state duty for state registration of a new owner in Rosreestr (2,000 rubles);

- payment for notary services and actions of authorized persons under a power of attorney;

- transport and other related costs.

For your information! If you cancel life (disability) insurance, the base rate increases by 1%. When buying housing on the secondary market, you can purchase a special policy to compensate for monetary losses due to loss of property rights. Such a document is issued according to the standard scheme for three years.

Mortgage loan payment procedure

Most often, the borrower chooses a mortgage with annuity payments, in which the monthly payment is divided into equal amounts. This scheme is good because the monthly contribution remains the same, and there is no need to look into the payment schedule every month to clarify the contribution amount.

You can set up automatic payment and deposit the required amount in advance on the card from which the debit will be made. Another option for depositing funds is to independently transfer money to your current account. This can be done from another card of the same bank or any other. You can transfer money from accounts. You can top up your card from the bank terminal by depositing the required amount into your account.

VTB Bank offers its users an online personal account through which they can control expenses and receipts of funds.

The bank provides for early repayment; this can be done by depositing a large amount. There are no fines or sanctions in this regard. But to do this, you will need to notify bank employees about your step a month in advance and indicate in advance the amount and date of the extraordinary payment.