Lending conditions in the CIS

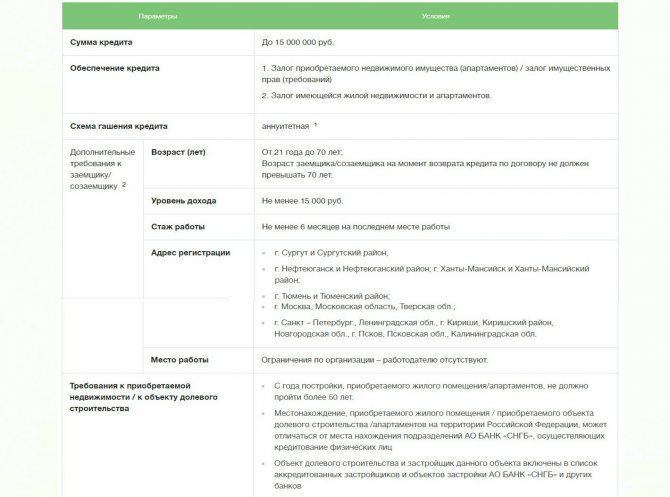

To obtain a mortgage-backed home loan, a potential borrower must meet the following requirements:

- Russian citizenship is mandatory;

- Mortgage guarantors can be both residents and non-residents of the Russian Federation;

- The minimum age to apply for a mortgage transaction is 21 years;

- The maximum age of the borrower may vary and depends on the specific lending program;

- Work experience in the last place is at least 6 months. For some types of programs this condition may vary;

- SNGB Bank issues housing mortgages only to those citizens who are registered in a certain territory - in the cities of Surgut, Nefteyugansk, Khanty-Mansiysk, Tyumen, Moscow, St. Petersburg, Pskov, etc.

Requirements for the borrower

Before submitting a loan application, each client must check himself for compliance with the following important requirements from the bank:

- Age limit is from 21 to 70 years.

- Availability of Russian citizenship.

- The minimum level of monthly earnings is 10-15 thousand rubles. per month.

- Experience – from 6 months at the current place of employment.

- Availability of registration in Surgut, Nefteyugansk, Khanty-Mansiysk, Tyumen, Kirishi districts, Moscow and Mo, Tver, Pskov, Kaliningrad, Novgorod, Leningrad regions, St. Petersburg.

- Full legal capacity.

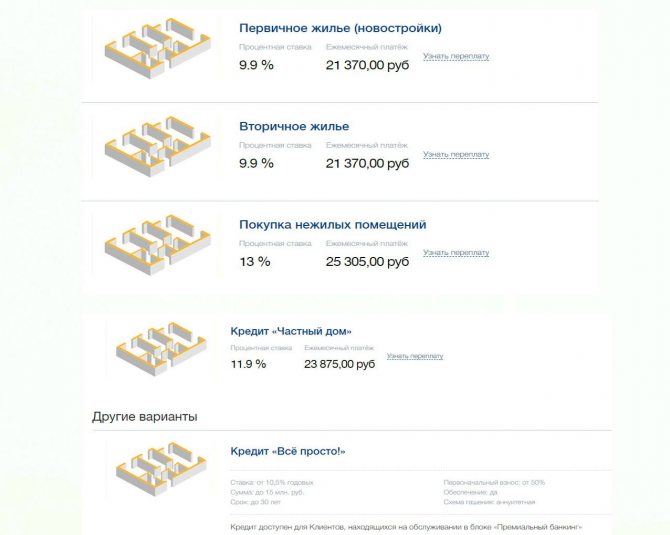

Mortgage offers SNGB

Mortgage from Surgutneftegazbank provides the following products:

- New buildings;

- Secondary housing;

- Loan "Private House";

- "It's simple";

- "Alternative-real estate";

- "Parking".

Each program has its own conditions and requirements for the borrower.

Secondary housing

Under this program, the borrower is provided with a mortgage for the purchase of an apartment under the following conditions:

- Down payment – from 20%;

- Interest rate: 10.5% – if the client takes out additional insurance against job loss or health insurance; 12.5% – if the borrower does not take out or renew an additional insurance policy;

- Clients who receive salaries from the SNGB Bank automatically receive a reduction in mortgage rates by 0.5% per annum.

Other parameters for the mortgage offer for secondary housing:

- The maximum loan size is 15 million rubles;

- The program requires the mandatory availability of collateral;

- The borrower's age is at least 21 years old, and at the time of expiration of the mortgage agreement he must be no more than 70 years old;

- There are no requirements for the place of work or the employer.

The bank also puts forward certain requirements for the mortgaged property:

- Housing must have been built no later than 1969 (as of 2019);

- The residential real estate developer must be included in the list of developers accredited by the bank.

Primary housing

Under this lending program from Surgutneftegazbank, there are 2 options for completing the transaction:

- With a down payment of 20%.

- No down payment required. Here we are talking about specific apartments located in the city of Dmitrov. The bank provides a mortgage for an apartment at 7.5% per annum. It is not necessary to take out a down payment and insurance. Other conditions of this program:

- Loan term – up to 30 years;

- The maximum mortgage amount is 8 million rubles;

- Mandatory provision of collateral.

"It's simple" offer

Only those clients of the SNGB bank who are serviced under premium banking can receive money to purchase housing under this program. Program conditions:

- Interest rate – 10.5%;

- Loan term – up to 30 years;

- Loan amount – up to 15 million rubles;

- Down payment of at least 50%;

- The borrower's work experience does not matter;

- The salary is not less than 10 thousand rubles. per month;

- Mandatory presence of collateral.

Refinancing program – “Alternative-real estate”

SNGB Bank makes life easier for those clients who took out a loan or mortgage from other banks at a high interest rate and want to repay the debt as quickly as possible.

To help such borrowers, the bank offers to refinance the loan by taking out a loan with a low interest rate.

Refinancing program rates:

- 12.5% per annum - this rate is relevant for repaying loans from other banks for residential real estate and apartments;

- 13.5% - the current rate for repaying a mortgage taken out for the purchase of a land plot and land with a house.

A loan is issued for a period of up to 30 years, the maximum amount is 8 million rubles, mandatory work experience in the last place for a period of six months. Under this program, the borrower must annually insure the property against the risk of loss.

Look at the same topic: Federal Law 102-FZ On Mortgage (Pledge of Real Estate): latest edition dated December 31, 2017

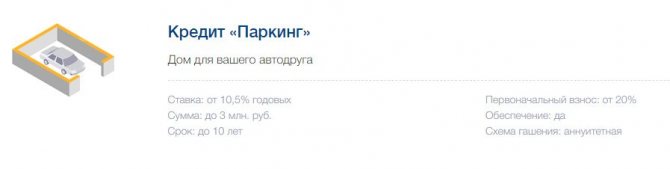

Mortgage in Surgutneftegazbank for the purchase of parking spaces

Vehicle owners can purchase a parking space on a mortgage either as an independent piece of real estate or as a shared piece of real estate.

Parking spaces can be purchased under this program only in certain cities: Omsk, Samara, Krasnodar, Kazan, etc. The list of cities can be found at the bank branch.

Terms of offer:

- The interest rate is from 13.5 to 14.5%, depending on whether the parking space is an independent object or it relates to a share in the common ownership;

- The loan term is no more than 10 years;

- Mortgage size – up to 3 million rubles;

- Down payment – no less than 20%;

- Securing the transaction – a deposit of a parking space, a surety;

- The borrower's monthly income is at least 15 thousand rubles;

- Work experience – minimum 6 months.

Home mortgage. Program "Private home"

Under the terms of this offer, the borrower has the right to buy a plot of land without a house or with a house, as well as with an unfinished house or for its construction. Down payment – from 20%, interest rate – 11.9% per annum. The borrower is credited for a period of up to 20 years, the maximum loan size is 15 million rubles.

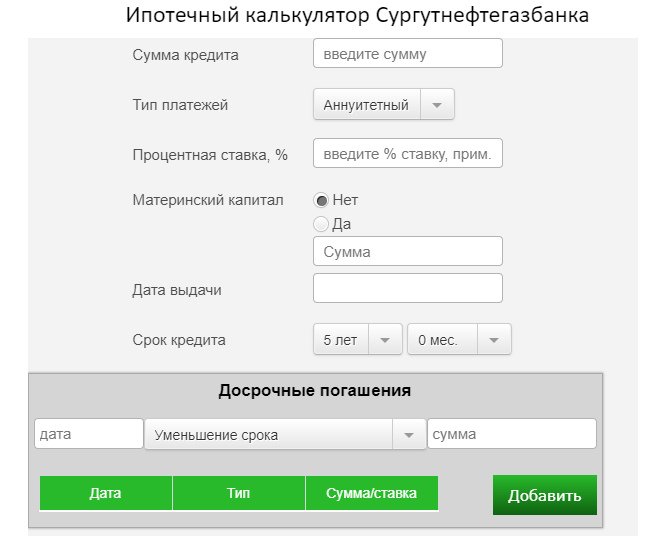

Mortgage calculator Surgutneftegazbank. Online mortgage calculation Surgutneftegazbank 2020.

- Mortgage calculator online

- Surgutneftegazbank

Select a mortgage loan from Surgutneftegazbank for online calculator calculation

Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 10.5% 8 000 000 up to 30 years old Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 11.9% 15 000 000 up to 30 years old Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 13% 3 000 000 up to 10 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 15% 2 000 000 up to 5 years

40 480

1 857 660

4 857 660

| payment date | Principal payment | Duty | Interest payment | Interest | Monthly payment | Remainder | Principal balance |

| October 2020 | 14 230,50 | 26 250,00 | 40 480,50 | 2 985 769,50 | |||

| November 2020 | 14 355,02 | 26 125,48 | 40 480,50 | 2 971 414,49 | |||

| December 2020 | 14 480,62 | 25 999,88 | 40 480,50 | 2 956 933,86 | |||

| January 2021 | 14 607,33 | 25 873,17 | 40 480,50 | 2 942 326,54 | |||

| February 2021 | 14 735,14 | 25 745,36 | 40 480,50 | 2 927 591,39 | |||

| March 2021 | 14 864,07 | 25 616,42 | 40 480,50 | 2 912 727,32 | |||

| April 2021 | 14 994,13 | 25 486,36 | 40 480,50 | 2 897 733,18 | |||

| May 2021 | 15 125,33 | 25 355,17 | 40 480,50 | 2 882 607,85 | |||

| June 2021 | 15 257,68 | 25 222,82 | 40 480,50 | 2 867 350,17 | |||

| July 2021 | 15 391,19 | 25 089,31 | 40 480,50 | 2 851 958,98 | |||

| August 2021 | 15 525,86 | 24 954,64 | 40 480,50 | 2 836 433,13 | |||

| September 2021 | 15 661,71 | 24 818,79 | 40 480,50 | 2 820 771,42 | |||

| October 2021 | 15 798,75 | 24 681,75 | 40 480,50 | 2 804 972,67 | |||

| November 2021 | 15 936,99 | 24 543,51 | 40 480,50 | 2 789 035,68 | |||

| December 2021 | 16 076,44 | 24 404,06 | 40 480,50 | 2 772 959,24 | |||

| January 2022 | 16 217,11 | 24 263,39 | 40 480,50 | 2 756 742,14 | |||

| February 2022 | 16 359,01 | 24 121,49 | 40 480,50 | 2 740 383,13 | |||

| March 2022 | 16 502,15 | 23 978,35 | 40 480,50 | 2 723 880,99 | |||

| April 2022 | 16 646,54 | 23 833,96 | 40 480,50 | 2 707 234,45 | |||

| May 2022 | 16 792,20 | 23 688,30 | 40 480,50 | 2 690 442,25 | |||

| June 2022 | 16 939,13 | 23 541,37 | 40 480,50 | 2 673 503,12 | |||

| July 2022 | 17 087,35 | 23 393,15 | 40 480,50 | 2 656 415,77 | |||

| August 2022 | 17 236,86 | 23 243,64 | 40 480,50 | 2 639 178,91 | |||

| September 2022 | 17 387,68 | 23 092,82 | 40 480,50 | 2 621 791,23 | |||

| October 2022 | 17 539,83 | 22 940,67 | 40 480,50 | 2 604 251,40 | |||

| November 2022 | 17 693,30 | 22 787,20 | 40 480,50 | 2 586 558,10 | |||

| December 2022 | 17 848,12 | 22 632,38 | 40 480,50 | 2 568 709,99 | |||

| January 2023 | 18 004,29 | 22 476,21 | 40 480,50 | 2 550 705,70 | |||

| February 2023 | 18 161,82 | 22 318,67 | 40 480,50 | 2 532 543,88 | |||

| March 2023 | 18 320,74 | 22 159,76 | 40 480,50 | 2 514 223,14 | |||

| April 2023 | 18 481,05 | 21 999,45 | 40 480,50 | 2 495 742,09 | |||

| May 2023 | 18 642,76 | 21 837,74 | 40 480,50 | 2 477 099,33 | |||

| June 2023 | 18 805,88 | 21 674,62 | 40 480,50 | 2 458 293,45 | |||

| July 2023 | 18 970,43 | 21 510,07 | 40 480,50 | 2 439 323,02 | |||

| August 2023 | 19 136,42 | 21 344,08 | 40 480,50 | 2 420 186,60 | |||

| September 2023 | 19 303,87 | 21 176,63 | 40 480,50 | 2 400 882,73 | |||

| October 2023 | 19 472,78 | 21 007,72 | 40 480,50 | 2 381 409,96 | |||

| November 2023 | 19 643,16 | 20 837,34 | 40 480,50 | 2 361 766,80 | |||

| December 2023 | 19 815,04 | 20 665,46 | 40 480,50 | 2 341 951,76 | |||

| January 2024 | 19 988,42 | 20 492,08 | 40 480,50 | 2 321 963,34 | |||

| February 2024 | 20 163,32 | 20 317,18 | 40 480,50 | 2 301 800,02 | |||

| March 2024 | 20 339,75 | 20 140,75 | 40 480,50 | 2 281 460,27 | |||

| April 2024 | 20 517,72 | 19 962,78 | 40 480,50 | 2 260 942,54 | |||

| May 2024 | 20 697,25 | 19 783,25 | 40 480,50 | 2 240 245,29 | |||

| June 2024 | 20 878,35 | 19 602,15 | 40 480,50 | 2 219 366,94 | |||

| July 2024 | 21 061,04 | 19 419,46 | 40 480,50 | 2 198 305,90 | |||

| August 2024 | 21 245,32 | 19 235,18 | 40 480,50 | 2 177 060,58 | |||

| September 2024 | 21 431,22 | 19 049,28 | 40 480,50 | 2 155 629,36 | |||

| October 2024 | 21 618,74 | 18 861,76 | 40 480,50 | 2 134 010,62 | |||

| November 2024 | 21 807,91 | 18 672,59 | 40 480,50 | 2 112 202,71 | |||

| December 2024 | 21 998,73 | 18 481,77 | 40 480,50 | 2 090 203,99 | |||

| January 2025 | 22 191,21 | 18 289,28 | 40 480,50 | 2 068 012,77 | |||

| February 2025 | 22 385,39 | 18 095,11 | 40 480,50 | 2 045 627,39 | |||

| March 2025 | 22 581,26 | 17 899,24 | 40 480,50 | 2 023 046,13 | |||

| April 2025 | 22 778,85 | 17 701,65 | 40 480,50 | 2 000 267,28 | |||

| May 2025 | 22 978,16 | 17 502,34 | 40 480,50 | 1 977 289,12 | |||

| June 2025 | 23 179,22 | 17 301,28 | 40 480,50 | 1 954 109,90 | |||

| July 2025 | 23 382,04 | 17 098,46 | 40 480,50 | 1 930 727,86 | |||

| August 2025 | 23 586,63 | 16 893,87 | 40 480,50 | 1 907 141,23 | |||

| September 2025 | 23 793,01 | 16 687,49 | 40 480,50 | 1 883 348,22 | |||

| October 2025 | 24 001,20 | 16 479,30 | 40 480,50 | 1 859 347,02 | |||

| November 2025 | 24 211,21 | 16 269,29 | 40 480,50 | 1 835 135,81 | |||

| December 2025 | 24 423,06 | 16 057,44 | 40 480,50 | 1 810 712,75 | |||

| January 2026 | 24 636,76 | 15 843,74 | 40 480,50 | 1 786 075,98 | |||

| February 2026 | 24 852,33 | 15 628,16 | 40 480,50 | 1 761 223,65 | |||

| March 2026 | 25 069,79 | 15 410,71 | 40 480,50 | 1 736 153,86 | |||

| April 2026 | 25 289,15 | 15 191,35 | 40 480,50 | 1 710 864,70 | |||

| May 2026 | 25 510,43 | 14 970,07 | 40 480,50 | 1 685 354,27 | |||

| June 2026 | 25 733,65 | 14 746,85 | 40 480,50 | 1 659 620,62 | |||

| July 2026 | 25 958,82 | 14 521,68 | 40 480,50 | 1 633 661,80 | |||

| August 2026 | 26 185,96 | 14 294,54 | 40 480,50 | 1 607 475,84 | |||

| September 2026 | 26 415,09 | 14 065,41 | 40 480,50 | 1 581 060,76 | |||

| October 2026 | 26 646,22 | 13 834,28 | 40 480,50 | 1 554 414,54 | |||

| November 2026 | 26 879,37 | 13 601,13 | 40 480,50 | 1 527 535,17 | |||

| December 2026 | 27 114,57 | 13 365,93 | 40 480,50 | 1 500 420,60 | |||

| January 2027 | 27 351,82 | 13 128,68 | 40 480,50 | 1 473 068,79 | |||

| February 2027 | 27 591,15 | 12 889,35 | 40 480,50 | 1 445 477,64 | |||

| March 2027 | 27 832,57 | 12 647,93 | 40 480,50 | 1 417 645,07 | |||

| April 2027 | 28 076,10 | 12 404,39 | 40 480,50 | 1 389 568,96 | |||

| May 2027 | 28 321,77 | 12 158,73 | 40 480,50 | 1 361 247,19 | |||

| June 2027 | 28 569,59 | 11 910,91 | 40 480,50 | 1 332 677,61 | |||

| July 2027 | 28 819,57 | 11 660,93 | 40 480,50 | 1 303 858,04 | |||

| August 2027 | 29 071,74 | 11 408,76 | 40 480,50 | 1 274 786,30 | |||

| September 2027 | 29 326,12 | 11 154,38 | 40 480,50 | 1 245 460,18 | |||

| October 2027 | 29 582,72 | 10 897,78 | 40 480,50 | 1 215 877,45 | |||

| November 2027 | 29 841,57 | 10 638,93 | 40 480,50 | 1 186 035,88 | |||

| December 2027 | 30 102,69 | 10 377,81 | 40 480,50 | 1 155 933,20 | |||

| January 2028 | 30 366,08 | 10 114,42 | 40 480,50 | 1 125 567,11 | |||

| February 2028 | 30 631,79 | 9 848,71 | 40 480,50 | 1 094 935,33 | |||

| March 2028 | 30 899,81 | 9 580,68 | 40 480,50 | 1 064 035,51 | |||

| April 2028 | 31 170,19 | 9 310,31 | 40 480,50 | 1 032 865,32 | |||

| May 2028 | 31 442,93 | 9 037,57 | 40 480,50 | 1 001 422,40 | |||

| June 2028 | 31 718,05 | 8 762,45 | 40 480,50 | 969 704,34 | |||

| July 2028 | 31 995,59 | 8 484,91 | 40 480,50 | 937 708,76 | |||

| August 2028 | 32 275,55 | 8 204,95 | 40 480,50 | 905 433,21 | |||

| September 2028 | 32 557,96 | 7 922,54 | 40 480,50 | 872 875,25 | |||

| October 2028 | 32 842,84 | 7 637,66 | 40 480,50 | 840 032,41 | |||

| November 2028 | 33 130,22 | 7 350,28 | 40 480,50 | 806 902,20 | |||

| December 2028 | 33 420,10 | 7 060,39 | 40 480,50 | 773 482,09 | |||

| January 2029 | 33 712,53 | 6 767,97 | 40 480,50 | 739 769,56 | |||

| February 2029 | 34 007,52 | 6 472,98 | 40 480,50 | 705 762,05 | |||

| March 2029 | 34 305,08 | 6 175,42 | 40 480,50 | 671 456,96 | |||

| April 2029 | 34 605,25 | 5 875,25 | 40 480,50 | 636 851,71 | |||

| May 2029 | 34 908,05 | 5 572,45 | 40 480,50 | 601 943,67 | |||

| June 2029 | 35 213,49 | 5 267,01 | 40 480,50 | 566 730,17 | |||

| July 2029 | 35 521,61 | 4 958,89 | 40 480,50 | 531 208,56 | |||

| August 2029 | 35 832,42 | 4 648,07 | 40 480,50 | 495 376,14 | |||

| September 2029 | 36 145,96 | 4 334,54 | 40 480,50 | 459 230,18 | |||

| October 2029 | 36 462,23 | 4 018,26 | 40 480,50 | 422 767,95 | |||

| November 2029 | 36 781,28 | 3 699,22 | 40 480,50 | 385 986,67 | |||

| December 2029 | 37 103,12 | 3 377,38 | 40 480,50 | 348 883,55 | |||

| January 2030 | 37 427,77 | 3 052,73 | 40 480,50 | 311 455,78 | |||

| February 2030 | 37 755,26 | 2 725,24 | 40 480,50 | 273 700,52 | |||

| March 2030 | 38 085,62 | 2 394,88 | 40 480,50 | 235 614,90 | |||

| April 2030 | 38 418,87 | 2 061,63 | 40 480,50 | 197 196,04 | |||

| May 2030 | 38 755,03 | 1 725,47 | 40 480,50 | 158 441,00 | |||

| June 2030 | 39 094,14 | 1 386,36 | 40 480,50 | 119 346,86 | |||

| July 2030 | 39 436,21 | 1 044,29 | 40 480,50 | 79 910,65 | |||

| August 2030 | 39 781,28 | 699,22 | 40 480,50 | 40 129,37 | |||

| September 2030 | 40 129,37 | 351,13 | 40 480,50 | 0,00 |

The Surgutneftegazbank online mortgage calculator will calculate all the data.

We have added the ability to select the Surgutneftegazbank mortgage lending program so that you can immediately start calculating and not have to think about what percentage to set.

Rate data is updated daily, so you can be confident in the relevance of interest rates and mortgage programs of Surgutneftegazbank.

You only need to indicate the amount you want to borrow and select the mortgage term. By changing this data, you can select online the necessary parameters of a mortgage loan, which you will be comfortable paying monthly.

Advantages of our Surgutneftegazbank mortgage calculator:

- Free, no registration required

- Formula for calculating monthly payments Surgutneftegazbank

- We regularly update data on conditions and interest rates for calculating a mortgage loan at Surgutneftegazbank in 2020.

- Mortgage calculator Surgutneftegazbank calculates both annuity and differentiated payments

To make a mortgage loan as profitable as possible for you, you should use our special financial tool - the Surgutneftegazbank online mortgage calculator. It will help you:

- Select a mortgage lending program from Surgutneftegazbank. Get interest rates

- Choose the optimal monthly payment amount based on your income

- Get detailed information about payments (how much you pay on interest, how much on principal)

- Calculate the possibility of early repayment of the mortgage

Who is our Surgutneftegazbank mortgage calculator suitable for:

- For individual entrepreneurs

- For pensioners

- For individuals

- For legal entities

- Of course, Surgutneftegazbank provides the most favorable conditions for salary card holders

We use the formula for calculating consumer loans specifically from Surgutneftegazbank, so you can be confident in the results of loan repayment.

If you need to calculate a consumer loan at Surgutneftegazbank, use the Surgutneftegazbank loan calculator for 2020

Loan for non-residential premises at Surgutneftegazbank

The bank offers individuals a mortgage on commercial real estate under the following circumstances:

- Down payment – from 20%;

- Interest rate – 13%;

- Mortgage term – up to 20 years;

- Loan amount – up to 15 million rubles;

- Collateral – non-residential premises;

- The premises must be put into operation;

- Less than 50 years must have passed since the construction of the building (structure);

- The borrower must provide the bank with a certificate of the market value of the collateral, as well as property insurance.

Mortgage in a private house

This type of loan involves obtaining funds for the construction of a house, as well as the purchase of a land plot with a completed property or unfinished construction. As in previous programs, an initial payment of 20% of the requested amount is required.

Basic conditions of the mortgage product:

- maximum loan amount is 15 million rubles;

- loan term up to 20 years;

- interest rate from 11.9%. Please note that this annual rate is based on the fact that the client takes out an insurance policy;

- Loan collateral is required in the form of collateral of either purchased property or existing property.

Mortgage at Tinkoff Bank - design features

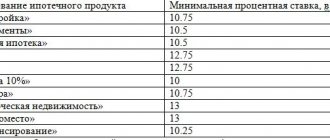

Mortgage interest rates in 2019

The amount of interest payments on a mortgage taken out in the SNGB differs depending on the chosen program:

- Primary housing – 9.9%;

- Secondary housing – 9.9%;

- Non-residential premises – 13%;

- House – 11.9%;

- “Everything is simple” – from 10.5%;

- Refinancing – from 10.5%;

- Car space – from 10.5%.

Calculator for Surgutneftegazbank

On the SNGB website, the borrower can independently calculate the amount of overpayment according to specified parameters: the size of the mortgage, the number of months of lending, the amount of the down payment. Having entered the necessary data, the system will automatically offer him available real estate options. The client can clearly see the amount of the monthly payment, as well as the amount of overpayment. It can edit numeric values if necessary.

Requirements for a candidate to receive a mortgage

A mortgage loan can only be issued to a citizen of the Russian Federation over the age of 21 with a work experience of at least six months at the last place of work. The applicant's monthly income must be at least 10–15 thousand rubles. (depending on the chosen loan program). A person must be fully capable, the address of residence also matters - residents of Surgut, Tver, Pskov, Kaliningrad, Moscow, St. Petersburg are provided with a mortgage.

Documentation

To become a participant in the SNGB mortgage program, a potential borrower needs to prepare the following documents:

- Civil passport (make copies of all pages);

- Application form (the form can be downloaded on the bank’s website or picked up at a branch);

- Certificate 2 – personal income tax or salary on the company’s letterhead. If the borrower receives a salary from the SNGB bank, then he does not need such a certificate;

- If a man takes out a loan, then he needs to provide a copy of his military ID or registration certificate.

The bank has the right to require other documents from the borrower: work book, history of the loan agreement, documents for collateral, etc.

Submitting an application to the SNSS

The application can be submitted in any convenient way:

- Through the bank branch at the place of registration.

- Through the bank's website. Having selected a mortgage program, you need to click on the “Submit an application” link. Check the approval boxes for processing personal information, create a form, indicating the address of the bank branch where the client wants to get a mortgage, the desired loan amount, loan term, debt repayment scheme, type of housing and other parameters. After entering detailed information on the questionnaire and submitting an application online, a bank employee will soon contact the potential borrower and notify him of the decision whether the bank will give a mortgage or not.

Look at the same topic: VTB: refinancing mortgages from other banks to individuals [y]

Application review period at Surgutneftegazbank

After receiving an electronic or paper application, the bank has 3–5 days to consider the borrower’s candidacy and make a decision on his application. Often, a bank delays processing an application due to the need to conduct additional checks. On average, a client needs to wait 7 working days for approval or refusal of a mortgage.

Package of mortgage documents

To apply for a mortgage, you must provide bank employees with a package of documents:

- Passport (copies of all pages will be required);

- Questionnaire - fill it out when visiting the bank;

- A document confirming the borrower’s income for the last six months, this can be a 2-NDFL certificate or a document filled out according to the bank’s form;

- If there are other loans, you must provide all information about them;

- A certified copy of the work record will confirm the borrower’s employment;

- Male borrowers under 27 years of age must provide military ID;

- It is necessary to provide a package of documents for the purchased property: certificate of ownership, cadastral passport, technical document, document on the basis of which ownership rights were obtained.

Application approved: what to do next?

If the client receives an approving decision on the application, then the further scheme of his actions will look like this:

- It is necessary to accurately determine the property.

- Agree with the home seller on a purchase and sale scheme through mortgage lending.

- Prepare documents for the property and submit the necessary papers to the bank.

- Conduct a home assessment by contacting the services of an appraisal company.

- Conclude a home insurance contract in case of damage or loss.

- Conclude a purchase and sale agreement with the seller.

- Sign the mortgage deal.

- Pay the down payment.

- Open a current account or safe deposit box for further transfer of money to the seller.

- Register ownership of the purchased apartment in Rosreestr.

- Transfer the remaining amount of money to the seller.

- Get the long-awaited apartment and start paying off the debt on it.

Insurance

Insurance of collateral is a mandatory requirement for any bank, including Surgutneftegazbank.

If desired, the client can take out here additional types of insurance against illness, accidents, and death.

To obtain additional insurance, you need to contact a bank branch and inform the employee of your desire to obtain the desired insurance product. The advantage of taking out health and life insurance is that the bank can reduce the interest rate; If an insured event occurs, the insurance company will fully reimburse all costs.

Pros and cons of mortgages in SSNB

Pros:

- Wide selection of mortgage offers;

- It is possible to take out a mortgage not only for residential, but also for non-residential real estate;

- Availability of bonuses and discounts subject to the bank’s conditions;

- It is possible to obtain a mortgage loan without a down payment;

- You can pay off your debt early without penalties;

- Convenient application system.

Minuses:

- Limited list of cities where you can get a mortgage;

- The bank provides surcharges on mortgage interest if the borrower fails to comply with a number of conditions.

Customer Reviews

People have different opinions about a bank's work in the mortgage lending industry. Here are some of them:

Elena, Tomsk: I tried to apply for a mortgage at one of the branches of the SNGB, but due to long queues and the slow work of the manager, I never got my turn. At home I decided to apply on the bank’s website. It took a lot of time to fill out all the fields, but I was pleasantly surprised when 2 days later they called me and told me the date when I could come to them. Over the phone, I discussed a suitable program with a bank employee.

Olga, Surgut: I am satisfied with the mortgage program for secondary housing. I refused health and life insurance, so the bank raised the interest rate. But the size of the down payment, the minimum package of documents for the transaction and the suitable form of payment - all this suited me. I plan to pay off my mortgage early. The good thing is that there are no penalties for early repayment.

Surgutneftegazbank concludes mortgage transactions only in a certain territory, so only those citizens who live in specific cities of Western Siberia and a number of other cities can receive a loan. The bank offers various programs for the purchase of a new apartment, housing on the secondary market, a house, land and even a parking space.

Surgutneftegaz mortgage insurance

Purchasing real estate using credit funds involves certain risks. The Surgutneftegaz Mortgage Insurance service allows you to protect yourself as much as possible from the undesirable consequences of concluding a transaction. A wide range of programs is available to applicants, taking into account the requirements of all Russian banks.

How to apply

When your home loan is approved, you can submit an application to Surgutneftegaz for mortgage insurance. Registration of such a product is a mandatory condition for lending funds. Some fields of the questionnaire can be left blank if, at the time of submitting the application, all the necessary data about the object of acquisition is not yet known. It is quite possible to provide the missing information later. After reviewing your application for mortgage insurance, Surgutneftegas will notify you of its decision as soon as possible.

It is advisable to use a free tool to calculate the total cost - a calculator. You will only need to indicate the most suitable insurance parameters, and the system will instantly perform all the calculations for you.

The big advantage is that there are several convenient ways to apply for the service:

- online;

- by calling;

- at the nearest branch of the organization.

Some features

How much you need to pay for the product is determined based on the amount of outstanding debt. This figure is decreasing gradually every year. The amount of the insurance premium depends on the coverage, as well as on the information contained in the client's documents. The insurance period must correspond to the loan term: you need to pay attention to this point.

To determine the total cost of the service, a convenient tool is provided on the official Internet resource of the “Surgutneftegas Mortgage Insurance” service - a calculator. By using it, you will find out how much it will cost to design the product.

How Banki.ru can help

Our portal provides all the information about the latest events in the financial sector. The appropriate section contains profitable offers from our regular partners. In addition, the latest economic news is regularly published here to keep you up to date. Now finding the most suitable way to protect against existing risks associated with purchasing real estate on credit will not be difficult.