Pros and cons of a mortgage at Levoberezhny Bank

This financial organization was founded in 1991, when the country's banking system was being established. During its existence, it has developed many programs under which you can get a loan on fairly favorable terms.

Now Levoberezhny Bank occupies a leading position in Siberia, having branches in all major cities of the region.

The products offered also include a housing loan, which any potential client can apply for.

Advantages of obtaining a mortgage from this financial institution:

- a large selection of lending programs with attractive conditions - both standard (military, with state support, for a young family) and specially designed for the bank;

- convenient service system;

- high percentage of application approval;

- absence of excessive requirements for the borrower;

- convenient solutions for clients (the ability to use maternity capital to pay off debt, apply for a loan without monthly payments, etc.);

- loan agreement without hidden fees and commissions;

- support for borrowers in difficult life situations (sale of collateral on a voluntary basis, restructuring of existing debt, etc.);

- various options for confirming income, among which the client can choose the most convenient for himself.

With so many advantages, the Levoberezhny Bank mortgage does not have any significant disadvantages.

The negative aspects include the standard disadvantages of a home loan:

- no mortgage without down payment;

- It is impossible to inflate the cost of the apartment.

Another disadvantage of the bank is that it operates only in the Siberian region, which makes it almost impossible for other Russians to apply.

Requirements for the borrower

The specific list of conditions that the client must meet depends on the type of lending. Standard Requirements:

- presence of Russian citizenship and permanent registration in the country;

- age over 21 years;

- a stable source of income, the size of which allows you to service the loan (documented);

- At least six months of experience at your last place of work.

Rural mortgage: how to apply online

Filling out an application for a mortgage loan is the first step to receiving money to purchase a new home or other real estate. The Rural Mortgage program, in essence, is no different from other proposals; here standard requirements are imposed on borrowers:

- Citizenship of the Russian Federation;

- Age 21-70 years;

- Stable income;

- Work experience of at least 12 years;

- Not a damaged credit history;

- Full package of documents.

A good plus is that Levoberezhny Bank does not have strict requirements for the presence of guarantors and co-borrowers.

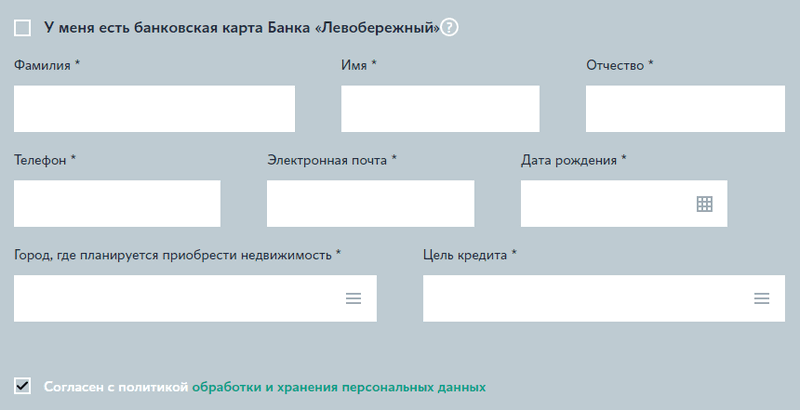

You will need to provide personal, contact and passport information, including full name, contact phone number (which in the future will be linked to the contract), email address, date of birth, city of residence and purpose of receiving money. The questionnaire is presented on the website in the section https://www.nskbl.ru/private/mortgage/order/.

All information provided in the application must be double-checked before submitting the application for review. If errors are detected, the bank will be forced to refuse to provide a loan.

Mortgage at Levoberezhny Bank: programs and conditions

A housing loan from a financial institution can be obtained both under standard programs and through special ones. The final terms depend on the client’s choice and the outcome of the application consideration.

Finished apartment

This type of real estate can be purchased through the following programs:

- Salary. Ready housing. Issued to salary clients of the bank for the purchase of living space on the secondary market. The minimum loan rate is 9.25% (if at least half of the cost of the property is paid, and apartment, life and disability insurance is taken out). Mandatory down payment – from 20% (for maternity capital managers the threshold is reduced to 10%). The loan term is up to 30 years.

- Stable, can be obtained to purchase housing on the secondary market or to improve living conditions. The minimum rate is 8.25%, the down payment is from 5% (for using maternity capital), the loan term is from 3 to 25 years.

- Universal-Invest – for the purchase of new housing on the secondary market without collateral of real estate. The loan rate is from 10.5%, the minimum down payment is 30% of the cost of the purchased apartment. The loan term is from 3 to 25 years.

Apartment in a building under construction

Such living space can be purchased through the following programs:

- Salary. Housing under construction, in which only salary clients of the bank can become participants. Interest rate from 8.75%, down payment from 20% (when using maternity capital - 10%), loan term - up to 30 years.

- Stable-Start for purchasing real estate in a house under construction. The minimum rate is 8.25%, the initial payment is at least 5% (if maternity capital is used), the loan term is from 3 to 25 years.

Apartments in a building under construction

For those who want to purchase apartments, the “Classic-Invest” program operates at a rate of 8.75% per annum. The down payment is at least 20%, the loan term is from 3 to 25 years.

Apartment in a finished house

For the purchase of this type of real estate, funds can be obtained under the “Classic” program with a rate of 9.25% (if at least half of the cost of housing is paid). Down payment from 10%, term - from 3 to 25 years.

Levoberezhny bank mortgage on a house with land

To purchase this type of housing, you can use the following programs:

- Stable.

- Universal-Invest.

Mortgage for a room or share

The conditions for purchasing a room or share in an apartment do not differ from the parameters for lending for an entire living space. Therefore, at Levoberezhny Bank you can obtain borrowed funds under the following programs:

- Salary. Ready housing;

- Stable;

- Universal-Invest, as well as for special types of mortgage lending.

The main condition is that real estate must be purchased on the secondary market.

Loan secured by real estate

At Levoberezhny Bank you can apply for a mortgage secured by existing real estate. This option is suitable for those who do not have the required amount for a down payment.

Conditions of this type of loan:

- rate from 12.5% per annum;

- loan term up to 30 years;

- loan size up to 10 million rubles.

For salary clients, it is possible to reduce the rate to 9.5%.

Mortgage calculator

Use a mortgage calculator and find out how much your monthly loan payment will be. Assess your financial capabilities by calculating the mortgage amount. Calculate your mortgage without a down payment in Novosibirsk. An online mortgage calculator will help you calculate loan terms in a few seconds. Indicate the value of the property, the amount of the down payment, the interest rate and the loan term. Leave an online application for a mortgage loan and find out what discounts our partner banks are ready to offer you.

- Finished apartments

- New buildings

- Houses, cottages and land plots

- Earth

| Program, bank | Bank rate(%) | Rate with Housing Fund(%) | Payment with bank (per month) | Payment with Housing Fund (per month) |

| Rural mortgage JSC Rosselkhozbank | 2.70 | 2.70 | 19 037 | 19 037 |

| Family mortgage PJSC ROSBANK | 3.20 | 3.20 | 19 498 | 19 498 |

| State program 2020 PJSC ROSBANK | 4.35 | 4.35 | 20 584 | 20 584 |

| Mortgage with state support for families with children JSC Rosselkhozbank | 4.60 | 4.60 | 20 825 | 20 825 |

| Mortgage with state support for families with children - refinancing of an existing loan from Rosselkhozbank JSC | 4.60 | 4.60 | 20 825 | 20 825 |

| Family Mortgage Bank St. Petersburg | 4.69 | 4.69 | 20 912 | 20 912 |

| Family mortgage PJSC Bank "FC Otkritie" | 4.70 | 4.70 | 20 922 | 20 922 |

| Family mortgage JSC "Bank DOM.RF" | 5.10 | 4.70 5.10 | 21 311 | 20 922 21 311 |

| Family mortgage Bank "RRB" (JSC) | 4.80 | 4.80 | 21 019 | 21 019 |

| Family mortgage Bank "Levoberezhny" (PJSC) | 4.90 | 4.90 | 21 116 | 21 116 |

| Family mortgage JSC Raiffeisenbank | 4.99 | 4.99 | 21 204 | 21 204 |

| Mortgage with state support for families with children PJSC Sberbank | 5.00 | 5.00 | 21 214 | 21 214 |

| Mortgage with state support for families with children VTB Bank (PJSC) | 5.00 | 5.00 | 21 214 | 21 214 |

| Family mortgage Gazprombank (JSC) | 5.00 | 5.00 | 21 214 | 21 214 |

| Mortgage for families with children, incl. refinancing of PJSC BANK URALSIB | 5.50 | 5.50 | 21 706 | 21 706 |

| Preferential mortgage for new buildings of JSC "Bank DOM.RF" | 6.30 | 5.90 6.30 | 22 507 | 22 104 22 507 |

| State support 2020 PJSC CB "UBRD" | 5.99 | 5.99 | 22 195 | 22 195 |

| State support 2020 VTB Bank (PJSC) | 6.10 | 6.10 | 22 305 | 22 305 |

| Refinancing of PJSC ROSBANK | 6.19 | 6.19 | 22 396 | 22 396 |

| State support 2020 PJSC Sberbank | 6.40 | 6.40 | 22 608 | 22 608 |

| Family mortgage VTB Bank VTB (PJSC) | 7.40 | 7.40 | 23 637 | 23 637 |

| Refinancing (no earlier than 6 months after the date of issue) VTB Bank (PJSC) | 7.40 | 7.40 | 23 637 | 23 637 |

| Military mortgage PJSC Promsvyazbank | 7.40 | 7.40 | 23 637 | 23 637 |

| Finished housing PJSC Bank "FC Otkritie" | 7.40 | 7.40 | 23 637 | 23 637 |

| Purchase of an apartment at the construction stage of JSC "Bank DOM.RF" | 8.20 | 7.40 8.20 | 24 478 | 23 637 24 478 |

| Mortgage with a full package of documents JSC Rosselkhozbank | 7.50 | 7.50 | 23 741 | 23 741 |

| Military mortgage JSC "Rosselkhozbank" | 7.50 | 7.50 | 23 741 | 23 741 |

| Military mortgage JSC "Bank DOM.RF" | 7.50 | 7.50 | 23 741 | 23 741 |

| Mortgage with a full package of documents Gazprombank (JSC) | 7.50 | 7.50 | 23 741 | 23 741 |

| NEW RESIDENTS Gazprombank (JSC) | 7.80 | 7.50 7.80 | 24 055 | 23 741 24 055 |

| Promotion Down payment from 10% PJSC JSCB "Metallinvestbank" | 7.60 | 7.60 | 23 845 | 23 845 |

| More meters - lower rate VTB Bank (PJSC) | 7.60 | 7.60 | 23 845 | 23 845 |

| Military mortgage PJSC Bank "FC Otkritie" | 7.60 | 7.60 | 23 845 | 23 845 |

| Refinancing of JSC "Bank DOM.RF" | 8.00 | 7.60 8.00 | 24 266 | 23 845 24 266 |

| Loan for the purchase of an apartment on the secondary real estate market of JSC UniCredit Bank | 7.70 | 7.70 | 23 950 | 23 950 |

| Apartment - secondary market, new building PJSC Bank Zenit | 7.79 | 7.79 | 24 045 | 24 045 |

| Refinancing of PJSC CB "UBRD" | 7.80 | 7.80 | 24 055 | 24 055 |

| Refinancing of PJSC Bank "FC Otkritie" | 7.80 | 7.80 | 24 055 | 24 055 |

| Refinancing of PJSC JSCB "Metallinvestbank" | 7.80 | 7.80 | 24 055 | 24 055 |

| Military mortgage PJSC Sberbank | 7.90 | 7.90 | 24 160 | 24 160 |

| Promotion for Developers of PJSC Sberbank | 7.90 | 7.90 | 24 160 | 24 160 |

| Mortgage refinancing Bank RRDB (JSC) | 7.90 | 7.90 | 24 160 | 24 160 |

| Special rate (Ministry of Internal Affairs, Post Office, Ministry of Emergency Situations, ALROSA, National Guard) VTB Bank (PJSC) | 7.90 | 7.90 | 24 160 | 24 160 |

| Mortgages for the military VTB Bank (PJSC) | 7.90 | 7.90 | 24 160 | 24 160 |

| Refinancing of PJSC Sberbank | 7.90 | 7.90 | 24 160 | 24 160 |

| Ready-made housing of PJSC CB "UBRD" | 7.95 | 7.95 | 24 213 | 24 213 |

| Refinancing of a mortgage loan from Raiffeisenbank JSC | 7.95 | 7.95 | 24 213 | 24 213 |

| Refinancing Bank St. Petersburg | 7.99 | 7.99 | 24 255 | 24 255 |

| Refinancing of PJSC JSCB Ak Bars | 7.99 | 7.99 | 24 255 | 24 255 |

| Refinancing of JSC "ALFA-BANK" | 7.99 | 7.99 | 24 255 | 24 255 |

| Megapolis PJSC JSCB Ak Bars | 7.99 | 7.99 | 24 255 | 24 255 |

| Military Mortgage Bank St. Petersburg | 8.00 | 8.00 | 24 266 | 24 266 |

| Finished housing Bank "RRB" (JSC) | 8.00 | 8.00 | 24 266 | 24 266 |

| Young family of Rosselkhozbank JSC | 8.00 | 8.00 | 24 266 | 24 266 |

| Finished housing JSC "Bank DOM.RF" | 8.80 | 8.00 8.80 | 25 120 | 24 266 25 120 |

| Finished housing/housing under construction VTB Bank (PJSC) | 8.10 | 8.10 | 24 372 | 24 372 |

| Military mortgage Gazprombank (JSC) | 8.10 | 8.10 | 24 372 | 24 372 |

| New buildings (apartments/apartments) PJSC "Sovcombank" | 8.15 | 8.15 | 24 425 | 24 425 |

| Purchase of real estate pledged by a third-party bank PJSC BANK URALSIB | 8.19 | 8.19 | 24 467 | 24 467 |

| Purchase of real estate on the primary market of Raiffeisenbank JSC | 8.19 | 8.19 | 24 467 | 24 467 |

| Secondary market of JSC Raiffeisenbank | 8.19 | 8.19 | 24 467 | 24 467 |

| Ready-made housing of PJSC BANK URALSIB | 8.19 | 8.19 | 24 467 | 24 467 |

| Primary market of PJSC BANK URALSIB | 8.19 | 8.19 | 24 467 | 24 467 |

| Refinancing Gazprombank (JSC) | 8.20 | 8.20 | 24 478 | 24 478 |

| Secondary market of PJSC Promsvyazbank | 8.20 | 8.20 | 24 478 | 24 478 |

| Purchase of real estate on the secondary market JSC "Bank Acceptance" | 8.20 | 8.20 | 24 478 | 24 478 |

| Family mortgage JSC "Bank Acceptance" | 8.20 | 8.20 | 24 478 | 24 478 |

| Refinancing Bank "Levoberezhny" (PJSC) | 8.20 | 8.20 | 24 478 | 24 478 |

| Classic Bank "Levoberezhny" (PJSC) | 8.20 | 8.20 | 24 478 | 24 478 |

| Purchase of real estate secured by an apartment owned by JSC Raiffeisenbank | 8.29 | 8.29 | 24 574 | 24 574 |

| Maternity capital in the initial contribution of JSC "ALFA-BANK" | 8.29 | 8.29 | 24 574 | 24 574 |

| Purchase of real estate objects pledged by another credit institution PJSC Sberbank | 8.30 | 8.30 | 24 584 | 24 584 |

| Apartments on the primary market of JSC "Bank Acceptance" | 8.30 | 8.30 | 24 584 | 24 584 |

| Purchase of finished housing PJSC Sberbank | 8.30 | 8.30 | 24 584 | 24 584 |

| Ready-made housing JSC "ALFA-BANK" | 8.39 | 8.39 | 24 680 | 24 680 |

| Refinancing of Bank Acceptance JSC | 8.40 | 8.40 | 24 691 | 24 691 |

| Refinancing of mortgage loans from third-party Banks, including pledge of rights (claims) of a participant in shared construction of PJSC Promsvyazbank | 8.40 | 8.40 | 24 691 | 24 691 |

| Pledge of another bank JSC "Bank DOM.RF" | 8.80 | 8.40 8.80 | 25 120 | 24 691 25 120 |

| Mortgage with maternity capital (finished housing) PJSC CB "UBRD" | 8.45 | 8.45 | 24 744 | 24 744 |

| Purchase of real estate objects that are pledged from another credit organization TKB BANK PJSC | 8.49 | 8.49 | 24 787 | 24 787 |

| Apartments on the primary/secondary market Bank St. Petersburg | 8.49 | 8.49 | 24 787 | 24 787 |

| Apartment Bank St. Petersburg | 8.49 | 8.49 | 24 787 | 24 787 |

| Primary market, secondary market TKB BANK PJSC | 8.49 | 8.49 | 24 787 | 24 787 |

| Secondary market of JSCB "Absolut Bank" (PJSC) | 9.00 | 8.50 9.00 | 25 336 | 24 798 25 336 |

| Mortgage according to the passport of PJSC Bank Zenit | 8.59 | 8.59 | 24 894 | 24 894 |

| Stable Bank "Levoberezhny" (PJSC) | 8.69 | 8.69 | 25 001 | 25 001 |

| Providing a loan for the purchase of real estate pledged by another bank JSCB Absolut Bank (PJSC) | 9.25 | 8.75 9.25 | 25 607 | 25 066 25 607 |

| Refinancing of JSCB Absolut Bank (PJSC) | 9.25 | 8.75 9.25 | 25 607 | 25 066 25 607 |

| Refinancing of PJSC BANK URALSIB | 8.79 | 8.79 | 25 109 | 25 109 |

| New buildings\Ready housing PJSC ROSBANK | 8.89 | 8.89 | 25 217 | 25 217 |

| Apartments PJSC ROSBANK | 8.89 | 8.89 | 25 217 | 25 217 |

| Refinancing TKB BANK PJSC | 8.99 | 8.99 | 25 325 | 25 325 |

| Refinancing of PJSC Bank Zenit | 8.99 | 8.99 | 25 325 | 25 325 |

| Secondary market of PJSC Sovcombank | 9.39 | 9.39 | 25 760 | 25 760 |

| Loan for the purchase of real estate in rubles with a fixed interest rate of PJSC ROSBANK | 9.39 | 9.39 | 25 760 | 25 760 |

| Individual Bank "Levoberezhny" (PJSC) | 9.75 | 9.75 | 26 155 | 26 155 |

| Easy start PJSC "BANK URALSIB" | 9.99 | 9.99 | 26 420 | 26 420 |

| Providing a loan for the purchase of real estate pledged by another bank VTB Bank (PJSC) | 10.20 | 10.20 | 26 653 | 26 653 |

| Universal (secured by real estate) Bank "Levoberezhny" (PJSC) | 11.75 | 11.75 | 28 406 | 28 406 |

| Alternative to PJSC Promsvyazbank | 12.50 | 12.50 | 29 276 | 29 276 |

Special mortgage programs of Levoberezhny Bank

In addition to the listed standard programs, the bank also operates special ones with favorable conditions for a specific category of borrowers.

Family mortgage

This type of loan is designed for large families. It has a reduced interest rate of 6%.

Important! It is set for 3 years if a second child was born in the family at the beginning of 2020 and for 5 years if a third child was born. After these periods, the rate is set in accordance with the key rate of the Central Bank on the date of conclusion of the agreement, increased by 2 points.

Under the program you can receive from 500 thousand to 3 million rubles for a period of 3 to 30 years.

Life and disability insurance, as well as the purchased apartment, is mandatory.

Military mortgage

Provided to military personnel who are on duty or have retired at a fixed rate of 9% (does not change for the entire period of debt payment).

You can get from 300 thousand to 2,410,000 rubles. Under this program, only a minimum loan term is established - 3 years. Insurance of the purchased living space is mandatory.

"Moving" program

Designed for those who change their place of residence and, accordingly, do not have a source of income for a certain time. With it you can get from 300 thousand rubles, the maximum threshold is no less than 60% of the market value of the living space.

Rate from 17.5%, term – 1 year.

A distinctive feature of the program is the absence of interim payments. The principal debt and interest on it are repaid at the end of the contract term.

This program is very convenient for those who do not have a down payment and are waiting for their existing apartment to be sold. In order not to wait, the bank offers to leave the apartment as collateral and buy a new one. When a client is found for the old apartment, with the permission of the bank, the apartment can be sold and the debt repaid. At the same time, you can pay nothing at all for a year.

Mortgage "Light"

Program from the bank without compulsory insurance. Using it you can get up to 450 thousand rubles at a rate of 16 to 19% per annum. The loan is available from 30 days to 15 years.

This mortgage from Levoberezhny Bank is used when cashing out maternity capital. If you have a maternity certificate and cash, then the bank can issue you a mortgage in the amount of the remaining maternity capital so that you can immediately purchase an apartment, and after 2 months the maternity capital comes in and the loan is closed automatically

Important! If maternity capital is used, it is necessary to promptly contact the Pension Fund so that the funds are credited to the bank account before the first write-off date. On average, the costs of such a transaction will be about thirty thousand rubles and they must be paid immediately.

Mortgage for a garage

You can get from 300 thousand to 1 million rubles for the purchase of a garage at a rate of 8.25%. The minimum rate is set upon payment of at least half of the cost of the property and connection (which must be paid in a lump sum of 2% on the day of signing the contract along with the down payment). All types of insurance (garage, life of the client and his ability to work) are mandatory. The maximum loan term is 10 years.

Mortgage "Perspective"

Under this program you can receive from 500 thousand to 10 million rubles at a rate of 9.67%. This indicator is revised every quarter, but despite its change, the amount of the monthly payment remains fixed.

The maximum loan term is 30 years.

Important! The rate on a loan issued under this program may decrease if inflation in the country decreases. This will shorten the debt repayment period and significantly reduce overpayments.

All mortgage programs of Bank Levoberezhny

Mortgages from Levoberezhny Bank are available on favorable terms. Depending on the selected program, the options may vary. Currently, the lender is ready to offer the following mortgage lending options for its borrowers:

- Classic mortgage program for the purchase of finished housing.

- A classic loan option for purchasing a house under construction.

- The classic type of loan is secured by the purchased real estate (resale).

- Mortgage programs for salary clients for housing under construction.

- Mortgage at Levoberezhny Bank for salary clients on finished property.

- A stable lending option to improve living conditions.

- “Stable” loan for the purchase of a property under construction.

- A universal loan for any client’s purposes.

- A universal mortgage option for purchasing a new home while retaining ownership of the existing property.

The type of loan product directly depends on the needs of the client. The bank has specially selected conditions depending on specific needs, which allows you to choose the most profitable program.

Important! Before deciding on a specific offer, it is recommended to make a small comparison with the calculation on a calculator, which will allow you to choose the best option.

Mortgage refinancing at Levoberezhny Bank

This bank offer has undoubted advantages:

- reduction in home loan rates;

- reduction of the monthly payment;

- obtaining comfortable service conditions.

The conditions for refinancing a mortgage at Levoberezhny Bank (Novosibirsk) are as follows:

- loan amount from 300 thousand rubles for clients who have an account with a financial institution, for other borrowers the minimum loan amount is 500 thousand rubles;

- interest rate from 9% (if you have personal insurance, a down payment of at least half of the cost of the property and proof of income in Form 2-NDFL);

- loan term from 3 to 30 years.

This service is available both to those who have obtained a mortgage in Levoberezhny and to borrowers from third-party banks. It is important that at least six months have passed since the conclusion of the loan agreement, and there should be no violations in the schedule for making monthly payments over the last 6 months.

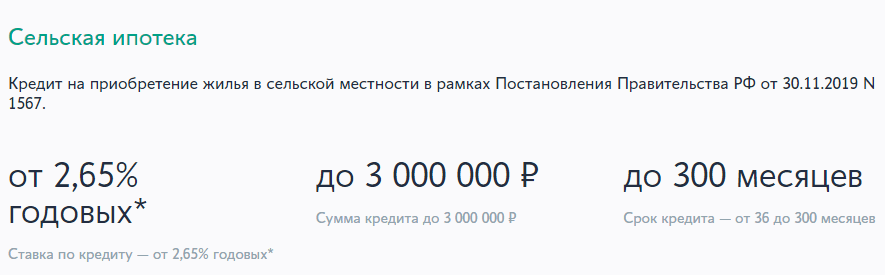

Conditions for rural mortgages at Levoberezhny Bank

Levoberezhny Bank, along with Sberbank, Rosselkhozbank and Center-Invest Bank, became a participant in this program. Currently, rural mortgages at Levoberezhny Bank are issued under the following conditions:

- The interest rate is 2.65 for “salary earners” of Levoberezhny Bank. For other categories of borrowers it is 3 percent per annum.

- The down payment is standard - 10 percent of the value of the property.

- The minimum mortgage amount is 300,000 rubles, and the maximum is 3 million. You can use maternity capital and other social benefits.

- Currency – Russian rubles.

- Term – 25 years.

- The payment is an annuity.

According to the terms of the Levoberezhny Bank, rural mortgage insurance is not mandatory, but in most cases employees will be urged to take it out. Refusal of insurance does not affect the interest rate.

Another feature of Levoberezhny is that you will need to pay a commission of 10,000 rubles for a letter of credit - this is a special account for rural mortgages, where funds from the bank will be transferred, and after registration they will be sent to the seller.

Interesting! Levoberezhny Bank accepts a certificate in the bank's form. Also, an interesting nuance is that an individual entrepreneur may not provide a declaration and all business documents, but will limit himself to a self-certified copy of the employment document and a certificate in the bank form. This simplifies the submission of documents and the speed of consideration of an application for a rural mortgage.

You can compare the conditions with Sberbank and Rosselkhozbank in the table:

Levoberezhny bank mortgage calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

To calculate the size of the monthly payment and find out the total amount of overpayment, you can use an online calculator. To obtain the necessary information, you must fill out all the fields and click on the “Calculate” button.

The result will be received within a few seconds. Using a mortgage calculator will allow you to objectively assess how profitable it is to obtain a loan from Levoberezhny Bank.

Levoberezhny Bank hotline

If you have any questions, the following hotline numbers are available:

- 8 — main number;

- 8 — calls for regions;

Calls to number 8 800 are free for subscribers registered in the Russian Federation. The service operates 24 hours a day.

You can also use your email address, and you can attach files and screenshots of documents to the message.

Video tips: how to get a mortgage

How to apply

An application for borrowed funds for the purchase of real estate can be submitted:

- at a bank branch;

- on the official website of Levoberezhny.

In the second case, the application will take a minimum of time. In the proposed application form you must indicate:

- Full name;

- date of birth;

- contact telephone number where a bank employee will call to inform about a preliminary decision on the application;

- the locality in which the living space will be purchased;

- purpose of obtaining a loan;

- the price of living space, the acquisition of which is planned;

- volume of own funds;

- monthly income amount;

- monthly payment on existing loans;

- passport data (series, number, when, by whom and where issued);

- a convenient time to talk with a bank employee.

After filling out all the fields, you need to send the application and wait for a call back. The bank's preliminary decision will be known by the end of the day. If it is positive, you need to collect a package of necessary documents and visit a branch of a financial institution to draw up an agreement.

Important! When submitting an application online, you can receive an additional discount of up to 1% from a partner of Levoberezhny Bank.

How to get a mortgage

The official website of the bank in the section https://www.nskbl.ru/private/mortgage/ provides complete information on tariffs and lending conditions. Here, every potential and current bank client can freely familiarize themselves with mortgage conditions and calculate the interest rate for a specific offer.

When visiting the bank in person, the application is submitted according to the following scheme:

- Contact a specialist in the credit department of Levoberezhny Bank. To do this, you can come in person to the bank’s office, having previously specified the operating hours and addresses of the nearest branches on the official website in the Offices and ATMs section. As an alternative, you can fill out an online application, call the bank's hotline, or request a call back at any convenient time.

- Having received preliminary approval, draw up a complete package of documents that are necessary for final approval of the application and signing of the loan agreement.

- Wait for the bank’s final decision regarding the issuance of a mortgage loan for the purchase of real estate.

- Come to the branch and bring a complete package of documents, which was compiled by the manager of Levoberezhny Bank.

- Sign the loan agreement.

- Register as the owner of the purchased housing.

A complete list of documents that may be required to conclude a contract and sign a mortgage agreement can be found on the bank’s official website in the Mortgage section.

It is recommended to prepare the entire documentation package in advance. On an individual basis, Levoberezhny may request additional information.

Documentation

The list of documents depends on the category of the borrower. Individuals must submit:

- application completed in person;

- personal passport (copy of all pages, including blank ones);

- SNILS;

- certificate of marriage/divorce;

- diploma of education (if available);

- work book (copies of all pages must be certified by the seal and signature of the manager, on the last page it is indicated that the borrower is currently working);

- employment contract for main place and part-time job;

- certificate in form 2-NDFL for the previous year and month of the current one;

- title documents for property (if available);

- documentary evidence of credit history.

Legal entities and individual entrepreneurs must submit:

- reports for the last two quarters;

- management report;

- OGRN;

- TIN;

- lease agreements or title documents for property;

- contracts with partners (for the supply of goods or provision of services);

- account statement for the last six months;

- certificate of absence of file cabinet No. 2 and loan debt from third-party financial organizations;

- a certificate of movements on the account for the last year (if it is opened in another bank);

- business photo.

In addition to the applicant’s documents, it is necessary to submit to the bank documents for the purchased property. The general list is as follows:

- title documents for living space;

- technical documents: cadastral and technical passports, explications, etc.);

- certificate of registered persons;

- certificate of absence of debt for utility bills;

- a report on the assessment of the purchased property, compiled by a specialist from an organization accredited by the bank.

If real estate is purchased from a legal entity, you must additionally submit:

- statutory documents;

- OGRN and INN;

- minutes of the general meeting or a certificate from the manager that the transaction is not a major one;

- documentary evidence of the representative's authority and his personal passport.

If living space is purchased from an individual, you also need to submit to the bank:

- personal passport;

- permission from the guardianship and trusteeship authorities, if the seller has not reached the age of majority;

- consent of the second spouse to the transaction, certified by a notary (if the property was acquired after the registration of the relationship).

Important! The Bank reserves the right to require additional documents if necessary.

List of documents for the borrower

Package of documents required when submitting an application to Levoberezhny:

- Questionnaire.

- Passport - all pages (copies).

- SNILS.

- Marriage certificate (copy).

- Diplomas, certificates of education (copies, if available).

- Work book (copy).

- Employment contracts (copies).

- Certificate 2-NDFL or according to the bank form.

- Available loan agreements (copies).

- Documents confirming the presence of any property.

For business owners and individual entrepreneurs, the list of documents is somewhat different. You will need to provide management and official reporting, a certificate of state registration, registration, lease agreements, agreements with suppliers and bank statements.

Mortgage servicing

Mortgage from Levoberezhny Bank means not only favorable conditions, but also comfortable customer service.

How to pay a loan

The received loan is repaid by depositing funds in a fixed amount into the account opened when the agreement was executed every month. The payment schedule is attached to the agreement.

You can deposit money in the following ways:

- through an ATM of a financial institution using a special “Express card” (receipt costs 500 rubles, the account is replenished free of charge);

- through the cash desk of a bank branch (you need to have your passport with you);

- by activating the service for automatic debiting of funds from an account opened in Levoberezhny;

- through a transfer from a third-party bank;

- through Euroset and Beeline salons;

- through the City system;

- via Russian Post.

Please note that the period for crediting funds depends on the payment method.

Early repayment of mortgage

The client can repay the debt early in full or in part at any time. This will reduce the loan term or the size of the monthly payment.

To withdraw additional funds, you must submit a corresponding application to the bank via the Internet or by visiting a branch.

It is important to note that without an application, the established amount will be debited from the account, even if additional funds are available.

If partial repayment has been made, you must contact the bank and obtain a new payment schedule. If the debt has been closed in full, it is advisable to obtain a confirmation certificate from Levoberezhny.

Mortgage programs for holders of salary cards of Bank Levoberezhny

There are two options for a financial product available here: for the purchase of a finished property, as well as for the purchase of a property under construction. For borrowers who receive their salary into an account at this financial institution, loans are available under the following conditions:

- A bank loan is provided for the purchase of finished or under construction housing;

- minimum interest rate depending on the program 9.75-10.25% per year;

- early repayment is available for borrowers at any stage without penalties;

- A down payment of 10% of the property value is required;

- borrowers can claim up to 10 million rubles;

- You can choose a comfortable monthly payment, since the loan term ranges from 1 year to 360 months.

From Levoberezhny Bank, a profitable mortgage is available for the purchase of housing from the secondary market, a finished property from the developer and new property that is just under construction by a company that is a partner of the lender.