A mortgage from Rosselkhozbank is actually a loan at affordable interest rates for the purchase of housing. Many Russians are faced with the need to purchase housing on the secondary or primary market. Not everyone has enough savings and has the opportunity to spend money on an apartment or house. Most have to look for additional sources of funding. One of the most affordable in 2020 is a mortgage. There is a myth that this is unprofitable because the client overpays a lot. But using the example of the Russian Agricultural Bank, we will tell you that this is not so.

Mortgage programs of Rosselkhozbank in 2020

RSHB offers its clients 16 different tariff plans for loans. Among them there are offers for apartments, houses, primary and secondary markets, with and without collateral, targeted, with government support, for maternity capital, and so on. Before choosing a specific position, read in detail the conditions for mortgages at Rosselkhozbank in 2020.

Conditions

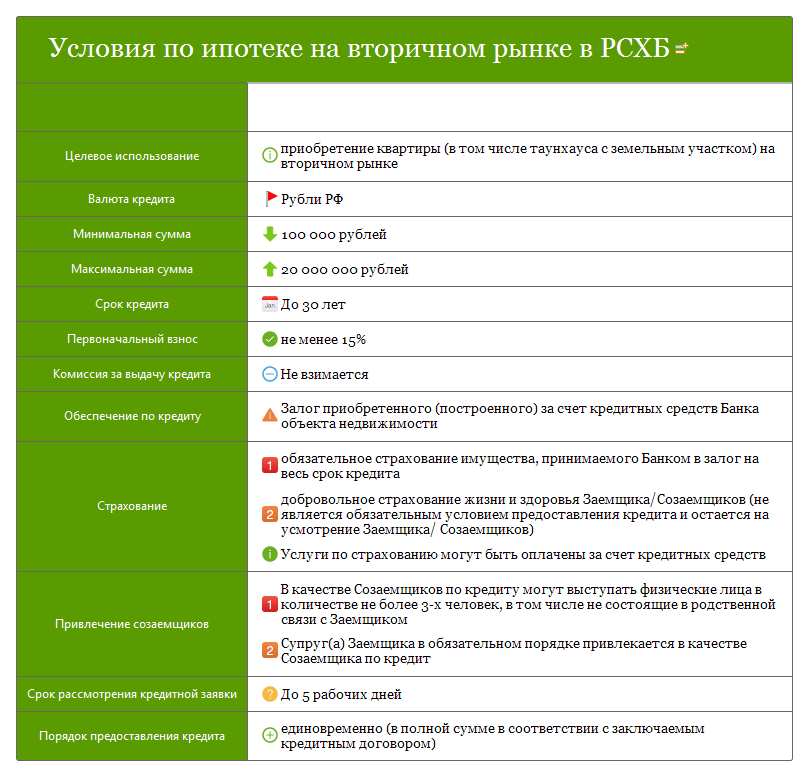

Rosselkhozbank puts forward the following conditions for issuing mortgages for secondary housing at the optimal interest rate:

- The mortgage is issued in rubles.

- The minimum amount is 100 thousand rubles.

- The maximum loan size is 20 million rubles.

- The loan period is no more than 30 years.

- The down payment is 15% of the loan amount.

- There is no commission fee for issuing loan funds.

- as collateral .

- It is possible to attract co-borrowers ; they can be no more than 3 people, incl. who are not related to the client or the husband or wife of the borrower, only if the housing is owned by two spouses.

- The application submitted by the borrower is reviewed by the bank within 5 days.

- A positively reviewed application is valid for 3 months.

- The loan amount is not divided into parts, it is issued in full at once.

- A contract of home insurance against destruction or complete loss must be concluded ; life and health insurance is taken out on a voluntary basis.

Article on the topic: Mortgage loan for the construction of a private residential building

Conditions for issuing a mortgage at Rosselkhozbank in 2020

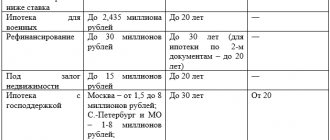

Below is a table with the main parameters of targeted real estate loans. The information is true, as it was taken from the official website of the credit company.

| Title/Description | Time frame (years) | % |

| Dreams come true is a special loyalty program that is aimed at purchasing housing in an apartment building or purchasing a townhouse. Condition: residential. Whether the property was previously in use is irrelevant. In rubles you get from one hundred thousand to 60 million rubles. The company splits this fairly large amount over a maximum of thirty years. In this case, the first payment is at least a fifth of the purchase price. | 30 | 8,2 |

| Mortgage “Rural” is a tariff plan, the purpose of which is to activate citizens to purchase residential premises under construction or in operation. The transaction is possible with individuals or legal entities, individual entrepreneurs. It is allowed to purchase both premises and a plot of land of any size attached to it. The peculiarity is that a targeted subvention is issued for purchases in rural areas. Funding amounts range from one hundred thousand to 3-5 million. At the same time, up to three million are received by those wishing to purchase a house/apartment in any region of Russia, except for the Kaliningrad region. If you decide to move there, the bank gives up to five million. | 25 | 2,7 |

| A dream home - everyone probably has one. Some people dream of panoramic windows and a view of the park, while others have long been planning a cozy house on the outskirts of the village. This is possible, because Rosselkhozbank gives from one hundred thousand to 20 million. The currency is rubles. At the same time, the down payment is relatively small - a tenth of the purchase price. | 30 | 9,3 |

| “Don’t overpay” is a tariff that is given not for the purchase of real estate directly, but for the repayment of previous loans on them. Target areas: apartment (I/II markets), residential building + land plot, townhouse (separately or with a plot), restructuring of existing debt. Min. size - 100 thousand. The maximum amount depends on the direction of funds. They give up to 20 million for loan repayment, from 10 to 20 million for apartments, and up to 10 million for houses. Ensuring payment is a pledge of the property you are purchasing. | 30 | 8 |

| “Special offers” is a tariff at a record low percentage for a shared apartment. That is, a construction contract is drawn up with the condition that for a share of the contribution you receive a certain number of square meters in the new building. In 2020, this type is popular, as more and more young people are looking for apartments on the primary market. The amount of financial assistance is from one hundred thousand to 60 million RUB. In this case, your down payment is at least 15% of the total amount. | 10 | 3,75 |

| Mortgage holidays are a mortgage aimed at purchasing an apartment (in a new building or a previously used building). A key feature is the deferment of the down payment for a year. This is beneficial because you won’t have to think about payments for a whole year. Record price - up to 60 million rubles. | 30 | 10 |

| “Home mortgage lending” - money for the purchase of a country house with or without a plot. To ensure your comfort, Rosselkhozbank provides up to 60 million rubles for 30 years without interest or hidden overpayments. The key is that these funds can be used to purchase a separate plot of land. The first payment depends on your purchase, and ranges from 15 to 30% of the transaction value. | 30 | 9 |

| Military mortgage refinancing is a special program that is responsible for restructuring old debts for the military. Among the features: changing the repayment period, changing the amount of contributions, the ability to reduce the overpayment ratio. The amount is no more than two million seven hundred thousand rubles. | 3 — 27 | 8,75 |

| The state RSHB provides mortgage refinancing to all categories of borrowers who submit the necessary documents. The advantage is the quick repayment of previous loans, regardless of which market the apartments were purchased in. The payment amount is from 100,000 to 20,000,000. | 30 | 10,15 |

| State support for families with children is an opportunity to buy their own nest at reduced rates. We focus on the fact that Rosselkhozbank is completely state-owned. This means that he is interested in providing loans to socially vulnerable segments of the population. Here, purchase and sale agreements are considered for the following objects: a share agreement with the developer, for residents of the Far East - the purchase of apartments/houses on the secondary market. | 30 | 4,7 |

| Young family and maternity capital - a tariff from the Russian Agricultural Bank, which is aimed at purchasing apartments for families with small children. Currently, Russia has a program for providing maternity capital. This money goes towards improving housing conditions, education or investing in retirement. Increasingly, young parents choose the first option and buy a house for their family. If such funds were used in another direction, then there is a special profitable mortgage for you. According to it, the bank gives up to 60,000,000 RUB. | 30 | 9 |

| A target mortgage is the purchase of an apartment secured by the real estate that you already own. Issued without commission. | 30 | 10,10 |

| Non-targeted loan secured by housing. Main advantages: long term and large amount (10 million for 10 years), compared to other offers, the interest rate is much lower, there are no commissions or hidden fees, it is possible to close debt obligations to the bank prematurely (without penalty), the client chooses the payment scheme himself repayment. | To 10 | 10,7 |

| A mortgage based on two documents is advantageous in that you do not have to confirm your income and type of employment. There is no specific goal - you can buy either an apartment in a new building or a residential house with a small garden and access to the river. | 25 | 10,3 |

| Military mortgage is money that is provided to military personnel according to the following requirements: a citizen of the Russian Federation with valid registration in any region, at the time of application - at least 22 years old, at the time of debt repayment - no more than 50 years. Participation in the savings-mortgage system - from three years. | Up to 27 | 8,75 |

| The state support program for large families is aimed at providing comfortable and spacious housing to all families with small children. This program is valid for those who had a 3rd or subsequent child between the beginning of 2020 and the end of 2022. This is state support - a subsidy in the amount of 450,000 rubles. | — |

Features of providing a mortgage for secondary housing

It is possible to become the owner of a mortgage for secondary housing in Rosselkhozbank with a low interest rate for the purpose of purchasing housing, namely an apartment, a residential building or a plot of land.

To start applying for a loan, you must first pay the commission set by the bank, and only after that insure the property you are purchasing.

Simultaneously with the registration of the mortgage, a purchase and sale agreement must be signed. The seller of the home will only receive an advance payment from the buyer before registering the transaction with Rosreestr. The remaining amount will be paid after 5 days from the bank’s receipt of the encumbrance document.

Documentation

To receive any type of loan, you will have to submit the following package to Rosselkhozbank:

- petition (drawn up according to a template at a bank branch);

- document confirming the identity of a Russian citizen;

- military ID for men under 27 years of age;

- certificate of family composition;

- certificate from place of work;

- statement of income.

Requirements

RSHB puts forward the same requirements for each borrower:

- age - from 21 to 65 years;

- Russian citizen;

- valid registration in the state;

- work experience of at least one year over the last five years (at least 6 months in the last place of work);

- for people who receive a salary on a Rosselkhozbank card, the length of service requirements is 6 months over the last 5 years (minimum 91 days at the end).

How to get a mortgage at Rosselkhozbank?

There are currently two options for submitting an application - through the website and in person at a bank branch.

Online application

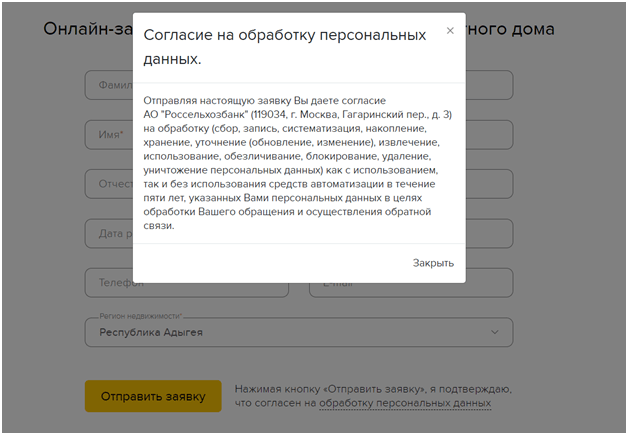

The online application is not grounds for issuing a mortgage. After filling it out, a manager will contact you and invite you to the nearest branch.

Information you fill out on the web portal:

- surname;

- Name;

- surname;

- Date of Birth;

- telephone;

- email address;

- region in which you want to build property.

Fill out these fields manually and click “Submit Application”.

Registration at the bank

Having arrived at the bank with all the documents, you can open an account and issue funds within a short amount of time. If you are not a bank client, you will have to open a plastic card. The procedure for clients is as follows:

- submit an application + package of documents;

- expect 5 working days - the period for reviewing your documents and credit history;

- If the response is positive, the funds are credited to the account within 45 calendar days.

Mortgage loan calculation

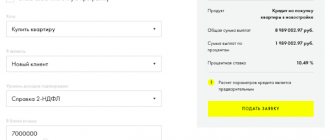

There is no calculator on the RSHB website to help calculate the parameters of soft loans. Therefore, third-party services are used for calculations, which help to find out the following data:

- the amount of overpayment for the entire loan term;

- amount of monthly payments;

- the amount of income needed to pay off the debt.

Mortgage calculator provided by calcus.ru

In the appropriate lines of the program enter:

- interest rate;

- the cost of the purchased apartment;

- loan terms;

- repayment method (differentiated or annuity payments);

- date of registration of the mortgage;

- down payment amount.

The values obtained are not exact; a clear schedule can be requested from the bank.

Advantages and disadvantages

There are pros and cons to any loan program. Some parameters are controversial, as they depend solely on the individual needs of the borrower.

pros

The positive aspects include the fact that real estate can be purchased through real estate agencies, realtors and in cottage villages. Other advantages include:

- clear contract;

- no hidden fees;

- flexible payment system;

- the client chooses the repayment format;

- possibility of early payment without penalty;

- it is possible to calculate payments using an online calculator;

- restructuring of debts on earlier loans.