Residents of a number of Russian cities, including Moscow, St. Petersburg and cities with a population of over a million, have access to a good alternative to the largest domestic banks - Transcapitalbank (TCB). Almost 30 years of continuous and reliable work in the financial sector give the bank the opportunity to quickly and accurately respond to the needs of the population, including developing profitable, competitive housing loans. Mortgage in Transcapitalbank (TCB) today is a combination of modern services with low rates and loyal conditions.

Mortgage lending at Transcapitalbank

The completely private Transcapitalbank offers several mortgage loans from which any borrower can choose the appropriate option. With a mortgage from Transcapitalbank you can buy:

- finished or under construction housing;

- country houses, apartments, townhouses;

- commercial real estate for business.

TKB participates in state support programs for the population, so among its loans there is a mortgage with state support in 2020 and a special offer for family borrowers.

One of the significant advantages of Transcapitalbank is that you can even buy an apartment with an unformed redevelopment with a mortgage, if the load-bearing structures are not affected. As a rule, banks do not undertake to lend for such purchases, but TKB will approve the loan.

Interest rates on mortgage loans at TKB

Transcapitalbank has a wide range of interest rates. We have collected the minimum ones in the table below.

| Program | Mortgage interest rate |

| State support 2020 | 4,84% |

| Mortgage in sliders - for those with replenishment | 5,9% |

| Standard mortgage for primary and secondary | 7,49% |

| Purchasing housing from partner developers | 7,4% |

| Refinancing a mortgage from another bank | 7,49% |

| Commercial real estate with mortgage | 13,49% |

Mortgage TKB

Choosing a mortgage program

Make a request

When issuing a loan, Transcapital offers to make a one-time payment of 4.5 to 4.99% of the loan amount to reduce the rate by 1.5%. The minimum rate is only possible if this payment is made.

What determines the mortgage interest rate?

The final mortgage rate will depend on many factors:

- down payment (from 30% and above the rate is reduced);

- for individual entrepreneurs and business owners the rate is higher;

- when confirming income with a bank certificate or without confirming income, the rate is higher;

- public sector employees and civil servants have lower rates;

- the bank takes into account the liquidity of the property and the availability of insurance;

- The borrower's income and its ratio to expenses are also taken into account in the calculations.

The size of the loan, as a rule, does not affect the rate.

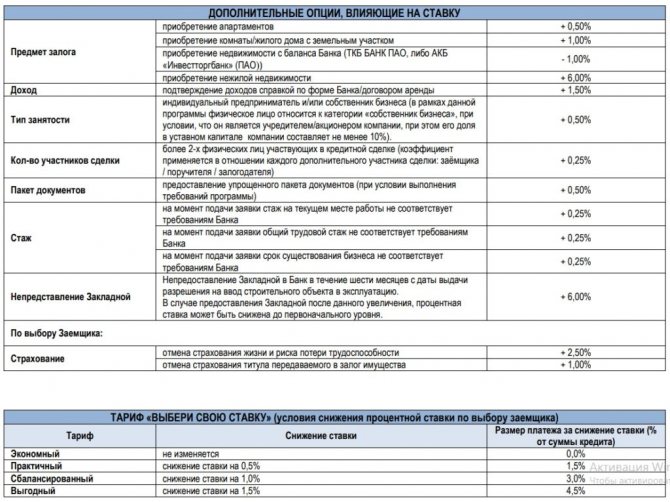

Discounts and allowances

Transcapitalbank has developed a flexible system of discounts and premiums, which are used to calculate the final mortgage rate.

Allowances:

- +1% when buying a room or private house with land;

- +0.25% for each borrower or guarantor, if there are more than two;

- +2.5% if you refuse personal insurance;

- +1% if title insurance is waived;

- +6% in loan agreements for housing under construction, if you do not submit a mortgage to the bank within six months from the date of putting the property into operation.

Interest rate discounts:

- -0.25% when joining a collective insurance contract;

- -1% when buying a home from your bank balance.

When calculating a mortgage, you need to take into account a one-time payment of 4.5 to 4.99% of the loan amount, which allows you to reduce the rate by 1.5%.

Transcapitalbank mortgage interest rates in 2020

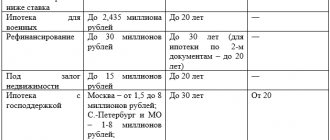

Transcapitalbank offers a variety of mortgage products, the interest rate is set depending on the specific conditions of each of them. The table below shows the minimum bet values.

| Type of mortgage loan | Minimum interest rate | |

| Mortgage in sliders | 6% | |

| Mortgage for new and secondary housing | 7,7% | |

| Refinancing | 8,4% | |

| Mortgage without borders secured by real estate | non-residential | 21% |

| residential | 18% | |

| Commercial mortgage | 14,4% | |

| Mortgage without down payment | 7% | |

| Loan for any purpose secured by residential real estate | 10% | |

Most often, the lowest interest rate is provided to the borrower subject to certain conditions, for example, making a significant down payment or connecting additional paid options.

Surcharges and additional interest options

The bank offers to connect to the “Favorable” tariff in order to reduce interest on a mortgage loan. The condition for applying the minimum rate is the payment of a one-time contribution, the amount of which is established specifically for each mortgage program.

Mortgage under two documents in Transcapitalbank without proof of income

Transcapitalbank approves a mortgage without proof of income (according to two documents) under any program, except for a family mortgage with state support, but subject to an increased down payment and interest rate.

| Program | Interest rate | Down payment |

| State support 2020 | 6,49% | From 30% |

| Standard mortgage for primary and secondary | 8,99% | From 30% |

| Purchasing housing from partner developers | 9,4% | Up to 90% |

| Refinancing a mortgage from another bank | 10,74% | From 30% |

Current programs

Transcapitalbank has many mortgage offers that will suit everyone. You can choose a banking product in accordance with your capabilities and goals. Favorable conditions and low interest rates are the main distinguishing features of Transcapitalbank.

"Mortgage without stress"

This program from Transcapitalbank is designed for those who are not used to being heavily burdened with problems. The loan is issued in one day. All you need to bring is your passport, INN and SNILS.

Conditions:

- Mortgage for up to 25 years;

- Loan up to 20,000,000 rubles;

- Interest rate from 9% per annum.

As part of the program, the bank offers special conditions to certain categories of clients:

- Owners of salary cards;

- Military personnel.

They are provided with benefits and more favorable conditions. Such borrowers can receive a loan immediately in cash from the bank, without resorting to transfer to an account. It is enough for the client to inform about this when filling out the application in order to include this clause in the contract.

Conditions for military personnel from Transcapitalbank:

- Loan term up to 7 years;

- Loan amount from 100,000 to 3,000,000 rubles;

- Possibility of making loan funds in the form of a down payment;

- The only documents you will need are a passport of a citizen of the Russian Federation.

Mortgage 0-7-7

This type of lending is specifically for those who want to buy real estate in:

- The village of Gorki, Moscow region;

- Residential complex "Uspensky Kvartal";

- The city of Korolev (Moscow region);

- Microdistrict "Textilshchikov";

- On Tarasovskaya street (Moscow).

The loan is issued in amounts from 200,000 rubles to 1 million. Entry fee from 10%. For the first seven years, the bank offers an interest rate of 7% per annum. The maximum payment period is 25 years.

Mortgage 10-10-10

This program involves the purchase of secondary or primary residential property. The disadvantages include a limited range of addresses where it is allowed to purchase real estate. The full list can be viewed on the Transcapitalbank website.

For the first 10 years, borrowers have an interest rate of 10% per year. It is allowed to extend the payment period to 25-30 years.

Mortgage 8% for 8 years

The name of the program speaks for itself. By applying for this type of mortgage lending at TKB, you receive a reduced interest rate (8%) for 8 years. After the end of the term, you can extend the loan, but with different interest rates.

Conditions:

- The borrower's age is over 21 years;

- Having a positive credit history;

- No late payments on previous payments;

- Citizenship of the Russian Federation.

When extending payments, the interest rate increases, the level depends on the newly selected program.

Commercial mortgage

This program provides for the acquisition of non-residential property. This could be office space, warehouses, private rooms.

Look at the same topic: Refinancing mortgages from other banks at Tinkoff Bank - review of the service

The loan is issued for a period of up to 10 years. The lowest rate under the “Profitable” tariff plan is equal to 16% per year. The highest percentage is 19.5% per annum. An important condition is to pay the entry fee.

Loan secured by residential real estate

This type of lending is called targeted. It is drawn up in order to carry out repairs and improve the purchased home, which will become the subject of collateral for this loan. Transcapitalbank allows the purchase of one more residential premises.

When planning repairs, the interest rate will be from 15% to 21% per annum. Entry fee – from 10% of the total amount. Loan amount – from 500,000 rubles to 12,000,000 rubles.

Participation in the state support program

Officially, Transcapitalbank is among the top banks that took an active part in the acquisition of real estate with the help of subsidized rates by the state. The initial fee was set at 12% per year.

The rate can be reduced to 10.5% if the borrower pays a lump sum of 4.9% of the entire loan amount. Mortgage lending with state support from TKB allows you to obtain an amount from 500,000 rubles to 8,000,000 rubles.

Mortgage according to two documents from Transcapitalbank

Salary clients can apply for a mortgage with only two documents:

- Russian Federation passport;

- SNILS.

The borrower is required to:

- Work period in one place for at least 3 months;

- Total work experience of 1 year;

- It is prohibited to register an individual entrepreneur or own a business;

- The bank will consider only the money received on the card as income.

Requirements for borrowers

General requirements of Transcapitalbank for mortgage borrowers:

- registration on the territory of Russia;

- age from 20 to 75 years (75 years at the time of repayment of the mortgage);

- total work experience of 1 year, in the last place from 3 months;

- for individual entrepreneurs and businesses - the period of existence is at least 12 months (the tax regime does not matter).

There are no mandatory citizenship requirements or minimum income requirements.

The spouse of the main borrower is considered a co-borrower under the agreement. Common-law spouses (cohabitants) can purchase real estate as shared ownership.

Documents when applying for a mortgage loan

LIST OF DOCUMENTS TO BE SUBMITTED TO THE BANK

- Application form

- Passport of a citizen of the Russian Federation, or passport of a citizen of a foreign state (provided by all participants in the transaction and persons obtaining consent to provide a loan)

- Certificate of income in form No. 2-NDFL, or a certificate in the form of the Bank, certified by the employing organization for at least the last 3 months, or a certificate from the Pension Fund/pension account

- A copy of the work record certified by the employing organization. In the absence of a work book: - employees of the Ministry of Defense, Ministry of Internal Affairs, FSB, FSO and other structures provide a certified copy of the contract by the relevant department / Certificate confirming completion of service

- - in the case of work under civil law contracts - a copy of the contract certified by the employer

- - in case of work in a representative office of a foreign company under a contract - a copy of the contract certified by the representative office

- — for pensioners – a certificate from the Pension Fund/pension certificate

- Clauses 3 and 4 do not apply to the Co-borrower/Guarantor, whose income is not taken into account in calculating the limit.

- State certificate for maternity (family) capital

- A document (certificate, notification, etc.) from the territorial body of the Pension Fund of the Russian Federation on the balance of maternity capital must be provided at the stage of submitting documents for loan approval

- Passport of a citizen of the Russian Federation, or passport of a citizen of a foreign state

- Application form

- Articles of association

- Balance sheet and income statement (for the last reporting period)/tax return for the last reporting period (in case of applying the simplified tax system). Confirmation of tax payment and reporting to the Federal Tax Service

- Certificate in form 2-NDFL/3-NDFL, or minutes (extracts from it) of the constituent meeting of the Company/Shareholders on the distribution of profits, confirming the receipt of dividends, with the obligatory provision of an account statement certified by the bank

- Passport of a citizen of the Russian Federation, or passport of a citizen of a foreign state

- Application form

- Individual entrepreneur registration certificate/USRIP entry sheet

- Certificate of TIN assignment

- Tax return (with confirmation of payment of taxes and submission of reports to the Federal Tax Service) for the 2 previous reporting periods (for quarterly reporting)/for the past year (for annual reporting)

- Lawyer ID (for lawyers only)

- Licenses (for notaries)

- Submitting an application for an amount of up to 12,000,000 rubles for Moscow and St. Petersburg, or up to 5,000,000 rubles for other regions of the Bank’s presence

- Making a down payment (for apartments, apartments) in the amount of at least 30% of the cost of the purchased property

- Not applicable for individual entrepreneurs and business owners

- Application form with mandatory provision of the employer’s TIN

- Passport of a citizen of the Russian Federation, or passport of a citizen of a foreign state (provided by all adult participants in the transaction)

The bank has the right to request additional documents.

Mortgage insurance at Transcapitalbank

Transcapitalbank, in addition to mandatory insurance of the structure (collateral), asks to insure the life/health of the borrower and the title (ownership) of the property. At the same time, title insurance affects rates for all programs, even for lending to new buildings, except for mortgages with state support in 2020.

If you refuse insurance, the rate will change:

- +2.5% if you refuse personal insurance;

- +1% upon cancellation of the title protection policy.

To save on interest rates, you can take advantage of a special offer from Transcapitalbank and join a collective insurance agreement. This will reduce the rate by 0.15-0.25%.

Collective insurance, unlike personal insurance, is carried out through a bank and is issued not for a specific borrower, but for a group of persons. The bank receives a commission for such insurance, so it is profitable for it to enter into such contracts. There will be no fundamental difference for the borrower.

Mortgage insurance will cost approximately 0.8-1% of the insured amount per year. The insured amount is formed from the balance of the loan outstanding + 10%.

Read in detail:

Mortgage insurance.

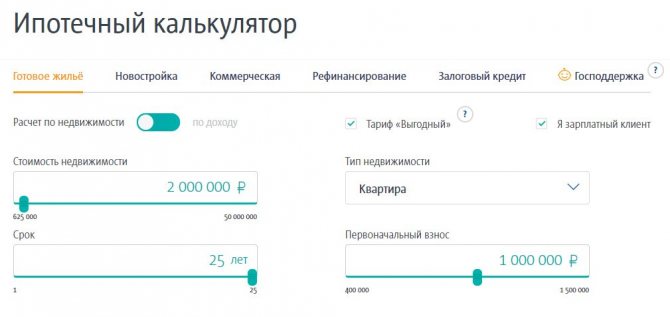

How to calculate a mortgage loan

On the official website of Transcapitalbank there is a special visual tool - a mortgage calculator. A potential borrower can always go to the resource, use the counter, which will help make a preliminary analysis and compare the client’s desires and capabilities.

Look at the same topic: Housing Mortgage Lending Agency (AHML) - what is it and how can it help?

The final data is provided to the borrower in a simple form that is understandable to the average person. It is clearly written there:

- How much money can a bank allocate for a mortgage? Your personal data is taken into account: salary, work experience, length of service.

- The main parameters are entered. The desired amount, loan term, amount of the down payment, interest rate, amount of the final overpayment for the entire time.

Transcapitalbank's mortgage calculator allows you to:

- Save time;

- Schedule a payment schedule in advance;

- Make adjustments to your plans.

Mortgage conditions in TKB

Below we will look separately at each mortgage program at Transcapitalbank. They are mainly aimed at residents of Moscow; in the regions it is better to clarify the conditions.

4.84% - the lowest rate in TKB

A mortgage loan with state support under the new rules of 2020 allows you to reduce the interest rate to an extreme 4.84%.

The base rate on this mortgage is 6.49%, you can reduce it to the minimum by making a one-time contribution of 4.99% of the loan amount (minus 1.5% to the rate), and by joining comprehensive insurance (another minus 0.15 % to the rate).

- You can only buy housing in a new building – ready-made or under construction. It will not be possible to purchase a secondary property, make repairs or build your own house on a plot of land with this loan.

- The down payment is 20%, and if the borrower provides only 2 documents, then 30%. For individual entrepreneurs and business owners – from 40%.

- Title insurance is not required. If you refuse personal insurance, +1% to the rate.

- The loan term is up to 25 years.

- Minimum amount – 500 tr. for regions, 1 million rubles. for Moscow, Moscow Region, St. Petersburg and Leningrad Region.

- The maximum amount is 6 million rubles. for regions and 12 million rubles. for Moscow, Moscow Region, St. Petersburg and Leningrad Region.

full terms of mortgage lending with state support at Transcapitalbank.

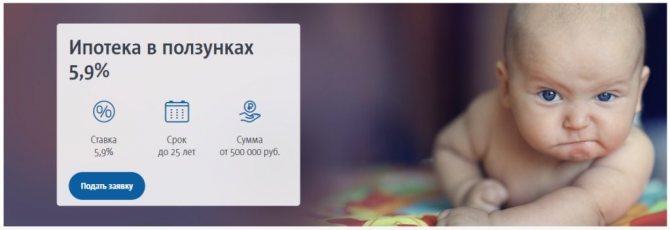

Mortgage for families from 5.9%

A mortgage loan with state support can be taken out by borrowers who had a second or subsequent child between January 1, 2020 and December 31, 2022. The “Mortgage in sliders” loan from TKB is available to both individuals and individual entrepreneurs / business owners. You can only buy a primary residence, a residential building or a townhouse.

Under this program, you can refinance a previously issued loan, as well as refinance a previously refinanced mortgage.

Basic conditions of Transcapitalbank:

- rate 5.9%, preferential 5% for residents of the Far Eastern Federal District;

- when refinancing until the collateral is re-registered in favor of Transcapitalbank, the rate is calculated as the key rate of the Central Bank of the Russian Federation + 4%;

- amount from 500 thousand rubles. up to 12 million rubles;

- term from 3 to 25 years;

- down payment from 20%.

Children must have Russian citizenship. This requirement does not apply to parents.

family mortgage at Transcapitalbank.

Submit an application to TKB

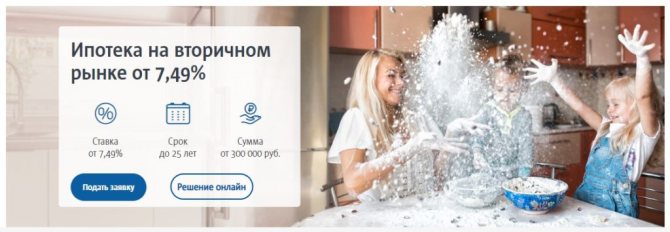

Buy a home with a mortgage from Transcapitalbank from 7.49%

A standard mortgage program at Transcapitalbank, which is approved for those who do not qualify for preferential mortgage terms with state support. Available for the purchase of housing on the primary and secondary market, apartments, residential buildings and townhouses, as well as commercial real estate.

You can also buy a share in an apartment, but the entire apartment will be used as collateral.

Basic conditions for a down payment from 20 to 29.99% of the property price:

- base rate 8.79%;

- business owners are approved at a rate of 9.29%;

- when confirming income with a bank certificate, the rate is 9.54%;

- without proof of income, the rate is 8.99% (down payment from 30%);

- public sector employees, civil servants and employees of enterprises with more than 500 people are approved at a rate of 8.29%.

A contribution of 30% and above gives a discount to the rate of 0.3%. Mortgage amount from 300 thousand rubles. up to 50 million rubles, for a period of up to 25 years.

Detailed mortgage terms at Transcapitalbank.

Submit an application to TKB

7.4% - offer from special developers

From 1 to 20 million rubles can be obtained through a TKB partner mortgage for the purchase of housing at a number of addresses. The apartment can be primary or secondary - it will not affect the rate.

Property addresses:

Rates vary by borrower:

- minimum 7.4% – for public sector employees and civil servants;

- standard for individuals – 7.9%;

- for individual entrepreneurs and business owners – 8.4%;

- mortgage without proof of income – 8.4% (down payment from 30%);

- if the income is confirmed by a bank certificate, the rate will be 9.4%.

This is the only program at Transcapitalbank for which an initial payment is not required.

Mortgage term up to 25 years. You can download detailed terms and conditions for special mortgages here.

Go to checkout

Refinancing from 7.49%

Transcapitalbank is ready to refinance clients of other banks; this is not possible for its own clients. The refinancing period is up to 25 years, the maximum amount (Moscow) is up to 15 million rubles.

A more profitable alternative to this program is refinancing a family mortgage at Transcapitalbank, available only to those borrowers who have had a second and subsequent child.

Refinancing rates vary:

| Base rate | From 9.49% |

| Individual entrepreneurs and business owners | From 10.49% |

| Confirmation of income according to the bank form | From 10.74% |

| According to two documents | From 10.49% |

State employees and civil servants are given a 0.5% discount, and employees of companies with more than 500 people are given a 0.25% discount. The most favorable rate of 7.49% is available to government employees who will make a one-time payment when issuing a loan of 4.5% of its amount, thus reducing the rate by another 1.5%.

You can download detailed terms and conditions here.

Apply for refinancing at TKB

Transcapitalbank for merchants – mortgage for business from 13.49%

Individual entrepreneurs and business owners at Transcapitalbank can finance the purchase of real estate for the purposes of their enterprise. Mortgages under this program are also issued to ordinary individuals, but the rate on it is significantly higher than on all other loan products.

Basic conditions:

- interest rate from 13.49%;

- mortgage up to 10 years;

- amount up to 6 million rubles;

- You can buy non-residential real estate and even land plots.

Transcapitalbank allows the use of maternity capital in this mortgage, but the possibility needs to be clarified with the Pension Fund, because funds under the certificate can only be spent on improving housing conditions.

You can reduce the rate to 1.5% by depositing up to 4.5% of the loan amount at a time.

on commercial mortgages (PDF file).

Submit an application to TKB

Transcapitalbank mortgage programs: conditions

The mortgage line is represented by various offers for all categories of clients. Mortgage funds can be used to purchase real estate in the residential and commercial sector, in new buildings and on the secondary market. In addition, the bank issues loans for personal purposes secured by existing housing.

Secondary

Individuals and individual entrepreneurs can apply for a loan for the purchase of secondary real estate. A loan from 300,000 rubles is issued for a period of up to 25 years. Families with two or more children can contribute maternity capital funds as a down payment, the minimum amount of which is 5%. You can repay the debt at any time without collecting additional payments. When you subscribe to the “Favorable” or “Balanced” paid tariffs, the mortgage rate is significantly reduced.

New building

The program allows you to buy new finished housing with a mortgage. The maximum debt repayment period is also 25 years, the range of amounts is from 300,000 to 12,000,000 rubles.

Mortgage refinancing

Mortgage borrowers from third-party banks can take advantage of the TransCapitalBank refinancing program. Conditions and requirements depend on the category of the client and the property. The refinancing currency is Russian rubles, but a foreign currency loan can be converted at the Transcapitalbank exchange rate current on the date of registration of the refinanced loan.

Under this program, TransCapitalBank does not refinance its loans. The loan size cannot exceed half the value of the collateral. The minimum validity period of the loan agreement that is intended to be refinanced must be at least six months as of the date of application.

The borrower can choose a form of refinancing - reducing the amount or reducing the payment period. The program also applies to mortgages issued against existing housing.

Important! All owners of collateral real estate are required to participate in the transaction. The exception is for spouses who have a certified marriage contract indicating the shared ownership of the property as collateral.

The bank considers each object that potentially serves as collateral individually and, if it does not meet the requirements, may give a negative answer.

When applying for mortgage refinancing, you must take into account the possibility of additional costs to pay for the following procedures:

- Obtaining the consent of your spouse, certified by a notary office.

- Carrying out a valuation of the property being purchased with a mortgage or pledged as collateral.

- Payment of the state fee for re-registration of the pledge at the registration chamber.

- Purchasing an insurance policy.

- Preparation of supporting certificates.

Important! When submitting an application for refinancing, you must take into account that the term for processing a mortgage with Transcapitalbank can be up to two months. Throughout the unsecured period, the mortgage interest rate will remain increased in order to cover possible risks.

Family mortgage

Housing family lending at Transcapitalbank is represented by the “Mortgage in Sliders” program. It allows you to purchase a primary home, as well as refinance an existing mortgage loan. The main requirement for issuing a family mortgage is the birth of the 2nd and subsequent child during the program from 2020 to 2022.

If a second child is born in the family during this period, the 6 percent rate on the mortgage loan will be valid for three years, the third, the fourth, etc. - five years, at the birth of 2 children, starting from the second - eight years.

Secured loan

At Transcapitalbank you can get a revolving loan secured by real estate you own. The client can use the loan funds for personal purposes multiple times. In the first five years, the money can be withdrawn, paid off and used again, all while paying only interest. The remaining debt can be repaid over a period of up to fifteen years in equal monthly payments.

Another option for a loan secured by real estate from Transcapitalbank is a program that allows you to use borrowed funds for repairs, reconstruction of your own home and for the purchase of additional living space. An advantage of this program is the ability to report unofficial income information.

Commercial real estate

Individual entrepreneurs and business owners can purchase commercial real estate with a mortgage, for example, non-residential premises or land. You can also receive money for consumer purposes by pledging commercial real estate owned by the borrower. The maximum loan term is ten years. The loan size must be at least 300,000 rubles and no more than half the estimated value of the collateral. You can repay the debt ahead of schedule at any time during the term of the loan agreement.

Mortgage under two documents

Almost all mortgage programs of Transcapitalbank can be issued using 2 documents: a passport and a borrower’s application form. The main condition is to make a down payment of at least 30% of the estimated value of the property selected for purchase. This is how the borrower confirms his solvency to the bank without additional certificates. The package of real estate documents remains standard.

The use of this program is beneficial for borrowers with high incomes or those who have the necessary funds, but are unable to confirm their income with official certificates.

Required documents

The manager of Transcapitalbank (TCB) will need:

- borrower application form;

- passport;

- a certificate in form 2-NDFL or in a bank form on income for the last year;

- a copy of the work record book (certified by the employer) or other employment document (for example, a copy of the contract for employees of law enforcement agencies);

- certificate of the balance of maternity capital, if used.

Business owners submit tax returns and financial statements. Pensioners - a certificate from the Pension Fund on the amount of payments.

You can submit a minimum package of documents to Transcapitalbank (application with employer’s TIN and passport), after which the manager will request additional information if necessary.

There are separate requirements for real estate purchased with a mortgage. You can download their list here.

Package of documents for refinancing

If you want to use the service of refinancing mortgage loans from other banking organizations at Transcapitalbank, then you will need the following package of documents:

- statement;

- passport of a citizen of Russia (another state for foreigners);

- certificate form 2-NDFL;

- a notarized copy of the work record book;

- a copy of the current mortgage agreement with another bank;

- a certificate of the remaining amount of debt valid for no more than five working days;

- details of the bank whose loan obligations have not been fully fulfilled.

Almost all reviews on Transcapitalbank mortgages are extremely positive. Most clients consider the main advantage of the offers from the banking institution described to be the number of different mortgage offers.

An individual approach is used to each client, which is also a definite plus. In order to apply for a loan, it is not necessary to personally visit bank branches. This can be done online and only after approval of the application, visit the bank. By the way, the average period during which a submitted application is considered is only 2-3 business days.

Mortgage scheme at Transcapitalbank

Mortgages at Transcapitalbank are issued according to the following scheme:

- At the stage of preparation for the transaction, the parties agree on all the conditions, a package of documents is drawn up - DCT (DCP), credit (mortgage) agreement, insurance agreement, documents on settlements with the seller.

- On the day of the transaction, a loan agreement and an insurance agreement are signed.

The documents are sent for verification, after which the bank is ready to issue a loan to pay for housing. - On the same day or earlier, a real estate purchase agreement is signed with the seller, and

the method of payment is agreed upon. - Signed documents are submitted for registration to Rosreestr through the MFC.

During the registration process, ownership of the property is transferred to the buyer and a pledge (mortgage) is created in favor of Transcapitalbank. - Depending on the chosen method, payment is transferred to the seller before or after registering the transaction.

Once registration is completed, the mortgage is considered issued. It can be repaid according to the schedule.

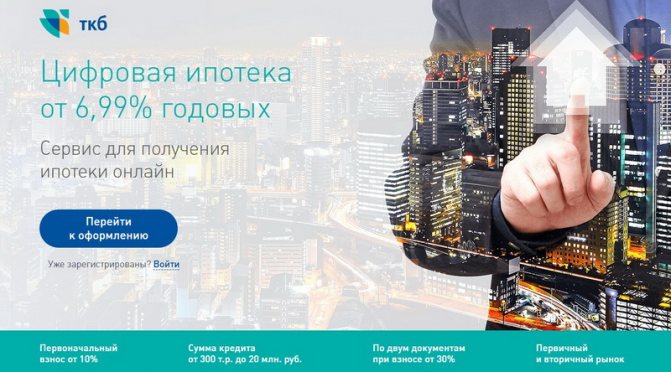

Digital mortgage of Transcapitalbank

Transcapitalbank is introducing remote mortgage processing services. The “Digital Mortgage from Transcapitalbank” portal allows you to: without visiting the bank:

- calculate the terms of a mortgage loan;

- fill out an application;

- Get mortgage pre-approval on the same day you apply.

You can connect to the service from any device online, and a preliminary decision will be sent via SMS instantly. Subsequently, you will need to go to the bank to sign all the necessary documents for the transaction.

Transcapitalbank offers

The first thing the lender himself emphasizes is that the client can count not only on a loan intended for the purchase of real estate, but also on receiving additional funds. This is very important for many borrowers, because after, for example, a mortgage has been issued for a secondary home, funds may be required for repairs, equipment or furniture, and Transcapitalbank is ready to include them in the loan.

As for the conditions, they depend on the chosen program. Today, there are 3 main loans in the line: for new buildings, secondary housing and commercial real estate. There is also a mortgage with government support for families with small children. In addition, the bank is ready to refinance a mortgage taken out from a third-party bank.

Ready housing

Clients can receive funds for the purchase of finished housing for up to 25 years. TKB mortgage provides such opportunities as:

- confirmation of income according to the bank form;

- involvement of maternity capital;

- repaying the loan ahead of schedule without fees or penalties;

- lending to individual entrepreneurs and business owners.

Transcapitalbank also offers a mortgage based on two documents, but only on the condition that the down payment amount is at least 30%. And for clients using maternity capital, the minimum contribution is only 5%. The bank issues from 300 thousand rubles, and mortgage rates at Transcapitalbank start at 8.7%.

Reviews from real borrowers about TKB

In general, reviews of Transcapitalbank are positive. Clients note the quick response of employees to applications, instant approval decisions, and favorable loan conditions.