Instability of economic realities and the emergence of private life difficulties may lead to the fact that previously assumed obligations to repay the mortgage debt cannot be fulfilled by the borrower in the same amount. Banking organizations are interested in ensuring that citizens do not accumulate loan debt, so they restructure the debt or give credit holidays. But all these steps are not always able to help families who find themselves in difficult situations.

To receive government support, you must meet the established criteria and go through the registration procedure.

In 2020, a government program began to operate aimed at helping mortgage borrowers who, due to current circumstances, cannot repay their loans. Certain amounts of money are allocated from the budget, which are used to partially repay the mortgage debt.

State support for mortgage holders

Mortgage as a special lending program was developed and implemented in the Russian Federation to enable citizens to purchase real estate without major initial investments. The very essence of this program is to help people. Many families have the opportunity not to save for many years for housing, but to buy it today and, while living in it, pay off the borrowed amounts. The mortgage is issued for a period of up to 30 years, and all funds spent on housing, along with interest for their use, are paid in monthly installments.

The mortgage program is good and convenient for everyone, but it also has a significant disadvantage - you cannot predict your well-being for decades to come. Every person's life undergoes changes and, unfortunately, not all of them are positive. Over many decades, a citizen can start a family, children, lose a well-paid job or even health. The very principle of mortgage lending implies that if a person can no longer pay monthly installments, the living space is sold and the bank takes the balance of the unpaid debt, and the difference in the amount is returned to the former borrower. Of course, such an outcome is considered deplorable, because years of contributions go down the drain, not to mention the fact that the home owner ends up on the street. To prevent such a situation, a state program to support mortgage borrowers was developed in 2020.

AHML interest rate

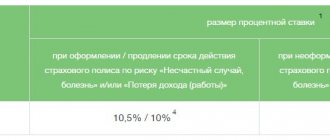

Interest rates under the AHML program depend on the loan amount, the duration of the mortgage and the value of the collateral. For 2020, the following interest rates have been established for the programs:

New building:

- Min. rate – 9.25%

- Min. contribution – 20%

- Duration from 3 to 30 years

- Additional options:

- Variable rate

- Easy mortgage

Maternal capital

For finished housing:

- Min. rate – 10%

- Min. contribution – 20%

- Duration from 3 to 30 years

- Additional options:

- Variable rate

- Easy mortgage

Maternal capital

On-lending:

- Min. rate – 9.75%

- Duration from 3 to 30 years

- Additional options:

- Variable rate

Easy mortgage

Mortgages for Urban Group properties:

- Min. rate – 9.75%

- Duration from 3 to 30 years

- Additional options:

- Easy mortgage

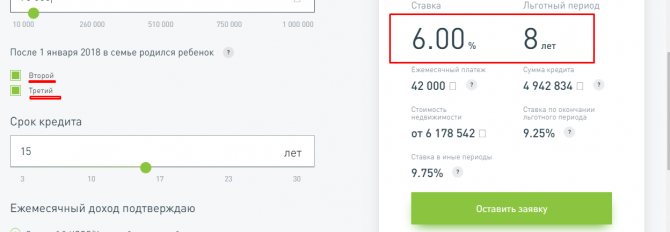

Family mortgage:

- Min. rate – 6%

- Grace period from 3 to 8 years

- Additional options:

- Easy mortgage

Secured by an apartment:

- Min. rate – 11%

- Duration from 3 to 30 years

Military mortgage:

- Min. rate – 9.25%

- Min. contribution – 20%

- Term from 3 years

Social mortgage of the Moscow region:

- Min. rate – 8.50%

Preferential regional programs:

- Min. rate – 5.75%

Legislative framework

This system began to operate in 2020. Its foundations are set out in Decree of the Government of the Russian Federation No. 373 “On the main conditions for the implementation of the assistance program...” dated April 20, 2020. For less than two years, it was suspended, but then resumed again. In August 2020, the Government of the Russian Federation decided to resume the program that had been stopped by that time, which was enshrined in Resolution No. 961 of August 11, 2017. The expiration date for state support was not specified and in 2020 it is valid to the established extent. To date, government support has been provided to almost 19,000 families who find themselves in a difficult financial situation.

Resolution No. 373 has been constantly refined and improved since its first adoption; new significant points were introduced into it that improved the interaction procedure and took into account the interests, first of all, of borrowers. The document specifies the basic conditions for participation in the program and the amount of funds allocated from a special government fund. In 2020, two billion rubles were allocated for the implementation of the program.

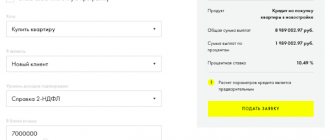

AHML loan calculator. How to use and make calculations?

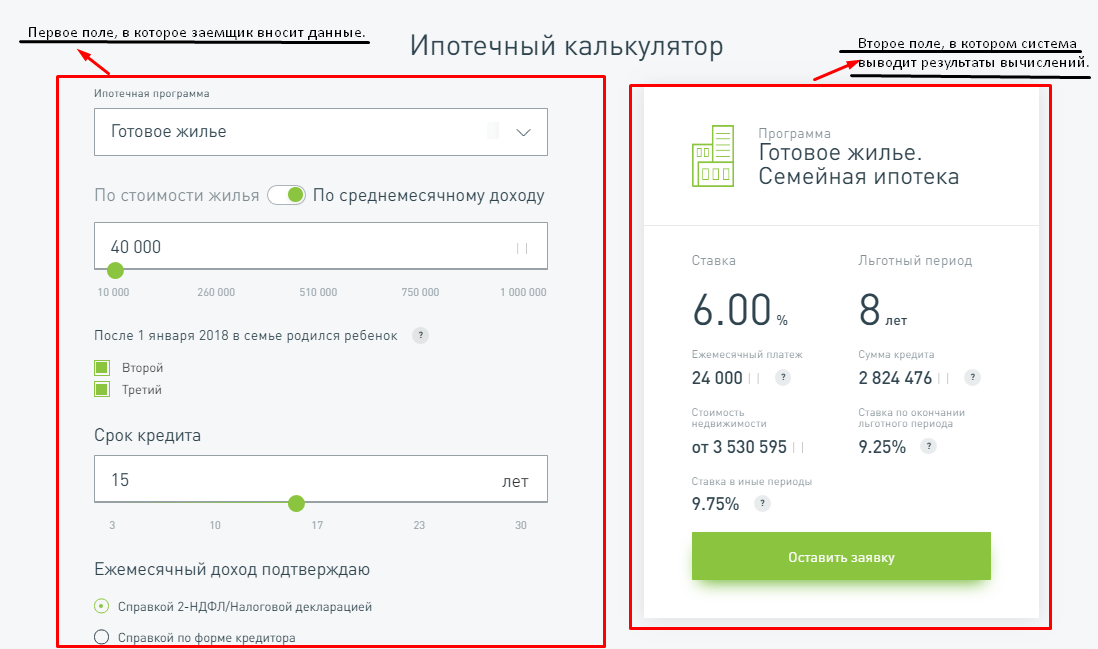

You will find the AHML mortgage calculator on the organization’s official website.

The program consists of two fields: the borrower enters data in the first field, and the calculation results are displayed in the second.

In the future, you will see how the indicators in the right field will change after entering certain data into the left one. It’s easy to use the AHML mortgage calculator and calculate the mortgage amount for 2018:

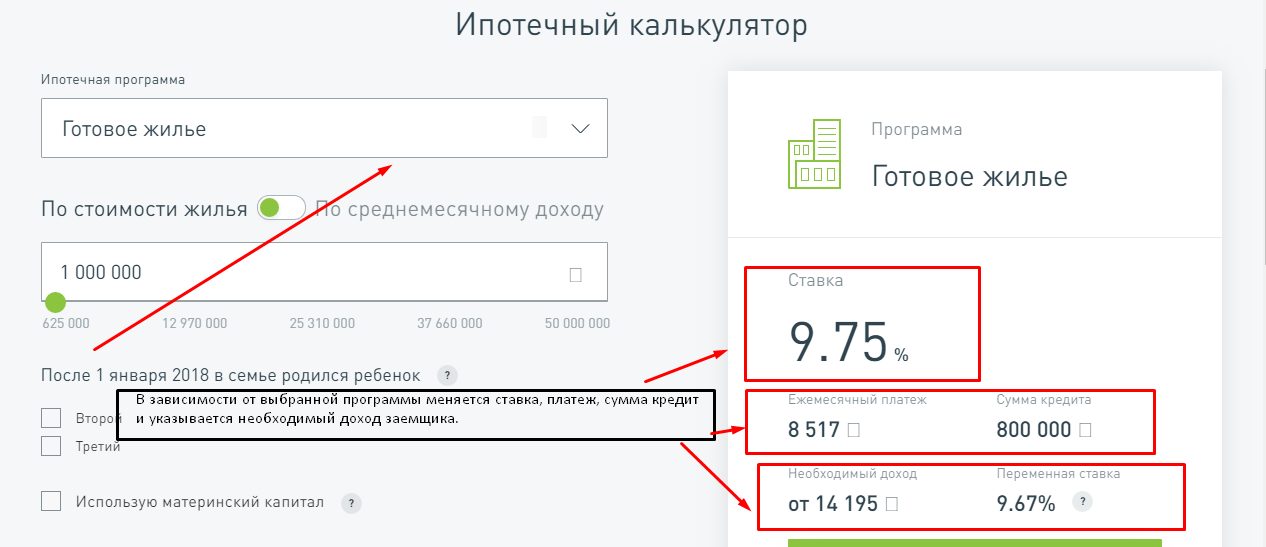

- In the first field, select your mortgage program from the drop-down list. The left window will immediately display the rate, monthly payment and loan amount.

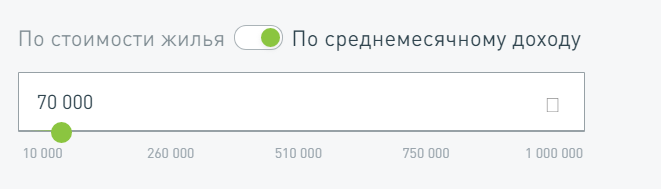

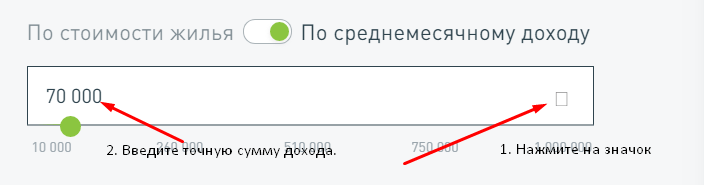

- Select the algorithm by which the AHML mortgage calculator will calculate - based on the cost of housing or average monthly income. To do this, move the slider to the right or left. If you have not decided on housing, but want to assess the burden on your budget, then it is more convenient to calculate your mortgage based on your income level.

- Specify the cost of housing or the amount of income (depending on what type of calculation you have chosen) by dragging the slider to the desired value. The minimum loan amount starts from 625 thousand rubles, and the minimum income from 10 thousand rubles.

You can also enter the exact income figure by clicking on the rectangular icon in the window.

- If children appeared in the family in 2020, then this should be noted. In this case, the adjacent window will display information about the grace period, during which the rate will be 6%.

- Specify the loan term by dragging the slider to the value you need, or enter numbers by clicking on the field.

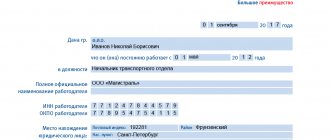

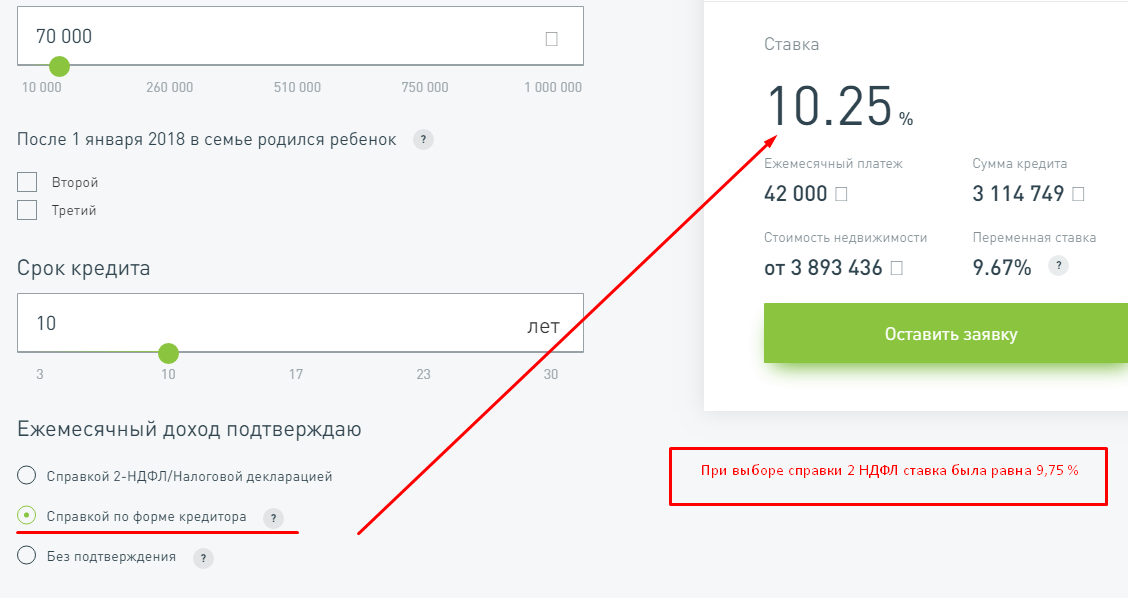

- Select your income verification method. There are only three of them: personal income tax certificate 2 or personal income tax 3 (tax return), a certificate in the bank form and without confirmation. When choosing the last two methods, please note that the rate will increase by 0.25%.

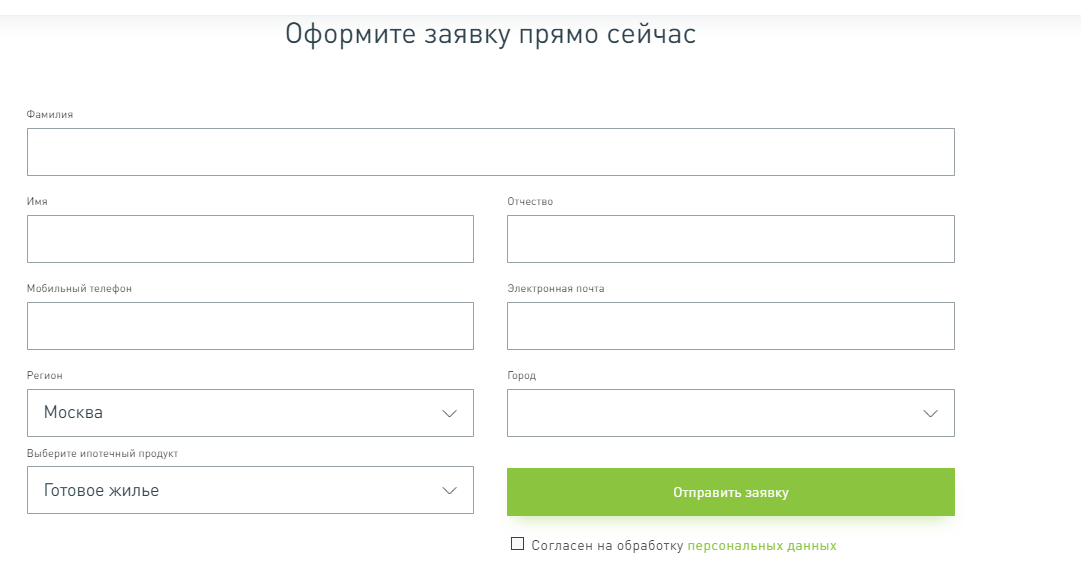

After entering the data, click on the green “Leave a request” button, after which the following online form will open:

Within 24 hours, an employee of the organization will contact the borrower and advise on further actions.

Supporting body

The program of state support for mortgage borrowers is carried out through the Ministry of Construction of the Russian Federation, and is directly implemented by the joint-stock company “Agency for Housing Mortgage Lending” (AHML). This structure is authorized to consider candidates applying for monetary government support and to stimulate housing lending.

AHML is a state organization and its budget consists of 100% state capital money. This structure has a clear purpose - to provide support to banks that engage in long-term mortgage lending.

Cooperation between banks and AHML takes place according to the following scheme:

- A citizen applies to a credit institution and receives a loan from it to purchase housing.

- If certain conditions are met, the borrower turns to AHML for state support. The allocated money is not given in cash to the needy, but is transferred directly to the creditor for partial repayment of the debt.

- The bank restores its financial reserves using the funds issued, and the transferred amount is written off from the payer’s debt.

In such operations, the bank respects its interests, and the borrower receives financial support from the state and extends the possibility of repaying the debt.

AHK borrower’s personal account: how to control calculations and pay contributions to VTB 24 without commission

Home › Services › How to use your AHML personal account and pay fees without commission

The AHML electronic service, the borrower’s personal account, provides the user with the opportunity to monitor the status of settlements and send various requests to the lender.

When applying for a mortgage, few people think about the technical side of payment transactions.

But after the first months of payments, the borrower understands the complexity of the situation: for many years he will have to repay large amounts every month over a certain period of time.

In other words, for the next fifteen or twenty years, the borrower must plan his time in such a way as to be able to deposit money on time.

If you have taken out a mortgage with VTB 24 through the Housing Mortgage Lending Agency, the AHML client service in the form of a personal account will help with planning. And the bank will ensure quick and economical transfer of funds to the recipient’s accounts: special transfer rates apply to AHML borrowers at VTB 24.

We will tell you about the functionality of the AHML personal account and about VTB 24 offers for borrowers.

Functionality of the AHML electronic service

Since 1997, an organization has been operating in Russia that implements the state strategy to provide the population with housing. AHML (Housing Mortgage Lending Agency) acts as a kind of intermediary between the state and creditor banks , helping borrowers in obtaining loans and resolving complex financial issues.

In fact, the program works in two directions:

- Ensures the promotion of social mortgages (including for military personnel and large families);

- Restructures the debt of borrowers who find themselves in difficult financial situations.

If your mortgages belong to AHML, you can use a modern service: an electronic account. Full service is provided here remotely. The following functions are available to the user:

- Submitting an application for early repayment of the loan, in whole or in part;

- Filling out requests to creditor banks for the issuance of certificates about the status of the account, paid debt and interest;

- Formation of payment schedules;

- Checking the history of loan transactions;

- Informing about the terms of settlements under the insurance policy;

- Control over the amount of current debt and the date of upcoming payments.

Access to the service is provided by the official website of the organization. In the upper right corner of the page there is an active link to enter your personal account. To register a new user you need to do the following:

- Read and approve the offer agreement;

- Fill out the information form, indicating your personal information and mortgage number.

After checking the information, the user will be sent a message with a temporary password and login.

Cooperation between VTB 24 and AHML

At the end of 2020, VTB24 and AHML entered into a five-year contract to support the agency’s portfolio of mortgage loans. From this moment on, the bank acts as a partner of AHML in managing mortgages, collecting debts, and selling collateral real estate.

In addition, an agreement was concluded between the structures on participation in the state program of assistance to certain categories of borrowers. VTB 24 is restructuring mortgage loans, receiving compensation from the Agency.

As part of this partnership, VTB 24 offers its clients special conditions for transferring payments to the Agency via VTB24-Online.

Each borrower who has entered into a service agreement with the bank can transfer money to repay the AHML mortgage without commission.

Owners of the Privilege package are given the opportunity to repay the loan at any bank office, without paying a commission fee.

Read also: Loans: their maximum number and payment procedure

Thus, owners of mortgage loans obtained through the mediation of AHML can service their debt at VTB 24 without additional payment.

by HyperComments( 2 5.00 out of 5) Loading…

by HyperComments

Source: https://vbankit.ru/servisy/kak-ispolzovat-lichnyj-kabinet-aizhk-i-platit-vznosy-bez-komissii/

Borrower categories

Government Decree No. 373 provides a complete list of citizens who have the right to count on participation in the developed program. The list was approved in 2020 and slightly adjusted in November 2020. It includes:

- Parents who have one or more minor children.

- Guardians or trustees raising one minor child or more children under 18 years of age.

- Citizens who took part in hostilities.

- People with any degree of disability, subject to official confirmation of this fact.

- Parents raising a disabled child.

- Parents who support children over 18 years of age, but under 24 years of age, provided that they are full-time students in educational institutions.

The conditions apply only to people who have Russian citizenship, a Russian passport and permanent registration in Russia.

AHML Mortgage Borrower Assistance Program

The family loan is aimed at helping mortgage borrowers: families who will have a second or third child between January 1, 2020 and December 31, 2022. Both new borrowers and those who have previously signed a contract for a different type can take part in the program. Reduced interest rate, from 6%. The period depends on the number of children:

— upon the birth of the second child, the grace period is 3 years;

– for 2nd and 3rd – 8 years.

Requirements for borrowers

Repayment of a mortgage at the expense of the state is possible, but it is necessary to meet established requirements. The borrower must fall under one of the listed categories and be a citizen of the Russian Federation, but this does not guarantee that assistance will be provided.

One of the most important indicators is the level of wages at the moment and the ratio of the size of the loan payment on the day of registration and on the day of applying to AHML. The applicant must have a low monthly income. The salary limit is calculated as follows:

- The mortgage payment amount is deducted from your monthly income.

- The remaining amount should not exceed twice the minimum subsistence level. The PM of a specific region is taken as a basis. The amount of income is divided among all family members.

The calculation takes into account data for the last three months. AHML specialists proceed from the fact that the previously established loan payment should increase by at least 30%. This situation often occurs for those citizens who have taken out a foreign currency mortgage or taken out a loan at a floating interest rate.

Variable rate from AHML - the first recalculation of the rate or subtleties of the methodology

Gordeyko Sergey

Head of the Analytical Center, Rusipoteka company

At the beginning of the year, the Agency for Housing Mortgage Lending (AHML) offered a new product, “Variable Rate”. The deadline for the first scheduled recalculation of the lending rate has arrived, which gives us reason to once again remember how the new loan product works.

The main idea of the “Variable Rate” product is to tie the lending rate to the inflation rate, and leave the monthly payment constant. It is expected that in the coming years the inflation rate will decrease, and the loan will become more profitable for the borrower.

Since the payment is fixed, a reduction in the rate will lead to a reduction in the loan term. The reason for this is the peculiarity of the payment on a mortgage loan, the so-called annuity, within which both the payment of the principal debt and the payment of interest.

Interest decreases, therefore, more funds are used to pay off the principal debt and it decreases faster. The stability of the monthly payment should protect the borrower in the event of rising inflation by increasing the loan term.

It turns out that providing a variable lending rate with a constant monthly payment occurs by changing the loan term. The new mortgage may more accurately be called one of two alternative names: Variable Term and Rate or Stable Payment.

Read also: What documents are needed to apply for a credit card at Sberbank Samara

New mortgage terms

In order to understand a new loan, you need to look at the general conditions and features of its application at a specific point in time. Using the developer's website, we compiled table 1. Table 1.

General terms of the “Variable rate” loan A potential and current borrower will always be interested in the parameters that influence the calculation of the rate, namely the inflation index (see Table 2). Table 2.

Calculation of the variable rate and inflation indicators Thus, the first recalculation of the lending rate resulted in its increase from 13.20% to 14.41% per annum.

Subtle methodological assumptions

The developer demonstrates the features of the product for the borrower using the example of a loan of 1 million rubles issued for 30 years. For a new product the introductory rate is 13.20%, for a standard fixed rate product it is 13.25%.

Results: the new loan will be repaid in 14 years, and the fixed one in 30 years. The volume of payments on a new loan for the entire term is 1,797,096 rubles, on a fixed loan - 4,053,600 rubles. The benefit is obvious.

To formulate the key advantages of a loan product, two assumptions are used:

- inflation target values (decrease) will be achieved fairly quickly;

- if the rate is increased due to rising inflation, it must be raised only for a quarter, and then, in a demonstration calculation, lowered to positive forecast values.

For example, when receiving a loan in March 2020, it will have three rates:

- lending rate for the first quarter of 2020 - 13.20%;

- lending rate for the second quarter of 2020 - 14.41%;

- The lending rate for all subsequent months and years is 8.90%.

It should be noted that there is one more feature that distinguishes the variable rate product from standard mortgage loans. The monthly payment amount is 95% of the usual annuity calculation. The meaning of this innovation has not yet been understood.

The authors of the product cleverly avoided the pitfalls of a changing rate on a long-term mortgage loan. So, the above assumptions are of fundamental importance for the performance of the product. The authors of the product cleverly avoided the pitfalls of a changing rate on a long-term mortgage loan.

According to the classical approach, if it is necessary to recalculate the interest rate, such recalculation is carried out and the rate is considered constant until the next recalculation condition. The only difference is that in the classical approach there is no forecast of an event that has not yet occurred. Note that the classical approach means “usual for perception,” and not “the only one allowed.”

Subsidizing mortgage loans as a window of opportunity for banks in 2015–2016. In 2020, 32.7% of all ruble loans were issued under the subsidy program. This share varied throughout 2020. How are things going for mortgage market participants? Let us demonstrate what was avoided using this little trick.

Let us assume that with the classical approach it is necessary to build a new payment schedule after recalculation, assuming that in all subsequent years the rate will remain constant (conditionally). As we remember, only the loan term can change. Table 3. Loan behavior when the rate changes using the classical approach

It is obvious that a classic annuity loan practically does not tolerate an increase in the rate for the issued loan. Playing with the initial loan term can provide some salvation. Table 4.

The impact of changes in the interest rate on the loan term For each initial loan term, there is a limit to the growth of inflation when the loan can never be repaid, that is, there is no such period for the monthly loan payment to remain constant and the loan to be repaid. All the money will go to interest - just eternal debt.

For objectivity, we note that mortgage loans longer than 20 or even 15 years do not make sense. In practice, this means that the planned recalculation when moving to the second quarter of 2020 gives an increase in the lending rate by 1.21 percentage points, which would force the issuance of a loan for a period not more than 180 months.

For the sake of objectivity, we note that mortgage loans longer than 20 or even 15 years do not make sense. Increasing the term beyond 15 years results in a slight reduction in the monthly payment, and after 20 years the reduction is almost unnoticeable.

Usually the loan term is increased in order to obtain a larger loan amount, but it turns out that after increasing the loan term beyond 20 years, only the overpayment increases, that is, the loan becomes absolutely unprofitable for the borrower. It can be stated that without these tricks the “variable rate” product would be workable with very significant limitations.

Typically, payment schedules are calculated automatically. In this case, the calculation requires manual input of parameters, namely the artificial assignment of lending rates for subsequent quarters. Roughly speaking, all past quarters, the current one and the next one (from a certain date) have an exact value, and all future ones have a mythical or forecast value.

As a result, the borrower will not repay such a loan throughout his life, but will live in an apartment that is pledged, and will pay as if for rent. The second key assumption is based on the positivity of the forecast: what will happen if the forecast does not come true and inflation does not decrease, but remains at 14.41%? In this case, the loan rate will be recalculated quarterly, but it will remain unchanged. As a result, the borrower will not repay such a loan throughout his life, but will live in an apartment that is pledged and pay as if for rent. At the next step of the negative forecast, the apartment is inherited with debts, and the heirs will wait for low inflation and quick repayment of the loan. The scenario does not look very realistic, but if you compare it with the situation with foreign currency borrowers, another positive point appears - even with the most fantastic and negative forecast, the borrower will not find himself in a situation where the payment will exceed his income and he will be left without an apartment at all. These assumptions indicate that a variable rate product is much more complex in terms of methodology and marketing than a fixed rate product.

Marketing

Read also: How to get a loan for any purpose?

According to the developer, the “Variable Rate” mortgage loan, a new AHML product with a variable rate and a fixed payment, is designed for citizens who plan their expenses based on the current economic situation.

The modern borrower must have skepticism and mistrust. It is believed that the product is designed for a borrower who is not afraid of complex concepts. There have been suggestions that there is little potential demand for this product. The modern borrower must have skepticism and mistrust.

The first question is: what will happen if inflation rises? Formal answer: “The interest rate on the loan will be increased, which will lead to a change in the distribution between interest payments and principal repayment within the monthly payment. After some time, inflation will decrease, and at the next recalculation, the loan term will decrease again.”

An inquisitive client must be explained that such a recalculation occurs once a quarter and his calculation schedule for the remaining loan payments simply changes. For those who are especially inquisitive, the schedule should be printed, sent or posted in your personal account.

How to briefly outline the advantages of a variable rate loan for a meticulous borrower? We have come to the peculiarity of modern banking, when all lending conditions must be open and set out in detail. The main thing is that the loan product has not only the advantage of a classic mortgage loan in the form of a constant monthly payment, but also an additional effect, which in the short term can give a reduction in the loan term and reducing loan overpayments. We have come to the peculiarity of modern banking, when all lending conditions must be open and set out in detail. In this loan, the more details, the more questions. This is a product for “advanced” people, for whom the main thing is not to dig into it. An attempt to simplify leads to the loss of formally important details, but not important for the essence. The conclusion suggests itself: what is missing from the new “Variable Rate” loan to attract borrowers en masse? Answer: trust, when there is no need to explain the subtleties in detail. But this trust is not only in the creditor, but also in the entire economic policy. This is the paradox. The result is a rather complex product, the benefits of which may not be visible due to mistrust. On the other hand, it is simple and profitable if there is trust.

So we have come to the conclusion that for this loan product you need to create a special campaign and promote trust, and not a lot of important and useful details.

RUSIPOTEKA, 03/26/2016

Source: https://rusipoteka.ru/ipoteka_sekyuritizaciya/ipoteka_2016/peremennaya_stavka_ot_aizhk/

Loan requirements

To receive financial assistance, it is extremely important that the loan itself meets the established requirements. They apply mainly to the amount of the mortgage loan. It is extremely unreasonable to set any restrictions in monetary terms, because the cost of residential properties varies depending on the region and locality, so the requirements are put forward directly to the real estate taken on a mortgage. Collateral housing must meet the following criteria:

- The area of the property must be no higher than 45 m2 for a 1-room apartment, 65 m2 for a 2-room apartment and 85 m2 for a 3-room apartment.

- The cost of one square meter is calculated based on the average price in a given locality. Exceeding the average is allowed by no more than 60%.

- The mortgaged property is the borrower's only living space. If he has a share in other premises, then it is important that it does not exceed 50% of the total area. Data on the availability of other real estate is taken from 2020.

Please note that all of the above restrictions on credit and living space do not apply to families with three or more minor children.

Conditions for participation in the program

You can apply for state support only if you meet one of the main conditions, which is often not taken into account by debtors - the mortgage loan must be issued at least a year ago. If the loan was taken out just a few months ago, you should not count on debt restructuring. All efforts of the state are not aimed at freeing the borrower from loan obligations. Support only reduces payments to an acceptable level, leaving the citizen with an amount that he can repay on his own.

You can count on financial assistance only once. Moreover, if the application is rejected due to insufficient grounds, the citizen can appeal to a special interdepartmental commission. It was approved in 2020 and allows for a more individual approach to considering situations. The commission can not only decide on the need for assistance on a previously rejected application, but also increase the amount of compensation by any number of units, up to 100%.

Help format

The final result of government assistance is expressed in monetary terms, but which format will be chosen in each specific case depends on many circumstances. There are two main ways to reduce your monthly payments:

- Reducing the borrower's debt obligations.

- Converting a foreign currency loan into ruble equivalent.

The choice of option depends, first of all, on the initial data of the loan taken.

The state support program was developed after the economic crisis significantly weakened the financial capabilities of payers. A few years ago, mortgages were issued at variable rates, since this aspect was not regulated by the state. This procedure well protects the credit institution itself from loss of profit, but for the borrower it can become a debt trap, which is what actually happened to many payers.

Difficult circumstances and the fact that the income level of a large number of citizens has seriously fallen, had a negative impact primarily on their solvency.

Reducing the borrower's obligations

The borrower's obligations are reduced according to a certain scheme. The first thing the financial institution decides is how much to compensate the applicant. There is no established minimum size in this case, but there is a maximum. Often 20-30% of the total balance owed on the mortgage is reimbursed. It is stipulated that the amount of state support should not exceed one and a half million rubles.

The following categories of citizens will be able to repay 30% of the debt:

- The family has two minor children.

- Disability has been established.

- Parents are raising a disabled child.

- The applicant is a combat veteran.

Families with one child can receive only 20% of the remaining mortgage debt. Please note that an exception may be made to this rule if the interdepartmental commission decides that a large amount of debt must be paid.

It is important to determine not only how much money will be compensated from budget funds, but also how it is provided. There are two options for assistance:

- The entire agreed amount is written off from the debt balance, after which the amount of monthly payments is recalculated.

- The provided amount of money is divided into parts, each of which will be used to compensate for the monthly payment. In this case there are two significant limitations. Firstly, you can compensate no more than 50% of the monthly contribution. And secondly, the duration of such payment should not exceed 18 months.

Which option to choose is decided between the borrower and the lender, but the prerogative is given to the citizen, because the financial organization loses nothing in either case.

Replacing foreign currency mortgages with ruble ones

Many mortgage borrowers found themselves in the unpleasant situation of financial collapse precisely because at one time they took out a loan in foreign currency. Long-term stability in the foreign exchange market weakened the vigilance of citizens, and it began to seem that nothing would shake the current situation. The amount of mortgage loans taken due to the jump in the exchange rate increased several times. And given the interest rate applied to them, repayment of dues has become simply unrealistic.

The state support program allows citizens who have taken out a mortgage in foreign currency to convert the loan into the ruble equivalent.

The restructuring of such loans is carried out not at the established rate, but according to the laws adopted today. The interest rate applied to the ruble equivalent should not exceed that provided by the bank today for issuing mortgage programs. The rate can be increased only in one case, if the borrower has violated the established insurance rules provided for in the loan agreement.

Documents for restructuring

Financial organizations consider an application for debt restructuring with the help of state support only if the borrower provides the required package of documents for consideration of his candidacy. Information about his financial and family situation must be confirmed and fit the conditions of the program.

The list of documents consists of the following forms:

- Passport.

- Valid loan agreement.

- Documents for minor children - birth certificates.

- Certificate of disability or participation in hostilities and receipt of veteran status.

- A certificate from a medical institution if a minor child has a disability.

- Certificate of income for the last three months.

- A copy of the work book from the employer or its original if the person is not working at the moment.

- A certificate from an educational institution stating that the adult child is a full-time student.

- Guardians and adoptive parents must provide a decision from the guardianship authorities and a court order.

- Extract from the Unified State Register.

- Insurance policy.

The list may be supplemented at the discretion of the credit institution. Attached to the article is a sample application for mortgage restructuring.

Procedure

To receive government financial support to repay part of the remaining mortgage loan, the borrower will need to go through a step-by-step procedure. It consists of the following steps:

- A package of documents is submitted to the credit institution that issued the mortgage loan.

- The bank reviews the submitted application and issues its verdict.

- If the decision is positive, the applicant moves on to the next step, and if the decision is negative, he can contact the interdepartmental commission for a more detailed consideration of the circumstances and a more individual response.

- A new loan agreement is concluded or an additional agreement is prepared to an existing form.

First, the bank repays the difference from its own funds, but then the entire specified amount is compensated by AHML

Contacting the bank

Many borrowers complain that the bank refuses to restructure their mortgage loan, not wanting to consider documents for receiving government support. It should be taken into account that not all credit institutions are included in the AHML list, which complicates the possibility of cooperation. If the refusal is the initiative of the bank, then you can safely submit an application to the interdepartmental commission, since such actions are considered unlawful.

A borrower who, in his own opinion, meets the established requirements and conditions of state support is required to fill out an application form. This form is confirmed by the collected documents and submitted to the creditor for examination and a final verdict.

A positive decision results in a revision of previously established payment amounts. Before signing new agreements with the bank, you should decide on the method of compensation - one-time or in installments to pay off monthly payments.

Contacting AHML

The entire registration procedure is carried out in close cooperation between the bank and AHML. If the process follows a standard path, then the citizen will not have to apply to AHML on his own; this will be handled by the lender. The bank submits the already reviewed documents to the agency, which, based on them, transfers the agreed amount of compensation to the financial organization.

If the creditor rejected the application for debt restructuring or decided to compensate only a small part of it, which, in the opinion of the property owner himself, is unjustified, a commission review of the situation can be initiated. In some cases, the commission may decide to pay 100% of the debt, but for this purpose the reasons must be very compelling.