A dacha acts as a desirable purchase for people who dream of spending weekends and vacations with family and friends in nature. A mortgage, which can be issued for a dacha, its construction, or the acquisition of a plot of land, can bring the implementation of the plan closer. This is a relatively new product on the lending market, so you should not hope for benefits or lower interest rates.

At the same time, the dacha is not considered a highly liquid property, which means that the requirements for the acquired land plot with a house will be quite strict. However, if all conditions are met, a bank loan may be the only option for realizing your dream of outdoor recreation.

Is it possible to get a mortgage for a dacha?

The pledge implies the possibility of selling the dacha in the event of force majeure circumstances for the borrower regarding payment

A mortgage involves issuing a loan secured by a purchased or other object, and lending for the purchase of a summer house is no exception. However, the very concept of “dacha” is interpreted quite broadly by ordinary people. For some, this is a comfortable house outside the city with all the amenities and a plot of land, while others will be content with the notorious six hundred square meters and a small summer house for farming.

If in the case of an apartment, the requirements for the borrower regarding his solvency and loyalty to the bank come to the fore, then when purchasing suburban real estate, more attention is paid to the condition of the property.

The bank’s decision depends on the liquidity of the potential purchase object: whether the issuance of a mortgage will be approved or not.

Even after obtaining the bank's prior consent, difficulties may arise:

- with the collection of documents - discrepancy between the area of the land plot, the presence of unregistered objects on the site, etc.;

- with assessment - lack of uniform criteria, methods and standards for dacha assessment;

- with insurance - insurance companies charge higher rates, since there is a high probability of fire or intruders.

Requirements for the property

First of all, it is necessary to obtain the bank’s consent to consider the application. This is possible if the dacha meets the following criteria:

- a cadastral plan for the land plot and buildings has been drawn up;

- access roads have been improved;

- the plot is intended for individual residential development;

- the building is in good condition with a high level of fire protection;

- a number of banks impose requirements on the materials from which the house is built - the foundation is made of concrete, the building itself is not made of wood, etc.;

- proximity of the location to the city limits (maximum distance from the nearest settlement - 120 km);

- availability of electricity, running water, heating systems, sewerage.

Expert opinion

Roman Efremov

5 years of experience. Specialization: all areas of jurisprudence.

Requirements for the site selected for purchase

When applying for a loan to purchase real estate, you must ensure that the property meets the bank’s requirements. The general points are:

- Be sure to provide a cadastral plan of the site, which shows the existing buildings on the land.

- There should be detour routes near the plot.

- Buildings must meet fire safety requirements.

- If there is a residential building on the land plot, it must be in good condition.

- The base material for the housing must be brick or stone; concrete pouring is allowed.

- Often banks will require that the acquisition be located within a certain distance of one of their branches. It could be 120 km.

If there is a discrepancy with any of the points, bank employees will refuse the application for a loan.

Look at the same topic: Commercial mortgage for individuals: how to buy commercial real estate with a mortgage in [y] year?

For most garden houses, obtaining a loan for the purchase is unlikely. Modest dachas, where there are no communications or where there are difficulties with their organization, are almost not considered. The chances of getting borrowed funds increase if you are going to purchase a large house located on a summer cottage, but similar to a residential cottage.

Requirements for the borrower

A mortgage loan for the purchase of a summer house can be issued to persons who meet a number of mandatory conditions:

- age limit within 21-65 years;

- the presence of your own real estate or other expensive property resources that can be pledged;

- having a good credit history. It is worth noting here that at the time of application the user must already have a credit history. If he has not previously used lending services from banking or credit institutions, with a high degree of probability his application will be rejected;

- presence of a passport and TIN;

- availability of permanent registration in Russia. You must apply for a mortgage loan in the locality where the applicant is registered;

- stable high level of income with official documentation confirming this fact;

- work experience at the last place of work for at least 12 months;

- the applicant’s total work experience is at least 12 months;

- availability of funds to make a down payment.

When deciding whether to grant a mortgage loan, banks use a scoring system. For all parameters that are important for a banking organization, the potential borrower is awarded points, based on which a conclusion is made about the client’s solvency. To increase your scores, and, as a result, increase the chances of a positive decision on your mortgage application, the user should submit additional documents to bank employees:

- characteristics from the place of work;

- recommendations from the manager;

- certificates confirming timely repayment of loans taken earlier;

- an extract from the passport office confirming that the applicant is permanently registered and has been living at the same address for more than 12 months;

- if the applicant has additional sources of income (renting out real estate, bank deposits, securities, etc.), documentation confirming this fact must be provided to a bank employee.

Mortgage for a townhouse

Townhouse is a type of modern housing and the dream of many. But as a rule, the cost of such housing is high. And if you don’t have the entire amount, a townhouse mortgage will come to your aid right away. This will allow you to purchase the necessary housing in a short time.

But you should always remember when concluding a mortgage loan agreement for a townhouse that banks will first of all defend their interests and draw up an agreement in their favor (insurance, increased interest, commissions). To avoid such situations, we recommend contacting lending professionals at IQ Credit. We guarantee you cooperation on mutually beneficial terms and full information support when concluding an agreement.

Process of cooperation with us

Getting a mortgage for the desired home is becoming more and more difficult every year, especially when it comes to expensive housing. Banks play it safe and very carefully double-check the potential borrower. To avoid bureaucratic delays, we recommend contacting professional credit brokers.

To start cooperation with our company, leave a request on our website or call our office by phone. Our manager will tell you all the nuances of cooperation. We work officially and sign a cooperation agreement so that you can be as sure as possible of our honesty with you.

We work with many large banks on special partnership terms, which allows us to offer you a mortgage on the most favorable terms.

And we are ready to offer the most profitable mortgage lending programs:

- With government support

- Family mortgage

- Military mortgage

- Mortgage with a reduced interest rate upon the birth of a child

We will select the most optimal solution for your situation

Advantages of working with us:

- We work with all clients, even problem ones: overdue loans, open active loans, etc.

- We will help you conclude a mortgage agreement with the lowest possible mortgage rate

- We will help you get a mortgage without a down payment

- We will issue you a mortgage, even if you are not officially employed and cannot confirm your income with a certificate

It is worth noting that to apply for a mortgage you will need a minimum package of documents. We will do the rest of the work for you.

Thanks to partnerships with banks, we have a single database on all bank loan programs, and you can choose the optimal conditions that suit you. Legal knowledge and business reputation allow us to achieve a positive result in 99% of cases.

Today, living in comfortable housing has become accessible to almost everyone thanks to a mortgage on a townhouse. With us, your dreams will come true.

Bank programs

There are many programs from leading Russian banks that provide both mortgage loans and non-targeted loans

To obtain a mortgage, you can use special loan products from leading Russian banks:

- PJSC Sberbank of Russia. Offers its clients a special program - “Country Real Estate”. It is intended for the purchase of a finished dacha or land plot with subsequent construction. For participants in the salary project, a benefit of 0.5% per annum is provided. When insuring life with partner companies, the interest rate is reduced by 1%. It is permissible to attract co-borrowers, and after receiving a loan, a credit card with a limit of up to 600 thousand rubles can be issued. If the loan was taken for construction, and the amount of expenses exceeded the estimate, then you can get a “loan holiday” for up to two years after providing supporting documents.

- JSC Rosselkhozbank. A “Gardener” credit line has been developed, which allows you to purchase a garden plot, erect a building on it and organize landscaping. The interest rate depends on the loan term, the characteristics of the collateral, the borrower’s consent to provide personal insurance, the provision of documents on the intended use of the loan, etc. When determining solvency, different forms of income are taken into account, including from running a personal subsidiary plot.

- Bank VTB24. It does not provide specialized mortgages for suburban real estate, however, bank clients can use a non-targeted cash loan. Participants in the salary project can receive up to five million rubles for 7 years at a rate of 11.9% per annum. The interest rate depends on the form of application (benefit for online applications), the amount of funds requested (benefit for an amount of half a million rubles), the availability of a mortgage in another bank, etc. Since the loan is not targeted, you will not need to collect documents for the plot and country house.

- Mortgage bank DeltaCredit. Issues a loan for the purchase of a finished house with a plot or part of it. The interest rate on the loan depends on the solvency of the borrower, the term of the loan, the amount provided, the characteristics of the purchased object, the number of participants in the transaction, the completeness of the insurance policy, etc. The monthly payment is split into two parts, with payment being made every 14 days. If the borrower has other real estate that he can provide as collateral, then it is possible to obtain borrowed funds to purchase a plot or build a house on it.

- Tinkoff Bank. Acts as a broker, accepting documents on the object and the borrower online and sending them to partner banks. An agreement between credit institutions allows you to offer a lower interest rate than if you contact a specific bank directly. It is possible to use a maternity capital certificate.

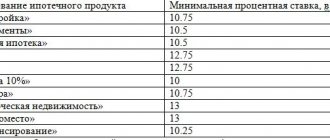

A comparison of the described loan offers is presented in the table.

| Sberbank | Rosselkhozbank | VTB 24 | DeltaCredit | Tinkoff Bank | |

| Buying a summer house | + | + | + | + | + |

| Construction of a summer house | + | + | + | + | + |

| Purchase of land | + | + | + | + | + |

| Loan amount, rub. | from 300,000 | from 10 000 | from 100,000 | from 300,000 | up to 99 million |

| Interest rate | from 9.5% | from 11.25% | from 11.9% | from 9.75% | from 9.75% |

| Loan term, years | up to 30 | up to 5 | up to 7 | up to 25 | up to 25 |

| An initial fee | from 25% | – | – | from 40% | from 20% |

Mortgage programs of different banks

Not all lending organizations are willing to issue loans in amounts sufficient to purchase a summer cottage. Those banks that agree to work with average amounts provide clients with different conditions. Here is a list of requests from the most popular organizations.

What are the conditions at RosselkhozBank

Here, clients are offered minimal loan amounts - it is possible to take out a mortgage for 100 thousand Russian rubles. The down payment is determined at 15%. The period during which the borrower will repay the loan can be 30 years. Special programs have been developed for young families, with the help of which you can buy a plot of land - a rate of 14.5% is used. To buy a plot of land with buildings, you can use the “Gardener” loan, the repayment period is up to 5 years, rates start from 19.5%. It is possible to obtain it on bail or guarantee.

Look at the same topic: Mortgage refinancing at Uralsib Bank in [y] year - review of the program

Registration in Sberbank

This bank offers the smallest loan amount from 300 thousand Russian rubles. But the annual rate starts from 12%. The down payment is at least 25% of the purchase amount. The main advantage of applying for a loan from Sberbank is that the largest loan amount can be calculated taking into account income that is not confirmed. Loans are issued up to the age of 75 years.

Conditions at VTB-24

VTB-24 Bank does not have individual programs for purchasing suburban real estate. It is possible to purchase a dacha by working with standard parameters. The conditions that are used to purchase housing on the secondary market are taken as a basis.

The loan can be issued for an amount of at least 600 thousand rubles. The payment period is no more than 30 years. As a down payment you need to have 10% of the value of the property. If the house has more than 65 square meters, you can get a 0.5% discount. Those clients who participate in the VTB-24 salary project or have a deposit with the bank have the right to more favorable conditions.

Required documents

Before contacting the bank, you must collect all the necessary documents

The list of required documents is established by banks independently, but there is a certain basic set that you cannot do without:

- completed application for a mortgage;

- Borrower's TIN;

- if the applicant has a guarantee, his personal documentation (passport, TIN) will be required;

- military ID if the borrower is a man;

- a certificate from the place of employment confirming the duration of work duties and the presence of a permanent source of income;

- title documents for the dacha (house and land plot with buildings);

- the value of the object as determined by the appraiser;

- cadastral passport;

- borrower's passport;

- certificate of income from the official place of employment in form 2-NDFL;

- employment history.

Expert opinion

Roman Efremov

5 years of experience. Specialization: all areas of jurisprudence.

Applying for a mortgage

The application for a mortgage loan in each bank has a unified form and a certain structure. When preparing a document, you must provide the following information:

- Full name of the borrower;

- Full name of the co-borrower (first-degree relatives or spouse can act in this capacity);

- Full name and contact details of the immediate supervisor. Banks pay great attention to checking the work activity of potential borrowers, so they always try to contact the employer directly to clarify information about the employee;

- Information about the enterprise where the applicant works;

- The purpose of obtaining a mortgage loan (in this case, purchasing a summer house);

- Indication of documents confirming the purchase of the house;

- The period during which the borrower intends to pay the banking organization;

- Obligations for a mortgage loan, namely the willingness to take out insurance, the presence of expensive property that can act as collateral;

- Details of the bank card or account where the bank will transfer the funds if the application is approved;

- Signature and date of document preparation.

Registration process

The procedure for obtaining a mortgage loan for a dacha is practically no different from a similar transaction algorithm for an apartment:

- Selecting an object that meets the bank's requirements.

- Involvement of a lawyer (optional) to study documents for land and house.

- Sending an application to a credit institution.

- Positive decision to issue a loan.

- Signing a loan agreement.

- Crediting funds to the borrower's account.

- Settlements with the seller.

- Registration of the transaction at the MFC or the nearest branch of Rosreestr.

Country mortgage banking programs

It is possible to buy a house with a mortgage through financial lending from various banks, such as VTB, Sberbank or DOM.RF. For example, VTB offers a mortgage loan for an individual house under the terms of a standard program for secondary housing: an average term of 17 years; average loan size RUB 2,900,000; rate 9% (salary borrowers) and 9.5% (retail clients).

The mortgage program for the “fence” of the DOM.RF bank (house with land, secondary market) offers borrowers a rate of 11.1% with a 50% down payment. A smaller contribution (range 40-50%) is allowed at a higher rate of 12.1%. In the Moscow and Leningrad regions, DOM.RF lends a maximum of 30,000,000 rubles, in other regions - no more than 10,000,000 rubles.

Sberbank offers mortgages both for the purchase of a finished secondary cottage and for the construction of an individual house or summer cottage. Sberbank's conditions for construction loans are as follows: down payment of 25% or more; repayment period up to 30 years; loan rate from 9.7%. Temporarily, while the secondary house being financed with a land plot undergoes collateral registration, the bank will need collateral in another form (collateral for another premises, guarantee of individuals).