What is maternity capital?

Matkapital (MK) is one of the forms of material support that the state provides to mortgage borrowers. Certificates for receiving money are received by large families and citizens who have adopted children. Budget funds are provided only to residents of the Russian Federation. Subsidies are not provided to borrowers who have taken advantage of other government support measures. The volume of maternity capital is 453 thousand rubles (this amount is not indexed according to current legislation).

Public funds can be spent for the following purposes:

- Purchase of living space;

- Construction of a house with the involvement of relevant companies;

- Reconstruction of the apartment;

- Payment for materials consumed during construction;

- Making a down payment and paying interest on a mortgage;

- Depositing funds under a share participation agreement;

- Making a share contribution (for housing cooperative clients);

- Payment for tuition and accommodation in a student dormitory (provided to students of educational institutions with state accreditation);

- Payment of funds to organizations that provide childcare and care;

- Purchasing goods that help improve the quality of life of disabled children;

- Replenishment of pension capital (investment can be carried out through private or public organizations).

State funds can be spent on designated purposes after the child turns three years old (with the exception of making a down payment on a mortgage loan, paying interest on a loan and social adaptation of boys and girls with disabilities). Repayment of a mortgage loan is carried out on the basis of an application signed by the owner of the certificate.

What documents need to be collected?

How to pay off a mortgage with maternity capital? What documents are needed?

The answer is simple. In order to pay off a mortgage with maternity capital, you need to collect documents from the bank where you are going to take out or have taken out a mortgage, and documents from the Pension Fund of the Russian Federation.

Bank

You need to contact the bank to get a certificate about the balance of the mortgage debt . For this you will need the following documents:

- passport of a citizen of the Russian Federation;

- mortgage agreement.

Some time later, the bank will notify you that the certificate regarding the balance of the mortgage debt is ready.

Pension Fund

List of documents required by the Pension Fund:

- passport of a citizen of the Russian Federation;

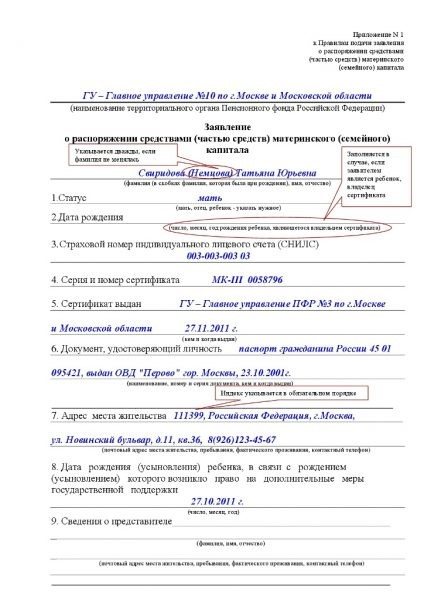

- application for repayment of a mortgage loan with matkaptal (issued and filled out by the Pension Fund of the Russian Federation);

- certificate for receiving maternal capital;

- agreement with the bank on the availability of a mortgage (mortgage agreement, payment schedule, etc.);

- a certificate from the bank about the balance of the debt;

- certificate of ownership and purchase and sale agreement for residential premises;

- bank details (so that the Pension Fund of the Russian Federation can transfer maternity capital to pay for the mortgage).

After all documents have been collected and submitted, the Pension Fund verifies their authenticity within a month . After this period, the Pension Fund of the Russian Federation issues a written decision with consent or refusal.

If a positive answer is received, then the Pension Fund must transfer the capital to the bank within a month to pay off the mortgage. A recalculation will occur, which you can find out about by contacting the bank. Why the Pension Fund may refuse, we will consider below.

MK recipients

The following persons can apply for a subsidy:

- A citizen of the Russian Federation who became a mother of many children (including adopted children). This norm has been in force since 2007;

- A resident of Russia recognized as the sole guardian of the child (relevant for decisions of judicial authorities that gained legal force after 2007);

- The child’s father (the subsidy is given to the head of the family if the children’s mother died or had limited parental rights);

- A child who has not reached the age of majority or a full-time student. The subsidy is issued after the state stops transferring funds to the guardian.

The right to use budget money is certified by a uniform document. Repayment of a mortgage loan is made only if there is paper certifying the right to receive a subvention. Forgery of government documents is punishable under current legislation.

Preparation of documents for registration of MK

A candidate for a subsidy must bring the following papers to the office of the Russian Pension Fund:

- Written application;

- Identity document;

- Birth certificate of a daughter or son;

- Judicial decision on adoption;

- A certificate confirming the citizenship of minor citizens (provided in cases where one of the parents is a non-resident).

The originals of the listed documents remain with the applicant. Copies of documents must be provided to the Pension Fund. The subsidy certificate is issued within 30 days. If a mother with many children is not able to visit the Pension Fund, then the paper will be sent to her by registered mail. The government agency allows the acceptance of digital applications (they can be sent through your personal account).

Procedure for early repayment of a mortgage with maternity capital

We will describe step by step where to apply, with what documents, in what order.

Obtaining a certificate

Apply to the pension fund. You will fill it out on site with the help of a staff member. You will definitely need:

- passport;

- birth certificates of children in your family;

- confirmation of citizenship of family members.

If events such as the death of a mother, a crime against a child/children, or deprivation of parental rights occur, documentary evidence will be required.

Applying for a mortgage loan

According to current legislation, a loan can be obtained before or after the certificate is issued. To register you will have to:

- confirm financial security to the bank (2-NDFL, income certificate in the bank form, copy of employment, 3-NDFL, account statements), more details about the requirements for documents in another article: Requirements for documents for an online mortgage

- obtain approval for the loan amount;

- provide documents for the purchased property (seller's title documents, assessment report, cadastral passport, in rare cases, technical passport);

- obtain site approval;

- sign a loan agreement;

- conclude an agreement for the purchase of real estate; more details about the purchase and sale agreement with a mortgage and important points for the buyer and seller are in another article;

- register the transaction in Rosreestr;

- provide the agreement and an extract from the Unified State Register to the bank.

Application for early repayment of mortgage with maternal capital

You have the right to pay off the mortgage principal or interest with maternity capital. In the vast majority of cases, families pay off the principal debt. The second option is attractive if further early repayments are not planned.

Recommended article: Otkritie Bank mortgage terms

In the bank:

- present your passport and maternity capital certificate;

- Based on your words, the employee will fill out the application, check and sign it;

- Receive notification of the outstanding balance.

Obligation to allocate shares

The document is drawn up by a notary. Take with you:

- passport;

- birth and marriage certificates;

- agreement for the purchase of an apartment;

- an extract from the Unified State Register of Real Estate confirming the registration of ownership rights

- a certificate from the bank about the balance of debt under the loan agreement.

Obtaining the consent of the Pension Fund for the transfer of funds

- Submit an application to the pension fund to dispose of the money. The form to fill out is available at the institution and is also available on its website for downloading.

- Submit the following documents:

- passport;

- SNILS;

- certificate;

- a copy of the loan agreement;

- bank certificate about the balance of debt;

- a copy of the agreement registered in Rosreestr;

- extract from the Unified State Register of Real Estate;

- documentary evidence of non-cash receipt of credit funds by the borrower from the bank;

- obligation to allocate shares;

- marriage certificate if the borrower/co-borrower is a spouse;

- a copy of the refinanced or restructured loan agreement, if any;

- confirmation of participation in the cooperative, if entry was credited.

- Get a receipt, check the list of documents you are transferring.

- Wait for the decision. The notification will be sent by mail.

If the Pension Fund has granted the application

The money will be transferred to the credit institution. Partial repayment of the mortgage with maternal capital at Sberbank provides for a subsequent reduction in the monthly amount while maintaining the total loan term. But clients can choose which parameter of the repayment schedule to leave unchanged: the total term or the size of payments.

After the mortgage is fully repaid, the debt under the loan agreement is closed and the encumbrance on the real estate is removed.

If the Pension Fund refuses

The notice will indicate the reason for the refusal. The most common are typographical errors, as well as an incomplete set of documents. Resubmit your application taking into account the indicated inaccuracies.

Recommended article: How to confirm your mortgage down payment

The reason may be legal in nature. For example, a house is recognized as unsafe and does not meet the requirements for premises to participate in the maternity capital program. If you think you can prove your case, appeal the refusal in court.

General questions regarding mortgages and maternity capital in another article: Mortgages and maternity capital

Action plan

Repayment of the mortgage loan is carried out according to the following plan:

- Contact the bank branch for a certificate containing information about the current mortgage debt;

- The received document is provided to the Pension Fund employee. After this, you need to sign an application to pay the down payment using budget money.

The following are attached to the application:

- Certificate;

- Insurance number of an individual personal account;

- Identity cards of citizens living in the apartment being financed;

- A notarized copy of the mortgage agreement registered in the prescribed manner;

- Certificate confirming the rights of the owner of the premises;

- Personal account statement (it indicates the balance of funds);

- A written commitment confirming the intention to provide the premises as shared ownership (the paper is certified by a notary). The document obliges the borrower to allocate shares belonging to the spouse and minor owners within six months (an encumbrance is placed on the property, which can be removed after receiving permission from the guardianship authorities);

- Extract from the house register.

The application is analyzed by the government organization within 60 days. If it is approved, budget money will be transferred to a special account. If the submitted set of documents is incomplete, the Pension Fund will reject the application. The package of papers will have to be submitted again. Errors in the certificates may also result in the application being rejected.

To whom should the mortgage be issued?

When a family receives a certificate, state funds can be used to repay the mortgage issued to the wife or husband ahead of schedule. The main condition is legal marriage. It does not matter whether the loan was issued during marriage or before its registration.

Before using maternity capital money, the borrower prepares an obligation with a notary to allocate shares to all family members. Regardless of which of the spouses and when they entered into a deal to purchase housing, after it is removed from the bank’s collateral, each child and parent/adoptive parent will own a share. An exception are children from the husband's first marriage who were not adopted before marriage (Federal Law 256 of December 29, 2006, Art. 3, Clause 2).

Recommended article: Mortgage for families with 2 children in 2020

If the obligation is not fulfilled, subsequent transactions with the apartment may be declared invalid. If a violation is detected by the pension fund, it can withdraw the maternity capital funds back.

Mortgage preferences provided to owners of maternal capital

Bank employees have developed a special program that allows you to pay off a mortgage loan using maternity capital.

This loan has a number of advantages:

- Low overpayment;

- No commission costs;

- Individual approach to application analysis;

- Discounts provided to participants in salary projects.

Funds received from the state cannot be used to make penalty payments, which are assessed in connection with the borrower’s violation of payment discipline. The recipient of the loan can issue a plastic card with a limit of up to 200 thousand rubles. The purchased premises must be registered as joint shared ownership.

Conditions and procedure for repaying a mortgage loan with matkapital

The step-by-step procedure for repaying part of the loan with government subsidies is presented in the table.

| Deal stages | Borrower actions | Notes |

| 1 step | Apply for a loan from your chosen bank. 20% of the total value of the property must be your own funds to be used as a down payment. For the remaining 80%, an application is submitted to the bank for a loan | For all types of transactions: purchase and sale of an apartment, house or child care home |

| Step 2 | Get approval from a credit institution | |

| Step 3 | Together with the seller, draw up the necessary documents for an apartment or house | * |

| Step 4 | The mortgage agreement must be registered with the territorial body of Rosreestr and confirmation of ownership of the property must be obtained Housing must be registered as shared ownership for all family members. | Since 2020, certificates will be replaced by extracts from the Unified State Register of Real Estate |

| Step 5 | The bank transfers the full cost of the property to the seller's account | Down payment + loan amount |

| Step 6 | Obtain a certificate from the bank about the loan debt | Notify the bank of your intention to repay part of the mortgage early |

| Step 7 | Collect and submit to the Pension Fund a set of documents for disposing of funds under the maternal certificate | Without waiting until the child is three years old! |

| Step 8 | Wait 30 days required by the Pension Fund to consider the application | |

| Step 9 | After the application is approved by the Pension Fund, within 10 working days the amount on the certificate is transferred to the bank as repayment of the principal debt on the mortgage. | Matcap can be used to repay only a housing loan |

| Step 10 | You should contact the bank for a new payment schedule, taking into account the reduction in the principal loan debt, and continue to pay the mortgage, but with a reduced monthly payment, or a shortened period for full repayment of the loan. | It is important to avoid delays and make mandatory loan payments strictly on schedule - otherwise your credit history will be damaged. |

*

List of documents for the purchase and sale of an apartment

— Homeowner’s passport

— Documents confirming the basis for the emergence of property rights to housing.

— Certificate of ownership. Cadastral passport of the apartment.

— Technical data sheet and explication.

— Certificate from the tax service confirming that there are no tax arrears.

— Certificates from housing and communal services and management companies about the absence of debt on utility bills.

— Statement of the apartment’s personal account.

— Extract from the house register.

— Extract from the Unified State Register.

— Consent of the spouse to the transaction, certified by a notary.

— Consent of guardians and guardianship authorities to the transaction.

Buying ready-made housing

This program is in great demand among young families. It has the following key characteristics:

- The loan is provided in Russian currency;

- The loan is issued for a long term (up to 30 years);

- The minimum loan size is 300,000 rubles;

- Mortgage interest rates start at 8.6% per annum;

- The loan is provided in a single payment or in installments;

- The collateral for the loan can be the apartment or other residential property being financed.

Purchasing a new residential property should not worsen the quality of life of children. The terms of the loan program allow for the involvement of co-borrowers. The mortgage loan is repaid in equal installments. Applicants who have a stable financial situation and official employment can receive a loan. The borrower can return part of the interest paid on the mortgage. To do this, he should apply for a property deduction. The maximum amount that the budget can reimburse is 260,000 rubles. Information about property deductions can be found on the Federal Tax Service portal.

List of documents for repaying a mortgage with maternity capital

The list of documents for repaying a mortgage with maternity capital can be divided into two subcategories:

- Papers required to apply to the Pension Fund.

- Papers for obtaining a loan.

Applying to the Pension Fund is the main step in using the payment. If the Pension Fund refuses, then further cooperation with the creditor will be impossible. The result of the application depends on the completeness of the documents and their accuracy.

Before submitting an application to the Pension Fund, you need to contact the bank and obtain pre-approval for the loan. After receiving a positive decision, provide loan documents to the Pension Fund. If the loan has already been issued, then you need to obtain a certificate from the bank about the balance of the debt. It is free and issued on the day of application.

Documents that the Pension Fund will require to repay the mortgage with maternity capital:

- state certificate;

- passport of the certificate holder;

- a lending agreement between a borrower and a lender. If the agreement has not yet been signed, then a preliminary agreement or other papers confirming loan payments;

- certificate of debt balance on the credit account;

- documents confirming registration of marriage/divorce;

- certificates confirming the birth of children. Submitted for all minor children;

- the applicant's obligation that after registration of ownership the housing will be distributed in equal shares among all members of the children;

- statement.

Please note: the owner of the certificate must contact the PF. If an authorized person applies, he must have a power of attorney certified by a notary.

Regarding the question of what documents are needed to repay a mortgage from a bank, everything is simple. The bank doesn't care who closes the account. The PF will independently transfer the funds using the specified details.

Purchase of housing under construction

The program allows you to buy an apartment or a room in a new house from a developer accredited by Sberbank (the client can study the offers of construction companies on the portal domclick.ru). The borrower can also purchase living space under a DDU agreement.

Lending terms:

- The loan is issued in rubles;

- The maximum loan volume depends on the estimated value of the collateral apartment (no more than 85% of the market price of the loaned premises);

- The loan amount cannot be less than 300,000 rubles;

- The maximum duration of the loan agreement is thirty years (12 years if the interest rate is financed by a construction company);

- The amount of the first payment cannot be less than 15% of the price of the premises being financed (if the client has not provided a work book and a certificate in Form 2-NDFL, then the amount of the first payment increases to 50%);

- The loan rate starts at 7.4% per annum (the borrower who has life insurance receives a discount).

Mortgages can be obtained by applicants over the age of 21 who have a permanent job. The spouse of a citizen who has taken out a loan to purchase a house under construction automatically becomes a co-borrower (unless the marriage agreement provides for another form of disposal of joint financial obligations).

Legislative norms

The Russian government plans to provide mortgage subsidies until 2021. The authorities want to expand the list of purposes for which maternity capital can be spent. Young families will be able to transfer maternity capital funds to pay for kindergarten services after the child turns two years old. In June 2020, officials passed a resolution allowing federal money to be used to refinance mortgages. The corresponding decree was signed by Russian Prime Minister Dmitry Medvedev.

Parents with low income will be able to receive monthly payments from MK. The Pension Fund plans to introduce a special hardware and software complex that will issue electronic certificates. An applicant who wants to use budget subsidies will have to install an application on his smartphone that allows him to complete paperwork remotely.

What is maternity capital and how can it be managed?

First, let's understand the concept of maternal capital. The essence of this concept is expressed in two components:

- As a way of government support for families with two or more children

- Maternity capital as a way to improve the demographic situation in Russia

Given that the state program aims to strengthen and improve the quality of life of families, the possible ways to use the amount of money allocated by the state are limited.

[offerIp]

Maternity capital can be used in the following ways:

- Using maternity capital funds to purchase or build your own housing

- Transfer the amount to the Pension Fund so that the mother’s pension will increase in the future

- Pay for educational services for any child in the family

- Pay for services or purchase means for rehabilitation and adaptation to the everyday life of disabled children

As you understand, the first method is most in demand. Thus, you can legally use maternity capital funds to purchase your own home in two ways:

- By direct purchase of real estate

- By taking out a mortgage loan

If you opted for the second option, then the amount of maternity capital can be used to pay for an already issued housing loan (mortgage), or used as a down payment amount when concluding a transaction. You should know that you do not need to wait until your child reaches 3 years of age, since you have the right to use maternity capital funds without any problems immediately after it is received.

We would like to draw your attention to the fact that it is established at the legislative level that family capital funds can only be used for non-cash payments - it is impossible to receive cash in your hands. The state made this decision to control the intended use of the allocated amount of money. Therefore, if you plan to use maternity capital funds when purchasing or constructing your own real estate, you need to contact the Pension Fund of Russia and write a corresponding application.

Maternity capital in a mortgage. How the rules of the game change:

Despite the strict rules established by law, there are exceptions. For example, if a family decides to build a house according to its own design, then half of the maternity capital can be received into a current account opened in a bank even before the start of construction. To receive the second part of the family capital, you should contact the Pension Fund (this is possible no earlier than the next six months from the date of transfer of the first part of the maternity capital) with a package of documents and an application. Documents must confirm the cost of the work performed. For example, these could be certificates of work performed (erecting the walls of a building, pouring the foundation, installing a roof, etc.) and agreements with contractors.

Local (regional) maternity capital

Each subject of the Russian Federation has its own regional program to support mothers of many children (regional MK). Local subsidies differ from federal ones in terms of payment, registration and use (local MK is usually paid at the birth of the third child). Local subsidies can be used to purchase an apartment, build a house, pay off mortgage interest, and renovate an apartment. The scope of regional MC varies depending on the region and the policies of local authorities.

How to avoid becoming a victim of scammers?

The recipient of budget subsidies must remember that cashing out government funds will lead to a violation of the law. In Russia, criminal cases related to the misuse of subventions are constantly being initiated. You cannot succumb to the temptation of easy money and use the services of dubious citizens who offer to cash out government subsidies. Also, do not contact real estate agencies offering to purchase living space at an inflated price.

Criminals often take advantage of the legal illiteracy of the population, offering certificate holders to receive “real money”. Pseudo-lawyers ask for a “deposit” for their services. After a person gives money to scammers, he is asked to wait one month. During this time, the criminals promise to settle all “legal issues” and cash out the budget subsidy. The victim who paid the “commission” will never receive the promised amount. A deceived citizen will not go to court, as he understands the illegality of such “financial services.”

Citizens who use maternity capital funds to buy out real estate from their relatives are putting not only themselves, but also their loved ones, at risk. This action can be qualified as fraud committed as part of an organized criminal group. Operations with MK should be carried out only within the legal framework.