What is the down payment amount?

Until the 2008 crisis, mortgage clients of banks could count on receiving a home loan without a down payment. After economic instability, it turned out that most borrowers who could not meet financial obligations took out a mortgage without a down payment. Based on this fact, many large Russian banks abandoned mortgage loan programs without a down payment.

The amount of the down payment is determined by the cost of the purchased home. The down payment, in essence, is a payment for part of the total price of the purchased property. These funds are deposited into the bank's cash desk during the mortgage process. The remaining amount is issued to the borrower as a loan for the purchase of real estate. The mortgage client of the bank undertakes to repay these funds throughout the life of the loan in accordance with the established payment schedule.

Today, leading banks offer their clients mortgage lending with a down payment of 10-30% of the value of the mortgaged property. Experts believe that the best option for the client and the lender is an amount of 30% of the apartment price. Loans with a down payment below 10% are rarely issued, since in this case the bank does not receive sufficient guarantees for the client’s continued solvency. Interestingly, if the down payment exceeds 50%, credit institutions are also reluctant to cooperate, since interest can only be charged on the remaining loan amount. Accordingly, the bank’s income in this case is significantly reduced in comparison with options when the first mortgage payment on an apartment is 20-30%.

Requirements for the borrower

To take out a mortgage with a down payment of 10 percent, you need to meet the requirements set by the bank, and they are more stringent compared to standard loans.

The list of general requirements includes:

- the borrower’s income must exceed the monthly loan payments by at least 2, and in some cases 2.5 times;

- the borrower must document his income (documents other than 2-NDFL are often not accepted);

- age restrictions range from 18-65 years;

- citizenship is mandatory;

- The length of service at the last place of work must be at least six months.

The banking organization is interested in the borrower's conscientious and regular repayment of the mortgage loan. The lower the down payment for mortgage lending, the larger the remaining loan balance, and in this case, the risk of non-payment of the loan by the client for the bank is higher.

A mortgage program with a down payment of 10% is a rather rare product and is not available in all banks. For many consumers, this mortgage option remains the only chance to purchase their own home, which is why these loans are highly popular. With accurate calculations and proper financial planning, this lending scheme can be quite comfortable and effective.

Down payment functions

Non-targeted consumer loans are issued without a down payment. In this regard, many borrowers have questions about why a down payment is needed when applying for a mortgage. There are several answers to this question.

The down payment has the following impact on the loan program:

- Changes the amount of the mortgage loan - the larger the down payment, the lower the loan amount that the client will have to pay over the life of the mortgage. Accordingly, the overpayment decreases proportionally as the down payment increases;

- Affects the interest rate - most credit institutions are ready to reduce the interest rate as the amount of the down payment on the loan increases;

- Reduces insurance costs - due to the fact that when applying for a mortgage, the borrower will have to take out insurance for real estate, and sometimes for life, health and title of the home, the level of insurance costs should be taken into account. The amount of insurance depends on the loan amount. The larger the down payment, the lower the remaining amount of the debt and the lower the insurance payment on it.

- Confirms the client’s reliability – the presence of a certain amount of money in the form of one’s own personal savings acts as confirmation of the client’s solvency for the bank. Accordingly, if the borrower has the opportunity to contribute 30% of the cost of the purchased property, the likelihood of approval of the application for approval of a mortgage loan increases significantly.

- Provides an opportunity to get a loan for clients with a bad credit history - in some cases, if the borrower is willing to pay most of the cost of housing in the form of a down payment, the bank may turn a blind eye to some negative aspects of the credit history. This point is at the discretion of the lender.

In connection with the above, before purchasing a home with a mortgage, experts recommend thinking about accumulating a certain amount of funds.

Where can I get the down payment?

- Personal savings . Quite often, a person hesitates for a long time to apply for a mortgage, trying to save up for his own home on his own. If this fails over a period of time, a certain amount of cash accumulates, which can be used as a down payment on a mortgage. This option is suitable for those borrowers who have a certain amount of money that is insufficient to pay the full cost of the property. To make it easier for the borrower to accumulate the required amount, some banks offer special mortgage deposits.

- Sale of existing real estate . If a person already has an apartment or house, but wants to improve his living conditions, he can sell his old property and make a down payment on a mortgage for a new home. Such transactions in the Russian credit market are called alternative. This option is also very beneficial for those who have commercial real estate that has no use.

- Applying for a consumer loan . Sometimes, not having his own funds to make a down payment on a loan, the borrower decides to take this money from a bank or microfinance organization. Experts in the field of lending consider this decision to be extremely unfortunate, since in this case the borrower is subject to a double credit burden. Over a certain period of time, a bank client will have to repay two loans at once. At the same time, interest and overpayment on a consumer loan will be significantly higher than on a mortgage loan.

Some categories of borrowers can count on preferential conditions for making a down payment. State mortgage lending programs provide assistance to certain categories of borrowers, including by making a down payment.

- “Maternity capital” is a state assistance program designed for families with two or more minor children. According to current legislation, a citizen who has the right to receive maternity capital can use it, including to improve housing conditions by purchasing real estate with a mortgage. The state program allows for the possibility of using a maternity capital certificate as a down payment on a mortgage. The only condition and limitation is that before this, maternity capital funds should not be used even partially. If the borrower intends to use maternity capital funds to pay the first installment on a mortgage loan, he must understand that the funds will arrive in the bank account only several months after submitting a corresponding request to the pension fund branch.

- “Military Mortgage” - this state support program is aimed at providing housing for military personnel. The program assumes that upon enlistment, an individual savings account is opened for a serviceman. Throughout the entire period of service in the Armed Forces, annual cash receipts are credited to the program participant’s account. Three years after joining the program, the participant can use the savings portion of the military mortgage to pay the down payment on the loan.

Some banks agree to accept additional collateral as part of the down payment.

Pros and cons of a large down payment

There are many benefits to making a large down payment on your mortgage. A fairly significant down payment on a mortgage significantly increases the bank’s loyalty to the borrower. The argument of the client’s high solvency is quite convincing for the bank, which in most cases makes a positive decision to issue a mortgage. Also, many banks, when making a large down payment, significantly reduce the overall mortgage rate.

The downside of making a large initial payment is the possibility of losing a significant part of your finances during the possible sale of an apartment that is pledged to the bank. If difficulties arise in paying the mortgage, the bank will be forced to sell the mortgaged property.

At the same time, it is important for the financial institution to return the total amount of the mortgage debt as quickly as possible.

Therefore, if there is a large down payment, a banking organization can sell the collateral at a reduced price - in this case, the borrower will not be able to receive even part of the down payment, which will be completely used to pay off the mortgage debt.

What does the law say?

Issues of mortgage lending are regulated at the legislative level through the Federal Law “On Mortgage (Pledge of Real Estate)” dated July 16, 1998 N 102-FZ. This legislation regulates all the main aspects of mortgage lending, without specifying any restrictions on making a down payment. This means that setting the minimum level of the down payment on the loan is left to the discretion of the credit institution.

Some banks are now ready to provide mortgages without a down payment, but this fact has a significant impact on the interest rate on the loan.

At what stage of the mortgage process is the down payment made?

Most banks, even at the stage of collecting documents for approving a mortgage application, require the potential borrower to provide, among other things, documents confirming the availability of funds necessary to make a down payment. The funds themselves must arrive at the account of the lender (bank) immediately before signing the mortgage agreement. If the borrower actually contributes less than the amount stipulated in the terms of the loan agreement, the application may be revised.

When purchasing an apartment with a mortgage with a down payment, the client can deposit funds either by bank transfer or by paying the agreed amount directly to the bank’s cash desk.

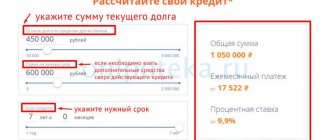

Mortgage calculator.

Let's sum it up

Before buying apartments with a mortgage with a minimum payment, it is worth considering the general conclusions:

- If it is not possible to make a down payment of more than 10%, then do not neglect this chance to get your own home .

- The more you can pay with your own funds , the less interest you will need to overpay to the bank.

- With a small contribution you can only win if you take advantage of the state benefit .

- A 10% down payment is considered a risky method of registration, but this does not mean that it is not allowed by the bank.

Each borrower must decide for himself whether it is better for him to borrow the entire amount or use his savings funds to the maximum. The risks of a small down payment are actually present for both the bank and the client.

Credit offers from leading Russian banks

Depending on how much the potential borrower has to make a down payment, banks are ready to change the terms of the loan, in particular the mortgage interest rate. Let's consider the conditions of the largest Russian banks regarding the down payment.

| Bank | Minimum down payment | Features of making a down payment on a mortgage |

| Sberbank | 20% | The vast majority of Sberbank's mortgage programs set the minimum down payment at 20%. This means that if the estimated value of the property is 4 million rubles, you will have to make at least 800 thousand rubles as a down payment. Only participants in the federal program “Young Family” can count on reducing this figure to 15%. The interest rate depends on the amount of the down payment. If the down payment on the loan is between 20% and 30%, the interest rate will be 13%. If from 30% to 50%, the rate is reduced to 12.75%. If the borrower is ready to pay more than half the cost of the property when drawing up a mortgage agreement, the interest rate can be reduced to 12.5%. The example is given taking into account the same loan term of 10 years. If a mortgage is taken out to build a house, the minimum contribution will be 30% of the construction estimate. |

| VTB 24 | 15% | You can get a mortgage from VTB24 Bank with a minimum down payment of 15%. This feature is not available in all regions. For residents of the Vladimir, Chelyabinsk, Kemerovo and Ivanovo regions, the minimum down payment is 20%. Mortgages at VTB24 are issued for a period of up to 30 years. If the borrower chooses the “Mortgage on two documents” loan offer, the minimum down payment amount will be 50% of the appraised value of the home. The amount of the down payment on a mortgage for a secondary home does not differ from the conditions when purchasing an apartment in a new building. |

| Deltabank | 15% | DeltaCredit Bank is ready to provide borrowers with a mortgage if the client has at least 15% of the cost of the purchased property. The interest rate in this credit institution is also very attractive for clients and is 12% per annum. Moreover, if a potential borrower is ready to pay more than half of the cost of housing in the form of a down payment, the interest rate on the loan can be reduced to 11.5%. |

| AHML | 20% | The Agency for Housing Mortgage Lending (AHML) offers borrowers to take out a mortgage for an apartment in a new building or on the secondary real estate market at 12% per annum. The minimum down payment amount is always 20% of the appraised value of the selected home. |

| Rosselkhoz Bank | 15% | The minimum down payment on mortgage loans at Rosselkhozbank is 15%. If real estate is purchased on the primary market (in a new building), this amount should be more than 20% of the price of the apartment. If a bank client takes out a mortgage to purchase luxury apartments or a large private house, the bank will require a down payment of at least 30% of the cost of the expensive property. The maximum life of the mortgage will be 30 years. |