Many people dream of their own cozy apartment, but given the current situation in the country, not everyone will be able to purchase a home without first saving up money or taking out a loan. For most Russian families, the main reasons for the impossibility of making a home purchase are the price level, low wages (especially in the regions), as well as legal difficulties in obtaining documents.

Practice shows that you can buy a home without resorting to borrowed funds from banking institutions. There are many proven ways to earn money for an apartment without a mortgage and where to get money to realize your dreams.

Basic aspects of saving money

Not all people can save money. This ability is directly related to the ability to organize your life and self-discipline. There is nothing complicated in the process of saving money; you just need to systematically save part of your income and not spend it.

Before you start saving money, a person should answer two questions. Firstly, what is the purpose of accumulating funds (in this case it is quite clear - it is buying an apartment). Secondly, how to do it correctly so as not to limit yourself and at the same time get tangible results.

Problems

In the process of saving, most people face some problems.

Main difficulties:

- Storage risks. The safest way to store money is in a bank, although even in this case there is a chance of losing your deposit, but it is extremely insignificant. You can spread your money among several reliable banking institutions so as not to exceed the guaranteed minimum.

- Inflation risks. Inflation can reduce investment returns. This is why many people think about investing. But even in this case, the risks even increase (there is no guarantee that the price of the invested product will not fall in the future).

- Psychological errors. Some people adhere to the tactic of saving the money remaining after a large number of “mandatory” expenses. This shouldn’t happen, you need to save money right away, it shouldn’t be a huge amount, 5-10 percent is enough if there is a strong need for money at the moment.

- Disruption and waste of accumulated funds. In this case, it is impossible to get closer to achieving your goal. Money must be safe and sound, except for serious problems (for example, health-related).

- Deterioration in quality of life. You shouldn’t go to extremes and save most of your income. You should stick to the golden mean - set aside some acceptable percentage, distributing funds so that part is saved for the medium term, and the rest as a strategic reserve.

Goals and priorities: correct formulations and working with resources

The formulation of a goal like: “to save at least some amount for any housing” is incorrect. It is important to clearly understand what kind of apartment you need to buy, how much it costs at the moment, in what realistic time frame you can collect this amount, and what the expected percentage of inflation may be during this time.

Of course, the market can bring surprises, and housing can either become cheaper or more expensive, but with systematic savings and analysis of price dynamics, this aspect can also be kept under control.

A good way is to “gradually” purchase the desired apartment.

That is, first a room in a communal apartment or a small one is purchased, then a one-room apartment on the outskirts of the city or even in the suburbs, then more comfortable housing. Of course, this approach involves periodic moving, but the dream will quickly take on real shape.

It is necessary to soberly assess the current financial situation, assessing all cash receipts and expenses, finding both ways to increase income and opportunities for painless savings. If the income is not regular, and sometimes there is a lot of money, sometimes not enough, it is worth setting aside a percentage of each income, and taking the average monthly figure for calculations.

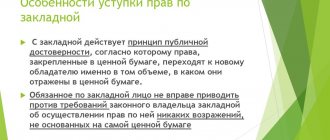

All expenses must be carefully recorded, purchases must be planned, current inevitable payments must be made in a timely manner to avoid fines and hassle. All figures and calculations regarding the purchase of an apartment, plans to increase income must certainly be outlined on paper or in a computer file. It is important to constantly monitor three personal financial indicators:

- monthly amounts received;

- deferred money;

- the total amount of accumulated funds.

This is important from both an economic and psychological point of view. Having an approximate idea of the required amount means pretending that you are saving for an apartment. Periodic review and analysis of numbers, among other things, creates very strong motivation, which periodically weakens along the long path to the goal.

Possibilities

Saving money to buy an apartment on your own has several advantages.

Advantages:

- To apply for a mortgage, you must make a down payment. Self-saving allows you to make a purchase any time you want.

- A mortgage loan is not suitable for everyone, because you will have to pay a certain amount to the bank every month. The bank does not care about financial problems at all (you can get a deferment only in the most severe cases, for example, dismissal from work, and after providing certificates). There are no risks when saving on your own; you can save as much as possible in a given period of time.

- In case of serious problems, there is initial capital, the so-called safety stock.

- By cutting down some expenses, you can save up for an apartment quickly enough without overpaying interest to the bank.

- The process of accumulation makes a person more organized and disciplined, allowing him to move towards his goal step by step.

Five options to buy an apartment without a mortgage

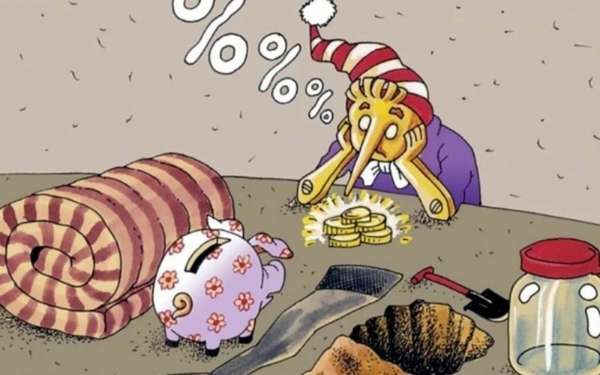

If there is an urgent need to purchase housing on such terms, if you have an average income, you cannot rush. You will always have time to get yourself into a bad situation for 25–30 years by signing a loan agreement. Psychologists say that such a debt pit is reminiscent of serfdom in its emotional content. A person wraps himself in the chains of slavery, wanting to instantly achieve material benefits.

Living on the “patrimony”, the borrower must buy back his home every day with hard work. Buying with a loan is selling your future, because everyone in your head will be thinking about paying the required amount by a certain date.

It is much easier to assess your own needs and find a solution to the problem without the help of a bank. Advertising tries to convince that taking out a mortgage is profitable. They constantly explain to us the necessity of an increase in the cost of housing, the depreciation of money. Sometimes the thought arises that you will have to pay mere pennies. All this is thoughtful marketing leading to financial enslavement.

Analyzing reality using the examples of the last 10 years, one can see that prices for housing stock on average in the Russian Federation have remained at the same level, and even tend to decline. The reason for this phenomenon is due to the following factors:

- Low purchasing power of citizens;

- Increased competition in the field of construction;

- Constant increase in consumer prices.

All this leads to the fact that the average social class of the population is no longer able to buy housing even with the help of credit products.

Let's look at one example of the real estate market in the Irkutsk region. In 2000, a one-room apartment there was valued at 2,500,000 rubles. But now similar housing is already offered for 1,500,000, they even offer discounts of 200,000 and organize all kinds of promotions.

The salary level in Russia remains similar to what it was 7–8 years ago. A monthly income of 20,000 is considered the norm. Only in Moscow there are high rates. Even in the Northern capital, only specialists with higher education can receive a salary of 30,000 rubles.

Summing up, we can say that having taken out a mortgage, you will have to pay off 10 years later, having the same income of 20,000 monthly, but you will need to spend more on food and utilities. The level of official inflation will remain virtually unchanged.

With mass layoffs due to economic crises that regularly occur every 2-3 years, it is easy to imagine a future existence a couple of decades into the future. How to change the situation and what it is advisable to do:

- Making a profitable purchase in big cities is not so easy.

- During this period, we will have to abandon the “comfort zone” (it is different for each family: living together with parents, living in communal apartments, renting housing).

- You will need to look for additional income that will improve the family’s situation and allow you to pay off your mortgage faster.

- Use the methods of earning money described below to pay off your debt.

Method No. 1. Conclude a lifelong maintenance or annuity agreement

One option for purchasing housing is caring for a single elderly person. To do this, you need to enter into an agreement with him so that after his death the property becomes yours. The lifelong maintenance agreement includes the following responsibilities on the part of the housing applicant:

- Providing the elderly with proper care;

- Providing people with good nutrition;

- Provision of medical services.

The rental agreement also obliges the caregiver to pay the landlord a monthly allowance. Then you are not obligated to take care of the old man. Despite the fact that this is one of the most attractive ways to get housing from an elderly person for free, there may also be pitfalls here:

- The ward can always terminate the contract if he is not satisfied with your content.

- The owner of the home can live quite a long time. In this case, it will be more profitable to decide to save money to buy an apartment.

- Caring for a stranger requires a lot of endurance and patience from you.

- His distant relatives may show up from the outside and also apply for housing without a mortgage. Then there will be a need to defend your rights in court.

Look at the same topic: How to get a mortgage from Surgutneftegazbank in [y] year? Terms of mortgage programs and bank rates

This method is recommended for those who are confident in the adequacy of the pensioner, the absence of loved ones and their self-control. It is advisable to draw up a rental agreement with a lawyer and have it notarized.

Method No. 2. Borrow money for an apartment from relatives or friends

If your relatives have some savings and therefore want to help you in this situation, then this is a good solution. It will help you purchase a home without incurring loan obligations.

Advantages of this method:

- The ability to repay debt in installments over a long period of time;

- No interest.

To purchase real estate without a mortgage using funds from relatives, it is advisable to write them a receipt indicating the following information:

- Passport details of the lender and the person borrowing funds;

- For what period is the loan intended?

- Amount borrowed;

- Loan repayment schedule (there are different options here - monthly repayment or repayment of the entire debt after the due date);

- Borrower's signature and date.

Method number 3. Sell other property to get an apartment right away, without a mortgage

When your family with children is huddled in a Khrushchev-era building, then it makes sense to sell the apartment at the same time as the dacha in the near Moscow region in order to significantly improve your living conditions. Always remember about state social support for families with children.

To buy a home without getting into banking bondage, you can use maternity capital by adding your money to it. But be sure to take into account some features:

- The benefit amount in 2020 was 453,026 rubles;

- Only families who have had a second and subsequent children can receive such assistance;

- You cannot use maternity capital until the child is 3 years old;

- No amount of cash is given to purchase an apartment without a mortgage (young families are given only a special certificate).

This paper must be presented during the process of completing a real estate purchase and sale transaction so that the state can transfer the specified amount for you. More information about the use of maternity capital can be obtained from the nearest social security office.

Method number 4. Buy real estate in installments in a house under construction

The cheapest way to start buying a home without a mortgage is at the foundation pit stage. Many developers offer to make a down payment of 25–40% of the cost of the proposed housing, and pay off the rest in installments until the property is put into operation.

The cost of the apartment is indicated in the purchase and sale agreement or the shareholder’s participation in shared construction. After this, the citizen ceases to worry about any fluctuations in the cost of housing.

When using this method, you cannot make a mistake in choosing a developer. To do this, it is advisable to read reviews on the Internet, look at the official website of the construction company, and talk to those who have already completed similar activities with this developer. It is necessary to make sure that there are no significant claims regarding the timing of construction completion or the quality of finishing work.

Method No. 5. You can buy an apartment without a mortgage by saving up for it

Financial analysts focus on the fact that if adults with average earnings buy housing (a two-room apartment) in region 2, they will have to put aside 40% of the monthly salary and save it for 5–10 years. You will need to simultaneously limit yourself in food, rest, shopping and paying for certain services.

In this matter, everything will depend on the region where the property is located and the area of the desired housing. However, purchasing real estate through this option is still more profitable than taking out a mortgage loan.

Actionable tips

People often wonder where to get money for an apartment and how to save correctly. To avoid saving for housing for many decades, you should cut down on spending. The effect will be obvious. Just be patient a little, limiting your expenses, and you can become a happy owner of an apartment.

Most of the budget is spent on little things that most often are not even needed by a person. Over the course of six months or a year, quite large sums are obtained that could go into the “piggy bank”. By eliminating unnecessary expenses, you can increase your family budget by 30% per year.

Keeping daily records

It is important not only to record daily records of income and expenses, but also to analyze and optimize them. Cost analysis will help you avoid them in the future.

This also works in relation to income, only in the opposite direction. By analyzing your income, you can identify the main source of money, which will help you increase your earnings by making great efforts in the right direction. To achieve the goal, maintaining personal cash records is a prerequisite. When a person approaches purchases consciously, his expenses are significantly reduced.

Setting a goal

Don't set unrealistic or abstract goals. The required final result must be formulated in quantitative units.

To achieve the greatest effect, the overall goal should be divided into the expected result (the cost of the apartment) and the tasks (the part of the income that will be postponed every month).

Rejection of bad habits

Saving money helps to give up bad habits, in particular alcohol and tobacco. It’s easy to understand how expensive this area is; just calculate how much money you spend on cigarettes a week or a bottle of beer every day.

This seriously increases budget costs, not to mention the harmful effects on the body. If you can’t completely get rid of bad habits, it makes sense to reduce your dependence on them and spend money on such products as little as possible.

Refusal of entertainment activities

This point does not imply a refusal to have fun. After all, man is a social being, and he requires emotional rest and interaction with society.

Not everyone is ready to sit at home in front of the TV or computer and feel comfortable alone. However, going to clubs, bars, restaurants and cinemas is an expensive undertaking. To save money, it is recommended to reduce expenses on such pastimes and find an alternative: going out with friends, meeting at home, or free events organized by establishments in your city.

Spending control

Planning and controlling spending is an important aspect when saving money. By distributing costs over time and size, you can avoid difficult situations when some costs overlap with others. By controlling your expenses, a person will be able to get rid of most rash actions.

Reducing personal expenses

A good saving habit is to not go shopping without a list. This applies not only to grocery stores, as is commonly believed.

Without notes, a person is susceptible to spontaneous acquisitions of completely unnecessary goods. It is advisable to include prices in the list and take 5-10% more money with you than the total amount. This will help you avoid unnecessary purchases, because there simply won’t be any cash left for them.

Phone assistant

There are applications in which you just need to enter your expenses and income, and if you do this in a timely manner, you can easily track how much is spent on each item.

There are a lot of such programs, everyone can choose their own, taking into account individual requirements (simplicity of the interface, availability of additional functions, design and convenience). In addition, you can use various applications to search for discounts and promotions.

Saving on rent

To save on rent, you can rent an apartment together with someone, while dividing the rent into equal parts. Apartments in Khrushchev-era buildings and residential areas are cheaper than in the city center. Unfurnished housing is also available for lower rent. If you already have all the necessary items, you can import them and take them with you when you move.

It is rare, but there is a way to reimburse the cost of rent by bartering for a service. For example, some elderly owners allow boarders for a nominal price in exchange for help around the house.

Housing and communal services

New technologies allow you to save up to 30 percent or more on utility bills (LED lamps, water pressure regulators, etc.). Investing in such devices will pay off in the future.

It is also very important to accustom yourself and family members to conscious consumption of electricity, water and gas. Do not turn on appliances unless necessary.

No debts or loans

You can take out a loan or borrow money from friends only in emergency situations. Usually, a spontaneous desire to buy something erases from the mind the awareness that money will need to be given back in the future (in the case of banks, with high interest rates). Such situations will not bring a person closer to buying an apartment.

Where and how to store money

It is better to store savings in a place where it is impossible to withdraw funds quickly. For example, a bank deposit with a favorable interest rate and the possibility of replenishment. In case of early withdrawal, the client loses accumulated interest and possible profits.

When choosing a bank, you should take into account various nuances; it is important to increase capital, and not leave it unchanged. Before opening a deposit, you should analyze the ratings of financial institutions and the conditions under which they provide their services. Keeping money at home is not the most rational solution. Firstly, this is a fairly large amount, and secondly, there is no deterrent at home, and a person can easily spend the accumulated amount.

Purchasing minimum affordable housing

Some people prefer to buy an apartment that is available to them now or in the near future.

And after purchasing there are two options:

- Rent out an apartment (and, receiving money from tenants, save for a new apartment).

- Live in it, while saving for more suitable housing (after the sale - combine the money from the sale and your own funds).

Those who are included in a special category of citizens (young professionals, young families, military personnel, young scientists) can participate in the state housing programs “Affordable Housing” (loan from the state).

Setting a new goal

At any stage of accumulation, some events may occur that will change the current situation. Depending on various factors, the goal must be flexible and adapt to new conditions.

If your income level has decreased, you need to adjust the amount of the monthly amount you set aside, and vice versa. If you successfully complete a task, you should encourage yourself, then the motivation to save will not disappear and will not be perceived negatively.

Top 10 tips from experts on how to save for an apartment

In order to acquire the required amount of money, you must try to live out the period required for accumulation as comfortably as possible. Experts advise taking the following steps to ease your worldview and strengthen your financial condition.

Get organized

Develop your personal resource in order to increase your own effectiveness. This includes:

- time management

- cost control

- improved workflow efficiency

These skills help not only in financial but also in personal growth.

Goal setting

It is necessary to exclude everything unimportant and focus on the main goal.

Get rid of destructive personality traits that prevent you from achieving your goal

What you can get rid of:

- from bad habits.

- from uncertainty and pessimism.

Among other things, it saves money.

Developing your physical and mental skills

This will be facilitated by:

- daily exercise and regular exercise.

- systematic development of cognitive abilities through reading.

A healthy body means a healthy mind. Excellent human condition contributes to success and this is a very important factor.

Planning your income and expenses

Strict economic discipline

- home accounting.

- You must save the planned amount each month.

- reduction of expenditure items.

Stop spending money on unnecessary things

If you make a list of the things you need before going to the store, your shopping will take place without incidents or unforeseen expenses.

Increasing the level of psychological independence

- Insecure people depend on the opinions of others and are forced to buy meaningless things in order to fit into society.

- Not everyone can keep to themselves the information that they are saving for an apartment: words spoken by envious people can significantly shake a person’s confidence, or even turn him away from his goal.

More activity - less laziness

Smartphones and other gadgets take up a lot of time for frivolous activities.

Additional earnings on the Internet

- “Youtube” is a popular video hosting that brings in money: it is necessary to interest the public in the videos posted on the channel, the income after a year of the startup is from 15,000 rubles.

- The social network Instagram also begins to generate income for its owner already with 10,000 subscribers.

- Freelancing, in demand: designers, copywriters, programmers, SEO - optimizers, administrators.

- Investment.

Shlomo Benartzi's principle

The famous economist Shlomo Benartzi created a standard model of human behavior. It showed that people are not used to reducing their expenses and denying themselves the usual things. To get rid of this problem, Shlomo suggests collecting money according to the “more tomorrow” scheme. The idea is to gradually increase investments (for example, first save 3% of your monthly income, and then save more). The period during which the accumulation part will grow depends on the person and his goal.

Naturally, it will not be possible to increase the share indefinitely. Gradually, a maximum will be reached that will be most comfortable. The economist believes that money should be saved on a residual basis. If your personal income increases, it makes sense to transfer the difference between your current and previous salary into savings.

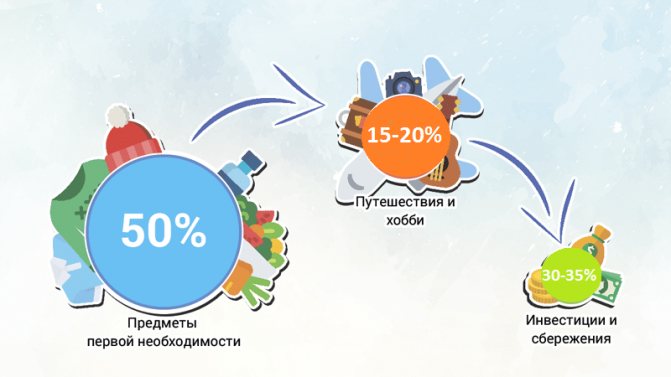

Fraction method 50/20/30

This method is more popular and easier than the previous one, and is based on rationalizing the division of income.

All monthly income received should be divided into 3 groups:

- 50% - for mandatory expenses (housing and communal services, food, tuition, medicine, communications and the Internet),

- 30-35% is the part set aside for accumulation,

- 15-20% - money for entertainment (shopping, cafes, meeting with friends).

This method helps you realize that the important part is future savings, but this does not mean that you need to forget about current expenses and save on yourself without allowing any additional expenses.

Additional income: where to get it?

“If you want an apartment, know how to move around!”

- Those who managed to save up for at least their first home paraphrased the well-known saying approximately this way. Most people have opportunities for additional income; the main thing is to understand in which direction to move.

A good way is to write down all the options that come to mind and immediately implement at least one of them. As practice shows, part-time work in the evenings, for example, translations, private consulting, and even washing neighbors' windows or walking dogs, can eventually turn into a fairly profitable business.

At the same time, you should beware of dubious offers, especially if new activities require some kind of contribution.

In search of additional income, it is worth risking only your time for a certain period, but not your hard-earned money. The amount set aside for an apartment must be inviolable, and this is the most important rule.

In addition, regularity is important when saving money. If at any time there is a hole in the budget, you still need to try to set aside some amount, even at the cost of effort for one more additional income.

It is important to remember that income can be either active or passive, and the latter is more profitable, since you do not have to spend valuable resources (time, effort) to maintain the process. For example, if you create a valuable intellectual product and put it up for sale, all that remains is to periodically receive money. You can qualitatively reconsider your own resources and make them profitable. For example, if a car is not a tool for earning money, but a means of transportation, you can rent it out for a while, “transferring” to more economical public transport.

How much should you save?

There is no clear answer to this question. You need to save as much as your personal income allows - in accordance with the salary received and other money received, minus payment of mandatory payments and additional expenses. Monthly savings may change over time based on changes in income. The optimal option is considered to be up to 20-30% of the salary.

The speed of achieving the goal depends on the size of the monthly portion set aside, so all “free money” can also be deposited into the account.

Based on approximate calculations and average incomes and expenses in the capital and remote regions, it will take a young family without high incomes approximately 5-8 years to buy their own home without the help of banks, parents, or private lenders.

Increasing your income

To quickly implement your plans, having a main job, you need to find a part-time job or an alternative source of income. Here you need to find an option that is more acceptable to a particular person.

Some run their own website or blog or run a small business. Finding additional profit increases the buyer's potential, helping to quickly solve the problem of purchasing real estate.

Creating passive income on the Internet

In practice, there are many cases when a website or blog becomes a family business that provides serious income. All that remains is to compare current offers on the Internet market, discover your own niche, take a master class and start doing full-fledged work. Western analysts suggest that people who want to improve their financial situation look around and figure out what else they can offer themselves.

The Internet provides great opportunities for earning additional income. There are a considerable number of copywriting exchanges. If a person has writing talent, a high degree of literacy, or the ability to organize a team of authors, this is an excellent option for improving their financial situation.

Look at the same topic: Is it possible to take out a mortgage on a house with land? Conditions for obtaining a mortgage for the purchase of a house with land

Moreover, this activity does not require spending time on daily trips to work or torturing yourself with hard physical labor. It is enough to engage in this activity in your free time, and use the earnings from it to buy an apartment. Another option is to take out a consumer loan for a home and pay off monthly installments using funds from passive income on the Internet.

Buying an apartment with a mortgage and renting it out

Taking out a mortgage and then paying monthly installments from the proceeds from your rental is a viable option. But it is acceptable only to those who have other real estate in which they can live until the loan is closed. If the apartment you are purchasing is located in an attractive area (near a university), then the likelihood of renting it out will always be high.

Difficulties will only arise if the housing is located far from the center with its developed infrastructure. Then the cost of rent will decrease significantly, and it will be more difficult to cover loan costs in case of unstable leases. The situation is similar with small studio apartments.

They are convenient for students to live in due to the low cost of rent, but a family with a stable income will not settle there for a long time. We cannot ignore the fact that moving tenants into the premises inevitably entails damage to property. To compensate for further costs, it is recommended to include in the contract a requirement to pay an insurance deposit.

Taking into account all such important circumstances, it will be possible to acquire ownership of the premises in 15 years, subject to the permitted early repayment of the loan. The advantage of this option is that rental payments will be a separate source of income, without interfering with the main income and contributing to family prosperity.

Obtaining a mortgage loan secured by existing housing

This method is the optimal solution for people with low income, which is not enough to apply for a loan. If the borrower has his own home with a small area where many people live, or if he needs to change his area of residence, then such real estate can be used as collateral for a loan from the bank.

But there are some restrictions - the apartment should not be under an encumbrance: collateral for other credit obligations, arrest or other restrictions.

Organization of a business with high income

In order to make a profit, you need to go through a complex procedure for registering a business, as well as have initial capital. But in practice, this is just an established belief, and completely groundless.

To register the simplest form of an enterprise - LLC, you need an authorized capital of only 10,000 rubles. Moreover, these costs can be divided among all co-founders of the organization, of which there may be many.

By attracting a large number of co-founders to your business, in the future you will have to depend on their opinions when making decisions. As profitability increases, material claims will appear. To buy a share from someone, you will have to pay more than the initial contribution of the co-owner. It is better to work for yourself and your family than to feed strangers.

What kind of housing to buy

The price range for an apartment depends on the region and the situation on the real estate market. Even within the same city, housing costs vary greatly. For example, a little closer to the center the price will increase; it is also affected by the accessibility of transport, shops, schools, etc.

In the province

Of course, it is easier to calculate your expenses in order to purchase housing in a small town. In addition to the much lower price, this option has many more advantages.

Buying a home in the province has a number of advantages:

- A quiet and measured life is suitable for those people who want to get away from the hustle and bustle. It is difficult to find a secluded place in a metropolis.

- There are no big traffic jams. In big cities, this is an acute problem that is unlikely to be resolved in the near future. In regional settlements there are no such difficulties.

- Difficulties in the social sphere (enrolling in kindergarten, seeing a doctor or obtaining a certificate). Providing free services in densely populated cities is a difficult task, and residents increasingly have to turn to private specialists for help.

- Good ecology. Moscow and other big cities are heavily polluted, and numerous public gardens and parks do nothing to help the situation.

- Availability of parking spaces. It is almost impossible to park a car in Moscow near your home (without additional costs).

- The cost of apartments in regions neighboring metropolitan areas is noticeably decreasing.

In the metropolis

Living in a large city also has its advantages, so it is natural that many people dream of owning their own home in a metropolis.

Advantages of buying such housing:

- Availability of infrastructure (shopping centers, cafes, restaurants, etc.).

- Registration. May have an impact on obtaining a prestigious job, higher social benefits and improved social status.

- In some cases, utilities in the Moscow region are more expensive than in the capital. This is due to low population density and a high level of dilapidated housing.

- Housing stock. New buildings in large cities are distinguished by convenient layout, square footage and accessibility. In addition, with secondary housing, technical problems may arise (repairing pipes, ceilings and wiring), and such apartments are most often made according to a standard design.

- Job. On average, salaries, for example, in the capital are 30-40% higher than in the Moscow region. This is why many Russians go to work in large cities. It’s easier to climb the career ladder and improve your competence here than in a provincial town (of course, don’t forget about professional skills). Moving to a large city increases wealth.

Useful tips

And finally, a couple of tips that will help you realize your dream of owning your own home in the very near future:

Don’t try to buy an apartment on your own, save with like-minded people

Be that as it may, saving the amount necessary to purchase a home on your own is an extremely difficult task. Just think about it: you will need to live somewhere, pay for utilities and food. To make your task easier, write on a piece of paper a list of family and friends whom you completely trust . Choose among them those who find themselves in the same situation as you and have an identical housing problem. Invite them to save for an apartment together with you, setting aside equal shares for the property.

If you divide all payments equally, you can significantly reduce the term of your mortgage loan and live with your partner in a rented apartment. The only difference is that you will pay for your property. As soon as half of the loan is paid, the apartment can be sold and the remaining debt can be repaid using the proceeds. The remaining difference can be divided equally and used as a down payment on a mortgage loan for your own apartment.

If you apply, you need to comply

Unfortunately, nothing falls on your head just like that . To achieve the desired results, you need to work hard , develop and improve yourself. You must understand that any experience and knowledge can subsequently be monetized. A person who does nothing but whine about his salary of 30,000 rubles, of which he has to pay 20,000 monthly for a rented apartment, will never become successful. You need to learn new professions, try to make money in other types of activities, or improve your own qualifications in order to move up the career ladder and earn a higher salary. Take the habit of saving money at the same time, investing it (at least in a bank deposit), and making it work for you. If you don’t like such changes and you’re not ready for them, then all you can do is continue to make ends meet, live in rented apartments and make large purchases exclusively on credit.

Apartment or car

When making a choice between purchasing a car and an apartment, it is worth taking into account some nuances.

The following points need to be considered:

- Purchase as an investment object. The car is not suitable for such purposes; only collectible stamps do not lose significant value over time. The apartment is more attractive in this regard. In big cities, housing prices will rise in the future.

- Financial expenses. The cost of a car is much lower than an apartment (in most cases).

- Liquidity. Selling a car is faster and easier if you urgently need money.

- Life time. Housing can remain even for future generations; the service life of a vehicle is usually 5-10 years.

- Family needs. If a machine is needed for work, then the choice is obvious. But don't forget where the family lives. If this is a rental property, then you should think about your apartment (since the payment will go, for example, to repay the loan for a mortgage apartment).

- Financial opportunities. You should estimate the costs of both purchases. Purchasing an apartment is a larger expense, and sometimes you have to turn to banks for help.

You should also analyze the conditions of the area in which the person lives. Housing in the regions is cheaper, but it is unlikely to be considered a way to increase capital (unless these are promising areas near megacities). For large cities, buying a home is an opportunity to save existing funds, and when selling, there is also the prospect of increasing your funds. But there is a problem with traffic jams and parking, which reduces the attractiveness of using a personal car.

Should I take out a mortgage on an apartment or save up?

It is more profitable to take out a mortgage loan if you urgently need housing. The apartment can be rented out to generate additional income. The mortgage fixes the market value. Having issued it, you will not have to worry about rising housing prices, since the amount of payments will not change. When you take out a mortgage, you can get a tax deduction and use it to pay off your debt.

Savings for housing are reduced by inflation. If it increases, the term will increase by several years. A tax deduction can be obtained when the entire amount is collected and the property is purchased.

Saving money for a goal that can be achieved no earlier than in 10 years is psychologically difficult. During this time, there will be many reasons to invest your finances in something more useful, especially if you do not limit access to savings. Reducing the amount that was planned to be saved will lead to an increase in deadlines.

It is more profitable to save for real estate if there is no right to receive a tax deduction, housing prices are low and inflation does not exceed 3-4% per year. You should not take out a loan if the cost is high. Taking out a mortgage will lock in that price. If it goes down, you could lose a lot of money.

How to save up to 150,000 on a purchase

For support of a real estate transaction, agencies charge approximately 1.5-2% of the value of the property (from 150,000 to 250,000 rubles). It is necessary to distinguish between the concepts of real estate services (search for offers and buyers) and legal support. In practice, agencies are limited to offering a couple of apartments, information about which is not publicly available (it is not a fact that these options are suitable).

Legal support is a complete analysis of available information (from Rosreestr, house management and personal information), as well as the development of a forecast of the legal consequences of the purchase and sale contract.

The job of realtors consists largely of presenting existing properties on the market to buyers and characterizing them. Anyone can do this on their own, thereby reducing significant costs. There is a group of realtors that checks the legal information about housing, but there are only a few of them, and the cost of their services is often inflated. In most cases, by overpaying for real estate services, the buyer does not even receive a guarantee of the legal purity of the transaction (there is no optimal level of security and predictability).

The assistance of a lawyer is 2-2.5 times cheaper than the services of real estate agencies, while the level of buyer protection is much higher (but you should pay attention to the lawyer’s work experience and professional skills).

Buying a home: how much can you save?

If you take into account several mandatory points, you can significantly reduce the initial amount requested for an apartment.

- Pay attention to the condition of the property. This includes everything from the year the house was built and the quality of construction, to the state of communications in the house and apartment. But you must be sure that you will not spend more on repairs and replacement of necessary communications than you could save on it.

- Bargain. This is a mandatory consideration when purchasing an apartment. The amount that the owner wants for his apartment is based on what prices for analogues are on the market. He may not want to reduce the price much, but he definitely needs to try. This way you can save several tens, or maybe hundreds of thousands.

- Don't use an intermediary. Real estate agents charge substantial sums for their services. But they only engage in the selection of the necessary options, and do not bear any legal responsibility. You can independently search for suitable housing, saving between 100-200 thousand.

Example of savings

Raising money for an apartment with a salary of 50,000 rubles is a fairly realistic task. To do this, you need to decide on the cost of the apartment and keep a notebook (or electronic diary) of income and expenses. With reasonable savings, you can save 25,000-30,000 rubles per month. By investing the saved money in a bank at 8% per annum, after 4 years you can accumulate 1,200,000-1,500,000 rubles.

If a family consists of 3 people and the total income is 70,000 rubles, then an apartment for 2,000,000 can be bought in 3 years.

You can save on some things besides the monthly portion you put aside:

- Expenditure on cigarettes is 60,000-65,000 per year.

- Coffee. For example, 300 rubles per can in two weeks - 7,200 per year.

- Unnecessary spontaneous purchases - 5,000-15,000 per month.

- A set lunch outside the home or a trip to a restaurant costs about 70,000 rubles per year.

- If you use public transport rather than a personal car, you can save up to 200 rubles per day, 72,000 per year.

Total: 334,200 per year, you can earn 1,002,600 rubles in 3 years of such savings.

Good for your budget and health: give up smoking and alcohol

According to statistics, a man who smokes a pack of cigarettes a day since adolescence “smoke” an entire apartment in his life. Don't believe me? To do this, it is enough to make a simple calculation, taking as the calculation the cost of a pack of cigarettes at 60 rubles:

60×30 = 1800 rubles per month

1800×12 = 21,600 rubles spent per year

21.600×70 = 1.512 million rubles spent over a lifetime

One and a half million rubles will be given by a smoker with 70 years of experience - and this is precisely the experience of our grandfathers, who began dabbling in cigarettes at the age of 12-14. One and a half million is the cost of a one-room apartment in a small town or two houses in a village. If we make a similar calculation with alcoholic beverages, you will realize that you will lose two apartments in your entire life. So maybe you can give up bad habits today?

See also: How to quickly sell a car with maximum profit - 6 working methods. Websites for selling used cars online

Video: A story about a guy who saved a lot... and bought an apartment at 25+ years old

Alternative methods

To save for an apartment, you need to have a good income. If the salary is small (but changing jobs is not possible), you need to look for new sources of income. These options will also be effective for purchasing a mortgaged apartment.

Additional income

There are many options for part-time work and additional income.

Everyone chooses their own method, based on personal preferences, free time and skills:

- You can take on extra hours at work or earn extra money using your car (for example, in a taxi service or as a courier).

- In the 21st century, earning money on the Internet has become widespread - both in social networks (YouTube, Instagram) and freelancing (designers, programmers, SEO optimizers, copywriters).

- A creative person can sell paintings, photographs and make money from the results of his creativity.

- If you have unnecessary things, you can sell them, and add the money received to your savings.

Passive income

Passive income is the receipt of cash regardless of daily activities.

Main sources of passive income:

- Bank deposit. The transaction will bring more income if you choose a proven bank with a high interest rate.

- Lease of movable and immovable property. This applies not only to apartments, rooms, garages, but also construction tools, personal belongings and equipment.

- Receiving cashback from credit card transactions. This is not so much passive income as reducing expenses from actions that are performed (for example, shopping in stores - you can save from 1% to 5%).

Investment

Investing also refers to sources of passive income. When investing, the funds “work”, and the investor, investing money, expects to receive a large amount in the future. But do not forget that investing entails risks. Instead of the expected profit, a person may receive a loss or even lose his money completely.

Objects for investment:

- currency and precious metals,

- securities (high-yield shares),

- mutual funds,

- brokerage companies,

- venture investments,

- business,

- real estate,

- content sites.

How to earn money for an apartment: TOP-6 modern ways

There are various ways to buy without a mortgage. Each of them will lead to the final result, you just need to not give up.

No. 1. YouTube

Video hosting has long moved from the category of entertainment to a large platform for the production of media content. According to statistics, after just 1 year of hard work, a blogger reaches 15-50 thousand rubles per month.

The main task in this business is to guess the direction and interest the audience. There will be viewers - advertising will appear. For effective channel development:

- Think over a content plan;

- Release videos regularly;

- Regularly improve the quality of the material;

- Advertise;

- Look for sponsors.

Find your niche that will be of interest to viewers. How to run a business on YouTube is a separate topic in the article, but in general it all comes down to attracting the attention of the public and retaining views.

A blogger’s entire income depends on the price of his advertising and the demand of advertisers. On a channel of 100,000 viewers, a commercial display costs 5-50 thousand. Make 4 inserts + third-party sources per month and 25,000 are guaranteed.

No. 2. Instagram

A media personality develops simultaneously in many sources. Instagram bloggers earn no less than others; already with 10-50 thousand subscribers you can earn money from commercial posts. As a rule, Instagram is promoted simultaneously with another source of income.

According to statistics, advertisers consider $1.5-2 per 1000 subscribers to be the norm. Based on calculations with 20 thousand subscribers for one post, we get $40, which is approximately 2000 rubles. 4 orders in a month and 8-10 thousand in my wallet. The main thing is to learn how to choose advertisers correctly and communicate competently with the audience.

No. 3. Freelancing

Voluntary labor is quite profitable and stable. The most popular on the Internet are:

- Designers;

- Programmers;

- SEO optimizers;

- Copywriters;

- Site administrators.

It is enough to devote 1-2 months to learning any specific task and you can enter the stock exchange. Master website administration or backend development skills and you can significantly increase your income.

No. 4. Investments

Large millionaires do not work around the clock; part of their income comes passively from investments. Investing 100,000 you get 1000-5000 monthly. But the problem is that to start, you must first accumulate finances.

No. 5. Resale of Chinese goods

A simple and effective method: you buy goods abroad and sell them at a higher price. The question is that you need to learn how to sell and negotiate with suppliers correctly.

No. 6. programming

The 21st century is a time of active development of technology; there are not enough programmers and there is a great demand for them. To become a specialist, you need to graduate from a university, but for a freelance exchange, a month’s course is enough, and then it’s a matter of practice. The main thing is to be able to find customers and do the job well.

In the field of programming there is a simple rule. The more skills, the higher the pay. They don’t look at education; practical skills and experience are more important.

No. 7. SMM, SEO and online marketing

The Internet has become an indispensable part of modernity. Sales are carried out through a global network and, according to statistics, they bring excellent income. But competition in the market does not allow anyone to enter the field. Therefore, companies need specialists who will bring their products to search results, promote accounts and increase sales.

How to save your savings

Every person is interested in ensuring that his savings are not lost, but only increased. There are several ways to do this. The easiest option is to put money in a bank (open a bank deposit - long-term or short-term). Its purpose is to keep money like this for some time and receive interest from the institution for using it. Thus, after closing the deposit, the client receives an amount greater than it was at the beginning.

You can store your accumulated money by investing (the objects for which were discussed above).

How to save money for an apartment correctly

You shouldn’t save for an apartment by putting a certain amount of money in a white envelope every month. So the money will not work for you, and you will bite your elbows because you spent several thousand from your stash.

Choose a reliable bank with high interest rates and visit it monthly in order to top up your account with a minimum fixed amount. Agree, it will always be nice to invest one amount, and after a few years withdraw one and a half to two times as much. If you find yourself with extra money (a gift from relatives for your birthday, a cash bonus at work, or the discovery of a wallet with several hundred) - do not try to immediately spend it on unnecessary trinkets. Remember the rule: the more you invest today, the sooner you will move into your corner.

Is it possible to do without a mortgage?

How to save money for an apartment and not take out a mortgage - this problem plagues many people. Some doubt that this is possible. But you can buy an apartment without resorting to mortgage lending.

A mortgage loan has become almost the most common option for purchasing a home.

However, many borrowers know that this is not always profitable:

- an initial fee,

- large monthly payments,

- final overpayment.

In Moscow

As practice shows. a person with the average salary for a large city - 30,000-60,000 rubles - will be able to save up for an apartment after 5-7 years, without taking out a loan. Depending on the total family income and the chosen area, the characteristics of the apartment, these periods may vary and be reduced. At the same time, there is no need to deny yourself everything during the period of accumulation; you can only reduce unnecessary costs.

In the region

In the regions, apartment prices are much lower. Some residents of megacities tend to buy housing in the provinces because of the fresh air, less fuss and cost. The average salary - 25,000-30,000 rubles - will be enough to save up for a standard two-room apartment in 4-5 years. The timing of the plan also varies depending on the housing choice and changes in income.

Pros and cons of a mortgage

Purchasing a home with a mortgage is suitable for those who need to improve their living conditions in a short time.

Advantages:

- Solving the housing problem. You can become the owner of real estate after making a down payment. It is profitable to take out a mortgage loan if there is a high risk that apartment prices will rise or money will depreciate.

- Opportunity to save. Young families, military personnel and some other categories of borrowers may receive benefits. Reduced interest rates and subsidies will cover part of the costs. Part of the amount can be paid using maternity capital or the return of tax deductions.

- Investment. Buying a home is a way to save money. A good apartment after a few years practically does not change its value; it can be sold at a high price.

Disadvantages of a mortgage loan:

- High interest rates. The mortgage is issued for a long term. High interest rates increase the cost of housing several times. The amount of overpayment directly depends on the return period.

- Targeted spending of finances. The bank issues money for the purchase of a specific property. Expenses for repairs, purchase of furniture, equipment are not included in the amount. Therefore, the borrower pays them from his own funds or takes out another loan.

- Securing a loan in the form of real estate collateral. Housing purchased with a mortgage is pledged to the bank. The borrower cannot remodel, donate the apartment or re-mortgage it. If complex repairs need to be carried out, this should be agreed upon with the lender.

- Making a down payment. The minimum amount is 15% of the market value of housing.

- An increase in the cost of the loan due to mandatory additional payments. The borrower pays for the purchase of an insurance policy, the services of an appraisal company, a notary, registration costs, etc.

- Loss of property rights if there is no ability to service the debt. Loss of a source of income, deterioration of health are common reasons for delays or refusal to pay a debt to the bank. The lender puts the home up for auction, and the borrower loses the apartment legally.

How to save money from a small salary

Regardless of your salary, you will have to put in a lot of effort to save money. This also applies to people with low incomes. People often ask how to save up for an apartment with a salary of 20,000 rubles or 30,000, if you have to pay bills and live, is this realistic? This is possible, but in order to live a comfortable life without limiting yourself even in the most necessary things, you will have to increase your income. There are a lot of ways, the main thing is to have desire and patience.

Much depends on the area where you live. In the regions, prices for food, transport and apartment rent are lower; in some areas, a salary of 20,000 is considered average, and saving some of it does not take much effort, which cannot be said about large cities.

To implement your idea, do not forget that saving 5-10% of your income is the first steps towards buying your own home. In addition, during the month, many people spend a significant portion of their salary on necessary purchases. The main thing is to believe in yourself, and everything will work out.

Is it possible to save money with a small salary?

If you set a goal in the near future to purchase your own apartment or house without the help of a mortgage, then even the low income of an ordinary Russian family will allow you to do this. To understand the reality of such a statement, you need to arm yourself with a regular calculator and compare the results obtained. The main thing is to establish what will be more profitable in a particular case - savings or collateral in the form of a mortgage.

Let's make simple calculations for a borrower who wants to buy a 1-room apartment in the region and separately in Moscow, taking into account the average salary.

Calculation example for Moscow

Moscow is considered a separate city when calculating most economic, social and other indicators due to its size, population and standard of living. Let's look at an example of whether it is realistic for a working Muscovite with the average salary in the city to save up for housing (a one-room apartment).

For calculations we will use official data from Rosstat. So, let’s assume that a potential real estate buyer receives 80 thousand rubles per month (the average monthly salary in Moscow at the beginning of 2020) and plans to buy a 1-room apartment in a new building with a standard layout costing 4,520,000 rubles (with an average price per 1 sq. m. 113,022 rubles) with an area of 40 sq. m. m.

Let’s say that the client will deposit 31,000 rubles into his bank account every month. In a year the account will already have 372 thousand rubles. Over 12-13 years, the amount of savings will be approximately 4.5 million rubles. By releasing additional funds or searching for alternative sources of income, the accumulation period will decrease.

This is a real example of how you can save up for your own apartment without going to the bank for a mortgage for an ordinary busy citizen living in Moscow. Of course, the calculation did not take into account many factors, such as: inflation, rising/lowering prices for housing, crisis phenomena in the economy, the possibility of placing accumulated funds on deposit at interest, receiving other additional income, etc. But the general message is very clear.

CONCLUSION: Without overpaying banks millions of rubles, a Muscovite with a salary of 80 thousand rubles quite realistically save up for his own home in about 10-12 years For a family with two working spouses, this will be even easier.

Calculation example for regions

For calculations by regions of the Russian Federation, we will use the average monthly wages at the beginning of 2020 and prices per 1 sq. m of a typical apartment in a new building. For example, let's take data for the Volga Federal District.

So, the input data:

- a person’s monthly salary is 30 thousand rubles;

- cost of 1 sq. m. - 42.7 thousand rubles;

- area 1 room apartments – 36 sq. m.;

- the price of an apartment in a new building is 1.5 million rubles.

We will send 13 thousand rubles monthly towards savings. For the year, the amount of savings will be 156 thousand rubles. In 10 years, you will be able to accumulate about 1.5 million rubles.

That is, within 9-10 years , a resident of an ordinary Russian region with average income (with the current level of salaries and prices), instead of cooperating with the bank and paying it huge interest, will be able to buy an apartment in a new building.