What are the costs of a mortgage?

Before making a final decision on the advisability of taking out a mortgage loan and submitting a loan application, each potential borrower must be extremely careful in summing up all the upcoming expenses that make up the final cost of the mortgage.

A standard mortgage loan involves basic (mandatory) and additional costs. The first include:

- making a down payment to the seller's account;

- payment of interest for the use of borrowed funds from the lender;

- registration of insurance (payment of insurance premium);

- ordering a report on the assessment of the purchased property;

- payment of the state fee for registering a mortgage transaction;

- expenses for settlements between the parties (via a safe deposit box or letter of credit).

In this case, the client may additionally be charged the following fees:

- application processing fee;

- notary expenses (for registration and certification of consents, powers of attorney, contracts, etc.);

- banking costs (for example, a one-time fee for lowering the lending rate on a mortgage);

- expenses for a realtor and lawyer.

IMPORTANT! The tariff and credit policy of each bank may or may not provide for the above expenses for borrowers.

What other expenses should you be prepared for?

Additional costs must be added to the listed main costs and included in the final estimate. Such costs can be divided into mandatory and possible.

Mandatory expenses

Notarial services.

To complete a transaction, you will need to have a number of necessary documents certified by a notary:

- your spouse’s consent to the purchase if you are in a registered marriage;

- power of attorney for a representative if you cannot be present at the transaction in person;

- power of attorney on behalf of minors, if they take part in the transaction;

- a power of attorney may be required for the developer’s representatives to register the DDU with Rosreestr;

The total cost of notary services can average from two to five thousand rubles.

State duty

- for registration of DDU (or assignment agreement under DDU) - 350 rubles;

- for registration of ownership rights after putting a new building into operation - 2000 rubles.

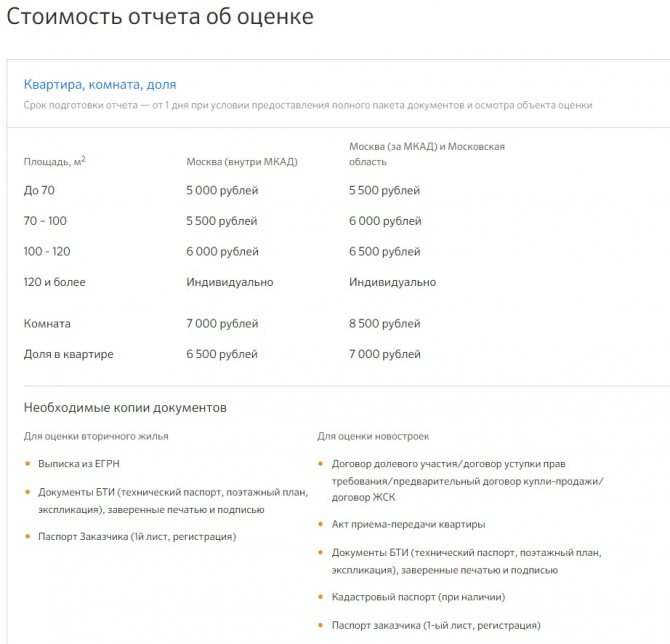

Property valuation for mortgage

If you purchased an apartment with a mortgage, then to register ownership of it you need to prepare a mortgage from the bank. For a mortgage, in turn, a report on the valuation of the property is required. Most likely, the bank will offer the services of a specific appraiser or a list of companies from which you can compare and choose the one that suits you in terms of price.

On average, the assessment will cost 5,000 rubles.

Possible expenses

Registration of property.

You can do this yourself by collecting the documents necessary for registration and paying only the state fee, or you can do it through a developer or third-party companies.

Sometimes the developer may add a clause to the DDU where the shareholder undertakes to pay for the developer’s registration services. You need to carefully read the contract for such a clause or be prepared to pay for services that can cost on average from 25 to 50 thousand rubles.

Lawyers' services.

If you were looking for an apartment on your own, then you should have the equity participation agreement and mortgage agreement checked by lawyers. The cost of a lawyer’s services is on average seven thousand rubles per contract. In agencies for the selection of new buildings, such services may be free.

Rent of a safe deposit box or commission for non-cash payments

will be required if you are purchasing an apartment in a building under construction under an assignment agreement. On average, these services cost two to five thousand rubles.

The developer's commission may be unexpected

if you yourself want to transfer the apartment purchased under the DDU. This can be a percentage of the transaction or a fixed amount, on average it will be equal to 1-3% of the transaction amount.

Real estate insurance

if you are afraid of such surprises as leaks and breakdowns in your new home. The cost of insurance depends on what risks will be included in it and what amount of compensation will be paid. On average, the policy will cost from seven thousand rubles per year.

Mandatory expenses

Let's look at the nuances and approximate cost of obtaining a mortgage, which are mandatory.

Insurance

In accordance with Russian legislation, only insurance of collateral property against destruction and loss is mandatory. Registration of personal insurance occurs at the initiative of the client himself.

As for the priority of the procedure, at the stage of receiving official approval of the mortgage application, the borrower must enter into an insurance agreement and pay the insurance premium for the selected type of policy.

Typically, the lending bank provides the borrower with a list of accredited insurance companies that he trusts and does not find fault with whose insurance policies. The cost of insurance varies depending on the insurer and the range of risks included. Property insurance in monetary terms on average in the market ranges from 0.1 to 0.5% of the market price of the purchased living space. Personal insurance will be a little more expensive - from 0.3 to 0.6%.

Also, the client can additionally insure the title (loss of property rights). The costs of such a policy will be approximately from 0.2 to 0.5% of the price of the property.

You can find out the cost of mortgage insurance using this calculator:

Important point! Using the calculator on our website, you can issue an insurance policy online with a discount to the regular price of 10-15%, so we recommend that you make a calculation before applying for a policy at an insurance company or bank.

Grade

It is also better to have real estate appraised by companies recommended by the lender. The cost directly depends on the subject of the Russian Federation and the type of housing being assessed. It is logical that the rating is 1-k. apartments will cost significantly less than the valuation of a country house. The same applies to regions - an assessment report in Moscow will cost more than in any other Russian locality. Typically, the cost of an appraisal in Moscow and St. Petersburg ranges from 5-8,000 rubles, in the regions from 2 to 5,000.

The final report on the assessment of collateral property is drawn up in the form of a structured folder listing the assessment methods, attaching photographs and certification by an appraiser.

Interesting fact! In some cases, starting from 2020, an appraisal for a mortgage at Sberbank can no longer be done thanks to the capabilities of the DomClick website. You can find out more details from our post.

An example of an appraiser's report can be downloaded here.

Issuance and transfer of funds

Bank costs for obtaining a mortgage loan consist of:

- expenses for transferring funds from the buyer to the seller;

- commission costs for money transfers;

- additional options (for example, a one-time fee for lowering the interest rate for the entire loan term or for a certain period of time - usually at least 1% of the loan amount).

Transfer of money under a mortgage transaction can be carried out by agreement of the parties using a safe deposit box or letter of credit. Both options are paid. Bank prices can vary significantly. The minimum price for a letter of credit is from 1.5 thousand rubles, for a cell – from 2 thousand rubles.

State duty for registering a transaction

The mortgage agreement is registered with the MFC or Registration Chamber, subject to the mandatory payment of state duty. Currently you will have to pay 1 thousand rubles. If it is necessary to make changes, as well as upon termination of the contract, the client will have to add another 200 rubles.

If one plot of land serves as collateral, then the state fee for registration will be 350 ₽.

NOTE! If the assignment of rights under a mortgage is made (replacing one borrower with another), the amount of the fee will increase to 1,600 rubles.

Additional square meters

When signing a contract, you are counting on an apartment in a new building with a certain number of square meters. But due to inaccuracies and mistakes of builders, in reality your apartment in a new building may turn out to be slightly larger or smaller than calculated.

If the area of the apartment has decreased, the developer is obliged to recalculate the cost in your favor. Builders are trying to get money from buyers for additional square meters. Study the contract with the construction company in advance. If such a clause is not provided, consult with a lawyer. Most likely, in this case, an additional payment amount can be avoided, and the developer’s demand will be considered illegal.

Additional expenses

Additional costs may be added to the mandatory costs listed above. Let's take a closer look at them.

Consideration of the application

Most Russian banks have already moved away from the practice of charging fees for processing loan applications. In the mid-2000s, it was paid by every client who applied to the bank for a mortgage.

In modern conditions, there remains a small percentage of credit institutions in which borrowers still bear such costs (for example, DeltaCredit and some regional banks).

Notary costs

Notary expenses include:

- payment for registration of the spouse’s consent to conclude a loan agreement and a collateral agreement (in the regions, prices start at 1000 ₽);

- certification of the marriage contract (from 10 thousand rubles);

- drawing up and certification of any power of attorney in relation to a mortgage transaction (from 1 thousand rubles).

Each case is individual, and often only notarized consent to the transaction from the spouse is required.

Banking

Some banks offer mortgage borrowers an additional product to change the established interest rate. The idea is to make a one-time payment, which averages 1-4% of the loan amount, after which the rate will be reduced.

It is important to understand that not a single bank will agree to significantly reduce its profits, therefore, after paying such a commission, the percentage will decrease by 0.5-1.5%. A striking example is the “Set your own rate” option at DeltaCredit Bank, where the rate can be reduced by a maximum of 1.5% if you deposit 4% of the loan debt at a time.

Costs for a lawyer and realtor

Borrowers who do not have the opportunity to independently handle the mortgage registration procedure from start to finish, and in some cases simply do not have sufficient competence, hire specialists for these purposes - a lawyer and/or a realtor - for an additional fee.

The costs include paying for the drafting of a purchase and sale agreement, checking the legal purity of the transaction being concluded, searching for a property and obtaining other advice. The total amount of such costs for the client depends on the amount of the contract, its type and a number of other factors. The starting point is from 1% of the price of real estate.

Mortgage costs and down payment

If you take out a mortgage for an apartment, think and calculate how much loan you need, how much you can pay as a down payment, what maximum amount you are willing to pay monthly and how many years you want to take out the loan for. Carefully compare the terms and conditions of different banks and mortgage rates. Remember, the longer the term you take out the loan, the greater the final overpayment, up to 100% of the mortgage amount. You can calculate approximate monthly payments and overpayments to the bank using any mortgage calculator, for example this one.

Keep in mind that, according to banks’ conditions, the amount of regular payments, as a rule, cannot be more than 50% of the salary of the borrower and co-borrower.

Additional

mortgage costs:

- One-time bank commission for issuing a loan. This is either a fixed amount or 1-1.5% of the loan amount, several thousand rubles.

- Insurance. It is mandatory to insure the collateral against damage and loss. Additionally, the bank may ask for life and disability insurance. This is voluntary, but if you want to save money and decide to refuse this insurance, the bank may increase the interest rate on the loan by 1-5%. Insurance premiums are paid once a year for all years of the mortgage and average from 0.2 to 2% of the total loan amount per year. But now a bill is being considered that would no longer oblige buyers to take out insurance for the entire term of the mortgage. In our article you can read how to choose insurance.

Unexpected

Costs may include fines and penalties for late payments. Even if you are one day late with payment, you may be charged a fine/penalty.

Down payment

The share of the down payment varies from 10 to 50%, but usually it is 20% of the amount of the apartment. There are banks that offer to buy a home without a down payment, but it is not worth taking such a mortgage - the terms of the programs are unfavorable for the borrower: the interest rate increases by 1-5%, and the approved loan amount is often less. In addition, you need to additionally secure the mortgage with collateral.

It is better to save up a larger down payment in order to pay a larger share of the apartment amount - this way you can save on the interest rate and the amount of monthly payments.

If you want to take out a consumer loan for a down payment, then expect that in the first years you will have to pay two loans, and this will greatly increase your debt load. In addition, your mortgage application may be given less or even rejected because the bank will check your credit history.

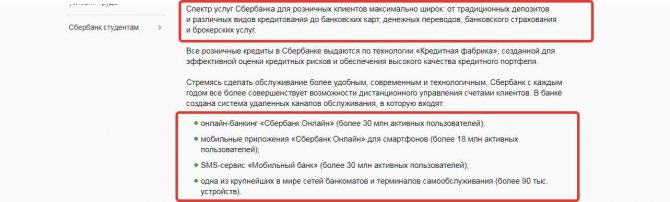

Additional costs for a mortgage at Sberbank

Sberbank, as one of the most popular mortgage lenders, offers its clients a number of additional services that are designed to save a lot of time and effort for the parties to the transaction. Let’s take a closer look at what optional expenses exist when applying for a mortgage at Sberbank.

Secure payment service

The essence of the service is that the buyer transfers the amount under the contract to the nominal account of the Central Tax Service (a specially designated structure of Sberbank), which only in case of successful registration in Rosreestr will be transferred to the seller’s account. By using settlements through such a service, the rights of each party are taken into account as much as possible, with continuous monitoring by Sberbank.

After concluding an agreement with the Central Tax Service, the buyer (borrower) will have to pay 2 thousand rubles.

Electronic transaction registration

Remote registration of a mortgage agreement allows you to avoid unnecessary visits to the Sberbank branch and the Registration Chamber. For a set fee (from 5,550 to 10 thousand rubles, depending on the type of housing and region), the transaction will be processed remotely (using an electronic digital signature) through a personal manager from Sberbank. This item of additional costs when applying for a mortgage at Sberbank has recently become increasingly popular.

Utility payments in a new building

When buying an apartment in a new building, you will most likely be asked to pay utilities for several months in advance. Such an advance payment allows the management company to establish an uninterrupted supply of necessary resources and reliable service. The amount may vary depending on the company and region, but most often it is about 20-30 thousand rubles.

To plan for these expenses, study the contract with the developer and clarify all issues related to the management company at the stage of signing it.

Additional costs for a mortgage at VTB

The client may incur the following additional costs when applying for a mortgage at VTB Bank:

- Fee for transferring money to the seller's account (if the client purchases a primary home and the money will be transferred to the developer).

- Costs for a letter of credit or cell rental.

- Personal and title insurance (the bank, of course, recommends VTB Insurance).

- Notary services (if necessary).

That is, in comparison with Sberbank, additional expenses at VTB are standard and do not imply the use of additional products and services.

Additional amounts of money

The mortgage transaction is carried out on the bank's premises. A financial organization, as a full-fledged participant in the process, has a number of requirements for the procedure for transferring money. Lease of a safe deposit box, letter of credit can be used, additionally the amount will be recalculated or the banknotes will be checked for authenticity. Services will cost from 5 to 10 thousand rubles.

If you're unlucky, the bank may require a fee for its services . It is almost completely a thing of the past; moreover, it has been declared illegal by the Supreme Arbitration Court. However, bankers still find loopholes and opportunities to get paid for their services.

The commission in the loan agreement can be disguised under the column “checking the accuracy and completeness of documents when submitted by the applicant” or, for example, “filling out a loan application.” It ranges from 0.1% to 2% of the loan amount.

Since the lending market in Russia is competitive, a borrower can easily find a credit institution without commissions; the main thing is to clarify this issue already at the stage of agreeing on an agreement.

Attention! If the loan document has already been signed, you will have to pay a commission.

Secure payment service

The essence of the service is that the buyer transfers the amount under the contract to the nominal account of the Central Tax Service (a specially designated structure of Sberbank), which only in case of successful registration in Rosreestr will be transferred to the seller’s account. By using settlements through such a service, the rights of each party are taken into account as much as possible, with continuous monitoring by Sberbank.

After concluding an agreement with the Central Tax Service, the buyer (borrower) will have to pay 2 thousand rubles.

Realtor or broker commission and attorney's fee

Price: about 5% of the cost of the property.

Nowadays, it is extremely rare for a buyer to do without the services of a realtor. It’s easier to pay for the services of a professional, but get proven options so you can choose the most suitable one. In addition, the realtor takes care of checking the apartment, recommends reliable developers and gives advice on what is the best thing to do or what you can save on without harming yourself.

In addition, if a real estate agency has its own broker, then often the fee for the assistance of specialists in the transaction will be compensated by a reduction in additional costs and overpayments to the bank on the loan, which were avoided thanks to competent consultations. And the complex of services itself will cost less than the work of specialists separately.

The same applies to the services of a lawyer - it is better not to save on fees, but to be sure that all documents are drawn up correctly, there are no pitfalls in the purchase and sale agreement, and all the terms of the loan agreement, even those written in small print, are clear to you and you satisfied.

Sanction fees

Sberbank imposes fines only for late mortgage payments

Particular attention should be paid to the section of the contract that contains sanctions for violating its terms. Banks can set:

- fines;

- fines;

- increase the loan rate.

And also completely terminate the contract with the borrower. Sberbank imposes fines only for late mortgage payments.

They are spelled out in the contract as a penalty. In its typical form, it will be 20% per annum of the debt that has arisen due to non-payment.

Some of the subtleties that are important to consider are related to the fact that when applying for a mortgage, the property being purchased is pledged to the bank.

Obtaining a credit history

Price: from 500 rubles.

The bank does not need a credit history - they check everything themselves at the stage of considering the application. But knowing your credit history will help you understand which bank will be more likely to be approved, because you can see whose requirements your credit card fits best. Another advantage of receiving it: before submitting the application, you can correct errors in your credit history or attach an explanation with supporting documents.

There are two ways to get a credit history: shareware and paid.

Credit history is stored in credit history bureaus, and in Russia there are already thirteen of these bureaus. Moreover, your story can be in two, three or all thirteen at once. And there are times when the information stored in different places differs. This is due to the lack of debugging of the system and failures in the operation of bank programs.

The Central Bank knows which bureaus can find your credit history. All information is stored in the Central Catalog of Credit Histories database. To find out where yours is located, you need to make a request to the Central Control Committee and get from there a list of organizations to which you need to contact for history.

You can send the request yourself, or you can use a paid service. By the way, you can apply for the issuance of a IC on your own and free of charge no more than once a year.

Sometimes data appears in the CI that is not true. For example, a person applied for a loan, accurately calculating the required amount, but he was approved for a slightly less amount. It turned out that his credit history included a credit card that this person had never actually received. The bank itself activated this card. And although the hero of this story never used this card, since he did not even know about its existence, the amount of the mortgage loan was reduced by 10% of the card limit - these are the rules of many banks.

By the way, if you order a CI and see that it contains incorrect or inaccurate information, write a statement to the Central Bank so that the errors are corrected. According to tradition, rescuing drowning people is the work of the drowning people themselves, so take the time to ensure that only reliable information is indicated in your document.

Costs for registration of the DCP and the shareholder

The contract for the sale and purchase of housing and the DDU can be drawn up and certified by a notary. These actions are not required by law, but are in demand among the population in order to save time and minimize risks.

The cost of notary services varies significantly among the constituent entities of the Russian Federation. For the services of drawing up and certifying one contract, a notary will charge a minimum of 5000+0.3% of the contract amount. That is, about 10-15 thousand will have to be paid to the notary for one certified document.

Important! If you need to do documents, our specialists have the best rates. Just sign up for a free consultation through an online consultant on our website and compare prices.

The total amount of all mortgage costs

For secondary housing

If we take a standard transaction, for example, for the acquisition of a secondary 2-k. apartments worth 3 million rubles with a 20% down payment in a Russian city with a million population, then the final costs for borrowers will include:

- estimate – approximately 4,000₽;

- insurance (property only) – 3,600₽;

- state duty – 1,000₽;

- rent of a safe deposit box for payments – 2,000 RUR.

The total is 10,600₽. These are mandatory expenses that cannot be avoided. This minimum should definitely be laid down at the planning stage of applying for a mortgage loan.

Advantages and disadvantages of obtaining a mortgage loan at Sberbank

Let's start with the good - there is much more of it in the bank:

- Throughout the country, Sberbank boasts the lowest interest rates on mortgage loans.

- The Sberbank network is so widely developed that every resident of Russia can easily find its branch.

- convenient online client account allows you to use the bank’s services with even greater comfort.

- The bank does not include additional fees for servicing a mortgage loan in its tariffs.

- For young families, Sberbank offers a special program under which a mortgage loan is issued on preferential terms with a low rate and down payment.

- Families that have recently added new members can choose the “Mortgage Maternity Capital” program, where this capital participates in repaying the down payment on the mortgage loan.

- Apartments from Sberbank are available even for non-working people of retirement age (maximum age up to 75 years) and people with disabilities.

- Many businessmen find it difficult to take out a mortgage due to the fact that they are officially registered as private entrepreneurs, but Sberbank lends even to this category of clients.

- To reduce the amount of time spent on obtaining a mortgage loan to purchase an apartment, the bank introduced a two-document program .

- Additional income does not have to be documented .

- At Sberbank, clients have the right to refuse title insurance.

The bank is constantly improving its products.

But at Sberbank there are also negative aspects when applying for a home mortgage. Of course, compared to the mentioned advantages, there are not many disadvantages:

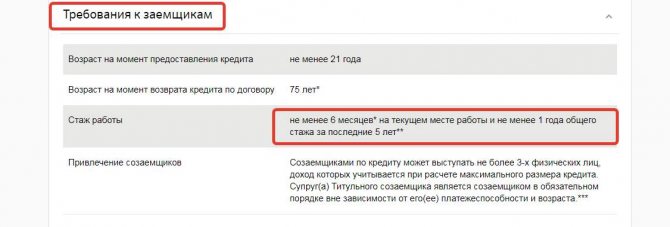

- The borrower must have worked at the last place of work for at least six months.

- The same conditions apply to all clients - there is no individual approach here .

- The process of document verification at Sberbank takes a very long time and is detailed.

- Mortgage deferment is not possible even for good reasons.

The bank requires compliance with a number of conditions.

Well, having studied the pros and cons, we see that there are much more of the former and this speaks in favor of Sberbank.

Next, we will talk about the conditions under which a mortgage is issued at Sberbank.

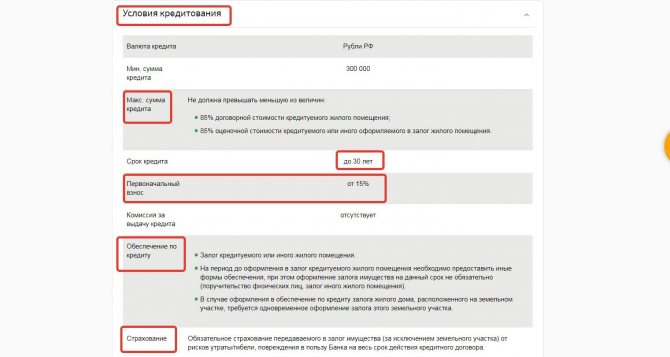

Sberbank conditions in the mortgage market

The main conditions for any Sberbank mortgage lending program are:

- The amount of the loan provided is at least 300,000 rubles. and a maximum of 8 million for the Moscow region , and for the rest 3 million rubles.

- The annual rate for servicing a mortgage loan is from 7.9% .

- 15% a down payment is required.

- The mortgage can be issued for a period of up to 30 years .

Credit conditions.

For properties located on the secondary market, there is an additional condition: a mortgage on secondary housing is considered only if the life of the property is at least 3 years.

Sberbank also has certain criteria that a future borrower must meet:

- Work experience at the last job should not be less than 6 months, and the total - less than 1 year .

- It is unacceptable to have any criminal record , even expunged.

- Although the age of the borrower has a huge range, it still has clear boundaries - from 21 to 75 years .