Terms and rates of life insurance at Sberbank

- Terms and rates of life insurance

- Travel insurance

- How to insure an apartment

- Bank card insurance

- How to get money back for loan insurance

- Buy VSK insurance for a car

- Official insurance partner companies

- Insurance hotline number

- Insurance policy to protect your home

- Deposit insurance for individuals

- How to cancel insurance

- Family insurance

- Activate Sberbank Insurance policy online

- Insurance program “Protected Borrower”

- Insurance against involuntary job loss

- Business insurance

- Investment insurance

- How to find out the insurance contract number

The rules of the borrower's life and health insurance contract can be found on the official website of the insurance company (IC) Sberbank. This is a separate legal entity associated with the largest bank in the country. The price and tariffs of the program to protect life and health from accidents and other unforeseen circumstances are also presented here.

Insurance is provided against illnesses and other types of disability (family circumstances, dismissal, injury). Several programs have been developed for clients that allow them to individually select a list of risks. The insurance rate depends on the number of insured risks and starts from 1.99% of the payment amount.

Those wishing to accumulate funds to achieve certain goals should pay attention to endowment life insurance (CLI). It provides for the payment of savings contributions and protects against unpleasant surprises during the validity period, providing compensation in the event of an insured event. Contributions cannot be seized by court order or divided during divorce.

When applying for loans, regardless of the amount and terms of the agreement, bank employees recommend concluding a life and health insurance agreement. Is life insurance legal when taking out a loan? The law provides for compulsory life insurance in two cases: car insurance and mortgage. Both loans provide for the receipt of a large amount. In other cases, the insurance service is provided exclusively on a voluntary basis.

The website presents tariffs that allow you to calculate the cost of life and health insurance on a loan from Sberbank. You can also apply for insurance benefits there.

What can you insure yourself against at Sberbank?

Insurance is a financial product that can be used to protect yourself from financial losses that may arise as a result of an unforeseen event.

The official website of Sberbank contains all the products that are available to everyone. Having studied them, it will become clear that you can purchase protection for your home, property, travel, life and health. Additionally, you can draw up an agreement that provides for profitability: savings and investment life insurance.

Travel insurance in Sberbank

One of the most popular insurance services is travel insurance. The bank offers preferential rates for travel insurance abroad for Premier Sberbank cardholders. Persons who are not Premier card holders can also use the service.

To do this, you need to provide: Russian Federation passports (your own and those whose health will be insured), any Sberbank card, the correct Latin spelling of the names of the persons indicated in the insurance (can be taken from foreign passports). Providing foreign passports is not required.

The insurance is valid in Schengen countries, the USA, China and in most popular resort areas.

The cost of insurance depends on the amount of coverage. Tariffs can be found in the office or on the website of Sberbank. To get a discount of up to 5%, you need to have a promotional code for insurance.

The influence of life insurance on obtaining a loan from Sberbank

When receiving a loan, it is advisable to take care of obtaining insurance. Managers are required to make appropriate proposals. If the client does not plan to take out an insurance policy, he should not be persuaded. The legislation of the Russian Federation protects the interests of borrowers, despite the fact that it is not known for certain how much the refusal to issue an insurance policy affects the receipt of a mortgage loan.

The bank's policy allows it to refuse to provide funds to a potential borrower without explanation, which leads to a certain incomprehensibility of the situation.

When making a decision regarding life insurance, you need to keep the following aspects in mind:

- the service remains voluntary, so a representative of the target audience can refuse the offer;

- You can buy a policy and cancel the provision of insurance services within a specified period.

Recently, many borrowers are agreeing to life insurance to obtain a loan. Mortgage holders subsequently surrender the policy and receive the premium. This approach helps to increase the chances of receiving the required amount, but at the same time you need to be prepared for large financial investments when using a mortgage due to an increase in interest rates.

How to insure an apartment

When applying for a mortgage, you will have to take out insurance for the property with Sberbank. If the housing is not pledged, compulsory property insurance is not required. However, it is a good idea to protect your property from fire, flooding and other unexpected events.

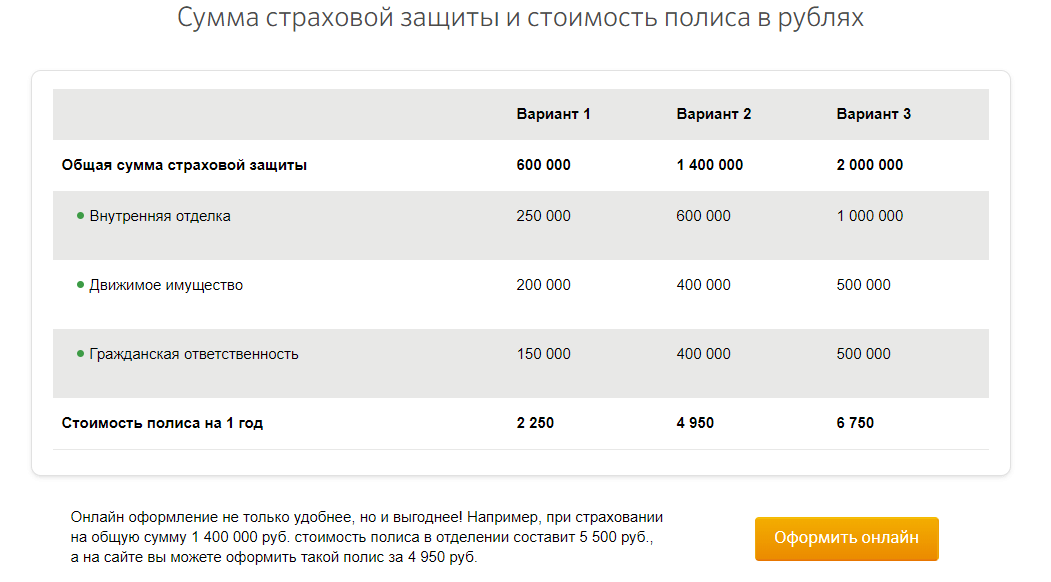

The minimum annual cost of insurance for an apartment against flooding by neighbors and other troubles in 2020 is 2,250 rubles. For this amount you will receive 600 thousand rubles of coverage (250 thousand for restoration of interior decoration, 200 thousand for damage to movable property, and 150 thousand for civil liability).

When going to the office to sign an agreement, you should know what documents are needed for registration:

- title documents (purchase agreement, donation agreement, equity participation agreement);

- registration certificate;

- property valuation;

- certificate f.9 (list of persons registered in the premises).

To apply for a policy, it is not necessary to visit a bank branch. The website offers an online registration service.

Important: even when concluding a compulsory insurance contract, you have the right to refuse a number of risks and reduce the insurance payment.

Features of using insurance services

Sberbank provides insurance services based on an issued policy. In this regard, you need to carefully study the mandatory conditions for using insurance.

- Protection of life and limb is usually mandatory when executing a mortgage agreement. A potential borrower has the right to refuse insurance services, but he must understand the reduced chances of obtaining a mortgage to purchase real estate.

- The amount of insurance must be equal to the amount that was received on credit. The extent to which financial benefits will be manifested depends on this.

- The insurance policy is initially valid for one year (12 months). Subsequently, the validity period of the document is extended, since the protection of life and health is mandatory for the entire mortgage loan.

- The client has the right to refuse to use insurance. In this case, bank employees increase the interest rate.

- If an undesirable situation occurs, part of the insurance will be transferred to the bank to pay off the mortgage. The remaining amount is sent to the client SK Sberbank LLC to pay for all necessary medical services.

Obtaining insurance is a voluntary service. Refusal of insurance services cannot guarantee the exclusion of the possibility of obtaining a mortgage loan. The borrower must carefully evaluate the potential benefits for minimal overpayments and profitable acquisition of residential real estate.

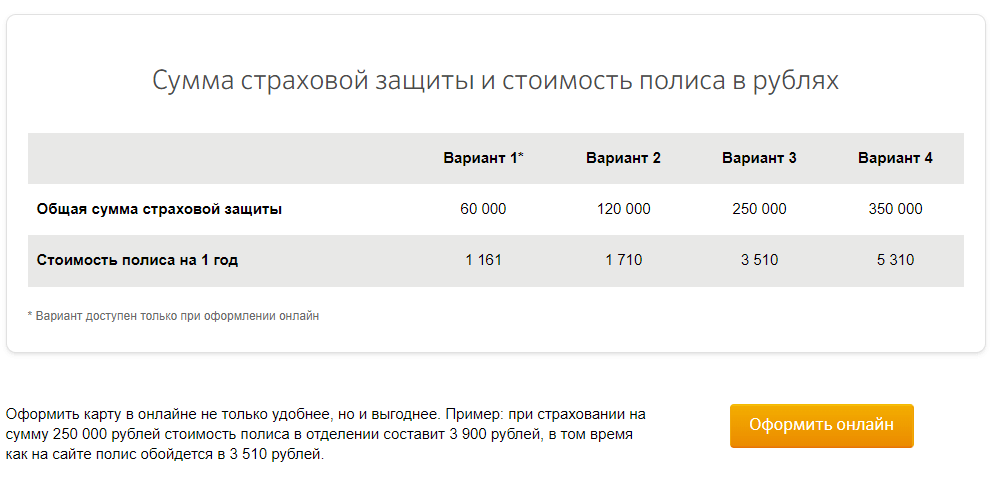

Insurance of Sberbank bank cards

The insurance program against fraud with plastic cards is valid only for banking products serviced by Sberbank. Insurance of money on a debit card is intended for customers who actively use them to pay via the Internet, make money transfers through remote services, pay for purchases, and withdraw money from ATMs.

The insurance program covers the following risks:

- theft of funds by forging a signature;

- fraudulent and forcible seizure of a PIN code with subsequent withdrawal of money;

- falsification of information (phishing, skimming);

- loss, theft or forcible taking of a card with subsequent use by criminals;

- mechanical damage to plastic;

- ATM breakdown resulting in the loss of the card;

- theft or robbery with loss of money withdrawn from an ATM.

To receive compensation, you must notify the bank by phone and apply for payment within 2 days after the insured event. To receive the money, you will have to provide supporting documentation.

Endowment health and life insurance

Insurance is available to users of packages and Sberbank First. A special insurance program allows everyone to accumulate the required amount of financial resources by a specific date, as well as receive financial assistance in case of unforeseen health problems.

If you are interested in life insurance at Sberbank, then pay attention to the savings option. It will allow you:

- Create capital for the child, which may be useful for studying at the institute or other essential needs.

- Form investments and generate income using conservative tools.

- Create reserve capital.

The program operates according to a special principle:

- You set the amount of capital and the period within which it needs to be collected. Choose dates that are convenient for paying insurance premiums.

- Decide on a list of events in the event of which the insurance company will be obliged to compensate for damage.

- Next, you will need to make a down payment, after which the insurer will activate insurance protection.

- Taking into account the dates specified in the agreement, you continue to make regulatory payments.

- The amount of contributions that you have made is invested by the insurance organization, which allows you to have additional investment income.

- If you lose your ability to work and can no longer make payments, then you receive a release, the amount of savings is preserved, and the parameters of the contract remain unchanged.

- If an insured event occurs during the validity period of the contract, the insurance payment specified in the policy is generated. The target savings amount remains unchanged.

- When the insurance period ends, the company pays out the target amount that was formed, as well as money from the investment.

The money can only be received by the person indicated in the contract as the recipient.

How to return money for loan insurance and terminate the contract

Part of the loan agreements includes payment for compulsory life insurance of the borrower and the safety of collateral during the loan term. Bank employees do not inform whether it is possible to return insurance from Sberbank with early repayment. You can receive part of the paid funds back in the following cases:

- The insurance was illegally imposed and you changed your mind about using it. The contract contains a clause that stipulates the period for its termination without payment of a fine. In Sberbank it is 14 days. At this time, you will be able to fully refund the insurance amount.

- The loan was fully repaid ahead of schedule. Accordingly, the insurance period is reduced. The contract states that only 50% of the insurance can be returned. Thus, in order to return part of the insurance paid for a loan agreement for a period of 4 years, you need to pay it off faster than in two years.

To terminate the life insurance contract early and return the connection fee, you must contact the bank branch with an application for termination of the insurance contract. It must be filled out in accordance with the requirements of Sberbank. A sample application for insurance return can be downloaded from the link.

Actions upon the occurrence of an insured event

If an insured event occurs, the borrower must:

- notify the insurance company as soon as possible;

- collect and present all documents confirming the fact of the insured event;

- complete and submit an application for monetary compensation. Its processing may take some time, as the Investigative Committee will check all the papers;

- if there are no claims or questions from the insurance company, the money is transferred to pay off the mortgage loan. The remainder is due to the borrower or his heirs.

Attention! Once a mortgage life insurance policy is issued, there is a 14-day hold period. At this time, you can refuse insurance and return the entire amount paid to the insurance company.

It is important to remember that during the hold period, obligations are not assigned to the insurance company. This rule applies to all services, including life insurance. It protects the interests of two parties: the borrower can refuse insurance, and the company itself does not risk becoming a victim of fraudulent activities.

OSAGO insurance for a car in Sberbank

At IC Sberbank you can sign up for a compulsory motor third party liability insurance contract. To do this, you will need a passport, driver's license, PTS and a diagnostic card.

The cost of insurance depends on the place of registration and engine size of the car, the driving experience of the insured person and other parameters. To clarify the specific amount, use the MTPL calculator for the car.

If the car acts as collateral, in addition to compulsory liability insurance, the lender will have to take out CASCO insurance.

Why is it worth taking out an insurance policy?

In an attempt to protect their lives and property, people turn to private legal organizations that offer insurance at a seemingly more favorable price. Such a transaction may become unprofitable for the client, because the company may engage in fraud.

It is much more profitable to enter into an insurance contract with large financial organizations that are under state control. Thus, you can get a full range of insurance services at a reasonable price and with a guarantee of fulfillment of the terms of the contract.

Registration of an insurance contract with Sberbank has a number of advantages:

- There is no need to waste time searching for a reliable private organization;

- The insurance contract is drawn up according to the same documents as the loan agreements;

- The procedure does not affect the client’s property and requires a minimum of time;

- The list of insurance risks is compiled taking into account possible real threats;

- The client will be familiar with all rates under the agreement;

- You can terminate the agreement without sanctions upon written request.

An insurance contract can be concluded with entrepreneurs and companies, as well as with individuals. The bank does everything possible to create favorable insurance conditions for each client and select the most suitable terms of the agreement.

Sberbank insurance hotline phone number

For residents of the regions and Moscow there is a hotline that operates around the clock. Sberbank support phone numbers:

- for Moscow - 8 (499) 707-07-37;

- for regions - 8 (800) 555-55-57;

- for international calls - +7 (495) 500-55-50;

- from mobile phones - 900.

Calls to the hotline (except for international numbers) are free.

You can also contact support via the form on the website or by email.

Program "NSJ"

Endowment life insurance allows you to create a certain capital for retirement, sending a child to university, buying real estate and realizing other goals.

During the entire term of the contract, the policyholder and his relatives are protected from unforeseen circumstances.

Pros of this program:

- concluding a contract for a period of 5 to 30 years;

- use of rubles or dollars;

- possibility of early withdrawal of money;

- legal protection of contributions;

- receiving a social tax deduction;

- provision of insurance guarantees in case of unforeseen circumstances.

During the entire duration of the program, you can add insurance options to the contract, change the frequency of payment of premiums and their amount through your personal account.

Sberbank insurance policy to protect your home

The Home Protection policy helps protect property from the following troubles:

- bay;

- fire;

- falling of flying objects;

- explosion;

- mechanical impact;

- natural disasters;

- theft and damage from third parties.

The insurance also covers civil liability in case you flood your neighbors or cause other unintentional damage to their apartment.

The price of home insurance depends on the amount of coverage and the list of insured risks. The website presents all available tariff plan options. It is possible to issue and activate the policy online through the Sberbank website.

Insurance “Protection of loved ones” online

One of the most profitable insurance policies is “Protection of loved ones”. This option is available to everyone and will help take care of loved ones. You will always be under reliable protection, because it remains active even during tourist trips around the world. In addition, the payment under the program significantly exceeds the cost of insurance.

| Option one | Option two | Option three | |

| Total amount of protection | 1200000 | 1400000 | 2000000 |

| Injuries after an accident | 100 thousand rubles. | 200 thousand rubles. | 500 thousand rubles. |

| Death due to accident | 100 thousand rubles. | 200 thousand rubles. | 500 thousand rubles |

| Death after a railway or plane crash | 1 million rub. | 1 million rub. | 1 million rub. |

| Insurance price for 12 months. | 900 rub. | 1800 rub. | 4500 rub. |

Convenient health and life insurance at Sberbank can be obtained in just a few minutes using your personal account and the Internet:

- On the Sberbank Insurance website page, select the appropriate policy.

- Decide who will be insured (children, spouses, parents).

- Please indicate the appropriate amount of insurance cover.

- If you have a promotional code for a discount, enter it in the special window.

- Enter the last name, first name, patronymic and date of birth of the insured.

- His contact details, as well as information from his passport.

- Please provide your registration address.

- Confirm registration.

- Receive an insurance contract by email.

Important! The electronic version of the policy has the same legal force as a paper copy. You can print the document yourself. It does not require additional signing.

How to cancel insurance at Sberbank

Bank employees often insist too actively on signing a life or property insurance contract when issuing a loan. Therefore, it is useful for clients to know how not to pay loan insurance at Sberbank. There is no separate law on the waiver of loan insurance.

The activities of insurers are regulated by the Central Bank, which obliges them to provide for the possibility of termination. The time to refuse insurance is 5 days, during which the lender can write a statement of refusal if insurance is imposed.

Important: life and health insurance is voluntary and can be refused. For a mortgage or car loan, collateral insurance is required.

Opportunities for using insurance services

The main objective of insurance services is to protect borrowers from potential loss of ability to work. Risk includes illness, injury, disability, accidents, and death. In this regard, insurance programs with various conditions are offered. Each client has the right to choose a suitable program with individual or general parameters, taking into account the characteristics of his life situation.

The available conditions for life and health insurance at Sberbank are determined not only by the type of program, the set of risks, but also by the cost. To obtain policies from Sberbank SK LLC, the following tariffs are used:

- life and disability – 1.99 percent per year;

- life, health and forced loss of employment – 2.99 percent;

- individual parameters when using insurance services – 2.5 percent.

To get the maximum benefit, you should choose the appropriate type of insurance program. The interest rate determines the possibilities of using banking services and the chances of obtaining a mortgage or any other loan for a large amount and a long period.

Family insurance

IC Sberbank offers insurance contracts for children and spouses. Purchasing the “Protection of Loved Ones PLUS” policy allows you to insure parents, children, grandchildren and spouses in case of:

- frostbite;

- burns;

- fractures;

- injuries.

The “Comfort” package provides payments in the event of loss of ability to work or death.

Rules for life and health insurance

Before concluding a contract, it is necessary to understand who, why and how is insured.

The contract is concluded by two parties: the Insurer and the Policyholder. The insurer is an accredited insurance company of Sberbank. Policyholder - client, individual, Third Party - Beneficiary, the one who will receive insurance if an insured event occurs.

Under the essential conditions of the insurance contract, the policyholder is the payer of the insurance premium. The beneficiary is a person whose health and life are insured against unforeseen situations that threaten health and life. If the policyholder insures himself, then the recipients of the insurance in the event of his death will be his heirs.

The video shows general information on insurance:

Insurance for loved ones means the ability to insure health and life:

- wife (husband);

- parents;

- children;

- grandchildren.

The list of possible health deterioration includes:

- fractures of the limbs, back, head;

- burns and frostbite;

- wounds with blood loss and fractures;

- car and plane accidents;

- development of the oncological process;

- brain disorders (stroke);

- heart attacks;

- accidents.

The Life Insurance Rules define the following sections:

- basic concepts;

- parties to the contract;

- purpose, risks, insured events;

- financial calculations to determine insurance premiums and the insured amount;

- conditions of conclusion, execution, changes;

- procedure for terminating contractual relations;

- terms and conditions of insurance payment.

According to the General Provisions, the Insurance Contract is considered concluded if the Policyholder has signed the insurance certificate and paid the insurance premium on time.

If payment was not made in full or on time, the Agreement is not considered concluded. The validity of the insurance policy has no interruption and no restrictions on the coverage area. Read about title insurance when buying an apartment here.

The purpose of the Insurance Agreement is compensation in the event of an insured event for loss of health or life in a certain amount of money. An insured event is a visualization of the insured risk (the probability of an adverse event).

The insured amount is the compensation that the Insurer will pay to the Insured Person (or his heirs) in the event of an insured event.

Based on the insured amount, the insurance premium, tariff, and contribution are calculated. An insurance premium is a one-time insurance payment. In other cases, contributions are paid monthly depending on the tariff. The tariff is determined as a fixed rate based on the sum insured. Payment, depending on the type of insurance, can be made in installments during the validity of the contract or one-time. Read about apartment insurance with a mortgage here.

The video shows the purpose of the Insurance Contract:

The validity period depends on the type of insurance policy:

- accident insurance is valid for a year;

- life insurance has a finite age up to which it is insured;

- illness, injury, or death terminate the contractual relationship.

Each insurance policy has individual characteristics, which take into account the health and age of the Insured. Reducing and increasing coefficients regulate the size of the insurance tariff, and with it the insurance premium with a premium.

Sample contract application

The application form is provided by a company employee electronically or on paper.

The document must indicate:

- Full name of the Policyholder;

- residential address;

- Date of completion;

- text of the application: request to conclude an agreement (name of the policy), indicate the amount of the amount, validity period;

- the applicant’s signature + his signature certifying receipt of the second copy of the application;

- Full name , position of the person who accepted the application, date of acceptance.

Based on the submitted application, an Insurance Policy is issued in accordance with the insurance rules “protection of loved ones”.

Agreement clauses:

- full details of the Insurer;

- Full name of the Policyholder, insured person, passport details, place of residence;

- conditions under which the contract is not concluded;

- exceptions under which insurance coverage will not be paid;

- list of risks, amount (insurance);

- the procedure for payments in the event of insurance events;

- the amount and procedure for paying the insurance premium;

- validity.

The contract also lists the grounds for refusing payment and the procedure for its termination. The Policyholder's agreement with all conditions is confirmed by signing the relevant declaration.

The Client is obliged to provide the Insurer with reliable information about the state of health of the insured person (medical certificate), information on whether he is registered with law enforcement agencies, drug treatment and mental institutions.

A sample application for a life insurance contract can be found on the Sberbank website in PDF format.