A mortgage at B&N Bank is issued for almost any type of housing.

There are several special mortgage programs of this bank, which are distinguished by loyal interest rates and current offers for residential real estate, new buildings, and land plots.

The mortgage terms and limit amount are different, so the borrower needs to get to know each loan more closely, learning all the nuances.

Binbank's loan rates today are relatively loyal, and there are noticeable benefits for every borrower:

- Convenient repayment terms.

- Fast consideration of any loan application.

- Wide selection of loan agreements .

- You can take out a mortgage with the inclusion of maternity capital .

- The bank takes into account all additional income .

- There are no maximum amounts on some products.

Mortgage programs at Binbank in 2020

In 2020, this financial institution offers a wide range of mortgage programs for individuals and businesses. B&N Bank clients can receive a loan for the purchase of real estate under the following conditions:

- the minimum mortgage loan amount is RUB 300,000;

- residents of St. Petersburg and Moscow are given a maximum of 20,000,000 rubles, and clients from other regions no more than 10,000,000 rubles;

- the term of the mortgage cannot exceed 30 years;

- for young families the lowest possible interest rate is offered, fixed at 6.00% per annum;

- clients who decide to use maternity capital will be required to make an initial payment of 5.00% of the loan amount;

- Applicants are requested to provide documents confirming their source of monthly income;

- Individuals can involve co-borrowers and guarantors in mortgage lending, etc.

Attention! The terms of mortgage lending at Binbank directly depend on the method of receiving income: an employee or an individual entrepreneur. Documentation confirming the level of financial solvency is also taken into account.

Mortgage for a new building

Registration of a mortgage for the purchase of an apartment under construction is carried out under the following conditions:

- the duration of the program varies from 3 to 30 years;

- the down payment amount is 20.00%;

- the minimum loan amount is fixed at RUB 500,000;

- clients can count on no more than 10,000,000 rubles, and residents of St. Petersburg and Moscow on 20,000,000 rubles;

- applications are reviewed within three days.

Mortgage for secondary housing

Under the program intended for the purchase of housing on the secondary real estate market, the same conditions apply as for new buildings. The only difference is the package of documents and the interest rate.

Family mortgage at 6% in B&N Bank

For young families, the financial institution offers a program for purchasing real estate under construction or ready-made from legal entities. Couples who, during the temporary period from January 1, 2020, can take part in mortgage lending. until December 31, 2022 the second (and subsequent) baby will be born. This category of borrowers can count on a long grace period:

- 2nd baby – three years old;

- 3rd child – five years old;

- The 2nd and 3rd children are eight years old.

Attention! Young families can receive from 500,000 rubles. up to 3000000 rub. (for St. Petersburg and Moscow the maximum loan amount increases to 8,000,000 rubles). Family mortgages are discussed in more detail in a special post.

Refinancing

In 2020, mortgage refinancing at B&N Bank is carried out on the following terms:

- purchasing a room, share/last room, housing under construction or finished housing;

- The loan amount varies in the range of 500,000 rubles. – 10000000 rub. (20000000 rubles for St. Petersburg and Moscow);

- the duration of the program ranges from 3 to 30 years;

- decisions on applications are made within three days (working hours).

Military mortgage

Military personnel, thanks to B&N Bank's mortgage, can purchase housing that is ready or under construction. For this category of clients, a loan is issued for a period of 3 years until they reach their 45th birthday. A financial institution issues a minimum of 500,000 rubles and no more than 2,486,535 rubles for a military mortgage.

Apartments

Those wishing to purchase luxury apartments can apply for a mortgage at B&N Bank on standard terms. But, from this category of borrowers an advance payment is required in the amount of:

- When purchasing finished housing – 30.00%.

- When purchasing a property under construction – 20.00%.

Mortgage for a room

For the purchase of a room in an apartment (secondary market), Binbank gives clients from 300,000 rubles. up to 6,000,000 rubles. The duration of the mortgage program varies from 3 to 25 years. Applicants will have to pay an advance payment of 25.00% of the room price.

Mortgage for the last room or share

Under this program, individuals can purchase real estate from the secondary market. They should expect a loan of 300,000 rubles. – 10,000,000 rubles, which is issued for a period of 3 to 25 years. The down payment amount is 10.00% of the mortgage amount.

Mortgage on a house with land

In 2020, Binbank offers Russian citizens the opportunity to purchase country houses with land plots under a mortgage program. For these purposes, they are given from 300,000 rubles, without any upper limit. The term for which the contract is concluded varies from three to 25 years. The amount of the advance payment is 50.00%, but for residents of Moscow, Moscow Region, St. Petersburg, and Leningrad Region it is reduced to 40.00%.

Mortgage secured by real estate

Individuals can apply for a mortgage at B&N Bank secured by their personal property. The following conditions apply to this program:

- term 3-30 years;

- minimum amount – 500,000 rubles;

- maximum amount – 20,000,000 rubles;

- consideration of the application - up to 3 days.

Free meters

Program characteristics:

- This includes both primary and secondary housing – apartments, houses and even rooms.

- Payments are made in equal amounts.

- Loan amount: 500 thousand – 15 million rubles.

- Duration: 3-30 years.

- The share of the initial contribution is 30-80%.

- Rate – from 11%.

- You can repay early without penalty.

- Mandatory documents - 2-NDFL certificate, passport, certified copy of the work book.

- The property must be insured.

- Necessarily on the security of a room, apartment, house.

- Borrower: 18-65 years old, has citizenship, permanent or temporary registration, minimum 12 months of experience (at least 3 months at last job).

- All types of cash and non-cash payments are possible.

Interest rates

In 2020, interest rates on B&N Bank loans will start at 6.00% per annum and can reach 9.75%. The table shows the current rates for each of the mortgage programs offered by the financial institution:

| Name of mortgage products | Annual rate |

| For the purchase of housing in a new building | from 8.75% |

| For the purchase of real estate from the secondary market | from 9.00% |

| Family program at 6% | 6.00% (during the grace period) Key. Central Bank rate + 2.00% (as of the date of conclusion of the mortgage agreement) upon expiration of the grace period |

| Military mortgage | 9,00% |

| Apartments | from 8.75% (housing under construction) from 9.00% (finished property) |

| To buy a room | 8,75% |

| To purchase the last room in an apartment or a share | 8,25% |

| To buy a house with land | 9,75% |

| Mortgage secured by real estate | from 9.25% |

Attention! Using Binbank's mortgage calculator, applicants for participation in lending will be able to calculate the total amount of overpayment for the selected program.

General characteristics of the bank

Binbank appeared in the banking sector in 1993 .

During this time, the bank managed to achieve the necessary reliability indicators. Even in the most remote regions, Binbank’s activities became known, and it attracted a large number of borrowers with corporate loans and mortgages. Binbank's assets as of mid-2020 amounted to 1.2 trillion national currency.

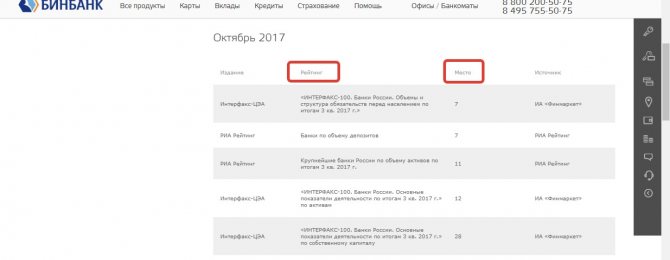

Binbank occupies one of the first positions in various ratings.

According to reviews, the bank ranks 7th in the national rating and is a member of the banki.ru portal.

Basic information about Binbank:

- Contact phone number

- Main office : Kotelnicheskaya embankment, 33/1, Moscow time.

- Official website: binbank.ru.

- Registration region: Moscow.

- Director: Shishkhanov M. O.

Interesting video:

In which cities and regions does the bank operate?

Binbank belongs to a reliable group, therefore it is distributed in all regions:

- St. Petersburg

- Vladivostok.

- MSC.

- Rostov.

- Tolyatti.

- Kazan.

- Izhevsk

- Nizhny Novgorod.

- Yaroslavl.

- Voronezh.

- Permian.

- Orenburg.

- Ekaterinburg.

- Ufa.

- Samara.

- Kemerovo.

- Chelyabinsk.

On the bank's website you can fill out an online application for a free consultation.

If your city is not on the list, then detailed information can be found on the bank’s website , where you can consult about obtaining the desired mortgage amount. Borrowers can receive a free consultation by indicating the phone number and the essence of the issue.

It is also easy to find out online the conditions for issuing a loan by B&N Bank and methods of repayment.

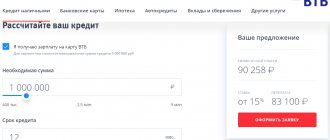

Without coming to a bank office, you can make a preliminary mortgage calculation on the website.

Binbank mortgage calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

To find out how much interest you will have to pay for the entire term of the mortgage, you need to enter some data into the B&N Bank calculator:

- the cost of the property;

- advance payment amount;

- duration of the program;

- interest rate;

- chosen repayment scheme;

- the amount of commissions.

Attention! Applicants for participation in lending should understand that using the B&N Bank mortgage calculator they will be able to find out indicators that are close to real ones. The exact amounts will be established after signing the documentation at the financial institution.

Important: on what terms does the bank lend?

The interest rate on a Binbank mortgage depends on the following factors:

- accreditation of the developer company and the new building where the apartment was chosen with the bank;

- participation of the loan applicant in the bank’s salary project;

- insurance of the collateral, life and health of the borrower;

- presence of co-borrowers.

B&N Bank's mortgage conditions for accredited new buildings are flexible - the promotional rate is set at 8.9% per year. For salary clients, it is possible to get a loan at 9.3% per annum; for other applicants - 12.62%. If you cancel insurance, base rates increase by 2 percentage points per title. Additionally reduce the rate by 1-1.5 percentage points. per year is possible by connecting paid packages, “Media”, “Ultra”.

Recommended article: What does a mortgage by law mean and when does it arise?

The bank plans long-term lending for residential real estate and issues loans for a period of 5 to 30 years. The maximum amount is up to 30 million rubles. for Moscow, Moscow region and St. Petersburg; for regions - up to 15 million rubles. The loan can be increased through the participation of co-borrowers. For those interested in a small loan, the minimum amount can be 500 thousand rubles.

The borrower is recommended to have his own funds for a down payment of 10% of the expected loan amount. If the work experience is insufficient, the “starting” contribution increases to 20%.

How to get a mortgage

The process of obtaining a mortgage at B&N Bank involves a standard procedure:

- An individual or business entity must study all available offers and choose the most suitable program according to the parameters.

- The applicant personally visits the nearest branch of a financial institution or fills out and submits an application form via the Internet/mobile application.

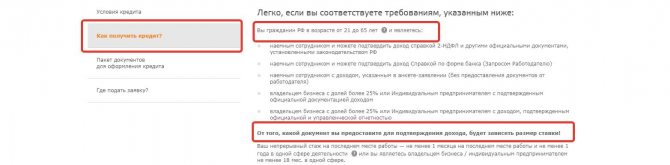

Requirements for the borrower

Binbank has standard requirements for applicants for a mortgage:

- only persons with Russian citizenship and permanent residence in the region where a branch of a financial institution is present can take part in lending;

- the age of borrowers must vary from 21 to 65 years;

- experience in one specialty should not be less than a year, and with the last employer more than one month;

- applicants should not have any outstanding loans under other credit programs or existing loans;

- business entities must have been engaged in business for at least 18 months;

- if a potential client has a share in the business, then it should not be less than 25%.

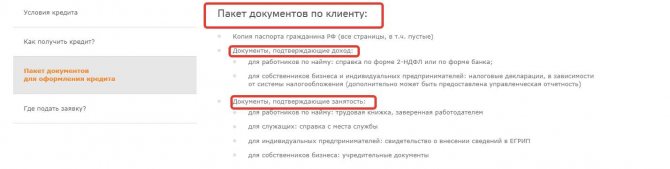

Documentation

When filling out an application form for a mortgage from B&N Bank, applicants must have personal documents with them, the list of which should be supplemented:

- original and copies of completed pages of a civil passport;

- copy and original tax identification number;

- certificates confirming the monthly source of income (the document can be in the form of a financial institution or 2NDFL);

- when using maternity capital, you will have to present a certificate;

- a copy of the work book certified by the last employer (certificate of employment for employees);

- if business entities plan to issue a mortgage at B&N Bank, then the financial institution will require constituent documentation, reporting, bank statements, and contracts from them;

- when attracting guarantors or co-borrowers to mortgage lending, it is necessary to provide their civil passports, tax identification codes and income certificates, etc.

Attention! The financial institution may require additional documents from the applicant, for example, a foreign passport, military service, driver’s license, etc.

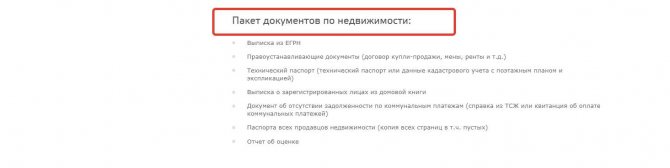

The applicant must have the following documentation for the property being purchased with a B&N Bank mortgage:

- extract received from the Unified State Register of Real Estate;

- purchase and sale agreement or any other title documentation;

- an extract from the house register indicating that there are no individuals registered in the property;

- technical certificate;

- civil passport and tax identification number of the property owner;

- real estate valuation act;

- a document confirming the fact that there are no debts on utility bills.

Attention! Applicants for a B&N Bank mortgage may, if they wish, present additional documents confirming their level of reliability and solvency. For example, the presence of a deposit agreement with this financial institution may be a reason to reduce the interest rate on a mortgage loan.

List of required documents

The borrower does not have to have permanent registration , but he must have a passport of a citizen of the Russian Federation in his hands (the bank must provide a copy of all pages, including blank ones).

In addition to your personal documents, you will need to worry about real estate registration forms (technical passport, purchase and sale agreement, assessment report, etc.).

Pay attention to the list of documents for real estate when applying for a loan.

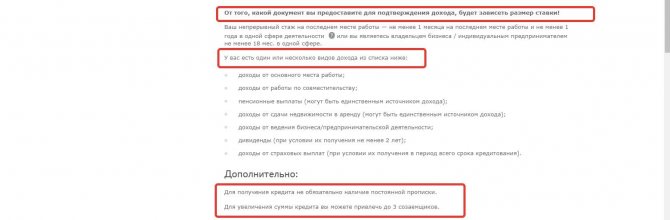

To obtain any type of loan from B&N Bank, you need to confirm the borrower’s income:

- employees using form 2-NDFL .

- business owners and individual entrepreneurs with a tax return or management reporting.

The bank also needs to take documents that confirm the borrower’s employment :

- Certificate from your place of work.

- A copy of the work book with a seal certified by the employer.

- Certificate of entrepreneurial activity.

- Founding papers (for business owners).

Insurance

According to the terms of mortgage lending at B&N Bank, borrowers should purchase insurance policies only when pledging valuable property. In all other cases, clients independently decide to participate in insurance programs. If an individual declines life/health/disability insurance, the financial institution can automatically raise the prime mortgage rate by three points. But, if the borrower voluntarily takes out a policy, then if it is impossible to repay the mortgage due to illness, the insurance company will make payments for it within six months.

Attention! If the borrower has taken part in life insurance, then in the event of a sudden death, the credit burden will not fall on his family members, since BinStrakhovanie IC will fully repay the debt existing at the date of death.

Requirements for the borrower

If you want to apply for a mortgage loan from B&N Bank, you must meet the following requirements :

- Age barrier: 21-65 years .

- Employment of the borrower according to the book and confirmation of income .

- At the last place of work, the borrower must have at least 4 months of experience , and generally 1 year.

- Business owners must provide current financial statements .

- Individual entrepreneurs must work in a given field for at least 24 months.

Before applying for a loan, read the requirements. indicated on the Bank's website.

The borrower must also confirm his place of registration, but it may also be temporary (this indicator often affects the loan amount provided).

To increase the mortgage limit, you can attract up to three co-borrowers, who must also meet the bank’s existing requirements.

To calculate the mortgage amount, the bank takes into account not only the basic income.

You can confirm your income not only with a payroll certificate, but also by presenting other documents that indicate additional income:

- From private activities.

- From part-time collaboration.

- From renting.

- Pension, scholarship, other assistance.

Pros and cons of mortgages at B&N Bank

The advantages of B&N Bank mortgages include the following:

- applicants are given the opportunity to use a calculator to calculate (calculation is carried out online) the total amount of overpayment;

- application forms are processed very quickly, so individuals do not have to wait a long time for a decision;

- Some programs do not have credit limits, so the loan amount is determined individually;

- loyalty and flexibility are shown to new and regular borrowers;

- To confirm financial solvency, you can present any certificates (your own and those of co-borrowers);

- a wide range of programs is offered to individuals and business entities;

- when applying for a mortgage at Binbank, young families can use maternity capital funds when paying an advance payment or repaying the loan (housing subsidies can also be used);

- The down payment amount can be reduced to 5.00%, subject to compliance with the lender's requirements.

The disadvantages of mortgages from Binbank include the possibility of increasing the base interest rate if doubts arise about the client’s solvency. Another disadvantage is the lack of a program, which can be completed using only two documents.

Customer Reviews

In recent years, a huge number of Russian citizens have taken part in mortgage lending from B&N Bank. They leave reviews about cooperation with a financial institution, from which applicants can learn a lot of useful information:

Valentina, 28 years old

My husband and I took out a mortgage at 6.00% in the spring. We used maternity capital to pay the down payment, now we are taking advantage of the grace period. The attitude towards us was excellent, no bureaucracy.

Valery, 34 years old

I’m planning to apply for a military mortgage, I’m currently collecting documents. Due to my busy schedule, I couldn’t come to B&N Bank in person, so I submitted my application through a mobile application. I received a response within a day.