Brief description of the bank

Promsvyazbank is one of the three best banks in Russia. It was opened 20 years ago, and now it is one of the largest credit institutions with a developed regional network, which now has 300 branches, 200 bank terminals and 8,500 ATMs.

At the moment, the bank specializes in issuing large loans. This lender provides mortgage lending services to its clients.

But before applying for a loan, you need to find out how profitable it is to take out a mortgage from Promsvyazbank today.

Mortgage conditions

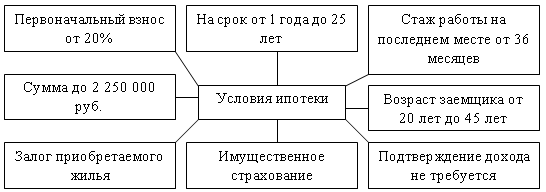

Promsvyazbank does not have too strict mortgage lending conditions. Of course, they will change depending on the program chosen by the client, but they are still subject to the basic parameters set in the SIS.

Overpayment on mortgage

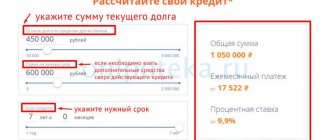

And the parameters are as follows:

- You cannot take out a loan for an amount less than 500,000 rubles;

- But along with this, loans more expensive than 8,000,000 rubles are not issued ;

- The minimum mortgage term is at least 3 years ;

- The maximum mortgage term is 25 years ;

- If you have a spouse, he automatically becomes a co-borrower without fail. In addition, no one can become a co-borrower except a person who is married to you;

- The interest rate can range from 11.4% to 17.5% per annum , depending on the mortgage program, loan amount, loan duration and other factors.

Note! The interest rate will depend on the loan amount, loan term, your income level and the chosen mortgage program. In addition, this can be affected by the availability of loan collateral and conditions that allow you to participate in mortgage programs on preferential terms.

Only two large Russian banks are ready to issue mortgages without a down payment

MOSCOW, January 6 — PRIME. The Bank of Russia has recently been actively trying to limit the issuance of mortgages with a small down payment, as it considers them more risky. However, there are large banks in the country that are ready to finance the purchase of housing for Russians without any savings at all, a survey of experts and credit organizations conducted by the Prime agency showed. However, there are only a few such banks.

In Russia, since January 1, 2020, increased risk ratios have been in effect for mortgage loans with a down payment below 20% to calculate the capital adequacy of banks. And from July 1 of this year, the Central Bank intends to further tighten the issuance of mortgages for banks, making their contributions to reserves dependent on the debt load and the borrower’s down payment.

The survey showed that so far only two banks from the top 30 - Promsvyazbank (PSB) and Sovcombank - are ready to issue a loan for the purchase of housing without a down payment at all. Under the terms of the PSB, housing can be purchased in a building under construction from more than 80 developers. Sovcombank is ready to provide funds for a period of up to 20 years for the purchase of an apartment, apartment or non-residential premises secured by other real estate of the borrower.

The largest mortgage banks, such as Sberbank, VTB, Rosselkhozbank, Gazprombank, Raiffeisenbank, Alfa Bank, Otkritie, and Bank St. Petersburg do not issue such mortgages. Their minimum down payment, according to their websites and call centers, is from 10 to 15%.

World statistics say that with a down payment of less than 20%, the risk of non-payment on a mortgage increases significantly, the Bank of Russia points out. But experts are confident that the mentality of Russian citizens must be taken into account.

According to Mikhail Doronkin, director and head of bank ratings at the NKR agency, Russians, as a rule, strive to have their own housing and often consider refusal to make mortgage payments as a last resort. Promsvyazbank believes that the quality of mortgages without a down payment is even higher than for other mortgage loans. “We do not see any additional risks compared to other mortgage programs. All risks are taken into account in the interest rate,” says Tatyana Chernysheva, head of PSB’s mortgage sales department.

Mortgage rates without a down payment at Promsvyazbank start from 10.2%, at Sovcombank - from 11.4% per annum. The average mortgage rate in the country is 9.19%, and this is the minimum value over the past two years, according to data from the Central Bank of the Russian Federation for December. As follows from the information posted on the websites of the largest credit institutions, the rate depending on the size of the down payment differs significantly. So, with a down payment of less than 20%, the rate can immediately increase by 0.5 percentage points.

Currently, loans issued without a down payment are minimal - in PSB they amount to no more than 3% of the entire mortgage. Sovcombank notes that they recently launched such a product and next year they plan to refine it to make it “even more interesting for clients.”

According to BCS Premier financial analyst Sergei Deineka, further development of mortgage programs without a down payment is simply impossible against the backdrop of the Central Bank’s measures: this direction will be unprofitable.

Requirements for the borrower

Up to 13.9% per annum

The first thing you should pay attention to before applying for a mortgage at Prosvyazbank is whether you meet all the lender’s requirements.

This bank is not particularly picky about its borrowers, but a prerequisite for participation in any mortgage program is compliance with all established parameters.

And they are next:

- Russian citizenship;

- At the time of obtaining a mortgage, the client must be 21 years of age or older ;

- At the time of making the last mortgage payment, the borrower must be no more than 65 years old (unlike most Russian banks, at Promsvyazbank the age threshold is identical for both men and women);

- Be registered in the region in which the bank branch where you are going to take out a mortgage is located;

- Work in the same region;

- An individual must work under an employment or employment contract;

- Have a total work experience of at least 1 year;

- at your last place of employment for at least 4 months ;

- You must not be called up for military service during the entire term of the mortgage.

How to get a mortgage at Promsvyazbank

Promsvyazbank reviews your mortgage application within 3 days. Once it is approved, you can start looking for housing. It must meet not only your expectations, but also the requirements of the bank. The latter can be clarified after receiving a positive decision on the mortgage.

The found apartment or house must be assessed by an independent expert.

After this, you can submit real estate documents and the appraiser’s report for approval to the bank. Promsvyazbank employees will inspect the housing and documents related to it. Now you can negotiate a deal with the seller and register ownership in the Registration Chamber.

Mortgage programs at Promsvyazbank (description of programs and interest rates)

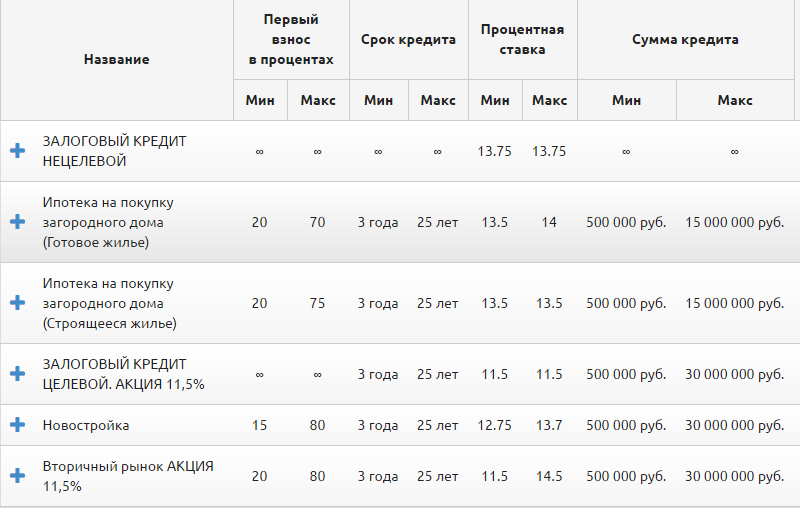

Now Promsvyazbank offers its clients only 4 mortgage programs, which differ in the type of real estate that can be purchased through this service, as well as in their conditions.

| Program | Mortgage amount | Interest rate | Down payment | Peculiarities |

| Secondary | Up to 30,000,000 rub. | 12,75% | 20% | The collateral for the loan is the collateral on the mortgaged property. There is the possibility of early repayment, without having to pay a commission. |

| New building | Up to 30,000,000 rub. | 13,8% | 20% | Mandatory registration of an insurance policy. In case of refusal, the annual interest rate on the mortgage will increase by 6%. |

| Collateral target loan | Up to 30,000,000 rub. | 11,5-13,35% | 20% | The loan is secured by existing property. You can purchase any residential property, but you must specify the purpose of the loan. |

| Secured non-targeted loan | Up to 30,000,000 rub. | 11,5-13,35% | 20% | The conditions are identical to the previous program. The only difference is that in this case you do not need to indicate the purpose of the loan. |

Business mortgage at Promsvyazbank

PromsvyazBank reviews

Rating:

★ Why do you need an electronic signature to access Internet banking?

I decided to open an account and went to the PA “Red Path” of the Siberian branch of PJSC Promsvyazbank. The leading manager printed out a lot of contracts, I started signing them, and saw a document for an electronic signature. The employee explained this by saying that otherwise I “would not be able to log into the Internet bank, and now we will set up a login.” (We (?) will set the login). After I refused to sign, she said that I would not have access to the Internet bank (I did not have a card). She gave me an application to open a bank account and answered my question that: “That’s all, there will be no more documents.” This surprised me greatly. I called the hotline, where they confirmed to me that an electronic signature is not required to access the Internet bank, a banking service agreement is issued, etc. I returned to the office to the same employee, who told me that she “forgot to give it out.” I closed the account, took the money, withdrew my consent to the processing of personal data, etc. I have questions for the representative of Promsvyazbank - a) why an electronic signature is needed when opening an account for an individual; b) why doesn’t the employee give the client the required contracts? Is this negligence or...what? I am ready to tell the bank representative the name of the employee. Rating:

★ The so-called bank is simply robbing its customers!

This is the second time I have been burned by this disgusting bank. The first time there was a loss of money on a credit card due to errors in their algorithms. I swallowed it. Second time now. So the situation is as follows. There was a need to transfer money to Tinkov’s card; to do this, I linked the PSB card in Tinkov’s application and made a test payment for 1000 rubles. And then attention, when confirming the operation via 3D-secure (via SMS), it wrote to me that 1000 rubles , and I confirmed. Then I went into the mobile application and made sure that for this transfer the bank wrote off exactly 1000 rubles from me and no commissions. After that, I made a transfer of 30,000 rubles in the same way. Then, a week later, today I made a transfer of 150,000 rubles according to the same scheme. Please note that I confirmed the transfer of exactly 150 thousand rubles , but after I returned to the PSB mobile application, I saw that 152 thousand rubles had left the account. Those. I allowed the bank to write off 150 rubles, but they wrote off 152 (I think they just robbed me). I started to figure out what was going on and it turned out that in previous transfers there was a line about the withheld commission, but this transfer does not yet have information about the commission, but the bank prudently blocked it. Those. The bank blatantly writes off more than you confirm, hides information about the commission in the mobile application during the transfer. As a result, the bank scammed me for 2,720 rubles out of nowhere without providing any services at all, I simply withdrew MY own money. I left a request to the quality service, but they think they will simply send it citing tariffs. If they had displayed normal information about the commission, and not hidden it until it was written off, I would have understood everything during the test translation and there would have been no questions, but no, these scammers hide it. Normal banks take a commission from the transfer amount, but these ones take it on top and in the dark. In a word, damned schemers who mislead and steal money. I don’t advise anyone to work with them, and I myself will try to get the company’s salary project transferred to a normal bank, and not this sham. Rating:

★ Last Friday I stopped by the office on Vernadsky Street and asked to change the phone number linked to the Internet bank of my individual entrepreneur.

As a result, they changed the number by which you can contact me, but forgot about the Internet banking. I spent 3 days calling support to understand that the employee simply didn’t know how to do it and decided not to bother, and the comment from the PSB employees was “come spend another hour to make it work.” Now I have to spend another couple of hours on the visit and control of PSB employees - so that what I need is done. I don’t recommend anyone to open and work with PSB: terrible service and incompetent employees. Rating:

★★ I became a salary client of PSB (switched from VTB). There is also an existing loan there (18%) because I am a military man, after talking with a bank employee, they promised me a good rate for refinancing a consumer loan by submitting an application to PSB (4361023 ) a positive answer came with a rate of 17.4 (with insurance of 14.4. Well, that’s what it turns out to be).

Is everyone there sane?? Why do I need all this fuss over 0.6%, for the sake of decency they reduced it by at least 1.6%! I’m surprised that it’s not at the same 18% And where is that advertising?? Where is the agreed reduced rate for the military? Just kapets!!! Not a single delay! Also a salaryman! Rating:

★ On July 30, 2020, in Moscow, additional office “Dobryninsky”, I wrote an application (No. 98939100 to close account 40817810351001983909) of a credit card.

More than 45 days have passed, the account is still valid, the monthly card statement is still being received by mail, the card is valid in all credit history bureaus. I contacted the bank’s support several times, but the issue has still not been resolved. Also, on September 18, 2020, 12:09 16.08.2019, loan agreement No. 69022380 was closed. However, information about this was received only by the United Credit Bureau, nor by Equifax, nor by the National Credit History Bureau, nor by the Russian Standard Credit Bureau. there is no contract to close! To verify this information, I have already spent money on statements from the BKI. 10/01/2019 received new statements - the information has not changed! Rating:

★ Transferred funds through a bank.

The purpose of the payment did not indicate an additional commission. As a result, more than 2 thousand were written off from 200 thousand for the transfer. At the same moment, I contacted the bank and said that I did not need such a transfer and asked to cancel it. They categorically refused to do this. I left a claim by phone and promised to send a letter by mail within 30 days (the bank has no other ways to respond to a claim in the 21st century), but they never responded. Zero customer focus. Rating:

★★★ Dear sirs!

I am interested in the possibility of purchasing mutual fund shares from a brokerage account (IIS) on the over-the-counter market through the NRDirect system. I ask you to carry out/accelerate work on the implementation of this service. A simple procedure for connecting to this service will allow you to expand the range of services provided, increase your income through new transactions and increase customer loyalty. According to the Kommersant newspaper, the volume of receipts into retail mutual funds in the summer of 2020 alone exceeded 29 billion rubles, one and a half times higher than the figure for the same period in 2018. (). Towards the end of the year, the flow of investments will increase and most of these clients, including myself, plan to buy mutual funds on IIS through brokers with access to NRDirect, in order to receive a tax deduction. Please connect the service as soon as possible. Sincerely, Alexander Petrov Rating:

★★ In March 2020, I took out a mortgage in a new building at 9.4% per annum. The loan agreement states that “If the Bank of Russia decides to reduce the key rate, the Lender has the right to reduce the current interest rate under the Loan Agreement.” Due to the fact that the Central Bank reduced the key rate in the summer, on 08/09/2019, entry No. 625-2019/ITs, I wrote an application to reduce the interest rate on the loan. On August 28, 2019, signed by the head of the mortgage center of the St. Petersburg branch of Promsvyazbank PJSC, I received a response stating that it was impossible to satisfy my request. What this impossibility consists of is not specified. On September 6, 2019, the Central Bank again decided to reduce the key rate. 09/13/2019 input. No. 677-2019/IC of the year, I again wrote an application to reduce the interest rate on the loan. At the same time, the answer from the bank was received much faster. On September 17, 2019, signed by the head of the mortgage center of the St. Petersburg branch of Promsvyazbank PJSC, I received an answer stating that it was impossible to satisfy my request. What this impossibility consists of was again not indicated. At the same time, the bank’s interest rate for new buildings is currently 8.7% per annum. I would like to find out from the bank management why it is impossible to satisfy my request.

Housing programs at Promsvyazbank

State mortgage programs provide that the borrower can obtain a loan with relaxed conditions and a reduced interest rate.

Housing programs

Promsvyazbank offers several mortgage programs with government support:

- Maternal capital;

- Young family;

- For state employees and salary clients.

In order to find out who has access to such offers, it is necessary to consider each of the above programs in more detail.

Maternal capital

Mortgages with the support of maternity capital are intended for citizens who have received the appropriate certificate. That is, people who have two or more children can get such a loan.

Its conditions provide:

- That the down payment will be paid with funds from maternity capital;

- The interest rate will be reduced. It can range from 11.4% to 13%, depending on the loan amount and the size of the down payment.

Young family

Spouses who are under 35 years of age are eligible to participate in the program for young families. It also provides for the payment of subsidies from the state, from which the first installment will be repaid.

However, they can only be obtained after the birth of the first child. But a guaranteed condition will be a reduced interest rate.

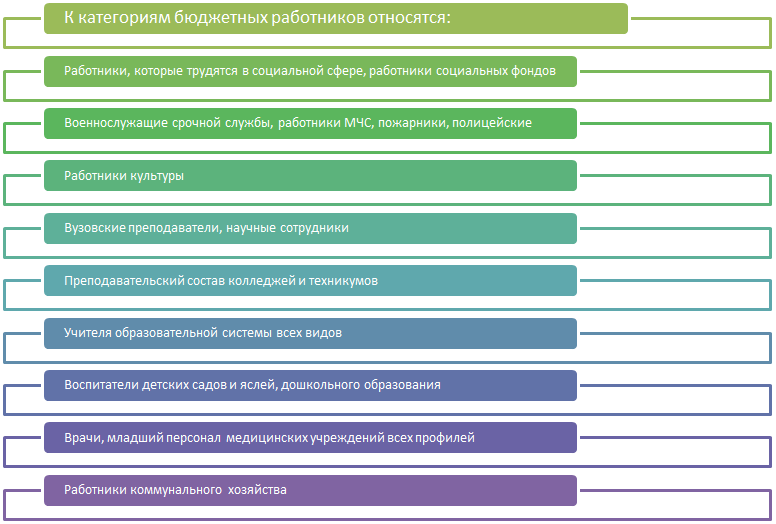

For state employees and salary clients

State employees mean people who are employees of non-profit organizations. Salaries are people who receive a payment to a bank account opened in Promsvyazbank.

List of professions related to public sector employees

For both categories of citizens the following conditions are provided:

- You don’t have to confirm your income;

- Interest rates are falling.

Conditions for obtaining a mortgage at Promsvyazbank

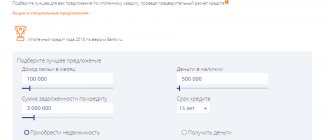

Promsvyazbank (PSB) is one of the few banks that issues mortgages without a down payment for the purchase of new housing and secondary housing. The collateral for the loan can be an existing or purchased apartment. For salary clients, PSB offers rates reduced by 0.1%.

When receiving a mortgage, you must insure the mortgaged property against loss or damage. Life insurance at Promsvyazbank is issued on a voluntary basis. Or you can become a participant in the comprehensive insurance program against all risks.

Also read: Consumer cash loan at Promsvyazbank: rates, conditions and customer reviews

Procedure for obtaining a mortgage

If you decide to apply for a mortgage at Promsvyazbank, you will have to perform the following steps:

- Collect the package of necessary documents in advance;

- Fill out and submit a mortgage application;

- After reviewing and approving the application, the client selects a property;

- An agreement is drawn up with the seller and submitted to the bank;

- Signing agreements with a bank and an insurance company;

- Getting a loan.

Recommended viewing:

List of required documents

Before filling out and submitting a mortgage application to the bank, you will have to collect the necessary papers. They are immediately attached to the application so that during the consideration of the application, the bank can verify the authenticity of your documents. Their list will be as follows:

- Identification;

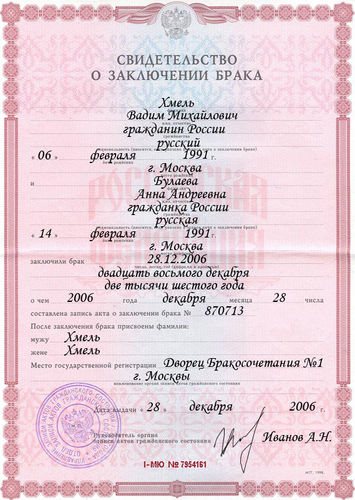

- Marriage certificate;

- A copy of the work record;

- Confirmation of the fact and amount of your income;

- Military ID (if you are a man under 27 years old).

Photo gallery:

Russian passport

Marriage certificate

Military ID Work book

Certificates 2-NDFL

Customer Reviews

Judging by most reviews, Promsvyazbank clients are satisfied with its work. The mortgage is issued quite quickly, and the lender does not set too strict conditions for its clients.

Mikhail : “A few months ago I took out a mortgage for a secondary home in PSB. The employees are quite polite, they explain everything right away if you ask. There were no surprises during the registration process - everything was exactly as originally stated. According to the program itself, everything is standard, but I am a salary client, so my rate was reduced by 0.5%.”

Of course, mortgage lending in the Russian Federation is still viewed with a degree of mistrust. Therefore, you can also find reviews that somewhat criticize the bank’s policies or the implementation of its mortgage programs.

Olga : “I took out a loan for a new building. But it turned out to somehow soften the conditions, according to the certificate of swearing. capital. Of course, the rate dropped by 1.5%, and we didn’t actually have to pay the first installment, but otherwise, we had to bring a bunch of documents.”

Customer reviews about mortgages at Promsvyazbank

Shchukina Marina:

Shestakov Eduard:

Vorobyov Gleb:

“We spent a long time choosing a bank, but when we saw the PSB mortgage program for secondary housing, we decided that we had to apply for it. After the application, the manager contacted us and told us in detail about all the conditions. Within 2 days the application was approved. There were also no problems with approving the apartment. The transaction itself with the buyer went very smoothly. So far, the impressions from cooperation with Promsvyazbank have been only positive.”

Simonova Nadezhda:

“I have long wanted to buy my own apartment, but I still couldn’t raise the money for the down payment. I accidentally saw PSB’s offer for a mortgage without a down payment. Everything was formalized literally within 2 weeks and at every stage they talked about how best to proceed. I recommend this bank to anyone who does not know how to save for a down payment on a mortgage, but wants to live in their own apartment.”