State support in mortgage loan restructuring

Government authorities are also taking part in the mortgage restructuring program carried out by Sberbank. Federal budget funds support certain categories of borrowers, which include:

- Young large families with minor children;

- Families with children recognized as disabled;

- Families whose members are people with disabilities;

- Participants in combat operations.

Financing of the state's participation in the restructuring of mortgage loans occurs with the help of a specially created Agency for Housing Mortgage Lending (AHML). It acts as an intermediary between the individual who is the borrower and the bank issuing the loan. Sberbank, being one of the leaders in the country's financial sector, takes part in such schemes much more often than other credit institutions.

Who can apply for restructuring?

The restructuring program developed by Sberbank is intended for those clients of the credit institution who meet the following requirements:

- The borrower's income has decreased by 30% or more;

- The regular payment increased by 30% or more due to changes in the ruble exchange rate for foreign currency mortgages;

- The income remaining after the mortgage payment is less than 2 times the subsistence level for each family member;

- The existing mortgage loan agreement is valid for more than a year;

- The borrower has not been in arrears on regular payments for at least a year.

The following circumstances in the life of the borrower may also be grounds for restructuring a mortgage loan:

- Conscription for military service;

- Staying on parental leave to care for a child whose age does not exceed 3 years;

- Temporary loss of ability to work;

- The occurrence of serious health problems, etc.

Who is eligible for mortgage restructuring?

The state transferred a large amount from the federal budget, but still it was not enough for all the families facing difficulties. Because of this, the problem mortgage restructuring program can be used by certain segments of the population:

- Families with 2 minor children;

- Families with spouses aged less than 35 years, where a child has already been born;

- Veterans of hot spots:

- Disabled people of all groups, as well as families with disabled children;

- Employees of budgetary organizations;

- Families who have obtained a mortgage under government programs.

Such borrowers have the right to submit an application to change the terms of the loan. The constant rise in foreign exchange rates requires this, as the debt continues to increase every day. Accordingly, the situation affects the monthly payments and the schedule that people have to deal with.

Features of restructuring a mortgage from the state at Sberbank

If an individual belongs to one of the categories of borrowers subject to the state restructuring program, the bank client can count on the following additional benefits:

- One-time payment of funds in the amount of 10% of the loan debt, but not more than 0.6 million rubles;

- Reducing the interest rate to 9.5% for the entire remaining term of the mortgage;

- A two-fold reduction in the monthly payment for up to one and a half years by reducing the interest rate or increasing the term of the contract.

The specific option for receiving benefits depends on the category of the borrower. It is determined jointly by the bank client and AHML specialists, after which it is communicated to Sberbank.

What is a mortgage

A mortgage loan is a type of lending where the collateral is the property being purchased. Mortgages are usually taken out for a period of 10 to 30 years. During this time, everything in a person’s life can change, loss of a job, moving, death of loved ones. As a result, paying off your loan every month can become a big problem. But this is life, the bank and the state understand that such life situations can happen to people. A mechanism of assistance is needed. It is necessary to change the payment schedule, take a deferred payment or increase the loan term, thereby reducing the amount of monthly payments.

Restructuring options

Detailed conditions of the mortgage restructuring program are provided on the official website of Sberbank at sberbank.ru. Some regional divisions of the credit institution conduct their own activities aimed exclusively at mortgage restructuring. An example of such a territorial program is given on sberbank.ru

That is why, if you want to restructure a loan, it is advisable to first consult with Sberbank specialists. This will make it possible to more effectively use the opportunities presented to clients of the country's leader in the financial industry. In general, when approved for participation in a restructuring program, the borrower is offered to use one of the following options to reduce the financial burden:

- Reduced mortgage interest rates;

- Increasing the loan term;

- Changing the currency of the mortgage loan to rubles if it is issued in dollars or euros;

- Providing credit holidays, providing for the payment of only interest or complete exemption of the borrower from regular payments for a specific period of time;

- A mix or combination of the above restructuring options.

Requirements

When considering a client’s application for restructuring, it takes into account not only his relationship to the above categories of borrowers. In addition, the condition and characteristics of the housing purchased with a mortgage are taken into account, as well as the financial integrity of the debtor.

To housing

Among the mandatory conditions for participation in the restructuring from Sberbank is the compliance of the mortgaged property with a number of requirements. These include:

- good technical condition of housing, which should be repaired if necessary;

- absence of illegal actions related to redevelopment or other types of work that could reduce the value of real estate;

- the borrower lacks other real estate, unless we are talking about shared ownership of an apartment.

In addition, the following are usually put forward as additional conditions for participation in the program, which are not mandatory:

- Price sq. m of housing purchased with a mortgage cannot be higher than 60% of the average cost in the region;

- The area of a one-, two- and three-room apartment should not exceed 45, 65 and 85 square meters, respectively. m.

To the borrower

The main requirement that is presented to the borrower when restructuring a mortgage loan is the absence of delays in current regular payments. In addition, it is extremely important to competently justify the need to reduce the financial burden, confirming it with the presence of objective factors and factual documents.

Mortgage restructuring conditions

There are also certain conditions for receiving support. They suggest that it will not always be possible to take advantage of government assistance. So they need to be listed.

- The delay period for the next payment is from 30 to 120 days;

- No lien on the property.

It is necessary to separately highlight space requirements, as they have become a real problem for some families. Using certain calculations based on the market value of housing before restructuring, the elite status of the property is determined. If the price per square meter exceeds a certain amount, then the owner does not need support.

How to apply?

The restructuring procedure proposed by Sberbank is quite simple. To launch it, the client will first need to contact the credit institution with an application. It can be issued either at the bank’s office or on the institution’s website at the address indicated above.

What will you need?

In addition to the application, the borrower will be required to provide the following set of documents:

- Copy of the passport. The original document will be required when signing the restructuring agreement;

- Documents of ownership in relation to the property pledged with a mortgage;

- Documents indicating the borrower’s income level for 3 months;

- Documents confirming the client’s compliance with the requirements for participants in the Sberbank restructuring program;

- Documents demonstrating the objective nature of the client’s financial difficulties and the need for restructuring.

The specific list of documents is determined individually. This is quite logical, since it depends on the specific life circumstances of the borrower, which caused difficulties in repaying the mortgage loan.

Procedure

In order to participate in the restructuring program, the borrower must complete the following steps:

- Study the terms of the program;

- Fill out an application for participation in it at a bank branch or submit an online application on the official website of the organization;

- If necessary, take part in an interview with a responsible Sberbank specialist;

- Sign restructuring documents if a positive decision is made.

How to restructure a loan

The bank considers the possibility of restructuring based on the client’s application and the documents provided, after which it makes a decision and reports it. If it is positive, the borrower must come to the branch to sign documents.

Submitting an application and documents

To submit an application, you must fill out an application of the appropriate sample indicating the circumstances preventing the repayment of the mortgage, details of the loan agreement, a request to revise the terms of the agreement and a list of attached documents confirming the difficult life situation.

In online mode

Sberbank offers the opportunity to submit documents online. To do this, you need to follow the link, log in using your mobile phone, fill out the application fields, and attach documents. After which the application is sent for consideration, the borrower will be notified of the result.

At a Sberbank branch

The application can also be submitted in person. To do this, you need to contact the nearest bank branch with a package of documents. The list of branches on the map is available on the Sberbank website at the link: https://www.sberbank.ru/ru/about/today/oib. This option is preferable. Despite the fact that you need to spend time visiting the bank, on-site employees will help you fill out an application and check your documents.

Waiting for a decision from the bank

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

The application is reviewed within 10 days, after which the bank notifies the borrower of the decision via SMS or email. You can find out about the result by contacting customer support by phone.

Signing an agreement with the bank for loan restructuring

After the application is approved, documents are signed that amend the terms of the loan agreement. In addition to additional agreements, a new payment schedule must be formed.

How are applications for restructuring processed?

Client applications for mortgage restructuring are reviewed by Sberbank specialists on an individual basis. Typically, such a procedure takes no more than 7-10 days. If necessary, the borrower is invited to substantiate his own position.

The final decision must be communicated to the client within 1-2 days after adoption.

How to increase the likelihood of approval?

There are several options to increase the likelihood of approval of an application for mortgage loan restructuring. Firstly

, participation in the state support program seriously increases the client’s chances.

Secondly

, the quantity and quality of documents provided in addition to the application can also influence the decision made.

Thirdly

, it is extremely important to demonstrate to the employees of the credit institution the objective nature of the difficulties encountered and the borrower’s desire to pay the bank.

What to do if you refuse?

The bank has the right not to inform the client of the reasons for the refusal. In such a situation, the borrower can use one of two possible options for further action. The first of them involves contacting another bank in order to refinance a mortgage loan on more favorable terms. Similar services are provided today by almost all major Russian credit institutions.

The second option involves re-applying for restructuring to Sberbank. However, this only makes sense if appropriate work is carried out with the employees of the institution to determine the reasons for the refusal in order to correct the situation.

What to do if the bank refuses to restructure?

The main thing is not to panic and continue to act. There are other ways out of this situation. Many banks offer to take advantage of restructuring. If you manage to find out the reason for the refusal, contact Sberbank again, correcting the shortcomings that caused the unsatisfactory decision. Temporary financial difficulties are also solved in other ways: an additional loan, mortgage holidays, refinancing a loan in an MFO. In the latter case, the percentage of overpayment will be large.

Applying for a consumer loan

An additional injection of credit funds into the family budget is a real way out of difficulties. It should be borne in mind that you will have to repay not only the mortgage. Total monthly costs will increase. But there will be no delay, for which there is a penalty, and you have to pay off fines. And if you don’t have time to wait for the bank to agree to restructuring, a consumer loan will help you avoid increasing your mortgage debt, which will increase your chance of getting approval.

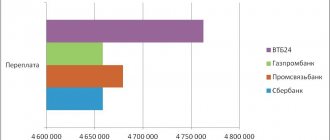

Mortgage refinancing

This is a separate service that also involves re-registration of the mortgage agreement. Unlike restructuring, refinancing involves getting money from another bank to pay off your mortgage loan. This is an opportunity not to ruin your credit history during a family financial crisis. In this case, you can not only get a deferment, increase the repayment period, but also reduce the interest rate on the balance of the mortgage debt.

Advantages and disadvantages of restructuring at Sberbank

The main advantages of participating in Sberbank’s restructuring program are the preservation of housing and the opportunity to pay off mortgage debts on more favorable terms. This will allow the client to remain with a good credit history, which is also extremely important in modern conditions. An important advantage is the reduction in the financial burden on the borrower, which will have a positive impact on his financial situation.

The only serious drawback of the restructuring procedure can be considered the serious time spent on preparing the necessary documents and negotiating with bank employees. It is important to understand that if the credit institution refuses, they will simply be useless.

Pros and cons of restructuring

Benefits for the borrower:

- possibility of payment reduction;

- no delays or penalties;

- credit history does not deteriorate;

- the ability to pay off your mortgage even if your solvency decreases.

For the bank, this is an opportunity to resolve the problem without going to court, the absence of risks associated with the occurrence of delays, and increased customer loyalty.

Restructuring a mortgage loan from Sberbank to an individual also has a drawback - most options imply an increase in overpayment on the loan. Another disadvantage is that the bank does not always cooperate, only if there are confirmed objective reasons.