Home » Articles » Mortgage » Foreign currency mortgage in Russia

February 26, 2020 No comments

Concluding a mortgage loan agreement in a foreign currency makes sense only for people who receive income in the same currency.

However, due to financial difficulties, most credit institutions have introduced a ban on issuing foreign currency mortgages in Russia.

The meaning of foreign currency mortgages

Difficulties with existing foreign currency loan products turned out to be very significant for many Russians who took out mortgages in euros or dollars.

It turned out to be impossible to solve them on our own.

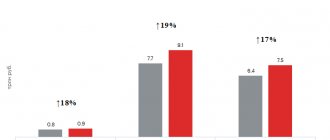

In 2010, according to statistical data, there were approximately 80 thousand people who took out foreign currency mortgage loans.

Based on data from the mortgage and housing lending agency, approximately 5 thousand of whom by this time already had large arrears on their debt.

Most of these borrowers, of course, turned out to be residents of federal cities of the Russian Federation: Moscow and St. Petersburg.

Compared to a mortgage in rubles, such loans cost debtors 5 times more, and the average loan amount in Moscow was around 15 million rubles.

Over time, the number of dissatisfied debtors has decreased, but the situation still remains difficult.

The economic crisis has hit the pockets of many of our compatriots hard; many have lost their income, lost their business, etc. Therefore, they were unable to pay the loan on the old terms, especially in the context of a significantly increased currency.

Citizens who took out foreign currency mortgages found themselves in truly enslaving conditions.

However, such a phenomenon as foreign currency mortgages still exists in Russia to this day.

The banks that use it have made the rules for issuing it more stringent. The interest rate has increased and a higher down payment amount is required.

The requirements for clients and properties purchased with a mortgage have become stricter - now you can only apply for a mortgage loan on the secondary housing market.

Therefore, it is extremely difficult for most people to obtain such a banking product during an economic crisis.

Mortgage interest rate in EU countries

The list of European Union countries for 2020 includes 28 countries. A single economic zone, the presence of a healthy competitive environment, and all-pervasive integration are not the basis for the application of a single credit policy in existing banks and financial institutions. On the contrary, mortgage products offered to potential borrowers are characterized by variations in interest rates, requirements for clients and the mechanism for registering transactions.

Below is a table with lending rates for obtaining a mortgage in EU member states.

| A country | Interest rate, % per year (average value) |

| Austria | 2,5 – 3,5 |

| Belgium | 2,47 |

| Bulgaria | 4,5 — 5 |

| Great Britain | 2,5 – 3 |

| Hungary | 6 |

| Germany | 1,5 – 2 |

| Greece | From 3.5 |

| Denmark | 2,2 |

| Ireland | From 3.8 |

| Spain | 2 – 3 |

| Italy | 2,1 – 3 |

| Cyprus | From 4 |

| Latvia | 2,9 |

| Lithuania | 2 |

| Luxembourg | 1,8 |

| Malta | From 3.5 |

| Netherlands | 2,5 |

| Poland | 3,7 – 4 |

| Slovakia | 1,9 |

| Slovenia | From 3.6 |

| Portugal | From 2.5 |

| Romania | 3,5 |

| Finland | 1,47 |

| France | From 2 |

| Croatia | 5 – 6 |

| Czech | 2 |

| Sweden | 1,85 |

| Estonia | 2 – 2,5 |

The given data on interest rates in European countries applies to residents. For foreign citizens, completely different conditions will apply.

Each country can set its own mortgage lending parameters for the population, apply fixed and floating rates, requirements, commissions and fees.

Important! The value of the lending rate in the EU largely depends on the Euribor indicator - the interbank lending rate in Europe. Since its value is prone to periodic fluctuations, rates (especially floating) will change in the same direction as Euribor.

Mortgage conditions in the TOP 5 countries with the lowest rates

In the table above, the top five EU countries with minimum mortgage lending rates are: Sweden, Finland, Germany, Luxembourg and Slovakia. The interest rate when taking out a mortgage loan does not exceed 2% per year.

The conditions for obtaining a mortgage in Europe for each of these countries are given in the table below.

| A country | Interest rate, % per year | Amount of borrowed funds | Maturity | Share of down payment, % of the cost of purchased housing |

| Sweden | 1,85 | Up to 85% of the price of the purchased living space | Up to 50 years | At least 15 |

| Finland | 1,47 | Up to 75% of the value of the purchased property | Up to 30 years old | From 25 |

| Germany | From 1.5 | Up to 80% of the property price | Up to 40 years old | Not less than 20 |

| Luxembourg | 1,8 | Up to 30 years old | From 20 | |

| Slovakia | 1,8 | Up to 100% of the cost of housing | From 0 |

The average loan term for the countries under consideration is 20 years. Getting a mortgage is not difficult; the main requirement is to confirm your solvency and reliable reputation, as well as meet the minimum requirements of the lender.

Advantages and disadvantages of foreign currency mortgages

Why were bank clients so willing to choose foreign currency as a means of payment for a loan?

In the situation before there was a sharp increase in the value of foreign currency, there was a demand for the provision of foreign currency loans.

The following factors motivated citizens to do this:

| Receiving income in foreign currency | or income linked to the exchange rate |

| Unlimited circulation of foreign currency (dollar) in the Russian Federation | circulation and storage do not require permission from authorities |

| Reduced initial fee | individual banks lower ruble loans by 4-5% |

| Setting prices in foreign currency by the developers themselves | real estate agencies and sellers in foreign currencies |

| Providing a loan | amounting to 100% of the property value |

| Long terms | validity of loan agreements |

| Government support | and low exchange rates |

As a result of increased demand, banks actively used inexpensive credit products from Western banks.

On the contrary, the Central Bank of the Russian Federation could not offer such favorable conditions, therefore commercial banks operating in our country did not provide low rates in rubles.

In addition, bank employees often told their clients that foreign currency mortgages were more profitable under all conditions.

Some banks hinted to future clients that applications for ruble mortgages would not be approved.

However, when debtors later began to apply for loan restructuring in rubles, they were refused for various reasons.

Some banks reported that there were no suitable programs, others drew attention to the debtor’s insolvency or simply delayed time without explanation.

As a result, a situation arose that the debt of foreign currency debtors increased 2 times more when converted to the ruble equivalent.

The essence of foreign currency mortgages and its features

A foreign currency mortgage is a targeted loan issued for the purchase of housing. However, the amount is provided not in state, but in foreign currency. It can be:

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

- dollars;

- Euro;

- pounds sterling;

- francs;

- other currency.

In Russia, loans provided in the first two monetary units from the above list are popular. Finding other offers is problematic. The difference in monetary units is the only difference between currency and classic mortgages. In fact, the offer is a standard method of lending. You will not have to obtain additional certificates, permits or documents. Cooperation in obtaining foreign currency mortgages is carried out on standard terms.

For your information

People prefer to get foreign currency mortgages due to savings. Due to the fact that the method of housing lending is associated with increased risks, the rate on offer is lower. The figure is 8 - 11% per annum. Additionally, borrowers are attracted by a more favorable loan term. On average, the repayment period for a foreign currency mortgage is 25 years.

Borrower risks

No one is immune from suddenly changing circumstances when lending. If a person loses his job, loses his health or loses his business, then serious problems will arise with paying the mortgage.

As the debt grows, penalties and fines are accrued. Restructuring does not change the situation in a positive direction.

As a result, a situation may arise that the family loses its housing, the reason for this is a foreign currency mortgage. The courts cannot resolve the issue in favor of the debtors.

With the annuity type of payments, the bank initially deducts interest on the loan, but the principal debt practically does not decrease.

In such a situation, the only reasonable way for bank clients not to get into even greater debt is to sell the mortgaged home.

However, the housing market remains virtually unchanged, and there are few people willing to purchase a mortgaged apartment.

This procedure will be too complicated, plus the likelihood of losing money is extremely high.

Is it profitable to take out a mortgage in dollars?

In recent years, a stable situation has developed in the Russian currency market in terms of the ruble-dollar ratio. If the currency remains at this level over the next 10 years, then it is most profitable to take out mortgage lending in American currency. Even if the dollar begins to depreciate, it will be much more profitable for the borrower. This way, money will be saved and the loan will be repaid faster. With periodic minor ups and downs in the dollar exchange rate, the borrower will repay the mortgage according to the planned schedule.

Problems with loan repayment may arise due to sudden currency fluctuations. If the dollar rate rises rapidly, citizens' incomes will decrease, and falling into a debt trap is inevitable. Also, no one excludes the risks associated with the loss of an apartment purchased with a mortgage. The apartment can simply be taken away by bailiffs to pay off the debt, and the borrower is left with nothing. No one is immune from currency fluctuations on the Russian currency market. And the risks associated with this do not depend in any way on the wishes of ordinary people.

Government decisions on foreign currency mortgages

Some economists believe that a sharp depreciation of the ruble and other financial difficulties in Russia could lead to another crisis. At the same time, debtors may lose housing purchased on credit in the absence of government support measures. The banks decided to fix the dollar exchange rate at 40 rubles in 2020. This decision may cause significant financial losses for credit institutions, and as a result, bank clients may suffer.

Banks cannot pay penalties on existing deposits.

The final option for government measures is to provide funding from the budget. These funds are used to compensate borrowers who received a mortgage loan in foreign currency.

In 2020, the Russian government intends to take the following measures:

- The total amount of mortgage debt can be calculated based on the value of the US dollar that existed before the crisis.

- Social assistance measures from the state may be taken for borrowers. But such a program does not apply to citizens who purchased real estate as part of a commercial activity.

- The interest rate on mortgage loans will be significantly reduced.

In 2020, a state program to support affected foreign currency debtors began to operate. They will be partially refunded funds from the federal budget of the Russian Federation.

Restructuring and refinancing of foreign currency mortgages

There is a golden rule - if you cannot pay the loan, contact the bank to solve the problem together.

Foreign currency mortgage holders can restructure their debt thanks to the Decree of the Government of the Russian Federation dated April 20, 2015 .

Banks offer the following solutions:

- increase the loan term;

- take advantage of mortgage holidays.

As the mortgage term increases, monthly payments automatically decrease, which significantly reduces the debt burden on the family budget. There is also a big disadvantage here - the total amount of overpayment increases.

Mortgage holidays are only effective for those who are faced with temporary financial difficulties and can solve them in the near future. The borrower is given the opportunity to reduce or even suspend payments for up to six months. In the case of foreign currency loans, it is almost impossible to solve the problem in such a short period of time.

Refinancing is the conclusion of a mortgage agreement with another bank on more favorable terms. The borrower, secured by the same real estate, issues a new mortgage, the interest rates of which are lower than those in force under the first agreement.

It turns out that the second bank buys the mortgage from the first and pays it off in full. Now the debtor will be a client of the second bank and pay debts under new conditions. The main thing is to arrange refinancing in rubles so as not to fall into the same trap again.

Restructuring and refinancing are possible only if the borrower has no arrears.

Restructuring

Back in 2020, the Central Bank of the Russian Federation recommended that banks consider restructuring.

This recommendation is not binding for banks; they can apply it at their own discretion.

Transferring debt from foreign currency to rubles at a cost of 40 rubles per 1 dollar and 50 rubles per 1 euro could lead to significant losses for banks.

In particular, DeltaCredit Bank, in pursuance of this Government Resolution No. 373, introduced several credit programs to assist foreign currency debtors.

Borrowers can reduce the amount of debt by 10 percent, but not more than 600 thousand rubles, with interest reduced to 10% for the remaining period.

When restructuring a foreign currency mortgage, the amount of monthly payments can be reduced by 1 year or until the end of the contract if its term is increased.

VTB also, through restructuring, reduced the number of debtors, by the beginning of 2020 there were 30% fewer of them.

Interest rate in European countries that are not EU members

Western European countries that are not members of the EU include: Switzerland, Monaco, Liechtenstein, Andorra, Norway, Iceland, Bosnia and Herzegovina, Montenegro, Albania, Macedonia, Serbia.

Mortgage interest rates are presented below.

| A country | Interest rate, % per year (average value) |

| Switzerland | From 1.8 |

| Monaco | From 1.9 |

| Liechtenstein | 2,2 |

| Andorra | From 4.5 |

| Norway | 6 — 8 |

| Iceland | From 1.5 |

| Bosnia and Herzegovina | From 8 |

| Montenegro | 4 |

| Albania | 3,9 |

| Macedonia | From 7.5 |

| Serbia | From 4 |

The presented mortgage rates are applicable with an average repayment period of debt to the bank of 15 to 20 years for citizens of these countries.

Mortgage conditions in the TOP 5 countries with the lowest rates

Non-EU countries with low mortgage rates include Iceland, Switzerland, Monaco, Liechtenstein and Montenegro. Let's take a closer look at the conditions for obtaining a mortgage in them.

| A country | Amount of loan funds | Debt repayment period | Share of down payment, % of the cost of purchased housing |

| Iceland | Up to 80% of the cost of the purchased residential property | Up to 40 years old | From 20 |

| Switzerland | Up to 90% of the housing price | Up to 50 years (even lifetime mortgage applies) | From 10 |

| Monaco | No more than 80% of the cost of the purchased object | Up to 15 years | From 20 |

| Liechtenstein | Up to 90% of the price of living space | Up to 20 years | From 10 |

| Montenegro | Up to 80% of the property value | No more than 25 years | From 20 |

A mortgage in Iceland can only be issued by a citizen of the country, since local legislation prohibits the sale of any real estate to non-residents. Loans are issued for a long term (up to 40 years). Mortgage conditions for its residents are extremely favorable and are characterized by a loyal attitude towards borrowers.

In Switzerland, the most popular are housing loans with a repayment period of up to 10-15 years, but loans with a lifetime repayment period are also common. If the borrower fails to repay the lender during his lifetime, the burden of payments passes to the direct heirs.

Monaco is a country of “cheap mortgages” and “expensive real estate”. The minimum loan amount cannot be less than 500 thousand euros. For mortgage transactions, both fixed and floating and combined interest rates are applied.

A mortgage in Liechtenstein is issued for a relatively short period (up to 20 years) with a mandatory down payment of 10% of the market value of the property being purchased.

The working population, who has the opportunity to officially confirm their income, can purchase housing with borrowed funds in Montenegro. The minimum mortgage size is 10 thousand euros, and the maximum is 500 thousand euros.

In most of the countries reviewed, citizens aged from 20/21 to 65-75 years can apply for a mortgage loan. In addition to compliance with the age limit, among the mandatory requirements for clients:

- having an account opened in a local bank (with funds flowing over the past few years);

- purchasing insurance;

- sufficient creditworthiness;

- permanent employment;

- provision of a complete set of documentation.

Debt refinancing

Some banks have introduced their programs for refinancing debt in rubles, which many of their clients have taken advantage of.

For what reasons a mortgage may be denied, see the article: why a mortgage was denied.

VTB set the standard rate as the base rate, but introduced reduced rates.

Foreign currency borrowers of these banks will be able to take advantage of these promotions until 2020.

Gazprombank, HomeCredit Bank, Sovcombank and Absolut Bank have set a reduced rate for foreign currency mortgage loans, which ranges from 45 to 60 rubles. for one dollar.

Sberbank of the Russian Federation proposed the following conditions:

| Converting foreign currency to rubles | at the time of execution of the mortgage agreement |

| Compensation of bank expenses | up to 30% of the debt amount |

However, refinancing is allowed not only where the mortgage was issued, but also in another bank.

During a crisis, of course, there are few such banking offers, but for some it may be very useful.

What is this anyway and why is it needed?

In general, a foreign currency mortgage is in no way different from a ruble mortgage. It can be obtained in the same manner as a regular one (we will discuss this in more detail below), and the same conditions are usually set for obtaining it.

The most important advantage of a foreign currency mortgage is a lower interest rate, which will allow you to pay much less extra money to the bank and reduce the time you have to pay. However, if foreign currency mortgages are so convenient, why is it not popular?

It's all about the risks that accompany any transaction with foreign currencies, especially in our economy: the ruble exchange rate may collapse and then the bank, by law, has the right to demand more money from you in rubles.

Of course, for people with a stable income in foreign currency there is nothing to be afraid of, but the majority of residents of our country and even the majority of foreign currency borrowers have very modest incomes in rubles.

Debt review

Without additional support measures, borrowers cannot solve this difficult situation.

At the same time, creditor banks are also interested in restoring the receipt of regular payments from debtors.

Therefore, banks are introducing different programs.

Among other things, credit holidays may be applied to bank clients, i.e. they can be exempted from paying the principal debt for a period of 6 months to 1 year; during this period only interest is paid.

Renegotiation of debt on loans, as a rule, does not lead to the benefit of banks.

Some banks can extend the mortgage term by reducing payments, while others can by changing the payment schedule, for example, introducing new payment schemes.

Vladimir Putin announced the registration in Russia of the second domestic vaccine against coronavirus

Vladimir Putin proposed extending the preferential mortgage program at 6.5% until next summer. Since the lucrative offer appeared, more than 200 thousand Russians have already decided to start a new life in a new home.

During the pandemic, this has become one of the most effective economic measures, the president noted at a meeting with the government. Although, of course, the main blow to the coronavirus comes from doctors and scientists. Vaccine production, according to Putin, needs to be increased. And, by the way, there are now two registered vaccines in our country.

V. Putin: Novosibirsk today registered the second Russian vaccine against coronavirus, EpiVacCorona. I would ask Tatyana Alekseevna Golikova to tell you more about this.

T. Golikova: Indeed, this is very good news. The registration certificate was received today. I would like to note that clinical studies were conducted on 100 volunteers.

The Deputy Prime Minister said that unlike the first Sputnik V vaccine, which was made from fragments of a real virus, the new one is created on the basis of synthetic proteins - peptides that imitate the virus. Short fragments of these proteins train the immune system to fight the real virus, while they are less dangerous for people at risk, including pensioners.

T. Golikova: “Vector” will begin post-registration clinical trials in various regions of Russia with the participation of 40 thousand volunteers. At the same time, I want to say that at the same time, Vector plans to conduct a clinical trial among 150 people over 60 years of age.

According to Golikova, the new vaccine opens up great opportunities for mass vaccination of citizens. Meanwhile, 13 thousand volunteers are already taking part in the research of the first Sputnik V vaccine and the vaccine is arriving in the regions

At the same time, the third vaccine is on the way - from the Chumakov Scientific Center. She has already received permission for clinical trials; 15 volunteers who feel well have already been vaccinated; the second phase will start soon - 285 people will already be vaccinated.

V. Putin: As far as I know, you yourself, among these 40 thousand, also got vaccinated, both you and the chief sanitary doctor of Russia Anna Yuryevna Popova. You have already given yourself the second vaccination, the second part of this vaccination. How do you feel and how did you feel?

Golikova explained that they vaccinated Anna Popova in the first phase to ensure her safety.

T. Golikova: We have already gone through two stages. Neither at the first nor at the second stage, neither Anna Yuryevna nor I had any side effects. And in the course of further life we did not feel any complications.

V. Putin: The temperature did not rise?

T. Golikova: No, Vladimir Vladimirovich, it was not. And I want to say that all the volunteers who took part in the first and second phases did not have a fever.

V. Putin: I see. Well, did the credits appear?

T. Golikova: Titles have appeared, and at a fairly good and high level.

V. Putin: I want to congratulate the scientists and all the employees of Novosibirsk on this success. This is, of course, a very important task, which you, dear friends, have successfully solved. Thank you very much for your work, for your work, for your talent, for your determination in your work. We now need to increase production of both our first vaccine and now our second vaccine. And, of course, first of all, it is necessary to provide the Russian market with these drugs; they should be supplied to the Russian pharmacy network as widely as possible.

Putin reminded once again: our citizens are a priority. All countries that intend to receive our vaccines will produce them themselves. The Deputy Prime Minister also spoke about the situation with coronavirus in Russia. She's tense. In the fall, there is a surge in incidence throughout the country. The readiness of medical institutions for this is high.

T. Golikova: I want to say that, in our opinion, the situation is manageable and does not require the introduction of restrictive measures. But I want to once again take this opportunity and appeal to the regions and citizens so that they comply with all safety requirements.

According to her, in those regions where sanitary standards are observed, the incidence is lower. But there are also those where this is not the case. There is growth there.

V. Putin: You said that testing is not properly organized in all regions. And what’s more, they said that six of them have obvious problems with this. I’ll call you a little later, please list these regions.

The conversation with the Prime Minister turned to support measures during the coronavirus, in particular, preferential mortgages.

V. Putin: One of these support measures - both for the construction industry and for citizens - is a preferential mortgage at 6.5%. It ends on November 1st. Mikhail Vladimirovich, taking into account the fact that the situation in our country is, in general, not easy, although the economy is recovering, nevertheless, it’s still hard for people, and for certain sectors of the economy, including construction, let’s extend this benefit at least until the middle next year. How do you think?

M. Mishustin: We see its demand, what families need, by the way, to support the construction industry, this played a role, it found itself in a difficult situation due to the coronavirus. In this regard, dear Vladimir Vladimirovich, we will support this and extend this program with a preferential mortgage rate of 6.5% until July 1, which you said, we consider important. And we are ready to quickly prepare all the necessary relevant orders.

V. Putin: Okay, let's do this.

Mishustin also recalled his recent meeting with the leader of the political council of the Ukrainian party “Opposition Platform - For Life” Viktor Medvedchuk, who conveyed the request of Ukrainian industrialists to open access for several Ukrainian companies to the Russian market.

M. Mishustin: We are talking about those industries that were focused on exporting goods to Russia. Vladimir Vladimirovich, we consider it possible to allow the supply of equipment and products from the Barsky Machine-Building Plant and the Rubezhansky Cardboard Mill.

V. Putin: As you know, we did not introduce these restrictions. All actions on our part are only reciprocal. We are always ready to restore full-scale interaction with Ukraine. The level and depth of cooperation between our enterprises was very high, and this brought mutual benefit, mutual benefit, saved jobs, and provided people with decent wages. We are ready to restore full-scale interaction with Ukrainian partners. Well, let's assume that this is the first step and a gesture of goodwill on our part.

The Minister of Agriculture reported on plans for this year's harvest. According to Dmitry Patrushev, this will be the second largest harvest in the entire modern history of Russia.

D. Patrushev: At the moment, 93% of the area has been threshed, and, as I reported to you, we expect that in 2020 the grain harvest will exceed 125 million tons in net weight, including at least 82 million tons of wheat, which is planned 7.5 million tons above the 2020 level.

Russia is fully self-sufficient and exports agricultural products. This year, the volume of foreign supplies will also increase. The export volume target is set at $5 billion more than the previous $25 billion.

Change of contract

All changes to the mortgage lending agreement must be recorded in the agreement. When making any changes, an additional agreement must be drawn up, which is signed by the parties and is an integral part of the contract.

To change the terms of the contract, the following conditions are necessary:

| Contacting a bank branch | ask a bank employee if there is a suitable program |

| Restructuring, deferment | or refinancing payments |

| Delays must not be allowed to occur | on loan |

If the debtor fails to pay monthly payments several times, the bank has the right to demand early repayment of the debt through the court.

This right to terminate a mortgage agreement unilaterally is enshrined in civil law.

Borrower bankruptcy

Bankruptcy legislation establishes a ban on the seizure of the only home or its sale at auction.

However, this rule does not apply to mortgaged housing.

Therefore, when a citizen is declared bankrupt, real estate encumbered as collateral in favor of the bank can be sold by the pledgee bank.

In practice, most citizens are afraid of the restructuring procedure and declaring bankruptcy through the court.

And a citizen who has been declared bankrupt will be written off the debt that was not covered through restructuring or sale of real estate.

other methods

In each specific case of foreign currency lending, it is necessary to individually look for ways to solve the current situation.

For a debtor in a difficult economic situation, there are legal support measures.

Ordinary citizens who take the risk of taking out a loan in foreign currency are often unaware of their rights and cannot resolve the mortgage issue.

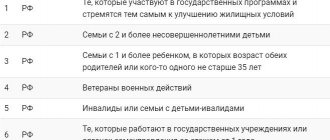

In the spring of 2020, a decree of the Russian government was adopted, giving the right to receive the necessary support to certain groups of the population.

The Government Decree is aimed at assisting about 22 thousand borrowers who received foreign currency mortgages.

As part of the implementation of the program for 4 billion rubles. The authorized capital of JSC Dom.rf (formerly AHML) was increased.

Many adopted support programs operating in various credit institutions do not actually bring any benefit to banks.

ARHML , a subsidiary, is engaged in the restructuring of mortgage housing loans, providing citizens with time to restore their financial situation and resume self-payment of their mortgage loans in the future. Since 2011, the agency began to also perform the functions of a collection agency. The borrower's payment schedule was changed taking into account his solvency for a period of up to 1 year.

The borrower pays as much money as he can afford at this time.

After 12 months, one of 2 options was used:

- Increasing the mortgage term.

- Increasing the amount of monthly payments up to 10%.

Even taking into account not the most favorable conditions, many compatriots participated in the program.

With the help of government assistance measures, citizens were able to preserve their property.

An example of calculating the rate for a foreign currency mortgage, depending on the Central Bank refinancing rate

Refinancing rate is an indicator used by the bank when carrying out transactions with commercial financial institutions. Additionally, it is used to calculate fines and penalties, as well as for tax purposes. The indicator is reviewed periodically. Information on changes in the key rate is published in the information message of the Central Bank of the Russian Federation.

The determination of the key rate depends on the period of delay. The following formula is used to calculate interest:

Amount of interest collected = Amount of debt x Key rate of the Bank of Russia valid during the period of delay / Number of days in a year (365 or 366) x Number of days of delay

It's easiest to understand with an example. Let’s say a citizen took out a foreign currency mortgage in the amount of $300,000 and was late in the period from November 1 to December 1, 2020. The non-payment period was 30 days. In this case, the calculation scheme will look like this:

300,000 x 6.5%: 365 x 30 = $1603

IMPORTANT

The above scheme is relevant if mortgage payments have not yet been made. When part of the principal debt is repaid, the amount of liabilities decreases.

Let’s say that by the time the delay occurs, the person has closed half of the mortgage. Then the calculation will be carried out according to the following scheme:

300,000: 2 x 6.5%: 365 x 30 = $801.

If there is a reduction in the key rate, the cost of a foreign currency mortgage will also decrease. However, the indicator usually does not affect previously concluded contracts. If you want to revise the established amount of overpayment, you must refinance the debt.

Who can count

Support from the state and some banks is aimed at individuals, under the following conditions:

| For foreign currency mortgage borrowers | who are in a difficult financial situation |

| If collateral housing | is the family's only place of residence |

| The borrower did not make any delays | until his income decreases |

| Decrease in income | and an increase in the amount of payments by 1/3 |

| If the borrower has children | Large families, disabled children and other important social factors |

Peculiarities

In order to avoid getting into a difficult situation, it is recommended that when signing a mortgage agreement, you carefully read all its clauses.

The following matters:

| Carefully read the terms of the contract, it is possible to involve a lawyer | any clause in the transaction may lead to unforeseen circumstances for the borrower |

| Mortgages should only be taken out in foreign currency | in which the borrower receives his income, in this case in a crisis situation this will not have such a strong impact on his solvency |

| Possibilities | related to restructuring, etc. |

| Availability of commissions | including hidden |

Mortgage for a young family, see the article: mortgage for a young family.

Video: Foreign currency mortgage in Russia:

(No Ratings Yet)

In what case does the contract become invalid?

Not every piece of paper with signatures is a correct and legally binding contract. And if the court recognizes its invalidity, then it will be possible to win on the dollar mortgage and terminate the deal.

Then you will be obliged to return the property that you borrowed, and the bank should return the money that you paid to it.

An agreement is definitely invalid if it:

- there is no required data to identify the subject of the mortgage;

- the place where the individual lives is not indicated;

- there is no description or size of the main obligation;

- The clauses of the contract can be interpreted in two ways.

If you see something similar in your mortgage agreement, you should contact the Prosecutor General’s Office and the court as soon as possible to justify the borrower’s position, because in most cases you can challenge a mortgage agreement only within a year after its conclusion.

I hope that after this article you have more accurately understood what a foreign currency mortgage is, when it is worth taking it (only if you have a good income in foreign currency), what to do if you were deceived and which banks have the best conditions for this type mortgages.