What types of mortgage loans have become more accessible and profitable in 2018?

The main changes and reduction in interest rates affected two types of housing lending:

- Mortgage with state support for families with children.

- Mortgage for the purchase of housing in a new building (promotion).

In addition, the following can count on preferential conditions and concessions:

- Those who receive salaries on a Sberbank card;

- Borrowers who have insured their life and health;

- Those who use the Electronic Registration Service;

- Participants of the “Showcase” campaign.

Calculate your mortgage loan using the Sberbank calculator and submit your application online.

Important!

Borrowers have quite a lot of questions about the possibility of getting a mortgage from Sberbank without a down payment. Unfortunately, Sberbank does not provide such programs. But you can take it on excellent conditions.

How it works

General changes

In the first new version of the decree of 2020, thanks to state support, it became possible to obtain a preferential mortgage at 6 percent per annum. Since April of this year (RF Government Decree of March 28, 2020), the latest changes have come into force, according to which:

- Families living in the Far Eastern Federal Circle have the opportunity to obtain a mortgage at 5% per annum, as well as purchase real estate in rural areas of their region at a preferential rate on the secondary housing market. The main condition is the birth of a second or subsequent children from the beginning of 2020.

- Refinancing of debts under the “family mortgage” program, which had already been refinanced previously under regular programs, is officially permitted;

- the effect of the preferential rate is extended for the entire loan period.

Changes regarding the Family Mortgage program

Lending under the “family mortgage” program involves the provision of loans for the purpose of purchasing housing for families in which their second and subsequent children have been born since 2020, including families participating in the NIS (military mortgage) program. For those wishing to take advantage of preferential lending conditions under this program, it is important to know the conditions for its implementation, the main ones of which are the following:

You can only purchase housing in a new building (except for families living in the Far East).- The program duration includes the period from the beginning of 2020 to 2022. This means that families that will have a second and subsequent children within a specified period of time are entitled to take advantage of the preferential program.

- The deed of purchase for housing must be issued after 2018.

- A preferential rate of six percent is valid throughout the entire loan period, regardless of its duration.

- It has become possible to use maternity capital funds for preferential lending.

- Transfers of funds to credit organizations and AHML are carried out from the federal budget. In turn, the allocation of funds to support the program becomes possible due to an increase in the tax on the sale of the country's natural resources (oil and gas).

- The advance amount is twenty percent of the total amount. At the request of the borrower, it is possible to make a down payment using maternal capital funds.

Note! Families in which the first child was born cannot participate in the program, but families in which the fourth and subsequent children were born are guaranteed participation, including the possibility of refinancing the existing debt.

Mortgage with state support for families with children 2020

This program can only be used by Russian citizens who, from January 1, 2020 to December 31, 2022, had a second or third child who is also a Russian citizen.

Those who fall into this category can take out a loan to purchase housing (secondary housing) in the amount of 3 to 8 million rubles. The amount depends on the region in which the property will be purchased. Residents of the capital can count on a large loan amount.

The down payment for this type of mortgage is slightly higher than for others. It is 20%, unlike, for example, a loan to purchase an apartment in a new building, where the down payment is only 15%.

The preferential rate for this type of lending is 6%. It should be borne in mind that it is valid only for the first 3 years for families who have a second child, or the first 5 years in the case of the birth of a third child. If you do not repay the loan within this period, the interest rate will increase to 9.25% for the entire remaining loan repayment period. In details…

Will Sberbank mortgage rates decrease during 2018?

Rates will almost certainly get lower. Sberbank's mortgage offers have been constantly falling in price throughout 2020; most likely, the same will happen to them this year.

There are prospects for this. Inflation in Russia is at a record low. In 2020 it was 2.5%, so the Central Bank has every opportunity to reduce the key rate further. In March it was 7.5%; by the end of the year it is quite likely to reach 6-6.5%. In this case, the mortgage could already average about 8% per annum.

As for the prospects of reducing rates to 7%, these prospects are assessed by economists, including the heads of Sberbank, as quite realistic.

How soon the market will see such rates depends on many factors, with observers citing a time frame of one to three years. If the Russian economy does not begin to experience a sharp fever, but its current state is maintained, a 7 percent mortgage is quite realistic.

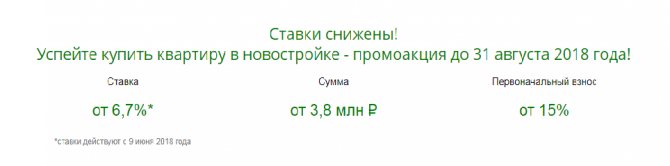

Promotion from Sberbank for the purchase of housing in a house under construction

This promotion, according to Sberbank, will end on August 31, 2018.

The size of the loan in this case is not limited to a specific amount, but depends on the value of the property being financed or the property that you offer the bank as collateral. It should not exceed 85%. The down payment is 15%.

With this type of mortgage loan, it is possible to use Maternity Capital.

Interest on this type of lending depends on the loan repayment period, as well as on the loan amount. It ranges from 6.7% to 9.10%.

Which banks refinance mortgages at 6%

The mechanism of the new preferential mortgage program is quite interesting. It is beneficial not only to the borrower, but also to banks. After all, financial institutions receive all their required profits, only from two sources: from the borrower and the state. The risk of organizations regarding non-return of issued funds is reduced. At the same time, the financial burden of the bank’s clients themselves is reduced.

You can refinance your mortgage at 6% on preferential terms in one of the banks approved by the Ministry of Finance to participate in the program (list). They cannot refuse to provide such a subsidy, especially since financing is provided from budgetary funds and not from the assets of the lender.

Benefits on housing loans for those who have insured their lives

The benefit for those who insure their life and health when receiving a loan from Sberbank is 1%. Your monthly payment will be reduced by exactly 1% if your life and health are insured by companies accredited by Sberbank. We previously reported on voluntary life and health insurance as a condition for receiving discounts on Sberbank loans. “Is it necessary to insure your life if you take out a mortgage from Sberbank” - that was the title of the article, which contains detailed explanations on this matter.

Mortgage refinancing at Sberbank

If a borrower has difficulties repaying a mortgage loan, he can use the refinancing service from Sberbank. You can apply for refinancing both for a mortgage taken out from Sberbank and for a loan issued from a third-party lender.

All types of mortgages can be refinanced - from a loan for a new building to a loan for a garage or land plot.

Rate and conditions

The main conditions for refinancing for individuals at Sberbank are as follows:

- Currency – Russian rubles;

- Minimum amount – 300,000 rubles;

- The maximum is no more than 80% of the cost of the purchased property, that is, the borrower had to pay 20% in the form of a down payment or monthly payments;

- Debt repayment period – from 12 months to 30 years;

- Security – secured by the property being purchased (house, apartment, garage, cottage, plot of land, etc.). Thus, an encumbrance is placed on the housing until the debt is fully repaid;

- There is no commission for provision.

The interest rate when refinancing a mortgage depends on several factors:

- Type of loaned object;

- Is insurance issued for the purchased property?

- No delinquencies with the previous creditor.

The refinancing percentage, depending on the listed facts, varies from 9.9% to 12% per annum.

Documents for refinancing at Sberbank

The documents that a potential client must collect to refinance a home loan are as follows:

- Application (can be submitted online and receive a preliminary decision);

- A questionnaire, which is filled out on a special form at the bank, after approval of the preliminary application;

- Russian Federation passport with registration stamp;

- Acts indicating the client’s financial condition (extract from the tax return, certificate 2-NDFL, etc.);

- Work book (certified copy of all completed pages);

- Documentation for the refinanced loan (loan agreement number, date of its conclusion, amount, interest rate, details of the original lender);

- Documents for collateral (if necessary).

At the same time, the bank reserves the right to request additional documentation from the lending entity.

Result: Obtaining a mortgage from Sberbank is possible using one of the programs presented. The conditions in this credit institution are more than acceptable. A rate reduction is possible when purchasing life and health insurance. Involving co-borrowers or providing other real estate as collateral will help increase the loan amount.

Quick application form

Fill out the application now and receive money in 30 minutes

Benefit for those who use the Electronic Registration Service

What is the Electronic Registration Service for Sberbank clients?

Electronic registration is a new paid device from Sberbank, which significantly simplifies the procedure for registering real estate in Rosreestr, and saves its owner from going to the bank and the MFC. The service costs from 7 thousand rubles or more, this amount includes the state duty for registering rights to real estate. This service can be used in all major cities of Russia. More details about this Sberbank service can be found here.

If you decide to use this service, the interest rate on the loan will decrease for you by 0.1%. This condition applies to most home loan programs.

Mortgage program “For the construction of a residential building”

This mortgage loan is provided for the construction of an individual residential building.

How to get a loan?

- Provide all necessary documents for consideration of the application;

- Wait for the bank's decision to grant the loan;

- Provide the bank with a package of documents regarding the property;

- Sign the necessary mortgage agreements;

- Register your rights to the property in Rosreestr.

| Mortgage currency | Russian rubles |

| Mortgage loan amount | from 300 thousand rubles to 75% of the contractual or estimated (registered as collateral for another property) value of the residential premises being financed |

| Interest rate | 10% per annum |

| Mortgage term | up to 30 years old |

| An initial fee | from 25% |

| Loan issue fee | won't take it |

| Loan collateral | Pledge of the loaned or other residential premises, guarantee |

| Insurance | compulsory insurance of the property pledged (in favor of the Bank) against the risks of loss or damage (except for land) |

Requirements for borrowers

- Age at the time of receiving a mortgage loan – from 21 years;

- Age at the date of full repayment of the loan – up to 75 years*;

- At least 6 months of experience at the current place of work, and at least 1 year of total experience over the last 5 years;

- Involvement of co-borrowers no more than 3 people.

* – if you did not confirm income and employment, the maximum age for loan repayment is 65 years.

Mortgage documents

- Application – questionnaire of the borrower (or mortgagor of a legal entity);

- Passport of the borrower (co-borrower, guarantor, mortgagor);

- Documents confirming the financial condition and employment of the borrower;

- Documents on the provided collateral.

Promotion "Showcase" Sberbank. What it is?

The “Showcase” promotion is a reduction in mortgage rates for the purchase of apartments selected on the DomClick portal. This is a Sberbank portal where you can choose an apartment or other real estate property and receive Sberbank approval. The mortgage rate discount for these properties is 0.3%. You can consider in more detail the possibilities of using the DomClick portal on the official website DomClick ru.

Important!

The list of partners participating in the subsidy program offering special interest rates for obtaining a mortgage for a new building is here.

Advantages of a preferential mortgage

The preferential six percent rate under the “family mortgage” program is now valid for an unlimited period of time. This means that from the first day of the mortgage until the date of the last payment, the interest rate does not change. Previously, credit institutions practiced providing a time-limited grace period for lending. Now the borrower and his family have nothing to fear, since the income lost due to the reduction in the interest rate will be compensated by the state. One of the main conditions imposed by banks when applying for a mortgage at a rate of 6% is the conclusion of a real estate and life insurance agreement for the borrower. If you refuse this service, the percentage may be increased, which generally does not affect the possibility of obtaining a preferential mortgage. The borrower will still repay the loan at a preferential rate, and the state will pay compensation to the lender. One cannot discount such advantages of the program as the possibility of using maternal capital funds and a fixed advance amount, as a result of which an increasing number of young families have acquired the opportunity to buy affordable housing on favorable terms.

Mortgage refinance calculator

By performing calculations using an online calculator, you can evaluate the profitability of a particular mortgage refinancing offer. Don't waste time and start calculating right now! Perform online calculation using a calculator

What other types of mortgages does Sberbank offer in 2020?

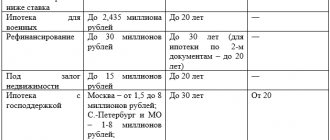

In addition to the two mortgage lending programs mentioned above, and under which borrowers can take advantage of benefits and discounts this year, Sberbank continues to provide other types of mortgage lending:

- Purchase of a finished apartment from 8.6%;

- Construction of a residential building from 10%;

- Loan for the purchase of country real estate from 9.5%;

- Loan for any purpose from 12%;

- Mortgage + maternity capital from 7.1%;

- Military mortgage from 9.5%;

- Loan for a garage or parking space from 10%.

In addition, in 2020, Sberbank continues to consider various options to solve borrowers’ problems. There are various options on how you can change the form of debt repayment or combine your mortgage with other loans and pay less. This way you can use debt restructuring or refinance.

Useful links:

- Sberbank - loan calculator;

- How to find details in Sberbank Online;

- Mortgage in Sberbank according to 2 documents.

Mortgage for a young family in Sberbank

For young families, Sberbank has developed a special mortgage project with state support and the same name. It can be used by individuals over the age of 21 who have Russian citizenship, permanent residence in Russia and official employment. Also the main requirements are:

- at least one member of the couple is less than 35 years old;

- having two or more children.

Program conditions for individuals:

- interest rate – from 6% per year;

- lending period – up to 30 years;

- the smallest loan amount is 300 thousand rubles;

- maximum loan amount – 8 million rubles;

- down payment – 20%;

- There is no issuance fee.

You can apply for a mortgage in person - at a bank branch or online through the official website of Sberbank. If your online application is approved, you must come to the bank with a complete package of documents.

Documentation

Young couples applying for a mortgage need to collect a standard package of documents:

- Application form for a loan (the form to fill out and a sample are issued by the bank);

- Russian Federation passports;

- Birth certificates of children;

- Marriage certificate;

- Certificate for maternity capital, if this amount is used as a down payment;

- Documentation confirming the borrower's employment and solvency.