Home / Real estate / Acquisition of real estate / Shared ownership

Back

Published: 08/30/2016

Reading time: 8 min

0

507

Many citizens suffer from a lack of comfortable housing. At the same time, new apartments or housing from the secondary market are inaccessible for many due to their high cost.

In this case, participation in shared construction can help, in which it is possible to get cheaper housing and pay for it in installments.

- History of origin

- What it is?

- Features of concluding a contract

- Advantages and disadvantages

- How to reduce the risk?

- Government measures

What is shared construction

Shared construction is a special type of housing construction in which a participation agreement is concluded between a construction organization (developer) and an individual (shareholder). The money raised by the developer from citizens covers construction costs, that is, in essence, the organization sells apartments that have not yet been built to shareholders.

The purchase of such real estate will cost shareholders significantly less than the cost of finished living space . This is beneficial for both participants in the construction, but there are certain risks for shareholders who cannot always receive their apartments on time.

A citizen's decision to take part in construction requires a balanced approach to this serious matter . Federal Law adopted on December 30, 2004 No. 214 “On participation in shared-equity construction of apartment buildings and other real estate” came into force on April 1, 2005.

Despite the legislation introduced, this type of construction had many violations by developers. Currently, after clarifications have been made to the legislation, most apartment buildings with pre-sale of real estate, starting from the foundation pit level, are built in compliance with it. This made it possible to consolidate the following provisions in the legal field :

- a clear list of requirements for the developer has been defined;

- the rights and obligations of the parties are determined;

- compulsory insurance of shareholders was introduced;

- the provisions of state control on shared-equity construction have been determined.

Regulatory framework

Today, there are three main legal acts regulating shared-equity construction:

- Law No. 294 (adopted on December 30, 2012) protects the relationship between the developer and equity holders and obliges them to insure them.

- Law No. 2300–1 (adopted on February 7, 1992) protects the rights of shareholders who purchase housing for non-commercial use.

- Law No. 214 (adopted on December 30, 2004) regulates the process of this type of construction as a whole.

For a long time, the latest Federal Law was considered too unfair by developers, since it significantly tightened the requirements for them.

What are the benefits and risks of participating in shared construction?

Improvements in shared-equity construction allow many families to invest in a future apartment. This provides a number of advantages, such as :

- significant reduction in the risks of double sales of real estate;

- strict requirements for the technical support of the house by the admissions committee;

- protection of the rights of the parties to the contract in the event of its termination;

- prohibition on increasing the price of an apartment in accordance with the law.

Such advantages in DUDS (equity participation in shared construction) provide guaranteed ownership of an apartment in a new building at 25-30% lower than the cost of a house already put into operation.

But there are also certain negative aspects that must be taken into account when concluding a DDU , which include the following provisions:

- the concluded agreement provides certain guarantees only if it strictly complies with Federal Law-214;

- regular payment of contributions by shareholders in accordance with the schedule and with a permissible period of late payment of no more than 2 months;

- in case of bankruptcy of the developer, a refund is possible, but this procedure has a long-term nature and moral costs;

- the absence of a single standard contract requires legal verification for compliance with the law.

Despite the protection of the shareholder by law, various violations occur on the part of the developer , mainly relating to the financial side of construction. Careful selection of a construction organization and scrupulous elaboration of an equity participation agreement with its legal assessment will allow you to avoid pitfalls when purchasing an apartment at the construction stage.

Payment

As for payment for this service, there are quite a lot of options. The cost of the living space as a whole, as well as the conditions under which payments will be made, will depend on how much the down payment is. For example, if the full amount is paid within three working days, the client receives a discount from the developer for each square meter of real estate. Otherwise, the calculation of the contract is carried out within the agreed time frame, and the cost prescribed initially cannot change, even under the pressure of inflation or simply during the construction process. The advantages of paying the cost of an apartment in installments are that even with a small amount, the participant can solve his “housing problem.” In this case, housing can be selected according to all the client’s wishes, starting from the number of square meters and ending with the characteristics and timing of its receipt of ownership. In addition, thanks to small monthly payments, the shareholder can successfully control his budget.

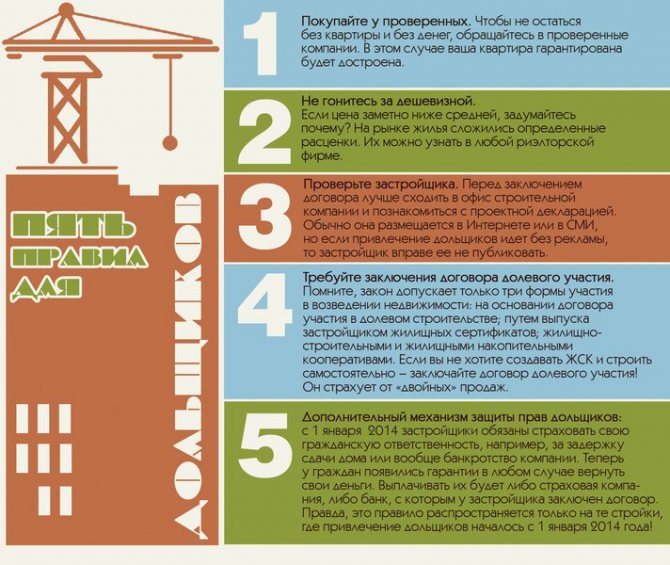

Criteria for choosing a reputable developer

The right choice of a conscientious developer is very important. Its reliability is determined by the company’s performance indicators, which consist of its quantitative and qualitative activity . These include:

- financial position of the developer (based on official financial statements);

- the period of activity of the company in the construction market;

- construction volume and developer work in different regions;

- number of completed construction projects;

- reasonable pricing policy, that is, compliance with market prices.

All this information can be found in the public domain from various sources (Internet, official press, analytical portals of the construction industry). The quality of the activities performed can be judged by the following criteria :

- support for local administration and interaction with large banks;

- participation of large investors or government agencies in the authorized capital;

- reputable contractors and timely delivery of building structures without freezing construction;

- assessment of independent organizations on the activities of a construction company on major analytical and industry portals;

- the presence of other types of business with the leading shareholder of the developer;

- reviews from other shareholders about construction projects, quality and timing of commissioning of finished objects.

Only complete and correctly collected information about the developer will allow you to make a final decision on choosing a construction company, investing in construction and purchasing a home.

What requirements does federal law impose on developers?

214 of the Federal Law is aimed primarily at protecting ordinary citizens, for whom it provides favorable and safe conditions for participation in shared construction. In relation to developers, the law, on the contrary, constantly tightens the requirements, however, the disadvantages of 214 Federal Law are only borne by unscrupulous construction companies that are gradually leaving the shared construction market.

Thanks to amendments to the law, which came into force at the beginning of 2020, the situation is excluded when citizens’ money for the construction of a house is collected by an unknown company with an authorized capital of 10 thousand rubles. Today, only financially stable companies that have their own funds can raise money. The minimum amount required for the construction is 1.5 thousand sq.m. housing - 2.5 million rubles. As the volume of construction increases, the amount of capital that must be available to the developer also increases. The maximum amount is 1.5 billion rubles. with a total area of objects of 500 thousand sq.m.

In addition, Article 214 3 of the Federal Law lists a number of requirements that a developer collecting money from citizens must meet. A construction company that violates the provisions of the law on raising funds may be subject to criminal penalties.

In 2014, the law introduced developer liability insurance. Before signing an agreement with a shareholder, the developer is required to enter into an insurance agreement or obtain a bank guarantee. If the developer fails to fulfill the obligations set forth in the DDU, the participant may make demands for payment of money to the insurance company or bank. Since 2020, a special compensation fund has been organized, to which all construction companies must contribute money (1% of each additional income). The fund's funds will be used to complete the construction of problematic facilities.

Construction companies today are required to disclose all information about the company (up to the history of its activities over the last three years) and the facility under construction (permits, title and design documents). All information must be publicly available on the company’s official website. In addition, the developer, upon request, is obliged to provide citizens with all documentation relating to the construction project for review.

Existing methods of insurance in shared construction

Currently, according to the law , every company operating in the construction segment is required to issue an insurance certificate for each newly constructed facility . The developer must do this before concluding the DDU. In addition, he insures the contract itself, which can significantly reduce the deception of shareholders by the developer.

The developer decides for himself how he will carry out insurance, guided by Federal Law No. 214 and Federal Law No. 236, which regulate:

- a guarantee from a bank that meets the requirements of the Central Bank is work in the financial market for at least 5 years, an authorized capital of 200 million and own funds of 1 billion rubles;

- through an insurance company that has a positive reputation according to the Central Bank;

- through membership in the OVS (mutual insurance society).

An insurance certificate is included in the list of required documents submitted for registration of an equity participation agreement. When registering a private insurance policy for each investor, shareholders are also insured. Activation of insurance occurs from the moment of registration of the contract.

Shared construction as a type of investment

Equity participation with the right developer is a profitable investment of your own money. If the developer is a reliable company, then investments in such projects provide high profits and minimal risks. Cottage villages and residential complexes are in demand among the population today, so a financial investment always pays off in a fairly short period. Considering that the cost of new buildings is significantly lower than the market price, the earlier you get involved in the construction process, the greater the profit you can get in the future.

Key points to pay attention to when investing in construction:

- choose a housing class. To do this, it is useful to monitor demand in the housing market in a specific region;

- study the documentation offered by the developer: the amount of the down payment, the price for the proposed apartments, the payment schedule, delivery dates, conditions for transferring documentation to the investor;

- availability of title documents from the developer;

- clarify which company will insure the developer’s activities;

- The number of real shareholders is of great importance. A small number of investors sharply increases the construction period of housing, which will affect its cost. During this period, many unforeseen events may occur that will complicate the conditions for fulfilling contractual obligations.

If it is difficult to determine the reliability of a construction company, it is advisable to use the services of a professional lawyer.

To obtain permission to construct a residential complex, the developer must:

- have permission for this construction;

- publish and place on your own Internet portal and in the media a project declaration outlining information about the developer, the purpose of the construction project, and the expected timing of commissioning;

- register land rights for the facility being built.

It is advisable to publish the project declaration in the media, especially for the purposes of necessary advertising. From a legal point of view, this is not a mandatory procedure. In search of the necessary object for investment, a potential buyer must constantly monitor the news of the construction market. And the more information he has, the less chance of fraud.

Important! Learn everything about the proposed developer and his partners, the buildings that have already been built. Pay attention to the delivery deadlines, namely whether they correspond to the planned dates at the initial stage.

If a construction organization hides the documents that it is obliged to provide at the first request, then this should cause mistrust among investors, and in this case it is best to look for another developer.

How to become a participant in shared construction - step-by-step instructions

Purchasing an apartment by share is a real benefit that allows you to save a significant amount of money. After making the important decision to buy real estate, you need to take certain steps to achieve this goal.

In order for the transaction to be profitable and successful, it is necessary to draw up a plan in which all actions and their sequence will be spelled out in detail:

- determining the most favorable terms for purchasing housing and the expected date of entry into the finished apartment;

- the amount of funds required, as well as establishing the type of payment. Conduct a preliminary calculation and determine the priority of payment, that is, a one-time payment of the entire amount, if the entire amount of cash is available, or stage-by-stage payments using borrowed funds. Will it be a mortgage or a loan, for a certain amount and in which bank;

- choosing a developer and desired property;

- a thorough check of the construction company in all aspects of its activities and study of a sample of the DDU;

- conclusion of a contract. Before signing it, it is advisable to conduct an independent examination by specialists, which can significantly increase the reliability and purity of the transaction;

- registration of a share participation agreement with the registration chamber, which protects the shareholder in all his rights determined by law.

Only carefully planned actions and their implementation will allow you to become a successful participant in the shared construction of an apartment building.

Process

The process of participation in shared-equity construction of an apartment building is as follows:

- Registration of a lease by a construction company of a land plot where the construction of real estate will be carried out. When concluding a lease agreement for a long time, it provides for the possibility of subsequent acquisition of ownership.

- Concluding a share participation agreement with each buyer of premises in a building under construction.

- Putting the constructed house into operation and transferring the subject of the agreement into ownership of the shareholder.

Of course, during the process of building a house and putting it into operation, various nuances may arise, so it is advisable to draw up the paper in such a way that the risks of shared construction do not affect the investor in any way. For this purpose, various mechanisms are provided for protecting the rights of participating people at the state level, including mandatory state registration of an equity participation agreement.

Possible problems that may be encountered when participating in shared construction

Despite the existence of a regulatory framework that determines the procedure for equity participation in construction, it is associated with certain risks, since the developer may be bankrupt or in the process of bankruptcy.

While waiting for construction to be completed, the equity holder may encounter the following problems::

- delay in putting the house into operation - it may occur as a result of misappropriation of the shareholders' funds, which are directed to another object not provided for in the contract. Failure to fulfill contractual obligations by subcontractors or contractors, which leads to their termination and the search for new contractors. Insufficient financing of the construction or the developer and contractor paying not with money, but with apartments, the implementation of which takes time;

- additional collection of funds - may occur due to a sharp increase in the price of building materials or an increase in the area of the apartment not provided for in the design documentation;

- impossibility of terminating the contract - the clause of its terms is not clearly stated;

- impossibility of registering property rights - the developer for some reason cannot submit documents for registration to the registration chamber;

- multiple sales of an apartment - may occur due to the legal illiteracy of the shareholder when signing the agreement or fraudulent actions of a company entering into an agreement with several shareholders;

- purchasing housing through a contractor rather than from a developer;

- the use of various schemes not provided for by law - purchasing bills of exchange, issuing an interest-free loan to the developer, transferring funds to a bank account not related to the construction of a specific house.

You can participate in shared construction and avoid these problems by carefully choosing a developer and carefully studying all the nuances of the contract before signing it.

Important! From July 1, 2020, changes were made to the legislation aimed at reforming shared-equity construction. Raising funds from shareholders will only be possible using escrow accounts. An individual bank account will be opened for each participant and, in fact, the share participation agreement will become a 3-party one. Construction projects started before this deadline are completed under the old rules.

Drawing up an equity participation agreement (DPA)

A shared construction agreement is always concluded between two parties: the developer and the shareholder. Who can be a participant in legal relations? A construction company always acts as a legal entity, regardless of its legal form. All project and permitting documentation must be completed within the framework of current legislation, otherwise the company does not have the right to attract citizens to invest.

The shareholder performs exclusively financial functions in construction . The fact that the buyer invests his money in construction gives him full right to subsequently register the property in his name after the house is put into operation.

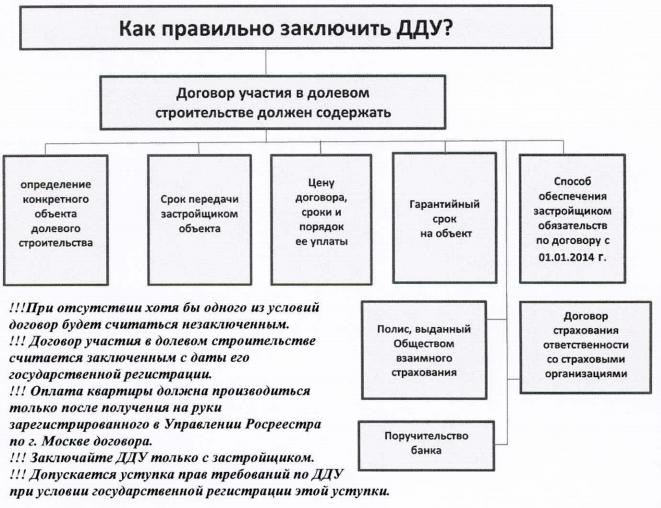

An agreement cannot be concluded if the following points are not stated in it:

- The final cost of the property;

- Stage-by-stage and final deadlines for putting the house into operation;

- Full description of the object;

REFERENCE! When it comes to residential real estate, the shareholder is obliged to obtain complete information about the future apartment in the construction of which he is investing money: area, number of rooms, floor.

- Rights and obligations of the parties;

- Options for action in the event of force majeure;

- The procedure for resolving controversial issues.

The document is signed by the shareholder personally or by an authorized representative from the developer - a responsible person who represents the company on the basis of a notarized power of attorney.

The investor of material assets has the right to terminate the management agreement if the construction company does not comply with the established deadlines or violates the requirements for the quality of construction, which is regulated by Federal Law No. 214. In this case, the developer is obliged to return the funds invested in the construction to him. Read more about the rules for terminating a real estate purchase and sale agreement after its registration here.

What else is new in the legislation on shared construction

· A register of developers has appeared. Now anyone can check a company offering its construction services to see if it falls under the criteria of a fly-by-night company.

· Citizens can now check the legality of a project under construction even before investing their own funds - the developer is obliged to make the necessary project information publicly available.

· The price of an apartment will now be determined strictly based on the cost per square meter and the area of the property being purchased. As a result, at the time of delivery it will not turn out that the apartment is smaller in area, and you paid more for it than expected.

· The construction company's own funds must be no less than ten percent of the project cost of construction.

· The responsibility of the developer is determined according to the provisions of the Law “On Protection of Consumer Rights”. Consequently, the amount of the penalty for refusal to correct deficiencies identified in the work will be increased.

· Creation of a compensation fund from which the demands of shareholders will be satisfied in the event of bankruptcy of a construction company. Previously, these functions were performed by the DIA with a limit on the return amount of 10,000,000 rubles.

· Innovations also protected the rights of the developer. If the shareholder delays the procedure for handing over and accepting the object without objective reasons, he will be charged a penalty.

· One building permit per object. Presumably, this may delay the construction process if a complex of objects is being built. Separate registration of permitting documentation also applies to engineering facilities