How are mortgage bonds issued?

When a borrower wants to get a loan to purchase real estate, he turns to a commercial bank or a specialized financial company. If the applicant meets the lender's requirements, he is given the necessary amount to purchase the property. In the future, the borrower will pay the lender interest and the deposit amount until the debt is fully repaid. This scheme is called a mortgage.

However, such a scheme is not very convenient for the bank for a number of reasons. The fact is that a feature of mortgage loans is their long-term nature. The borrower will pay interest and repay the principal gradually—usually over ten years. At the same time, the liabilities (the source of funds) of any bank are mostly short-term and consist of depositors’ money. Due to the disproportion between long-term loans and short-term liabilities, the bank may find itself in a situation with a liquidity crisis: at some point it may simply not have enough funds to pay depositors.

Also, the bank issuing mortgage loans may encounter other problems :

- Long-term dependence on the financial position of the lender. Over the years while the debt is being repaid, the borrower's financial situation may deteriorate dramatically, leading to his default.

- Low profitability. Mortgage loans make up the majority of the loan portfolios of Western banks. However, the profitability of such operations is lower compared to other types of activities (for example, issuing consumer loans).

- Difficulties in issuing new mortgage loans, since existing funds have already been issued to borrowers.

To solve the problem, you need to “cleanse” the bank’s balance sheet of long-term assets. This can be done by issuing mortgage-backed securities. Although mortgage bonds are often issued not by the banks themselves, but by mortgage agencies that purchase the debt of mortgage holders from banks. Let's consider this within the framework of the history of the emergence of mortgages.

Benefits

Thanks to mortgage bonds, each participant in the transaction can maintain an advantageous position, since financial security in this case reaches its maximum degree.

Mortgage securities can be put into circulation according to the following scheme:

- The bank provides a loan for the purchase of real estate to its client.

- Bonds are issued for the amount of this loan and put up for sale.

- The buyer-investor, who is ready to buy bonds at the stated price, deposits funds in a set amount into the bank and becomes the holder of the pledged property that was purchased by the borrower.

- After funds have been received from the investor, the banking institution can provide the next mortgage loan in that amount to another citizen, as a result of which the economic development of the company is stimulated.

- The search for an investor occurs again and everything goes in circles.

Look at the same topic: Foreign currency mortgage borrowers - the latest news for today

As a result, such a policy allows each of the parties participating in these legal relations to earn or save money:

- The organization issuing loans can conclude many more transactions secured by real estate, which, if payment is not made, can be sold on the real estate market.

- An investor who has purchased mortgage-backed bonds has the right to significant interest in the event of the development of a credit company, taking advantage of the constant increase in the price of real estate.

- The client can expect a slow decrease in the mortgage interest rate, since the growth of investments and the increase in mortgage lending turnover do not imply the need to maintain the same level of large loan rates.

Investment in such securities, which are secured by real estate, allows for the possibility, in addition to earnings, also of loss of existing finances due to the depreciation of the local currency.

Construction is one of the most rapidly developing areas. Over the past few decades, the price level for both apartments and non-residential premises has increased 2-3 times, so reliability is an important advantage of MBS.

History of mortgages and mortgage bonds

Mortgage-backed securities are relatively new, with a solid history of development in the mortgage market. There were analogues of mortgages back in Ancient Greece, and the word itself came from there - but let’s not go too deep and look at the 20th century. For example, what was the situation with mortgages in America in the 1920s? Back then, mortgage loans were issued for several years, but usually no more than five and in the amount of about half the cost of housing. Those. if the house cost $20,000, the bank might give ten thousand.

The peculiarity was that the interest on the loan did not include the total amount of debt. This means that in the example above, at the end of the contract term, an amount of $10,000 had to be paid. Which is a lot. However, this problem had a simple solution: trying to take out a new loan from the same or another bank. Since the value of the property grew and covered the loan taken, this was possible.

However, after 1929, not only were people unemployed and unable to pay interest on their loans, but real estate fell sharply. A house worth $20,000 could be valued at, for example, $8,000. This means that the loan taken out could not be repaid by such a sale, and the new bank would not issue ten thousand. As a result, the person ended up bankrupt, the houses were sold for next to nothing - and still people still owed money.

All this only worsened the crisis and the government was forced to buy out about a fifth of the mortgages. It became obvious that the scheme was not working and needed to be improved. As a result, during the crisis, the Roosevelt government came to approximately what we have today: the mortgage term was increased, and the loan payment began to be evenly distributed over the entire duration of the contract. In addition, the government in 1943 created a structure (Federal Housing Administration, FHA), which insured bank losses, provided that the loan term was at least 15 years and the deposit was not returned at the end of the term, as before. In the early 1950s, the United States already had 30-year mortgages.

As in Russia today, the mortgage rate was fixed for the term of the contract. This scheme is not available everywhere today - for example, in Canada or Germany the rate is floating. In the Russian scheme, when the rate rises, the borrower finds himself in a more advantageous situation - he still pays less on the mortgage. If the key rate falls, then everything is the other way around: a lottery where nothing depends on you. With a floating rate, conditions are equalized.

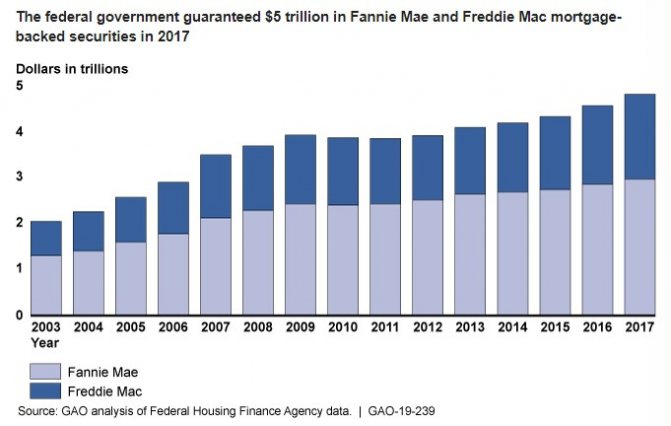

In the late 1930s and in 1970, two large government mortgage agencies were created in the United States: Fannie Mae (Federal National Mortgage Association) and Freddie Mack (Federal Home Loan Mortgage Corporation). Now they are private - Fannie Mae became so two years before Freddie Mack appeared. The purpose of the structures was to purchase mortgage loans from banks. There is a similar organization in Canada (Canada Housing and Mortgage Corporation), but it is government-owned.

And here we come to the issue of mortgage bonds - the obligations purchased by the agencies were “packed” into securities and sold to investors with their own guarantee. The process itself is called “securitization”; we’ll talk about it below. The new Freddie Mack was the first to issue such papers, followed by the older Fannie Mae. Mortgage-backed securities first peaked in popularity in the 1980s, when they were distributed by investment banks like Salomon Brothers. This is mentioned in the book Liar's Poker.

In passing, we note that mortgage bonds were not the only opportunity for democratic investments in real estate. In the 1960s, real estate trusts, the so-called REITs, appeared in the United States. In fact, these are funds aimed at collecting rent from different types of real estate: from residential to commercial. At the same time, ordinary profits are taxed twice: when received by the company and after being given to the investor as income tax. Trusts do not pay the first tax, only investors do. Over the past 60 years, this sector has achieved excellent returns, despite the 2008 crisis.

In effect, the mortgage agencies were taking on the risk of non-payment by the mortgage holders to their investors (bond buyers) - if the mortgagees were unable to pay, the mortgage agencies had to make up the loss. Later, even insurance companies appeared that insured this risk as well - the scheme became more and more complicated.

2008 crisis

Real estate boomed in the 2000s. Of course, no one remembered the lessons of the 1920s - if real estate grows, then large loans can be given against it without risk: otherwise, we take the house and remain with a profit. Therefore, at this time loans were issued to almost anyone. In Russia, by the way, too, since our stock market was growing rapidly. The result was almost incredible: American banks issued loans tens of times more than their own capital.

But what's even worse is that this scheme was supported by major rating agencies as risk-free. Those. Mortgage-backed securities issued against such loans were often assigned the highest credit rating of AAA. Not all issues had a complex structure in terms of the probability of early redemption - but on average this was the case.

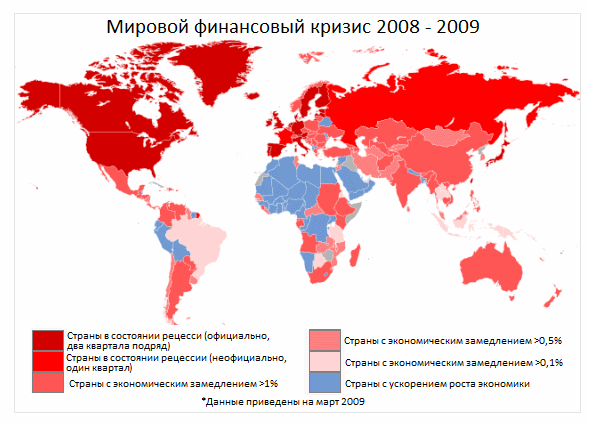

The result is a seemingly excellent product with good returns and a top credit rating or close to it. Of course, investors from all over the world began to eagerly buy such securities, and the financial real estate bubble inflated to its limit. And then there was what was written about in the article about the 2008 crisis.

The bubble burst. At some point, it turned out that people were not able to pay their loans, which is not surprising - the requirements for borrowers were below any criticism. Overheated real estate quickly went downhill - and its sales no longer covered the cost of cash issued by banks. In this regard, everything was the same as in the early 1930s. The credit reporting agencies later paid multibillion-dollar fines and there is still no consensus on whether this was bank collusion or gross negligence.

As a result, defaults of the largest financial institutions followed, the most notorious of which was the fall of Lehman Brothers. Investors in mortgage bonds from Bear Stearns lost about $22.5 billion. Fannie Mae and Freddie Mack, as well as the largest insurer AIG, were effectively bankrupt. The United States found itself in a delicate situation: investors around the world demanded the preservation of obligations on mortgage debts, but the mortgage agencies were private, not government-owned. And according to the letter of the law, the state is not responsible for them. However, the risks of undermining the financial reputation of the United States and the size of the companies turned out to be so great that the state intervened and the structures continued to exist.

Was there anyone who managed to make money from the fall in real estate? Yes, because there was such a product: credit default swap, CDS. It guarantees payment to the holder if the mortgage-backed security defaults. Essentially, this is an option to “short” the market by betting on its decline - but only in this case should the decline be complete. During the period of euphoria 2003-2007. this swap was clearly not a popular product.

House in Russia. What are mortgage-backed securities, where did they come from and what should we prepare for?

Many mortgage holders began to receive “chain letters” with the message that they had been sold. Well, that is, the bank from which they took out a loan transferred their mortgage to another agent. It looks something like this: Dear Pyotr Ivanovich! We inform you about the transfer of rights under the mortgage certifying the rights from the loan agreement No.... concluded between you and the Bank. dated 10/21/15, in favor of IA Fabrika ICB LLC.

MBS Factory... It sounds ominous, almost like a “Troll Factory”. Many mortgage holders became worried, feeling that somewhere they could once again mmm... be deceived.

In fact, for ordinary borrowers, nothing has changed externally. Many did not even notice how they were sold, continuing to pay off the loan as before.

But if you look more broadly, the lending scheme has fundamentally changed, taking on the more visible outlines of a mortgage pyramid.

The principle of securitization is to transfer assets (mortgage loans) into liabilities (proceeds from the sale of securities). Then, using fresh liabilities, issue even more mortgage loans. This is how banks mitigate the problem of lack of funds to issue loans.

And the shortage of funds is beginning to become more and more acute: interest rates are falling, the population does not want to save for tiny returns and is becoming more and more addicted to loans. This is discussed in more detail in the article People don’t want to save anymore. They want to spend. And what will this lead to?

So the banks are dodging.

Let's use examples.

Example 1.

Suppose a certain Petya opened a deposit for 2 million rubles. at bank A. at a rate of 6%.

Later, Vasya came to the bank and asked to take out a mortgage loan. The bank gave him 2 million rubles. at a rate of 9%.

In this case, asset = liability = 2 million rubles. The bank takes a 3% margin and everyone is happy.

Example 2.

The bank decided that it needed to increase lending. The problem is that rich Petya, who carries money at 6%, is alone, and there are already two mortgage borrowers - now it’s not only Vasya, but also Sasha, who also wants to take 2 million rubles. on credit. But where will the money come from for this?

What does the bank do? He sells Vasya’s mortgage to Bank B. Bank B issues a bond for 2 million rubles, secured by the mortgage, and gives it back to Bank A.

Bank A. sells the bond to investors or keeps it on its balance sheet and receives 2 million rubles from them. in liabilities.

Now the bank has the money to issue a loan to Sasha, which it does.

If necessary, the scheme can be repeated a n number of times.

The trick is that real savings in the second scheme are 2 million, and mortgage loans issued for 4 million!

In essence, this structure is nothing more than a financial pyramid.

As you know, any pyramid collapses sooner or later (the mortgage crisis in the United States is proof of this), but up to a certain point the scheme can look stable.

And now to our sheep.

In Russia, mortgage securitization is carried out by Bank Dom. Russia and he has become noticeably more active. So, if the issuance of mortgage loans by banks slowed down a little in 2020, the same cannot be said about the pace of production of mortgage-backed securities.

As the burglars themselves boast, “in the 3rd quarter. In 2020, the volume of investor investments in mortgage bonds guaranteed by DOM.RF increased by 52% compared to Q2. 2020"

home.rf/upload/iblock/348/348214bc78688d156a109af9e7ef5a1a.pdf

173 billion in 11 months. Is it a lot or a little?

Not much for now, because... 2.5-3 trillion are issued per year. rub. mortgage loans, but the dynamics are alarming, given the Napoleonic plans of the mortgage agent.

I wonder what's wrong with the House. The Russian Federation is predominantly operated by VTB Bank, which has repeatedly appeared in corruption stories, and is generally famous for its inefficiency, but the more successful Sberbank is not yet particularly eager to use securitization. As the release states:

Through the active issuance of mortgage bonds, VTB has securitized about 15% of its mortgage portfolio (plans include securitization of another 430 billion mortgages, including an issue for a wide range of investors for 300 billion rubles).

That is, these guys are clearly not going to stop.

Various manuals often write that mortgage bonds are bought by private investors, thereby reducing the risks of the system. Maybe in theory this is true. But in practice in Russia these same banks buy them. That is, risks are not redistributed across the market, as is often presented.

As for the mortgage bonds themselves, people sometimes ask where they can be bought. You can buy them on the stock market. But the profitability is unlikely to please you, although it is stated that it is higher than the profitability of OFZs and deposits.

To summarize. Of course, the current volume of securitization is not yet so large as to expect an immediate collapse. The pyramid has clearly not yet reached the size of Cheops: it still needs to be built and built. But it should be borne in mind that statistics on mortgage lending do not fully reflect the picture, because a significant part of mortgages has already been removed from the balance sheets of commercial banks. In the future, the share of securities will grow, as will the risks of the system.

More interesting materials about real estate in Nedvinomics

Author's blog

Securitization of mortgage lending

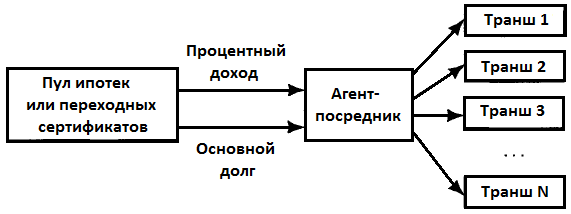

Let's return to the issue of mortgage bonds. The securitization process is as follows:

- The bank collects its existing loans and creates a mortgage pool from them

- The loan portfolio is written off from the bank’s balance sheet and transferred to a specially created intermediary company SPV (Special Purpose Vehicle)

- The intermediary issues mortgage-backed securities secured by claims to repay the mortgage debt.

- The bank receives money from the intermediary for issued bonds

An example of intermediaries was above - US mortgage agencies. In addition, the bank can issue bonds independently:

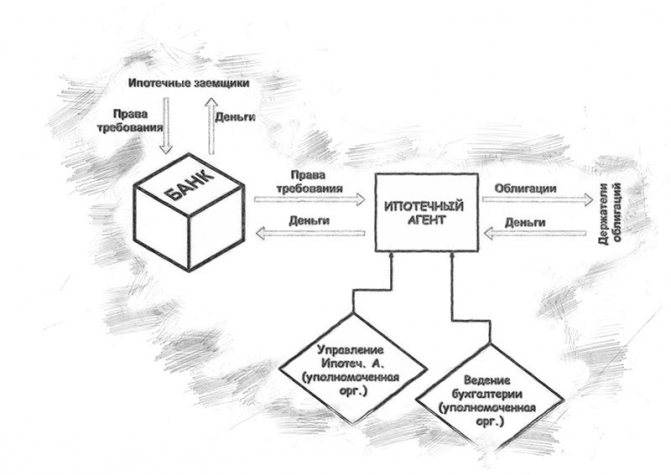

The following picture shows the mechanism of interaction between the bank and the intermediary organization that issues bonds. Having received a loan portfolio from the bank, the intermediary can securitize mortgage loans either in one issue or in several tranches.

Securitization allows the lender to:

- Obtain funds for issuing new loans, including mortgages

- Increase liquidity by replacing long-term debt with cash or securities

- Improve asset quality as the risks of borrower defaults are transferred to bond buyers

- Increase investment opportunities using freed up funds

What are they and why are they needed?

A mortgage bond is a long-term security secured by real estate as collateral.

Let's consider the mechanism of its operation:

- The borrower applies for a mortgage with the bank.

- The bank issues bonds for the amount of loans issued and attracts money from investors.

- The investor purchases an investment property and subsequently receives income from the borrower's loan payments.

- Real estate purchased by the borrower with bank funds automatically becomes collateral in the mortgage transaction and security for the bond.

In simple terms, a mortgage bond is a promissory note issued to an investor against funds that the bank undertakes to return with interest. The bank uses the investor's money by issuing a mortgage. In case of insolvency of the borrower, the debt to the investor is repaid through the sale of the mortgaged property.

Principle of operation

Let me give you an example: let’s say a bank issues mortgage loans in the amount of 50 million rubles. At the same time, he issues mortgage bonds with a price equal to the amount of loans, that is, 50 million, which he sells to investors.

The investor will receive his money back at the end of the repayment period, as well as annual interest for the use of his capital. It is also called coupon income. The bank pays the coupon from funds received as interest on the mortgage.

Characteristics of mortgage bonds

Mortgage bonds have the following characteristics:

- Frequency of payments. Typically, payments to investors are made monthly or quarterly.

- Payments consist of two parts: payment of coupon income and amortization (repayment of the loan body)

- The principal debt is repaid according to schedule and extends over a long period. Regular amortization is a characteristic feature of mortgage-backed securities. For example, on corporate bonds only coupons are paid regularly, and the par value is repaid once - at the end of the debt securities' circulation period

- Depreciation can be planned or early (as specified in the issue prospectus). With planned repayment, the borrower repays the principal amount of the debt according to a specific schedule. The issuer also has the right to early repayment of debt

Advantages and disadvantages of investing in MBS

Mortgage bonds have a number of advantages :

- Mortgage-backed securities are backed by actual real estate. But remember about 2008

- Mortgage-backed securities can diversify an investment portfolio by reducing correlation

- Bond payments are a long-term source of stable financial income

MBS are not without some disadvantages :

- Typically low returns

- Relatively low liquidity. Turnovers on MBS are usually lower than in the case of other stock market instruments

- There is a risk of early repayment of the debt. This makes it difficult to estimate the level of future income.

What it is

The key problem in the development of housing borrowing is the formation of a long-term resource base. Therefore, the main direction in expanding the financial market is to improve ways to attract long-term investments. MBS are precisely a mechanism for investing funds.

Mortgage-backed securities are debt securities with which lending institutions refinance their mortgage investments.

For example, a bank issues a housing loan for 8 million rubles and at the same time issues a security for a similar amount. The investor purchases it by returning its mortgage investment to the bank. Now the financial institution can issue a loan for that amount again. And the Central Bank Bank repays from the money that the borrower returns to him for the mortgage.

Similar instruments are widespread in the Western market. For example, the popularity of MBS is due to their collateral with real real estate. The profitability of the document depends on the value of the property, which grows annually by at least several percentage points.

Investing in securities in the West is characterized by a long-term period - 10-20 years. Russian investors prefer terms of 3-5 years. The market for such securities in the Russian Federation is still at the initial stage of development and is regulated by the Federal Law “On Mortgage Securities” dated November 11, 2003. For the correct use of this instrument in the market, it is first necessary to eliminate the shortcomings in the Law “On Mortgage”. Then banks will be able to rely on a good legislative basis when issuing such documents.

Function

The key function of mortgage securities is considered to be minimizing the risk of delays in payments on housing loans. The bank receives the borrowed money through investment. Thus, debt obligations are converted into securities with a relatively high level of liquidity. Such a mechanism can be implemented in one of the following ways:

- The credit institution issues secured securities documents.

- The investor sells the debt to a mortgage agency.

Rules for issuing mortgage securities

To protect the rights of investors, a separate mortgage cover is created for each issue of securities. It includes the right to claim repayment of debt, including interest payments. At the same time, real estate properties that have not yet been built or unfinished cannot be included in the mortgage coverage.

The requirement must be supported by relevant documents, including a mortgage agreement, a mortgage note, a certificate of registration of real estate rights, and an insurance policy. The amount of debt, interest, details, property value, terms and other parameters are registered in the register of mortgage coverage, which is maintained by a specialized depository. Only commercial banks and specialized financial companies have the right to issue mortgage securities.

If the issuer violates its obligations (for example, when payments are late), the investor forecloses on the mortgage collateral, but not on specific real estate purchased under the mortgage.

Note! Foreclosing on mortgage coverage can only be done by a court decision.

The parties' responsibilities are distributed as follows:

- The issuer is responsible to bond investors. The collateral is mortgage coverage, which includes claims on loans to multiple borrowers

- The borrower is responsible to the issuer of the bond. The property is used as collateral

Important! The amount of obligations under mortgage-backed bonds should not exceed 80% of the amount of the coverage itself.

Alternative MBS

There are also other types of securities that act as alternatives to MBS

- Mortgage (confirms the holder’s right to receive money under a financial obligation (from the borrower), as well as the right to property that was transferred by the borrower as collateral)

- Mortgage participation certificate (expressed as a share of the loan amount taken to purchase the asset)

- Covered mortgage bond (Mortgage Bond, Covered Bonds) - secured as collateral by mortgage loans or mortgages on the issuer’s balance sheet

- Mortgage Backed Securities (MBS) - Payments match cash flows from a pool of mortgages minus servicing fees for those securities.

Watch also the video “Review of Mortgage Securities”:

Related posts:

- Debt securities - what they are and how they work

- COBR - what it is and how it works

- Mortgage or loan to buy an apartment - which is better?

- Loan portfolio - what it is and how it works

- Coupon income on bonds - an overview for beginners

- OFZ-N (people's bonds) - what is it, pros and cons

- Subordinated bonds - what they are and why...

- Treasuries - US bonds, their types and how to buy

American mortgage bond market

To qualify for trading, US Mortgage-Backed Security Bonds must be issued by a licensed financial institution. Also, securities must have a rating from one of the accredited rating agencies.

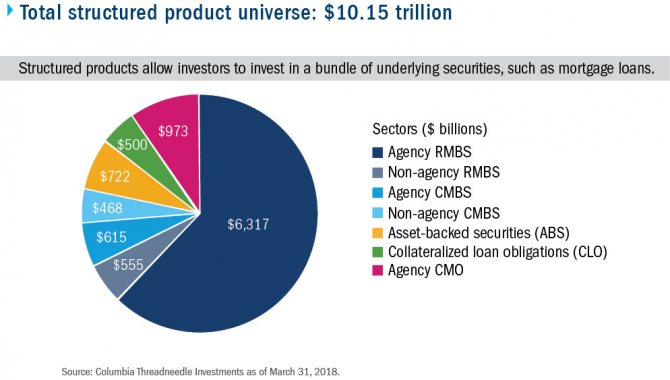

There are 2 types of mortgage-backed securities offered in the US market:

- Collateralized Debt Obligation or CDO (collateralized debt obligations). CDOs are backed by a credit pool where all payments are passed on to investors

- Collateralized Mortgage Obligations or CMOs (collateralized mortgage obligations). They are issues where the investor can choose the most suitable tranche based on the planned region, type of borrower, default risk, profitability and other indicators. Depending on the specialization, there are many subtypes of CMO (RMBS, CMBS, ABS, etc.)

The two largest US mortgage agencies control MBS totaling about 5 trillion. dollars.

At the same time, the total volume of the American Mortgage-Backed Security market exceeded 10 trillion. dollars:

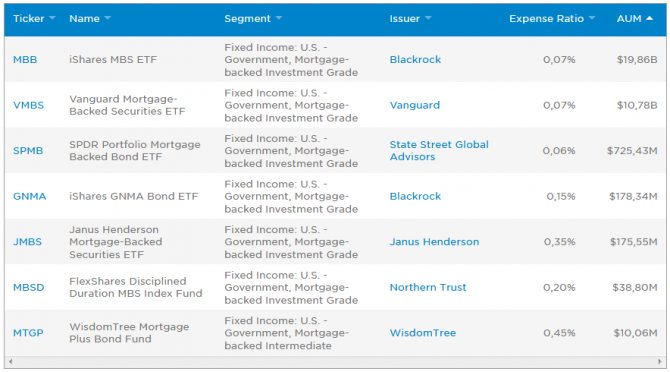

For global (including Russian) investors, there is an opportunity to invest in a pool of investment-grade US mortgage-backed securities through exchange-traded funds ETFs:

The volume under management in two cases exceeds 10 billion dollars, the management fee is calculated in hundredths of a percent. The average price of a share is several tens of US dollars.

Mortgage coverage concept

Mortgage coverage refers to the right to demand payment of interest on loan agreements and the return of funds invested in a security. If there is no return, foreclosure is applied to the property securing the transaction. This can only be done in court.

There is a statute of limitations for filing such claims. It is limited to two years. Requirements included in mortgage coverage must be documented. The coverage is used to insure investors against loss of invested assets.

Mortgage bonds in Russia

The issue and circulation of mortgage bonds in Russia are regulated by Federal Law No. 152-FZ “On Mortgage Securities”. The first issue of securities in the Russian Federation was carried out in the fall of 2003. Bonds were issued. Gazprombank acted as the organizer of the issue. He also served as a depository and paying agent.

Later, other issuers appeared on the market. In total, since the adoption of the law, several dozen issues of securities have been carried out. The total volume of mortgage securities issued as of July 2020 reached 320 billion rubles. There is evidence that in 2020 the volume was about 370 billion with 62 bond issues. Several large issues are planned before 2021, as a result of which the market volume may exceed 1 trillion. rubles

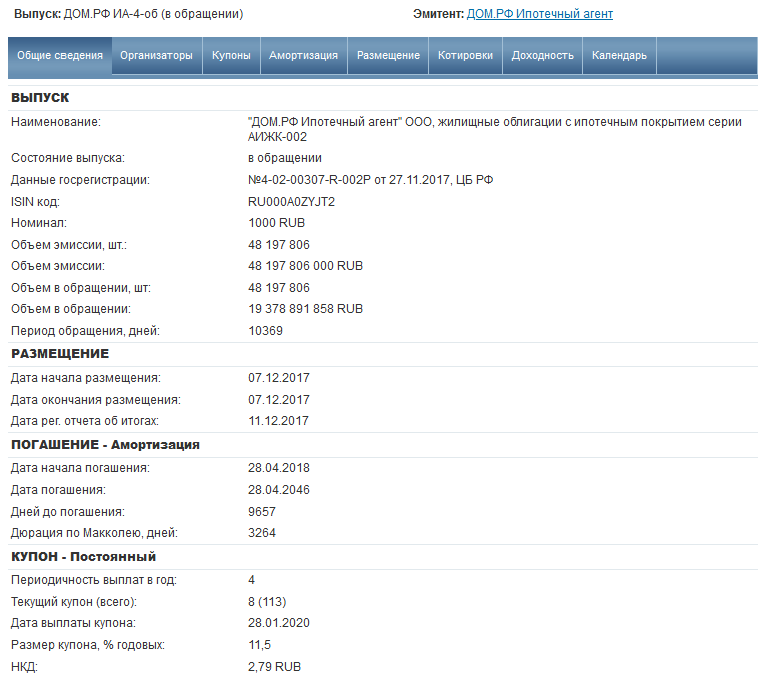

An example of the issue of mortgage securities is the issue of “DOM.RF Mortgage Agent” dated December 7, 2017.

The organizer of the issue was JSC VTB Capital. Investors were offered almost 75 million bonds with a thousand-ruble par value for a total amount of 75 billion rubles. Conditions for DOM.RF Mortgage Agent bonds:

- circulation period of securities - 30 years;

- repayment type - gradual amortization;

- number of payments per year - 4;

- coupon size, % per annum - 11.5

You can find information on issues of Russian mortgage-backed securities on rusbonds, where in the bond search form you need to select Coupon Type - Mortgage and get a list of both repaid and existing bonds.

What are the dangers of mortgage bonds?

Any financial transaction, even the most reliable and insured, has certain risks . These risks are associated with financial changes in the market and loss of invested funds. Housing, no matter how reliable and stable an asset it is, can also fall in price and lose liquidity.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

Obviously, the main disadvantages of such investments for investors are the low level of income at the rate and early repayment of the mortgage loan by the bank client.

If the mortgage is repaid early, the owner of the mortgage bonds ceases to receive interest income. The bank also repays debt securities to the investor early in a short period of time.

We should not forget the fact that the global financial crisis of 2008 arose precisely because of the unlimited issuance of mortgage-backed securities by American banks . Wanting to maximize profits, banks began to issue mortgage loans without conducting due diligence on borrowers. When applying for a mortgage, credit institutions immediately issued mortgage bonds that were sold to investors.

As a result of all this excitement, the market value of collateral real estate fell sharply, the solvency of borrowers and the quality of servicing mortgage loans deteriorated. This led to the depreciation of securities.

At the same time, banks were unable to cope with current obligations on bonds, and investors remained in the red. This story ended with the fact that credit institutions were forced to cease to exist through bankruptcy proceedings. Not many people were able to return the money they spent.

In Russia, the current market situation is still far from such a development of mortgage-backed securities, which is why we are not yet in danger of a market collapse . But the rapid growth of such emissions can lead to dire consequences for banks.

As financial market experts note, mortgage-backed securities will not be in high demand among investors in 2020. This is due to the unstable housing price market.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

Mortgage bonds are a new financial product for the Russian market that gives investors the opportunity to invest their funds in reliable collateral real estate.

Obviously, such securities are designed for very wealthy buyers . It will not be easy for an ordinary citizen to purchase mortgage bonds due to the high cost of real estate.

The benefit and profit of such an investment is not limited to the bank's interest payment; it lies largely in the increase in the price of the mortgaged property.

Issuers of mortgage-backed bonds

Two types of organizations can issue bonds secured by mortgage loan agreements - these are, naturally, credit organizations, as well as mortgage agents.

The regulator sets special requirements for credit institutions. In general, we can say this - at the time of issuing mortgage bonds, the credit institution should not have financial problems.

If for some reason the bank does not meet all the requirements, the law allows the establishment of a special organization - a mortgage agent - to issue bonds. In this case, the diagram will look like this:

A mortgage agent is an organization in the form of a joint stock or limited liability company established by a bank solely for the issuance of mortgage bonds. The established organization is transferred the rights of claim, which will serve as security for the issued bonds.

A number of restrictions are imposed on the activities of a mortgage agent. The management and accounting functions of this organization are assigned to two different specialized organizations. And the mortgage agent himself cannot hire employees. All this is done to increase the transparency of reporting and simplify possible legal disputes.

In Western practice, such a procedure for transferring assets and obtaining financing against them is called securitization . Used to rescue credit institutions on the verge of bankruptcy.

Risks and crisis of 2008 in the USA

Thanks to the great development of the bond system in mortgage lending, the United States emerged from the 2008 crisis with minimal losses, since part of the costs were compensated by the state and the other part by private investors. In fact, every second loan is issued for refinancing from the outside, which allows banks to constantly benefit from interest.

Since a mortgage is a long-term credit history, which in English is called “mortgage,” which translates as “collateral until death.” Despite the fact that the French were the first to call a mortgage this way, the name stuck specifically to English-speaking countries.

Many advantages cannot hide the shortcomings in the system, which include the following circumstances:

- There is always a risk of early repayment, which negatively affects the desire of investors to invest in the development of the financial industry. For some time now, some banks have been compensating for the difference between expected and received profits to retain customers.

- The popularity of mortgage lending cannot be at the same level, so it can decrease and increase, which does not allow investors to make quick or relatively quick profits.

Credit default swaps on mortgage bonds (from the English Credit default swap - CDS) are appearing more and more often. A CDS is a contract in which the buyer of a swap pays the seller a specified amount of cash in exchange for receiving a profit from “personal insurance” of any mortgage loan against default.

In other words, a CDS can be compared to several loans that the bank wants to get rid of. He may offer to some persons to insure the loan against non-payment, while the bank will pay the policyholder a certain amount monthly, and in the event of termination of debt repayment, the policyholder must return the entire amount. Usually, the policyholders then resell the debt to some other company, paying it extra from their own pockets, but protecting themselves from bankruptcy.