Khanty-Mansiysk Bank Otkritie (“KhMB Otkritie”) is one of the largest financial and credit institutions in the country.

In 2020, it underwent changes - it was merged together with other banks into the Otkritie Bank corporation. Today, this financial structure uses the Khanty-Mansiysk Bank brand, since this is the only way many clients recognize it and trust it.

Taking out a mortgage from the Khanty-Mansiysk Bank is a common service for residents of the Khanty-Mansiysk and Yamalo-Nenets Autonomous Okrug.

How to get a mortgage from Khanty-Mansiysk Bank?

If you decide to take out a mortgage on real estate, then it is easier to submit an application form online. To do this you need to do the following:

- Log in to the KMB Otkrytie website using the link www.open.ru.

- Select the “Mortgage” column and decide on the desired mortgage program (for example, “Apartment”).

- Click on the “Apply Online” button.

- If necessary, make a calculation online. By placing the cursor on the cost of the selected apartment, the size of the down payment and the loan term, the column on the right will automatically display information about the total cost of the mortgage and the amount of the monthly payment.

- If the mortgage parameters suit the client, then you need to click on the “Submit Application” button.

- Fill out the empty form with the necessary information: indicate your full name, select a lending program, region where the property is located, the client’s mobile phone number, his email address. Be sure to check the box indicating that the borrower consents to receiving a credit report, as well as to the use of his personal data.

- Having entered all the necessary information, all you have to do is click on the “Continue” button.

The bank reviews the application online within a week and checks the client’s credit history . And if everything is ok, then it sends him an email notification that the application has been pre-approved.

Next, the client should prepare the necessary package of documents, scan them and upload them into the bank’s system in order for them to pass verification.

If the bank approves the documents, then its next step is to check the property that the potential borrower wants to purchase with a mortgage.

If the apartment is “clean”, there are no encumbrances on it and it meets the requirements and conditions of the bank, then a notification is sent to the borrower or the responsible employee calls him and invites him to conclude a transaction.

Conditions of state programs

The Ugra mortgage agency offers residents of the region various options for purchasing home ownership. Let's take a closer look at the main housing state programs.

Compensation

The essence of state support for citizens is the allocation of funds from the state budget for a long period (up to 10 years). This money can be sold in one of two directions:

- Interest rate compensation. The bank's standard rate decreases by 1-3% annually, with the difference being paid to the banking organization.

- Compensation for part of a citizen’s expenses for the purchase of living space. Budget funds can be used to pay for an apartment in an apartment building under construction, the purchase and sale of finished real estate, or repay a mortgage loan.

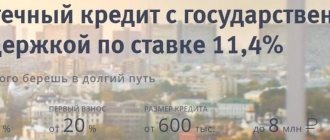

Mortgage 6%

The so-called family mortgage is available to those families in which a second child will be born between January 1, 2020 and January 1, 2020. Under the terms of the state program, such families can count on the following conditions:

- 6% per annum for 3 or 5 years if a third child is born in the family;

- reducing the interest rate by another 1 percent when receiving a loan from a mortgage agency in Ugra.

The received targeted loan can be used for:

- purchasing housing from a developer in a new building that is ready or in the process of construction;

- repayment of an existing housing loan.

On-lending

Refinancing is the repayment of an open loan using funds received from another credit institution on more favorable terms. Mortgage refinancing in Ugra banks allows borrowers:

- significantly reduce the interest rate;

- reduce the monthly payment, reducing the financial burden on the family;

- extend or shorten the loan term (at the client’s request).

The Ugra mortgage agency cooperates with many banks in the region, so borrowers have the opportunity to choose an organization with the most favorable lending conditions (interest rates vary from 8.7 to 10% per annum).

Compatriots

Residents who moved to the Khanty-Mansiysk Autonomous Okrug from abroad under the “Compatriots” state program can receive a Ugra mortgage to purchase housing. Each applicant is allocated up to 2 million rubles as compensation for part of the loan costs or to reduce the interest rate.

The property is purchased under the following conditions:

- execution of a share participation agreement;

- concluding a purchase and sale transaction;

- registration of a mortgage loan for the purchase of real estate.

Young families

Married couples under 35 years of age can become participants in the state program and receive monetary subsidies from the state in the form of:

- reducing the interest rate on mortgages;

- receiving a housing subsidy.

The amount of financial assistance does not exceed 2 million rubles.

Important! The presence or absence of children in the family does not matter for participation in the program.

Extension

Residents of Yugra who have already applied for a preferential mortgage in Yugra and feel the need to expand their living space can become participants in this program. State subsidies provide for the transfer of funds to compensate for the interest rate on a new loan.

Indigenous peoples

Representatives of small-numbered peoples of Ugra can apply for a preferential mortgage with the participation of budget funds. Funds are provided for:

- repayment of part of the loan;

- reducing the loan rate.

The amount of state assistance cannot exceed 2 million rubles.

Young scientists

Young scientists carrying out scientific activities in Ugra have the opportunity to receive subsidized mortgage loans of the following types:

- reduction in loan rates;

- receiving funds in the amount of 30% of the estimated cost of the selected residential premises;

- participation in the savings mortgage of Ugra.

Specialists in demand specialties

Yugra residents who have skills in demand in the region (teachers, doctors, etc.) are potential participants in the state program. Borrowers are provided with favorable mortgage terms and reduced interest rates through payments from budget funds (no more than 2 million rubles for a period of 10 years). The purchased housing must meet certain requirements:

- capital construction – no older than 15 years;

- wooden houses – no older than 7 years.

Waiting lists

Residents who are registered with local government bodies of Ugra as needing improved housing conditions can take part in the state program “People on the Waiting Line”. To do this you will need:

- write an application for participation in the Ugra mortgage agency;

- apply for a loan from your chosen bank;

- receive a subsidy in the amount of 2 million rubles to reduce the current interest rate.

Large and special families

Ugra families are considered large or special if:

- they are raising three or more children;

- one or more children are disabled;

- children were left without parents;

- adult family members have crossed the 35-year age limit.

An adult representative of such a family can apply for a mortgage in Ugra and become a participant in the state program, under the terms of which a housing subsidy will be provided to repay housing loans.

Important! Debt obligations for repayment must be issued before December 31, 2013.

To improve living conditions

Public sector employees of Khanty-Mansi Autonomous Okrug have the right to improve their living conditions through the consolidation of borrowed and state funds. The size of the subsidy provided is influenced by the following factors:

- number of family members (the purchased property must meet the standard of at least 18 sq. m per person);

- work experience in the public sector (the longer the experience, the higher the subsidization coefficient).

Residents of adapted premises

On the territory of Ugra there are conditionally residential premises converted from industrial and industrial buildings. Citizens living in them have the right to preferential mortgages. When they contact a mortgage agency, they receive a loan, part of which is repaid with a subsidy from the state budget. The amount of subsidies varies in each specific case and depends on the number of members in the family (compliance with the standard living space per person).

List of documents for a mortgage at Khanty-Mansiysk Bank

To consider the application form, the client must provide the bank with the following documents:

- application form (can be printed on the website www.open.ru, filled out and brought to the bank);

- a copy of the work record book or employment contract . The copy must be certified by the signature of the head of the organization and sealed;

- certificate 2-NDFL or in free form on the company’s letterhead , which must indicate the employee’s income for the last six months (or for the time actually worked, but not less than 90 days).

If the bank has previously approved the application form, then at the next stage you will need to collect documents for the desired apartment:

- certificate of registration of ownership - if available;

- extract from the house register;

- documents of title to the apartment (for example, a gift or sale agreement);

- documents confirming the identity of the apartment owner (civil passport or birth certificate);

- INN or SNILS of the current owner of the apartment.

This is the main list of documents that absolutely all borrowers must provide. On an individual basis, the bank may request additional documents:

- extract from the Unified State Register;

- report on the assessment of the market value of housing (the document is valid for 3 months);

- permission from the guardianship authorities - if minors are registered in the apartment being sold;

- written consent of the spouse of the owner of the property being sold - if the apartment was purchased by the spouses during marriage;

- driver's license, certificate from the PND or ED, permission to store and carry weapons - if the owner of the apartment being sold is over 70 years old.

Requirements for the borrower to approve a mortgage application

For preliminary approval of an application, a potential borrower must meet the following requirements of KhMB Otkritie Bank:

- Russian citizenship is mandatory;

- having an official job is mandatory;

- the citizen must have permanent or temporary registration in the Russian Federation;

- the minimum age of the borrower is 18 years, and the maximum is 65 years;

- work experience in the last place – at least 3 months;

- continuous work experience – at least 12 months;

- if the borrower is officially married, then his significant other must act as a co-borrower. And if the borrower does not have enough money to cover the mortgage debt, then the bank will involve his spouse in obligations. If the spouses have a prenuptial agreement, then the wife/husband cannot act as co-borrowers;

- the presence of co-borrowers is mandatory. Co-borrowers on a mortgage loan can be not only spouses who have officially registered their relationship, but also persons who live in a civil marriage, as well as close relatives of the borrower: his children, parents, siblings or half-brothers and sisters.

Each mortgage program has its own conditions . Therefore, it is advisable to briefly consider each mortgage object of the KhMB Otkritie Bank.

Basic requirements for the borrower

A citizen of the Russian Federation, aged from 18 to 65 years (for individual entrepreneurs - at least 2 years of registration in the Russian Federation) with a permanent or temporary place of residence in Russia, with a total experience of up to 1 year, has the right to request a mortgage loan from the Khanty-Mansiysk Bank , incl. from the last place of work – from 3 months.

In the absence of a marriage contract, the borrower's spouse is involved in the mortgage as a joint borrower. Common-law spouses or close relatives can be joint borrowers. A co-borrower under a mortgage, his rights and obligations have been discussed in detail earlier on our website.

Applications from persons working in the following specialties will not be considered:

- employees of entertainment establishments (casinos, restaurants);

- seafarers, members of international crews;

- security guards and bodyguards;

- hired employees of an individual entrepreneur working without a seal;

- real estate agents whose income directly depends on completed transactions;

- employees who are not registered under an employment contract or a GPC agreement.

When assessing the solvency of borrowers, KMB takes into account the borrower’s basic salary, part-time income from business or other legal activities, interest on deposits (including endowment life insurance), the level of the borrower’s pension, income from alimony and dividends.

To apply for a mortgage you must provide:

- Documents confirming identity, solvency and employment;

- A completed application form of the established form;

- A set of documents for the refinanced loan (upon its execution).

After approval of the mortgage, the borrower is provided with a complete set of documents for the loaned property, with the results of an independent appraisal examination.

Loan conditions under the “New Building” program

If a client wants to buy an apartment in a new building and his financial situation allows this, then he should know that the Khanty-Mansiysk Bank will give him that apartment in an apartment building that has been accredited by the bank.

Other program conditions:

- the loan amount is variable and depends on the region in which the client plans to buy an apartment;

- loan term – up to 30 years;

- number of co-borrowers – no more than 3 people;

- lending currency – rubles;

- an initial payment is required (its amount can be found on the website www.open.ru). By the way, for clients who have a KMB Otkritie salary card, the amount of the initial payment is reduced by several positions. This rate is also reduced if the borrower insures his life and ability to work, as well as if he plans to buy an apartment from a developer-partner of the bank;

- compulsory insurance for loss and damage to the apartment.

Current lending programs

KMB loans are divided into several programs. Each of them has its own purpose and special requirements for borrowers. When making a choice in favor of any credit program, it is worth taking into account regional characteristics, since most often not only the maximum debt repayment period, but also the annual rate may depend on them.

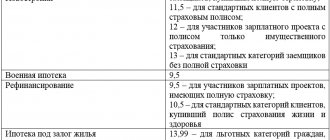

Consumer programs for 2020, the indicators of which are relevant for residents of Moscow and the Moscow region:

| Index | Universal | Necessary things (consumer loan refinancing program) | Refinancing |

| Loan amount | up to 3,000,000 | up to 5,000,000 | up to 3,000,000 |

| Minimum bid | from 10.9% | from 8.9% | from 11.9% |

| Maximum term | 60 months | 60 months | 60 months |

Mortgage programs relevant for Muscovites for the current year. The presented conditions do not apply to other regions of the Russian Federation.

| Index | Apartment | New building | Apartments | Military mortgage | Mortgage loan refinancing |

| Maximum amount | up to 30 million | up to 30 million | up to 30 million | up to 2.704 million | up to 30 million |

| Maximum term | up to 30 years old | up to 30 years old | up to 30 years old | up to 20 years | up to 30 years old |

| Minimum down payment | 10% | 10% | 40% | 20% | — |

| Minimum bid | 9,3% | 9,3% | 9,8% | 8,8% | 9,65% |

The processing time for an application for a mortgage or consumer loan may vary from 1 to 3 business days. Often, the duration of this process is influenced by the amount of information provided by the client about himself, as well as his credit history and solvency.

In addition to the listed features of lending, it is important to know that the KMB imposes general requirements on all potential borrowers:

- age over 18 years at the time of concluding the loan agreement and up to 65 years at the time of full repayment of the debt;

- permanent or temporary registration in the region of the country where there are KMB bank branches;

- salary exceeding 15 thousand rubles (for residents of Moscow and the Moscow region - 20 thousand rubles);

- official employment and work experience at the current place of work for at least 6 months.

"Military mortgage"

To improve the living conditions of military personnel, the bank provides them with the opportunity to take out a mortgage under the individual “Military Mortgage” program on the following conditions:

- purchased apartment only on the secondary real estate market;

- down payment is required;

- loan term – 1–20 years. The last payment under the agreement must be made no later than when the borrower reaches the age of 45;

- the loan amount is less than when applying for another mortgage program.

The borrower under the Military Mortgage program must provide a certificate of eligibility as a participant in the savings-mortgage system to receive a targeted housing loan. A marriage certificate (if the borrower is officially married) or a divorce certificate is also additionally provided.

How is a mortgage repaid?

Registration of a mortgage loan is accompanied by the opening of a bank account in the name of the borrower. If desired, an additional card can be issued. Using it will make repaying the loan much easier. Just by the payment date, place the required amount on it every month, which, according to the schedule, will be debited from the card account on the day of the regular payment.

The loan repayment methods are as follows:

- payment in cash at the cash desk of any office of the Khanty-Mansiysk Bank;

- replenishing a card account at any ATM with the CASH IN function of a given financial institution;

- replenishment of a card account in the largest terminal networks QIWI and Eleksnet;

- replenishment of a card account using the Rapida payment system through cash desks located at RosExpress, TelePay, Pinpay express, Eldorado, Alt Telecom and Svyaznoy retail outlets;

- making payments using the Zolotaya Korona service;

- replenishment of a card account through the Yandex.Money payment system.

You can choose the most preferred method by reading our article “”.

Program “Apartment + maternity capital” and “New building + maternity capital”

For families with children growing up, the bank offers a loan program with an initial contribution in the form of maternity capital.

The client chooses in which area he wants to buy a “maintained” apartment, what size, and the bank provides him with a mortgage on the following conditions:

- minimum loan rate;

- down payment – from 10%;

- loan term – up to 30 years.

The terms of the program are very favorable for the borrower. The down payment is minimal, but it can be increased if the client does not insure his life and ability to work, does not take out insurance against the risk of loss of ownership rights to the purchased housing, and if he is not a salary client of the bank.

There is no moratorium on early mortgage repayments . If you are not satisfied with the living space on the secondary real estate market, you want to move your family into a brand new apartment, then take out a mortgage for a new building with a mat. capital.

The conditions are almost the same as when taking out a mortgage on the secondary market with an initial payment in the form of mat. capital, but in addition the borrower needs to obtain approval from the bank for the construction project.

What is the state mortgage program in Ugra

Residents of the Autonomous Okrug of Khanty-Mansi Autonomous Okrug are presented with several options for state programs, the implementation of which is carried out by JSC Mortgage Agency Yugra. State aid can be expressed in the following:

- allocation of funds to pay part of the mortgage loan;

- change in interest rate (the difference between standard and preferential values is paid to the banking organization from the regional budget in the amount established by a specific state program);

- subsidizing loan payments from Ugra banks.

Financial assistance from the state allows residents of Khanty-Mansiysk Autonomous Okrug with different levels of income to take part in the programs of the Ugra mortgage agency and obtain targeted loans for the purchase of housing.

Mortgage under the Apartment program

For those who want to live in a spacious apartment and have the means for this (high salary, income from business activities, additional income), KMB Otkritie Bank offers the “Apartments” mortgage lending program.

Only those borrowers who agree to buy an apartment from INTECO Group can take advantage of this offer. In this case, the amount of the down payment will be minimal.

If the client is considering apartments from other companies, then the amount of the initial payment is doubled.

There is also a special promotional rate for this offer. It will reach its minimum only if:

- the borrower will buy apartments in the Inteko Group of Companies;

- he agrees to insure his life and ability to work.

The loan amount under this offer is the largest of all other offers under mortgage programs of the Khanty-Mansiysk Bank.

Mortgage - what is it?

This term is used in the following cases:

- when it comes to pledging real estate owned by the mortgagor for the purpose of obtaining a mortgage loan;

- when the applicant receives funds from a financial institution and uses them to purchase real estate. The loan in this case is targeted. This fact is important in the context of the subsequent regulation of emerging legal relations, and the specified real estate is transferred to the credit institution as collateral.

You will learn more useful information on this issue by reading our article "".

Mortgage refinancing at Khanty-Mansiysk Bank

Mortgage rates change every year. And if 10 years ago the rate could reach 30%, today it is easier for borrowers. They have the opportunity to get a mortgage at 15% per annum or even less.

In order not to overpay for a previously taken out mortgage, the borrower is given an unprecedented opportunity - he can refinance his mortgage at KMB Otkritie.

By taking advantage of the mortgage restructuring program, he will be able to change the current mortgage terms to more favorable ones. If a person took out a mortgage in foreign currency and wants to renew the agreement with the currency in rubles, then he can also refinance the agreement.

The bank will approve the application only under the following conditions:

- if at the time of contacting the bank for an on-lending loan, it has no overdue payments. However, the bank allows for delays under the previous agreement for 6 months (total duration);

- if the mortgagee is not KhMB Otkritie Bank, but another bank, then the period for granting the mortgage must be at least 6 months as of the date the borrowers submit a new application;

- the borrower plans to enter into a refinancing agreement for the purchase of an apartment under a shared construction agreement only from the developer that has been accredited by the Khanty-Mansiysk Bank.

If a serviceman who has been a participant in the savings-mortgage system for at least 3 years wants to refinance his mortgage, then the bank offers a new program “Refinancing for the Military.”

The essence of this program is that the bank offers clients to refinance a military mortgage that they received from another bank.

Is it possible to get a mortgage from KhMB Otkritie without a down payment?

Unfortunately, the bank does not have a program with such a condition. However, for families who own maternity capital, the bank provides the opportunity to obtain a mortgage with an initial payment in the form of mat. capital.

According to other programs, one of the mandatory items is the payment of a down payment, the amount of which, according to some offers, is lower than in other banks.

Methods for repaying a mortgage loan taken out from KhMB Otkritie Bank

When signing a mortgage agreement, an account is opened in the name of the borrower with the Khanty-Mansiysk Bank . If desired, the client can receive a bank card with which he can repay the debt.

Every month on a certain payment date, the borrower will need to place a specific payment amount in his account, which will be automatically debited from him on a certain day.

You can also make mortgage payments in other ways:

- At the cash desk of any branch of the KhMB Otkritie bank.

- By depositing cash at any Otkritie Bank terminal, as well as at the Eleksnet terminal.

- Through cash desks at retail outlets: Svyaznoy, Alt Telecom, Eldorado, Pinpay express, Telepay and RosExpress through the Rapida payment system.

- Through the Yandex.Money e-wallet.

- By performing an interbank transfer operation.

Mortgage lending conditions at Khanty-Mansiysk Bank are attractive for borrowers . The bank offers an extensive list of mortgage programs with minimum rates and flexible lending terms.

Here anyone can get a mortgage for a new building, secondary housing, apartments, or a share in an apartment. However, the bank does not issue a mortgage for a house, land, garage or parking space.

Customer Reviews

Unfortunately, the Khanty-Mansiysk Bank does not provide mortgages without a down payment for 2020. But I was able to find a profitable “Apartment” loan program for myself, for which I received a positive decision two days after submitting an online application on the bank’s official website. Having visited the branch to sign a loan agreement, I was pleasantly surprised by the lack of queues, since the order of requests was distributed by a special terminal.

Dmitry Petrov

I have been a client of HMB for several years now. I have a salary card in it, on which I receive my salary every month. In addition, from time to time I use the bank’s services for deposits, Western Union transfers and consumer loans. During the entire period of service, I did not notice any particular shortcomings, so recently my wife and I decided to apply for a mortgage loan, which was approved for us without any problems.

Valery Popov

Recently I was looking on the Internet for a reliable bank for lending. Having stumbled upon the website of the Khanty-Mansiysk Bank, I decided to submit an online application for a mortgage loan. Three days later, the application was approved and invited to the office closest to my home, where I was able to quickly receive the required amount in cash.

Andrey Vasiliev