Benefits, rate and restrictions of refinancing

Alfa-Bank offers a low interest rate - from 7.99% per annum, subject to comprehensive insurance. Another advantage is the ability to conclude a transaction without proof of income. The mortgage must be issued in any other credit institution at least 6 months ago, it must not be in arrears and refinancing has not yet been applied to it. Ownership must be registered directly in the name of the borrower.

A significant limitation is the region where the property is located. Your apartment or house must be located in Moscow, Moscow region, St. Petersburg, Leningrad region, Krasnodar, Rostov-and-Don, Kazan, Krasnoyarsk, Nizhny Novgorod, Novosibirsk, Perm, Samara, Tyumen, Ufa or Yekaterinburg. For other regions, you should contact Alfa-Bank’s partner, Deltacredit.

Real terms of refinancing

Alfa-Bank offers refinancing of loans from third-party banks at a rate of 9.29% per annum. In fact, only those who receive wages on a card or bank account can receive a loan at this rate. A prerequisite is the registration of the entire proposed range of insurance policies.

Those who are not “salary” clients can count on a rate of 9.79% per annum under the same conditions. The rate can be reduced by 0.2 percentage points if the transaction is concluded no later than 30 calendar days after the borrower is approved for the loan.

Important: if the borrower, for various reasons, refuses to insure the title of the apartment or his life and health, the interest rate will be increased by 2 points at once.

If the collateral for the mortgage loan is not an apartment, but a townhouse or private house, the base interest rate will be increased by 0.25 or 0.5 points, respectively.

Important: Alfa-Bank takes upon itself the resolution of all issues related to the issuance of insurance policies, assessment of purchased housing and registration of the mortgage agreement in Rosreestr.

You can obtain preliminary information about the monthly payment amount on the official website of the financial institution. It is enough to indicate the cost of the apartment or private house, the loan term and the remaining debt.

Recommended article: Refinancing a military mortgage with 2 children - conditions and banks

Refinancing from MTS Bank

Max. amount: up to 5,000,000 ₽

Proc. rate: from 9.9%

Min. amount: from 50,000 ₽

Age: from 20 years

Duration: up to 5 years

Duration: up to 5 years

More details at: https://refinansirovanie24.ru/predlozhenija-po-kreditnym-kartam/?elementor-preview=1392&ver=1578592827

Duration: up to 5 years

More details at: https://refinansirovanie24.ru/predlozhenija-po-kreditnym-kartam/?elementor-preview=1392&ver=1578592827

Duration: up to 5 years

More details at: https://refinansirovanie24.ru/predlozhenija-po-kreditnym-kartam/?elementor-preview=1392&ver=1578592827

Duration: up to 5 years

More details at: https://refinansirovanie24.ru/predlozhenija-po-kreditnym-kartam/?elementor-preview=1392&ver=1578592827

Solution: from 1 min.

More details

How does registration work?

Mortgage refinancing occurs as follows:

- An application for refinancing is submitted.

- If the bank's decision is positive, the borrower visits the office and submits documents relating to the collateral to the bank.

- If the bank approves the collateral, the borrower issues the necessary insurance policies and submits a certificate of the balance of the mortgage debt.

- A loan agreement is signed, the bank pays off the mortgage.

- The borrower removes the encumbrance from the apartment and re-registers it as collateral for a new loan.

- The new lender reduces the interest rate on the mortgage refinance loan.

Basic conditions and amount of mortgage refinancing

The main conditions for refinancing a mortgage are as follows:

The maximum mortgage loan amount is RUB 50 million. However, it cannot exceed 80% of the assessed value for an apartment or townhouse, 70% for apartments and 50% of a private house with a plot. For Alfa-Bank's salary clients, these values are 85%, 75% and 50%, respectively.- The minimum mortgage amount is 600 thousand rubles.

- The maximum mortgage amount is 50 million rubles.

- The refinancing term is from 3 to 30 years.

The interest rate is set by Alfa-Bank subject to comprehensive insurance, that is, against the risks of damage to property (from fires, earthquakes, etc.), loss of title (property rights), as well as loss of life, deterioration of health and loss of work.

The interest rate may be affected by:

- +1% if you refuse personal or title insurance;

- +0.5% when refinancing without proof of income;

- +0.5% if the mortgaged object is its own house with a plot;

- +0.25% if the collateral property is a townhouse.

Cost calculation including insurance and comparison with competitors

For example, let's calculate the cost of refinancing a mortgage loan at Alfa-Bank and compare it with some of its competitors. To do this, you can use the online calculator on our website. We are speculating purely theoretically.

The insurance fee is determined individually, but on average it can be assumed (according to Alfa Insurance tariffs) that property insurance in 2020 will cost 0.15% of the refinancing amount, title - 0.15%, borrower - 0.36%. We add them to the base rate and get 10.66%. That is, it is more profitable to insure than to refuse the policy.

Let's compare with other banks. In Sberbank, the base rate is 10.6% with mandatory property insurance and voluntary life and health insurance of the borrower (in case of refusal + 1.0%), which we will also accept 0.15% and 0.36%, respectively. The total is 11.11%. At VTB the base mortgage rate is 10.1%. When summed up with the same policies, we get 11.01%. Based on this, we can conclude that even with title insurance from Alfa-Bank, refinancing is more profitable.

Mortgage refinance calculator

By performing calculations using an online calculator, you can evaluate the profitability of a particular mortgage refinancing offer. Don't waste time and start calculating right now! Perform online calculation using a calculator

Advantages and disadvantages of mortgage refinancing at Alfa-Bank

The following benefits should be considered when comparing alternative mortgage refinancing offers:

- quick online check allows you to quickly find out a decision on the possibility of refinancing a mortgage and basic conditions;

- personal visits to the bank are not required to repay the loan received;

- a convenient mechanism for performing the necessary transactions in a mobile application or browser version of the Internet banking system is offered;

- If necessary, you can take out an additional amount with a slight increase in the interest rate.

The following list shows the disadvantages of refinancing a mortgage at Alfa-Bank with certain significant limitations:

- if refinancing is issued for an amount greater than the debt under the current mortgage agreement, the interest rate increases by 0.5% per annum;

- minimum loan term - 3 years;

- Conditions for obtaining depend on the type and territorial location of the property.

It should be emphasized that in order to approve the minimum interest rate when refinancing a mortgage, you must become a salary client of the bank.

Alfa-Bank requirements and list of documents

Alfa-Bank imposes the following requirements on borrowers:

- Citizenship of the Russian Federation or any other state.

- Age from 21 to 70 years (at the end of the contract).

- Work experience in the current position for at least 4 months with a total of more than 1 year.

List of required documents for refinancing:

- Passport or other identification document.

- Certificate 2-NDFL or in the bank form (if the “mortgage refinancing under two documents” program is not applied).

- Documentation of the current mortgage loan.

Object requirements

In order for the contractual agreement to be successfully concluded, the object being the subject of lending must also meet certain requirements. First of all, the room must be connected to a gas, electric or steam heating system. It must also be connected to the sewer system.

The facility must be provided with cold and hot water supply, and have:

- plumbing fixtures in good condition;

- door structures without damage or defects;

- windows in good condition;

- a working roof (the requirement applies to premises located on the top floors).

If the housing is in disrepair or falls into the category of “dilapidated properties,” then cooperation with the bank to obtain mortgage refinancing is not possible. The property should not be classified as a building scheduled for demolition. It must have a reliable (brick, reinforced concrete, or stone) foundation - a foundation.

Registration procedure

Registration of refinancing at Alfa-Bank is quite standard. You must submit an application on the official website of the credit institution. After reviewing the mortgage documents and approval, which will take 2 to 5 days, you will need to find an independent appraiser to determine the value of the home. After receiving data from him and providing it to employees, the next step will be signing the deal.

Funds intended for refinancing are transferred to an account to pay off the debt. Next, you will need to reissue the mortgage with Alfa-Bank and repay the new loan on time.

Reviews on mortgage refinancing through Alfa-Bank

The current rules do not provide for the opportunity to obtain an internal loan at a reduced rate to refinance an existing Alfa-Bank mortgage. Some problems can be solved using a consumer loan program. In such a situation, you can contact another bank for refinancing.

Communication with clients is recorded, so if conflict situations arise, it is easy to clarify the correctness of the actions of individual employees. To eliminate errors, it is recommended to consistently check the loan application procedure.

The conditions for refinancing a mortgage at Alfa-Bank are determined by the type of real estate, client status and other significant factors. If it is too difficult to make a decision on your own, use the help of our duty lawyer. Give it a like. Repost. In the comments to the publication, ask additional questions and leave your own comments.

Read on to learn more about mortgage refinancing.

Customer Reviews

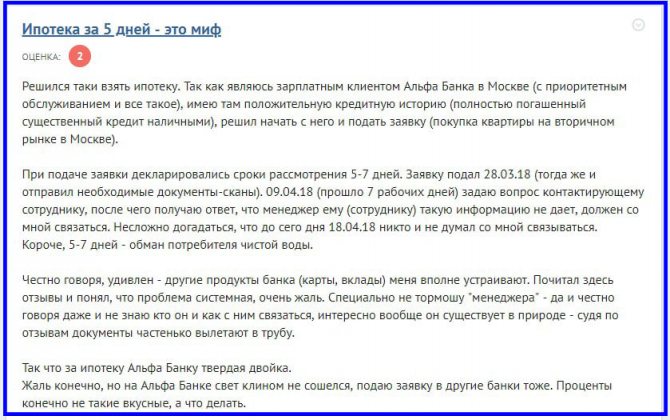

Feedback from Alfa-Bank clients is quite positive. People are satisfied with the conditions, requirements and service. It is noteworthy that in 2020 a lot of people come to refinance mortgages from other banks. But there are also quite a few dissatisfied clients, disappointed with the time it took for their application to be considered. Instead of a review in 5 days, it takes weeks, and in some cases, months. This may be due to the large number of clients refinancing and the inability to cope with all requests in a timely manner.

Feedback from an Alfa-Bank client about mortgages

Alfa-Bank offers one of the most profitable refinancing programs on the market in 2020, allowing you to reduce the financial burden of your mortgage. At the same time, insurance is provided to protect against all possible risks. A significant disadvantage is the need to make a down payment, which not every borrower can afford. But before making a final decision, we still recommend that you familiarize yourself with the offers of other credit institutions.

Required documents

Refinancing of mortgages from other banks in Alfa Bank is carried out only after the applicant provides all the necessary documents:

- Internal passport of the Russian Federation;

- Any second document - SNILS, TIN, international passport, etc.;

- Certificate of income in form 2-NDFL and a copy of the work record book. Salary clients do not need to provide these documents;

- Completed application form;

- Real estate documents: purchase and sale agreement, assessment report, etc.;

- Loan documentation from the bank's past;

- Notarized documents, if necessary: spouse’s consent to refinance, power of attorney, etc.