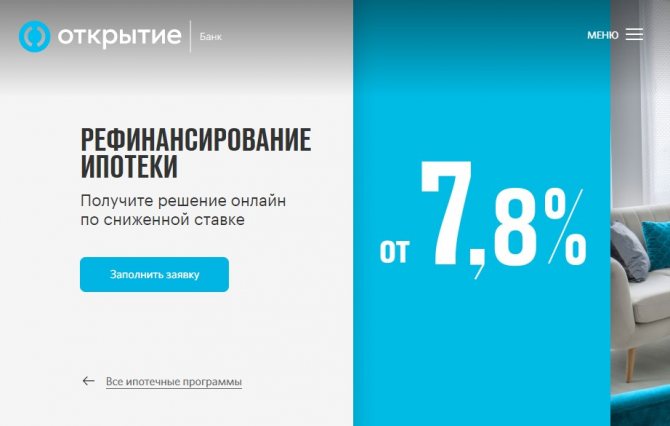

With the reduction of the key rate by the Central Bank, mortgage rates also crept down. The times when the interest rate for a home loan was 14-15% per annum are gone. For existing borrowers, Otkritie Bank offers a mortgage refinancing program at a rate of 7.8%. Both clients of other banks and Otkritie borrowers can refinance a mortgage loan.

Mortgage refinancing at Otkritie Bank in 2020

Otkritie FC offers several refinancing options:

- offer at 7.8% for clients of other banks;

- a rate of 9.1% is approved for own clients;

- special offer - mortgage refinancing under a program with state support for family clients at a rate of 4.7%.

Otkritie borrowers praise the good service, customer focus of the bank’s employees and sincere desire to quickly complete the necessary formalities.

Among the disadvantages, they note the imposition of additional services - credit cards and expensive insurance. Remember that the borrower has the right to refuse additional services, and choose insurance from the company at his own discretion, the main thing is that it is approved by the bank.

Read in detail:

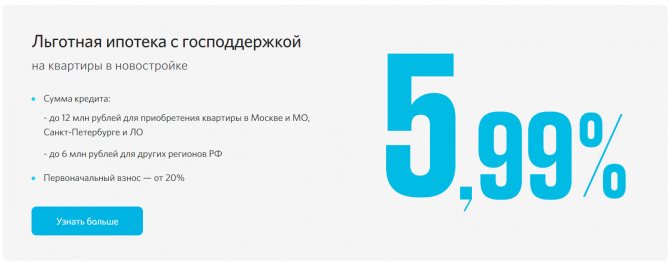

Mortgage programs of Otkritie Bank: State support for everyone at 5.99% in 2020; Family mortgage at 4.7%; Far Eastern mortgage 2%; Mortgage conditions for new buildings and secondary housing - from 7.5%; Mortgage for a private house with a plot of land at 8.9%; and other programs.

Interest rate

A single refinancing rate is established for all individuals. However, this does not mean that if the application is approved, it will act within the framework of the concluded agreement. The bank has a system of discounts and allowances.

Thus, a premium is established if:

- A certificate is provided that officially confirms the client’s income, not in Form 2-NDFL. The rate increase will be 0.25%.

- The client is not included in the payroll. In this case, the premium will be 0.25%.

- The recipient of the loan has the status of individual entrepreneur, shareholder, owner or co-owner of the business. The loan interest will increase by 1 point.

- Lack of insurance means plus 2% to the base rate.

- There will be an increase of 1% until the property is transferred to the bank as collateral.

Interest rates may vary slightly

Discounts are provided:

- If the client is salaried, then 0.25% can be adjusted from the base rate;

- The application was submitted through a mortgage broker. The deduction from the rate will also be 0.25%.

- Paying a commission amounting to 2.5% of issued funds will also make it possible to obtain more favorable conditions.

- On-lending under the program with AHML will also be more profitable. Recently, FC Otkritie Bank signed an agreement. It is worth remembering that according to bank rules, discounts cannot be combined.

When is it worth refinancing a mortgage for individuals?

Mortgage refinancing should be carried out when the overpayment on the new loan is significantly lower than the overpayment on the current one. To do this, you need to calculate the new monthly payment amount, overpayment indicators, taking into account the costs of refinancing the loan.

Mortgage refinancing, at its core, is the registration and issuance of a new loan, and not a revision of the terms of the old one, so the time and money costs here will be comparable. For example, you will have to reapply for assessment and insurance.

At the same time, the type of payment (annuity or differentiated) does not directly affect the profitability of mortgage refinancing. You need to count all the options and compare the final numbers.

You can compare the amounts on the current loan and the new one using the refinancing calculator.

Refinancing procedure

Next, we will analyze the process of refinancing a mortgage at Otkritie Bank step by step.

Step 1. Submit an application

At this stage, you need to collect a set of personal documents and submit an application for mortgage refinancing. This can be done remotely, through a special form on the Otkritie Bank website. Documents are also sent electronically.

Step 2. Approval of the collateral

After receiving a positive decision, it is necessary to obtain approval for the apartment. Documents are transmitted to the bank electronically. During the review process, the lender may require additional information. They should be provided as quickly as possible.

Step 3. Preparing to sign loan documentation

After receiving the final decision, the manager contacts the borrower and agrees on the time and date of the mortgage refinancing transaction. By this day, the borrower must conclude all insurance contracts. You will need to provide a certificate from another creditor about the balance of the loan debt indicating the account details for full repayment.

Step 4. Signing a mortgage agreement and early repayment of current debt

On the day of the transaction, the borrower arrives at the selected bank branch with a full set of documents and insurance contracts. The loan documentation and mortgage agreement are signed in favor of Otkritie Bank. Next, the amount for full repayment is transferred to the account specified in the certificate. The borrower needs to contact the current lender and fill out an application for write-off. Depending on the bank, this can be done either in your personal account or in an additional office.

Step 5. Removing the previous creditor's encumbrance

After the final settlement with the bank, the borrower must receive documents to remove the mortgage mark. This document is called a mortgage. It contains marks indicating full repayment of the debt. The set is transferred to the Registration Chamber to remove the encumbrance. Some lenders, such as Sberbank, have refused to use mortgages. In this case, the bank independently transfers the documents to the registrar; the borrower only needs to wait for an SMS about the completion of the procedure. More details here.

Step 6. Registration of collateral in favor of Otkritie Bank

After the previous creditor's encumbrances are removed, the borrower re-applies to the registration authority. A new loan agreement is transferred and the collateral is registered in favor of Otkritie Bank.

Step 7. Transfer of documents to the bank, reduction of interest rate

For the period of re-registration of the encumbrance, Otkritie Bank applies an increased interest rate - plus 2 points. After registering the collateral, the borrower must submit a set of documents to the bank. After this, the rate will be reduced.

Refinancing a military mortgage

In addition to standard refinancing, Otkritie Bank also provides a military mortgage refinancing service.

The minimum rate at Otkritie for clients of other banks is 7.8%

Mortgage refinancing

Make a request

The minimum possible mortgage refinancing rate is set for clients of other banks – 7.8%.

7.8% can be obtained if:

- submit an application online;

- the loan balance is no more than 60% of the cost of the apartment;

- take out personal insurance;

- buy a title protection policy (not necessary if the apartment was purchased from a developer).

If any of the conditions are not met, the interest rate on the mortgage refinance will be higher.

Surcharges to the rate

The mortgage refinancing rate in Otkritie will be increased if:

- submit an application not online (+0.5%);

- request from 60 to 70% of the cost of the apartment (+0.2%);

- request 70% of the cost of the apartment or more (+0.6%);

- fail to take out life and disability insurance (+2%);

- do not insure the title (+2%).

Before registering the encumbrance in favor of Otkritie Bank, 2% is added to the rate.

Refinancing a mortgage without proof of income

Only Otkritie’s salary clients may not submit income documents. Other borrowers must confirm their income, otherwise refinancing will not be approved even at a higher rate.

Required documents

To apply for credit debt restructuring, you do not need any documents other than a completed online application form. But after its approval, the client must come to the bank’s office to sign the agreement. You must have with you:

- loan application;

- identification;

- a photocopy of the work record book or contract, which must be certified;

- information about income in free form on the employer’s letterhead or according to the 2-NDFL sample;

- papers on ownership of the apartment and documents of co-owners of the property, if any;

- INN/SNILS of the property and an extract from the house register.

You should also bring a copy of the original loan agreement. If necessary, the bank may require additional documents. The absence of any document or doubts about its authenticity may be a valid reason for refusing approval of a loan application.

Mortgage loan refinancing rate for Otkritie Financial Corporation clients

Otkritie Bank also approves refinancing for its own clients, but at a higher interest rate. The minimum possible rate is 9.1%. It increases in the following cases:

- cancellation of a life insurance policy (+2%);

- waiver of title insurance (+2%).

The rate does not depend on the loan amount and application form.

Mortgage refinancing

Make a request

Possible surcharges

Additional payments may be added to the basic annual interest rate for refinancing. This occurs if the applicant client has not fulfilled certain specific requirements of the bank. These conditions are:

- refusal to insure the purchased property in case of loss of property rights or housing - 2%;

- refusal of disability and life insurance - 2%;

- if the mortgage is registered to a banking company - 2%;

- if the client is a business owner or individual entrepreneur - 1%;

- if the borrower cannot make the required down payment - 0.5%.

However, Otkritie itself determines what the client’s final annual interest rate will be.

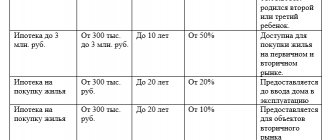

Refinancing a family mortgage at 4.7%

For borrowers who had a second or subsequent child between 2020 and 2022, mortgage refinancing is available at 4.7%. This is a special program with subsidies from the state budget; the rate does not depend on the loan amount and the relationship with the price of the apartment. The rate will increase by 1% if you do not take out personal insurance.

Family mortgage refinancing only applies to apartments purchased on the primary market. You can also refinance a loan if the original mortgage was also issued under the family program, but at a higher rate. Repeated refinancing is also allowed.

Conditions for refinancing loans from other banks

Otkritie Bank refinances not only third-party consumer loans, but also mortgage loans. There is a special program with specific conditions that must be met in order to become a participant. According to her rules:

- If the collateral property is held by a third-party organization, then from the day the mortgage is issued to the submission of an application for refinancing at Otkritie, at least 6 months must pass. This is a mechanism for weeding out dishonest and insolvent reloan applicants.

- The real estate, which acted as collateral in the original legal relationship, must in the same way secure obligations to Otkritie Bank after approval of the refinancing.

- The categories of residential real estate purchased with a mortgage vary. This can be either secondary or investment in construction (by concluding a shared construction agreement).

- The maximum that a client can request and receive when refinancing is the balance of the original loan with interest on it due for payment. Otkritie Bank does not lend beyond this amount.

- If the initial loan was obtained from a third-party financial institution, and the client is a salary earner at Otkritie, then he is available for lending in the amount of up to 90% of the value of the property that is pledged.

The bank has its own conditions for providing funds

Basic conditions for refinancing a mortgage at Otkritie Bank

Mortgage refinancing at Otkritie Bank is available under the following conditions:

- minimum amount – 500 thousand rubles. for any region;

- the maximum amount for Moscow, Moscow Region, St. Petersburg and Leningrad Region is 30 million rubles;

- the maximum amount for other regions of Russia is 15 million rubles;

- the ratio of the loan amount to the price of the mortgaged apartment is from 20 to 80% (up to 70% if a business owner applies for refinancing);

- only ruble mortgage;

- loan term from 3 to 30 years;

- You can involve up to three co-borrowers in the agreement.

Repeated refinancing is allowed.

Why they may refuse to refinance

However, despite the fact that clients fulfill all the requirements and conditions, refinancing is often refused. One of the most obvious reasons for this situation is the lack and unreliability of the documents provided by the borrower.

But there are other, more serious reasons for refusal of a service. For example:

- the client expects to receive a mortgage loan for a short term;

- The mortgage repayment period is too short: less than three years;

- the applicant’s credit history is damaged by late payments or open loans;

- the client is insolvent or, in the opinion of bank employees, will not be able to pay the required amount monthly.

Therefore, before applying for a service, it is recommended to evaluate your capabilities.

Otkritie Bank requirements

The opening imposes a number of requirements on the borrowers, the collateral and the original mortgage agreement.

| Requirements for borrowers | Russian citizenship and registration in Russia at the place of residence, age from 18 to 65 years (at the time of loan repayment), total work experience from 1 year, in the last place - from 3 months |

| Requirements for a mortgage apartment | Download (PDF document) |

| Requirements for the initial contract | You can refinance loans issued six months ago. During the last 180 days there must be no late payments exceeding 30 days |

Securing a mortgage

The need for collateral/guarantor Pledge of a residential building with a plot of land Other income Employee.

Own business: official confirmation of income - the minimum rate increases by 1.5%; official confirmation of income + management accounting data - the minimum rate increases by 2.5% Insurance

— Comprehensive mortgage insurance. In the absence of personal insurance, the interest rate increases by 5.5%, in the absence of title insurance - by 1.5%, in the absence of personal and title insurance - by 7%. Title insurance is not issued if the property being pledged has been owned by the borrower for more than 3 years

A loan to repay a mortgage loan previously provided by another bank for the borrower to purchase housing on the secondary real estate market or by investing in construction. The indicated minimum interest rates are valid if the borrower accepts the bank's offer to enter into an agreement to reduce the interest rate under the loan agreement. If you refuse to accept the bank's offer, the loan rate is set 0.5% higher

deposit update date October 21, 06:54

Other mortgages of Bank "FC Otkritie"

- Mortgage “Loan for major repairs” 15% from RUB 30,000,000.

- Mortgage “Loan for the purchase of a house with land” 12.75% from RUB 30,000,000.

- Mortgage “Loan for the purchase of other real estate secured by existing housing” 12.75% of RUB 30,000,000.

- Mortgage “Loan for the purchase of an apartment under construction together with Donstroy” 7.9% from RUB 500,000.

- Mortgage loan “Apartment” 11.75% from RUB 30,000,000.

- Mortgage loan “New building” 11.75% from RUB 30,000,000.

- Loan for a down payment - secured by an apartment 11.75% of RUB 30,000,000.

- Loan for down payment - secured by a house with land 12.75% of RUB 30,000,000.

- Program “Loan for refinancing a mortgage loan secured by an apartment” 11.75% from RUB 30,000,000.

- All mortgages of Bank "FC Otkritie"

Mortgage in other banks

- mortgage at Absolut Bank

- mortgage at Gazprombank

- mortgage in Genbank

- mortgage in Surgutneftegazbank

Similar loan offers from other banks

Mortgage "Country real estate" from Sberbank of Russia

| 13% | 45 000 | up to 30 years old | 15% |

Mortgage “Loan for the purchase of an apartment under construction together with Donstroy” from Bank FC Otkritie

| 7.9% | 500 000 | 3-10 years | 30% |

Apply for refinancing at Otkritie

To save on the 0.5% rate, it is recommended to apply for refinancing online. After initial processing, you will receive preliminary approval and information about the necessary documents.

After agreeing on the rate, refinancing will proceed according to the following scheme:

- Bank appraisal of real estate and preparation of final loan documents.

- Signing a loan agreement at the Otkritie Bank office.

- Paying off the original mortgage.

- Removing the encumbrance from the original bank.

- Re-registration of the encumbrance in favor of Otkritie Bank.

- Mortgage repayment according to the new schedule.

During the re-registration of the encumbrance, an increased interest rate (+2%) applies.

Mortgage refinancing

Make a request

How to apply

You can apply for a loan under the mortgage refinancing program from FC Otkritie at any branch of the bank. To do this, you will need to visit the selected branch with the designated set of documents.

You can also send a request to participate in the program on the organization’s official website. To do this, just go to the “Mortgage” section on the bank’s portal and select “Apply for refinancing” (link to page). In the application form that opens, provide information about the property, existing loan, and yourself personally.

Within 24 hours, the manager will call the client back and announce the bank’s preliminary decision. If the application is approved, you will need to collect the necessary documents and submit them to the mortgage center for further review.

Refinance calculator

Our online calculator will help you estimate the overpayment and determine the need to refinance your mortgage at Otkritie Bank. Registration costs can also be factored into the calculator (insurance, appraisal, payment of necessary fees and paperwork). Just enter your values and click “Calculate”.

If the calculator is not visible, go to the web version of the page: https://renovar.ru/finance/ipoteka/bank-otkrytie-refinansirovanie-ipoteki

Requirements for clients

The financial company focuses not only on the reliability of its consumer. In addition, the potential borrower must meet certain criteria.

Registration of refinancing is possible if you have the necessary characteristics of a professional plan, as well as certain age and personal parameters.

Mortgage refinancing is available to the following clients:

- people with Russian citizenship and permanent or temporary registration;

- those whose age at the time of conclusion of the contract did not exceed 65 years;

- people with a 3-month career at their last place of employment;

- if the borrower has the status of an individual entrepreneur, the period for his registration in Russia should be 2 years.

If the client wants to increase the chances of approval, it is permissible to include co-borrowers in the agreement. They may be the client's parents, children, brothers or sisters.

However, the product may not be provided due to incompatibility with the person’s job, because the bank does not work with workers in certain positions. An online application for mortgage refinancing at Otkritie Bank is submitted on the lender’s website.

Mortgage refinancing is not possible for the following persons:

- Bartenders and waiters.

- Employees of casinos and gaming clubs.

- Bodyguards.

- Realtors.

- International maritime crew members.

- Citizens working unofficially.

You can get this product in the following cases:

- in the process of concluding a contract, the citizen has no debts on another mortgage refinancing, which applies to both interest and regular payments;

- the client has no delays in regular payments on mortgage lending products exceeding 30 days.

If specific conditions are met, it will offer the client individual, favorable refinancing conditions.

Peculiarities

Military mortgages can be used by participants in the Savings Mortgage System, contributions to which are made by the state. The essence of this support measure is that a housing loan received by a military personnel is paid for from government funds. Contributions amount to a certain fixed amount. Therefore, the borrower cannot obtain a mortgage with a payment that exceeds the installments. Refinancing a military mortgage will reduce the loan term.

The bank opening program has several features:

- Only a military member participating in the savings system can be a borrower. Involving third parties in the transaction is unacceptable.

- The collateral must belong exclusively to the borrower.

- If the initial mortgage was taken out to purchase an apartment on the primary market, refinancing at Otkritie Bank is possible only upon completion of construction and receipt of ownership.

- If Rosvoenipoteka does not transfer payments on time, no penalties are imposed on the borrower.

List of required documents for refinancing

To get a loan, you need to prepare:

- passport;

- documents confirming receipt of a stable, permanent income;

- the loan agreement that needs to be closed and a certificate with information about the balance of the debt;

- later you will need documents for the property, including insurance and mortgage.

Additionally, you need to fill out an application form for refinancing mortgages from other banks at Otkritie Bank. If the debtor decides to refinance the loan issued by Otkritie, a loan agreement is not required.

Information on income deserves special attention. They can be confirmed:

- a certified copy of the work book (agreement) and a certificate (for individuals);

- a copy of the tax return if the borrower is an individual entrepreneur;

- 3-NDFL or 2-NDFL, if the application is submitted by the owner of a legal entity.

Bank requirements for a refinanced mortgage

Mortgage refinancing is possible when:

- the apartment was purchased on the primary real estate market in a building built by a bank-accredited developer, or on the secondary market (including payment for other inseparable improvements);

- collateral in the form of an apartment or property rights is transferred against the bank, and the funds received are used only to repay the remaining debt.

When applying for a loan for refinancing, the borrower should not be in arrears:

- at the time of signing a loan agreement with the bank;

- repaid during the last six months for more than a month.

The maximum loan amount depends on where the apartment being pledged to the bank is located.

The loan amount cannot exceed:

- the amount of the loan balance, if it was issued at a banking organization;

- the amount of the remaining balance of the loan and the interest accrued on the date of early repayment of the loan, if the loan was issued in another bank or organization. In this case, the mortgage loan must not be less than six months old.

Loan collateral can be:

- preliminary mortgage agreement, pledge of property rights under an agreement for participation in shared construction;

- mortgage of an apartment, which was the security and object of purchase under the loan.

You can refinance a mortgage loan issued at FC Bank Otkritie no earlier than 1 year from the date of its receipt.