Insurance is an additional service that is designed to ensure the economic security of the borrower and his family members in the event of circumstances classified as an insured event. If the client does not want to, he may not take out insurance. This opportunity is provided by the regulatory legal acts of the Russian Federation.

When issuing a consumer or car loan, Sberbank employees often require clients to enter into life and health insurance contracts. Termination is possible within 14 calendar days from the date of receipt of money, but you can apply at a later date, and the refund amount will be reduced.

What insurance can I refuse?

Exclusive insurance of the property transferred to the bank as collateral for payments is mandatory by law.

This means that the client will not be able to refuse to insure the structure of the apartment or house for which he is taking out a mortgage.

All other types of mortgage insurance are only voluntary.

Neither insurance of the purchase and sale transaction, the so-called title, nor insurance against loss of work, much less the life of the borrower, is mandatory.

To increase the protection of issued funds from non-return, the bank most often imposes life insurance when applying for a mortgage.

Is it legal to require insurance? ►►

Is this beneficial for only one bank? The site's editors have prepared examples of mortgage calculations with and without life insurance . Let's see what happened?

What does the policy give the borrower?

Often, some borrowers express dissatisfaction with the need for life and health insurance when applying for a mortgage, trying in every possible way to refuse life insurance on the mortgage.

However, if you understand the essence of this type of insurance, you can understand that it is beneficial not only to the bank, but also to the policyholder himself.

So, the main purpose of life insurance when applying for a mortgage is as follows:

- protection of the financial situation of the borrower, as well as his family, from unforeseen circumstances. Thus, in the event of the death or disability of the policyholder, responsibility for repaying the remaining amount of the mortgage will fall on the insurance company and the family of the deceased will not have to bear an unbearable financial burden;

- protection of the insured's mortgaged home. Even if unforeseen circumstances arise (death, loss of the ability to continue working), the mortgaged property will remain with the borrower’s family , since the insurer will be responsible for further repayment of the loan;

- the bank receives a guarantee that the mortgage loan will be repaid.

Do you need insurance every year? ►►

Benefits of Mortgage Insurance

Before you figure out how to refuse mortgage insurance from Sberbank, you should think about whether it’s worth depriving yourself of guarantees . After all, mortgage insurance covers various force majeure situations that can happen both to the mortgaged property and to the borrower himself, including:

- injury;

- accidents;

- acute diseases;

- loss of ability to work.

There is a possibility of such risks, given the duration of the mortgage. And if the borrower is unable to repay the loan in full, the resulting debt will be paid off for him by the insurance company. Or he will send funds to the victim himself for treatment and restoration of functionality. Therefore, for the borrower, insurance becomes a guarantor of fulfillment of all undertaken obligations.

Taking out a mortgage insurance policy guarantees borrowers full repayment of the loan and protects people from unpleasant moments that arise when further payments are impossible.

How to justify refusal during registration?

Undoubtedly, the client has the right to refuse life insurance immediately when applying for a mortgage.

In this case, the bank offers the borrower a different lending program, which contains more stringent conditions for issuing borrowed funds. As a rule, they are associated with an increase in mortgage rates.

has the opportunity to refuse life and health insurance immediately after purchasing a home using a mortgage.

This can be done during the so-called “cooling off period”, which lasts 14 days from the date of conclusion of the contract.

In this case, the policyholder will be fully (if the insurance contract has not entered into force) or partially (if the insurance has entered into force) refunded the amount of the insurance premium.

If the policyholder decides to refuse life insurance a significant time (1 year or more) after the conclusion of the contract, this can have very negative consequences.

But, we must take into account that the bank may significantly increase the mortgage lending rate or even require repayment of the loan ahead of schedule.

Features of military mortgage insurance ►►

Causes

It should be noted that the borrower is not at all obliged to indicate the reasons for refusing life and health insurance under the mortgage, since the acquisition of this type of policy is carried out on a voluntary basis. No one has the right to force a client to take out such insurance.

In most banks, in the application form for refusal of life and disability insurance, there is no column at all in which it is necessary to indicate the reason for reluctance to take out insurance.

Legislation to help

This procedure is entirely voluntary.

In accordance with paragraph 2 of Article 31 of the Federal Law of the Russian Federation “On mortgage (mortgage of real estate)”, the borrower must insure only the mortgaged property itself , that is, the mortgaged property.

Terms and conditions of the mortgage insurance contract ►►

Therefore, if the bank forcibly insists on issuing a life and disability insurance policy, the borrower has every right to write a complaint to the appropriate authorities, where he argues for the right to refuse mortgage insurance.

Waiver of insurance after signing a loan agreement

Clients who have taken out a housing loan from a bank and have taken out a voluntary insurance policy can cancel it not only during the “cooling-off” period, but also a year or more after signing the loan agreement. But, it is possible to return your own finances paid for insurance only if you pay off the mortgage early.

To return the money, the borrower must submit a corresponding application to the insurance company along with a certificate from a financial institution confirming that there is no debt on the mortgage loan. If the insurer does not want to give the money, this problem can be resolved in court. In other situations, i.e. Having decided not to pay out insurance issued for loss of ability to work or life, no refund is provided.

Experts recommend submitting applications simultaneously to a financial company and an insurance organization, but often clients stop paying insurance premiums without any reason. Before signing both a loan and an insurance agreement, it is important to carefully re-read all the information in the documents so that they do not subsequently contain any pitfalls. It is better to seek help from an experienced lawyer for this.

- Author of the article

SovetIpoteka.ru Administrator

Advice Mortgage

I have more than 12 years of experience, I know first-hand about the real estate market, I have worked with many banks and real estate agencies. I tell you all the details about getting a mortgage and related products in the articles.

email [email protected]

Advantages and disadvantages

The main advantages of life and health insurance when applying for a mortgage are as follows:

- in the event of the death of the policyholder, the policy will relieve the borrower's heirs from a significant financial burden, and will also allow them to keep their home ;

- in the event of the borrower becoming unable to work, such insurance will act as a guarantee that he will not lose the property purchased with a mortgage, and the debt to the bank will be repaid;

- For clients who have insured their life and ability to work, banks provide more favorable mortgage lending conditions;

- Life and health insurance allows the policyholder to feel confident in the future.

At the same time, this type of insurance also has a number of disadvantages, which boil down to the following:

- costs associated with obtaining insurance;

- not in all cases death or disability can be recognized as an insured event;

- If the insured event does not occur, the borrower will not be able to return the money spent on insurance.

Will interest rates be raised?

As noted above, for clients who refuse life and health insurance, banks have separate mortgage lending programs that provide for increased mortgage interest rates.

How will the percentage change without insurance? ►► On average, for borrowers without insurance, the fee for using a loan may be increased by 1-5%.

Waiver of insurance during the cooling-off period

If the credit institution nevertheless managed to impose optional and unprofitable insurance, the client has the right to refuse it even after signing the loan agreement. But, for such situations there are some restrictions.

According to the Central Bank Directive No. 3854 dated November 20, 2015 “On the minimum requirements and procedure for voluntary insurance,” during the first 5 banking days after signing the loan agreement, the borrower has the right to refuse the voluntary type of insurance by submitting an appropriate application. The insurance company will be obliged to return to the client the full amount that he managed to pay for insurance within 10 days after accepting the application. If the insurer refuses to return insurance payments, the client has the right to go to court.

After the borrower refuses voluntary insurance, the credit institution may increase the interest rate on the loan by several points. In this case, before filing an application with the court, you must once again carefully read the terms of the loan agreement, which may contain the following clauses:

- The lender can change the interest rate on the loan depending on the prevailing circumstances: the client’s refusal of the insurance policy, etc.

- The interest rate will not change during the entire loan term.

- The loan rate may change without specifying the period.

- Possibility of calculating floating interest.

- The loan agreement does not indicate anything about changes in the interest rate on a housing loan throughout the entire loan period.

The legislation of the Russian Federation is on the side of borrowers (Federal Law No. 395, Federal Law No. 2300).

Mortgage calculation example

In order to understand whether it is profitable to insure and refuse life insurance when applying for a mortgage, it is necessary to make an appropriate calculation.

Conditional data taken for calculation:

The client bought an apartment worth 3,500,000 rubles with a mortgage. The loan term is 10 years (10 * 12 = 120 payments). The down payment is 10% (350,000), respectively, the mortgage amount is 3,150,000 rubles.

Without insurance

Annuity payment will be 48,908.93 rubles per month.

The amount of overpayment on the loan for 10 years will be: 10 x 12 x 48,908.93 – 3,150,000 = 2,719,071.24 rubles.

Where is mortgage insurance cheaper ►►

In the presence of

Interest rate – 13%

Let's assume that when applying for a mortgage, the amount of life insurance is 0.65% of the loan amount. In this case, with each subsequent year, the calculation will be based on the remaining amount of the mortgage debt.

The annuity payment will be 47,032.88 rubles per month

The overpayment on the loan (excluding insurance) is equal to 2,607,333.62 rubles (for 10 years).

Insurance fee (for 10 years): 113,387.65 rubles.

Thus, the overpayment on a loan without insurance is 2,719,071.24 rubles, and with a policy – 2,720,721.27 rubles (2,607,333.62 + 113,387.65).

The difference between these amounts is 1,650.02 rubles.

Based on the above calculations, we can conclude that it is still more profitable to insure your life and health: firstly, the borrower will thus protect himself from serious risk, and secondly, the amount of overpayment in this case is insignificant (only 1,650.02 rubles).

Why comprehensive insurance is cheaper ►►

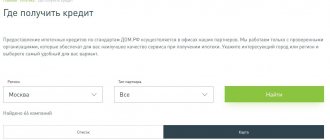

Which banks give mortgages without insurance?

As an example, here are several banks where you can get a mortgage without life insurance:

- "Alfa Bank",

- "Tinkoff Bank"

- "Sberbank"

- "VTB"

- Raiffeisenbank, etc.

Refund after registration ►►

In conclusion, it should be noted that when applying for a mortgage, it is still recommended to insure your life and health.

This will protect yourself and your family from the risk of losing your home, as well as from a significant financial burden (in the event of the death of the borrower).

In addition, from the above calculations it is clear that purchasing such insurance does not entail significant costs.

Refund after payment? ►►