When deciding to purchase a home with a mortgage, you should carefully analyze all possible situations. This includes the possibility of losing a stable income while using a credit loan. A decrease in financial solvency can occur for various reasons, sometimes independent of the actions of the borrower himself. Sberbank's credit policy takes into account such situations and in most cases meets its clients halfway. Mortgage payment deferment is one of the services aimed at helping in the event of possible negative situations regarding the payment of principal and interest rates.

What is deferment

Each party - both the lender and the client - is interested in the proper fulfillment of mortgage obligations. The bank will immediately feel the financial problems of the borrower, because delays automatically change the debt repayment schedule. If such delays are isolated, the lender is unlikely to impose serious sanctions.

When violations become systematic, the financial company has every reason to terminate the contract and compensate for its financial losses.

What affects the client's solvency?

- Salary reduction or job loss;

- Loss of ability to work due to an accident or serious illness;

- The period of pregnancy and child care;

- Planned change of job (if there is no savings);

- Divorce, illness, death of loved ones and other serious family circumstances;

- Sudden changes in the exchange rate (for borrowers who took out a mortgage in foreign currency).

The main thing is that the reason is valid - without an evidence base, the bank is unlikely to cooperate. Options for solving the problem depend on the amount of debt and the circumstances that contributed to its occurrence.

- Prolongation. Extending the debt repayment period allows you to reduce regular payments and reduce the financial burden on the borrower.

- Writing off part of the debt. This option is more the exception than the rule.

- Credit holidays. The client is temporarily exempted from mandatory payments; it will not be possible to defer the payment of interest.

- Refinancing. Apply for a new loan to pay off the problem loan. You can also refinance at another bank.

- Cancellation of penalties and fines (an extreme and unlikely measure).

If the borrower manages to convince the lender that the difficulties with repaying mortgage obligations are short-term, they can meet him halfway by arranging a deferment of the next payment. There are 3 types of mortgage debt restructuring:

- Preferential payment. Payment of the loan body is suspended for a certain period (interest is paid regularly) or the annuity monthly payment is reduced for a fixed period, the payment schedule is also adjusted.

- Credit holidays. The grace period is provided for several months (up to a year).

- The possibility of deferment and the conditions for its application are provided for in the mortgage agreement. Suitable for those mortgagers who have such a clause in the contract. It can be considered standard practice for banks to offer loyalty programs to mortgage applicants (an example would be credit holidays in the “Young Family” program).

You can also get a mortgage payment deferment on a general basis. If the bank’s policy regarding loan restructuring provides for such a possibility, mechanisms of state support for citizens who find themselves in difficult situations are also used (if your bank is a participant in such a program).

Deferment on Sberbank mortgage

It’s worth noting right away that such a measure as mortgage deferment at Sberbank does not apply to all borrowers. To get it approved, you will have to prove the presence of certain circumstances that do not allow you to repay the loan as usual.

Everyone who takes out a mortgage to purchase a home tries to calculate all the possible options and possible difficulties. However, this is not always possible. Often circumstances may arise that worsen the debtor's solvency and require some time to restore it. These include:

- birth of a child;

- pregnancy and subsequent maternity leave;

- job loss;

- loss of health affecting ability to work.

Each of these reasons must be documented, since a verbal explanation alone is not enough. It would be a good idea to get the support of guarantors, which guarantees that the borrower’s problems are temporary and the debt will be repaid. If you have them, your chances of getting what you want increase significantly.

What documentation to prepare

To defer your mortgage payment, you need to provide the bank with serious arguments:

- A certificate from the hospital or the patient’s medical card;

- Child's birth certificate;

- A copy of the work book;

- Certificate of divorce;

- Certificate of income (from work or employment service);

- An official letter from the employer with intentions to enter into a contract with the borrower in the near future.

A passport and SNILS must be attached to the application for deferment. To confirm your words, collect all the papers that are directly or indirectly related to the case: an extract from the order (if a shortened work week has been introduced at work), an extract from the medical history certified by the hospital, etc.

Each case is unique, therefore the decision to defer is made individually. The client’s task is to provide the maximum number of documents confirming the reason for the violation of the repayment schedule and convincing the lender that the problem is temporary.

Some banks (Sberbank, DeltaCredit, Uralsib, Rosselkhozbank) offer installment payments during construction if housing is purchased in a building under construction.

Who is entitled to installment plan

It makes sense for the following categories of mortgage holders to apply for a mortgage deferment:

- Clients who have been repaying their home loan for at least six months;

- Borrowers with an ideal financial reputation;

- Persons who, due to objective reasons, find themselves in a difficult life situation that has affected their solvency;

- Mortgages who have not defaulted on their loans.

Under the terms of the mortgage agreement, repayment of the loan can be suspended without penalties if the borrower participates in government support programs - such as “Young Family”, “Assistance to Families with Children”, mortgages for teachers, doctors, military, etc.

See this same topic: How to return mortgage interest in tax year [y]? Tips and documents

Every mortgage holder needs to understand that deferment (installment plan) is not the bank’s obligation, but its right. Therefore, the creditor has the right to refuse without any comments. Some banks offer deferment for various events occurring in the client's life.

- A deferment after the birth of a child for the entire period of maternity leave is provided in many large banks. In Sberbank of Russia, VTB 24, for this category of clients, the mandatory regular payment is reduced to the level of interest payment. For some time, such privileges help reduce the credit burden on a young family. You can count on benefits for a maximum of 3 years, but more often bankers limit themselves to a mortgage with a deferred payment for 1 year until the mother returns to work. Only a single mother can receive a 3-year deferment (if the contract is issued specifically for her).

- Postponement due to force majeure - loss of job, disability, breadwinner. If the grounds for dismissal do not discredit the victim (staff reduction, liquidation of the organization) and he has no other sources of income or they have decreased by 30% or more and do not allow him to fully fulfill his mortgage obligations.

- If the circumstances are recognized as an insured event. The borrower is recommended to contact insurers to receive compensation that will help pay off debts without risk to the bank. If the client does not have insurance, the lender may provide a deferment of 1-6 months. The main thing in this case is not to shy away from dialogue and look for compromises.

- Relief during economic crises. Mortgages who took out a foreign currency housing loan in 2014-2015 faced a serious increase in its cost due to currency exchange rate fluctuations. If it was impossible to pay on time, banks provided a deferment or reissued the mortgage to a ruble one at the average rate.

If the client, while his financial situation worsens, still receives an income above the average subsistence level in the region or owns valuable property, the lender will refuse the installment plan. The borrower will be advised to quickly sell additional real estate or a vehicle or find his own way to obtain the amount required for the mortgage.

How to apply

In general, applying for a mortgage deferment consists of the following procedures:

- Notifying the bank about difficulties encountered.

It is better to personally contact the bank’s credit/mortgage department and outline the essence of the problem in detail. Also during the conversation, it is worth consulting about the possibility of obtaining a deferment or debt restructuring. The management of the credit institution will advise what is best for the borrower to do and what actions to take in the future.

- Submitting an application for deferment.

The client must write an application requesting benefits for the payment of mortgage debt, indicating compelling reasons. Relevant documents and evidence are attached to the application. If the borrower himself, for objective reasons, is not able to solve problems and prepare documents, this can be done by an authorized person upon presentation of a notarized power of attorney.

- Waiting for a decision from the bank.

Practice shows that any bank that issues mortgage loans can provide preferential terms for debt repayment. However, large banks, especially those that issue loans under special programs of social significance, are more willing to make concessions due to the scale of their activities. Each client request and application is submitted to the next Credit Committee and is considered as planned. After this, the final decision is announced to the borrower.

If the bank makes a positive decision, the parties conclude and sign an additional agreement to the loan agreement, which specifies new conditions for making payments, indicating the terms and minimum amounts. An alternative option would be to designate in such an agreement a period during which the client is exempt from making all payments on the mortgage loan.

After the expiration of the additional agreement, events may develop in the following directions:

- the previous schedule of monthly payments is restored while the repayment period is extended;

- current payments increase taking into account the preservation of the original debt payment period;

- Monthly payments do not increase immediately, but gradually (the period will be extended).

Each borrower, before concluding a mortgage lending agreement, must realistically assess their ability to repay the debt, taking into account potential force majeure circumstances, from which no one is insured. However, material difficulties can directly affect the inability to fulfill one’s obligations to the bank to the required extent. A completely natural option here would be to request a deferment of payments until the situation is resolved.

Depending on the specific case, the bank may exempt the borrower from paying the principal when paying accrued interest, provide a credit holiday (usually for several months) or significantly reduce the monthly payment. In any case, it is important to remember: only trustworthy clients with a positive credit history who, due to objective reasons, find themselves in a difficult life situation will be able to receive such a benefit.

Read more: Application for acceptance of inheritance sample Belarus

If you are already in arrears on your mortgage, then urgently read our post on this topic, and also immediately contact our mortgage lawyer for a free consultation. He will definitely tell you the right way out of your situation. Sign up in a special form in the corner. Otherwise, you risk having a big problem for many years to come.

You will also definitely find our post “What to do if you have nothing to pay your mortgage with” to help you.

We look forward to your questions below. We will be grateful for likes and reposts.

In this article we will look at whether it is possible to defer mortgage payments. Let's find out whether the birth of a child is a reason for delay and what documents will be needed. We have prepared for you the registration procedure and bank conditions.

Under what conditions can you take a deferment?

Whether to provide a deferment to a specific client, and under what conditions - the law on deferment of mortgage payments leaves this issue to the discretion of banks. You can apply for a deferment at the bank that issued the mortgage. Another financial institution can resolve the issue only through refinancing.

Neither with a regular deferment nor after a credit holiday is granted, interest will stop accruing, so there is no need to talk about complete release from financial obligations.

The grace period ranges from 6-18 months. After submitting the application, the bank verifies the submitted documents. They can refuse an installment plan without explanation - the bank primarily cares about its profit and the profit of its investor partners, and therefore calculates all the risks.

Reasons for postponing the birth of a child can be included in the mortgage agreement. This is usually done in lending programs for young families. Single mothers also fall into this category.

It is important to understand that when assessing the financial situation of the borrower, the income of the co-borrower spouse is also taken into account. They also take into account how hopeless the situation is: whether the client, after overcoming force majeure, will be able to safely pay off the mortgage on new terms.

Registration procedure

In order to obtain a deferment on a mortgage loan. The borrower must follow the procedure.

Read more: Customs officer pension calculator

The step-by-step instructions are as follows:

List of documents

The application must be supported by documents that confirm the facts specified in the application.

That is, the borrower must confirm that the financial situation of his family is difficult, and there are temporarily no funds to pay monthly installments.

Therefore, the following must be attached to the application:

If for some reason the applicant cannot personally write an application and present the necessary documents and certificates, he can issue a notarized power of attorney to one of his family members or a stranger.

This person will be the official representative of the applicant and will be able to submit all the necessary papers to the bank on his behalf.

In addition, there are now specialized organizations that are ready to take on all the hassle of restructuring the client’s debt.

Naturally, for a certain reward!

Sample application for deferment

Each bank itself develops an application form for granting a deferment under a loan agreement.

But the application must indicate:

How to arrange an installment plan

The procedure consists of several stages:

- Tell the bank about your problems. It is better to contact the bank not in your account on the website, but in person, in order to tell in detail about your problems. During the consultation, you need to find out about the chances of loan restructuring. The manager will suggest a suitable option and conditions for its implementation.

- Submit an application for deferred payment. Usually the bank provides its own form and a sample for filling it out. The request for a grace period must be justified with convincing, documented reasons. If the client cannot be present in person for health reasons or other reasons, his interests may be represented by another individual who has a notarized power of attorney.

- Wait for the decision of the credit committee. Applications are considered on a first-come, first-served basis, no more than one month. In principle, any bank that works with mortgage products has the right to provide a deferment. But large financial companies with solid assets and capabilities are more willing to meet them halfway.

- Draw up an additional agreement to the mortgage. It indicates a new repayment schedule or simply the period for which the borrower is released from obligations.

At the end of the additional agreement period, events may develop as follows:

- The schedule is restored to its original form, the validity period of the mortgage agreement is increased;

- If you decide not to adjust the payment period, the amount of regular payments will be increased;

- The size of the annuity payment will not be raised immediately, but gradually (the terms will be extended).

Even if the bank is loyal, the borrower himself needs to assess the prospects of repaying the mortgage, taking into account new conditions and personal circumstances.

If financial problems do not allow you to meet the bank’s conditions, try asking for an installment plan until the financial situation improves.

Look at the same topic: How to get advice on a mortgage at Sberbank: contacts and phone numbers

Who can they meet halfway?

Sberbank will not give a deferment on a loan simply because you want it. To take advantage of the preference, you need to have documentary evidence indicating that you really have a difficult financial situation.

Why is it prohibited to write off a Sberbank credit card?

The reason for refusal may also be the borrower’s untimely application.

When should you apply for a deferment?

Sberbank is most loyal to organized clients. Having taken out a loan from a financial institution and discovered that you cannot pay it off on time due to unplanned circumstances, begin collecting documents to apply for a deferment. The accumulation of debt and the accompanying banking sanctions will ruin your credit history and negatively affect the decision made by the issuer's administration. If you miss several months of loan payments, you can get blacklisted and lose the trust of Sberbank.

Reasons why you can get a deferment?

Sberbank will accommodate a client who has taken out a loan and applied for a deferment in the following cases:

- a force majeure situation, which can be considered: car theft, fire, robbery, accident and similar cases;

- serious illness of a loved one, requiring care and large financial investments;

- temporary or permanent disability;

- birth of a child;

- dismissal from work, if it was not initiated by the borrower;

- other situations.

At the birth of a child, Sberbank can accommodate young parents who have taken out a loan and individually provide a deferment for up to 3 years.

The percentage of positive responses to requests for deferment is small, since many citizens do not provide a full documentary evidence of their insolvency due to changed circumstances.

Whom the bank refuses an application for?

The lender may not approve the deferment without giving reasons.

Most often this happens in the following cases:

- No good reason. If the borrower leaves the company of his own free will, you should not count on mortgage holidays.

- Questionable financial reputation. If the client has made late payments on the mortgage, it will be difficult to convince the lender of his reliability.

- The mortgage was issued relatively recently. If less than three months have passed since the mortgage was issued, installments are not allowed.

- The statement is not supported by documents. When the lender sees no prospects for changing the credit status, there is no chance of installment payment.

After refusing a deferment, the bank may offer other debt restructuring schemes. Do not rush to refuse, carefully study the offer. Sometimes this method will be the best solution to the problem.

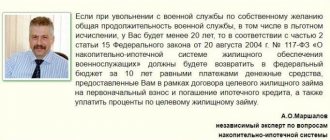

Alternative restructuring option

The state program to support mortgage holders is being implemented through the Unified Institute for Development in the Housing Sphere (the same AHML), but you need to contact banks. You can count on government subsidies in the following cases:

- Decrease in total income by 30% (compare data at the time of obtaining a mortgage);

- Increase in the amount of payments on foreign currency mortgages by 30%;

- The dependent family is a disabled child or simply minor family members;

- The borrower is a combat veteran or disabled.

Participation in the state support program does not automatically guarantee the possibility of deferment. When filling out an application, various assistance options are available:

- Changing the loan currency and reducing the tariff to 12% per annum (for foreign currency mortgages);

- Establishing a fixed rate for the entire period of the contract;

- Reduction of mortgage obligations by 10% of the balance of the loan at the time of restructuring, but not more than 600 thousand rubles;

- Reduction of the tariff rate for a maximum of one and a half years - the monthly payment will be reduced by half;

- Writing off part of the debt.

For participants in state programs, banks can set other conditions for restructuring. An important condition for state support is the bank’s participation in this program, where more than 70 banks are already accredited.

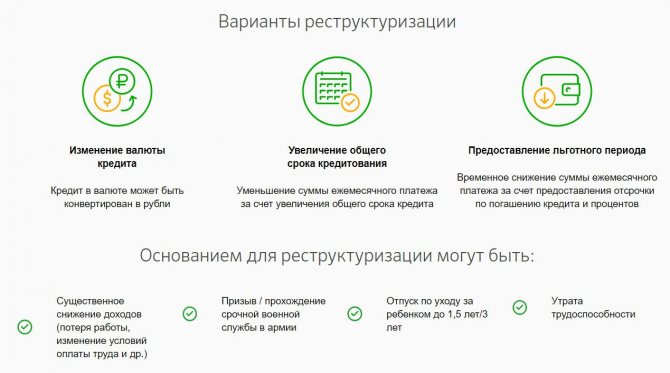

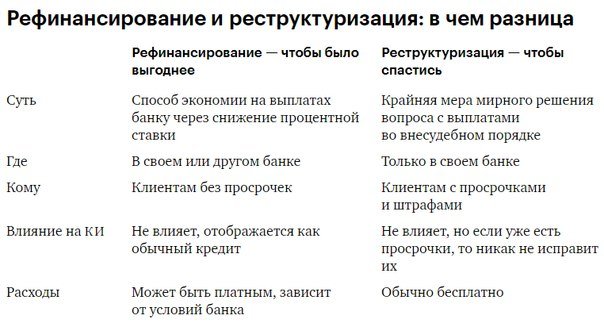

Is deferment a refinancing or restructuring?

The bank is deferring payments as part of the restructuring. The main goal of such a measure is to give the client a chance to overcome temporary financial difficulties and repay the mortgage on time. In parallel with the deferment or instead of it, other restructuring measures are being taken:

- They can write off penalties and fines that have already been accrued;

- Convert a foreign currency mortgage to a ruble one;

- Reduce interest rate.

Ideally, the possibility of restructuring the contract in the form of a deferment should be provided for in the mortgage agreement itself. But most often, when choosing a profitable banking product, the applicant pays more attention to the interest rate and the total cost of the loan. As a result, if restructuring is necessary, this possibility seems unlikely.

If the parties reach an agreement, the bank releases the client from paying the loan balance for a grace period (interest is paid monthly), provides a credit holiday for several months, and reduces the monthly installment. Just don’t forget that only reliable bank partners who find themselves in a difficult situation for objective reasons receive such privileges.

Judging by the reviews on the forums of representatives of the banking system, the very possibility of obtaining a deferment is not as inaccessible as many people think. A changed financial situation is a serious reason to contact the bank. If the lender has reason to believe that your situation is not hopeless and the restructuring will benefit both parties, he will help the client return to the normal rhythm of repaying the mortgage.

Bank conditions

The borrower can ask the bank for a deferment on the mortgage loan. But for this he must have compelling circumstances.

But the bank will not provide the client with a deferment without evidence.

That is, the borrower will have to provide the bank with documents confirming his difficult financial condition.

Only if there is strong evidence, the bank can grant the borrower a deferment to repay the loan.

Since our country still does not stand still and is developing quite dynamically, the Russian banking system has been closely cooperating with international financial organizations for several years.

This helped us establish relationships in this area, and the level of social orientation of Russian banks has increased significantly.

Now the bank, as a lender, can accommodate the client halfway if the latter encounters a difficult life situation that does not allow him to repay the loan on time.

Depending on how much debt has not yet been repaid by the client, and what reasons he has for deferring payments, the bank can offer the client the following options for the development of events:

Opportunities to receive

A loan deferment assumes that the bank will increase the loan term for the client. This will slightly reduce the monthly payment amount.

Video: loan overdue, how to get a deferment

As a rule, a deferment results in the client paying the bank only interest on the loan during this period.

This is convenient for both parties to the agreement, since the client receives a “financial break”, and the bank receives its “hard-earned” interest.

Guarantor agreement

But some banks require the borrower to provide guarantors.

This is necessary so that they can:

Guarantors are invited to sign an additional agreement for the mortgage loan agreement.

The essence of restructuring

You can restructure a mortgage loan only at the bank where it was issued.

Bankers offer the borrower to slightly change the terms of the loan, depending on the specific situation of the borrower.

Refinancing is possible for the client in the following cases:

Restructuring has benefits for both parties to the loan agreement.

- The accrual of fines and penalties for late payments is suspended.

- The monthly payment will be noticeably lower.

- Forced collection of penalties is excluded.

- This does not damage the borrower’s credit history.