Features of a military mortgage

By providing a military mortgage, certain categories of borrowers are given the opportunity to take advantage of a special banking program. These include:

- contract military personnel;

- FSB officers;

- FSO specialists;

- employees of the Ministry of Defense;

- members of the National Guard troops.

They are united by one main condition: all applicants for a mortgage must be participants in the savings-mortgage system (NMS). This is necessary because funds from a targeted housing loan are used to repay a significant amount of loan payments.

A serviceman can apply for a loan at a time if his NIS account contains such a volume of funds that is not enough to purchase housing. With a military mortgage, you can get additional money not exceeding 3 million rubles, and the loan rate itself is lower.

This mortgage loan allows you to:

- buy a separate apartment;

- purchase a house with land;

- pay off the down payment;

- pay loan payments;

- participate in shared construction.

A military mortgage differs from the more common civilian one in many significant ways. The military mortgage program provides for lending exclusively to those citizens who have the status of military personnel. The main category of borrowers includes officers who entered service after 2005.

Important! You should remember the age restrictions - the borrower cannot be less than 21 years old and more than 43 years old.

Another important nuance: to form loan payments and a down payment, finances from a targeted housing loan can be used within the limits established by the Federal State Institution Rosvoenipoteka.

The duration of the mortgage should not diverge from the period specified in the certificate indicating the right of the NIS participant to receive a loan.

The procedure for purchasing real estate is also different: you need to coordinate this issue not only with the bank (it checks the availability of a full package of documents and the creditworthiness of the applicant), but also with the military department.

After the military receives the right to use savings, a mortgage loan must be issued within six months. The borrowed funds must be repaid no later than ten years from the moment the service was terminated.

In the event of the death of a serviceman burdened with a mortgage loan, the residential property remains for the use of members of his family - his wife and children. The same thing happens if a military man goes missing. However, loan repayment occurs in accordance with the specifics of this program.

If a spouse and children have entered into an inheritance and assumed obligations to repay a mortgage loan, Rosvoenipoteka does this for them.

But if the heirs received additional funds and used them to pay off the loan, there are two options. Or there is not enough money, in which case the spouse of the deceased or missing person will pay the remaining debt on their own. Or more money than required, and it remains for her personal use.

When does a serviceman have to return money to the state?

- has more than 20 years of military service (the article may not be respectful at all, up to the NUC);

- has more than 10 years of military service and is dismissed on preferential terms (there are 4 of them);

- is recognized by the medical commission as unfit for further service (completely unfit for military service) regardless of length of service.

- independently expressed a desire to resign with less than 20 years of service, incl. in preferential terms;

- violated the terms of the contract with less than 20 years of service, incl. in preferential terms;

- dismissed on preferential terms, but their military service has not reached 10 years.

Expert opinion

Antonov Viktor Sergeevich

Practicing lawyer with 8 years of experience. Specialization: military law. Recognized legal expert.

“Military Relocation” is a navigator for military mortgages throughout Russia. The latest trends in the field of savings and mortgage system, exclusive solutions and maximum benefits for military personnel when purchasing finished and under construction housing.

This is important to know: When can you get a military mortgage for a contractor: how to get it, conditions

Apartments, townhouses, houses on land. Review of all possible housing options according to the NIS.

Legal support and judicial protection of military personnel. “Military relocation” is a military mortgage in a new way!

Military mortgage upon dismissal

All the subtleties of how a military mortgage is implemented after dismissal are spelled out in detail in the Federal Law of August 20, 2004 No. 117-FZ “On the savings and mortgage system of housing for military personnel.”

Much depends on the circumstances - what length of service turned out to be, on what grounds the service was terminated. These nuances will become decisive when deciding whether the military will repay the debt incurred to a banking institution or the state.

Expert opinion

Anastasia Yakovleva

Bank loan officer

Apply now

Right now you can apply for a loan, credit or card to several banks for free. Find out the conditions in advance and calculate the overpayment using a calculator. Want to try?

For example, if the reason for dismissal was non-compliance with the terms of the contract, the person leaving the service will have to repay the entire loan on their own. He will have to return everything received, since the reason for dismissal turns out to be disrespectful.

Moreover, such a situation does not imply that any compensation will be issued, regardless of the length of service and what achievements the serviceman achieved before.

For health

Employees with a military mortgage upon dismissal for health reasons enjoy some positive preferences. Dismissal from military service for the reason that one’s health has deteriorated and no longer allows one to perform one’s duties looks like termination of service on preferential grounds, since the military man himself cannot change the situation.

In this case, a military member participating in the NIS (it does not matter what length of service he has) before dismissal can use the funds that have been accumulated in his personal account. The second possibility is that if you previously purchased housing, the funds spent on the purchase of real estate will not have to be returned to the state.

If you have served for twenty years or more, you can receive additional funds and use them to pay off loan installments. If the debt to the bank still remains, the military man who retired for health reasons will have to pay it off on his own.

At your own request

The realities of a military mortgage in case of voluntary dismissal are as follows: a person expelled from the Armed Forces at his own request is not dismissed on preferential terms.

It should be remembered: if a contract soldier leaves the army simply because he does not want to serve anymore, and his service has not reached ten years, he will not receive the savings of an NIS participant. According to the law, he will not have the right to do this. With a military mortgage with less than 10 years of service, dismissal is extremely undesirable, although in most cases this happens for family reasons.

This is a difficult situation, since the owner of the already purchased housing will be in debt not only to the financial and banking institution (after all, part of the loan remains unpaid), but also to Rosvoenipoteka: he will be forced to return the funds allocated for the down payment plus those that went towards monthly fees.

In cases with more than twenty years of service, a leaving serviceman can count on the state to help him improve his living conditions. That is, regardless of the reason for which a contract employee who has served for 20 years or more leaves the service (except for disrespectful reasons), he retains the right to receive funds from the savings-mortgage account.

If the property has already been purchased, you will not have to pay Rosvoenipoteka: you will only need to repay the bank loan - in the case where it has not yet been closed.

At the end of the contract

Military personnel discharged at the end of their contract after 20 years of service are not required to return funds received from Rosvoenipoteka. However, they will not be able to receive additional payments either.

If at the time of dismissal there is not enough money accumulated in the personal account to fulfill all obligations to the creditor, the owner of the residential premises will have to use his own savings.

For those military personnel who have reached ten years of service before terminating their contractual obligations, the algorithm for repaying financial obligations occurs as follows. They pay off bank debt by paying monthly installments according to the same schedule as they were before leaving.

If the length of service is less than ten years, the former serviceman will have to pay both the state and the banking institution. The encumbrance will be lifted only after the debt is repaid.

The conditions for paying a military mortgage upon dismissal are as follows:

- Receiving a dismissal order.

- Submitting a corresponding report to the military unit outlining a request for the issuance of the entire or a certain amount from a personal savings account.

- Transfer of the report along with a package of necessary documents prepared by the military unit to Rosvoenipoteka.

- After waiting a month for a response, a transfer from a savings account to a bank account is completed.

Simultaneously with the accumulated amount, additional funds of a compensatory nature may be paid, if they were provided for by the terms of the concluded contract or additional agreements.

The procedure for paying a mortgage to military personnel after dismissal

What can an officer do to receive payments if he has the right to a subsidy for the purchase of living space? In such a case, the subsidy applicant has the right to receive a certain amount of money from Rosvoenipoteka. To do this, the subsidy applicant must go through the appropriate stages of applying for a mortgage:

- Having received an order for his dismissal, the military man must submit a report to the military unit about the issuance of a certain amount from his personal account.

- The military unit will transmit the required data to the authorities, and then this information goes to Rosvoenipoteka.

- The data will be processed, and within one month the warrant officer or officer can receive a transfer from his savings account.

- In addition, if a military man is included in the list of persons entitled to benefits for payments upon dismissal, then he will receive the right not only to receive a certain amount from an individual account, but also to additional subsidies for the purchase of the living space he needs.

- Only officers who do not use housing on social rent or are already owners of housing can apply for government subsidies after dismissal.

As a result, it turns out that officers whose service in the Armed Forces is at least 20 years old, and those officers and warrant officers who retired for preferential reasons after 10 years of service can use the military lending service upon dismissal. In addition, if the length of service is 20 full years, then the military man has the right to use the NIS credit as he sees fit. The same rights are available to career officers with at least 10 years of service, who were also dismissed for a reason falling under the list of benefits. In case of such dismissal, if the serviceman’s service is 10 years, he also has the right to the capital accumulated in his personal account.

The recipient of the loan may not give this money to the state, but he is obliged to pay the rest of the mortgage himself, while retaining the right to compensation. Of course, if he does not use an apartment received on a social loan. In such a situation, he will retain a preferential interest rate.

This is important to know: Military mortgage and maternity capital

Can you be fired if you have a mortgage?

Having a military mortgage does not affect the length of service. It is not a circumstance that may entail preferential retention in the service during organizational and staffing activities.

This program seems to be an excellent opportunity to improve the living conditions of all military personnel without exception. However, it leads to even greater dependence on the army, and the question of whether one can be fired if there is a mortgage is more correctly transformed into the following: what to do to avoid being fired, because then it will be much more difficult to pay off the mortgage loan.

Therefore, before you decide to take out a mortgage, it is better to study in the smallest detail what will happen in the event of an unexpected dismissal, and what is the best thing to do to preserve your savings.

Early dismissal from the ranks of the Armed Forces of the Russian Federation can be extremely dangerous from the point of view of maintaining a normal level of material well-being. Those who have to quit before reaching ten years of service suffer especially.

It is safer to dismiss those who have 10 to 20 years of experience, however, even in this case, the savings will be retained by the person if he has preferential grounds for resignation - for example, deteriorating health.

But if there are twenty years of service, the military man upon dismissal will not suffer at all financially, regardless of the reason for his resignation.

What happens if you don't pay off your debt?

The main feature of this method of lending is that funds are credited to the NIS regardless of whether the officer lives alone or is burdened with a family, especially not taking into account how many children he has. Therefore, for a military member with a large number of dependents, leaving the service with an unpaid mortgage can be a huge problem.

No claims will be brought against the former serviceman if he makes regular payments to repay the debt. What happens if a service member stops making mortgage payments after leaving the service? This is fraught with unpleasant consequences.

If bank requirements are ignored, a credit institution may initiate seizure of real estate to pay off debt obligations. It has every right to do this - the mortgaged apartment is pledged to the bank.

You shouldn’t ignore your debt to the state either. Rosvoenipoteka can file a claim in court, which, based on judicial practice, will be fully satisfied. After this, enforcement proceedings will be opened; to ensure repayment of the debt, the debtor’s property may be sold and his bank accounts may be seized.

Important! The consequences of not paying a debt can be severe and unpleasant. If it is not possible to make payments, you must contact the bank with a request for restructuring or providing a credit holiday.

Practice shows that this is often enough for the debtor to solve his current problems, find a job, begin to receive other regular income and gain the ability to cope with further loan payments.

Poll: are you satisfied with the quality of services provided by Sberbank in general?

Not really

Conditions of a military mortgage under a new contract

If a former serviceman decides to return to duty - the situation in the family has normalized, a new position has been offered, his health has improved - he is restored to the status of a participant in savings-mortgage insurance. For this purpose, the applicant receives the same identification data that has already been entered into the Register.

However, we must remember that when an employee signs a new contract, he does not always get access to the funds accumulated before dismissal. Payments and savings are subject to restoration if the reason for termination of the previous contract was for valid reasons:

- organizational and staffing measures;

- health status;

- family circumstances.

And if the reason for the previous dismissal was one’s own desire or, even worse, a violation of the terms of the contract, the funds previously accumulated in the account cannot be restored.

The state helps military personnel acquire comfortable and spacious residential real estate through a special program - military mortgages. To do this, they must become participants in the savings-mortgage system. It allows you to purchase housing on preferential terms. Whether or not a contract soldier will fully repay the borrowed funds depends on his length of service and on the reason for which he was dismissed from the Armed Forces.

Conditions for leaving the army

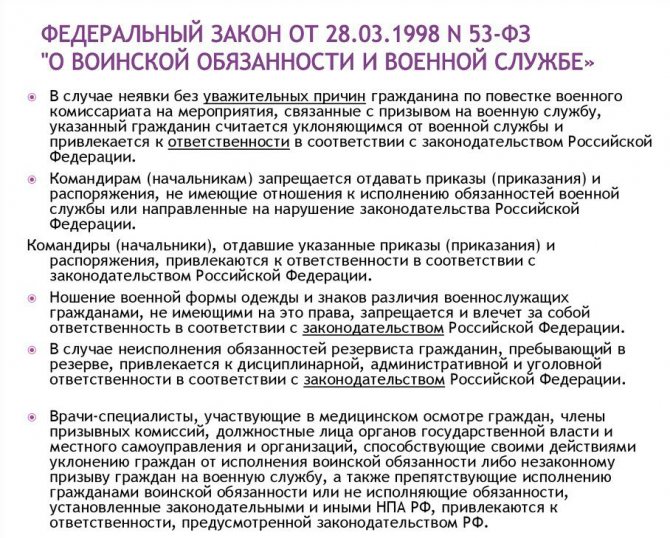

The reasons why a soldier or officer may be dismissed from the army are stated in Art. 51 Federal Law No. 56 “On military duty and military service.” Reasons undesirable for a mortgage program participant:

- Deprivation of rank. If there is no trust in the borrower, information about family income is not provided, the employee is engaged in business, has accounts and other valuable savings outside the Russian Federation.

- Deprivation of liberty. When a crime is considered committed intentionally (a suspended sentence is also taken into account).

- Expulsion from the university. If the borrower is expelled from a military educational institution.

- Court decision on the impossibility of holding a leadership position in the army. When the sentence becomes final, the soldier is deprived of his privileges for the specified period.

- Renunciation of Russian citizenship. If the bank client is not a citizen of the Russian Federation, the agreement becomes invalid. A similar restriction applies when obtaining foreign citizenship.

- Failure to fulfill contractual agreements.

- Refusal of access to state secrets or deprivation of such access.

- A court verdict of suspended imprisonment for a crime committed by a military man through negligence.

- Test of “violation of prohibitions, failure to comply with restrictions, failure to fulfill duties.” When the participant did not pass it.

- Chemical-toxicological examination. If the program participant has not passed a test for the presence of drugs in the body.

- An administrative offense related to the use of drugs and psychotropic drugs without medical supervision.

See this same topic: What happens to the borrower if he cannot pay his mortgage? And what to do when you can’t pay your mortgage?

A favorable result for the borrower of exiting the NIS is also possible:

- Dismissal after 20 years of service (preferential accrual);

- The decision of the Military Commission for Military Commissions is when a serviceman is declared unfit (in whole or in part, only in wartime) for health reasons for military service;

- Dismissal with 10 years of service;

- The maximum possible age for military service (50 years, military rank - lieutenant colonel);

- Organizational and staffing measures (OSM).

The neutral option is dismissal at the end of the contract (or for other reasons other than those listed).

A clear understanding of the reasons for leaving the state program will help to assess all the risks when applying for a housing loan.