Under what conditions is a mortgage issued?

What is a mortgage and under what conditions is it issued? This is a secured loan, most often provided for the purchase of real estate. Usually, it is the housing that is being loaned, that is, the housing purchased with borrowed funds, that is pledged, but the property that the borrower already has can also become collateral.

How is a mortgage different from consumer loans? Firstly, the rates: they are reduced by providing security in the form of collateral. Secondly, the amount is much larger, because it must cover the costs of purchasing expensive real estate. Thirdly, repayment periods are extended, because it is unlikely that it will be possible to pay off a lot of money in a short period.

Let's consider all the features of a mortgage, dividing them into advantages and disadvantages. The advantages are:

- The chances of getting a loan are higher than taking out a large loan, since there is collateral as security.

- The mortgaged property will belong to the new owner, who purchases it with mortgage money.

- You can get a large amount, enough to make a truly large purchase.

- The interest rate will be lower than under the terms of a consumer loan, and the payment terms will be much longer.

The disadvantages are the following:

- When you take out a mortgage, according to its terms, you pledge either the property you own or the property you are borrowing. And there is a risk of losing this property, because if you stop receiving payments from you, the bank sells the property and uses the proceeds to cover your debt.

- Applying for a mortgage with the help or independently requires collecting a considerable amount of documents.

- Not all real estate objects are credited and accepted as collateral under the terms of the mortgage.

- When receiving a mortgage, the property is encumbered, and the owner cannot re-mortgage it, change it, sell it, or register new tenants.

Functions of the credit department of Sberbank

Any relatively large branch of Sberbank has a credit department that works with applicants and borrowers for loans (including mortgages).

See this same topic: How to get a mortgage with deferred payment during construction? Sample application

The credit department oversees the processing and issuance of loans and performs a number of functions at each stage associated with their receipt. Department:

- Provides advice to mortgage applicants;

- Handles the application process;

- Checks the information from the package of documents collected by the applicant;

- Approves the application or refuses to issue a loan;

- Draws up a loan agreement;

- Issues money;

- Monitors the debtor's fulfillment of credit obligations;

- Issues to the pledgor a certificate of full payment of the debt.

The credit department also deals with refinancing mortgages (or other loans). In this case, he also performs all his functions - from consulting a potential counterparty to confirming the borrower’s fulfillment of financial obligations.

Where can I get a mortgage?

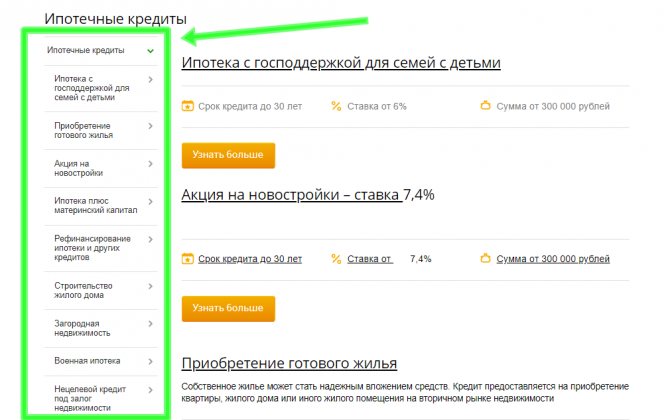

It is possible to obtain a mortgage loan in Moscow from various banks offering lending services. Let's look at the most popular ones along with their conditions:

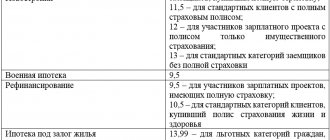

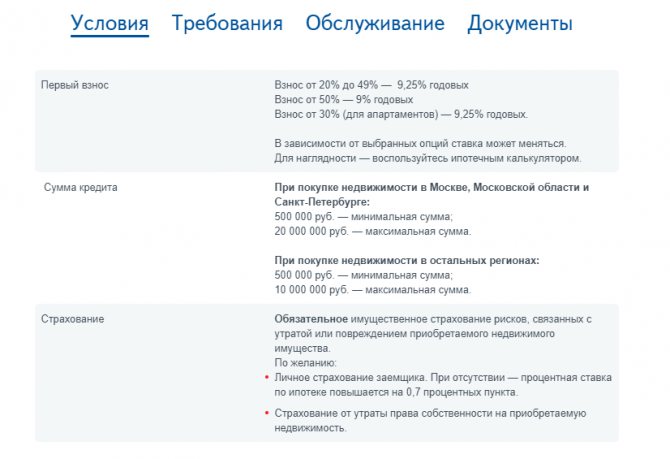

- Sberbank approves obtaining a mortgage, and for various objects: apartments, residential buildings, plots of land, country cottages, and so on, related to the secondary or primary market. There is also a non-target program. Rates start at an acceptable 10-11%, there are programs for certain social groups (military, young families), payment periods reach up to 30 years. A down payment may be required, but proof of earnings is not always necessary.

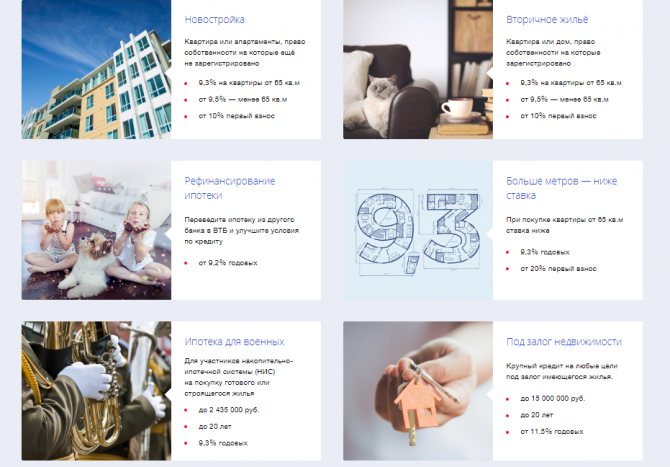

- VTB also has many mortgage programs, which offers rates starting at 9.3%, repayment periods reaching thirty years and amounts up to sixty million rubles. A contribution is almost always made, and comprehensive insurance is also provided (mandatory).

- A profitable loan can be obtained without outside help from the Vostochny Bank, which issues mortgages for periods from three to thirty years with a rate of 10 percent (the exact amount is determined by the amount of the contribution). In Moscow, the maximum amounts issued for housing reach twenty million in Russian currency.

For your information! There are also offices of other large banks in the capital and the Moscow region, so Muscovites have quite a large choice.

How does Sberbank set the loan amount for a borrower?

It is appointed by Sberbank based on the results of an analysis of the applicant’s financial viability and the value of the collateral real estate. The minimum mortgage amount is 300,000 rubles, and the maximum as of the current year is 15 million rubles. The loan term also depends on the listed factors.

Look at the same topic: How much does it cost to check the legal purity of an apartment before buying it? Is it possible to check the apartment yourself before buying?

Is it possible to reduce the overpayment on a loan?

Yes, such opportunities exist.

- Providing the maximum number of documents necessary to obtain a loan: a mortgage with two documents implies an increased rate.

- Use of preferential mortgage lending and maternity capital programs.

- Early repayment of mortgage.

When calculating the overpayment on a mortgage, Sberbank provides a discount to its salary clients and users of the service for buying and selling real estate DomClick.

How is the mortgage interest rate calculated?

The calculation of the rate is related to a number of factors:

- The specifics of the mortgage product (preferential programs involve lower expenses);

- The cost of collateral housing;

- Using maternity capital;

- Client's income level;

- Availability of a Sberbank salary card.

A potential borrower gets an approximate idea of the rate by reading the information on the Sberbank website.

More specific information is provided by an online calculator, into which you enter the required amount of a home loan and its repayment period. However, to specify the information, consultation with the bank manager is necessary.

What kind of living space do you buy with borrowed funds?

Sberbank's mortgage programs are varied. Having chosen the one that meets the requirements, the client can buy:

- An apartment or residential building on the primary real estate market;

- An apartment or house from the secondary housing stock;

- Wooden house (in the Moscow and Lipetsk regions);

- Garden house (dachas);

- Garage or parking space.

Sberbank participates in all preferential mortgage programs:

- With maternity capital;

- Military;

- Preferential 6% at the birth of the second or next child;

- "Young Family" program.

It is also possible to issue a non-targeted loan secured by real estate.

Real estate under construction or purchased with mortgage funds must meet the requirements set for it by Sberbank. If housing under construction is purchased, the bank checks the reliability of the construction company.

If the object of the mortgage is housing from the secondary market, it is checked for liquidity and general condition. It must not be in disrepair and/or built earlier than a certain year (as of the current year, the property must not be “older” than 1950).

Compliance with the requirements for the purchased property is due to the fact that, in addition to the object of purchase, it is also collateral that guarantees the return of money to the bank.

There should be no encumbrance placed on the collateral housing other than the current mortgage. Otherwise, it will not be able to secure the loan, and the loan will not be issued.

Who needs help getting a mortgage and in what cases?

Help in obtaining a mortgage in Moscow is needed by those who have been refused by banks. If you independently applied for mortgage loans from different financial organizations, and received negative answers everywhere, it means that the situation is critical, and there is little hope of receiving a loan.

There are several reasons why banks refuse to issue a mortgage:

- The borrower does not meet the basic requirements established by the bank , the list of which includes a certain age (usually from 20-21 to 60-75, depending on the specific lender), official employment and a certain minimum work experience, citizenship and registration.

- Lack or small amounts of income . Usually this condition is included in the list of mandatory ones, and you need to have “white” earnings, that is, official earnings that you can confirm. Sometimes alternative options for confirming solvency are accepted, but if the lender considers earnings insufficient to repay the mortgage without outside help, he will refuse to issue the loan.

- The property does not meet the established requirements . There are also requirements for the objects to be credited and pledged, and if the apartment (plot, house, etc.) you are buying or mortgaging does not meet them, then the application will be rejected.

- You should not count on getting a mortgage approved without outside help if your credit history is damaged . If you have numerous arrears on other loans, or have unfulfilled debt obligations (open active contracts), then it is unlikely that a mortgage will be issued.

- There is no money to pay the initial amount . If the contribution is included by the bank in the list of conditions required for obtaining a mortgage, then its absence or insufficient amounts may serve as a reason for refusing to obtain a mortgage.

- Other reasons that the bank may well not tell you . He has the right to refuse a mortgage for any reason, so if you receive a refusal, you should not contact the lender for clarification.

For your information! Help in obtaining a mortgage may also be needed in other cases, for example, when banks offer you conditions that are not the most favorable, do not meet your needs and requirements, or are not suitable. If they do not suit you or are too burdensome or impossible, then seek help.

Which banks do not request an income certificate?

You can get a mortgage without outside help, without having proof of income, in some Russian banks. They meet the needs of the unemployed and those without official income and offer options for issuing loans using a simplified scheme.

Let's take a look at the current offers:

- "Sberbank". In the absence of income certificates, a mortgage program for finished housing is suitable, providing the opportunity to take out an amount of up to 85% of the loaned and mortgaged property for a maximum of thirty years with a deposit of 15% initially at a minimum of 11.4 percent per annum.

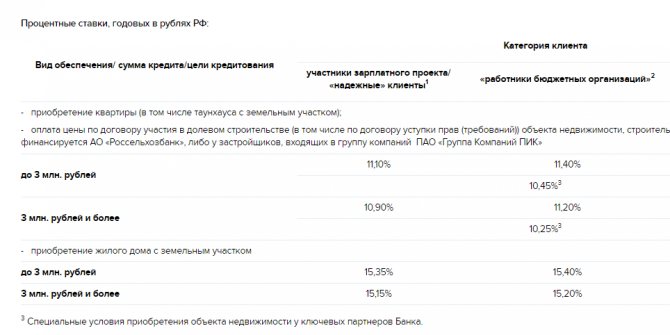

- Getting a loan for an apartment for clients without income certificates is offered by Rosselkhozbank, which issues mortgages based on two documents. You can get up to four million (up to eight in Moscow and the capital region), but no more than 60% of the apartment or 50% of the price of the house. The minimum mortgage terms can be several months or one or two years, and the maximum can be twenty-five years. A prerequisite in the absence of income is a down payment of 40-50%, depending on the type of housing being financed. The minimum rate is 11.1%.

- DeltaCredit has programs that eliminate the need to obtain income certificates. A mortgage can be issued based on a certificate generated in one click using the State Services portal, for a maximum of twenty-five years at a minimum of 8.25% per annum with an initial payment of 15%. There is a mortgage option for entrepreneurs, but it requires paying at least half of the total cost of the loan.

Who will help you get money?

Various mortgage brokers offer mortgage assistance. Such organizations are intermediaries between borrowers applying for money and organizations involved in financing. Companies are called upon to help find offers that are interesting and suitable in all respects, and ultimately receive money.

How does a typical loan broker work? You submit an application, which is usually completed online (brokerage organizations do everything to simplify the lives of their clients), and then it is reviewed by the broker: he analyzes your needs and selects options that are suitable according to the parameters you set: interest rates, mortgage repayment terms, amounts , penalties.

Then the reviewed application is sent further - directly to the creditors, who analyze the request and make their verdict. The decision is communicated to the borrower who submitted the request, and the brokerage company helps him enter into a deal: he provides a complete list of documents, guides him through the registration procedure and provides other assistance.

If you are interested in the services of a broker in Moscow, then for help in obtaining a mortgage it is better to contact trusted companies, and this is precisely DomBudet.ru, which helps to achieve approval from 85% of its clients and offers more than favorable conditions. Moreover, the organization undertakes to help everyone, including borrowers with damaged credit histories (but without active arrears), as well as citizens without official income.

"DomBudet.ru" can provide mortgage assistance on the following conditions:

- Interest rates starting at a minimum of 7.9 percent.

- The minimum repayment period for your mortgage is a year, and the maximum is as much as thirty years.

- It is quite possible to calculate an amount reaching 120,000,000 in Russian currency. The minimum amount of money is five hundred thousand.

- You can do without down payments on a mortgage.

- The total income of the family and up to three persons in total is taken into account.

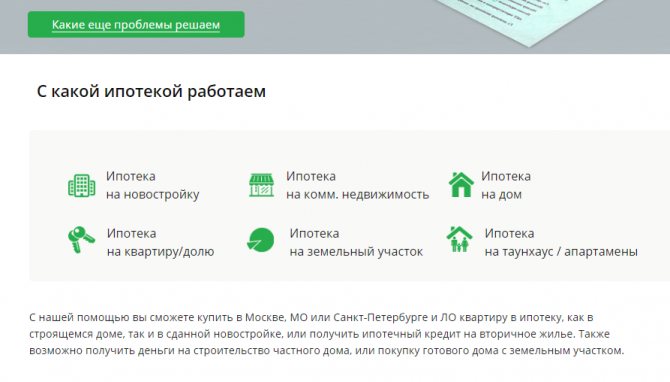

- Obtaining a mortgage with the help of DomBudet.ru is possible for different types of real estate: townhouses, apartments in new buildings and on the secondary market, houses, plots and shares of apartments.

Separately about brokers

Brokerage services have become popular, so it’s better to talk about them in more detail. If you are interested in obtaining a loan for housing in Moscow, then contact a brokerage company for help. She will accept and process your request, analyze solvency and other characteristics and select suitable programs. Next, the broker will help you receive money: send requests to lenders who have the best products, compile a list of documentation and help you conclude a deal.

An example of a successful brokerage that provides assistance in obtaining a mortgage loan without income in Moscow. She even cooperates with unemployed people who have low earnings or do not receive official income. This broker offers good conditions: a minimum of 7.9% per year, from one to thirty years to repay the mortgage, up to 120 million. A contribution is not always required; the income of co-borrowers can be taken into account.

It is possible to get a mortgage without an income certificate. Choose the appropriate method and become the owner of your own home.

What other options are there?

If you don’t want to ask for help with a mortgage, then there are other ways to get a loan for real estate, but they are not always feasible or simple:

- Try to get a large consumer loan: unsecured or secured in the form of collateral of your property. But it is not a fact that it will be approved.

- Take out a secured loan from an MFO. When providing collateral, the terms are extended and the amounts increase, but still the money may not be enough for your purposes (especially if this is the purchase of real estate), and overpayments will increase noticeably, since interest will be accrued monthly or daily.

- Involve co-borrowers or guarantors. Their earnings will be taken into account in the solvency analysis.

- Get a credit card and use the money included in the credit limit for the desired purchase. But finances may not be enough, and if you fulfill the conditions in bad faith and allow delays, the debt will increase exponentially.

- Find funds to deposit the first amount. This will significantly increase the chances of getting a mortgage, but sometimes it’s still not possible to do without help, because not everyone has that much money.

It is quite possible to count on getting a mortgage in Moscow, and if you ask for help, your chances will increase significantly. Knowing the conditions and features, it will be easier to take money.

Lending terms

In comparison with mortgage offers for ordinary citizens, lending conditions for merchants have a number of differences. Here is a typical commercial mortgage offer:

- loan term from 3 to 15 years;

- the amount depends on the capabilities of the borrower;

- the collateral is the loan property itself;

- down payment - at least 15%;

- The loan rate is determined individually and starts from 10%.

The difference is most noticeable in the duration (for an ordinary citizen - up to 30 years), the required down payment and the loan amount (it can reach several tens of millions of rubles). If the amount is large, the lender will most likely require an individual to provide a guarantor from the immediate family or co-owners of the business.

Some banks are developing special offers to attract customers:

- the opportunity to take advantage of credit holidays for up to 6 months in case of force majeure;

- drawing up an individual payment schedule at the client’s request;

- no hidden fees and minimal paid services;

- early repayment without penalties or overpayments;

- Additional deposit is not required.

In some banks, approval is possible even before purchasing the property itself, that is, you have some time (on average 2 months) to find a property that suits you and suits the lender.

Everyone knows that getting a mortgage for an individual entrepreneur is not an easy task, but today more and more banks are meeting individuals halfway and issuing profitable loans secured by mortgage real estate.

Features of a mortgage transaction with commercial real estate

One of the important nuances of a mortgage for the purchase of commercial real estate by an individual is the impossibility of registering a pledge on the subject of the transaction before the ownership has transferred from the seller to the borrower. In this regard, when registering a transaction with commercial real estate, complex schemes are used.

If the seller is willing to wait more than a month to receive money for the property, you can use the following scheme:

- an agreement is concluded between the seller and the borrower, the future owner;

- the borrower transfers to the seller an advance for the property (down payment on the mortgage, which is stipulated in the agreement with the bank);

- the bank provides the seller with a letter of guarantee confirming that after the transfer of ownership of the mortgaged property to the borrower and the execution of the collateral agreement, the seller will receive the remaining amount under the purchase and sale transaction;

- the bank deposits funds in a bank safe deposit box;

- The purchase and sale transaction and the mortgage agreement are registered in Rosreestr, and the corresponding entries appear in the Unified State Register of Real Estate;

- a pledge agreement is drawn up, the borrower personally transfers the money to the seller, or the seller himself takes it from the cell. The settlement procedure must be determined in advance so that the parties do not have a desire to abandon the transaction due to distrust of each other.

If the seller is not ready to wait, you can offer him to issue a mortgage on the real estate during the transaction:

- the buyer gives the seller an advance and a letter of guarantee from the bank, which confirms that after registration of a mortgage on the real estate, the seller will receive the remaining amount under the purchase and sale agreement;

- the bank deposits money in the safe deposit box;

- the seller pledges the property to the bank, enters into a purchase and sale agreement with the borrower and receives the remaining amount from the bank safe deposit box;

- after this, the transfer of ownership is registered in Rosreestr, and the collateral (mortgage property) passes to the borrower, remaining under encumbrance for the entire term of the mortgage.

This scheme is more complicated in terms of design, but it is equally acceptable for all parties to the transaction.

Payment of insurance is also an integral part of mortgage lending to individuals. Most often, to obtain a commercial mortgage, banks require the purchase of the following types of policies:

- insurance of the real estate itself;

- title insurance (risk of loss of ownership) for a period of 3 years.

The duration of title insurance is related to the statute of limitations. After 3 years, it is impossible to challenge the transaction in accordance with Russian legislation.

If desired, you can additionally insure an individual against non-payment of the mortgage in unforeseen circumstances. But keep in mind that insurance companies also analyze the risks when selling their products, so if your business is found to be unreliable based on the results of the audit, you will have to rely on your own strength.

Leave a request and find out how to get a mortgage for commercial real estate