Military mortgage after dismissal due to general military training

Organizational and staffing measures (OSM) are aimed at reducing the number of military personnel who do not meet the requirements of the positions they occupy, as well as employees whose service life has expired. During such events, both officers and contract soldiers of lower ranks may lose their jobs.

If an employee and at the same time a participant in the NIS took out a military mortgage, dismissal under the general military insurance policy can become a serious problem in terms of repaying the entire amount of the loan and the CPL.

List of general managerial positions that may lead to dismissal:

- Replacing one set of military personnel with another.

- Reduction of positions that duplicate each other.

- Recognition of an employee as unfit for further service in the position he occupies. If the officer refuses the demotion, then dismissal follows.

- Reduction of the staff position held by an employee.

- Expiration of the contract.

What will happen to the military mortgage upon dismissal due to military service?

NIS participants who have taken out a military mortgage and were discharged under the general military service have some guarantees, which depend not only on the fact of purchasing real estate on credit, but also, to a greater extent, on their length of service.

If a serviceman is discharged due to general military service, but is not burdened with a military mortgage, then:

- He has the right to use all his personal savings in his personal account at his own discretion if his service is 20 years or more.

- He can withdraw his savings and receive additional compensation due to him if his service is from 10 to 20 years.

- He does not have the right to claim savings in the NIS system if his service record is less than 10 years.

If a serviceman is discharged due to general military service and is burdened with a military mortgage, then:

- He may not repay the targeted loan for the purchase of an apartment and has the right to use the accumulated funds to pay off the balance of the debt if his experience in the military department exceeds 20 years.

- He may not return amounts already used and spent from his personal account, and also has the right to receive additional compensation if his service is from 10 to 20 years. The former soldier can pay the balance of the debt from the savings received or from personal funds.

- He must return all funds invested in the purchase of an apartment that were withdrawn from a personal savings account if the length of service is less than 10 years. Payment of the remaining debt on the loan is carried out at the expense of own funds.

Thus, military mortgages for officers who have served for more than 20 years are completely unaffected. Moreover, such military personnel can use their savings in the NIS system not only to repay a loan from a bank, but for any other purposes (purchase of a car, private house, repairs, etc.).

Repaying military mortgage debts upon dismissal

A military mortgage, if dismissed at will, due to a violation of the terms of the contract, or on preferential terms under the OshM (if the length of service does not exceed 10 years), must be returned to the Federal State Institution "Rosvoenipoteka". The former serviceman will have the opportunity to return the funds spent on the purchase of an apartment within a few years.

The maximum repayment period is 10 years, the rate is equal to the refinancing rate. For convenience of payments, a payment schedule is established.

M. "LENIN SQUARE", FINLANDSKY PR., BUILDING 4, BUSINESS, ATRIUM

*1 Permanent promotion provided by the developer. *2 Mortgage is provided by PJSC "Bank" St. Petersburg general license No. 436, LLC CB "RostFinance" general.

license No. 481, Sberbank of Russia OJSC, general. license 1481, OJSC Promsvyazbank, general license No. 3251 OJSC Zapsibkombank, general license for banking operations of the Central Bank of the Russian Federation No. 918 dated August 30, 2006, OJSC AK BARS BANK, general license of the Central Bank of the Russian Federation No.

2590 dated July 31, 2012, CJSC VTB24, general license of the Bank of Russia No. 1623 dated October 15, 2012, PJSC Khanty-Mansiysk Bank Otkritie, general. license No. 1971, OJSC Gazprombank, general.

persons No. 354, UniCreditBank JSC, general.

license No. 1 *3 In the assortment of MIR Real Estate LLC as of December 15, 2015

© Official website of the partner for the sale of apartments from the developer, 2020

Step-by-step instructions for obtaining a military mortgage

Step 1. After a three-year period of participation in the NIS state program, the serviceman writes a report on his intention to obtain a Certificate for obtaining a CWL.

Step 2. The NIS participant, independently or with the help of Military Relocation specialists, selects a property for its subsequent purchase. NIS participants are allowed to purchase finished apartments, residential square meters in a building under construction, houses with land, and town houses. Also at this stage, you should select a bank (with conditions favorable to the NIS participant), in which the mortgage will be issued on preferential terms.

Step 3. Documents are submitted to the lender for consideration by the military man as a borrower, after which the bank’s decision on issuing or refusing the loan is expected.

Step 4. Upon receipt of approval from the bank for lending to the participant under the military mortgage program, the collection and submission of documents for the selected residential property should be collected and submitted.

What happens to a Military Mortgage when you leave military service?

Answer: The Military Mortgage program was created in order to provide military personnel with housing through government subsidies. In order to purchase real estate with a military mortgage, a serviceman must register in the savings-mortgage system.

After just three years, he has the opportunity to choose a home, take out a loan from a bank and then conclude a purchase and sale transaction.

Expert opinion

Fedorov Nikolay Vasilievich

Lawyer with 7 years of experience. Specialization: family law. Has experience in defense in court.

What happens if, after purchasing an apartment under the Military Mortgage program, a serviceman decides not to renew his contract and resign from military service?

In this case, the serviceman must return the amount of the targeted housing loan to the state, as well as repay the bank loan using his own funds. If the serviceman does not repay his debt to the state and the bank, the mortgagees, that is, the bank and the Federal State Institution, have the right to recover the amount of the loan in court.

Military mortgages and dismissal for reasons beyond the control of the serviceman himself are another matter.

If a serviceman was forced to resign or go into the reserve due to health reasons, family circumstances, or was declared unfit (limitedly fit) for military service, then a military mortgage after dismissal does not imply the return of the targeted housing loan to the state. To repay a loan to a bank, a serviceman has the right to use the balance of funds in his personal savings account and funds that supplement savings for housing.

If they are not enough, then you need to repay the loan with your own funds.

Thus, dismissal with a military mortgage must be considered in each specific case, since the consequences directly depend on the reason for the dismissal.

Let's look at this problem in more detail using the following table:

Upon reaching the total duration of military service (including in preferential terms) 20 years or more.

With a total duration of military service of 10 years or more: - in connection with organizational and staffing measures; - for health reasons in connection with recognition as limitedly fit for military service; - for family reasons; - upon reaching the age limit for military service.

Any other reasons, including but not limited to:

At your own request or, for example, due to failure to fulfill the terms of the contract with less than 20 years of service.

With a total duration of service of less than 10 years under the same articles (general level of training, health status, family circumstances, age limit).

If an NIS participant has not exercised the right to enter into a targeted housing loan agreement (has not taken out a military mortgage), he has 20 years of service, or has retired on the grounds given in column “1,” he can receive the accumulated funds and use them at his own discretion. To receive savings you must submit a report:

Who can get extras?

Not all those discharged from military service are entitled to additional funds. You need “good” grounds for dismissal.

There are only five of them, it’s easy to remember:

- Organizational and staffing measures (OSM)

- Establishment (recognition) of unfitness for military service

- Establishment of limited suitability for military service

- Family circumstances

- Reaching the age limit

But that’s not all: in addition to meeting one of the points, you must have at least 10 calendar years of service (except for the case where the commission recognizes unfitness for military service (category D), the length of service does not matter here).

What if you already have housing? “As of recently, it doesn’t matter anymore.” If a serviceman meets the criteria for preferential dismissal, then additional funds will be paid, no matter how many meters he already has.

Funds supplementing savings for housing

Upon dismissal on “preferential” grounds (general medical condition, health status, family circumstances or age limit for calendar service of at least 10 years; dismissal due to recognition as unfit for military service - without limiting the minimum length of service) NIS participant (or members of his family) acquires the right to receive funds that supplement savings for housing, the payment of which is carried out at the expense of the limits of funds allocated for housing by the federal executive body where the serviceman served.

For military personnel discharged from military service (for family members of deceased military personnel) after the entry into force of Law No. 118-FZ of May 1, 2016 (after May 12, 2020), the presence of other housing is no longer a basis for refusal to pay additional funds.

- tenants of residential premises under social tenancy agreements;

- family members of the tenant of the residential premises under a social tenancy agreement;

- owners of residential premises or family members of the owner of residential premises (except for premises purchased under the Military Mortgage program).

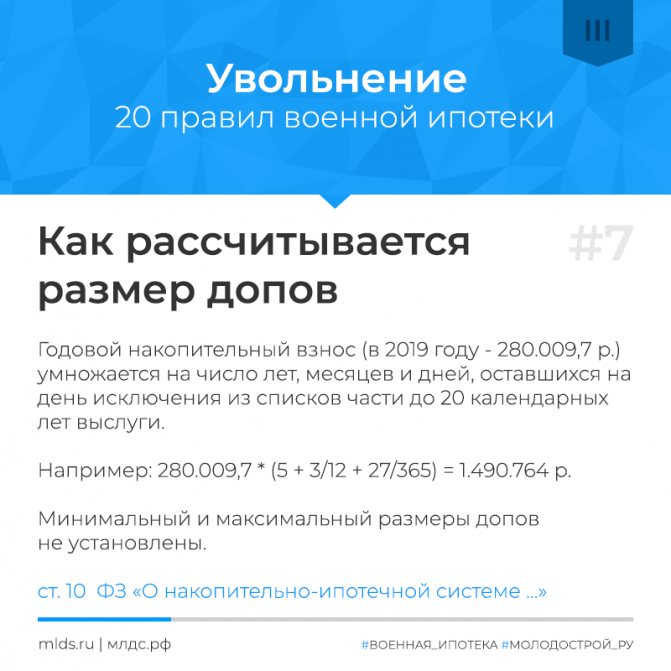

The calculation and payment of additional funds is made by the federal executive authority at the last place of military service of the NIS participant, once for the entire period of military service. The amount of additional funds is determined based on the amount of the annual savings contribution per NIS participant, established by the federal law on the federal budget for the corresponding year, and the number of full years, months and days that the NIS participant has not served since the date of occurrence of the basis for its exclusion from the register (date exclusion from the lists of personnel of a military unit) until the date when the total duration of his military service in calendar terms could be 20 years.

Additional funds can be used for their intended purpose, that is, to purchase residential premises or to pay off mortgage loan obligations existing on the date of receipt of funds, as well as for other purposes.

Why are “extras” needed, what is their essence?

One of the basic principles of military mortgages: everyone should receive assistance from the state equally. But what if a serviceman leaves military service early, not of his own free will?

This is where the “extras” come in handy. Dismissed NIS members are paid the amount they would have received had they continued to serve. Paid in a lump sum and without taking into account future indexation.

Why not taking into account indexation? Because indexation is needed to protect against inflation, and “extras” are paid here and now.

And what is the amount?

The amount is calculated as the amount of the savings contribution in the year of dismissal of the serviceman, multiplied by the number of years, months and days that remained to reach 20 years of service.

Leave comments at the end of this article - together we will calculate the amount of “extras” for your specific case.

Why only up to 20 years of service? — 20 years, this is a single reporting point established in matters of both housing and pension provision for military personnel. This is a kind of military work experience. Those who have crossed this threshold are already considered deserved and entitled to a full set of benefits.

Reinstatement and Military Mortgage

Military personnel discharged from military service and who have entered into a new contract for military service with any federal executive body where federal law provides for military service can again be included in the register of NIS participants. The basis for inclusion in the system will be the conclusion of a new contract for military service.

Graduated from St. Petersburg State Economic University in 2001 with a degree in Accounting and Analysis. Worked from 2009 to 2020 at the Bank of St. Petersburg. Currently practicing law.

A military mortgage is an excellent opportunity to improve living conditions for all military personnel. But you have to pay for this with even greater attachment to the army, because after connecting to the NIS system, you won’t be able to just leave.

So, for example, with less than ten years of experience, almost any dismissal automatically leads to the loss of all savings . There is only one exception - death or missingness.

Therefore, before applying for a military mortgage, it makes sense to study in detail the consequences of dismissal and ways to preserve savings. This is why we created this article - it covers the subject of discussion from all sides, with nuances and legal details.

When can I take it?

When, under what conditions is a military mortgage given, and how to use the funds? If a serviceman has become a participant in the NIS program, he can count on payment of budget funds . You can use them in a strictly designated order:

- One-time payment for:

- persons whose service life exceeded 20 years;

- military personnel who retired from the armed forces upon reaching retirement age, due to reduction or recognition as unfit for service, with at least 10 years of service.

- Registration of a mortgage loan.

Attention! Obtaining a certificate of a participant in the savings-mortgage system for obtaining a loan is possible only 3 years after the inclusion of a military personnel in the relevant Register.

In accordance with Federal Law No. 117-FZ, NIS participants can become:

- citizens who entered military service before 2005, as well as persons who received the rank of officer before this period of time;

- petty officers, warrant officers and midshipmen whose service life exceeded three years (since 2005);

- sailors, petty officers, sergeants and soldiers who entered into a new contract after 2005 and declared their desire to participate in the funded mortgage system.

A prerequisite for receiving funds under the NIS is their intended use.

Features of a military mortgage

The government and military departments are actively encouraging healthy young men to enlist. A solution to the housing issue is often cited as one of the arguments: special mortgage programs, preferential interest rates and even a savings system have been developed, where money earned by the military during their service is accumulated and increased.

All of the above opportunities are actively used by all contract military personnel.

But these same circumstances prevent many military personnel from resigning at will. Indeed, in this case, it is at least unclear what will happen to the property acquired for the service. What if it will be taken away or the terms of the loan will change dramatically?

First, a short educational program on this topic. A military mortgage refers to a targeted loan in which the debt for purchased real estate is repaid not by the serviceman himself, but by the Ministry of Defense.

It happens like this: every year an amount is subsidized into a special account in accordance with the military mortgage program (MMP), which can and should then be spent as initial and subsequent mortgage payments. The amount is sent by a special organization “Rosvoenipoteka”.

The savings-mortgage system (NIS) has a number of features that a serviceman needs to take into account even before he leaves the Russian military forces. These features, for example, contain the answer to the question of how to withdraw money upon dismissal. The list of these features includes:

- Connection to the NIS program can only be done if the contract with the RF Armed Forces was signed no earlier than 2005;

- At least three years of participation in the program and parallel service must pass before the military can use the money to purchase real estate;

- Having a bad credit history is not at all an obstacle to getting a loan. Almost all banks in Russia understand perfectly well that the serviceman himself may not be a completely responsible person, but Rosvoenipoteka, which stands behind him, is a completely different story;

- It should be taken into account that most loan agreements for military mortgages include the right to change the terms of the loan upon dismissal of the borrower . This means that the interest rate may increase, then returning the previous rate will either be impossible or difficult to achieve through legal disputes;

- 10 years of service is a kind of milestone for a military man. If the milestone is passed, even after the death of the borrower as a result of the performance of professional duties, the state will continue to pay the mortgage until the loan is fully repaid. If the required length of service was not obtained, upon the death of a serviceman, the burden of securing the loan falls on the co-borrowers and the family of the deceased.

This is only a small, but the main part of the features of this type of mortgage lending. Now let's look at what happens to the mortgage after certain events - dismissal, for example, or illness.

Military mortgage in 2020

The state program, which set the task of solving the housing problem of military personnel, was adopted in 2005. It is implemented on the basis of Federal Law No. 117, which defines the terms of the program, requirements for its participants, the procedure for subsidies and payments. A single body controls the work, distributes money and monitors compliance with requirements - the federal institution Rosvoenipoteka.

“The social program is implemented on the principle of a savings-mortgage system,” explains Tatyana Reshetnikova. — Unlike a regular mortgage, which can only be obtained if you have your own savings for a down payment, personal savings are not needed for a military one. The first installment is paid not by the borrower, but by the state in the form of a targeted subsidy.”

What happens to the mortgage after service ends?

It must be taken into account that preserving all savings is possible only with preferential dismissal. It occurs under the following circumstances:

- 20 or more years of service;

- If the continuous service has reached or exceeded 10 years, preferential dismissal is possible upon reaching the maximum age for the RF Armed Forces, upon dismissal as a result of organizational and staffing measures (OSM), as well as for family reasons;

- For health reasons, but only if the experience is more than 10 years. This refers to illnesses that make service impossible;

- Death of a military man or receiving the status of missing in action.

If we talk about the future fate of savings schematically, then we can divide the preservation of funds according to the main criterion - whether the money was spent before dismissal or whether the contract worker had not yet managed to invest it in real estate. It is also very important whether the serviceman retired on preferential terms or not. Let's present this data in the form of a table:

| Length of service | Was the money used? | The right to dispose of property and the future fate of the mortgage |

| Less than 10 years | The contractor managed to invest money in real estate before being fired | All monies already paid by the state for the mortgage will have to be reimbursed within ten years from the date of dismissal. The remaining debt to the bank must be repaid yourself |

| From 10 to 20 years | Everything is preserved - both savings and a preferential interest rate. But the remaining debt to the bank will have to be repaid without government help. The right to additional payments appears to compensate for the missing years of service up to 20 years | |

| 20 years or more | There is no need to return anything. Savings can only be used for the intended purpose, i.e. to pay off debt to the bank. If they are not enough, the balance remains with the borrower. The mortgage ceases to be military, so the interest rate may change. | |

| Less than 10 years | The contract worker did not have time to use up his savings | All savings of the NIS participant are confiscated |

| From 10 to 20 years | All money received under the program can be spent on purchasing housing or for other purposes, but only with preferential dismissal. In this case, he will also have the right to additional payments to compensate for the missing years of service up to 20 years. If the dismissal did not occur on preferential grounds, all savings are burned. | |

| 20 years or more | You can use it as you wish - either for real estate, or simply withdraw it by submitting a report and then spend it on any purpose |

Based on the information received, we can conclude: loyal conditions for a military mortgage remain in case of dismissal for health reasons, but if the dismissal occurred due to a loss of trust or with any violation of contract obligations, without 10 years of service you can not even think about receiving the money from NIS. And 10 years of service only saves you if the contract soldier has managed to invest money in housing.

For what reason can savings be withdrawn? Will the mortgaged apartment be taken away?

Expert opinion

Fedorov Nikolay Vasilievich

Lawyer with 7 years of experience. Specialization: family law. Has experience in defense in court.

It is now obvious that a situation is possible when all honestly earned savings are canceled due to one, but serious mistake. This happens when dismissal occurs for the following reasons:

- Repeated non-compliance or outright violation of the terms of the contract. It is also possible to fail to comply only once, but then it must concern an extremely important issue - for example, the preservation of military secrets;

- A military mortgage after voluntary dismissal simply expires if the service is less than 20 years;

- Even if the dismissal occurs on preferential grounds, if the length of service is less than 10, the savings are burned out;

- In the absence of serious (preferential) grounds, an NIS participant loses capital if his experience is less than 20 years.

Thus, without financial losses, you can resign of your own free will only after 20 years of service, if there are no preferential grounds. This is an axiom that every NIS participant needs to learn.

The period during which you need to repay the debt to the state is only 10 years from the date of leaving the RF Armed Forces. In order to mitigate the situation, a flexible payment schedule is being drawn up. If desired, the return period can range from three months to ten years.

What happens if you don’t repay the debt after you quit? Real estate will not be taken away if the debt is repaid on a regular basis. But if you ignore bank requirements, then the bank can always seize the property to pay off the debt, because The apartment is encumbered (pledged) by the bank.

As for ignoring the debt to the state, it is possible to begin enforcement proceedings. A lawsuit will come from Rosvoenipoteka, and the former military man will have to appear.

In court, it is almost guaranteed that the debt will be assigned to the violator of contractual obligations. From the moment the writ of execution is opened, the lion's share of income, transfers to cards and accounts of the debtor will be seized, and part of the property may be sold to secure the debt.

Considering all the burden and unpleasant consequences of such an outcome, it is still better to pay off the debt. In addition, often both the bank and Rosvoenipoteka agree to meet halfway - often the debtor is given debt restructuring and even short credit holidays.

Military mortgage upon dismissal at the end of the contract

Okay, we have already figured out what happens to savings on a military mortgage when you leave due to illness, at your own request, and in other cases. But is the end of the contract considered sufficient grounds for preferential dismissal?

The conditions in this case are quite strict. If the length of service is less than 20 years, the end of the contract is not considered a valid reason for leaving the Armed Forces. Accordingly, in this case:

- The life insurance certificate is fully returned to the state within 10 years from the date of leaving the army;

- All monthly payments transferred by the state are also returned within 10 years;

- Capital in NIS that is not invested in housing is burned;

- The military is not entitled to additional payments for missing years;

- The encumbrance is removed from the property only after the debt is fully repaid.

Applying for a military mortgage is not an easy procedure

An attractive banking product for military personnel.

Military mortgages attract servants of the Fatherland because they allow them to purchase housing using budget funds. The initial contribution is the funds of the Central Life Insurance Fund. The repayment of monthly payments is handled by the Federal State Institution “Rosvoenipoteka”, which pays the mortgage monthly instead of the military personnel. Applying for a military mortgage is a rather complicated procedure, which requires you to find housing and complete the transaction in a short period of time (six months). To dispel questions regarding the registration of a military mortgage, an algorithm for obtaining a military mortgage will be presented below.

The procedure for paying off a mortgage after dismissal

- First you need to get a dismissal order;

- After receiving it, the serviceman must submit a report to the military unit. The report must state a request to release the entire or a certain amount from the personal account;

- Next, the report, along with documents from the military unit, is transferred to the Rosvoenipoteka branch;

- A response will be given within one month, after which the contract employee will be able to arrange a transfer from a savings account to a bank account;

- Here, in addition to the accumulated amount, additional/compensation money is also paid, if any is due to the serviceman under the terms of the contract.

That's all. There is money in the account that you can use at your discretion with almost no restrictions.

Tax deduction

It is also provided when purchasing housing under a special program for the military. But when calculating it, not the entire amount paid for housing is taken into account. Since the first payment is not paid by the buyer, but represents a targeted subsidy, it is not included in the tax deduction amount. But for the rest of the cost you can get another “compensation” from the state.

The maximum amount with which it is allowed to request a tax deduction is no more than two million rubles from the price of the object and minus the subsidy per person. A deduction can also be obtained from mortgage interest paid in the amount of up to three million rubles. And even if the mortgage is refinanced, the deduction from the interest originally claimed will not be interrupted.

Who is eligible to receive additional payments?

It would seem that the requirement has been abolished by law, and you can breathe easy, now everyone who goes into the reserves on preferential terms (age limit, limited eligibility, general training, family circumstances) with more than 10 calendar years of service will receive “extra bonuses”, but less than 20. Also, those leaving under the heading “unfit” for any length of service, and family members of a deceased NIS participant, can also count on additional benefits.

The federal law has been changed, the requirement for housing no longer exists, as well as the procedure for paying additional funds, regulated by Government Resolution (No. 686).

In November 2020, changes were made to the Procedure for paying additional fees. Resolution (No. 1172) clarifies the list of documents approved by Government Resolution (No. 686) provided by NIS participants (family members) to receive additional funds.

At the same time, the orders of the military departments, which also contain a list of documents, have not yet been subject to changes in all federal executive authorities.

The process of obtaining additional funds

- once, during the entire period of service;

- within 3 months from the date of registration of the report (application);

- the transfer of additional funds from the budget of the Russian Federation is carried out by the financial authority where the military unit was on allowance on the day the NIS participant was excluded from the lists of the military unit.

- information about the absence of housing, except for that purchased with a Military Mortgage (as long as this information is present in the report, before changes are made to the orders);

- information about the recipient of additional funds (full data, including passport details, military personnel);

- details of the recipient's (military) bank account;

- obligation to use “additional additives” for their intended purpose;

- obligation to vacate official housing.

- extract of the Unified State Register (USRN) (for all family members, throughout the Russian Federation) - the document was canceled by RF PP No. 1172;

- extract from the house register—the document was canceled by RF PP No. 1172;

- a copy of the financial personal account at the place of residence—the document was canceled by RF PP No. 1172;

- copies of passports of the serviceman and all members of his family (copies of birth certificate);

- certificate of family composition;

- certificate of length of service;

- extract from the dismissal order;

- consent of the state program participant to repay the debt to Rosvoenipoteka (if any, the debt may arise under the CZL agreement if the NIS participant or family members did not promptly report exclusion from the lists of personnel of the military unit, and for some time after the dismissal Rosvoenipoteka made payments on the loan ).

It should be taken into account that each authority checks the data that is received electronically and on paper. If errors or discrepancies are found with the available information for each participant, documents are returned to correct the submitted data.

Therefore, if for any reason a serviceman has changed his personal data, for example his passport, he should immediately contact the person in charge of the military unit for the NIS to draw up a “Table of Changes” and send the new data to the authorities, to the regulatory authority. Making changes in a timely manner allows you to avoid delaying the process of obtaining additional funds.

Additional funds are credited to the personal bank account of the discharged serviceman for purposes such as repaying a mortgage loan and improving living conditions.

Separately, it should be said that the Federal Law and Government Decree are the dominant documents. The lack of changes in the orders of the military departments is just shortcomings of the relevant authorities, and the refusal to pay additional funds to a NIS participant for far-fetched reasons (members of the deceased’s family) is a direct violation of the rights of the military personnel.

If a trial is necessary, the legislative framework for the NIS will be on the side of the former military man.

Military mortgage is a government program aimed at purchasing housing for military personnel within the framework of the savings-mortgage system (NIS). In this article we will consider all the cases that may arise when a serviceman who has taken out a military mortgage is dismissed.

The essence of the program

In order to receive a preferential loan, a military personnel must become a participant in the savings system. The register of participants must include all persons who graduated from a military educational institution and signed the first contract for military service after January 1, 2005.

For such inclusion in the register, the fact of receiving an officer rank is sufficient.

Persons who graduated from educational institutions before January 1, 2005 are included on a voluntary basis. The basis for entry is the report.

The essence of the savings system is that its participants receive a certain amount of money into their personal account. Their size is the same for everyone and does not depend on rank, position held or length of service. The amount of revenue changes every year as a result of indexation.

- After three years, a serviceman who is a member of the savings system has the right to submit a report for a targeted housing loan (CHL). The result of reviewing the report is that the serviceman receives a certificate. Its validity period is six months from the date of signing.

- After providing the certificate, you need to select a property. A prerequisite is that the purchased housing meets the requirements of the Ministry of Defense of the Russian Federation.

- In order to apply for a loan, you need to contact the bank that operates within the framework of this military mortgage program, and open an account with it, as well as transfer the accumulated funds. This money will be used to pay the down payment. After completing the above steps, the serviceman provides a package of documents necessary to obtain a mortgage. It is also worth noting that housing must meet the bank’s requirements.

- As soon as the application is approved, a CZL agreement is concluded, the parties to which are the military personnel, the bank, and the federal economic institution Rosvoenipoteka. The lender and the borrower, in turn, enter into a separate loan agreement.

- The loan is repaid using state budget resources. The payment amount cannot exceed 1/12 of the military member’s savings contribution.

Procedure for receipt and service: stages of the transaction

The process of obtaining a mortgage for military personnel at Sberbank includes the following stages:

- Careful study of lending conditions (many military personnel at this stage consult with Rosvoenipoteka regarding the choice of the most suitable bank and the timing of the transaction).

- Selecting a property for purchase (this stage should be approached as seriously as possible, since not every item of collateral will be approved by the bank and Rosvoenipoteka).

- Preparing a set of documents and filling out an application form (usually this process does not take much time, since the package of papers required is minimal).

- Submitting a loan application to Sberbank and making a final decision (the decision is valid for 90 days from the date of announcement).

- Concluding an agreement with the housing seller (it must stipulate the terms of purchase using the military mortgage program and the procedure and payment terms).

- Opening a special account in Sberbank in the name of the seller, to which the down payment will be credited from NIS savings.

- Conclusion of a loan agreement with Sberbank with a mandatory attachment in the form of a payment schedule.

- Concluding a targeted housing loan agreement, which will become the basis for the allocation of funds from the state budget (concluded with Rosvoenipoteka).

- Providing Rosvoenipoteka with the necessary package of papers for further transfer of funds to the borrower’s account.

- Transfer of the first payment to the seller's bank account.

- Registration of insurance for the purchased property (insurance is paid by the borrower exclusively at his own expense).

- Registration of the transaction in Rosreestr and encumbrance of housing in favor of Sberbank.

- Final settlement with the seller (non-cash).

Since the procedure for obtaining a military mortgage involves the participation of government agencies, you should be prepared for the fact that the terms differ significantly compared to a standard mortgage loan. Study, analysis of documents by Rosvoenipoteka, transfer of money and the inevitable human factor - all this adjusts the time for registering a transaction upward. Customer reviews also indicate that the entire process of obtaining a military mortgage, as a rule, does not take less than one month.

After the final stage of the military mortgage, its gradual repayment will begin using contributions from the state. Once a month, the military borrower’s loan account will receive money calculated as 1/12 of the annual savings contribution received to his personal account.

Despite the fact that the program provides for government participation and the allocation of funds from the budget, early repayment of the loan is allowed upon a preliminary application. This can be done by agreement with Sberbank and Rosvoenipoteka. There are no penalties (commissions, penalties, etc.) provided.