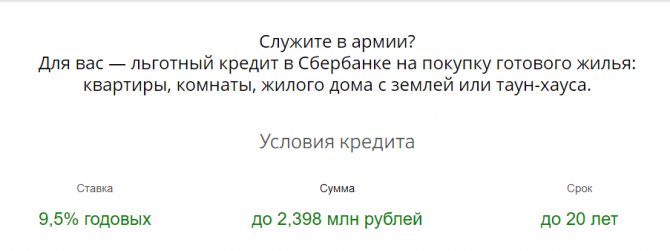

Mortgage conditions in Sberbank for the military

Depending on the type of housing purchase, the loan amount that a bank can issue to a military personnel differs, but not significantly. The maximum loan amount for purchasing an apartment in a new building is 2.33 million rubles. Up to 2.398 million rubles have been allocated for the purchase of finished housing. The interest rate for two options is fixed – 9.5% per annum.

Important! From 2023, military personnel will be able to purchase housing only with a mortgage.

Purchase of finished housing

The program allows you to buy not only an apartment, but also a residential building with a plot of land, a townhouse, or a room. Conditions in 2020:

- Loan term up to 20 years. The minimum period is 36 months.

- Minimum loan – 300 thousand rubles.

- The purchased housing is provided as collateral for the loan; it is secured.

- There are no fees for processing and issuing funds.

- The loan amount cannot exceed 85% of the market value of the apartment and the contractual value of the premises.

- Down payment of 15%.

Apartments are purchased from developers accredited by the bank through Dom Click.

Purchase of housing under construction

For new buildings, the conditions of a military mortgage from Sberbank are similar, with the exception of the maximum loan amount. It is worth adding points not mentioned earlier. The apartment must be insured against the risk of loss or damage; insurance is not issued for the land plot. The registration currency is in rubles. The loan term cannot exceed the maximum term of the LLP.

Important! Since 2020, Rosvoenipoteka has launched a program that allows you to refinance a loan and reduce the amount of the monthly payment.

Conditions for obtaining a mortgage for the military

In order for the bank to approve an application for a serviceman, he must comply with a number of bank requirements:

- he must be a participant in the savings-mortgage system;

- At the time of granting a mortgage, the borrower must be at least 21 years old.

For military personnel, the bank provides a mortgage on the following conditions:

- lending currency – national (rubles);

- the maximum mortgage size should not be higher than 85% (as of 2020) of the contractual value of the housing being financed;

- mortgage term - up to 20 years;

- no commission for issuing a mortgage;

- To secure a mortgage, the borrower must provide collateral in the form of the premises being loaned;

- minimum mortgage rate (its size can be clarified by following the link to the bank’s official website www.sberbank.ru);

- insurance of the property pledged as collateral (apartment, house) is mandatory.

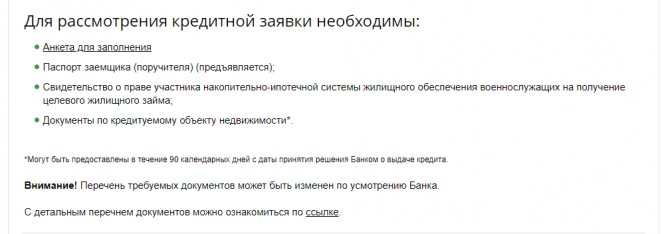

Required documents

In order for the bank to consider the application, the borrower must provide:

- application form;

- identification;

- document on the borrower's participation in the NIS;

- real estate documents. They can be provided within 3 months after the application is approved.

Real estate documents include a separate set, which includes: property registration certificate, purchase and sale agreement. A report on the valuation of the property is also produced. It is carried out by an independent expert commission, and the borrower submits the document with the specified cost to the bank. It is required to obtain a certificate from the Register of rights to real estate. In addition, a cadastral passport, a marriage contract, and the consent of the spouse on the transfer of property as collateral are provided. The paper must be certified by a notary. If the serviceman was not married at the time of registration of the mortgage, then he provides a notarized certificate of this.

Before applying, it is recommended to calculate the loan using a calculator. The calculation is done on Domklik. The borrower indicates the purpose of the loan (when switching from the official website, the parameter is set automatically), then adjusts the sliders for the loan amount, terms and sets the amount of the down payment. After registering on the site, the borrower will be able to use the help of a consultant in the chat. A smartphone application is available from where you can apply.

Interesting! Legislation is being drafted that would allow military spouses to combine mortgage loans to increase their living space.

Sberbank requirements for the recipient of a military mortgage:

- Citizenship of the Russian Federation.

- The borrower must participate in the NIS (savings and mortgage system), which is confirmed by entry into the appropriate register with the assignment of an individual number. Participation in the NIS program is possible both on a voluntary basis and on a mandatory basis. The procedure is regulated by Order of the Minister of Defense of the Russian Federation No. 245 dated April 24, 2020 “On approval of the procedure...”. With the beginning of registration as a participant in the NIS, the mechanism for processing documents and opening a savings account in the name of a military personnel is launched; the amount of annual contributions from the state is regulated by the corresponding article of the budget of the Russian Federation. The bodies involved in data processing (RUZHO and JO of the Ministry of Defense of the Russian Federation) transmit information to the Federal State Institution “Rosvoenipoteka”, on the basis of which a Certificate of entitlement to receive CZZ is issued. This document will need to be submitted to the bank.

- The minimum age of the recipient of the loan product is 21 years, the maximum age for this program is 45 years.

Recommended article: Rural mortgage at 1 percent

How does registration work?

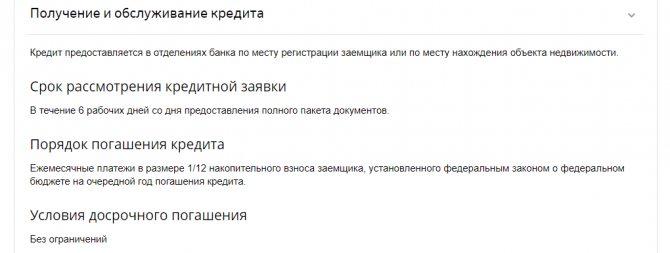

To apply for a mortgage for military personnel, the borrower must first obtain a certificate that allows him to obtain a CLO. Then the person selects a property on Domklik and sends an application to the bank through it. It reviews the borrower's application, verifies documents and notifies the borrower of the loan decision. The application is reviewed within six working days. The day of application submission is not taken into account.

If the answer is positive, the borrower begins to collect a package of documents for real estate. Then he transfers them to the bank and signs an agreement. At the same stage, you should insure the apartment. After concluding the agreement, the military man receives a loan and becomes the owner of the purchased apartment. The loan is provided at bank branches at the place of registration of the military personnel or at the location of the purchased apartment. If, due to busyness, the client is unable to complete the transaction, then an authorized representative can do this.

Important! Since 2020, the government has suspended the indexation of budget funds allocated to repay military mortgages.

Who is entitled to a military mortgage from Sberbank?

The following categories of military personnel can draw up a mortgage agreement for the purchase of real estate on preferential terms:

- officers;

- warrant officers, midshipmen who served for at least 3 years;

- soldiers, petty officers, sergeants and sailors who entered into a re-contract;

- military personnel who work in federal authorities.

These categories of military personnel must enter into a long-term contract for service in the Armed Forces. They must also take part in the savings-mortgage system.

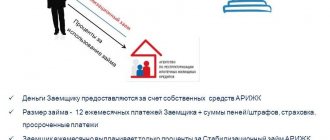

Repayment procedure

Payments are made according to the following scheme. The loan that the bank issued to the military man is repaid from budget funds. An employee takes out a targeted housing loan from Rosvoenipoteka. From there, an amount in the amount of 1/12 of the savings contribution, which is established in accordance with the Federal Law for a specific year, is transferred monthly. The amount is transferred to the military man’s account at the bank where he took out the loan. This payment is then debited from the military account automatically.

Over 20 years of military service, the money that was accrued to pay for the loan becomes a free state subsidy. The loan is considered repaid.

Important! Availability of housing does not affect the possibility of obtaining a military mortgage.

Mortgage for military pensioners at Sberbank

Upon retirement, a former military man can also take out a mortgage to purchase a home . It is provided only under one condition - if the pensioner has more than 10 years of service.

To obtain a mortgage, a non-working former military man must additionally provide the bank with a certificate from the Pension Fund.

It is also important to understand that a mortgage cannot be issued to a military pensioner for a maximum period, because the mortgage must be repaid before the pensioner turns 75 years old.

Early repayment

There are no conditions for early repayment. You can pay your loan urgently without restrictions. If the military gets indexation of funds back, they can pay off their mortgage early. Also, at his discretion, the employee can repay the loan early from personal funds.

Several leading banks now provide military mortgages. In addition to Sberbank, among them are DOM.RF, Absolutbank and others. Everyone offers their own conditions. A credit broker can help you choose the most profitable ones. He enters into agreements with several banks at once and offers the client the best conditions. The credit broker knows the pitfalls; as a result, the borrower will be able to save money. The broker's services are paid either for a separate service, such as selection of the optimal bank, or a percentage of the transaction. In Russia, the first payment method is the most popular. The question arises, which broker to contact? One of the options is dom-bydet.ru, which provides expert assistance to borrowers when obtaining a mortgage. The broker works in the new buildings market and the secondary housing market. This will be an ideal option if the client does not have time for a scrupulous selection of banking products, is not legally savvy, or does not have an understanding of where to turn.

Interesting! The average age of participants in a military mortgage is 27 years.

Thus, Sberbank is a good option for obtaining a military mortgage, as it provides a reduced rate. In addition, it is one of the largest and most reliable banks. But it is also worth familiarizing yourself with other offers from banks cooperating with Rosvoenipoteka.

How to get a military mortgage from Sberbank: step-by-step process

In order for Sberbank to issue a mortgage under the Military Mortgage program, the borrower must go through the following mandatory steps:

Step 1. Apply for and receive an NIS participant certificate . Upon entering the service, a serviceman must write a report addressed to his superior about joining the savings-mortgage system. After this, an individual account is opened to him, to which the amounts of government contributions will be transferred every month.

Only 3 years after joining the NIS, a serviceman can submit an application to Sberbank to purchase housing using a military mortgage. Before this, you need to write a report to obtain a certificate of taking out a military mortgage.

Step 2. Select real estate . If a person has difficulties finding housing, then it is advisable to contact a real estate company that will help you find a suitable apartment and conclude a purchase and sale agreement.

Step 3. Send an application for a mortgage to Sberbank . You can submit an application in person by going to a bank branch or fill out a form on the Sberbank website.

Step 4. Collect the necessary package of documents . If the bank has approved the application, then the borrower needs to prepare the following documents for further processing of the transaction: passport, military ID, NIS participant certificate. At this stage, it is also important to evaluate the property that the borrower plans to purchase.

Step 5. Sign the mortgage agreement . The bank client must carefully read the terms of the agreement and the payment procedure.

Step 6. Insure the collateral . According to the Military Mortgage program, the borrower must insure his property.

Step 7. Obtain a mortgage and register ownership of the property.

How to get a military mortgage

If Sberbank has approved the mortgage, you have 90 days to choose a property to purchase. When purchasing an apartment in a new building, you should consider only real estate properties accredited by a bank, and when purchasing housing on the secondary market, it is faster to find a suitable option using the DomClick.ru website.

The property will need to be assessed by a specialized company. Based on the assessment report, Sberbank will decide to approve the collateral. Then you can negotiate with the seller and conclude a deal.

A military mortgage must be registered with Rosreestr, as well as with Rosvoenipoteka. You must first contact the MFC or a branch of Rosreestr with the purchase and sale agreement and the mortgage, and after receiving an extract from the Unified State Register - to the branch of Rosvoenipoteka.

Military Mortgage Changes 2020 and 2020

The main changes in military mortgages are a reduction in the interest rate and an increase in the maximum loan amount. In 2020, Sberbank changed its interest rate terms three times. As a result, by the beginning of 2019, the rate dropped from 11.75% per annum to 9.5% per annum.

Reference! 11.75% per annum – rate at the beginning of 2017.

As for the mortgage amount, it increased from 2 million 50 thousand rubles to 2 million 330 thousand rubles . For Moscow, such an increase in the amount is more important than for the regions, but the amounts have increased in all subjects of Russia.

Registration procedure

To apply for a mortgage, you need to fill out a borrower application and collect a package of documents. In addition, you will have to go through a separate procedure for approving a mortgage with Rosvoenipoteka.

To receive a loan you must:

- Fill out the application form and submit the documents to the bank.

- Provide a set of documents for real estate within no more than two months.

- Sign the loan agreement, as well as three copies of the targeted housing loan agreement.

- After 10 days, receive a signed agreement from Rosvoenipoteka and receive funds for the down payment.

- Obtain loan funds from the bank and buy an apartment.

After the apartment is purchased, you can submit a package of documents to the insurance company and buy a policy. Next, you will need to provide the bank with a registered agreement for participation in shared construction or a bill of sale, after which the loan funds will be transferred to the developer or seller.

Important! The procedure for obtaining a military mortgage is longer than usual. You will need to not only collect documents and submit them to the bank, but also coordinate the signing of a targeted housing loan agreement with the military department.

What documents are required?

The most important thing at the loan application stage is to provide the bank with an exhaustive list of documents. Their list is on the Sberbank website.

The applicant will be required to:

- questionnaire to fill out;

- photograph of a military personnel;

- passport of the borrower (guarantor);

- certificate of the right of a participant in the savings-mortgage housing system for military personnel to receive a targeted housing loan;

- documents on the loaned property.

Within two months you can provide the bank with:

- a copy of the seller's passport;

- title documents for real estate;

- housing assessment report;

- extract from the Unified State Register of Real Estate;

- a certificate from the housing maintenance authority about the absence of registered residents or an extract from the house register containing information about the presence/absence of registered residents;

- refusal (for individuals - notarized) of participants in shared ownership of the pre-emptive right to purchase (if a room is being purchased);

- consent of the spouse to complete the transaction and others.

If you are buying housing on the primary market, you must provide the bank with a construction investment agreement, assignment of claim rights, or a preliminary purchase and sale agreement.

You will also need documents confirming the developer's rights to construction (development permit, documents on state registration of property rights, permission to commission an apartment building, etc.). If the housing has already been built, then a transfer deed or other document will be needed on the transfer of the property to the investor.

Filing an application

An application for a military mortgage can be submitted through the DomClick service, a mobile application, or in person at one of the bank branches. A list of branches where you can apply for a military mortgage is on the Sberbank website.

Features of the procedure:

- the application can be submitted online or in person;

- when filling out the form, you must indicate income, expenses, period of participation in the NIS and other information;

- before sending an application through the DomClick service, you can immediately calculate the loan payment;

- the ability to upload and send scans of documents to apply for a loan.

Thanks to a convenient online service, borrowers can send an application form and all scanned documents without leaving home. If everything is in order, then the bank will call and ask you to come to a personal meeting. The application review period is from 1 to 5 days.

Is a down payment required and how much is it?

The down payment on the mortgage is at least 15% of the value of the property. It is repaid from the funds accumulated in the serviceman’s account or his personal savings.

Answers on questions

What is the maximum amount Sberbank gives for a military mortgage?

In 2020, the maximum mortgage amount under the military program is:

- 2.398 million rubles – for the purchase of finished housing;

- 2.33 million rubles - for the purchase of housing under construction.

Can a military man apply for a mortgage agreement under an individual program if he already owns real estate?

Yes, this is not prohibited by law . In this case, the borrower can indicate as collateral not the apartment being purchased, but the one that he already owns.

Does credit history matter when applying for a mortgage for military personnel?

Yes, it has. If the borrower previously took out loans and did not pay them or paid them, but not on time, then the bank may refuse to issue him a mortgage.

Under the Military Mortgage program, a Sberbank client cannot buy a plot of land or obtain a mortgage to expand his existing real estate.

What to do if there is not enough money on a military mortgage?

If the funds are not enough to purchase the desired property, then the bank may offer the client to take out an additional mortgage. The additional mortgage is paid from the serviceman’s personal funds.

How will the mortgage be repaid if a serviceman leaves the army for medical reasons?

In this case, the serviceman's experience plays a big role . If he has served for more than 10 years, then he will not need to return the mortgage funds to the state.

If the borrower has not worked for 10 years, then all the money from the targeted loan will need to be returned to him. In addition, he should pay the rest of the mortgage to the bank.

Serving for the good of the Motherland is not only prestigious, but also profitable. Thus, today Sberbank offers military personnel a mortgage for housing under a special program.

If a person has served for at least 3 years and at the same time he has a NIS certificate, then he has the right to submit documents under the “Mortgage for the Military” program with suitable conditions.

Main stages of the transaction

At the first stage, the serviceman needs to become a member of the NIS. To do this, you need to submit a report to the unit commander and attach a list of required documents to it. The package of papers is transferred to Rosvoenipoteka for consideration and after 3 months the department issues a conclusion on whether the applicant is included in the register or refused. The result of a positive response will be the assignment of a unique 20-digit registration number of the participant and the issuance of a certificate.

After 3 years, the serviceman can begin to select real estate and apply to the bank to receive a loan under the preferential program.

Sberbank will need to go through the following stages of the transaction:

- Obtaining a certificate of the right to receive a targeted loan;

- Sending an application using the DomClick service;

- Obtaining a bank decision;

- Collecting a package of documents and passing their verification;

- Signing a contract, valuation and insurance of real estate;

- Obtaining a loan and registering ownership.

The certificate of participation in the NIS must indicate complete information about the serviceman, the accumulated amount in the account and the amount of the monthly subsidy. Such a document has a limited validity period, therefore, from the moment it is received, the potential borrower must select an object within 6 months and go through the procedure for obtaining a mortgage.

One of the mandatory steps today is the assessment of real estate purchased with mortgage funds and its insurance. To obtain such services, it is recommended to contact companies accredited by the bank. In this case, there will be no difficulties with document verification and the lending process will be completed as quickly as possible.

Rosvoenipoteka signs the contract after checking all the documents and there are no complaints. After this, the amount of the initial contribution is transferred to a specially opened bank account, and then a monthly contribution is received from the state.