Mortgage for a New Building from Sberbank - calculator, conditions and documents

alyatina

Today, in a difficult economic situation in the country, a mortgage for a new building from Sberbank is more relevant than ever. But few people are familiar with the nuances of housing lending. Therefore, in this article we have collected relevant information that will help you choose the most favorable conditions.

What is considered a new building for a Sberbank mortgage?

In a broad sense, “new buildings” are considered to be those apartments that are sold directly by the developer. If the owner of the premises is an individual, it already belongs to the secondary housing market. Even if no one actually lived in the apartment, and it is sold immediately after purchase.

Sberbank limits this concept even more. As part of its mortgage programs, housing in a new building can only be purchased from developers verified and accredited by the bank. A complete list of performers falling into this category is presented on the website domclick.ru.

Features of buying a “fresh” home

- “Primary” is purchased directly from the developer, who often makes tempting offers. Sberbank has its own circle of developer partners whose conditions purchasing housing are the most favorable.

- Housing in a new building is not always purchased in a house that has already been commissioned, and you will not be able to immediately move into the purchased property, but the price per square meter in such houses is lower than in the “resale” market.

- If you take out a mortgage for an apartment in a new building, then you will not need to check the legal purity of the purchase object and the parties to the transaction.

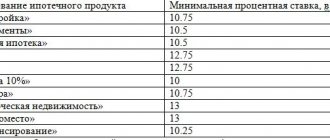

Mortgage interest rates

If previously it was possible to take out a mortgage loan at 7.4% per annum, in 2020 the mortgage rate for new buildings at Sberbank increased to 8.5%. Moreover, this is the minimum possible indicator, available only to those who have applied for a subsidy program for a period of no more than 7 years. If you take out a mortgage yourself, be prepared to pay the bank annually, in addition to the loan itself, another 10.5% of its amount.

Under certain conditions, the bank may increase the rate. So, if:

- the down payment is 15-20% (excluding the upper limit) of the cost of the apartment, the bank commission will increase by 0.2%;

- the client refuses the proposed insurance, another 1% will be added to the existing rate;

- the client does not have a salary card/account with Sberbank or cannot confirm his income and employment – + 0.3% to the current rate;

- the borrower refused to complete documents through the electronic registration service, + 1% to the interest rate.

As you can see, there are enough nuances. If you don’t want to overpay, before concluding a deal, carefully study the current offers, promotions, and conditions.

Special conditions for some developers

If, when purchasing an apartment in a new building, you are choosing between several options, carefully study the information not only about the premises themselves, but also about their owners. Thus, some developers (subject to obtaining a loan for a period of up to 12 years) offer a reduction in the interest rate down to -2%. Others may contribute to the bank's approval of the application. Still others offer good discounts if the amount of the down payment exceeds a certain percentage of the total cost of the apartment, etc.

Sberbank calculator

In the process of preparing to receive a mortgage loan, you will definitely be faced with the need to calculate your costs when concluding such a transaction. You can sit down at the table yourself, write down all the amounts on a piece of paper, and enter the results on the Citizen calculator. But this is the 21st century and there is a simpler and more convenient way. This is a Sberbank mortgage calculator in a new building.

This calculator is a convenient online service that allows you to quickly calculate:

- regular monthly interest payments;

- available loan amount.

Mortgage

After entering the basic parameters (price of the apartment, down payment, loan term and other units of account), this tool will instantly give you the result. It is fast, convenient and visually pleasing, the received data can be printed.

Credit term

The maximum possible term of mortgage lending at Sberbank is 30 years. However, there are certain limitations. So:

- For people whose profession requires early retirement, the time frame will be reduced accordingly.

- If you want to receive certain concessions from the developer, the mortgage term should not exceed 12 years.

- If you want to receive the minimum interest rate under the subsidy program (subject to all other requirements), you can take out a mortgage for a maximum of 7 years.

These conditions are valid at the beginning of 2020. Up-to-date information on specific mortgage programs is presented on the bank's website.

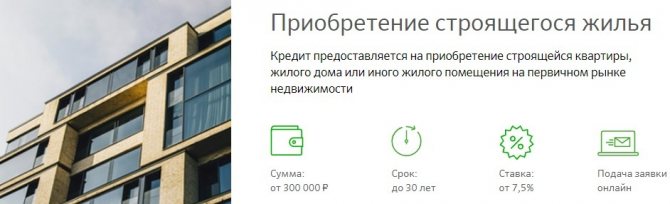

Features of a mortgage for the purchase of housing under construction

The mortgage program from 8.5% implies the purchase of housing only

from the primary market (in a new building). To purchase ready-made housing, Sberbank provides another mortgage program from 10.2% per annum.

Important!

According to the bank's terms, the minimum interest rate is calculated subject to life and health insurance of the borrower, subject to electronic registration of the transaction and a subsidy program for up to 7 years inclusive.

If you refuse all of the above, the interest rate will be higher - 9.5%. The most popular option is to buy an apartment in a building under construction (new building). The program does not provide restrictions on the readiness and delivery date of the object. They can be anything. The down payment on the mortgage is 15% of the market value of the finished home. The program may include other benefits, such as maternity capital, for subsequent interest repayment.

- Duration up to 30 years

. With such a payment period, it is convenient to purchase real estate in the mid-price category (in any city, but only in new buildings). - Down payment – from 15%

. This makes mortgages more accessible and easier to obtain. Under some conditions, the down payment may be higher. - Interest rate – from 8.5%

. It remains unchanged throughout the entire loan period. In other mortgage agreements, the rate may change in any direction, at the discretion of Sberbank, depending on financial market trends and/or the characteristics of the borrower.

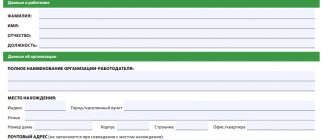

Documents required to obtain a mortgage for a new building

In order for Sberbank to accept a mortgage application for consideration, the borrower and each of his co-borrowers (if any) will need to collect the following basic documents:

- Completed application form for a housing loan.

- A passport containing a valid registration stamp.

- Documents that would confirm your employment status and financial income.

If you request a mortgage under special conditions, the bank may require other documents in addition to those listed. Thus, a young family will need to provide certificates of marriage and birth of a child (if any), and participants in the “Mortgage + Mat. capital” is a state certificate confirming the right to receive this very capital. You can clarify the list of required documents at the bank’s help desk or at any of its branches.

Requirements for the borrower

If you carefully study the terms of a mortgage for a new building from Sberbank, you will notice that they contain quite a lot of restrictions. So, as part of the basic requirements for consideration of an application:

- The borrower has citizenship of the Russian Federation.

- The age at the date of registration of the mortgage is not less than 21 years.

- Age on the date of payment of the last payment - no more than 75 years (if at the time the application is submitted, the borrower does not confirm his income and employment - no more than 65 years).

- If the client does not have a salary card at Sberbank, he must have worked in his last place of official employment for at least six months.

- The number of co-borrowers (if any) is up to 3 individuals. The borrower's spouse automatically becomes a co-borrower, unless he/she does not have Russian citizenship, or a marriage contract has been drawn up between the spouses, including a clause on the regime of separate property.

In addition to the basic requirements, there are additional restrictions within specific mortgage programs. You can clarify them at the bank office or at the electronic customer support service.

What documents are needed to apply for a mortgage?

Citizens of the Russian Federation aged 21 to 75 can apply for a mortgage loan for a new building.

The number of co-borrowers on a mortgage is no more than 3 individuals, whose income is taken into account when calculating the maximum loan size. The borrower's spouse is necessarily a co-borrower, regardless of age and solvency. The list of requirements for co-borrowers is identical to the requirements for borrowers. The spouse will not be included in the list of co-borrowers if he does not have Russian citizenship or there are restrictions under the marriage contract.

List of required documents for obtaining a mortgage:

- passport of the borrower, as well as co-borrowers;

- personal identification cards, military ID, international passport, pension certificate;

- income certificates: personal income tax-2 or other documents confirming income;

- certificate of work experience, a copy of the work record book, if available, or other documents certifying work experience and level of income for several years.

The list of documents must be clarified by calling the Sberbank Contact Center 8 800 555 55 50

.

How a mortgage is issued at Sberbank for new buildings: procedure and procedure

The procedure for obtaining a mortgage for a new building at Sberbank is not much different from a loan for the purchase of housing on the secondary market. Simplified, the process can be divided into the following stages:

- We go to the DomClick website, register (or log in if you already have a “Personal Account” there), find an advertisement for the sale of an apartment that suits us.

- Using a bank calculator, we calculate what we need: loan term, loan size, interest rate.

- We fill out the electronic form and see which of the existing mortgage programs are suitable for us.

- We check that all the data is entered correctly and fill out an application for a mortgage loan.

When all the stages of registration have been completed, all that remains is to wait for the bank’s decision and, if the application is approved, buy the apartment you like.

Decor

If these conditions interest you, then it’s time to find out how you can get a mortgage for a new building. To do this, you should contact a bank branch, and you can do this both at the place of registration of any of the co-borrowers, and at the location of the property for the purchase of which you are supposed to take out a loan.

When applying, you will need to provide a package of documents, and if all the documents are in place, the application will be reviewed within a few days - no more than five. What kind of documents are these? Here is their list:

- statement;

- passport;

- a certificate from your place of employment confirming your employment and income level;

- documents on the purchased property;

- documents on collateral in the event that the housing being purchased is not used in this capacity, but is already owned by the borrower;

- confirmation of the availability of the first payment.

Documents numbered 2 and 3 should be provided not only to the borrower himself, but also to each of the co-borrowers.

Sberbank calculator for a mortgage in a new building

When performing actual calculations, most borrowers make mistakes because they do not take into account the personal requirements/conditions of the chosen program. Therefore, in order to avoid problems with further payments, and also to understand on the basis of what amounts the monthly payment is formed, we recommend using the online calculator, which is presented in the article. Thanks to it, you can always get accurate information about the interest rate and upcoming payments.

Mortgage

How to pay a mortgage

When you come to the bank’s office to coordinate work issues and sign papers, the employee responsible for the application will present you with a monthly payment schedule. Payments in it can be annuity (same) or differentiated (gradually decreasing), depending on the chosen program. You can repay your mortgage using any of the following methods:

- Deposit cash into your account and then debit it yourself to repay the loan. All basic replenishment options are available: through Sberbank online, mobile bank, etc.

- Conclude an additional agreement to the existing deposit/account agreement so that the required amount is automatically debited from it every month.

- Issue a written order under which Sberbank will automatically debit a fixed amount from your bank card.

- Fill out an order in the accounting department, within the framework of which the employer will transfer part of your salary not to a salary card, but to a Sberbank card/account, from where the money will automatically be debited towards the mortgage. If you choose this option, do not forget to issue a corresponding order to write off funds from the bank.

If the opportunity arises to repay the loan ahead of schedule, you can do this at any day. You can deposit the remaining funds through the bank's cash desk or through Sberbank Online.

Mortgage without down payment

One of the main conditions for obtaining a mortgage from Sberbank is that the borrower makes a down payment in exchange for at least 15% of the cost of the apartment. However, some categories of citizens may qualify for approval of an application without fulfilling this requirement. These include:

- young families where the age of both spouses does not exceed 35 years;

- citizens of the Russian Federation who do not have their own housing;

- persons who have been on a waiting list for subsidized housing for over 10 years;

- other categories of citizens falling under the conditions of time-limited promotions or programs.

When a borrower applies for a mortgage without a down payment (if the lending program allows this), Sberbank employees carefully study his living conditions, financial situation, and financial activity. In some cases, based on these indicators, the bank may refuse to provide the borrower with preferential conditions.

Lending conditions for the primary market

Today, a special program has been created specifically for primary housing, which allows you to get a lower percentage than for other offers.

There is currently a promotion for new buildings, here are its main conditions:

- interest rate from 9.1% per annum, can be reduced to 7.6% under the program for subsidizing mortgages by developers,

- the minimum amount is 300,000 rubles,

- the maximum amount is limited to 85% of the assessed value of the property,

- a down payment of at least 15% is required,

- the duration of the contract is no more than 30 years,

- Maternity capital funds are accepted.

| CALCULATE LOAN: | |

| Interest rate per year: | |

| Duration (months): | |

| Amount of credit: | |

| Monthly payment: | |

| Total you will pay: | |

| Overpayment on loan | |

You can use our advanced calculator with the ability to build a payment schedule and calculate early repayment on this page.

Taking out a mortgage is the right decision for clients, which will help save both time and money. As a rule , loans are issued for apartments in such buildings on preferential terms, and the purchased housing will serve as collateral, which means that additional collateral will not be needed.

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

Are there deferments for such a loan?

In life, situations often arise when the financial burden increases so much that it becomes unbearable. In such cases, the client can contact Sberbank with an application to obtain loan refinancing (reducing the amount of monthly payments with a proportional increase in the repayment period) or mortgage “holidays” (when only interest is paid) for 1-3 years. However, the grounds for obtaining a deferment must be compelling. These include:

- Dismissal of the borrower from his job (provided that he can confirm that he is actively looking for a new one).

- Documented fact of salary delays.

- The borrower's loss of ability to work for a long period of time (confirmed by a sick leave certificate) or the need to care for a seriously ill relative, which arose after the mortgage was issued.

- The birth of a child in the borrower's family.

- Force majeure circumstances (fire, flood) that caused significant harm to the health or property of the borrower.

- Death of a close relative of the borrower or one of his co-borrowers.

However, you need to understand that even if there is a difficult life situation, the bank reserves the right to refuse the borrower. As a rule, the possibility of restructuring and/or suspension of mortgage payments is specified in the agreement. When signing the papers, do not forget to clarify this point with the operator.

Related Items