To provide housing for military personnel, the government has developed a special support program - a savings mortgage system. With its help, it became possible to obtain a mortgage, the fees for which are paid by the state. Borrowers who took advantage of the subsidy several years ago can now refinance their military mortgage at rates currently prevailing in the financial services market. The procedure will significantly reduce the financial burden, reduce risks and expenses in the event of dismissal from service.

Why refinance your military mortgage?

The need to refinance military mortgages arises due to the fact that contributions to the savings system are not indexed enough. The monthly government payment is not enough to fully cover the payment. Military personnel are forced to pay part of the payment from personal funds monthly, or to pay off the entire debt at once after the end of the loan term. Refinancing is a good way out of the situation.

Other risks of a military mortgage should also be taken into account:

- Upon termination of service, contributions to the savings system will not be received. The borrower will have to pay the remainder of the military mortgage debt himself.

- After early repayment of the mortgage debt, funds will continue to accumulate in the borrower’s personal account in Rosvoenipoteka, which can be used at their own discretion.

Important! Despite the fact that the state pays, it makes sense for borrowers to apply for refinancing on more favorable terms. Reducing the rate will bring the monthly payment closer to the amount of government contributions and will reduce the amount of payments from personal funds.

The amount transferred to the savings mortgage system is 288,410 rubles. It is unknown whether indexation will be carried out in 2020. Thus, the monthly payment made from the subsidy funds is 24,034. The difference is paid by the borrower.

Refinancing will allow the borrower to reduce the payment amount or the financing period. Many banks, following the reduction of the Central Bank key rate, began to offer lower interest rates on military mortgages.

Calculation example

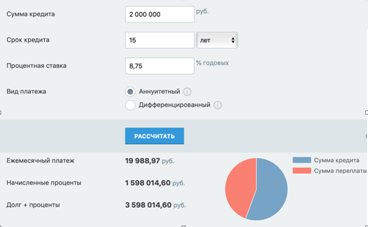

A calculation will help you understand the benefits of refinancing a military mortgage. For example, let’s take the following parameters of a refinanced loan: the remaining loan period is 15 years, the amount is 2,000,000, the rate is 12%.

For the entire term of the loan, you will have to pay interest in the amount of 2,320,604. Now we will carry out the calculation for the same period, using the average market rate at the end of 2020 - beginning of 2020. It is 8.75%.

Interest savings will be almost 700,000 rubles, and the monthly payment will be reduced by 4,000.

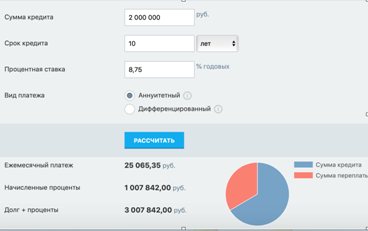

Let's consider the option of reducing the mortgage term. The payment will increase by 1000 rubles. But the final overpayment and the period of validity of the military mortgage will be reduced by 5 years.

After studying the calculations, the financial benefits of refinancing a military mortgage become obvious. The borrower has to decide for himself which option to choose.

Next, we will compile a list of banks offering refinancing for the military.

How does the procedure work?

First, the offers of banks refinancing military mortgages are studied, and if an optimal offer is found, you can contact Rosvoenipoteka. This organization works together with Zenit Bank, which establishes the possibility of refinancing in each specific case.

At this stage, the applicant may be refused if:

- He recently completed his service in the Russian Armed Forces% at his own request.

- Has a bad credit history.

- The mortgage balance is less than 400 thousand or more than 2 million 400 thousand rubles.

If not all the necessary documents are provided, then an additional 20 days are provided to collect them.

Required documents include:

- passport or other identity document;

- certified copies of the previous and new loan agreements;

- debt repayment schedule;

- details of the bank account where the funds should be sent;

- certificate in form 2-NDFL for the last 3 months.

Many large banks are engaged in refinancing military mortgages. An important condition is to deposit initially 10-20% of the cost of the loan object.

The average rate in 2020 is about 10% per annum. At the beginning of the year, interest rates increased slightly. It is expected that in 2020 these indicators will increase following the increase in the key rate of the Central Bank.

Video on the topic “Refinancing a military mortgage”:

List of banks: conditions and interest

Not all banks offer refinancing of military mortgages in 2020.

The table shows credit institutions where the process has already been launched. There are many lenders who cooperate with the savings system and issue new loans under military mortgages on favorable terms. However, refinancing has not yet launched with these lenders.

| Bank | Interest rate |

| Promsvyazbank | 8,6 |

| Opening | 8,8 |

| Dom.RF | 9,1 |

| Rosselkhozbank | 8,75 |

| Zenith | 9,1 |

| VTB | 8,8 |

| Sberbank | 8,8 |

| Gazprombank | 8,8 |

| Bank Russia | 8,5 |

The table shows that bank offers are approximately the same.

Review of bank offers

The table provides a list of banks and the conditions for refinancing military mortgages that they offer.

| Bank's name | Bid | Sum | Refinancing term | An initial fee |

| Sberbank | 9,5% | RUB 2.33 million | 20 years | 15% |

| Rosselkhozbank | 10,75% | RUB 2.23 million | 20 years | 10% |

| VTB | 9,8-10% | RUB 2.29 million | 20 years | 15% |

| Opening | 9,2% | up to 80% of housing cost | up to 25 years | from 20 to 90% of the cost of housing |

| Uralsib | 10,9% | 2.6 million rub. | is not limited | from 650 thousand rubles. |

| RNKB | 10,9% | 2.2 million rub. | 15 years | 10% |

| Gazprombank | 9,5% | 2.3 million rub. | up to 25 years | 20% |

| Rosbank | 10% | 3 million rub. | up to 25 years | 15% |

| Zenith | 9-9,9% | 2.8 million rub. | is not limited | 20% |

| Svyaz-Bank | 10,9% | 2.2 million rub. | is not limited | 20% |

| Absolute | 9,5% | 2.9 million rub. | is not limited | 20% |

| Russia | 9,5% | RUB 2.33 million | 20 years | 20% |

A complete list of banks that refinance military mortgages can be found on the Rosvoenipoteka website.

The disadvantages of refinancing include additional costs that accompany this procedure:

- real estate valuation - up to 45 thousand (Moscow region);

- apartment insurance – 3000 rubles;

- obtaining a technical passport, if you don’t have one – 6200 rubles.

Refinancing a military mortgage is not only profitable, but also a necessary banking product today. During the crisis years, the mortgage rate was increased and the military took out housing loans on the terms that were offered. The funds allocated under the NIS were not always enough to repay the loan. Refinancing a mortgage at a lower interest rate is a way out of this situation, especially since bank rates began to gradually decrease. The opportunity to refinance a mortgage for military personnel appeared only in 2018 and has become an excellent tool for improving lending conditions.

Documents for refinancing a military mortgage

The borrower will need to prepare the following documents:

- Passport.

- Certificate of participant of the funded mortgage system.

- A completed application form. Each bank uses its own form of this document.

- Existing mortgage agreement.

- Certificate of loan balance.

- Details of the mortgage repayment account certified by the lender.

- Some banks ask for the notarized consent of the other spouse to issue a mortgage.

For the property you will need:

- Grounds for the emergence of property. This could be an agreement on shared participation in construction, or a DCP.

- Certificate of registration of ownership or a document replacing it.

- A current extract from the unified state register, dated no later than 30 days at the time of contacting the bank.

- The act of transferring the apartment by the seller.

- Confirmation of full payment. These can be account statements, payment slips, receipts.

- Technical documents for the apartment. Different lenders have different requirements for these securities. For some banks, a copy certified by the management company is sufficient. Others require the provision of the original technical passport. Such a document must necessarily contain the data of the cadastral engineer and the address of the property. The technical passport must include a floor plan and an explanation. If an apartment was purchased at the construction stage and by the time the military mortgage was refinanced, ownership had already been obtained, the technical documentation must include permission to put it into operation and a decision on assigning an address.

- Documents confirming the legalization of the redevelopments carried out. Some banks accept for consideration real estate properties where work is not registered. In this case, there is a requirement to bring the papers into compliance within a certain time after the loan is issued.

- Certificate of registration.

- Confirmation of absence of debts for payment of utility services.

- Estimation of the cost of the apartment. Depending on the lender, the report can be ordered online or from a bank-accredited company. Some banks allow you to submit a report prepared by any company licensed to carry out such work. In this case, the borrower is provided with a list of requirements that the prepared document must meet.

Important! The list of documents is suitable for all banks. However, during the consideration, the creditor has the right to additionally request any paper necessary to make a decision.

Possible reasons for refusal

Despite the fact that the debt is paid with public funds, the bank may refuse to refinance a military mortgage.

A negative decision is made based on a number of factors:

- There are arrears on an existing loan.

- Age approaching 50 years. The term for providing military mortgage refinancing is limited to the end of service.

There are situations when the bank approves the mortgage amount, but makes a negative decision on the apartment. Failure may be caused by:

- The presence of unregistered redevelopments.

- Carrying out redevelopment that cannot be legalized - dismantling part of the load-bearing walls, moving a wet point. When drawing up a report, the appraiser indicates the cost of legalization or makes a note about the impossibility of registration. To obtain approval, the comments must be corrected.

- Errors in registration documents.

Step-by-step instruction

Let's look at the procedure for refinancing a military mortgage step by step.

- Selecting a creditor bank. As mentioned earlier, not all organizations provide the service; the offers are approximately in the same price range. At this stage, you should study the details of the procedure, review deadlines, and document requirements.

- Carrying out calculations. The borrower should decide on the parameters of the future loan. According to the rules of all banks, the amount of the new loan cannot exceed the outstanding balance on the existing military mortgage. Therefore, the borrower must decide what loan term will be most comfortable for him.

- Submitting an application form and a set of documents for approval of refinancing. Some banks allow you to send the kit remotely - by email or through special services. For example, Sberbank uses the Dom Click portal for communication between the bank and the borrower.

- Waiting for the bank's decision. The average processing time for an application is from 1 to 5 days. During this period, you can gradually begin to prepare a collateral review kit.

- Preparation of documents for the apartment. You will need to order a cost estimate and a current extract from Rosreestr. Preparation of the report takes about 5 days depending on the selected company. As for statements, some banks order an electronic version on their own through special access to the Rosreestr portal.

- Obtaining a decision on the collateral. Consideration of the possibility of pledging an apartment takes on average 1-3 business days. After receiving approval, preparations for the transaction begin.

- Opening a current account with a new lender. The operation is performed on the same day of treatment. A passport will be required. The documents will be prepared by bank employees.

- Coordination of the approved loan with Rosvoenipoteka. For approval, you must submit documents for the new loan - agreement and payment schedule.

- Registration of financial protection for the life, health of the borrower, as well as structural elements. When refinancing a military mortgage, you must purchase a new policy. The borrower can choose the company independently. Read more on our portal about the types of mortgage insurance and how to purchase a contract.

- Signing the documentation. The borrower is invited to a bank branch to conclude a mortgage agreement. During the transaction, the manager checks the original documents and explains further actions.

- Transfer of money to the previous creditor and early repayment of the debt. After signing a new agreement, the funds are sent to the previous lender. The payment is made using the previously provided details. Interbank transfers take place throughout the day. After receiving the money, the borrower submits an application for full repayment. Some banks allow you to submit an application through your personal account.

- Applying to the registration authority to remove the encumbrance and establish a new one in favor of the new creditor. Sets of documents for the registrar are prepared by bank employees.

Today there is no need to contact Rosreestr. Documents can be submitted through the MFC. You can submit two sets for registration at once. The process will take 15 working days. If an error is found in the documents, the registrar issues a suspension order for 30 days.

The entire procedure for refinancing a military mortgage will take about 1.5 months.

Subtleties and nuances of lending in other banks

Svyazbank refinances up to 5 loans from third-party banks simultaneously at a lower interest rate. Not only military personnel, but also any civilian who responsibly repays the loan can contact the organization.

Gazprombank is one of the first to conduct refinancing promotions to attract new clients, offering 9.2% per annum, and 9% for employees of partner enterprises. The application can be submitted online. The validity period of a positive decision is 3 months.

Rosselkhozbank announced that it is “cutting mortgage rates” and providing a lower interest rate - 9.05% per year. You can verify this on the calculator page by visiting the bank. However, if the borrower refuses life insurance, the rate increases by 1%. Add another 2% if your apartment is still under construction and you have not received an extract from Rosreestr.

Read also:

Social mortgage: changes and innovations in 2020

conclusions

The presented material allows us to formulate the following conclusions:

- Refinancing a military mortgage is a profitable procedure that allows you to reduce the burden on the family budget.

- Additional expenses accompanying the transaction are paid by the borrower independently.

- The terms offered by lenders are almost the same. Only the analysis processes and automation of some actions differ.

- Contributions from the state to the savings system have not been indexed for the last few years.

- The review period in various organizations can be up to 5 days.

- Not all banks work with the program; at the moment the choice is very limited.

- Even though the premiums are paid from savings in the mortgage system, the lender may refuse to refinance.

Was the article helpful? Like and repost. The portal's lawyer on duty will help you sort out any unclear issues.

Read on for an interesting article about the savings system.