Mortgage refinancing at Rosselkhozbank is a response to competition between banking structures to attract new borrowers. Sberbank was the first to offer re-issuance of housing loans. It was joined by Rosselkhozbank, which developed a refinancing program.

The bank's policy is aimed at providing funds on more favorable terms, which reduces the financial burden on its clients .

Mortgage refinancing at Rosselkhozbank 2020: rates and conditions

Mortgage refinancing at Rosselkhozbank today occurs on favorable terms. But before we begin to consider the conditions and interest rates, we will answer simple questions that will likely arise among those who intend to refinance their mortgage at Rosselkhozbank.

What mortgage loans can be refinanced at Rosselkhozbank

Rosselkhozbank allows you to refinance mortgage loans received for the purchase of an apartment on the primary or secondary markets, or the purchase of a residential building (including a townhouse) with a land plot. In addition, the bank accurately described the criteria for loans that can be refinanced.

Firstly, the refinanced mortgage loan must be in Russian rubles.

Secondly, the duration of late payments on the refinanced mortgage for the last six months should not exceed 30 days.

Thirdly, the validity period of the current mortgage before the date of submission of the application form for refinancing to Rosselkhozbank must be:

- at least 6 months, provided there are no overdue payments of any duration;

- at least 12 months in other cases.

Important criteria are the absence of cases of debt restructuring, as well as the presence of a positive credit history on the refinanced mortgage.

Is it possible to refinance a mortgage loan taken out here at a lower interest rate?

Any bank has the opportunity to apply to reduce the rate on an existing mortgage. This can also be done at Rosselkhoz Bank. There is no separate program for internal refinancing, so all applications are considered individually .

Terms and requirements

The main requirement for a borrower who wants to reduce the rate on his mortgage is the absence of problematic or, even worse, already restructured debt. The minimum loan amount that must remain with the client cannot be less than 100 thousand rubles.

Requests to the borrower:

- age at least 21 years, but not older than 65-75 on the date of loan repayment;

- Russian Federation citizenship, registration in the region of permanent residence;

- having a positive credit history;

- no overdue debt as of the date of application;

- stable job or business.

Real estate requirements:

- liquid apartment or house, townhouse with land;

- low degree of wear and tear of the building where the apartment is located;

- availability of a separate kitchen and bathroom;

- confirmed ownership rights.

The borrower's property is already pledged to the bank and therefore does not require additional appraisal or insurance.

The collateral was checked at the stage of applying for a mortgage loan. During this period, its liquidity, all title documents, as well as the report of an independent appraiser were checked. In the event of a decrease in mortgage rates, this information may simply be clarified or rechecked.

Who can get refinancing?

Individuals wishing to obtain refinancing from Rosselkhozbank must have mortgage agreements that meet the minimum requirements and conditions :

- A good credit history is required . A maximum late payment period of 1 month is allowed for the last 180 days. Debtors will not be able to become clients of Rosselkhozbank.

- The mortgage offered for re-registration must not have previously been involved in restructuring or extension .

- The period for which the agreement to be refinanced was concluded must not exceed 7 years .

- From the date of concluding the mortgage agreement to the expected date of its refinancing, at least six months must pass if there are no debts, and at least a year if there are any . The remaining term of an open mortgage loan cannot be less than 2 years.

Any application for refinancing is considered individually. If there are several mortgages, each of them is drawn up in a separate refinancing agreement.

If a young family is involved in refinancing, then upon the birth of a child it is possible to get a deferment on the repayment of the principal debt.

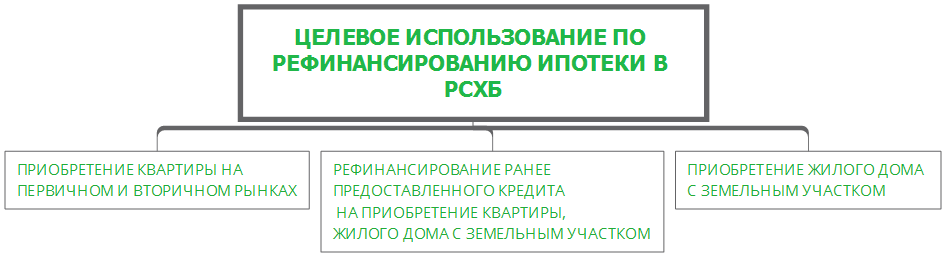

Mortgage refinancing goals

Funds under the mortgage refinancing program are issued only for strictly defined purposes .

A previously issued loan must go towards:

- Purchasing an apartment both in a new building and on the secondary real estate market (offers for townhouses are being considered).

- Purchasing a house along with a plot of land.

Requirements for the purchased property

Object type

- Apartment (resale)

- Apartment new building

- Townhouse

- House/cottage with land

Package of documents Finished housing (resale):

- Ground(s) of property rights (DCT, gift agreement, exchange, etc.)

- Certificate of ownership

- Certificate on the contents of title documents

- Cadastral passport for housing

- Cadastral passport for a land plot

- Technical data sheet / floor plan

- Extract from the technical passport

- Extract from the technical data sheet

- Extract from the house register

- Extract from the Unified State Register for the Subject of Mortgage

- Consent to the transaction from the Seller’s spouse

- Assessment report for purchased housing

- Land assessment report

- Permission from guardianship authorities to sell residential premises

- Consent of a third-party Bank (for refinancing)

- A copy of the Seller's receipt confirming receipt of the amount from the Borrower

- Copy of personal financial account

- Certificate of absence of debt

Housing under construction (new building):

Seller - Developer under an Equity Participation Agreement (DPA)

- Project/copy of DDU in housing construction

- Certificates/letters from the Developer indicating housing parameters

- Additional agreement to the DDU on changing the settlement procedure

- Document confirming payment of the down payment for the purchased housing under construction

Property insurance Mandatory For information, the Bank may request other documents

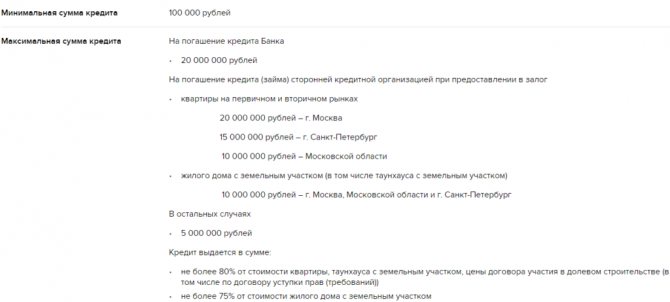

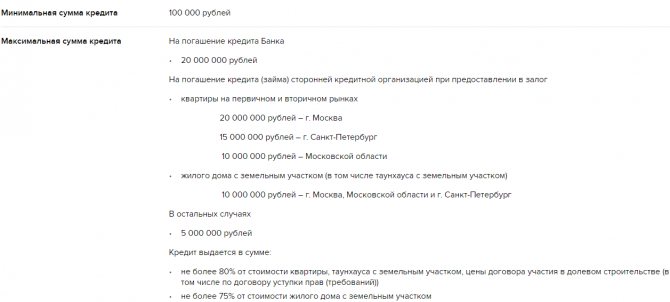

Maximum and minimum mortgage amount

Rosselkhozbank provides new mortgages only in Russian currency. The smallest amount offered for refinancing is 100,000 rubles .

The maximum funds that the bank allocates for new lending depend on the type of property being purchased and its location. When purchasing apartments by borrowers in Moscow, the Moscow region and St. Petersburg, the bank provides the largest amounts :

- Real estate in a multi-storey building, if it is located in Moscow, is valued by Rosselkhozbank at 20,000,000 rubles.

- For the Moscow region it is halved and amounts to 10,000,000 rubles.

- If similar real estate is found in St. Petersburg, the bank is ready to provide a maximum amount of 15,000,000 rubles.

Article on the topic: Restructuring of a mortgage loan at Rosselkhozbank

For houses for living together with a plot for clients of two capitals, Rosselkhozbank allocates a maximum loan of 10,000,000 rubles. Other borrowers can count on an amount not exceeding 5,000,000 rubles.

Another condition put forward by Rosselkhozbank when providing funds for mortgage refinancing is related to the share that the loan should make up of the total cost of the purchased property:

- Bank funds for the purchase of an apartment or townhouse should not exceed 80% of the market value of the real estate .

- no more than 75% for the purchase of a residential building along with a plot of land.

List of required documents

Documents for reviewing a mortgage application can be divided into those that relate to the borrower and those that characterize the property.

Article on the topic: How to repay a mortgage early at Rosselkhozbank?

Borrower's documents:

- Passport.

- Military ID for persons liable for military service.

- Certificate of income in the form of Rosselkhozbank.

- A copy of the work book.

- Documents about the presence of children and family.

- Application form.

Photo gallery:

- Passport

- Military ID

- Certificate of income

- Employment history

- Certificate of family composition

Documents for the property:

- Title papers.

- Certificate of ownership.

- Appraisal report of an apartment or house.

- Extract from the house register (Form No. 9).

- Cadastral or technical passport.

It is required to provide information on a previously concluded mortgage loan in the form of an extract , which should contain the following information:

- Date and number of the contract.

- Mortgage amount.

- Interest rate.

- Amount of monthly payment.

- Balance owed.

- Information about overdue payments.

Lending terms

Before receiving funds from Rosselkhozbank, you should familiarize yourself with the conditions under which mortgage loan refinancing takes place.

Article on the topic: Restructuring of a mortgage loan at Rosselkhozbank

Video on the topic:

Mortgage refinancing goals

Funds under the mortgage refinancing program are issued only for strictly defined purposes .

A previously issued loan must go towards:

- Purchasing an apartment both in a new building and on the secondary real estate market (offers for townhouses are being considered).

- Purchasing a house along with a plot of land.

Maximum and minimum mortgage amount

Rosselkhozbank provides new mortgages only in Russian currency. The smallest amount offered for refinancing is 100,000 rubles .

The maximum funds that the bank allocates for new lending depend on the type of property being purchased and its location. When purchasing apartments by borrowers in Moscow, the Moscow region and St. Petersburg, the bank provides the largest amounts :

- Real estate in a multi-storey building, if it is located in Moscow, is valued by Rosselkhozbank at 20,000,000 rubles.

- For the Moscow region it is halved and amounts to 10,000,000 rubles.

- If similar real estate is found in St. Petersburg, the bank is ready to provide a maximum amount of 15,000,000 rubles.

For houses for living together with a plot for clients of two capitals, Rosselkhozbank allocates a maximum loan of 10,000,000 rubles. Other borrowers can count on an amount not exceeding 5,000,000 rubles.

Another condition put forward by Rosselkhozbank when providing funds for mortgage refinancing is related to the share that the loan should make up of the total cost of the purchased property:

Article on the topic: How to reduce interest rates on an existing mortgage at Rosselkhozbank?

- Bank funds for the purchase of an apartment or townhouse should not exceed 80% of the market value of the real estate .

- no more than 75% for the purchase of a residential building along with a plot of land.

Deadline for providing funds

The loan period is limited to 30 years. This is the maximum possible period for which credit institutions issue refinancing.

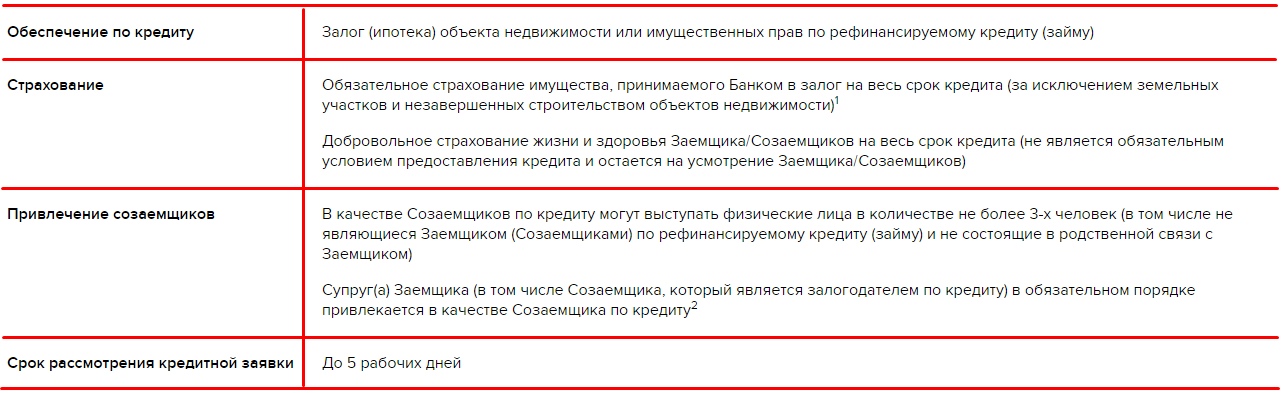

Guarantees for the bank

An important requirement that is met for all mortgage loans is the registration of a mortgage by Rosselkhozbank for the purchased property . Until full repayment, the apartment or house is at the disposal of the bank.

To increase its guarantees, Rosselkhozbank requires that a mandatory insurance contract be concluded for real estate.

When you take out insurance from RSHB-Insurance, you can protect your apartment or residential building from complete or partial destruction or damage as a result of a natural disaster, fire, flood, or explosion. The agreement is concluded for the entire loan period.

Life and health insurance is not a prerequisite for obtaining a mortgage. It includes risks such as death from an accident or serious illness, as well as disability. When taking out such an insurance policy for the entire period of the mortgage, the bank provides a reduction in the refinancing interest rate by 1 point.

Additional guarantees

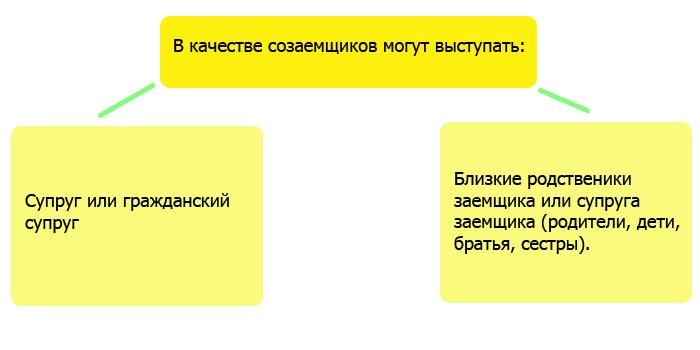

Rosselkhozbank offers to attract co-borrowers as additional security. Any individual who is not necessarily related to the borrower can act as such.

Article on the topic: How to repay a mortgage early at Rosselkhozbank?

It is important that the citizen who agrees to act as a co-borrower is ready to share responsibility for repaying the loan funds. This requirement is most relevant for persons with low income. First of all, this applies to pensioners. The client can attract no more than 3 co-borrowers.

Important! The borrower's wife or husband always acts as a co-borrower.

Mortgage refinancing with state support for families with children

This is a special loan for refinancing a previously issued mortgage loan for families in which a second and/or third child was born from 01/01/2018 to 12/31/2022.

Refinancing a mortgage loan under the preferential Program allows you to change the interest rate, loan term, monthly payment amount, as well as attract co-borrowers and pay off the mortgage loan on more favorable terms.

When refinancing, the 6% rate is valid for 3 years at the birth of the second child and 5 years at the birth of the third. After the end of the grace period, the interest rate is set at the key rate of the Central Bank of the Russian Federation on the date the loan was issued, increased by 1.8 percentage points.

The maximum loan amount for mortgage refinancing for Moscow and the Moscow region, St. Petersburg and the Leningrad region is 8 million rubles, for other regions of Russia - 3 million rubles.

The maximum loan term is 30 years.

An application for mortgage refinancing under the State Support Program at Rosselkhozbank is available using a standard package of documents, provided that confirmation is provided that a second or third child was born in the family after January 1, 2020.

Rosselkhozbank mortgage refinancing calculator

You can calculate the monthly payment and the amount of overpayment when refinancing a mortgage at Rosselkhozbank using an online mortgage calculator.

Description of the RSHB program and rates

Rosselkhozbank refinances mortgages at a favorable rate - from 9.15% per annum. However, if the client refuses life insurance, the rate may be increased by 1 percentage point. The cost of repaying the loan also depends on whether the borrower is an employee of a budget organization, a salary client of Rosselkhozbank, or simply a client with a good credit history.

Refinancing conditions:

- rate from 9.15-12% per annum;

- loan term up to 30 years;

- minimum loan amount – 0.5 million rubles;

- maximum amount 3-20 million rubles;

- Loan collateral is real estate collateral.

The mortgaged property will have to be insured until the end of the loan repayment. When refinancing an amount of 1 million rubles for a period of 20 years, the monthly payment amount will be slightly more than 9.8 thousand rubles (at a rate of 10.3% per annum). If the client has a good credit history with Rosselkhozbank and all insurance has been purchased, then refinancing is possible at a minimum rate of 9.15% per annum and then you will have to pay 9 thousand rubles per month.

Interest rates for refinancing in 2020

The interest rate for mortgage refinancing depends on the property being purchased and on the “reliability” of the client. It is also affected by the amount provided for refinancing.

What percentage exists in Rosselkhozbank today is indicated in the table, taking into account the main conditions:

Real estate Mortgage amount (rub.) “Reliable” and salary clients Public sector employees Other individuals

| Apartment | Over 3000000 | 9,05% | 9,1% | 9,2% |

| Apartment | Up to 3000000 | 9,5% | 9,2% | 9,3% |

| House | Any | 11,45% | 11,5% | 12,0% |

The official website of Rosselkhozbank constantly updates information on changes in interest rates on loan refinancing.

Important! Until an extract from Rosreestr is received indicating the absence of encumbrances, the interest rate on refinancing will be increased by 2 points to that previously approved in the agreement.

An example of loan refinancing at Rosselkhozbank

Rosselkhozbank refinancing mortgages from other banks to individuals

The number of individuals applying to Rosselkhozbank for refinancing is growing. Clients are attracted by the benefits received when refinancing. The benefit for customers is based on the following positive factors:

- Bank remuneration for the use of mortgage funds is reduced - interest rates and commissions.

- The total payment time increases, resulting in significantly reduced monthly payments.

- Changing the loan currency, which significantly reduces the overall financial burden on the individual.

The advantage is the way the loan is repaid. There may be several of them - cash desks of Rosselkhozbank, ATMs with a convenient function for receiving funds; using a card in a standard Internet bank, that is, online, you can make non-cash money transfers from a personal account previously opened for personal savings, as well as from a salary card .

Important! In certain cases, a commission may be charged for depositing. This applies to loan repayment through terminals of other institutions, from cards of other financial institutions, this includes electronic wallets.

How to refinance a mortgage at Rosselkhozbank?

After submitting all required refinancing documentation to Rosselkhozbank, it is reviewed. The period for consideration of such an application is limited to 5 working days .

If the decision is positive, if the borrower agrees with all the conditions specified in the loan agreement, then it is signed by him.

The final step in processing refinancing is drawing up and signing an application for a one-time transfer of funds by Rosselkhozbank to the account of the credit institution in which the refinanced mortgage is being repaid.

How does refinancing work?

To become a participant in the refinancing program, you must submit an application. This can be done both on the lender’s official website and at any branch of Rosselkhozbank.

If the decision is positive, a loan agreement is concluded between Rosselkhozbank and the borrower. The funds are transferred to the client for further repayment of the existing mortgage. The borrower is obliged, no later than 30 days from the date of execution of the new agreement, to provide to the Russian Agricultural Bank a document confirming the intended use of funds and repayment of debt to the previous creditor.

The living space must be registered as collateral. A document confirming registration must be submitted to Rosselkhozbank within 45 days after receiving a new loan.

Mortgage servicing and repayment

Rosselkhozbank is one of those credit institutions that provide all borrowed funds to individuals without receiving a processing fee.

Mortgage repayments through Rosselkhozbank cash desks and ATMs are made without additional fees. Interest is also not charged on non-cash transfers of funds from the borrower’s account opened with this bank.

We recommend viewing:

Early full or partial repayment of the loan does not lead to any financial sanctions.

How to repay a new loan

To make monthly payments, you can use the following free options:

- Bank operating cash desk.

- Rosselkhozbank ATMs equipped with a money acceptance function.

- Non-cash transfer of funds from another account of the borrower.

Transfer of funds using the specified methods is carried out on the day of the payment transaction.

For the convenience of the client, there are also other ways to pay the debt, however, an additional fee is charged for their use:

- depositing cash through the cash desk of another bank;

- debt payment through self-service terminals;

- transfer of funds from an electronic wallet.

The use of the above options must occur no later than 5 days before the settlement date so that the money has time to arrive in the account. For late fulfillment of debt obligations, Rosselkhozbank charges a penalty of 20% per annum of the payment amount and 0.1% for each day of delay.

FAQ

Can I reduce my mortgage interest rate?

Yes, with our refinancing program. We have a program for refinancing mortgages at a lower interest rate.

What are the benefits of refinancing your mortgage?

The main advantages of refinancing are changing the loan term and payment amount. You choose your mortgage repayment scheme and get the opportunity to close the loan early and without restrictions. The consent of the primary creditor is not required.

Will the mortgaged apartment be pledged to the bank?

Yes. A mortgage is a form of borrowing secured by real estate, and the terms remain the same after refinancing.

Bank partners

Developers and real estate

Real estate agencies, realtors and cottage communities

Key partners of the Bank

Is it possible to refinance a mortgage at Rosselkhozbank if the loan was taken out here?

To answer this question, you need to understand the difference between refinancing and restructuring—the two concepts are often confused. Refinancing involves refinancing, and the loan must be opened in another bank.

In other words, if you received a mortgage from the Russian Agricultural Bank, you will not be able to refinance it here .

But you can restructure. This term refers to making changes to the payment schedule: for example, as a result of restructuring, the monthly payment may be reduced, the loan term may be changed, or the interest rate may be lowered. In some cases, if documentary evidence of compelling reasons has been provided, the borrower may be given a deferment on payments.

Restructuring, unlike refinancing, can be carried out at the same bank where you originally took out the loan. Therefore, in a critical situation, you may not go to another bank, but simply ask the management of the Russian Agricultural Bank to restructure the debt.

Conditions for refinancing a mortgage loan

Basic parameters:

Repayment of a loan (loan) previously provided for the following purposes:

- Primary and secondary residential real estate markets.

- House with land/townhouse with land.

- Refinancing a previously provided mortgage loan (loan).

- Term 12 – 360 months.

- Maximum loan amounts:

- To repay the Bank loan 20,000,000 rubles.

To repay a loan (loan) by a third-party credit organization when providing collateral:

- apartments in the primary and secondary markets

20,000,000 ₽. – Moscow 15,000,000 ₽. – St. Petersburg 10,000,000 ₽. - Moscow region

- residential building with a land plot / townhouse with a land plot

10,000,000 ₽. – Moscow, Moscow region and St. Petersburg

In other cases, 5,000,000 ₽.

The loan is issued in the amount of:

- no more than 80% of the cost of an apartment, townhouse with a land plot, the price of an agreement for participation in shared construction (including under an agreement on the assignment of rights/claims);

- no more than 75% of the cost of a residential building with a land plot.

Pledge (mortgage) of real estate or property rights under a refinanced loan/loan.

No more than 3 co-borrowers. The Borrower's spouse is required to be involved as a Co-borrower for the loan, in the absence of a marriage contract.

Review of the application within 5 working days.

Additional terms:

The refinanced loan/loan must be in Russian currency.

The duration of overdue payments on a refinanced loan/loan for the last 180 calendar days should not exceed 30 calendar days.

The validity period of the refinanced loan/loan until the date of submission of the loan application form to the Bank is:

- at least 6 months, provided there are no overdue payments of any duration;

- at least 12 months in other cases.

No cases of debt prolongation/restructuring and the presence of a positive credit history for the refinanced loan/loan.

The collateral for a refinanced loan/loan is real estate or property rights in respect of which there are no other registered encumbrances other than a mortgage in favor of the primary lender.

If the Borrower has more than one credit/loan, refinancing is carried out for each credit/loan separately.

Insurance:

Mandatory insurance of property accepted by the Bank as collateral for the entire loan term (except for land plots and unfinished real estate)1.

Voluntary life and health insurance of the Borrower/Co-borrowers for the entire term of the loan (is not a mandatory condition for granting the loan and remains at the discretion of the Borrower/Co-borrowers).

1If property rights (claims) are provided as collateral under an agreement for participation in shared construction (including under an agreement for the assignment of rights/claims), then the obligation to provide insurance arises from the date of state registration of ownership of the property.

More detailed information can be found in the territorial divisions of JSC Rosselkhozbank.

Repayment of a loan (loan) previously provided under the Main Agreement for the purposes of:

Secondary housing:

Purchase of an apartment/townhouse/separate part of a residential building with a plot of land.

Refinancing of a previously granted loan/loan for the purchase of an apartment/townhouse/a separate part of a residential building with a land plot.

Salary project participants/“reliable” clients

1

- 8.40% up to 3 million rubles

- 8.20% from 3 million ₽

Employees of budgetary organizations

2

- 8.60% up to 3 million rubles

- 8.40% from 3 million rubles

Other individuals

- 8.70% up to 3 million rubles

- 8.50% from 3 million rubles

New building:

Payment of the price of the agreement for participation in shared construction / agreement for the assignment of the right to claim.

Salary project participants/“reliable” clients

1

- 8.40% up to 3 million rubles

- 8.20% from 3 million ₽

Employees of budgetary organizations

2

- 8.60% up to 3 million rubles

- 8.40% from 3 million rubles

Other individuals

- 8.70% up to 3 million rubles

- 8.50% from 3 million rubles

House with land:

Purchase of a residential building with a plot of land.

Refinancing of a previously provided credit/loan for the purchase of a residential building with a land plot.

Salary project participants/“reliable” clients

1

- 10.75% up to 3 million rubles

- 10.50% from 3 million rubles

Employees of budgetary organizations

2

- 12.00% up to RUB 3 million

- 11.75% from 3 million rubles

Other individuals

- 12.25% up to 3 million rubles

- 12.00% from 3 million rubles

- +1,00%

to the mortgage interest rate in the event of refusal or non-compliance with the continuity of voluntary life and health insurance of the Borrower/Co-borrowers throughout the entire loan term. - +2,00%

for the period until the Bank receives an extract from the Unified State Register of Real Estate confirming the absence of other registered encumbrances in relation to the property/property rights under the agreement for participation in shared construction, except for the pledge in favor of the Bank.

Requirements:

- Citizenship of the Russian Federation

- Registration on the territory of the Russian Federation at the place of residence or stay

- Age from 21 to 65 years (subject to repayment of the loan before the Borrower turns 65 years old)

Age up to 75 years, subject to the following conditions:

- Before the Borrower turns 65, at least half of the loan term has passed

- Before the co-borrower turns 65 years old, the loan repayment period expires

Work experience:

For individuals

- at least 6 months at the last (current) place of work

- at least 1 year of total experience over the last 5 years

For salary clients of the Bank / clients with a positive credit history with the Bank

- at least 3 months at the last (current) place of work

- at least 6 months of total continuous work experience over the last 5 years

For clients receiving a pension from the Bank

- at least 6 months at the last (current) place of work

For citizens running personal subsidiary plots (LPH)

- at least 12 months of running a personal subsidiary plot (presence of an entry in the household register of a local government body)

Bank requirements for borrowers when refinancing a mortgage

Have you taken out a microloan from an MFO?

Not really

In order for individuals to receive mortgage refinancing from Rosselkhozbank from other banks, they must meet the following requirements:

- Be a citizen of the Russian Federation (when applying to a bank branch you will need to provide a Russian passport).

- Have registration at the place of residence or stay in our country.

- The borrower's age must be at least 25 years and not more than 65 years.

- Work experience for individuals must be at least 6 months at the current place of work and at least 1 year of total experience. Similar conditions for refinancing mortgage loans apply to those who receive a pension into an account in the Russian Agricultural Bank (i.e., pensioners).

- For clients who receive wages into an account at Rosselkhozbank and have a positive credit history, the minimum work experience conditions have been reduced to 3 months.

- For borrowers running a personal subsidiary plot (LPH), the experience of running it must be at least 12 months.

Review of applications takes up to 5 working days. All applications for on-lending are considered by banks individually and the lender has the right to request any other documents. If the borrower has several mortgages, each of them is drawn up in the form of a separate refinancing agreement.

What documents will be required?

To refinance a mortgage loan at RSHB you will need to provide the following package of documents:

- Questionnaire – application (can be downloaded from the bank’s website).

- Passport.

- Certificate of family composition.

- A copy of the work book.

- Certificate of income (2 personal income tax or according to the bank form).

- Current mortgage agreement.

- Statement of the balance of debt.

- Documents for collateral housing.

Men under the age of 27 must also present military ID.

The list of documents is not final and can be changed by decision of the bank.

Required documents

Applications addressed to the head of a credit institution must be accompanied by a certain package of documents, which includes:

- Passport.

- Loan agreement.

- Title documents for real estate pledged.

- A certificate confirming a decrease in solvency (difficult financial situation), for example, about the birth of a child, the establishment of a disability group, stay for treatment in a hospital, a reduction in salary by a third or more, etc.

The entire package must be duplicated in copies, and its submission is carried out personally by the bank client.

The reasons can be very different, this is an assessment criterion, for example, a natural disaster, as a result of which the property was damaged, destroyed, which led to damage for a large amount (in practice, 500 thousand rubles or more), or the death of the borrower (the heirs apply with a certificate from the registry office about death).

Let's sum it up

Participation in the mortgage refinancing program allows Rosselkhozbank clients to receive more favorable lending conditions. This is expressed in a decrease in the interest rate, leading to a decrease in the amount of overpayment. The absence of fees for processing or early repayment of a mortgage also attracts borrowers.

The client has the right to choose the method of calculating and paying interest on refinancing. The property can be an apartment either in a new building or in the secondary housing market. It is possible to purchase a residential building with a plot.

Rosselkhozbank offers shares on mortgage loans, which can reduce the interest rate by 0.5%. They apply to “reliable” and salary clients, as well as employees of budgetary organizations.

| Independent rating of microfinance organizations that issue loans on the same day of application Get a loan |

How RosselkhozBank carries out loan restructuring

The bank's consideration of the application of restructuring or refusal to do so is carried out in compliance with a certain procedure by a specially created commission within the institution. In the course of their work, its members, when considering an application, assess the seriousness of the grounds that served as a catalyst for such a situation. The short-term perspective of establishing the client’s solvency is taken into account, who must describe what is expected and how the income situation will change.

For example, a borrower has an accident and is being treated in a hospital. Payment for sick leave does not make it possible to make payments on time and in full. However, as soon as the client recovers, which is tentatively planned for the next couple of months, the situation with payments will improve. The most common solution in such cases is the introduction of credit holidays. At the same time, in your application you must indicate a restructuring option acceptable to the debtor; this can be taken into account if the proposal is reasonable and sound. The loan calculator on the institution’s website will help with this.

RosselkhozBank clients have the opportunity to restructure their mortgage

The application for restructuring will be refused if the commission considers that a change in contractual terms, both temporary and permanent, will not make it possible to return to the previous payment schedule, or when it comes to the conclusion that the grounds are not so compelling (minor salary reduction) .

When assessing the possibility of applying such a rescue measure, the correctness of payments is taken into account. If there are delays, this can have a negative impact, because banks are not so loyal and compliant in matters of writing off accumulated debts.

What to do if Rosselkhozbank refused to restructure?

Despite the fact that Rosselkhozbank independently expressed a desire to participate in the state program for restructuring mortgage lending, it does not always strive to help borrowers who contact it. Therefore, some applications receive a negative response. The reasons are different.

What to do in case of refusal:

- Go to court and through it obtain permission for restructuring. In this case, you will need to prove your financial insolvency. But if the judge makes a decision in favor of the borrower, the bank will not only have to satisfy his request for recalculation, but also write off all fines and penalties incurred during the trial.

- If there is an AHML representative office in your city, you can contact it directly. However, this option is even preferable, since this agency has much more powers than any other bank. In addition to writing off fines, increasing the mortgage term and changing the currency, you may be offered to write off 30% of the principal amount or be offered a reduction in the interest rate by several points.

- Declaring a borrower bankrupt is not the best scenario for the borrower. In this case, events will develop according to the following scheme. After receiving official bankruptcy status, the debtor must open a special bank account. After this, the procedure for selling the borrower’s property begins: real estate, cars, etc. All money from sales goes to an open account. After which the funds are written off in favor of creditors. As a result, the borrower is left without an apartment. But he also gets rid of the burden of debt.

What documents and certificates will be needed?

The borrower attaches the usual package to the application form for refinancing a mortgage loan, which is typical for such operations in all banks:

- General civil passport of the Russian Federation (for military personnel - identity card).

- Military ID or registration certificate for citizens liable for military service (men under 27 years old).

- Confirmation of marital status and presence of minor children.

- Documentation for real estate purchased with a mortgage. A more detailed list is available at this link.

- A valid mortgage agreement or bank statement with all the information about when the agreement was concluded, for what amount, under what conditions, and how the debt was repaid. RSHB is also interested in the size of the residual parameters (term and size of the loan). The statement is valid for a month.

After repayment of the borrower's debt by Rosselkhozbank, the client must provide confirmation of this fact from the lender. 30 days are allocated for this.

The client is given 45 days to re-register the collateral (collateral or right of claim) in favor of the Russian Agricultural Bank.

How to pay off your mortgage early?

Mortgage is a way to ensure the fulfillment of loan obligations by pledging real estate. The credit institution issues funds to the borrower in the amount established by the agreement and approves the payment schedule for it. The state registrar records collateral obligations. The right of ownership becomes limited based on the contract.

This agreement is long-term. The payment schedule can reach 20-25 years. In most cases, it is possible to pay off your mortgage debt faster. This is facilitated by improving the financial situation of the debtor, receiving subsidies and government support (for example, maternity capital).

Registration of early repayment

The system for writing off funds is approved by the mortgage lending agreement. This means that when funds are written off at a credit institution, the account is not reset to zero, but the amount established by the agreement is withdrawn. For the correct and intended use of the deposited increased amount, you must come to the Bank’s office and write a statement in the established form.

This service is provided remotely in your personal account or mobile application. There is an electronic document flow with the lender. The bank, based on the client’s order, writes off the increased amount at a time, and if it is not enough to fully repay the debt, the debt obligations are recalculated with a decrease in the monthly debt load or a change in the loan term.

If the client decides to personally visit the bank office, then a new payment schedule will be generated by the system and handed to the client in printed form. When using the remote method, the client will see changes in the payment schedule in his personal account.

The second way to repay a mortgage loan early is to apply for loan refinancing to another organization. The amount of money given to the client covers all costs associated with closing the mortgage in one payment. In this case, collateral obligations are terminated if, during refinancing, not targeted, but consumer lending is issued to the borrower.

Who benefits from early mortgage repayment?

First of all, the benefit is obvious to the borrower. Reducing the deadline for fulfilling the obligation will allow you to save on annual charges. In addition, if additional amounts are paid at the beginning of the contract, they will be used to reduce the principal debt. In the first months of lending, the borrower is forced to pay off interest on the loan to a greater extent than the debt itself. Subsequently, the amount of interest will be significantly lower due to the fact that it was possible to reduce the size of the principal debt. Unfortunately, you will not be able to change the key rate.

For the creditor, the benefit is that he is calm about his investments and saves resources on collecting funds through the judicial system with the subsequent sale of property by the bailiff service.

Using maternity capital for early repayment of a mortgage

Maternity capital is a certificate that is issued to citizens of the Russian Federation upon the birth of a second child. This subsidy does not have a clear monetary implementation. A mother who applies for such state support receives an appropriate certificate; it can be used to pay for education, perform expensive medical procedures, or to improve the living conditions of children.

The last paragraph allows parents to use funds from maternity capital to pay off mortgage obligations early. The owner of the certificate must come to the branch of the Pension Fund of the Russian Federation and submit an application for the transfer of funds from the account on which the maternity capital is located in favor of the credit institution where the mortgage is opened. The debtor will need to go through a number of formal procedures, in particular, to draw up an obligation to redistribute shares in the property in the name of the children and spouse, but in the end, the transferred funds will significantly reduce the debt burden of the parents.

Early repayment of a mortgage always makes life easier for a person. The bank builds its activities on a commercial basis and strives to make money. When the loan term is shortened, the bank's earnings per person decreases.

Restructuring with state support

The economic crisis that occurred in 2014-2015 significantly reduced the solvency of citizens. As a result, mortgage borrowers could no longer cope with their debt obligations. To improve the situation with problem debt, the state decided to provide citizens who were left in a difficult financial situation with support for repaying their housing loans. All conditions and requirements for such a program were specified in Resolution 373 of April 20, 2020.

Initially, this assistance was intended to be provided until the end of 2020; a little later, amendments were made to the resolution and the program began to operate until March 2020, and then the end of May of the same year. But in March 2020, the state announced that all funds for this project had been spent: the provision of support to problem borrowers was suspended.

In July 2020, the Government of the Russian Federation allocated new funds for the program, and already on August 11, an “amendment” law appeared on providing state support to borrowers who find themselves in a difficult financial situation - decree number 961. It meant writing off 20 or 30% with state money ( depending on the number of children) on the amount of the principal debt or transfer of a foreign currency mortgage to ruble.

Important! The program was suspended in December 2020 and remains inactive to this day.

Mortgage: how to get it on preferential terms and pay it off faster?

For many Russian families, a mortgage is the only way to purchase their own home. Having taken on debt obligations, you want to pay off the loan faster. There are several ways to quickly pay off your mortgage. In particular, you can try to collect a good down payment, find out about benefits and government support, taking advantage of all suitable programs, or use your income tax refund to pay off your mortgage.

Down payment when applying for a mortgage

Despite the fact that today banks offer various mortgage programs, including those without a down payment, the starting amount for purchasing real estate will reduce the debt burden and pay off the loan faster. Almost all preferential programs that allow you to buy an apartment with state support provide for a down payment of at least 20% of the amount paid. You can save a lot on overpayments if the down payment is less than the amount taken out for a mortgage.

Mortgages without a down payment are usually used by citizens whose purchased housing is of low cost or who additionally pledge other real estate of the borrower as collateral.

If desired, the mortgage loan can be repaid ahead of schedule: in whole or in part. Partially – that is, increase the amount of the next contribution. For this purpose, an application is drawn up, and the bank determines the terms and conditions of debt repayment.

Refund of income tax (NDFL) from a mortgage

The mortgage provides a refund of income tax to borrowers, provided that they have official income from their work activities. This situation, of course, helps improve the family budget.

When buying an apartment with a mortgage, a citizen has the right not only to a tax deduction in the amount of 13% of the cost of the apartment, but also to an additional deduction for mortgage interest. This applies to all types of mortgage loans: for housing under construction, when buying an apartment, for a plot of land for housing under construction, etc. If both spouses are the owners of the apartment, each of them can apply to the tax office for an income tax refund and receive a deduction. The maximum amount of real estate for which a tax deduction is calculated for each owner is 2 million rubles, and the maximum amount of an apartment with mortgage interest for a tax deduction is limited to 3 million rubles.

Benefits for young families

At the moment, the state program “Young Family” is in effect. The basis for participation in the program is: age under 35 years and non-compliance of living conditions with living standards. Young families can receive a subsidy and use it to pay off their mortgage. The amount of the family benefit reaches 35% of the cost of the apartment or house (if the living space meets the conditions of the state program).

Also, young families can take advantage of a mortgage with a preferential rate of 6% for the entire period of debt repayment. For residents of the Far East, the rate is set at 5% if the contract was concluded on March 1, 2019. The main condition for receiving a preferential loan is the birth of the 2nd and subsequent child during the period from January 1, 2020. Down payment - 20% of the cost of housing purchased on the primary market. The apartment must be purchased directly from the developer.

Maternal capital

As another state support program, the state provides maternity capital for families where a second child is born. Its size is 453,026 rubles. As you know, the certificate is sent only for certain purposes. It is important that the mortgage allows it to be used immediately after the birth of the child. According to the law, maternity capital can be divided into shares, and only one of them can be used for a loan.

In 2020, the law on state support for large families came into force. For the 3rd and subsequent children, they are given a one-time allowance in the amount of 450 thousand rubles, which can only be spent to pay off the mortgage issued for an apartment from the developer. The condition for receiving a preferential subsidy is the birth of a child from January 1, 2020. It is provided to either the father or mother of the child. Any family can receive compensation, regardless of their income and the age of the spouses. At the same time, you can use maternity capital to pay off the mortgage.

Social mortgage for low-income citizens

There is a mortgage for the poor.

Social loans are used by people living in:

- houses in disrepair;

- small premises;

- those standing in line to improve their living conditions;

- living with seriously ill and disabled people.

With the support of the state through a mortgage, they can purchase real estate below market value, receive a subsidy, or take out a loan with low interest.

Mortgage restructuring program

Mortgages help many citizens solve their housing problems. But due to emerging financial difficulties, it can be very difficult to pay off the debt. In order to improve the financial situation, a mortgage restructuring program was adopted, that is, a change in the terms of the loan.

Under the program, a credit institution can go:

- to reduce the interest rate and, accordingly, increase the debt repayment period;

- defer the main payment. In this case, only mortgage interest will need to be paid;

- according to the law of May 1, 2020, you can completely stop payments for up to 6 months, but this requires the consent of the bank;

- write off part of the debt if there is an overdue debt. Subject to payment by the borrower of some part of the overdue amount.

Reasons for restructuring a mortgage may be:

- dismissal from work, including due to illness;

- salary reduction;

- divorce, etc.

In any case, you should contact the bank with a request in time.

When setting the goal of getting a mortgage loan, you need to familiarize yourself with the lending conditions of different banks. After submitting the application, the organization will accept it for consideration and only then give an answer: to grant or refuse a mortgage. It is better to apply to several banks to find a suitable option and not waste time.

List of documents

One of the following mandatory conditions for obtaining a Military Mortgage at Rosselkhozbank is the presentation of a complete list of necessary documents. So, the main package will consist of the following items:

- application for a loan (you can also print the document here);

- passport of a citizen of the Russian Federation/other document replacing it, permitted by the rules of Rosselkhozbank;

- certificate of entry into the NIS register;

- documents for the purchased housing.

The type of document requested under the last point depends on the type of property being purchased. So, if the object of lending is an apartment in a new building, you will need to prepare the following papers:

- title documents of the developer;

- certificate of ownership/lease of land;

- document providing the basis for the emergence of such a right;

- an extract from the Unified State Register of Real Estate for the land plot (the validity period of such a certificate is no more than 1 month);

- permitting documentation for the construction of a house;

- project declaration;

- agreement on participation in shared construction.

If we are talking about purchasing real estate on the secondary market, you should collect and submit the following documentation to bank employees:

- certificate of ownership;

- the document that provides the basis for the emergence of such a right;

- extract from the Unified State Register (validity period is the same - 1 month);

- real estate assessment report (performed by appraisal companies: it is permissible to apply only to organizations authorized by Rosselkhozbank) - the document is valid for six months;

- extract from the house register (valid for 1 month).

If the borrower is officially married and personal money was paid as a down payment, the specified package will need to be supplemented with the notarized consent of the spouse to purchase real estate.

It is important to note that Rosselkhozbank has the right to change the list of requested documentation. This is stated on the official page of the company.

Rosselkhozbank military mortgage

| Currency | Amount ₽ | Bid % | Deadline until |

| Military mortgage | up to 2.485.825 | 9.50% | 20 years |

Conditions for military mortgage

Age: at least 22 years old. For participants of the NIS (Savings and Mortgage System of Housing for Military Personnel). Participation in the savings mortgage system for at least 3 years. Down payment: from 10%. Security: pledge of the purchased property. Positive decision period: 3 months.

Who can count on refinancing

Not every application submitted to Rosselkhozbank to refinance mortgages from other banks can be approved. Which applicants and under what conditions can count on a positive decision:

- Borrowers with a “clean” credit history who do not have large debts. The maximum debt period that the lender can allow is a delay of 1 month within the last 180 days. The bank does not welcome outright debtors.

- Mortgage agreements that were previously extended or restructured are not subject to refinancing.

- Housing loans issued for a period of no more than 7 years are accepted for consideration for refinancing.

- If there is no mortgage debt, the borrower can submit an application no earlier than six months after the date of signing the previous contract. If there was a debt, then an application for refinancing can be submitted no earlier than 1 year after the mortgage is issued.

- Housing loans that have at least 2 years left until final repayment are accepted for consideration.

Despite the described requirements, the bank makes an individual decision for each applicant.

Types of restructuring

Regarding the types of restructuring, there are not many of them. In most cases, restructuring involves prolonging the loan term. By increasing the loan term, the size of the monthly payment is reduced, therefore, the financial burden of the payer is reduced.

There are no problems with regular lending, but the same cannot be said about mortgages. A home loan involves lending for a period of 20 to 30 years. And most borrowers enter into contracts for a maximum period. In such a situation, it is impossible to extend the loan term and then it is necessary to look for other ways to solve the problem or ask for another type of restructuring.

Kinds:

- Reducing the interest rate. The method is extremely rarely used due to the organization’s reluctance to lose profits. A decrease in rate implies a decrease in income.

- Writing off fines and penalties. The method is also not often used in practice, mainly in the case of bankruptcy of an individual by court decision. The bank rarely writes off such debts on its own and only if there are good reasons.

- Credit holidays. A popular method that allows borrowers to solve financial difficulties without worrying about the need to pay off debts. The duration of the credit holiday cannot be more than 1 year, but, as a rule, it is up to 6 months. The essence of the holiday may lie in the fact that the subject is not completely exempt from paying the contribution, but simply pays the obligatory part of it - either interest or the principal of the loan.

- Currency change. Previously, all housing loans were issued in dollars or euros, but due to the instability of the national currency exchange rate, the owners of such loans simply cannot fulfill their obligations to creditors. Therefore, it is permissible to convert the loan amount into a ruble loan at the Central Bank exchange rate that was at the time the agreement was concluded. The method is used only in tandem with AHML and with the help of government support.

Not everyone knows, but renting out real estate can also be an option for the procedure. We remind you that the apartment or house is the creditor’s collateral for the entire term of the contract, so it is impossible to manipulate the property without his actions. But in some cases, it is permissible, with the permission of the bank, to rent out an apartment and pay monthly obligations using rental payments.

Step-by-step instruction

To change the terms of the loan you need:

- When you encounter the first difficulties in repaying your debt, contact the bank and explain the current situation.

- Promptly collect the required package of documents. It is better to immediately ask for help with documents at the first consultation.

- Write a statement requesting help in solving the problem with a clear and clear explanation of the reason.

- Keep a copy of the application that must be registered. Useful in legal proceedings and proving that the client wanted to resolve the conflict.

- Re-sign the contract and receive a new payment schedule.

- Fulfill obligations to the extent provided for in the new agreement.

How does the mortgage refinancing process work?

Before applying for refinancing, the borrower should evaluate the feasibility of this operation. Its goal is to issue current debt at a lower interest rate, and if the difference is small, then refinancing most often makes no sense. For example, Sberbank's mortgage conditions are generally better (from 8.6% per annum) than those offered by the Russian Agricultural Bank for refinancing.

The procedure for applying for on-lending at the Russian Agricultural Bank is not original. The borrower should contact the bank manager by phone (including an Internet call, which is very convenient) and receive detailed instructions. There is also a toll-free number available throughout the Russian Federation.

The preliminary application can be submitted online, but only the most general information of the applicant is entered into it: region of residence, last name, first name, patronymic, date of birth, contact information and the required amount. All other details will have to be clarified during a visit to the bank.

Then everything is as usual: filling out a paper application form at a bank branch and providing a package of documents. An application for mortgage refinancing at the Russian Agricultural Bank is considered no longer than five banking days. If approved, the refinanced loan is repaid by Rosselkhozbank.

Go to website

Features of mortgage loan restructuring at Rosselkhozbank

The main thing you need to know is that mortgage restructuring at Rosselkhozbank is a forced measure applied to the client, and not a popular service included in the list of financial services. In order for a financial organization to allow a citizen to restructure a debt, it is necessary to have good reasons for this. The main basis for the procedure is the client’s inability to fulfill his obligations to the extent provided for in the loan agreement. The justification for such insolvency must be an important reason, supported by documents.

Reasons that may be taken into account when considering restructuring a borrower's debt:

- Job loss. A person must register with the employment center and provide the company with a certificate from the center stating that he is officially unemployed.

- Own illness or illness of any family member. It will be necessary to provide medical certificates, as well as evidence that the subject is the breadwinner of the family. All receipts spent on medical care will be useful.

Perhaps these are the two main and most common reasons why a bank is ready to carry out the procedure.

In practice, Rosselkhozbank carries out restructuring not independently, but with the help of the Agency for Housing Mortgage Lending - AHML. The service can also be carried out upon initiation of legal proceedings, when by a court decision the creditor is obliged to change the terms of the loan agreement.

In any case, if your financial condition worsens and you are unable to pay your obligations this month, you need to contact the institution’s credit specialist and explain the current situation. You should never wait for money to appear or for something to change. In the first month of delay, the bank will calculate penalties and fines, as well as worsen the level of credit history. Such sanctions will entail an even greater deterioration of the situation, as well as the inability to solve the problem in an amicable manner in the future.

Regarding the procedure, it is carried out at the RSHB by performing the following steps:

- A special commission is convened at the bank to study the matter. Representatives of the commission carefully consider the situation, make a forecast about the possible financial condition of the client in the future and decide on the possibility of applying restructuring.

- The wishes of the borrower are listened to, and the borrower also calculates his ability to fulfill his obligations.

Based on the results of studying the case, several options for solving the problem can be made:

- Providing restructuring to the client based on re-signing the contract and changing the terms of the loan.

- Providing preferential holidays without re-signing the agreement. If the commission understands that financial problems are temporary and within a couple of months the person will be able to restore their previous solvency. For example, a person is in the hospital due to a fracture, flu, etc., and his sick leave payments are not enough to repay the loan. But, as soon as the subject recovers and returns to work, his level of financial well-being will improve.

- Refusal to change the terms of the contract. The option is the most difficult. In this case, the client has the right to appeal to the AHML or to the court, where they can competently help him.

The third option based on the results of the commission’s work is not possible so often. The lender is interested in ensuring that his client fulfills his obligations and the money goes into the account. In case of refusal, the subject may stop repaying the debt and the mortgage will become problematic.

But if the institution provides a refusal, then it is better to immediately apply to the AHML. It is authorized to provide assistance to those individuals who have taken out mortgage loans and found themselves in a difficult situation.