Is there a mortgage in Belarus?

Since 2008, the Law “On Mortgage” has been in force in Belarus, but about 5 years have passed from the moment of its adoption to the actual implementation in practice.

Now mortgages in Belarus are not as popular as in the Russian Federation, since banks offer high interest rates, and the level of income of the population remains low.

Also adding to the shortcomings is the poorly regulated procedure for dealing with mortgage obligations.

Thus, before changes to the Housing Code, which were adopted in 2013 in Belarus, banks did not have the right to seize the collateral from clients in case of non-payment of debt.

Instead, it was necessary to attract a guarantor, which was not always available to ordinary citizens.

Now in Belarus it is expected that the interest rate will be reduced to 5-10% compared to the current one, as well as the abandonment of the institution of guarantee in favor of the possibility of imposing harsh sanctions for persistent defaulters.

Video on the topic:

What is a mortgage and how to get one

A mortgage is a pledge of real estate (land plots, permanent buildings, etc.) and other property, which by law is equated to real estate.

With a mortgage, the debtor retains in his possession and use the real estate, which is pledged to the bank, and the creditor (bank), if the mortgage user does not fulfill his obligations, receives the right to return the money through the sale of the pledged property.

Mortgages in Belarus are regulated by the Law of the Republic of Belarus “On Mortgages”, which was adopted on May 14, 2008. Twice – in 2010 and 2013 – changes and additions were made to it.

According to the document (Article 22 of the Law), the bank insures the property that is taken out as a mortgage, for its own benefit or for the benefit of the borrower. The insurance period is the same as the validity period of the contract itself.

Mortgage of residential premises (Article 52-53 of the Law)

In Belarus, banks only take as collateral the residential premises of citizens that are their private property or the property of organizations.

To transfer housing on a mortgage, the borrower must obtain the written consent of his adult family members, former family members living in the apartment, as well as citizens to whom it was provided by testamentary refusal or under a lifelong maintenance agreement with dependents.

The mortgage agreement is concluded in writing and registered with the agency for state registration and land cadastre.

If the borrower becomes insolvent and cannot repay the money, the apartment is transferred to the bank with or without a court order. It is sold at auction for the highest amount offered.

How to get an apartment with a mortgage

A mortgage loan is a loan that is secured by the property for which it is being purchased.

A loan (for the construction (reconstruction) of an apartment, an individual residential building, as well as for the purchase of real estate) can be obtained by Belarusians with a permanent official income.

The bank will ask for the following documents for the mortgage - a passport and a certificate of income for 6 months.

If the borrower is married, a guarantee from the husband or wife will be required.

If the borrower turns out to be insufficiently solvent, the bank may include the income of the guarantors in his total income. They can be close relatives - husband or wife, parents, siblings of both spouses, children, grandchildren.

The loan amount will also depend on whether the borrower has other outstanding loans with this or another bank at the time of receiving the loan.

To obtain a loan for construction, the bank will ask for a certificate of the cost of the apartment.

Mortgages differ from other types of loans in that they have long repayment terms that reach 25 years. As a result, your monthly payments become smaller. Many people choose this type of lending to reduce the burden on the family budget.

A mortgage loan can be provided up to 75-80% of the total cost of the apartment. In some cases – up to 90% of its cost.

Interest rates in some banks depend on the refinancing rate of the National Bank of the Republic of Belarus (from April 19, the refinancing rate of the National Bank is 14% per annum).

In individual banks, the interest rate depends on the overnight rate, which is also set by the National Bank (from March 15 it is 18% per annum).

Mortgage loans are provided by all leading banks in the country.

Why mortgages in Belarus have not received proper development

Mortgage in Belarus as a way to solve the housing problem of citizens has not yet received its proper development. The main problem lies in the high interest rates on loans, as a result of which a large financial burden falls on borrowers.

According to experts, mortgages in Belarus may receive an impetus for development when interest rates drop to 5%, maximum 10%.

As for banks, they also do not have large resources to lend at low interest rates from their own funds.

In order to make housing with a mortgage more affordable for the population, it is necessary to reduce inflation (in 2020 it was 10.6%). And, no less important, increase the income of the population. All this is possible only if the overall economic situation in the country improves.

What mortgage programs are there?

Most often, mortgages for the purchase of housing in Belarus are taken out by those categories of the population that have certain benefits and the right to assistance from the state, since it is very difficult to save up on your own for a high down payment and pay unaffordable interest.

Read about what the down payment on a mortgage is like here.

Banks offer several programs that allow you to reduce interest rates and obtain a mortgage on more favorable terms.

For large families

Large families in Belarus are considered to be families that have 3 or more children.

If the state commission recognizes that such a family needs to improve their living conditions, then they can be provided with a mortgage with a reduction in the interest rate to 12% per annum.

The loan is issued for a maximum of 20 years.

Useful video:

For civil servants

For employees of government agencies or those equivalent to them, there is a list for improving housing conditions.

Belarus supports its employees by the fact that it can act as a guarantor for issuing a mortgage, but only as long as the person works in certain bodies.

The loan amount may also be increased with installment payments of up to 3 years.

To improve living conditions

Citizens of Belarus who are in line to improve their living conditions, after getting to the top of the list, have the right to obtain a mortgage on more favorable terms.

Banks offer interest rate reductions of 1-3% compared to those who are not registered.

Mortgage in small towns

To support regional development, a program has been developed to issue mortgages for the purchase of housing in small settlements on attractive terms.

A small settlement is a city or town with a population of no more than 20,000 people.

Banks offer lower interest rates than for the purchase of real estate in big cities, namely they reduce them by 2%.

Preferential offers

The country has special programs that are aimed at supporting certain categories of citizens in different situations. Let's look at them in more detail:

- For large families, loans are offered for 20 years, with an interest rate of 12% per annum. Monthly payments must be feasible for the family, i.e. be no more than 40% of the total income,

- For persons in public service, mortgages are provided at a bank rate reduced by 1-3 percentage points. At the same time, it is important that there is not a single delay in the CI,

- To improve housing conditions, the loan is provided at a fixed 16% per annum. Of course, in this case you need to register and go through the procedure of checking your living conditions and solvency,

- For the purchase of housing in sparsely populated areas, where the number of residents is no more than 20,000 people, the conditions are similar to those under the program above, but the rate is reduced by another 2 percentage points.

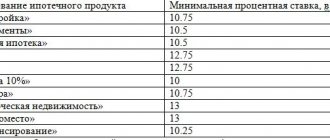

Which banks offer mortgages?

Many banks in Belarus are trying to attract potential clients to apply for a mortgage, so they are developing unique programs that may seem attractive compared to other offers.

Below we present to your attention a list of some banks that allow you to buy a home with a mortgage:

Belagroprombank - offers mortgages under various programs that include all types of real estate.

Thus, the program “Loan for construction by purchasing housing bonds in a certain residential complex” provides for the purchase of a share from the developer of the Novaya Sloboda residential complex at favorable interest rates - 22% per annum.

Other programs “Loan for the purchase of residential premises” and “Loan for the construction of residential premises” also provide interest at 22%, and for those in need of improving housing conditions, 13.5% per annum is established.

Priorbank has developed the “Friendly Family” and “Construction of Housing with Security” programs, which provide an interest rate of 23%.

Useful video:

BSP-Sberbank opens up wide opportunities for purchasing apartments in new buildings with the “Own Housing” and “Building a House” programs.

For the purchase of housing from developers Arqub-service and Pinskevrostroy, interest rates are 24.5%, and from Zhilstroykomplekt - 29% per annum.

Belarusbank makes it possible to use the profitable program “Loans for housing construction under the construction savings system” with interest reduced to 18%.

Social program

There is also a good point in the form of a social mortgage, which is issued at an interest rate of 5% per annum in Belarusian rubles. Certain categories of citizens will be able to take part in it, namely:

- pensioners,

- disabled people,

- those in need of improved housing conditions,

- young and large families.

To become participants in this program, you will need to document your need for new housing (this also applies to those living in dilapidated buildings).

The interest rate is calculated based on the current refinancing rate and is strictly linked to it. The size does not exceed 70-85% of the cost of the purchased housing, and the down payment is at least 20-30%.

Registration of a mortgage in Belarus

In order to obtain a mortgage, the client must provide the necessary package of documents, which includes a certificate of income for the last six months for the borrower and his guarantors.

An identification document is required, and other documents are determined by banks individually.

The application form along with the documents is submitted to the location of the bank branch, after which the borrower’s candidacy is carefully checked, and the liquidity of the collateral is assessed.

Banks often refuse to issue a loan due to low solvency and income level; previous credit history is also taken into account.

The conclusion and signing of a mortgage agreement is carried out at the bank in the personal presence of the borrower, as well as his guarantors, if they are involved.

The necessary information about the issuance of a mortgage is entered into the register, and if a loan is given to a client who has special benefits, then he is removed from the queue for improving housing conditions with an appropriate note.

Mortgage loans from Belarusian banks for the purchase of housing

Mortgages in Belarus can be obtained from different banks. Among them are Belarusbank, BelAgroPromBank, BPS-Sberbank, VTB Bank Belarus, BelGazpromBank, Priorbank.

Loan programs provide the opportunity to purchase an apartment on the market of new buildings or secondary housing, a private house, or a plot of land. Plus, there are housing loans for housing construction. The loan amount in almost all banks does not exceed 70-80% of the total cost of a residential property (sometimes it can be 95%). As a rule, mortgages are issued for 180 months, with a maximum of 240.

To select a bank and loan terms, you can use the loan calculator provided at the link https://benefit.by/kredit/real/.

Documents confirming solvency for the bank are a certificate of income of the borrower and guarantors for the last three to six months. The entire list of requested documents is determined by the specific bank.

The main requirements that determine a positive result of considering a loan application are a high level of income and a good credit history.

Mortgage lending at Belarusbank

Belarusbank has several real estate financing programs.

There are also programs using construction savings, which include 2 stages:

- accumulative – accumulation of one’s savings by opening a special deposit;

- credit.

The loan can be obtained 12 months after the end of the savings phase and subject to compliance with all terms of the agreement. Only one residential property can participate.

| Loan name | Bid | Maximum amount* | Term |

| For construction | From 11% | Up to 90% of the value of the property | Up to 20 years |

| For housing construction using the construction savings system | 12 % | Up to 75% of the cost of housing construction | 20 years |

| Preferential loan according to Decree No. 75 (for settlements with a population of less than 20 thousand people) | 3 % | Up to 90% of all costs | Up to 10 years |

| For the purchase of housing using the construction savings system | 12 % | Up to 75% of the cost of purchasing housing | Up to 20 years |

| To purchase housing | From 11% | Up to 90% of the cost of the object | Up to 20 years |

| Preferential loan under Decree No. 13 (assistance to young and large families) | 1 % | Up to 95% of the property value | Up to 20 years |

| For those in need of improved living conditions | From 5.5% | Up to 75% of construction costs for borrowers, Up to 95% for large families. | Up to 20 years |

| For the construction (reconstruction) of residential premises using a subsidy for its repayment | 14 % | Up to 90% of the value of the property | Up to 20 years |

*taking into account the solvency of the borrower and guarantors

A distinctive feature of some programs is the repayment of the principal debt on the loan, starting from the month following the expiration of one and a half years from the date of conclusion of the loan agreement, or the commissioning of the house.

How to expand living space with a mortgage

Ways to expand living space with a mortgage:

- If you have a sufficient level of income, take out a mortgage loan for a second apartment with a larger area.

- Pay off the existing mortgage loan, remove the encumbrance from the apartment, sell it and buy a new apartment with a new mortgage.

- Find a buyer and contact the bank for permission to sell the apartment. The bank will reissue the existing loan to the buyer, and the buyer will pay off the mortgage and remove the encumbrance.

The first two options require the availability of sufficient funds. The latter is the most time-consuming, since not every buyer will agree to take out a mortgage on an apartment, but this is the most realistic way to expand living space in the absence of funds.

Mortgage for the construction of a private house in Belarus

A mortgage for the construction of a house is one of the opportunities for citizens of Belarus to become owners of their own home in a fairly short period of time. Basically, all banks offer approximately similar lending conditions:

- Rate from 11 to 37% per annum.

- Attracting guarantors as security.

- Lending period – no more than 20 years;

- Down payment from 10 to 30%.

Advantages and disadvantages

The underdeveloped procedure for issuing mortgage loans makes it difficult for many citizens of Belarus to purchase their own home.

The advantages and disadvantages of mortgages in Belarus are presented in the table:

| Advantages | Flaws |

| Banks have stopped using guarantors and now obtaining a mortgage has become more accessible. | High interest rates. |

| You can buy a home right away, rather than saving for it for many years. | For many years, the client becomes dependent on the bank and payment of loan debt. |

| A more crowded market for new buildings makes it possible to purchase the highest quality housing. | Low level of offers in the banking sector due to lack of widespread practice. |

| — | A high minimum down payment that few can afford. |

| — | The loan term is quite short compared to other countries. |

Thus, we see that obtaining a mortgage in Belarus is quite an expensive pleasure, which not everyone can afford.

Registration of mortgages by foreign citizens

The algorithm for obtaining a loan is exactly the same as for citizens of the Russian Federation. To begin, the client must collect an initial package of documents and submit an application for consideration. Rosbank House has implemented the ability to contact the bank via the Internet. For this purpose, a special service “Rosbank Dom” has been developed, with its help it is easy to send certificates for verification. A preliminary decision on an online application is received in 5-10 minutes.

If the application is approved, the borrower signs up for the transaction, visits the office at the appointed time and can then begin searching for real estate. The entire registration process is accompanied by managers who will provide professional assistance. They will help you collect documents, indicate the requirements for the property, select the optimal insurance program, organize an assessment, etc. If you are still thinking about which bank to contact, consider the offer of Rosbank Dom. He works with foreign citizens and offers attractive conditions for obtaining a mortgage.

Reviews

Oksana, 29 years old : “My husband works in a government agency, and therefore we have been registered for several years to get our own housing. Recently the opportunity became available to take out a mortgage to purchase an apartment with government support. We monitored the interest rates and decided that we could afford it. As it turns out, you can invest in a new building, especially since the developer cooperates with the bank to get an even bigger discount. Now we are waiting for our apartment to be ready so we can move in.”

Dmitry, 34 years old : “My wife is already pregnant with her third child, so the issue of expanding the living space has become especially acute. After giving birth, we plan to take advantage of the program for large families, and are also thinking about moving to a small town, because apartments there are cheaper and interest rates on loans are more profitable. We will register at Priorbank, which is located closest to us, plus I receive a salary there, so I hope for an additional discount.”

The legislative framework

According to the law, no one prohibits banks from issuing mortgages in the absence of Russian citizenship. But credit institutions are in no hurry to contact foreigners because of the risk of receiving another problem debt. There are many cases where, after obtaining a loan, a non-resident returned to his country and never appeared in Russia again.

If a financial institution provides a loan to a Belarusian or a citizen of another country, it is subject to more stringent requirements. For example, the borrower must be a tax resident, have a residence permit, and an official job (this point follows from the first). You are also required to confirm your experience and make an initial payment.

In any case, when asked whether a Belarusian can take out a loan in Russia, credit market experts and bank employees answer in the affirmative. The main thing is at the registration stage to prove to the financial institution the reliability and guarantees that the client has many things that keep him in the Russian Federation (for example, work, relatives). But it is worth considering that the requirements and list of documents required for registration for citizens of other countries in different credit institutions differs.

Mortgage in Russia with a residence permit

If a Belarusian who applies for a loan has a residence permit, his chances of getting a mortgage increase. Almost all banking institutions require confirmation of residence permit status. It implies that the foreign citizen has registered with the authorized bodies and has been living in the country for some time. Without a residence permit and permanent income received on the territory of the Russian Federation, you cannot count on a mortgage. Banks work only with those clients who have lived in its territory for more than 183 days and paid all taxes.

A number of commercial organizations still take risks and work with non-residents. In such a situation, the client will have to collect an impressive package of papers and hand it over to a banking institution for examination. In addition, you have to pay at least 50% of the cost of housing.

The rules discussed above are typical not only for Belarusians, but also for residents of other states - Ukrainians, Kazakhs and representatives of other countries.

Requirements

If we consider the loans available to Belarusians and other foreign citizens, mortgages come first. This is easy to explain, because according to the terms of the agreement concluded between the lender and the borrower, real estate plays the role of collateral. Therefore, if the loan is overdue, the lender has the right to take the apartment and sell it at auction to cover costs. Moreover, most often the purchase of real estate is available within the city where the banking institution operates. This means that a Belarusian, Ukrainian or representative of another country will not be able to obtain a loan, for example, in Moscow, but will not be able to buy real estate in St. Petersburg.

Let's consider the requirements that apply to citizens of Belarus and other countries:

- Official employment. This condition is mandatory and in the absence of work, banks do not cooperate. At the same time, the time of employment in the last place is six months or more.

- Registration in the Russian Federation (permanent or temporary). In the second case, the procedure takes longer, but some banks cooperate.

- Lack of existing loans.

- An official salary that is sufficient to meet the obligations of a mortgage loan.

- Residence permit or dual citizenship. As noted above, this is not a mandatory requirement, but having a residence permit increases your chances of getting a mortgage.

- Additional collateral. When taking out a mortgage loan, the property being purchased is used as collateral. Some banks require additional collateral, for example, a car. In such a situation, credit institutions offer more profitable programs.

- Age from 21 to 65 years.

Otherwise, the requirements for Belarusians when applying for a loan are identical to those put forward for Russian citizens. Interest increases due to citizenship of another country are not provided. It is worth considering that the bank checks the availability of other property (real estate, cars, etc.), which is also taken into account when making a decision.

What's the result? A foreign citizen has the right to expect to receive a mortgage in Russia. But this does not mean that banks are happy with such clients. The likelihood of refusal is high due to the increased risk for lenders. If the banking institution has analyzed the borrower and is convinced of his reliability, the loan is issued without problems.