For many years, the Russian government has been developing new and improving existing social support programs for employees of various industries in the field of housing lending. One example of a long-standing and successfully implemented project is a military mortgage for the Ministry of Emergency Situations, which includes fire department workers. The implementation takes place with the support and partnership with the largest credit institutions in the country. In the article we will analyze the legislative acts underlying the program and the procedure for obtaining a military mortgage for employees of the Ministry of Emergency Situations in 2020.

Legislation

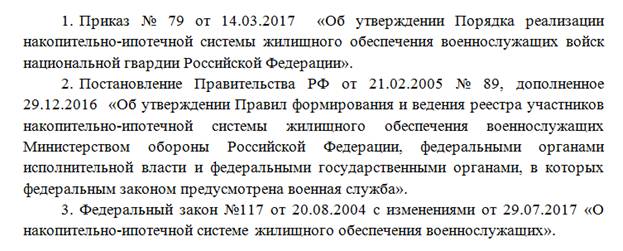

To date, at the federal level (i.e., valid throughout the country), three main legislative acts have been adopted in the field of military mortgages:

Subjects of the federation, in addition to basic laws, can adopt their own rules in this area, which will apply in the territory of only one region. Implementation will take place at the expense of the local budget.

All these legislative acts establish the rights of employees, the conditions and parameters of a military mortgage, including for employees of the Ministry of Emergency Situations in 2020.

Mortgage from Rosselkhozbank

The Main Agrarian Bank actively lends to public sector employees. The following conditions have been approved for this category of borrowers:

- rate 10.5-11.7% per annum;

- without personal insurance +1% to the base rate;

- loan term 30 years;

- mandatory advance 15%;

- the maximum limit is 60 million rubles.

Persons aged 21-75 years with at least six months of experience can get a mortgage from Rosselkhozbank. It is possible to attract up to three co-borrowers.

Advantages of the product: the client chooses a repayment scheme, it is possible to pay the advance with maternity capital.

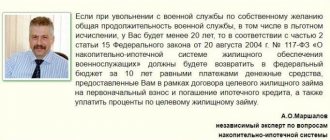

Procedure for obtaining NIS

NIS stands for “savings mortgage system”. It is used to help military personnel and employees of the Ministry of Emergency Situations in purchasing their own housing.

Important! Joining the savings system is voluntary for some employees and automatic for others. It depends on the rank, place of service and position held. The amount of annual contributions from the budget also depends on these criteria.

A very important and useful point for employees of the Ministry of Emergency Situations is that whether relatives or the employee himself have his own or official housing does not affect participation in the NIS. Mortgages are issued by partner banks of the department. This product has a reduced price and more favorable conditions.

The operating principle of the system is as follows:

- The serviceman becomes a participant in the savings program. Depending on the position and rank, this will require either drawing up a report addressed to management, or joining occurs automatically.

- A special account is opened in his name, to which monthly deductions are made from the budget in the amount established by law.

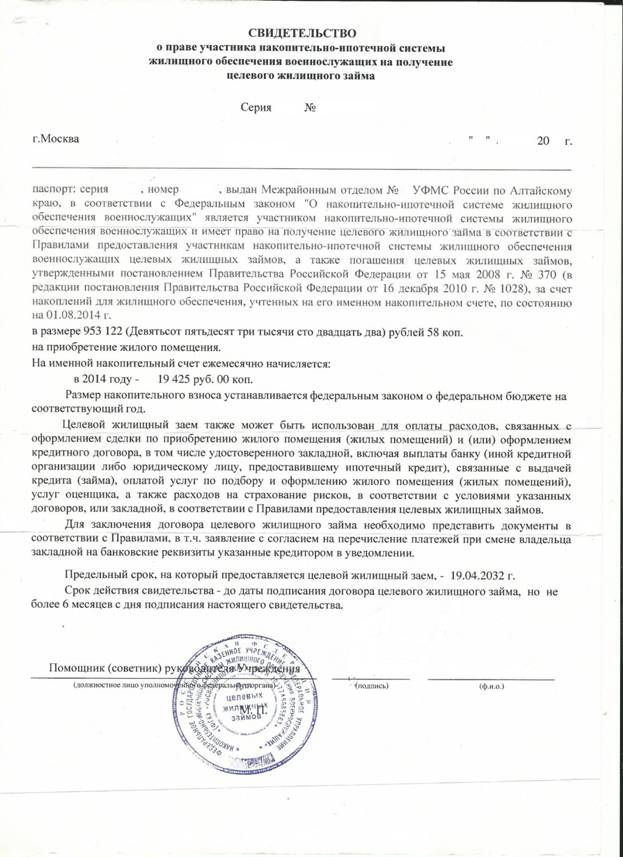

- After three years, the employee is issued a NIS participant certificate.

- This document gives the right to purchase an apartment on the secondary or primary market, a house with a plot of land, with a mortgage. The accumulated funds are used as a down payment on a military mortgage.

The debt is also paid off through savings. The state continues to replenish the employee’s personal account until his dismissal.

Participation in the program does not limit the geography of possible purchases. An employee of the Ministry of Emergency Situations can buy a property located in any of the federal subjects with a mortgage, both on the secondary market and in new buildings. There is no connection to the place of service or registration. The minimum term of participation is three years. The employee has the right to participate in the program for as long as he needs.

What documents will be needed

To become a participant in the mortgage savings system, an employee of the Ministry of Emergency Situations must provide a report on inclusion in the program. To assign him a personal participant number, you will also need a copy of your passport and contract. After the end of the three-year period, a participant certificate is issued.

Attention! Download a sample form of a report on inclusion in the NIS here.

Mortgage from Gazprombank

Funds for the purchase of housing on the secondary and primary real estate markets in this institution are provided under the following conditions:

- rate 10.5% per annum;

- if you refuse personal insurance, the rate increases by 1%;

- the debt repayment period is 30 years;

- mandatory advance 10%;

- the maximum limit is 60 million rubles.

Gazprombank issues loans to persons aged 20-65 years. Their total experience must be at least 12 months. At the last place of work, the client was employed for at least six months. Advantages: the borrower independently chooses the repayment scheme (annuity or standard), low down payment.

The procedure for obtaining a mortgage for employees of the Ministry of Emergency Situations

The full cycle of purchasing an apartment using borrowed funds using NIS savings consists of the following stages:

- Entry of an employee of the Ministry of Emergency Situations into the program by drawing up a written application addressed to the manager.

- Including an employee in the register and assigning him a personal participant number.

- Waiting for the end of the three-year period.

- Obtaining a NIS participant certificate.

- Choosing a bank and apartment.

- Concluding a mortgage agreement, a preliminary contract for the purchase and sale of real estate, issuing an insurance policy.

- Transfer of documents to Rosvoenipoteka - a state body that monitors savings and makes payments.

- Verification of documents and conclusion of the main agreement for the purchase of an apartment.

- Final settlements with the seller.

What documents will be required

To complete a mortgage transaction, an employee of the Ministry of Emergency Situations will need:

- Application form for obtaining a loan. On our portal you can download forms for filling out an application for Sberbank and VTB.

- Certificate of the right to receive a targeted housing loan.

- Documents for the purchased apartment. A detailed list of them is here.

Mortgage from FC Otkritie

Employees of the Ministry of Emergency Situations can apply for a loan for the purchase of finished housing in this bank on the following conditions:

- standard rate 9.8-10.2% per annum;

- for salary clients – 10% per annum;

- debt repayment period is 30 years;

- mandatory advance 15%;

- limit up to 30 million rubles.

Individuals aged 18-65 years, with a total experience of 12 months, can take advantage of the Otkritie Financial Corporation offer.

Advantages of the loan: you can pay the down payment using maternity capital; minimum age limit for a borrower.

Where to apply for a mortgage for an employee of the Ministry of Emergency Situations in 2020

Many employees of the Ministry of Emergency Situations are interested in the question of whether there are credit organizations in which the terms of military mortgages are significantly lower than market ones. Until recently, the answer to this question was rather negative. All NIS partner banks offered approximately the same lending conditions, differing very slightly from the market average. However, on the 20th of April 2020, an interview with the deputy head of the Ministry of Emergency Situations A. Chupriyan was published. According to him, a partnership agreement has been concluded with the two largest credit institutions - VTB and Sberbank. Military mortgages for the Ministry of Emergency Situations will soon become more profitable and affordable.

New conditions were not announced in the official statement. It has not yet been possible to obtain specific information from banks' hotlines. Products are in the development and launch stages. Follow our feed to be the first to know about their appearance in the line of these banks.

We described the parameters currently in effect in these banks earlier. Let's remember the key points.

Sberbank conditions

The following conditions currently apply:

- It is possible to purchase an apartment both in a new building and on the secondary market.

- Fixed loan fee – 8.8% per annum.

- The maximum financing period is up to 20 years.

- The maximum loan amount is RUB 2,629,000.

- Down payment – 15%.

- It is mandatory to purchase a property insurance policy.

VTB terms

Now employees of the Ministry of Emergency Situations can get a mortgage according to the following parameters:

- The property is purchased in a new building or on the secondary market.

- The interest rate for the entire term is 8.8%. If the borrower ceases to be a participant in the savings system, the fee will remain the same.

- The duration of the financing agreement is up to 25 years. At the same time, at the time of its completion, the borrower must be no more than 50 years old.

- The maximum you can get is RUB 2,840,000.

- 15% - down payment.

Monthly loan installments are paid by NIS as long as the borrower continues to serve. After dismissal, this responsibility passes to him.

The conditions of the two banks are practically no different from each other. However, other credit organizations also participate in the program.

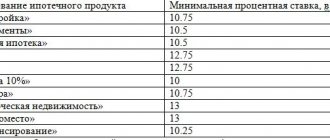

Pivot table

The table will help you compare the current conditions in banks participating in the military mortgage program.

| Bank | Bid, % | Amount, thousand rubles | PV, % |

| DOM.RF | 7,5 | 3252 | 20 |

| VTB | 8,5 | 2990 | 15 |

| Gazprombank | 8,1 | 3050 | 20 |

| Bank Zenit | 9,1 | 3800 | 20 |

| RNKB | 8,65 | 2964 | 10 |

| RosselkhozBank | 9 | 2700 | 10 |

| Sberbank | 8,4 | 2788 | 15 |

| Absolut Bank | 9,95 | 2656 | 20 |

| Bank "Saint-Petersburg | 10 | 2800 | 15 |

| Promsvyazbank | 7,8 | 3173 | 20 |

The maximum possible loan amount in all banks differs slightly and is within the limit of 2,800,000 rubles. This amount was not chosen by chance. It is calculated based on the state’s ability to pay monthly contributions to the NIS, which, in turn, are used to pay off the mortgage.

Some credit organizations, such as Absolut, Uralsib and Zenit, give borrowers the opportunity to increase the maximum loan size. In this case, the serviceman must pay part of the monthly payments independently from his own savings. As a rule, the share of personal funds in the payment cannot exceed 25-30%.

Mortgage from Tinkoff Bank

Apartments in new buildings have an improved layout, and the cost of 1 sq. m. is significantly lower compared to finished real estate. For the purchase of new housing, Tinkoff Bank issues a mortgage on the following conditions:

- interest rate 6-11.25% per annum;

- if you refuse personal insurance, the rate increases by 2%;

- the client is given 25 years to repay the debt;

- mandatory advance – 15%;

- It is possible to issue up to 100 million rubles.

Individuals aged 20-64 years can apply for a loan from Tinkoff. At the last place of work, the length of service is at least three months, and the total length of service is at least one year.

The main advantage of a mortgage from this bank is that maternity capital can be used to pay the down payment. It is not necessary to document your income.

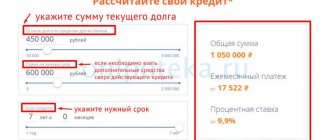

MOE Mortgage Calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

Our calculator will allow you to calculate the amount of financing required to purchase the selected property, the amount required for the down payment, and the amount of monthly payments depending on the term and rate.

Mortgage from Sberbank

This bank issues the largest number of housing loans. The institution is a participant in preferential government programs, so its clients have the opportunity to get a mortgage at a minimum interest rate. The following conditions apply to new buildings:

- the interest rate for salary clients is 10.5-10.7% per annum;

- standard rate 10.8-11% per annum;

- if the personal insurance policy is not paid, the rate increases by 1%;

- debt repayment period is 30 years;

- advance from 15%;

- maximum amount is 100 million rubles.

The loan is issued to citizens aged 21-75 years, whose total length of service is 12 months. At the last place of work - from six months. If a client receives a salary from Sberbank, then the restriction on total length of service does not apply to him.

Advantages of the program: low interest rate, borrower age up to 75 years.