A mortgage is the provision of funds by a bank secured by real estate.

The state supports people and strives to provide mortgages to more people, therefore it reduces the rate for certain categories of citizens. Thus, the state provides support and creates various programs.

One of these is mortgages for young professionals.

Conditions of the “Social Mortgage” until 2018

Let us immediately note that each region and constituent entity of the Russian Federation has its own social housing lending programs, and imposes certain requirements on citizens who want to take advantage of this program. It is for this reason that the conditions in force in your city need to be clarified with the Administration.

What types of government assistance are there:

- Partial subsidization of mortgage interest rates. In other words, the bank assigns you one rate, and the state reduces it by a certain amount. Thus, you reduce your expenses, monthly payment and final overpayment. It is noteworthy that this form of support can be implemented both through government subsidies and through special offers from the bank itself,

- Subsidy for payment of the down payment or part of the cost of the purchased property. In this case, you receive funds that partially cover your debt. On average, it ranges from 30 to 40% of the estimated cost of housing, the exact amount will depend on the number of family members and the cost of one square in your region,

- Sale of real estate from social housing stock. In this case, the price will be preferential, i.e. much lower than market value. Most often it is offered to employees of various government agencies.

It is noteworthy that you cannot choose which form of support you want to receive. The decision in this situation is made by local authorities, who individually select the most optimal solution for each application.

Offers from commercial banks

What to do if you are denied a loan? You can try applying to a commercial bank. You should contact several financial institutions. The classic lending program has its positive aspects. You can choose housing from a new complex or on the secondary market. Clients can attract a co-borrower or maternity capital. During promotional periods, banks often offer preferential interest rates. A state employee does not need to stand in line for a long time for real estate.

There are also negative aspects of taking out a loan. The bank will not be able to issue a significant amount if the client receives little income. For example, if the official salary of a teacher is about forty thousand rubles, the mortgage amount will not exceed one million eight hundred thousand rubles.

The bank will set the loan term to fifteen years. The teacher also needs to prepare a sufficient amount of savings for the down payment.

How to participate in the program?

Social mortgages are available to almost all employees of the public sector, state and municipal organizations. The participants here are:

- workers in the public sector - teachers, professors, graduate students, researchers,

- young and large families,

- low-income citizens, i.e. those who live in conditions that do not meet sanitary standards or whose area is less than 14 square meters per person,

- people living in emergency housing, etc.

In order to take advantage of this offer, you must have Russian citizenship, registration on its territory, a permanent income and official employment. In addition, you must be registered as a family in need of improved housing conditions (you need to contact the local Administration of your city district at your place of residence).

Can I, as a young specialist (teacher), get an apartment or a preferential mortgage for the purchase of housing?

You can submit an Application (2 copies) to the housing department of the City Administration, the main thing is that your copy is stamped with a seal, entry. No. and signature, if they refuse to accept it, then send it by registered mail with notification and inventory, perhaps you will be put on a waiting list for free social housing.

Article 51 of the Housing Code of the Russian Federation. Grounds for recognizing citizens in need of residential premises provided under social tenancy agreements 1. Citizens in need of residential premises provided under social tenancy agreements are recognized (hereinafter referred to as those in need of residential premises): 1) who are not tenants of residential premises under social tenancy agreements or family members of the tenant of residential premises under a social tenancy agreement or owners of residential premises or family members of the owner of residential premises; 2) who are tenants of residential premises under social tenancy agreements or family members of a tenant of residential premises under a social tenancy agreement, or owners of residential premises or family members of the owner of residential premises and provided with a total area of residential premises per family member less than the accounting norm; 3) living in premises that do not meet the requirements established for residential premises; 4) who are tenants of residential premises under social tenancy agreements, family members of a tenant of residential premises under a social tenancy agreement or owners of residential premises, family members of the owner of residential premises living in an apartment occupied by several families, if the family includes a patient suffering from a severe form of chronic a disease in which living together with him in the same apartment is impossible, and who do not have other residential premises occupied under a social tenancy agreement or owned by right of ownership. The list of relevant diseases is established by the federal executive body authorized by the Government of the Russian Federation. 2. If a citizen and (or) members of his family have several residential premises occupied under social tenancy agreements and (or) owned by them by right of ownership, the level of provision with the total area of the residential premises is determined based on the total total area of all these residential premises. Article 52 of the Housing Code of the Russian Federation. Registration of citizens as those in need of residential premises 1. Residential premises under social tenancy agreements are provided to citizens who are registered as those in need of residential premises, except for the cases established by this Code. 2. The categories of citizens specified in Article 49 of this Code who may be recognized as needing residential premises have the right to be registered as those in need of residential premises. If a citizen has the right to be registered on several grounds (as a low-income citizen and as belonging to a category defined by federal law, a decree of the President of the Russian Federation or the law of a constituent entity of the Russian Federation), at his choice such a citizen can be registered on one of these grounds or for all reasons. 3. Registration of citizens as those in need of residential premises is carried out by a local government body (hereinafter referred to as the body carrying out registration) on the basis of applications from these citizens (hereinafter referred to as applications for registration) submitted by them to the specified body at their place of residence or through a multifunctional center in accordance with the interaction agreement concluded by them in accordance with the procedure established by the Government of the Russian Federation. In cases and in the manner established by law, citizens can submit applications for registration at a location other than their place of residence. The registration of incapacitated citizens is carried out on the basis of applications for registration submitted by their legal representatives. 4. With applications for registration, documents must be submitted confirming the right of the relevant citizens to be registered as those in need of residential premises, except for documents received upon interdepartmental requests by the body carrying out registration. The citizen who has submitted an application for registration is issued a receipt from the applicant for these documents, indicating their list and the date of their receipt by the body carrying out the registration, as well as indicating the list of documents that will be received upon interdepartmental requests. The body carrying out registration independently requests documents (their copies or the information contained in them) necessary for the registration of a citizen from state authorities, local government bodies and organizations subordinate to state bodies or local government bodies, which have the data at their disposal. documents (their copies or information contained in them) in accordance with regulatory legal acts of the Russian Federation, regulatory legal acts of constituent entities of the Russian Federation, municipal legal acts, if such documents were not submitted by the applicant on his own initiative. In case of submission of documents through a multifunctional center, a receipt is issued by the specified multifunctional center. 5. The decision on registration or refusal to register must be made based on the results of consideration of the application for registration and other documents submitted or received upon interdepartmental requests in accordance with Part 4 of this article by the body carrying out registration, no later than than thirty working days from the date of submission of documents, the obligation to submit which is assigned to the applicant, to this body. If a citizen submits an application for registration through a multifunctional center, the period for making a decision on registration or refusal to register is calculated from the day the multifunctional center transmits such an application to the body carrying out registration. 6. The body carrying out registration, including through a multifunctional center, no later than three working days from the date of the decision on registration, issues or sends to the citizen who submitted the corresponding application for registration a document confirming the adoption of such a decision . If a citizen submits an application for registration through a multifunctional center, a document confirming the decision is sent to the multifunctional center, unless another method of receipt is specified by the applicant. 7. The procedure for keeping records of citizens as those in need of residential premises by a local government body is established by the law of the relevant constituent entity of the Russian Federation.

Program for the Moscow region

The purpose of this mortgage offer is to attract young professionals to the Moscow region, as well as their support and assistance in resolving the housing issue. The state provides certain categories of citizens with monetary compensation:

- 50% of the cost of housing in the form of a down payment on a loan - paid in a lump sum,

- another 50% is paid over 10 years in the form of monthly installments under the mortgage agreement.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

It turns out that the borrower pays only the interest accrued on the loan amount, while the first installment and the principal amount of the debt are paid by the state. The size of the subsidy will depend on the number of family members, as well as on the size of 1 sq.m. in the city where the specialist lives.

Advantageous mortgage offers from Sberbank of Russia ⇒

What should be done:

- Contact the relevant ministry of the Moscow region (education, or healthcare, or social development, or investment and innovation), which depends on the borrower’s field of professional activity.

- Submit an application for participation in the program and the package of documents established by the ministry. The list can be viewed on the official website at the link sotsipotekamo.rf

- After the documents have been accepted and reviewed, you will receive a written notification about the opportunity to participate. If approved, through partner banks DOM.RF (formerly AHML), you will be able to obtain a mortgage loan for primary (at 9.9%) or secondary housing (at 10.25%) on the most favorable terms for 10 years. After this, you will be able to get a mortgage from Primsotsbank.

You might also be interested in these articles:

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

What salary is needed to get a mortgage at Sberbank ⇒

Please note that this preferential mortgage for public sector employees applies to both existing teachers living in the Moscow region and those specialists who are just ready to move there. You can find out more on the portal dom.rf or on the website of the Department of City Property of the City of Moscow

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

Real estate requirements put forward by banks

With a preferential mortgage provided for young teachers, you can purchase any type of real estate. Some banks may consider the option of purchasing housing from the financial institution's database, which includes real estate seized from borrowers who do not fulfill their obligations. If you want to buy an apartment in a new building, you must initially contact the bank to obtain a database that reflects accredited developers. In its absence, the banking organization will not allocate money for a mortgage for the purchase of real estate.

An apartment in secondary housing will also be assessed in terms of characteristics and parameters before considering a loan application. It must be liquid, located in a multi-storey building and not have undocumented redevelopments. The requirements for the living space are that it must be located separately from the kitchen, toilet and bath. Equipment with all types of communications is required. Loan applications for the purchase of real estate in the private sector and apartments located in buildings in disrepair, built before 1957, and in the presence of wooden floors are not considered.

Application approval criteria

Issuing large sums involves certain risks. Therefore, a mortgage loan can only be issued if the candidate meets the requirements for the level of solvency. The purchased property was also subjected to a thorough check.

According to the law, monthly loan payments should not exceed 45% of income. As is known, the level of wages in the educational sector is not high enough. Therefore, the solution to this issue was to attract co-borrowers or guarantors. For example, when applying for a loan to a married couple, the total income of both partners is of great importance. In this case, the loan obligations are divided equally.

An important fact for receiving a positive response from the bank is the absence of problems with repayment of previous loans. All types of loans for any purpose are taken into account. There is no statute of limitations here. Therefore, you should be careful about contractual obligations with financial institutions.

The condition for participation in the state mortgage program for teachers at Sberbank was that the applicant did not own housing suitable for living. According to the standards set by the authorities, the size should not exceed 18 square meters per person.

Mortgages for teachers (educators) and their main features

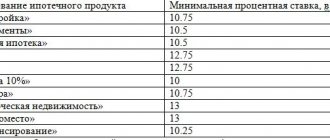

Several years ago, Sberbank developed several special lending programs aimed at improving the conditions for the purchase of housing for teachers, for example, “Teacher's House”, “Young Teacher” and others. Teachers received loans on a general basis. Certain benefits were added to them. They became possible due to the support of teachers by government agencies. Here are some of them:

- Down payment amount

. For conventional mortgage programs it is 20% of the cost of housing. Up to half of this amount was covered by the state through subsidies. - Monthly payment amount

. It is limited by law to 45% of wages. - Raising additional funds

. With low monthly incomes, it is difficult to pay a mortgage, so the program provided for the possibility of attracting co-borrowers or guarantors. - Reducing the interest rate

. The law of the Russian Federation provides for a fixed mortgage rate for teachers of 8.5%.

The law defining preferential conditions for teachers to obtain a mortgage ceased to apply in 2020. Fortunately, all agreements remained in force for those who managed to sign the loan agreement. There have been no changes in this matter since the end of the law.